What does labor law dictate?

There have been no changes to the timing of vacation pay in 2021. According to the Labor Code of the Russian Federation, accrued vacation pay must be issued 3 days before the start date of the vacation (Article 136 of the Labor Code of the Russian Federation). At the same time, there are no clarifying points that are especially worrying for accountants - which days does the law refer to, working days or calendar days?

Based on Art. The Labor Code of the Russian Federation, which determines the calculation of the periods specified in the legislation in calendar days, can be considered that the deadline for paying vacation pay in 2021, as in previous years, is 3 days before the vacation. When setting the date for issuing money, it should be taken into account that the three-day calendar period may include weekends and holidays, therefore, vacation pay will have to be paid on the eve of their onset.

Payment of vacation pay in 2021: new rules

Calculation, timing and transfer of personal income tax.

In 2021, the rules for paying holiday pay have changed. A new law was adopted that determined the timing and transfer of personal income tax. The rules for calculating average earnings, taking into account different conditions, raise the most questions. Let's figure it out.

An employee receives the right to leave after working continuously for 6 months. After six months of work, the employer’s consent to granting leave is not required. In 2018, changes affected the timing of vacation pay. 3 days before the employee is going to go on vacation, the employer is obliged to pay him vacation funds. The amount of vacation pay is calculated from the average daily earnings, which is multiplied by the number of vacation days.

If there was a bonus

What to do when calculating vacation pay if the employee received a monthly bonus? In this case, the accrual is done in the usual way, taking into account the total income. But if there were a lot of bonuses in a month, then they take one amount for calculation. Which one the employer chooses, and usually this is the highest. The bonus portion for three months is taken into account in full if the payment of vacation pay coincides with their accrual. The annual premium must also be included in full.

Compensation upon dismissal

An employee who quits loses the right to receive vacation pay, but he is guaranteed to receive compensation for unspent vacation. In this case, accruals are made according to a different scheme. The calculation is made from the date of the last vacation until dismissal.

When did the salary increase?

If before going on vacation the employer raised the salary, then the calculation is made using a special coefficient. The new salary amount is divided by the amount that was paid before. This coefficient is then multiplied by the average salary.

Calculation formula

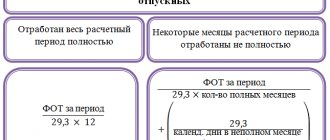

To calculate average earnings, use the following formula:

SDZ = V / Dr

B – payments accrued to the employee for the billing period;

Dr – number of days in the billing period.

Billing period

The time for which payments to an employee are taken into account is called the payroll period. He can be:

- standard

, for the 12 months preceding the month in which the employee goes on vacation. Depends on what month the employee’s vacation begins. - special

, which the employer chooses at his discretion.

A billing period of more than 12 months is established in cases where an employee’s salary changes during the year, or extra days need to be excluded from the period. When a special pay period is used for calculation, vacation pay is calculated in two ways: standard and special.

When to pay personal income tax on vacation pay in 2021?

Before you pay tax, it must first be withheld from the employee’s income.

According to Article 226 of the Tax Code of the Russian Federation, tax must be withheld on the day the employee is paid. Clause 6 of Article 226 of the Tax Code of the Russian Federation specifies the deadline for transferring personal income tax from vacation pay. In 2021, this is the last day of the month in which they were issued. If the date falls on a weekend, the date of payment of personal income tax on vacation pay is the next working day.

Registration of vacation in 1C:ZUP, edition 3.1

Program 1C: Salaries and personnel management 8 allows you to register and calculate different types of vacations. In addition, in version 3.1 it is easy to perform operations such as:

- Assigning vacation rights to an employee;

- Implementation of calculation and accrual of vacation pay;

- Estimating average earnings for vacation pay;

- Generating a certificate of employee leave balances;

- Registration of vacation schedule in the program;

- Accrual of monetary compensation in lieu of vacation leave.

If you use the program, but have not yet managed to switch to the new version of 1C:ZUP, you can contact our specialists. They will help make the transition easy.

Opinion of Rostrud: what is the period for payment of vacation pay?

It echoes the norms of Art. 136 of the Labor Code of the Russian Federation and letter of Rostrud dated July 30, 2014 No. 1693-6-1, defining a three-day minimum in calendar days counted before the start of vacation. The document also notes the need to take into account non-working days. If they exist, the period by which payments must be made increases, i.e. The required amounts will have to be paid out in 4, 5 or more days. For example, when providing leave from June 14, 2021, payment is made not on the 10th, but on the 9th of June on Saturday (it was a working day), since the 10th and 11th of June are weekends, and the 12th is a holiday day.

However, letter No. 1693-6-1 does not clarify this circumstance: whether the day of payment should be counted within the three-day period. Only the possibility of issuing vacation pay on Thursday or Friday to an employee who goes on vacation on Monday is mentioned.

The absence of this clarification has given rise to differences in the interpretation of deadlines in different regional labor inspectorates. Thus, in the Irkutsk region, it is considered legal to pay vacation pay 2 days on the 3rd day before the vacation, and in the St. Petersburg GIT it is recommended to transfer or issue money for vacation 3 days on the 4th.

In practice, based on legal regulations, security considerations and simple everyday caution, accountants make payments exactly on the 4th day. In addition, there are many conflicting decisions of the Arbitration Court.

The main nuance of vacation payment terms in 2021: how to count 3 days before the start

In fact, 3 days can be interpreted in different ways. This can be 3 calendar or 3 working days. The difference can be quite serious. If, for example, the vacation starts on January 10, then this is only the 2nd working day of the year, and in this case, payment must be made almost 2 calendar weeks before the start of the vacation, in December.

However, even in the general case, the period can increase to 5 calendar days, if we understand the Labor Code norm as 3 calendar days.

In reality, of course, we mean 3 calendar days, and this is how accounting departments interpret it when paying vacation pay. But even here, not every time there will be a correct idea of how to count the data for 3 days.

Usually, when paying vacation pay in Russia (with the condition that they are generally paid correctly, before the employee goes on vacation), accountants/organizational managers rely on the fact that the 1st day of vacation should be included in the 3-day period before the start of the vacation.

Let's say, if an employee goes on vacation on August 10, then vacation pay should be paid on August 7. Another common practice is for an employee to go on vacation on Monday, and vacation pay is paid on the Friday preceding it.

Roughly similar explanations were given by Rostrud, but this year it was finally clarified that this practice violates labor legislation.

Judges' position

Like the Trudoviks, the courts of different regions differ polarly on the question of whether to include the payment date within a three-day period or not. Thus, the arbitrators of the Leningrad and Kemerovo regional courts believe that the day of extradition should be included in the three-day period, and the courts of other constituent entities of the Russian Federation have the opposite opinion. For example, the regional court of Chelyabinsk, in decision No. 11-11043/2015 dated September 17, 2015, determined that the dates of vacation and its payment should be separated by 3 full days. The Perm Regional Court has the same opinion (decision dated January 23, 2018 No. 21-46/2018).

This difference in court decisions is due to the lack of clear legislative clarifications. And since the issue of timing of payments is a fundamental one, and failure to comply within the allotted limits can lead to fines, it is safer to pay vacation pay 3 full days before the start of the vacation, i.e. on the 4th.

Let's look at how to calculate the payment period for vacation pay using an example:

The employee goes on vacation on Friday, July 20, 2021. Let's count back 3 days - July 19, 18, 17. Vacation pay should be issued on Monday the 16th. In this case, the company certainly does not risk receiving a fine for late payment of vacation pay when checked by the labor inspectorate.

Indicators taken into account in the calculation

The calculation is carried out on the basis of Regulation No. 922 dated December 24, 2007, which provides for the procedure for calculating average earnings. Today there is no new law that would change the existing order.

The amount of payments is affected by:

- billing period;

- average monthly salary;

- duration of vacation;

- seniority.

The standard duration of PO established by current legislation is 28 calendar days. The right to use it is granted only to an employee officially accepted by the organization (documentary basis - employment contract).

The specified period can be reduced or divided into several parts, while its dates and duration are pre-agreed with the higher management of the company, and then entered into the consolidated schedule for the enterprise.

In addition, the employee is given the right to apply for an annual one after 6 months from the date of employment, as well as to receive an early PO, the basis for which is:

- a woman going on maternity leave or at the end of time to care for a child until he reaches the age of three;

- adoption of a child under three months of age;

- the employee is a minor.

Also, in addition to the mandatory annual one, the hired person has the right to take leave without pay. It will not be paid, but its duration will affect the period and length of service, which will become the basis for calculating annual leave, respectively.

For example: the date of employment is considered to be 05/01/2015. Therefore, the working year will be the period from 05/1/2015 to 04/30/2016. During this time, leave without pay was issued for 30 days. When determining the period for accrual, its duration will be adjusted by 16 days. Thus, the time period for calculation will be from May 1, 2015 to May 16, 2016.

Violation of deadlines for payment of vacation pay

Failure to comply with the established deadline for paying for the next vacation is punishable by a fine. And if this violation is recorded by a labor inspector, then you will have to bear responsibility for it. So, clause 1st. 5.27 of the Code of Administrative Offenses of the Russian Federation provides for fines:

- for enterprises – from 30,000 to 50,000 rubles;

- for officials (for example, personnel officer, accountant, company director) - from 1000 to 5000 rubles;

- for a businessman-individual entrepreneur – from 1000 to 5000 rubles.

However, in the event of a single violation detected for the first time, the inspector, as a rule, confines himself to a warning. If non-compliance with labor legislation is systematic, and the company has already been given administrative responsibility, repeated sanctions by the State Labor Inspectorate are tightened, and fines increase significantly, amounting to:

- for companies – from 50,000 to 70,000 rubles;

- for officials – from 10,000 to 20,000 rubles. or disqualification for a period of 1 to 3 years;

- for individual entrepreneurs – from 10,000 to 20,000 rubles.

Let us note that the employer will violate the deadlines for issuing vacation pay even if he urgently releases an employee based on an application with motivated circumstances, written later than 3 days before the start of the vacation, since there are no exceptions in Art. 136 of the Labor Code of the Russian Federation is not provided for (letter of the Ministry of Labor of the Russian Federation No. 14-2/B-644 dated August 26, 2015).

Which days are taken into account?

To determine the amount of vacation pay, you need to take the previous 12 calendar months, as well as the length of time actually worked by the employee during this period. But the organization retains the right to change this period (for example, 3 or 6 months), which is confirmed by the contract concluded during employment.

Regardless of what period is adopted for calculation, the interests of employees should not be infringed, nor should the amount of vacation pay be affected in a smaller direction.

If an employee is employed in the middle of the calendar year and has not fully worked the time used for accrual, then when determining the amount of payment, the period that he actually worked at this enterprise is taken. In this case, the following are excluded from it:

- sick leave;

- decree;

- time of maternity leave;

- other cases of actual absence of a person when he was not at work, and wages were not accrued.

Thursday

However, recently the opinion of labor inspectors has changed and now paying vacation pay on Friday is already considered a violation.

The employer's obligation to pay for vacation no later than three days before its start, provided for in Article 136 of the Labor Code, is one of the conditions established by law. This condition cannot be worsened either by agreement of the parties or on the basis of a collective agreement.

According to the Ministry of Labor, expressed in letter No. 14-1/ОOG-7157 dated 09/05/2018, when an employee goes on vacation on Monday, vacation pay must be paid no later than Thursday of the previous week. The judges reach a similar conclusion. Thus, a company from the Perm region was fined for the fact that vacation pay was paid on Friday, and the vacation itself began on Monday.

The company paid vacation pay 3 days before it started (so, on 01/15/16, vacation pay was paid for vacation from 01/18/16, that is, payment was made on Friday, and vacation began on Monday). The Decision of the Perm Regional Court dated January 23, 2018 in case No. 21-46/2018 states that in accordance with Part 8 of Article 136 of the Labor Code, if the payment day coincides with a day off or a non-working holiday, vacation payment is made on the eve of this day.

Thus, the court concluded that the deadlines for paying vacation pay were violated.