What does the Labor Code say?

Factors that determine the amount of pay for night shifts The law establishes increased pay compared to daytime hours for each night hour worked. The size of this increase depends on several important nuances:

- the minimum wage for night work established by the state;

- numbers set out in the relevant local act (usually the additional payment is a percentage of the daily salary or tariff);

- the number of night hours during which the employee was busy.

The amount of additional payment for each night hour of work cannot be less than a fifth of the regular daily salary (Article 154

Important

Labor Code of the Russian Federation, Decree of the Government of the Russian Federation of July 22, 2008 No. 554). NOTE! A shift schedule or a regular schedule is accepted in the organization; night hours are paid according to the same principle - with an additional payment.

At the same time, the Labor Code of the Russian Federation does not mention such a thing as the evening shift, and does not establish the employer’s obligation to pay at an increased rate for work on the evening shift. Previously, an additional payment for evening shifts in the amount of 20% was provided for in paragraph 1. Additional payment for work on evening and night shifts. This Resolution has become invalid in accordance with Decree of the Government of the Russian Federation dated April 28, 2011 No. 332.

Attention

In accordance with Art. 96 of the Labor Code of the Russian Federation, the time from 22 pm to 6 am is considered night time. In order to reduce the unfavorable factors of night work, there is a rule according to which the duration of work (shift) at night is reduced by one hour without further work. Payment for work on the evening shift In this mode, the evening shift will be from 14 to 22 hours.

What additional payment is due for working on the evening shift? The amounts of such additional payments cannot be lower than those established by law.

His evening shift is from 20:00 to 04:00. According to his schedule, he has 10 such shifts per month. The local act of the enterprise establishes a 20% share of additional payment for work outside normal hours.

We will calculate the amount of the surcharge. For the accounting month Polivanov K.I. fully worked the hourly quota corresponding to the production calendar (170 hours). Night hours each shift account for 6 hours (from 22:00 to 04:00), for a month this will be 6 x 10 = 60 hours.

Info

We need to find the average hourly tariff rate: 25,000 / 170 = 147 rubles. Let's calculate the amount of the night supplement for each hour: 147 x 0.2 = 29.4 rubles.

For 60 odd hours you will need to pay an additional salary of 60 x 29.4 = 1,764 rubles. Example 2. Payment of night hours to an hourly worker for overtime work. The production calendar for the accounting month provides for 172 hours worked, and employee Belchenko L.A. worked 176.

There are only documents of the USSR and regulatory legal acts of ministries and departments of the Russian Federation, in which different standards of payment for work at night are established for different industries. Unfortunately, it is not clear from the question which industry the enterprise belongs to. In any case, if in the organization in a collective or individual labor contract, taking into account the opinion of the representative body of workers, an allowance for night work is established for each full hour worked at night, and this amount is not lower than the norms for additional payment established in the industry for night work, this does not contradict the requirements Article 154 of the Labor Code of the Russian Federation.

100% additional payment:

- workers of bakeries, flour and cereal production enterprises.

There is an explanation of the State Committee for Labor of the USSR and the Secretariat of the All-Union Central Council of Trade Unions No. 294/14-38 dated 05/07/1987, which states that if work at an enterprise is organized in several shifts, with a duration established by law, and more than half of the shift occurs at night, then all of it considered nocturnal. Accordingly, employees can receive additional payment not for night hours. Almost all of the exceptions described above are enshrined in acts from the times of the USSR.

They are valid because no regulatory acts replacing them have been issued in Russia, and they have not been officially repealed. Some points related to payment for night work Many employers who engage an employee to work on non-working holidays and weekends do not want to pay extra for night work, citing Article 153 of the Labor Code.

On this page:

- The law allows you to work at night

- Which shifts are considered night shifts?

- Documents on payment for night work

- Special contingent of personnel

- Factors determining the amount of pay for night shifts

- Night on a business trip

- Examples of night wage calculations

Shift work schedules often include night work. For the employee, such work carries an increased burden, therefore, the payment for it should be higher.

Employees are often concerned about the issue of pay during shift work, in particular when they are busy at night. Let's consider how the laws of the Russian Federation relate to this issue, how accounting occurs when working outside of normal hours, how to calculate payment, and we will show this with a specific example.

Article 154 of the Labor Code of the Russian Federation directly states that every hour of work at night is paid at an increased rate. Consequently, the employer needs to establish and record in the Regulations on Remuneration or other local act the amount of increased pay per hour.

Accordingly, the administration must ensure separate accounting of night hours worked by each employee. This will be required both for the ease of calculating surcharges and for providing the necessary information at the request of regulatory authorities. For example, during an inspection by the labor inspectorate (scheduled or at the request of an employee).

The employer must take into account that there are a number of categories of workers who cannot be involved in night work. All of them are listed in Article 96 of the Labor Code of the Russian Federation.

There is also a category of workers who can be involved in night work only with their written consent (also see Article 96 of the Labor Code of the Russian Federation). In this case, these employees must be informed in writing of the possibility of their refusal to work at night.

When calculating additional payment for night work to piece workers, the procedure for applying it remains the same as for time workers. That is, the number of hours worked at night is calculated and the amount of additional payment is calculated. It is worth considering that hourly wage rates for piece workers should be established that correspond to the type of work they perform.

Calculation example

The employee works on a shift schedule. Shift duration is 8 hours.

1st shift from 8:00 to 16:00

2nd shift from 16:00 to 00:00

3rd shift from 00:00 to 8:00

There are no night hours on the 1st shift. On the 2nd shift, the number of night hours is 2 (from 22:00 to 00:00). And on the 3rd shift there are 6 night hours (from 00:00 to 6:00).

Using these initial data, it is easy to calculate the number of night hours for any work schedule.

For example, the tariff rate is 50 rubles per hour, and the surcharge for night hours is 20% (that is, 10 rubles).

The employee worked 5 days in each shift for a month. Then the amount of payment for time worked will be:

15 shifts * 8 hours * 50 rub. 5 shifts * 2 hours * 10 rub. 5 shifts * 6 hours * 10 rub. = 6400 rub.

It should be noted that this additional payment should be subject to a bonus and a regional coefficient or northern bonus, since it is an increased payment for night time worked.

August 28, 2015

Having considered the issue, we came to the following conclusion: Current legislation does not oblige the employer to make additional payments to employees for working on the evening shift.

Article 96 of the Labor Code determines that night work can take into account the hours that fall between 10 pm and 6 am. Only if more than 50% of a person’s time at work falls during this period, his work is considered night and has additional pay.

Under current laws, a standard night shift is 60 minutes shorter than a day shift. For example, if the staffing schedule specifies 8 hours, work after 10 p.m. is set to 7, and the missing time is not required to be worked.

In some cases, the employer is required to reduce hours at night, including:

- the employment contract specifies the person’s night work type;

- the employee initially works on a reduced schedule;

- employees work in shifts and have one day off per week.

The legislation establishes some nuances and restrictions on work at night:

- When reducing work on night shifts, the employer does not have the right to impose sanctions on employees or reduce wages. The change is considered complete.

- A night shift can be the same length as a day shift if the company's operations require employees to perform their duties full time, or if employees work shifts 6 days a week.

- The law establishes a list of citizens who are prohibited from being involved in night shifts, regardless of their duration or duties.

- Some employees can be involved in night shifts only after receiving written consent, providing them with an order for familiarization and allowing them to refuse without imposing sanctions or fines.

- If the enterprise employs employees of the media or creative professions, the night regime is stipulated in the collective labor agreement. In some cases, confirmation from the commission about the need to introduce a night shift is required.

The Labor Code establishes that the amount of bonus for night shifts should be 20% of the salary.

Night hours start at 10 pm, the exact amount of the increase is indicated in the organization’s internal documentation. The Tax Service has collected statistics according to which the average salary increase is 40%.

| 35% | if the organization provides guard or security services |

| 35% | for employees of penitentiary organizations |

| 50% | employees of healthcare institutions |

In all other cases, each hour of night work is paid at the discretion of the organization’s management, but the amount cannot be less than that established by the Labor Code. To correctly calculate working hours, you need to take the monthly salary and divide it by the number of working days according to the staffing schedule.

Evening shift period according to the labor code

Accordingly, the administration must ensure separate accounting of night hours worked by each employee. This will be required both for the ease of calculating surcharges and for providing the necessary information at the request of regulatory authorities.

For example, during an inspection by the labor inspectorate (scheduled or at the request of an employee). The employer must take into account that there are a number of categories of workers who cannot be involved in night work. All of them are listed in Article 96 of the Labor Code of the Russian Federation.

There is also a category of workers who can be involved in night work only with their written consent (also see Article 96 of the Labor Code of the Russian Federation). In this case, these employees must be informed in writing of the possibility of their refusal to work at night.

When calculating additional payment for night work to piece workers, the procedure for applying it remains the same as for time workers.

Additional payment for evening hours labor code

- When does the night start?

- How much to pay extra

- Legacy of bygone times

- Some features of calculating additional payments

- Calculation example

However, the current level of development of means of production does not allow us to abandon the use of human labor at night. Continuous production processes or long material processing cycles require constant human presence at any time of the day. At the same time, night work requires increased effort from a person in order to maintain the intensity of work similar to daytime work. Therefore, labor legislation provides a number of guarantees and compensations for night workers. And you need to be able to use these compensations. When does the night start? Article 96 of the Labor Code of the Russian Federation defines night time. They consider the time from 22 o'clock to 6 o'clock.

Payment for work in the evening and at night

Labor consultant Legislatively, the amount of additional payment for night work is set at no less than 20% of the salary or tariff rate, but in practice the additional payment is usually 40%. The fact is that until 2008, some Soviet-era regulations continued to be in force, and this payment figure appeared there.

But let's look at the question in more detail. From time immemorial, the rhythm of human life is such that the greatest activity occurs during the daytime. At night, there comes a period of recuperation, time for sleep and rest.

Over many thousands of years of evolution, the body has adapted to this regime, determined by the change of day and night.

Who is not allowed

There are several situations that prohibit night shifts:

- according to the employment contract, the employee works during the day;

- a person works under the condition of reduced working hours;

- employees cannot work at night, since such a ban is established in internal legal acts.

Regardless of working conditions, the following groups of citizens cannot work at night:

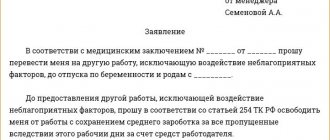

- pregnant employees;

- imperfect employees, except those involved in work of an artistic nature.

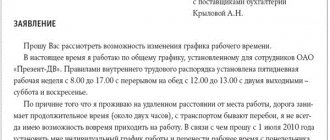

How to translate

If a citizen initially signs an employment contract with working hours from 10 pm to 6 am, then the manager must make sure that the person understands the need to regularly work at night.

If a person was initially employed during the daytime, but at work it became necessary to work at night, the employer is obliged to notify the employee 30 calendar days in advance about the change in schedule.

One of the benefits for workers is additional pay for night shifts. Not all employees know at what point the additional payment begins. For example, if a person goes to work at 8 pm, the salary increase will begin at 10 pm, and the previous 2 hours will be paid at the standard rate.

Payment for night hours during a shift work schedule

This should be implemented in the following local acts:

- in the regulations on wages (general or issued specifically for night hours);

- in the collective agreement (the opinion of the trade union body must be taken into account)

- in an employment contract with an individual employee;

- in the order to attract an employee to work at specified hours (if this is done one-time or an employee is attracted from a special contingent).

IMPORTANT! An order is necessary only in special cases; with a permanent schedule with night shifts, it is enough to fix the payment procedure in the Regulations. Special contingent of personnel Certain categories of employees do not have the right to work night shifts, without taking into account their opinion on this matter. Another list defines the circle of workers who can be involved in night work if they express their consent.

“HR service and personnel management of the enterprise”, 2007, N 4

Question: We are introducing a multi-shift operating mode at the enterprise. Tell us in what cases payment for work in the evening is required.

P.Yu.Proshkina, St. Petersburg

Answer: The Labor Code of the Russian Federation does not determine what work hours should be considered evening; accordingly, there are no direct instructions on the employer’s obligation to pay for evening time.

However, in Art. 149 of the Labor Code of the Russian Federation provides an approximate list of work performed in conditions deviating from normal (performance of work of various qualifications, combination of professions (positions), overtime work, work at night, weekends and non-working holidays and performance of work in other conditions deviating from normal ).

According to the interpretation given by the Presidium of the Supreme Court of the Russian Federation in Determination No. 48pv-03 of November 19, 2003, working conditions on evening shifts are the same deviation from normal working conditions as working conditions on the night shift. Consequently, working the evening shift requires higher pay.

How much should I pay in this case? As follows from Art. 149 of the Labor Code of the Russian Federation, such payments must be made in the amount established by labor legislation and other regulatory legal acts containing labor law norms, a collective agreement, agreements, local regulations, and an employment contract.

Such a regulatory legal act is Resolution of the Central Committee of the CPSU, the Council of Ministers of the USSR and the All-Russian Central Council of Trade Unions of February 12, 1987 N 194 “On the transition of associations, enterprises and organizations of industry and other sectors of the national economy to a multi-shift operating mode in order to increase production efficiency.” According to clause

This norm, despite the fact that it was adopted long before the Labor Code of the Russian Federation came into force, is valid, which is confirmed by the already mentioned Determination of the Presidium of the Supreme Court of the Russian Federation of November 19, 2003 N 48pv-03.

Let us note that from the contents of this Resolution it follows that increased pay is not due to all workers who work in the evening hours, but only to those who work in a multi-shift mode (two- or three-shift work modes). Employees who have a different working schedule are not entitled to increased pay, even if they performed work in the evening.

An additional payment of 20 percent for work in the evening for employees on a multi-shift schedule is a guaranteed legal minimum. A collective agreement, agreement, local regulation, or employment contract may establish a higher wage.

When determining the time limits for evening time, one should be guided by the Explanation of the State Committee for Labor of the USSR, the Secretariat of the All-Union Central Council of Trade Unions dated May 7, 1987 N 14/14-38 “On the procedure for applying additional payments and providing additional leave for work in the evening and night shifts, provided for by the Resolution of the CPSU Central Committee, the Council of Ministers USSR and the All-Russian Central Council of Trade Unions dated February 12, 1987 N 194"{amp}lt;1{amp}gt;.

Legal Consultant

Law office of lawyer V.M. Kalinina

Signed for seal

Additional pay for working evening and night shifts

The Labor Code of the Russian Federation does not contain a definition of the concepts “evening time” and “evening shift” and does not regulate the employer’s obligation to establish increased wages in the evening.

Previously, additional payment for work in the evening shift was provided for by the Resolution of the Central Committee of the CPSU, the Council of Ministers of the USSR, the All-Union Central Council of Trade Unions dated February 12, 1987 No. 194 “On the transition of associations, enterprises and organizations of industry and other sectors of the national economy to a multi-shift operating mode in order to increase production efficiency.” This Decree has lost force in accordance with Decree of the Government of the Russian Federation dated April 28, 2011 No. 332.

In accordance with Art. 96 of the Labor Code of the Russian Federation, the time from 22 pm to 6 am is considered night time. In order to reduce the unfavorable factors of working at night, there is a rule according to which the duration of work (shift) at night is reduced by one hour without further work. In accordance with the legislation of the Russian Federation, a night shift is considered to be a shift in which at least half of the work time is at night. The duration of work at night can be equalized with work during the day only in cases where this is caused by production conditions (for example, in shift work with a 6-day working week; in continuous production, etc.).

The duration of night work is not reduced for employees for whom a reduced maximum working time limit has been established. In addition to the exceptions to this rule in Part 3 of Art. 96 of the Labor Code of the Russian Federation stipulates that the duration of night work is not reduced even in the case where an employee is hired specifically for night work. The Labor Code of the Russian Federation contains only an approximate list of workers who cannot be allowed to work at night.

Night work is paid at an increased rate established by the collective agreement (remuneration regulations) of the organization, but not lower than provided by law.

Article 154 of the Labor Code of the Russian Federation establishes that each hour of work at night is paid at an increased rate compared to work under normal conditions, but not lower than the amounts established by laws and other regulatory legal acts. This means that for every hour worked at night, the employee is entitled to an additional payment.

The minimum increase in wages for work at night is established by Decree of the Government of the Russian Federation of July 22, 2008 No. 554 “On the minimum increase in wages for work at night.” This amount is 20% of the hourly tariff rate (salary per hour) for each hour of work at night. And the specific amounts of the increase are established by the employer, taking into account the opinion of the representative body of employees, a collective or labor agreement.

The duration of work at night is equal to the duration of work during the day in cases where this is necessary due to working conditions, as well as for shift work with a six-day work week with one day off. The list of such works may be determined by a collective agreement or local regulations.

Employee consent

1. Additional payment of 35%:

- railway and metro workers;

- workers working on river ships;

- trade and catering workers;

- employees of motor transport companies, in the absence of shifts;

- workers of guard, paramilitary, fire protection.

2. 50% additional payment:

- workers working at pasta factories.

3. 75% additional payment:

- yeast factory workers working in shifts or continuously;

- textile workers;

- workers in plywood factories.

The clarification of the State Labor Committee of the USSR and the Secretariat of the All-Union Central Council of Trade Unions No. 294/14-38 dated 05/07/1987 is in effect. which stipulates that if work at an enterprise is organized in several shifts, with a duration established by law, and more than half of the shift occurs at night, then all of it is considered night. Accordingly, employees can receive additional payment not for night hours.

Almost all of the exceptions described above are enshrined in acts from the times of the USSR. They are valid because no regulatory acts replacing them have been issued in Russia, and they have not been officially repealed.

- railway and metro workers;

- workers working on river ships;

- housing and communal services workers;

- trade and catering workers;

- employees of motor transport companies, in the absence of shifts;

- workers of guard, paramilitary, fire protection.

- yeast factory workers working in shifts or continuously;

- textile workers;

- workers in plywood factories.

There is an explanation of the State Committee for Labor of the USSR and the Secretariat of the All-Union Central Council of Trade Unions No. 294/14-38 dated 05/07/1987, which states that if work at an enterprise is organized in several shifts, with a duration established by law, and more than half of the shift occurs at night, then all of it considered nocturnal. Accordingly, employees can receive additional payment not for night hours.

Some employees must provide written consent to switch to night work. This category includes disabled people and workers in enterprises if this work involves risks to life or health.

Consent is issued by the citizen personally and confirmed with a date and signature. The document states that the person is ready to work from 10 pm to 6 am. In addition to consent, a disabled person is required to undergo a medical examination and provide an opinion on the ability to carry out activities at night.

The document must indicate the following information:

When consent is given to the manager, he issues an order to change the schedule and switch to night work. The order is accompanied by the consent of the employee and, if any, the conclusion of a medical expert.

Consent is drawn up in free form; no requirements are provided for by law. It is checked by the HR department and then forwarded to the director. The result is that the employee is assigned to night shifts and the salary calculation is changed.

Weekends and non-working holidays: calculation features

The minimum payment in such circumstances is double. But it depends on what schemes are used at the enterprise:

- In the case of piece workers, at least double piece rates are used.

- With daily and hourly tariff rates - regular rewards are also multiplied by two.

- Single or daily hourly rate is combined with salary.

You can use any internal regulations to establish the exact amount of compensation for a particular enterprise.

Employees receive increased compensation for hours during which they actually performed their duties. If part of a weekend and a holiday is transferred from a working day, then this part of the time is counted separately.

Remuneration of employees at any enterprise includes several components:

- Additional payments and allowances, bonuses, other incentive payments.

- Compensation transfers. This includes additional payment for work in difficult climatic conditions. Increased premiums are applied for work in areas prone to radioactive contamination.

- Additional payment for labor depending on the level of training of employees. The quality and conditions of the work performed also determine the result.

When calculating wages for holidays and weekends, in the evening, the employer must take into account the following factors:

- Tariff salary.

- Regional coefficients.

- Percentage allowances.

- Bonuses and compensation.

This law applies to all employers, regardless of their sector of employment.

Bonuses for working on weekends and holidays

Bonuses for work are calculated taking into account additional payments for shift schedules

Article 153 of the Labor Code states that wages are set only in accordance with a valid agreement between the interested parties.

It is necessary to take into account the system in force at a particular employer. When paying for work on a day off, almost all types of bonuses are taken into account.

If the contract specifies monthly bonuses, you cannot do without them.

Annual bonuses usually do not meet such criteria. Therefore, no accounting is carried out for this indicator.

The employer may provide other types of compensation:

- Financial assistance in connection with vacation.

- Compensation for the price of gasoline, car.

- Payment for food and travel.

Example of compensation calculations for night work

If you're paid hourly, it's easy to find out what your copay amount is. For example, if you earn 100 rubles per working hour, then when working at night, 20% of 100 rubles is added to this amount.

120 rubles x 8 hours = 960 rubles (total additional payment was 160 rubles);

Another case: for example, you receive a fixed payment of 20,000 rubles per month, working 22 days for 8 hours. Of the bottom 6 days you worked at night. You need to find out what compensation is due in this example.

20,000 rubles/22 days=909.1 rubles.

909.1 rubles X 20% = 181.82 rubles.

The employee will receive 181.82 rubles X 6 days = 1091.1 rubles in compensation for going to work at night.

When giving your consent to night work, remember:

- Night work from 22.00 to 6.00 is paid additionally 20% of your rate or salary.

Additional payment for night work is the responsibility of the employer. The clause in the employment contract regarding regular payment for such work is contrary to the law and is invalid. If the employer for some reason refuses to compensate for such work, contact your trade union or court.

The definition of “night shift” in this case is significant for deciding the issue of attracting or not attracting a certain category of employees. ATTENTION! According to Art. 96 of the Labor Code of the Russian Federation, the night shift should be 1 hour shorter than the corresponding day shift. The night shift is not reduced by an hour in certain special cases, namely:

- the employee was specifically hired for night work, and this is reflected in the employment contract;

- the employee has a reduced schedule;

- The shift schedule is based on a 6:1 scheme;

- when the shift cannot be shortened due to the nature of production.

Documents on remuneration for night work The enterprise must necessarily regulate the conditions for organizing and calculating remuneration for work at odd hours.

When giving your consent to night work, remember:

- Night work from 22.00 to 6.00 is paid additionally 20% of your rate or salary.

- For certain categories of employees, the additional payment can reach 35%, 50%, 75% and even 100%;

- If you work under a civil contract, you are not entitled to this compensation;

- The additional payment cannot be replaced by reduced working hours;

- The additional payment for night work is not canceled if the employee was involved in work on weekends and holidays: then both compensations are summed up.

Evening time: additional tips

Almost all enterprises provide additional pay for working on the evening shift.

The legislation strictly regulates only night time, and regarding evening time there are no additional regulations for work.

But the General and Industry Rules contain additional descriptions regarding such arrangements.

This is especially true for multi-shift work. This is a mode when the enterprise supports 2 or more shifts throughout the day.

The main thing is that the duration of each of them should not exceed the limits established by current laws.

With a shift schedule, workers go to work at certain periods of time during the day. The internal labor regulations establish the procedure for such processes.

Typically, the transition from one shift to another occurs according to a standard schedule. A break between shifts is required. Its minimum period is double the working time for the previous shift.

One practical example:

An enterprise with a 4-brigade schedule. After 4 days of working 8 hours from 15:00 to 23:00, the team gets a day off before moving on to night shifts.

If the trade union and representatives of the owner did not take part in concluding the General Agreement, the rules and regulations in force at the national level apply to employees. This also applies to evening shifts. But the ban on the application of the norms of general agreements is not completely imposed.