The form presents a table containing information about presence at the workplace and the number of absences per month for all employees of the institution. This form must be completed for:

- An accountant who, thanks to the completed timesheet, accrues wages to employees, vacation pay, benefits, and travel allowances.

Tax officers who are involved in verifying the correct crediting or deduction of taxes from wages. For such a check, the information on the time worked, displayed in the timesheet, is compared with the information on payroll calculation. And if someone is paid a salary during absence from work, the institution may be subject to claims for increased costs, and accordingly, a reduction in the tax threshold for deduction of income tax. For such a violation, the institution may be fined up to 40% of the unpaid tax (Article 122 of the Tax Code of the Russian Federation). In addition, the institution will have to transfer the missing amount of tax to the state, and also penalties.

Thus, given the important role of the hours worked form, it must be properly formatted.

Form T-12 is a standard form adopted by the State Statistics Committee of the Russian Federation and used by institutions of the Russian Federation to record days worked by working workers. The full name of the form is “Working time sheet and calculation of wages.”

The T-12 form is used to fill out information manually on a computer in the Word office program or by entering data with a ballpoint pen on paper.

The form consists of a table that is divided into 55 columns to display the most accurate data on days worked by employees of institutions, as well as to display information about the employee’s salary.

If the worker went on vacation, then according to the standards, the report card must be marked “OT” or “OD”. However, there are ambiguities here. For example, how to indicate a reduction on the form if the vacationer is sick or the vacation falls during a holiday. It should be borne in mind that due to incorrect display of the code, wages may be calculated incorrectly. Therefore, the person responsible for maintaining the time sheet must carefully study the table of catch codes in order to display all cases of the employee’s work activity correctly.

For example, when an employee is on leave, you can mark the boxes with the code OT or 09. You can use any of the 2 designations, but the letter designation of the code is more clear. Displaying two codes does not make sense.

October 21, 2020

The Department of Budget Methodology and Financial Reporting in the Public Sector of the Ministry of Finance of the Russian Federation (hereinafter referred to as the Department) has considered the appeal on the issue of filling out the Time Sheet and reports the following.

In accordance with Article 4 of the Federal Law of May 2, 2006 N 59-FZ “On the procedure for considering appeals from citizens of the Russian Federation,” the following types of appeals from citizens are subject to consideration:

proposals for improving laws and other regulatory legal acts, the activities of state bodies and local governments, developing public relations, improving socio-economic and other spheres of activity of the state and society;

requests from citizens for assistance in the implementation of their constitutional rights and freedoms or the constitutional rights and freedoms of other persons, or reports of violations of laws or other regulatory legal acts, shortcomings in the work of state bodies, local governments and officials, or criticism of the activities of these bodies and officials persons;

citizen complaints - requests for the restoration or protection of his violated rights, freedoms or legitimate interests, or the rights and freedoms or legitimate interests of other persons.

The request contained in the appeal does not correspond to the given types of citizens' appeals that are subject to consideration by federal government bodies.

Taking into account the above, and also taking into account that the essence of the issue in the appeal comes down to the peculiarities of accounting by public sector organizations, please note that such questions should be sent in the form of a request from an organization (budgetary institution), formalized properly (on the letterhead of the organization (budgetary institution) institution) signed by an authorized person.

At the same time, we inform you that according to Article 91 of the Labor Code of the Russian Federation, the employer is obliged to keep records of the time actually worked by each employee.

The form of the Time Sheet (f. 0504421) and instructions for its use are established by Order of the Ministry of Finance of the Russian Federation dated March 30, 2015 N 52n “On approval of forms of primary accounting documents and accounting registers used by public authorities (state bodies), local authorities self-government, management bodies of state extra-budgetary funds, state (municipal) institutions, and Guidelines for their application" (hereinafter referred to as Order No. 52n, Guidelines).

The Timesheet for the Use of Working Time (form 0504421) (hereinafter referred to as the Timesheet (form 0504421) is used by public sector organizations to document the actual working time worked (to record the use of working time for the purpose of calculating obligations to pay wages to employees).

Reflection of actually worked time in the Timesheet (f. 0504421) is carried out using one of two methods established by regulations:

— reflection of the registration of employee appearances and absences during the time for which the Timesheet is generated (f. 0504421),

— reflection during the time for which the Timesheet is generated (f. 0504421) of various cases of deviations from the normal use of working time, ensuring the determination of deviations from the standard volume of working hours (standard working hours) actually worked by the employee.

At the same time, we inform you that the unified forms of primary accounting documentation for recording labor and its payment, approved by Decree of the State Standard of January 05, 2004 N 1 for organizations of all forms of ownership (except for budgetary institutions), including forms N T-12 “Working time sheet and calculation of remuneration" and N T-13 "Working time sheet" (hereinafter - together - the Timesheet) and agreed (clause 2 of the said resolution) with the Ministry of Finance of the Russian Federation, the Ministry of Economic Development and Trade of the Russian Federation, the Ministry of Labor and Social Development of the Russian Federation Federations, as well as the procedure for filling them out in terms of recording working hours, contain similar instructions on the use in the Timesheet of the method of complete registration of appearances and absences for work or registration of only deviations (no-shows, lateness, overtime, etc.).

As amended by the Labor Code of the Russian Federation No. 1 dated December 30, 2002 (in force at the time of approval of the Timesheet forms by Gosstandart Resolution No. 1 dated January 5, 2004) and as amended No. 104 dated July 31, 2020, the provision on recording the time actually worked by each employee remains unchanged.

Taking into account the above, in the opinion of the Department, when complying with the regulations for maintaining the Timesheet (f. 0504421) reflecting deviations from the normal use of working time established by the provisions of Order No. 52n, the requirements of the Labor Code of the Russian Federation for recording the costs of working time actually worked by the employee are met.

It should be noted that the chosen method of recording working time must be approved by the accounting entity as part of the formation of its accounting policy.

These provisions are reflected both in the provisions of Order No. 52n and in the provisions of the federal accounting standard for public sector organizations “Accounting policies, estimates and errors”, approved by Order of the Ministry of Finance of the Russian Federation dated December 30, 2017 No. 274n.

| Deputy Director of the Department of Budget Methodology and Financial Reporting in the Public Sector | S.V. Sivets |

The work time sheet form corresponding to OKUD number 0504421 (T-12 has a very similar name to it, so sometimes confusion can arise when applying a particular document) was introduced into business circulation by the Ministry of Finance of the Russian Federation, which issued order No. 52n dated March 30, 2015. This document is used for the same purposes as T-12, but is subject to use in government agencies.

The time sheet corresponding to form 0504421 also has a fairly similar structure to form T-12. Therefore, for an employee of the HR department, as a rule, there is no problem adapting to a document approved by the Ministry of Finance if he is accustomed to using the form from Goskomstat, and vice versa.

The use of timesheets in form 0504421 is not prohibited for private companies. The fact is that from 01/01/2013, companies that are not directly required by law to use specific unified forms of primary sources are allowed to use any others. Therefore, a private company has the right to use, in order to monitor the time spent at work by hired employees, a time sheet on the form T-12, form 0504421, or another form developed independently. One way or another, the company must have such a document - due to the fact that, in accordance with the provisions of Art. 91 of the Labor Code of the Russian Federation, each employer must monitor the time spent at work by hired employees.

Read more about filling out the T-12 form in the material “Unified Form No. T-12 - Form and Sample” .

Unified forms for keeping records of employee visits at Russian enterprises T-12 and T-13 involve reflecting information about vacations using the codes given on the title page of form T-12.

These codes are presented in two varieties: alphabetic and digital. The use of both is equivalent. Moreover, the organization’s local regulations may also stipulate a certain mixed application option or involve the use of completely different codes. The employer also has the right to independently develop and use a report card form with symbols in it.

Let's see what designations apply to vacations.

In the provisions of Art. 128 of the Labor Code of the Russian Federation, leave at the expense of the employee is divided into 2 types:

- provided by the employer voluntarily at the request of the employee - in this case, the DO code (16) is reflected in the timesheet;

- mandatory provided by the employer at the request of the employee - OZ code (17) is used.

Study leave also has 2 types according to labor legislation (Article 173 of the Labor Code of the Russian Federation):

- leave for study with preservation of earnings - reflected using code U (11);

- unpaid leave for passing entrance exams, sessions, state exams - is recorded in the report card using the UD code (13).

You can learn more about the legislative regulation of the provision of study leave in the article “Study leave under Article 173 of the Labor Code (nuances).”

General requirements

All employers are required to organize the keeping of records of time worked by subordinates. Accounting responsibilities either lie with the manager or are delegated to a responsible employee. For example, an accountant, secretary or personnel officer. It is permissible to assign accounting responsibilities to the heads of structural divisions of the enterprise if the company has a solid staff.

Hours worked and shifts must be recorded in specialized accounting forms - timesheets. You can use standardized forms or develop your own.

The unified forms are report cards T-12 and T-13, approved by Decree of the State Statistics Committee of Russia dated January 5, 2004 No. 1. State employees are required to work according to a separate form - OKUD 0504421, approved by Order of the Ministry of Finance No. 52n dated March 30, 2015.

Why mark on the report card?

In Part 3 of Art. 91 of the Labor Code of the Russian Federation there is a requirement for the employer to keep records of working hours. For this purpose, time sheets are used. Resolution of the State Statistics Committee of the Russian Federation “On approval of unified forms of primary accounting documentation for accounting of labor and its payment” dated January 5, 2004 No. 1 approved two forms of primary accounting documentation:

- No. T-12 “Working time sheet and calculation of wages”;

- No. T-13 “Working time sheet”.

All types of labor time costs that must be taken into account are indicated on the forms. This greatly simplifies the process and allows you to avoid missing details.

The use of these forms for commercial organizations has not been mandatory since 2014 (Article 9 of Federal Law No. 402 of December 6, 2011). The employer can develop and apply his own. The most commonly used is the T-13. It is convenient for automating the process. It does not provide for the calculation of wage accruals. T-12 is used, as a rule, for manual filling or entering data on a computer. It has a column for calculating salaries.

Form OKUD 0504421 is recommended for state authorities, local governments, budgetary and municipal institutions. It was approved by Order of the Ministry of Finance of the Russian Federation No. 52N dated March 30, 2015.

In all of the above forms, two accounting methods are used:

- complete registration of attendance and absence from work;

- registration of deviations (only absences, tardiness, etc. are entered into the form).

IMPORTANT!

Timesheet data is used not only within the organization. Based on them, summary statistical reports are generated.

Accounting Rules

The chosen form for accounting must be fixed in the accounting policy of the organization. If the company decides to work using its own forms, then indicate the procedure and rules for filling out the accounting form. Familiarize yourself with the provisions with the responsible employees against their signature.

The designated employee maintains daily records of hours worked. For this purpose, appropriate marks are made in the forms. Working hours are reflected in days of actual attendance. And all deviations are recorded in the report card under special codes.

Codes are universal designations of the reasons why an employee was absent from the workplace. The reasons can be either valid: a business trip, illness or training, or disrespectful: absenteeism, downtime due to the fault of the employee, no-shows, etc. For example, how study leave is noted on the report card, we will analyze further.

IMPORTANT!

The company decides which code, alphabetic or digital, to indicate in the accounting register. The decision made must be stated in the accounting policy or in the regulations for keeping records of working hours.

How are paid and unpaid days designated?

How is paid educational leave indicated on the report card? In accordance with labor legislation (Article 173 of the Labor Code of the Russian Federation), it comes in two types:

- rest for study while maintaining earnings - reflected using code U (11);

- unpaid leave without saving earnings is reflected using the UD code (13).

The mark on the report card can be made using the continuous method (every calendar day and type of employment, absence (including in connection with training) is noted) or selectively - only the reasons for absence from the workplace are noted.

Study leaves: basic provisions

Employees who combine work with training are entitled to study leave. Moreover, it is important to meet a number of conditions:

- You can only get leave from your main place of work. Part-time workers are not entitled to paid periods; they will have to take unpaid time off.

- We are talking about education being received for the first time. For example, you cannot claim compensation when receiving a second higher education. Although the employer has the right to pay for training periods at its discretion.

- When studying full-time, only unpaid leaves are provided (Article 173 of the Labor Code of the Russian Federation).

- Full-time and part-time forms of education are subject to paid vacation periods (Article 173 of the Labor Code of the Russian Federation). Their terms are limited. Claiming for longer paid periods is not permitted. But payment in excess of the norm is possible at the discretion of the employer.

- Absence will have to be documented. To do this, the employer is provided with a special form - a summons certificate. You need to receive a summons certificate in advance at the place of study.

- The educational program must undergo state accreditation.

IMPORTANT!

Study leave cannot be transferred, added to the main one, or replaced with monetary compensation. They are also not included in the calculation of compensation upon dismissal.

Read about the rules for registering and calculating vacation pay for the period of study in the material “How payment for study leave is calculated in 2021.”

Keeping records of working hours

Russian labor legislation outlines the need to keep records of hours worked by an employee.

For this purpose, the State Statistics Committee has approved 2 forms of recording time sheets: T-12 and T-13.

Companies can also develop and implement their own form, but the approved form is quite easy to use and is widely used by HR employees.

The time sheet is the primary document for recording the attendance of company employees and is filled out by a specialist in the HR department. Next, it is handed over to the manager for signature, and then to an accounting employee.

The director has the right to appoint any subordinate to enter information into the timesheet. In large companies, each department has a responsible employee who, after a month, passes the completed form to the head of the structural unit, who, after a thorough check, passes it on to the personnel officer. In small companies, a HR specialist fills out the timesheet himself and then passes it on to the accounting department.

Based on the completed timesheet form, the HR service takes into account the number of days worked and monitors compliance with the working time schedule (lateness, absenteeism, no-shows). Based on the document, accounting employees calculate wages in accordance with hours worked and fill out reports to statistical authorities.

The report card also serves as evidence of the correctness of the calculation of wages and compensation payments and the imposition of a disciplinary sanction on the offending employee in resolving controversial issues with company employees.

How are absences due to study noted?

There are two ways to fill out a time sheet:

- 1. Continuous - marks are placed for each calendar day.

- 2. Selective (with deviations) - only lateness and absenteeism are indicated.

The method of recording deviations is used for the same length of working day for the entire working period. The report card indicates non-standard cases (business trip, vacation, including educational leave, no-show).

This method takes less time to fill than a solid one. It is most popular for personnel officers and accountants with extensive work experience, as well as for small companies with a small number of staff.

Information in the report card on the attendance of employees of the organization is entered in the form of codes, the designations of which are written on the title back of the T-12 form.

Codes can be presented in the form of numbers or letters; the use of both options is equivalent.

When designating study leave, it is allowed to use a mixed filling system or a completely different coding if this fact is stated in the company’s internal documentation.

How to mark study weekends on your report card depends on whether earnings are maintained during the vacation or not. For paid time off, the designation is different from personal time off.

How are paid days designated?

Cases when vacations provided for study are paid are discussed in detail in this article.

For student leave with preservation of average earnings, the following designation code is used:

- letter "U";

- number "11".

The company decides independently how to indicate educational leave on the report card, with a letter code or a number. Any convenient notation can be used.

What code is used for time off without pay?

The specifics of providing unpaid days off can be studied here.

Study leave for which earnings are not saved is indicated differently in the report card:

- letters "UD";

- number "13".

Again, a convenient designation method for the company is determined independently. You can enter both a numeric code and an alphabetic one.

How to mark study leave on a report card

Depending on the type, educational leave in the report card is designated as paid or unpaid.

If the employee has the right to paid days, then indicate “U” or the digital code “11” in the accounting form. This means additional leave in connection with training while maintaining the average salary.

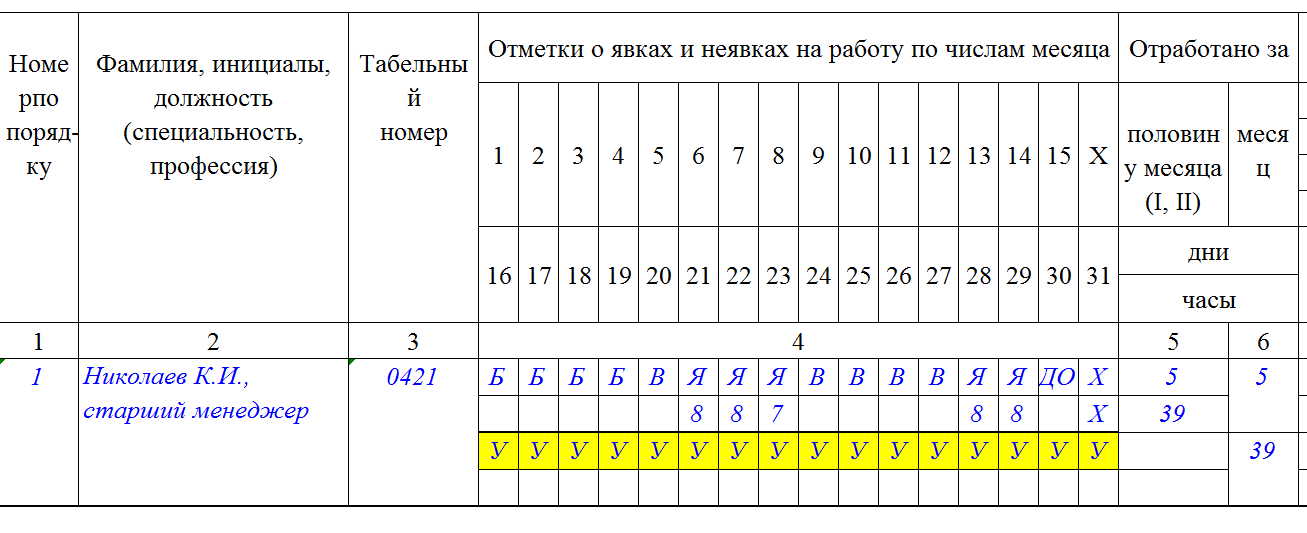

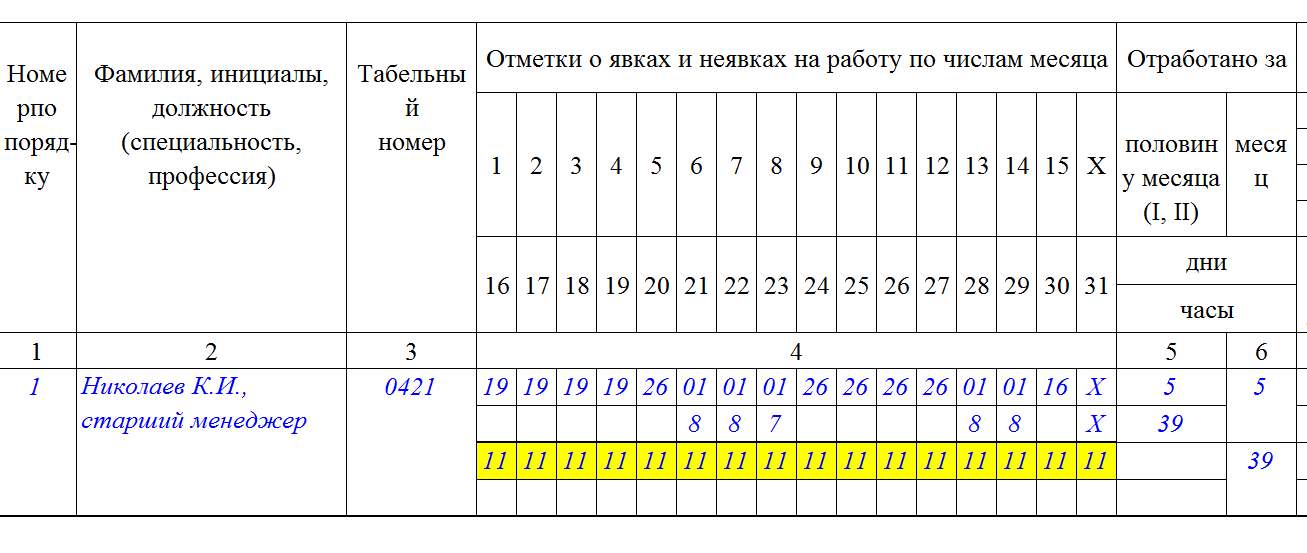

Example 1. With payment

Let's look at an example of how paid study leave is indicated on a report card.

If the organization uses letter codes:

If digital codes are used:

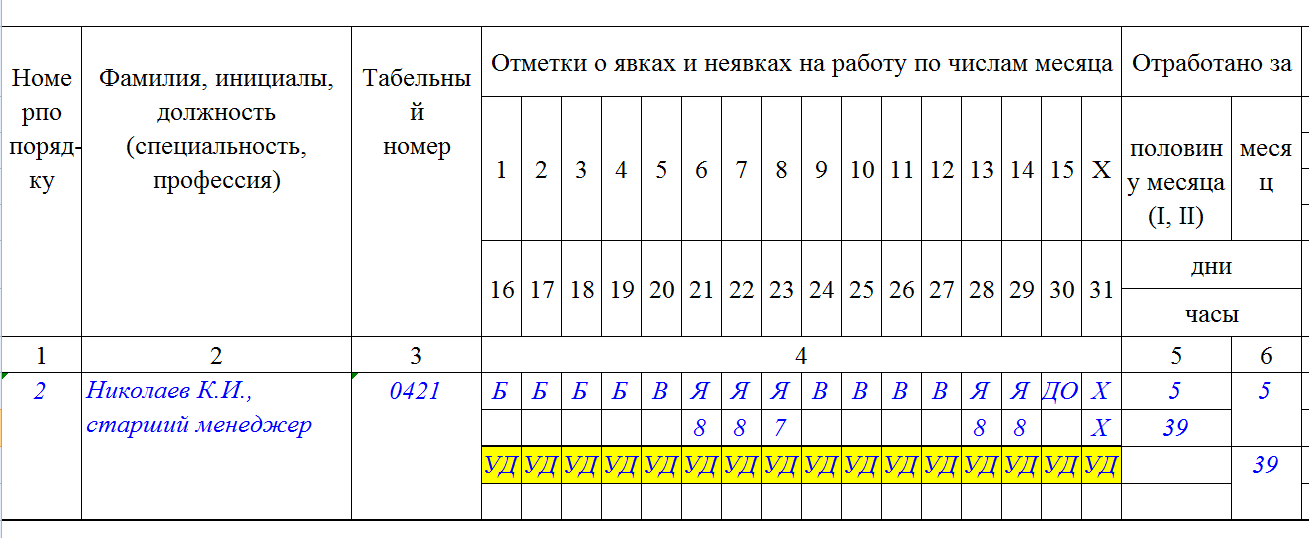

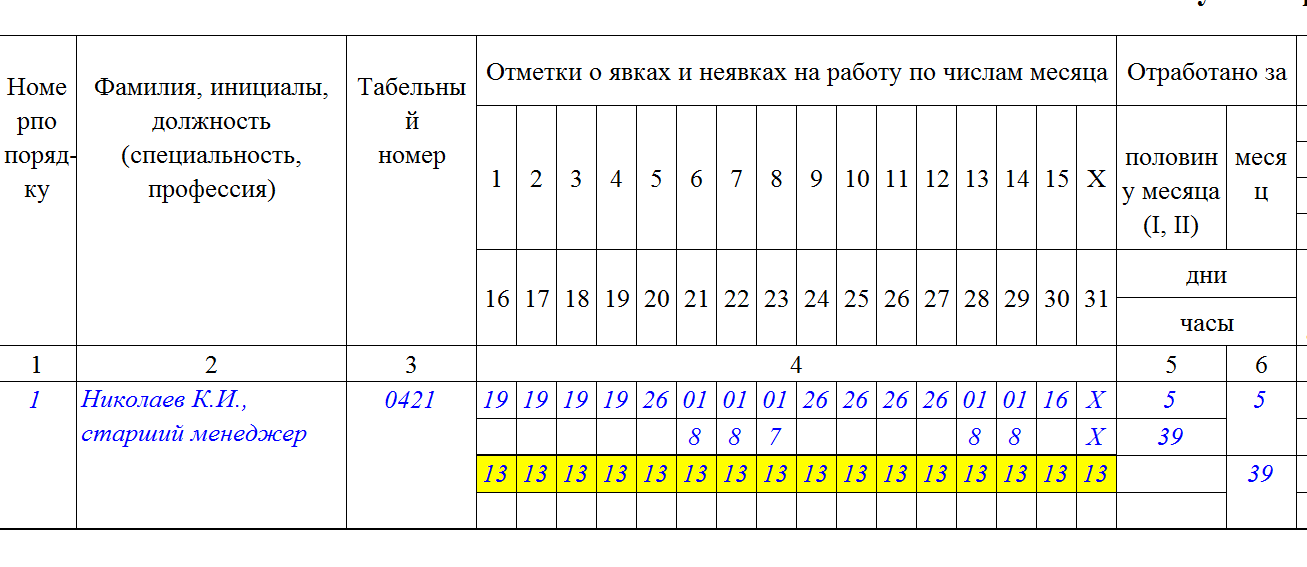

If a specialist does not have the right to paid days or the maximum period of study leave has already been exhausted, then indicate “UD” or the digital code “13” on the report card. This means additional leave in connection with training without pay.

Example 2. No payment

An example of how study leave without pay is indicated on the report card.

Letter codes:

Digital codes:

Maintaining and filling out timesheets

Time sheets in organizations of all forms of ownership are kept by an authorized person. It is appointed by order of the head of the organization. Signed by the head of the department and the HR employee. The completed document is submitted to the accounting department in a timely manner. The smaller the organization, the shorter this path.

Special letter designations are used for filling. Any educational leave in the report card is designated by the letter U. Its various subtypes have variations with an abbreviated designation. All codes can be found in the article about symbols in timesheets.

Types of absence in connection with studies are usually designated by personnel officers in different ways. We show in the table how study leave is indicated on the report card. Numerical and alphabetic designations that can be used in practice are given. The main principle is uniformity. In accordance with it, either letters or numbers are used in the report card.

| Designation | Type of study leave | |

| U | 11 | With the same salary |

| UV | 12 | On-the-job (short-time) |

| UD | 13 | Without salary |

The table shows the symbols used by personnel officers. Below we will clearly show how to mark study leave on your report card.

Instructions for filling out the T-13 report card

Let's determine a step-by-step algorithm for filling out the T-13 form. Entries must be made daily, based on actual employee performance. The timesheet is drawn up for one calendar month, starting on the first day of the month and ending on the last day of the month. A separate line is allocated for each employee. Combining or summarizing entries is not permitted.

How to reflect study leave on the T-13 report card:

- In columns 1-3 of the form, reflect the employee’s personal information. Write down his full name, personnel number, and serial number on the form.

- Column No. 4 is intended for daily recording of attendance notes at the workplace. Days of attendance o or “01”. Designate the period of study leave as “U” or “11” if the days were paid. And “UD” or “13” if the average earnings were not maintained.

- In columns 5 and 6, it is necessary to calculate the total values of days and hours actually worked.

- Columns 7 and 8 are filled out based on accounting data and information on accruals made.

- In column 9, indicate information about the time (hours) worked, taking into account the classification of types of payment.

- In columns 10 and 12, indicate the codes that explain the reason for the specialist’s absence from the workplace. Also include the number of hours.

The finished timesheet is signed by the responsible employee. Then it is submitted to the head of the company for approval. Accounting registers must be stored for at least 12 calendar months.

and to work:

T-12

T-13

Sample of filling out form T-12

Sample of filling out form T-13 with payment

How to record student leave without pay

To enter study leave without pay on your report card, you need to use the designation “UD” (if we are talking about a document in the T-12 form). In the ATC log of the T-13 form they put “13”.

The designation “VU” can be used to indicate study leave on the report card if a journal of the type 0504421 is used. These letters are placed in the case of time off without pay. Institutions can independently establish other designations for use in the document of form 0504421. This is specified in Order No. 52n. New letter combinations must be approved at the company level.

It also happens that an employee formalizes an exemption from work under the Labor Code of the Russian Federation by providing a certificate of summons while maintaining payment. But something goes wrong during the exam, and the exam period has to be extended. It is unlikely that the employer will agree to continue paying for time actually not worked, especially since it is unknown how long this will last. And then, if the management is loyal, it is possible to take time off at your own expense. In this case, first the report card shows study leave with pay and then without it. Different codes are used for this. In table T-12, in this case, first put “U” and then “UD”. If you use the T-13 report card, the codes “11” and “13” appear sequentially. In form 0504421 they put “U” and “VU” in turn. This design option will help you accurately calculate the amount that is supposed to be paid to the employee at the end of the month.