The amount of the minimum pension depending on the region - table

Contributions in 2021 will be equal to the norms of the previous year. The benefit is calculated taking into account the consumer basket for food and non-food products. Regions of the Russian Federation set their own deduction amount; it can vary from 8 to 16 thousand Russian rudders.

| № | The subject of the Russian Federation | Sum | NPA |

| 1 | Altai region | 8 669 | Law of November 2, 2018 No. 91-ZS |

| 2 | Amur region | 8 846 | Law of October 31, 2018 No. 256-OZ |

| 3 | Arhangelsk region | 10 258 | Law of October 26, 2018 No. 15-2-OZ |

| 4 | Astrakhan region | 8 352 | Law of October 26, 2018 No. 101/2018-OZ |

| 5 | Belgorod region | 8 016 | Law of November 27, 2018 No. 310 |

| 6 | Bryansk region | 8 523 | Law of October 24, 2018 No. 72-Z |

| 7 | Chechen Republic | 8 735 | Law of December 5, 2018 No. 59-RZ |

| 8 | Chelyabinsk region | 8 691 | Law of October 30, 2018 No. 804-ZO |

| 9 | Chukotka a.o. | 19 000 | Law of October 30, 2018 No. 65-OZ |

| 10 | Chuvash Republic | 7 953 | Law of October 19, 2018 No. 65 |

| 11 | Jewish Autonomous Region | 9 166 | Law of October 25, 2018 No. 316-OZ |

| 12 | Saint Petersburg | 8 846 | Law of November 30, 2018 No. 711-714 |

| 13 | Sevastopol | 8 842 | Law of December 17, 2018 No. 463-ZS |

| 14 | Khabarovsk region | 10 895 | Law of October 24, 2018 No. 371 |

| 15 | Khanty-Mansi Autonomous Okrug-Yugra | 12 176 | Law of October 16, 2018 No. 69-oz |

| 16 | Irkutsk region | 8 841 | Law of October 30, 2018 No. 82-OZ |

| 17 | Ivanovo region | 8 576 | Law of November 1, 2018 No. 51-OZ |

| 18 | Kabardino-Balkarian Republic | 8 846 | Law of September 27, 2018 No. 24-RZ |

| 19 | Kaliningrad region | 8 846 | Law of November 19, 2018 No. 224 |

| 20 | Kaluga region | 8 708 | Law of October 31, 2018 No. 397-OZ |

| 21 | Kamchatka Krai | 16 543 | Law of September 27, 2018 No. 250 |

| 22 | Karachay-Cherkess Republic | 8 846 | Law of October 29, 2018 No. 67-RZ |

| 23 | Kemerovo region | 8 387 | Law of October 29, 2018 No. 80-OZ |

| 24 | Kirov region | 8 474 | Law of September 27, 2018 No. 182-ZO |

| 25 | Kostroma region | 8 630 | Law of October 18, 2018 No. 469-6-ZKO |

| 26 | Krasnodar region | 8 657 | Law of October 30, 2018 No. 3882-KZ |

| 27 | Krasnoyarsk region | 8 846 | Law of November 23, 2018 No. 6-2201 |

| 28 | Kurgan region | 8 750 | Law of October 30, 2018 No. 118 |

| 29 | Kursk region | 8 600 | Law of October 31, 2018 No. 61-ZKO |

| 30 | Leningrad region | 8 846 | Law of December 20, 2018 No. 130-oz |

| 31 | Lipetsk region | 8 620 | Law of October 29, 2018 No. 214-OZ |

| 32 | Magadan Region | 15 460 | Law of November 1, 2018 No. 2305-OZ |

| 33 | Moscow region | 9 908 | Law of October 30, 2018 No. 180/218-OZ |

| 35 | Murmansk region | 12 674 | Law of October 26, 2018 No. 2295-01-ZMO |

| 36 | Nenets a.o. | 17 956 | Law of October 29, 2018 No. 6-oz |

| 37 | Nizhny Novgorod Region | 8 102 | Law of October 2, 2018 No. 88-z |

| 38 | Novgorod region | 8 846 | Law of October 29, 2018 No. 315-OZ |

| 39 | Novosibirsk region | 8 814 | Law of October 31, 2018 No. 304-OZ |

| 40 | Omsk region | 8 480 | Law of October 5, 2018 No. 2102-OZ |

| 41 | Orenburg region | 8 252 | Law of October 25, 2018 No. 1284/344-VI-OZ |

| 42 | Oryol Region | 8 730 | Law of November 6, 2018 No. 2283-OZ |

| 43 | Penza region | 8 404 | Law of September 25, 2018 No. 3243-ZPO |

| 44 | Perm region | 8 539 | Law of November 1, 2018 No. 299-PK |

| 45 | Primorsky Krai | 9 988 | Law of October 30, 2018 No. 365-KZ |

| 46 | Pskov region | 8 806 | Law of November 7, 2018 No. 1886-OZ |

| 47 | Republic of Adygea | 8 138 | Law of October 31, 2018 No. 177 |

| 48 | Altai Republic | 8 712 | Law of November 20, 2018 No. 74-RZ |

| 49 | Republic of Bashkortostan | 8 645 | Law of October 29, 2018 No. 1-з |

| 50 | The Republic of Buryatia | 8 846 | Law of October 31, 2018 No. 136-VI |

| 51 | The Republic of Dagestan | 8 680 | Law of October 30, 2018 No. 63 |

| 52 | The Republic of Khakassia | 8 782 | Law of December 10, 2018 No. 66-ЗРХ |

| 53 | The Republic of Ingushetia | 8 846 | Law of October 26, 2018 No. 43-rz |

| 54 | Republic of Kalmykia | 8 081 | Law of September 26, 2018 No. 6-VI-3 |

| 55 | Republic of Karelia | 8 846 | Law of October 22, 2018 No. 2286-ZRK |

| 56 | Komi Republic | 10 742 | Law of October 29, 2018 No. 77-RZ |

| 57 | Republic of Crimea | 8 370 | Law of November 1, 2018 No. 535-ZRK/2018 |

| 58 | Mari El Republic | 8 191 | Law of November 1, 2018 No. 53-Z |

| 59 | The Republic of Mordovia | 8 522 | Law of October 31, 2018 No. 80-З |

| 60 | The Republic of Sakha (Yakutia) | 13 951 | Law of October 19, 2018 2050-Z No. 11-VI |

| 61 | Republic of North Ossetia-Alania | 8 455 | Law of November 6, 2018 No. 84-RZ |

| 62 | Republic of Tatarstan | 8 232 | Law of September 25, 2018 No. 50-ZRT |

| 63 | Tyva Republic | 8 846 | Law of November 30, 2021 No. 448-ZRT |

| 64 | Rostov region | 8 488 | Law of November 1, 2018 No. 31-ZS |

| 65 | Ryazan Oblast | 8 568 | Law of October 31, 2018 No. 65-OZ |

| 66 | Sakhalin region | 12 333 | Law of December 11, 2018 No. 73-ZO |

| 67 | Samara Region | 8 413 | Law of October 31, 2018 No. 85-GD |

| 68 | Saratov region | 8 278 | Law of October 26, 2018 No. 99-ZSO |

| 69 | Smolensk region | 8 825 | Law of October 25, 2018 No. 105-z |

| 70 | Stavropol region | 8 297 | Law of November 2, 2018 No. 91-kz |

| 71 | Sverdlovsk region | 8 846 | Law of November 6, 2018 No. 126-OZ |

| 72 | Tambov Region | 7 811 | Law of November 6, 2018 No. 283-З |

| 73 | Tomsk region | 8 795 | Law of November 13, 2018 No. 128-OZ |

| 74 | Tula region | 8 658 | Law of October 25, 2018 No. 90-ZTO |

| 75 | Tver region | 8 846 | Law of October 26, 2018 No. 47-ZO |

| 76 | Tyumen region | 8 846 | Law of October 25, 2018 No. 101 |

| 77 | Udmurt republic | 8 502 | Law of September 28, 2018 No. 52-RZ |

| 78 | Ulyanovsk region | 8 474 | Law of October 29, 2018 No. 110-ZO |

| 79 | Vladimir region | 8 526 | Law of October 24, 2018 No. 94-OZ |

| 80 | Volgograd region | 8 569 | Law of October 23, 2018 No. 115-OD |

| 81 | Vologda Region | 8 846 | Law of December 5, 2018 No. 4450-OZ |

| 82 | Voronezh region | 8 750 | Law of October 29, 2018 No. 138-OZ |

| 83 | Yamalo-Nenets a.o. | 13 425 | Law of October 2, 2018 No. 60-ZAO |

| 84 | Yaroslavl region | 8 163 | Law of October 31, 2018 No. 51-z |

| 85 | Transbaikal region | 8 846 | Law of November 15, 2018 No. 1653-ZZK |

Changes for 2021

Minimum old-age pensions will be indexed by 6.3% in 2021. We should also expect an increase in the cost of living. After this, the average amount of social payments will be 9.2 thousand rubles.

an update of the IPC system is still expected , namely the creation of individual pension capital. It is intended to ensure that the accumulated money is used for specific purposes. For example, to buy points if you don’t have enough experience, to increase the minimum pension. A period will be formed for each person during which he can make any decision on converting existing savings. The new IPC system will be voluntary and will not require any costs or transfer of interest to the tax service of the Russian Federation.

What is the social supplement today?

Every elderly person is guaranteed to receive an additional payment if he had a low income. When forming, the following is taken into account:

- Income from a business enterprise.

- Social benefits from the state. It can be obtained in case of registered disability, guardianship, as well as when receiving a military pension.

The state and working citizens of the Russian Federation are obliged to support socially vulnerable segments of the population. Every elderly woman or man has the right to demand additional payment if his income is less than the limit established by the state.

Payments by age

One of the types of monthly pension provision is a lifetime old-age pension. It is appointed after reaching the legal age, taking into account the length of service and earned pension points. The insurance pension is calculated depending on the payments that the employer paid to the Pension Fund during the period of work. The specifics of the purpose of insurance coverage are regulated by Federal Law No. 400. Citizens who have not earned compulsory work experience for one reason or another are provided with an old-age benefit. The social pension is guaranteed payments to persons who have reached retirement age, but do not have grounds for assigning a labor pension.

The minimum old-age pension usually corresponds to the regional subsistence level. As a rule, it is received by citizens who have a short work experience - less than 10 years. They are assigned social support. The following persons have the right to receive a minimum social pension:

- upon reaching age (according to the new legislation, in stages: for men - 70 years, for women - 65 years);

- in the absence of employment or other types of activities subject to pension insurance.

The reform sets a higher age for registration of social benefits than for old-age insurance benefits. Therefore, such a pensioner receives an increase up to the regional subsistence level. And if the local PM does not reach the total for the country, then he is also paid extra up to the federal level. These conditions apply only to non-working pensioners; employed persons, except for the insurance pension itself, are not entitled to any additional payments; starting from 2021, it is not even indexed.

Minimum if you have experience

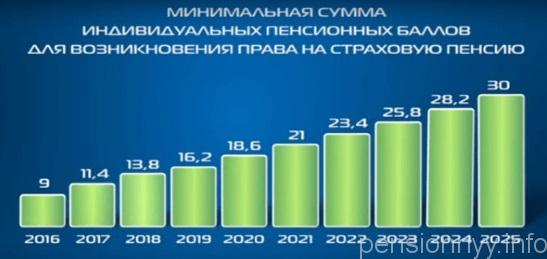

In addition to the arrival of certain years, in order to receive old-age payments, mandatory work experience and a generated number of points are required. From January 2021, the minimum allowable number is 16.2, and from July you will need to have 18.6 points and 16 years of experience. The indicators will be increased step by step until they reach the maximum value for experience (15 years) and points – 30.

According to Federal Law No. 400, pensioners who have earned financial support in the northern and equivalent regions have the right to retire early.

Important! The length of service on which the size of the pension depends is calculated only for the period of officially registered employment, when the employer paid contributions to the Pension Fund.

Actually, monthly minimum pensions in Russia in 2021 consist of several parts:

- the amount of pension coverage itself (insurance, social, state);

- amount of money intended for recipients of federal benefits;

- compensation for social services;

- some regular social support measures established by local legislation, expressed in monetary terms, excluding one-time amounts;

- additional payments to some categories for special differences.

In addition, when calculating material support for pensioners, the entire amount of monetary compensation for social support measures is taken into account:

- payment for telephone use;

- benefits for utility bills;

- free travel on public transport.

With a small amount of experience and, accordingly, a minimum number of points, the amount of pension coverage will also be the smallest and equivalent to the subsistence level in the region. In total, in the Russian Federation from January 2021 it is equal to 8846 rubles, and the pension cannot be less than this amount. For example, for Moscow non-working pensioners, according to the municipal standard, the minimum old-age pension is 17.5 thousand rubles, taking into account their residence in Moscow for more than 10 years.

For other categories of elderly people who do not meet these criteria, the payment is calculated according to regional parameters, and now in Moscow it is equal to 12,115 rubles. In St. Petersburg, the minimum pension for non-working pensioners is the general value for Russia, equal to the minimum wage.

The highest pension benefit range in the country, due to high food prices, is set for remote regions:

- Chukotka – 19 thousand rubles;

- Nenets Autonomous Okrug – 17,956;

- Kamchatka – 16,543;

- Magadan – 15,460.

The lowest size of PM is in the Central Federal District: in Tambov (7811), Belgorod (8016), Yaroslavl (8163) regions. In addition, it is below the national average in Bryansk (8523), Vladimir (8526), Ivanovo (8576), Kostroma (8630), Kursk (8600) and many other regions.

The living wage coincides with the all-Russian level in the Vologda, Kaliningrad, Leningrad, Novgorod, Sverdlovsk, Tyumen regions, the Republics of Ingushetia, Kabardino-Balkaria, Karachay-Cherkessia, Buryatia, Tyva, and the Krasnoyarsk Territory.

Despite the implementation of reforms and attempts to reorganize the system, pension provision in the Russian Federation is leveling out the majority of citizens. On the one hand, this is a humane approach to those who have almost never worked and have not paid taxes, but who, in old age, can claim to receive benefits from the state in the amount of monthly income. However, this procedure insults citizens who have worked their whole lives in difficult conditions in low-paid jobs and received a pension at the same low level.

Comments (17)

Showing 17 of 17

- Alevtina 03.20.2019 at 21:43

Our pension in the Stavropol region is 8300. How much will it be from April 1?answer

- Galina 04/06/2019 at 22:09

As Allah said in his holy book: all the natural wealth that I created for you should belong to you equally. I'm not quoting verbatim, I'm just conveying the meaning. Those who do not keep the laws of the Lord will be cursed. And their bones will decay in the layers of the earth.

answer

- Sergey 04/19/2019 at 16:51

What about disabled people? I am disabled group 1. Somehow they forgot about them. Are we entitled to at least some allowances? Thank you in advance.

answer

- Elena 05/07/2019 at 18:04

It turns out that practically the situation will not change after additional payments. It looks like everything will remain the same. We can only hope for a miracle.

answer

- Leo 09/07/2019 at 06:15

Putin’s decree is not being implemented, it’s already September, and my pension still hasn’t been recalculated according to the new law. The pension fund responded that they do not know the new laws, and they have their own bosses.

answer

- Lyudmila Nikolaevna 09.20.2019 at 18:30

Why weren’t accountants and economists included in the list of 25% additional payments for rural workers? There are many of us who are outraged. Will a law be adopted for those who worked in the village but live in the suburbs?

answer

- Margarita 10.28.2019 at 00:15

Interesting! Why in St. Petersburg did they set the cost of living for pensioners lower than, for example, in Pskov, Sevastopol, Vorkuta? What is worse for St. Petersburg pensioners? Are the products cheaper here?

answer

- Alina 11/13/2019 at 20:50

It’s not clear: our minimum pension in the Moscow region was 9,908 rubles on January 1. The article for 2021 provides the same pension amount - 9,908 rubles, especially since the minimum wage was indexed twice by 7.05% in January and May and today is more than 10,500 rubles.

answer

- admin 11/14/2019 at 12:54 pm

Hello, Alina. Law of the Moscow Region No. 173/2019-OZ sets the cost of living for a pensioner for 2021 at 9,908 rubles. The governor of the Moscow region did not change this value and left it the same as in 2021.

answer

Today I received a pension of 8060 rubles. Krasnodar region, city of Armavir. Why so few?

answer

In Bashkiria, the cost of living has not changed - 8645 rubles. I receive a pension below the subsistence level. In 2021, my pension was 8192.61 rubles. + 992.08 rub. In 2021 - 8733.4 + 452.39 rub. As a result, the additional payment was 1.5 rubles. It's a shame to the point of tears. Will our PM increase?

answer

As I understand it, if the cost of living in the region has not increased, then the promised indexation towards pensions for those with a lower monthly minimum will not be given. They added 6.6% to the pension and reduced the social supplement by the same amount. And in the end, you get an addition for those who have large pensions, and zero for those who have a lower monthly pension.

How many people can you deceive! A shame! So they would immediately say that half of the country’s pensioners will not receive the bonus!

answer

Mom received an additional payment to her pension today. The size of the surcharge was surprising, as much as 1 ruble 21 kopecks! Shouldn’t the surcharge also be indexed according to the Presidential decree of 2021? This is funny and offensive to the point of tears. Or was this a one-time act of generosity? The surcharge has been halved! In the 3rd quarter of 2021, the pension is 9178.68, the additional payment is 1334, this year the pension is 9784.57, the additional payment is 729.32. Result: a “tangible” increase of 1.21 rubles. A shame!

answer

What about in the Republic of Crimea?

answer

Today I received my pension. Not a penny extra, no indexing. As it was 8980, it remains so. It is not clear who did the indexing. Maybe I need to go write a statement? Someone explain. I have social media. old age pension. I live in Omsk. I do not work.

answer

admin 04/10/2020 at 12:45 pm

Hello, Galina. Do you know for sure that you have an old-age social pension? It is received by those who have never worked, and it is assigned to women from the age of 60.

Maybe you still have an insurance pension with a social supplement up to the subsistence level?

answer

What kind of comments can I write here? Shame, miserable pensions. Isn’t the Government ashamed before the world community? If you don’t work in retirement, it means you’re not living, but surviving. A country where there is so much wealth in the depths, and a certain group of people use it all. We, Russian pensioners, cannot afford anything to live with dignity.

answer

Share your opinionCancel reply

Read other news on this topic

- 3 314 11.10.2018

Retirement from 2021

.

- 1 415 27.04.2018

Pension in May

Read about the May pension payment schedule in 2021 in the article at the link.

- 1 736 16.05.2019

Pre-retirement people

In the process of changing pension legislation related to the pension reform, a new term was established in a number of legislative acts - pre-retirement age.

All news

FSD or RSD

The federal social supplement is paid by the territorial bodies of the Pension Fund of the Russian Federation and is established if the total amount of cash payments to a non-working pensioner does not reach the pensioner’s subsistence level established in the region of residence, which, in turn, does not reach the pensioner’s subsistence level in the whole of the Russian Federation.

That is, FSD is paid when the regional PMP is lower than the federal one (living in the region is cheaper than the average in Russia).

A regional social supplement is paid by regional social protection authorities if the cost of living of a pensioner in a constituent entity of the Russian Federation is higher than the same figure in the Russian Federation, and the total amount of cash payments to a non-working pensioner is lower than the regional subsistence minimum.

That is, RSD is paid when the regional PMP is higher than the federal one (living in the region is more expensive than the average in Russia).

Approximate pension calculator

Over the past four years, a special application has been operating on the website of the Pension Fund of the Russian Federation - the so-called pension calculator. This is a simple program that allows anyone to pre-calculate what pension they will be entitled to. If desired, you can make a forecast of future amounts, taking into account certain significant factors.

The main parameters requested by the system are the amount of official income and length of work experience, as well as military service or lack thereof, etc. The special feature of the calculator is that it determines the final amount for immediate retirement based on the data entered by the user.

Experts draw special attention of citizens to the peculiarities of the system. During the preliminary calculations, it slightly reduces the amount of payments due during the preliminary calculations. That is, the real amount will be slightly higher. Exactly how much will be determined by the current pension coefficient, which is set on the basis of the demographic and economic situation, and some other factors of development of the state and region. You should definitely remember this when calculating your expected pension payments on the website.

The year 2016 will be remembered for numerous innovations in the pension sector. Experts say that not all of the envisaged changes are positive.

The main advantages are that the retirement age will not be increased, contrary to popular rumors. All those who had already applied for a pension at the time the changes came into force are not subject to the innovations.

As part of this reform, a system of pension points and additional coefficients was introduced. The minimum retirement period has also increased.

It is not yet clear which of the innovations are positive and which will have a negative impact on the system. This will become clear after several years or even more.

| Year | Maximum IPC size |

| 2018 | 8,7 |

| 2019 | 9,13 |

| 2020 | 9,57 |

| 2021 onwards | 10 |

Over the past four years, a special application has been operating on the website of the Pension Fund of the Russian Federation - the so-called pension calculator. This is a simple program that allows anyone to pre-calculate what pension they will be entitled to. If desired, you can make a forecast of future amounts, taking into account certain significant factors.

The main parameters requested by the system are the amount of official income and length of work experience, as well as military service or lack thereof, etc. The special feature of the calculator is that it determines the final amount for immediate retirement based on the data entered by the user.

Experts draw special attention of citizens to the peculiarities of the system. During the preliminary calculations, it slightly reduces the amount of payments due during the preliminary calculations. That is, the real amount will be slightly higher. Exactly how much will be determined by the current pension coefficient, which is set on the basis of the demographic and economic situation, and some other factors of development of the state and region. You should definitely remember this when calculating your expected pension payments on the website.

The year 2016 will be remembered for numerous innovations in the pension sector. Experts say that not all of the envisaged changes are positive.

https://www.youtube.com/watch?v=4vvuJo168Uc

The main advantages are that the retirement age will not be increased, contrary to popular rumors. All those who had already applied for a pension at the time the changes came into force are not subject to the innovations.

As part of this reform, a system of pension points and additional coefficients was introduced. The minimum retirement period has also increased.

It is not yet clear which of the innovations are positive and which will have a negative impact on the system. This will become clear after several years or even more.