“Maternity benefits” and who receives them

Let us remind you that only women apply for “maternity” benefits for pregnancy and childbirth, while men can also receive child care benefits. Moreover, if a woman has the right to two benefits at the same time—maternity and child care—she must choose one.

The conditions for accruing maternity benefits to a woman are specified in Art. 6 of the Federal Law of May 19, 1995 No. 81-FZ. According to the Law, the expectant mother will receive benefits if she:

- works;

- unemployed due to company liquidation;

- studies (full-time);

- is undergoing military service under a contract;

- is an adoptive parent and falls into the categories listed above.

Please note that for female part-time workers, the benefit is calculated based on earnings from all places of work. If an employee has not changed employers in the two-year period before going on maternity leave, she has the right to receive benefits from each of them. In the event of a change of place of work, only one employer receives the maternity leave, but when calculating the payment, he takes into account the amounts from the income certificates from the previous places of employment of the expectant mother.

Important! To receive maternity benefits, a female individual entrepreneur needs to conclude an agreement with the Social Insurance Fund in advance and transfer the corresponding contributions - 4,451.62 rubles - for at least one year before going on vacation. in year. Otherwise, the entrepreneur will not receive benefits.

“Maternity benefits” are paid to employed women from the Social Insurance Fund at the place of work (service), and to women unemployed due to the liquidation of the company - at the place of residence.

Another nuance is that “maternity” benefits are paid when a woman actually goes on maternity leave. If the employee does not take advantage of the right to “maternity leave” and continues to work, she will receive only a salary; the employer does not have the right to simultaneously accrue both wages and benefits.

Submit electronic reports via the Internet. Kontur.Extern gives you 3 months free!

Try it

Help questions

Next, we will try to answer the questions that are most often asked by future parents before 30 weeks of pregnancy, that is, even before submitting a sample application and issuing an order from the employer.

Can a grandmother go on maternity leave to care for her grandson?

Yes, she was given such a right in accordance with the disposition number 256 of the Labor Code of the Russian Federation. Moreover, this right is given to any of the parents.

Is maternity leave included in the length of service when calculating a pension?

Now, in accordance with the relevant order of the Ministry of Health and Social Development of the Russian Federation (number 91), rest to care for a child is necessarily included in the general and insurance period.

Terms of "maternity leave"

“Maternity leave,” also known as maternity leave, is available to employed women who are issued sick leave at the 30th week of pregnancy. The period of maternity leave is set depending on the probable date of birth of the child and can be equal to:

- 140 days, if pregnancy is progressing normally;

- 156 days in case of complications;

- 194 days when a woman is pregnant with two or more children.

Adoptive parents can also go on maternity leave:

- from the moment of adoption until the end of the 70th day after the birth of the adopted child;

- from the moment of adoption until the end of the 110th day after the birth of adopted children (two or more).

To receive maternity benefits, a woman must contact her employer before the end of the sixth month after maternity leave. Maternity benefits are paid in total for the entire vacation period.

Submit electronic reports via the Internet. Kontur.Extern gives you 3 months free!

Try it

Vacation before maternity leave

If a pregnant woman has not used her right to leave, which is mandatory once a year, she has every right to add it to her upcoming maternity leave. Even if she did not work the required six months, she can take a vacation.

You can take all the allotted days or only a part - everything is at your personal discretion. The employer’s opinion is not taken into account in this case - the corresponding rule is spelled out in the law.

A woman has every right to take paid leave every year. The period must be calculated for the entire year that was worked before leaving before childbirth. It must be paid and it does not depend on maternity leave or parental leave.

Since 2014, an amendment was made to the Federal Law of the Russian Federation “On Labor Pensions”: if a mother (or another family member) has been on maternity leave for a year and a half, he can count on including this period in his work experience. But there is one “but” - the number of such leaves should not exceed 3.

The most common mistake against this background: the vacation is extended to 4 and a half years (3 times one and a half years). This is not true: up to 4, 5 or 6 years, maternity leave can be extended only after agreement with the employer.

In case of complicated childbirth, sick leave for childbirth increases

This only happens if the job can be saved. In addition, the boss will have to partially pay for such a maternity leave - pay a salary or benefit, which is taken from personal funds.

The only valid reason for extending leave is the child’s poor health. However, this will have to be documented - to convene a special medical advisory commission, or VKK for short.

We invite you to familiarize yourself with: Deadlines for registering an inheritance in the Russian Register

This is the only way to obtain a certificate - a conclusion that must be provided to the management at the place of work. The diagnosis must be confirmed with a new certificate every year.

If there are no serious and compelling reasons, the employer may refuse the employee. In addition, if the case goes to court, he will win the process.

Pregnant women, according to Article 260 of the Labor Code of the Russian Federation, have the right before maternity leave or immediately after it to annual paid leave. Moreover, the right to use such leave arises regardless of the length of service with a given employer, that is, a six-month period of continuous work with a given employer is not required. All the details are in the article “Vacation for pregnant women before maternity leave.”

Amount of maternity payments

Benefit amounts may be as follows:

- 100% of average daily earnings - for employed women;

- RUB 12,792 in 2021 - for employees whose work experience is less than 6 months, the benefit does not exceed the minimum wage;

- RUB 708.23 from February 1, 2021 - unemployed due to the liquidation of the company;

- scholarship amount - for full-time students;

- monetary allowance for female contract workers in military service.

Also, starting from June 2021, the rules for calculating average earnings for employees who had no salary over the previous two years or were below the minimum wage have changed. Now, for women on maternity leave who work in areas with a regional coefficient, when comparing average earnings with the minimum wage, the established coefficient must be taken into account (Federal Law No. 175-FZ dated 06/08/2020). Previously, the average earnings calculated by income were compared with the minimum wage × 24 / 730 (without the RK) and only if it turned out to be less, and the calculation was based on the minimum wage, the regional coefficient was applied to the final benefit amount.

Basis for calculating maternity benefits

To receive maternity benefits, the following documents are required (clause 5, article 13 of Federal Law No. 255 of December 29, 2006):

- information about the insured person. They can be requested upon employment or during the period of employment. Employees are required to provide information in a form approved by the Social Insurance Fund in the form of a paper or electronic document;

- a paper “maternity” sick leave or an electronic sick leave number, which contains the corresponding disability code;

- a certificate of income received in the pay period from another employer;

- application for changing years in the billing period (if necessary).

Submit electronic reports via the Internet. Kontur.Extern gives you 3 months free!

Try it

Algori

The amount of the “maternity” benefit depends on which years are accepted as the calculation period, on the maximum amount of payments that can be taken into account, and on the minimum wage.

If the expectant mother’s experience is more than 6 months, step-by-step instructions for determining “maternity leave” will look like this:

Step 1. Select a billing period. The two years preceding maternity leave are taken into account. For example, if the maternity leave is in 2021, then the billing years are 2021 and 2021.

The law allows you to “move” the calculation period if a woman did not receive income in the years preceding the vacation due to another maternity leave or to care for a child under 1.5 years old. Please note that replacement of both years is acceptable.

Step 2. Determine the amount of payments for the billing period. Income for the accounting years should consist only of payments that were subject to insurance premiums. In this case, the amounts taken into account cannot exceed the maximum values. See the table for the maximum income from 2010 to 2021:

| Year | Income limit, thousand rubles. |

| 2021 | 966 |

| 2020 | 912 |

| 2017 | 755 |

| 2016 | 718 |

| 2015 | 670 |

| 2014 | 624 |

| 2013 | 568 |

| 2012 | 512 |

| 2011 | 463 |

| 2010 | 415 |

Step 3. Determine the number of days for the calculation years. To determine maternity leave, the actual number of calendar days in the billing period is taken (Article 14, paragraph 3.1 of the Federal Law of December 29, 2006 No. 255). It could be 730 days, but if the calculation period falls into a leap year, it could be 731 or even 732 days. The following days are excluded from this number:

- temporary disability;

- maternity leave and parental leave;

- exemption with preservation of earnings on which contributions were not calculated.

Step 4. Calculate average daily earnings. In this step, the amount of income received in the second step is divided by the number of days from the third step.

Step 5. Calculate the maximum allowable amount of average daily earnings. The maximum benefit amount is determined by annual income limits. In 2021, the maximum income for 2021 and 2019 is taken into account - this is 912 thousand rubles. and 865 thousand rubles. respectively. Hence, the maximum average daily earnings is 2,434.25 thousand rubles ((865,000 + 912,000) /730 days). Even if over the previous two years the maternity leaver earned more than 5 million rubles, the maximum benefit that can be paid in 140 days is 340,795 (2,434.25 rubles × 140 days).

Step 6. Select average daily earnings. At this stage, you need to compare the values obtained in the fourth and fifth steps and select the smaller one.

Step 7. Compare the average daily earnings with the earnings calculated according to the minimum wage. In 2021, the minimum wage is set at 12,792 rubles, hence the minimum average daily earnings: 12,792 × 24 / 730 = 420.56 rubles. Additionally, the average daily earnings received must be increased by the regional coefficient, if it is established in the region. Then we compare the average daily earnings selected in the sixth step with the minimum and select a larger amount (Federal Law No. 175-FZ dated 06/08/2020).

Let us remind you that from June 19, 2021, the minimum wage for comparison must be taken taking into account the regional coefficient (Federal Law dated 06/08/2020 No. 175-FZ).

Step 8. Calculate maternity benefits. The amount of the benefit is determined by multiplying the average daily earnings by the number of days of maternity leave.

The algorithm described above can be expressed by the formula:

Benefit amount = Income for the billing period subject to contributions / number of days in the billing period x duration of maternity leave

If a woman’s insurance period is less than 6 months, the maternity benefit is limited to the amount of the minimum wage, taking into account regional coefficients, if they are established in the region (clause 3 of Article 11 255-FZ).

For example, sick leave from January 1, 2021, less than 6 months of experience, no earnings in the previous two years. Average daily earnings: 12,792 × 24 / 730 = 420.56 rubles. Sick leave on average in January: 420.56 × 31 = 13,037.36 - and this is more than 12,792, which means that 12,792 must be paid (if there is a regional coefficient, the minimum wage must be increased by it). For February, respectively: 420.56 × 28 = 11,775.68 rubles. - this is less than 12,792, which means that for February the benefit will be 12,792 rubles. etc.

Submit electronic reports via the Internet. Kontur.Extern gives you 3 months free!

Try it

Who calculates the “maternity leave”

The duration of maternity leave is clearly stated in labor legislation:

- if the pregnancy is singleton - 140 days, 70 before birth and the same amount after;

- for multiple pregnancies – 194 days, 84 before delivery and 110 after;

- if problems and complications arose during childbirth - 156 days (70 before birth, 86 after);

- if a woman lives in a region with a large emission of radiation - 160 days (90 before childbirth, 70 after).

The list of incapacity indicates the time frame for the beginning and end of the maternity leave.

What financial assistance is a woman entitled to:

- maternity benefit, which is paid before childbirth. It is equal to the full amount of the average salary for 1 month;

- an amount paid once when registering for pregnancy in the early stages (first trimester). Payment can be made only if a certificate from a gynecologist confirming the fact of pregnancy is provided;

- payment from the federal budget, carried out 1 time. In 2021, it was equal to the amount of 16,350 rubles. Payment is made for each child; for the birth of twins, the amount increases. The amount can also be increased according to the coefficient fixed by local authorities (if the woman lives in the northern regions).

If the period of prenatal and postnatal rest is over, the young mother has the right to receive child care benefits. This is approximately 0.4 of the average monthly earnings. After the child reaches the age of 1.5 years and until the age of 3 years, the mother receives 50 rubles every month.

Obstetricians have established the average length of pregnancy as 40 weeks (or 280 days). From what week expectant mothers go on maternity leave is clear from the content of the law. The 70 days of prenatal leave a woman is entitled to equals exactly 10 weeks. A simple subtraction shows: an employee has the right to go on maternity leave from the 30th week of pregnancy.

The obstetrician-gynecologist will handle the calculations for the first day of maternity leave; the employer does not need to calculate anything. First, doctors set the date of pregnancy. How long women go on maternity leave depends on how it is determined. According to medical rules, the doctor records the date of onset of pregnancy using:

- or obstetric period - from the last female cycle;

- or gestational age - based on the results of an ultrasound scan.

The difference is 2 weeks. The gestational period begins to flow with a 14-day “lateness”. It is beneficial for full-strength employees who want to work longer. Women whose pregnancy is not easy and want to go on maternity leave early are in a hurry to take advantage of the obstetric period.

280 days are counted from the beginning of pregnancy. The resulting date is the baby's expected birthday. 10 weeks before giving birth, the doctor opens a sick leave for a pregnant employee. First, the woman presents the gynecologist with a civil passport, insurance policy, and SNILS. Sick leave is issued for the entire duration of the vacation. It needs to be extended only in unforeseen cases.

Instructions for the online maternity leave calculator

To avoid wasting time calculating maternity benefits, use our free calculator. With its help, in just three steps you will determine the amount of maternity benefits:

1. From the proposed list, select the calculation of sick leave for pregnancy and childbirth and indicate the dates from the “maternity” sick leave. Then set the billing period years and click Next.

2. Indicate the employee’s monthly earnings for the period under consideration. If your region has adopted a regional coefficient, the woman works part-time and/or her work experience is less than six months, check the appropriate boxes. Go to stage 3.

3. In the final table you will receive a detailed calculation of maternity leave by month.

Online calculator for calculating the date of maternity leave

A bill with innovations has been prepared at the end of 2021. Its implementation will stretch until 2021. The main change to the current legislation is an increase in monetary assistance to parents for a child under six years of age and for children raised in a large family. It is planned to increase the monthly amount to 1700 UAH. for one child.

Also under consideration in the Verkhovna Rada is a regulatory act providing for 10 days of paid leave for the father of a newborn. The bill describes in detail the types of assistance at the birth of a child, payments until the child is 3 and 6 years old.

The document states that those who become fathers in 2019-2021 will receive an additional two months of leave, which will give them equal rights with women who receive undeniable benefits when going on maternity leave. The duration of the upcoming vacation is: 2021 - 12 weeks, 2021 - 12 weeks, 2021 - 16 weeks.

In this way, the government is trying to support young and large families, help them experience fatherhood, and care for their wife and newborn.

The calculator will calculate maternity benefits and monthly child care benefits up to 1.5 years old in three steps.

- To calculate maternity benefits, provide data from the sick leave certificate that the employee received at the place of observation of pregnancy at 30 or 28 weeks. To calculate child care benefits for children up to 1.5 years old, enter information about the child. The payment procedure established in 2013 obliges us to exclude periods of temporary disability from two calculation years: they must be indicated in the calculator, if any.

- Indicate your earnings for 24 billing months, the regional coefficient (if any) and other parameters that the calculator will request. If the employee’s work experience is less than six months, the system itself will make adjustments to the calculations.

- In the third step, the calculator will offer the final calculation of the benefit with explanations.

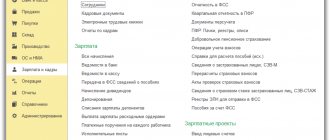

The maternity leave calculator is part of the accounting service Kontur.Bukhgalteriya. We have many more easy calculations for complex things. You will be able to quickly calculate vacation pay, benefits, travel and sick leave, calculate salaries and keep records of employees, prepare reports on employees to the Pension Fund of the Russian Federation, the Social Insurance Fund and the Federal Tax Service.

maternity calculator calculates the amount of three maternity benefits: based on average earnings, minimum and maximum. The result changes automatically as you enter data.

All rules, limits, regional surcharges and situations are taken into account in the online calculator. It will help increase benefits through clarifications, replacement of years, exceptions of “zero” days.

- 140 days (70 days before the expected date of birth and 70 days after) for uncomplicated pregnancy;

- 156 days (70+86), if the birth was complicated or the baby was born;

- 156 days (0+156) premature birth (between 22 and 30 obstetric weeks).

- 194 days (70+124), if several children are expected to be born;

- 194 days (84 days before the birth of the child and 110 after), if several children unexpectedly appeared;

- 160 or 176 days of maternity leave in the Chernobyl zone or in another contamination zone;

Mothers entitled to maternity benefits during the period after childbirth have the right, from the day of birth of the child, to receive either a maternity benefit or a monthly child care benefit (255-FZ Article 11.1).

To assign and pay maternity benefits (maternity benefits), the following documents are needed:

- certificate of incapacity for work (sick leave);

- if the calculation of the B&R benefit will be made for one of the last places of work of the woman’s choice, a certificate from another policyholder stating that the appointment and payment of this benefit is not carried out by this policyholder;

- if you want to replace the accounting years (or one year) with an earlier one, then you also need an Application for Year Replacement;

- A salary certificate from a previous job (excluded periods must also be indicated there) (if the woman worked for other employers during the billing period). This certificate is not mandatory. You should first make a calculation and understand whether you need to provide it. After all, if you worked a little during the billing period and/or you had a small salary, then the calculation (for example, 20,000 rubles) will come out less than the minimum (35,901.37 rubles for full time) and then there is no point in wasting time on a certificate;

- Sometimes they ask for an application: Sample application for maternity leave for benefits. Although sick leave is usually enough.

If the employee was on maternity or children's leave during the two years included in the calculation, one or both years of the calculation period can be replaced with the previous ones (255-FZ Article 14). Of course, if it’s more profitable for the employee. To do this, she must write a special application. But keep in mind that real payments are taken into account and are not indexed in any way.

Vacation for all these days, including weekends and holidays, is paid at the expense of the Social Insurance Fund. Moreover, it does not matter what taxation regime the company is in. Payments are made by the employer, and then the FSS (social insurance) reimburses him.

In those regions where the Social Insurance Fund pilot project operates (there are now more than 20), benefits will be reimbursed directly to employees from the Social Insurance Fund. In this case, the employer helps the employee collect all documents.

Maternity benefits must be calculated and accrued no later than 10 calendar days from the moment the employee applied for it. The basis is the original sick leave certificate. The benefit is paid on the next day when the company pays wages, and in full. That is, there is no need to “split” it by month.