In this article we will examine in detail the payment order and such concepts as KBK, OKTMO, basis of payment and other required fields in the receipt for payment of social contributions. Let’s try to tell you technically how to correctly make a payment yourself and fill out all the fields so that your money “goes” to its destination.

Each individual entrepreneur must pay two mandatory insurance contributions to the Federal Tax Service. The first goes in favor of OPS, the second compulsory medical insurance.

For 2021 the numbers are as follows

For mandatory pension insurance in a fixed amount: 26,545.00 rubles + 1% of income over 300 thousand rubles. For compulsory medical insurance: 5,840.00 rubles

OPS - compulsory pension insurance OMS - compulsory health insurance

We have already prepared an increase for 2021:

- OPS “for yourself”: 29,354 rubles

- Compulsory medical insurance “for yourself”: 6,884 rubles

- The final amount of insurance premiums in 2021 is 36,238 rubles.

For 2021:

- OPS “for yourself”: 32,448 rubles

- Compulsory medical insurance “for yourself”: 8,426 rubles

- Total amount: 40,874 rubles.

If the individual entrepreneur has not been open since the beginning of the year, then the amount of fixed payments will be less. For correct calculation, use a calculator or the official calculator from nalog.ru.

Payment details can be found at this address.

Generating a receipt

The Federal Tax Service on its official portal nalog.ru offers many services for individuals and businesses. Among other things, an entrepreneur can create a receipt for paying taxes or insurance premiums. To do this, on the tax service website you need to find a section dedicated to individual entrepreneurs.

Step 1: General Settings

On the Federal Tax Service website, in the block of information intended for entrepreneurs, you need to follow the link “Pay taxes or duties.” Of the proposed services, you need the first one - “Payment of taxes and insurance premiums”.

Next, you need to choose for whom the amount will be paid. An entrepreneur can pay for himself, that is, transfer money from his own card or account. In this case, “Pay for yourself” is selected. But often deductions are made from the account of another person - this option is also not prohibited by law. If someone else pays for the entrepreneur, you need to select “Payment for a third party.”

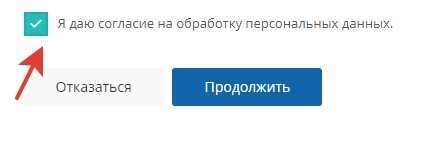

Before generating a receipt, you must agree to the processing of personal data by the tax service website. To do this, check the box next to this option and click the “Continue” button.

In the next window you need to select which payments will be made. They are divided into 2 groups:

- Property taxes and personal income tax of an entrepreneur. The calculation of these amounts and the generation of a receipt is carried out by the Federal Tax Service. To pay taxes online, an individual entrepreneur needs to know the unique identification number (UIN) of the receipt.

- Other taxes that the entrepreneur calculates independently. This group, for example, includes deductions under the simplified tax system and UTII, as well as pension and medical contributions. The individual entrepreneur must generate the receipt himself, filling out all the details.

Step 2. Entering details

First of all, you need to select the type of payment document:

- payment document - suitable for payment both online and through a bank;

- payment order - only for online transfer.

Then the recipient’s details are selected from the directories: Federal Tax Service code and OKTMO. The latter can be determined automatically if you check this option and enter the address of the object. It must also be selected from the directory. In the same window, it should be noted whether the Federal Tax Service Inspectorate and OKTMO are located in the same area.

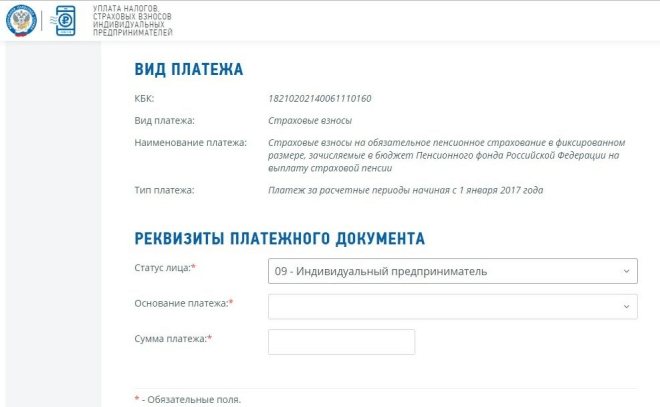

It's time to move on to filling out the details. The budget classification code (BCC) is mandatory. Read about the BCC for paying taxes under the simplified tax system here. If it is known, it must be entered in the appropriate field. But if you don’t know the code, you can fill in the other three parameters - type, name and type of payment. In this case, the BCC will be determined automatically.

The next screen states:

- person status - for an individual entrepreneur this is code “09”;

- basis - “TP” for payment for the current year, “ZD” - if the debt is paid off voluntarily, “TR” - transfer of arrears at the request of the Federal Tax Service and others;

- taxable period;

- sum.

In the last window, you must enter the last name, first name and patronymic of the entrepreneur, his tax identification number and address (by selecting its elements from the list). It should also be noted whether the address coincides with the real place of residence.

How to fill out receipts for mandatory insurance premiums for individual entrepreneurs “for yourself” in 2021?

Important update. Please note that from January 1, 2021, it is necessary to indicate new details of the Federal Treasury when paying taxes and contributions (although there will be a transition period, but read about this in the article at the link below). Moreover, there will be one more mandatory detail that will need to be filled out in the payment order.

Read more in the article:

Important: New details from 2021 when paying taxes and contributions

Good afternoon, dear individual entrepreneurs!

Let’s assume that a certain individual entrepreneur without employees decided to pay mandatory contributions “for himself” for the full year 2021. Our individual entrepreneur wants to pay mandatory contributions quarterly, in cash, through a branch of SberBank of Russia.

Also, our individual entrepreneur from the example wants to pay 1% of the amount exceeding 300,000 rubles per year at the end of 2021, but we will talk about this case at the very end of this article.

Of course, individual entrepreneurs on the simplified tax system “income” with zero annual income, or less than 300,000 rubles per year should not pay this 1%.

In this case, our individual entrepreneur must pay the state for 2021:

- Contributions to the Pension Fund “for yourself” (for pension insurance): RUB 32,448.

- Contributions to the FFOMS “for yourself” (for health insurance): RUB 8,426.

- Total for the full year 2021 = RUB 40,874.

- Also, don’t forget about 1% of the amount exceeding 300,000 rubles of annual income (but more on that below)

A little hint. To understand where these payment amounts come from, I advise you to read the full article on individual entrepreneur contributions “for yourself” for 2021:

https://dmitry-robionek.ru/calendar/strakhovyye-vznosy-ip-za-sebya-v-2021-godu.html

I remind you that you can subscribe to my video channel on Youtube using this link:

https://www.youtube.com/c/DmitryRobionek

But back to the article... Our individual entrepreneur wants to pay quarterly in order to evenly distribute the load throughout 2021.

This means that he pays the following amounts every quarter:

- Contributions to the Pension Fund: 32448: 4 = 8112 rubles.

- Contributions to the FFOMS: 8426: 4 = 2106.5 rubles.

That is, our individual entrepreneur prints two receipts for payment of insurance premiums every quarter and goes with them to Sberbank to pay in cash.

Moreover, the deadlines for quarterly payments are as follows:

- For the first quarter of 2021: from January 1 to March 31

- For the second quarter of 2021: from April 1 to June 30

- For the third quarter of 2021: from July 1 to September 30

- For the fourth quarter of 2021: from October 1 to December 31

In our example, we will consider exactly the case when an individual entrepreneur pays quarterly. Almost all accounting programs and online services offer these terms for payment of contributions. Thus, the burden of mandatory insurance contributions for individual entrepreneurs is distributed more evenly.

And an individual entrepreneur using the simplified tax system of 6% can still make deductions from advances under the simplified tax system. Please note that if you have an individual entrepreneur account with a bank, it is strongly recommended that you pay contributions (and taxes) only from it. The fact is that banks, starting from July 2021, control this moment. And if you have a bank account for an individual entrepreneur, then be sure to pay all taxes and contributions only from the individual entrepreneur’s account, and not in cash.

How to fill out receipts?

Follow the link to the official website of the Federal Tax Service:

https://service.nalog.ru/payment/payment.html?payer=ip#paymentEdit

We agree to the processing of personal data and click on the “Continue” button.

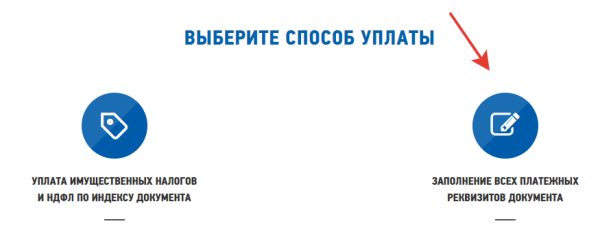

Select the payment method “Filling out all payment details of the document”

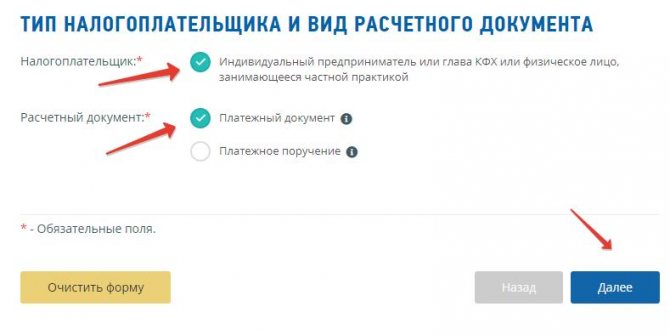

Since we pay as individual entrepreneurs, we check the boxes as follows:

Click on the “Next” button and you will be taken to the next step.

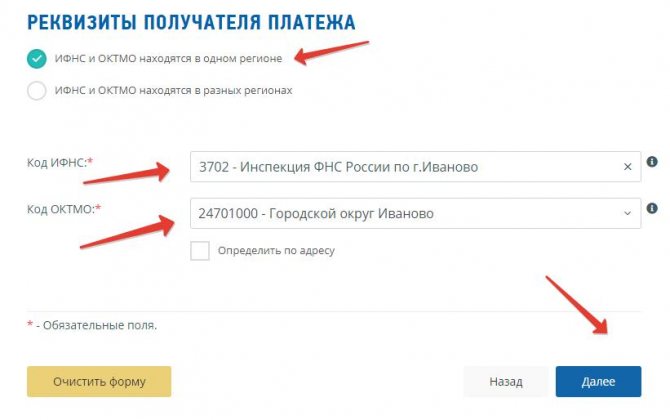

In the “IFTS Code” field, enter the code of your tax office. Let our individual entrepreneur live in the mountains. Ivanovo, its tax office code is 3702, and its OKTMO code is 24701000 (see screenshot below).

Of course, you will enter your tax office code and your OKTMO. If you don’t know them, you can check with your tax office.

Or try to determine the code of your tax office + OKTMO using the “Determine by address” function.

Check the box next to “Locate by address” and enter your registered address. But, nevertheless, I recommend checking this data again with your tax office if you are not completely sure.

Moreover, pay attention to two switches:

- The Federal Tax Service and OKTMO are located in the same region

- The Federal Tax Service Inspectorate and OKTMO are located in different regions

In our example, let them be in the same region, so the following setting was chosen:

If you are in doubt about what to choose, it is better to check with your tax office. The fact is that, indeed, sometimes the tax office may be located in a different region than OKTMO. This happens when one tax office registers entrepreneurs from several regions of the Russian Federation. For example, from remote villages and small settlements. It’s even better to use programs and services for maintaining accounting/tax records for individual entrepreneurs. These receipts are automatically generated in them in a few clicks.

And we press the “Next” button...

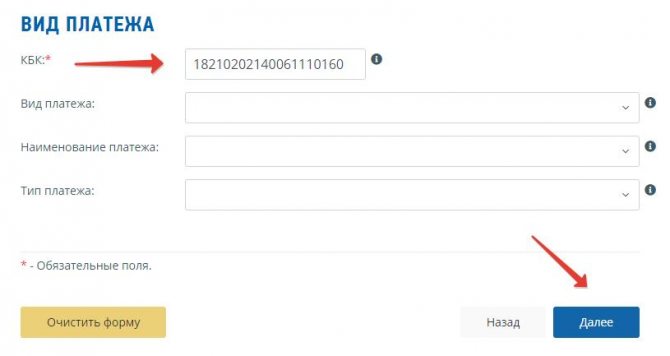

And we immediately indicate the required KBK

- If we pay a mandatory contribution to pension insurance “for ourselves,” then we enter the BCC for 2021: 18210202140061110160

- If we pay a mandatory contribution to health insurance “for ourselves,” then we introduce a different BCC for 2021: 18210202103081013160

Important: enter KBK WITHOUT SPACES and immediately click on the “Next” button!

That is, when you issue these two receipts for pension and health insurance, you will do this procedure twice , but at this step you will indicate different BCCs and different amounts of payments for pension and health insurance of individual entrepreneurs “for yourself.”

Let me remind you once again about the payment amounts for the full year 2021:

- Contributions to the Pension Fund “for yourself” (for pension insurance): RUB 32,448.

- Contributions to the FFOMS “for yourself” (for health insurance): RUB 8,426.

If you pay quarterly, the amounts will be as follows:

- Contributions to the Pension Fund: 32448: 4 = 8112 rubles.

- Contributions to the FFOMS: 8426: 4 = 2106.5 rubles.

It is clear that if the individual entrepreneur has worked for less than a full year, then you will have to recalculate the contributions yourself, taking into account the date of opening (or closure of the individual entrepreneur). Instead of paying fees for a full year.

And again click on the “Next” button.

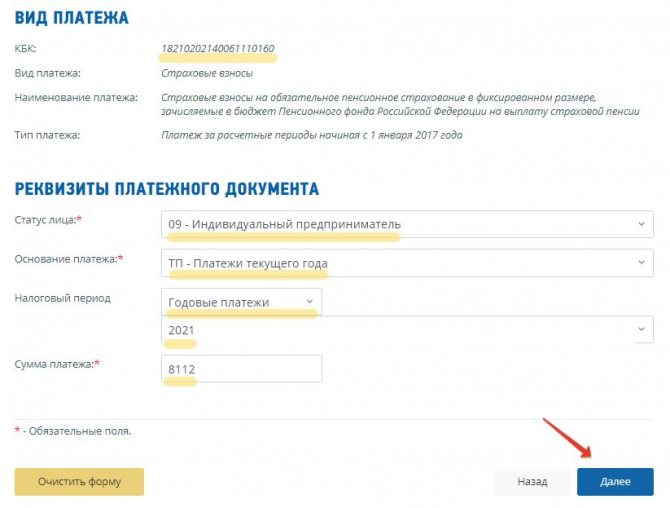

- We select the status of the person who issued the payment as “09” - taxpayer (payer of fees) - individual entrepreneur.

- TP – current year payments

- And indicate the tax period: GY-annual payments 2021

- Enter the payment amount (of course, you may have a different amount)

Please note that starting from October 1, 2021, in field 101 instead of code “09” you will need to write code “13”

Changes when filling out field 101 when paying taxes and contributions from October 1, 2021

And again click on the “Next” button.

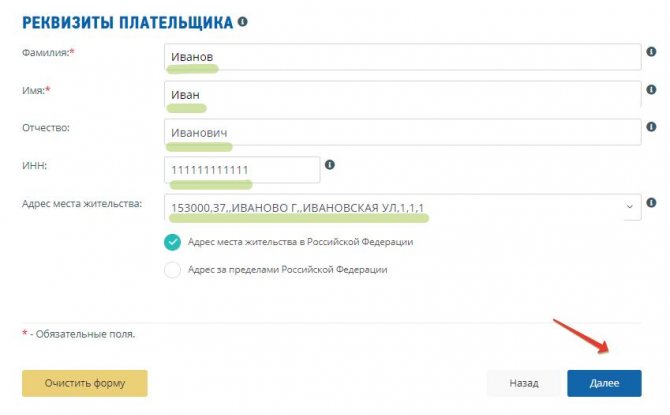

Next, enter your information. Namely:

- Surname

- Name

- Surname

- TIN

- Registration address

Please note that you need to pay fees on your own behalf.

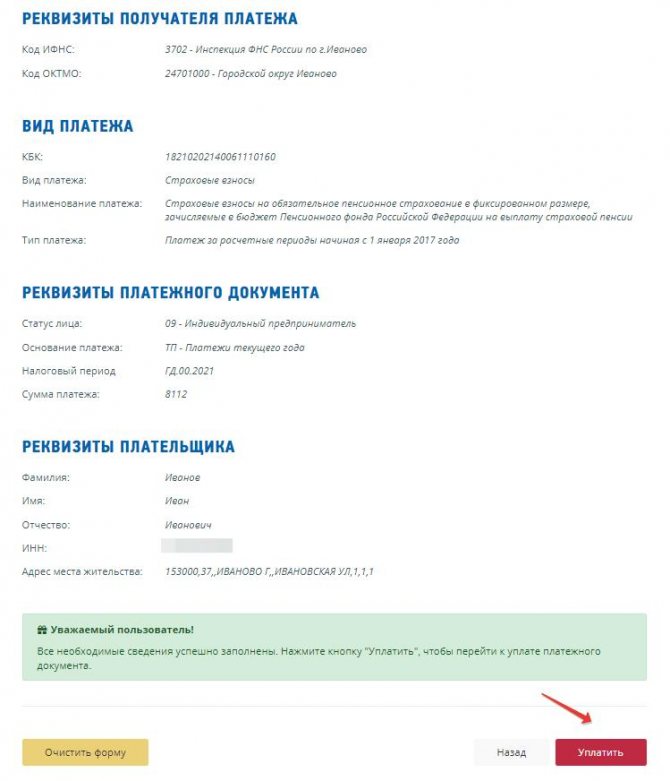

Click the “Next” button and check everything carefully again...

After making sure that the data is entered correctly, click on the “Pay” button.

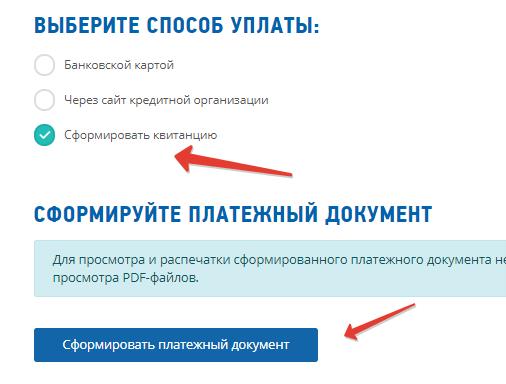

If you want to pay in cash using a receipt, then select “Generate receipt” and click on the “Generate payment document” button

That's it, the receipt is ready

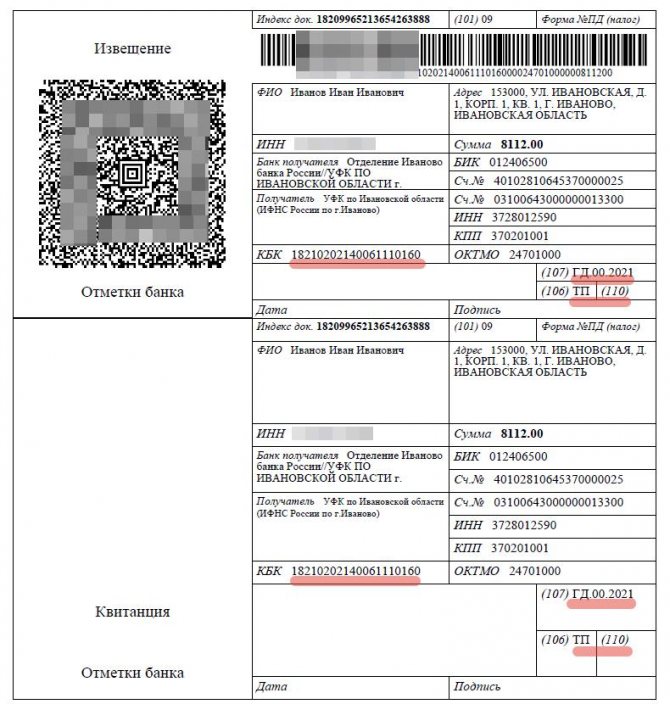

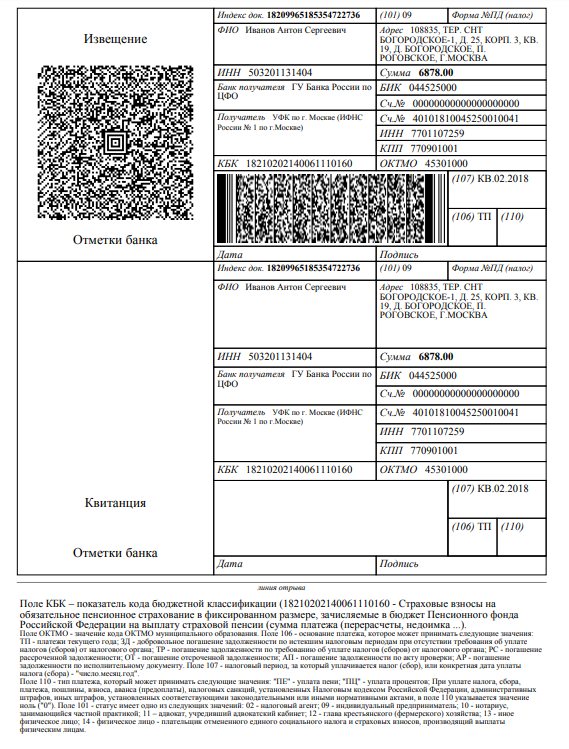

- Since we entered KBK 18210202140061110160 , we received a receipt for payment of mandatory contributions to the pension insurance of individual entrepreneurs “for ourselves”.

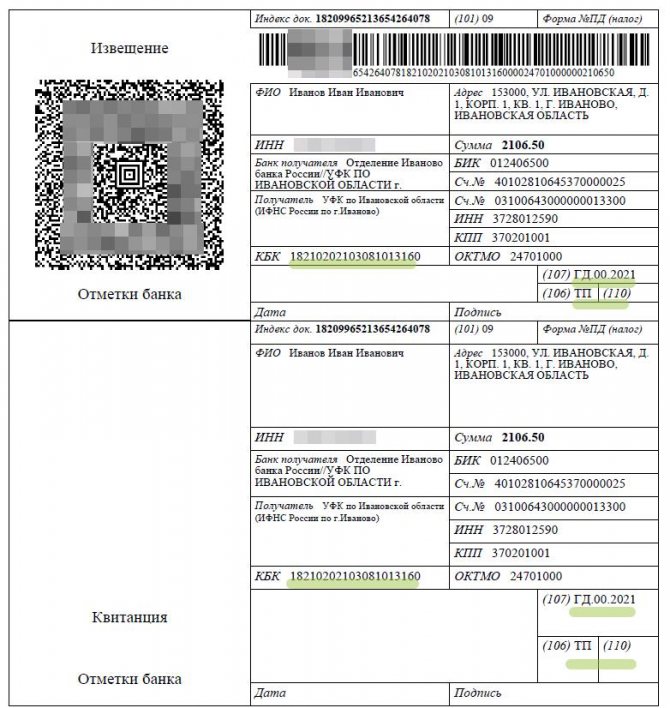

- In order to issue a receipt for payment of the mandatory contribution for medical insurance of an individual entrepreneur “for yourself,” we repeat all the steps, but at the stage of entering the BCC, we indicate a different BCC: 18210202103081013160

Example of a receipt for a quarterly payment for compulsory pension insurance:

An example of a receipt for a quarterly payment for compulsory health insurance (note that the BCC in the receipt is different):

We print these receipts and go to pay at any Sberbank branch (or any other bank that accepts such payments).

Payment receipts and receipts must be kept!

Important: It is better not to delay the deadline for paying mandatory contributions “for yourself” until December 31, as the money may simply “get stuck” in the depths of the bank. It happens. Please pay at least 10 days before the due date.

How to generate a receipt for payment of 1% of an amount exceeding 300,000 rubles per year?

Indeed, those individual entrepreneurs whose annual income in 2021 will be MORE than 300,000 rubles are also required to pay 1% of the amount exceeding 300,000 rubles. In order not to repeat myself, I am sending you to read a more detailed article about individual entrepreneur contributions “for yourself” in 2021:

Insurance premiums for individual entrepreneurs “for themselves” in 2021: examples and answers to frequently asked questions

We are now more interested in another question: where can I get a receipt for paying this 1%?

Let me remind you once again that this payment must be made strictly before July 1, 2022 (based on the results of 2021, of course).

So here it is. There is no separate BCC for payment of 1%. This means that when it comes time to pay this 1%, you will need to generate exactly the same receipt as for paying contributions to compulsory pension insurance.

That is, when issuing a receipt for payment of 1%, indicate BCC 18210202140061110160 (but it is possible that this BCC will change in 2021. Therefore, follow the news and update your accounting programs in a timely manner).

In fact, you will receive exactly the same receipt as when paying a mandatory contribution to pension insurance. Only there will be a different payment amount, of course.

That's all, actually.

But finally, I will repeat once again that such payments need to be processed in accounting programs and services. There is no need to do everything manually in the hope of saving several thousand rubles...

For example, these two receipts can be issued in 1C. Entrepreneur" in literally three clicks. Without thoughtfully studying such boring instructions =)

Best regards, Dmitry Robionek.

Receive the most important news for individual entrepreneurs by email!

Stay up to date with changes!

By clicking on the “Subscribe!” button, you consent to the newsletter, the processing of your personal data and agree to the privacy policy.

KBC for insurance premiums in 2021

The budget classification code or BCC is a requisite of banking and payment documents. Based on the BCC, the distribution of funds transferred by the taxpayer takes place. If an incorrect BCC is indicated, the payment will be counted, but due to its incorrect distribution, the payer will be considered arrears.

Order of the Ministry of Finance of Russia dated July 1, 2013 N 65n, as amended by the latest edition dated June 22, 2018, contains the KBK reference book for 2021. The income codes for state duties and various tax regimes have undergone changes.

KBK for payments in 2021

If you need to make payments to the Federal Tax Service and the Social Insurance Fund in 2021, for the periods 2017-2020, then you need to use the following BCCs:

| Name of insurance payment | KBK | KBK fines | KBK penalties |

| for compulsory pension insurance (for employees) | 182 1 0210 160 | 182 1 0210 160 | 182 1 0210 160 |

| for compulsory health insurance (for employees) | 182 1 0213 160 | 182 1 0213 160 | 182 1 0213 160 |

| for maternity and sick leave (for employees) | 182 1 0210 160 | 182 1 0210 160 | 182 1 0210 160 |

| for injuries in the Social Insurance Fund (for employees) | 393 1 0200 160 | 393 1 0200 160 | 393 1 0200 160 |

| for compulsory pension insurance (for yourself) | 182 1 0200 160 | 82 1 0210 160 | 182 1 0210 160 |

| for compulsory health insurance (for yourself) | 182 1 0213 160 | 182 1 0213 160 | 182 1 0213 160 |

| in retirement with an income of 300 thousand rubles (1%) | 182 1 0210 160 |

In addition, it is necessary to pay contributions to the Federal Tax Service for employees working in conditions that give the right to early retirement, in particular:

| Name of insurance payment | Base | KBK (field 104 of payment) |

| for those employed in jobs with hazardous working conditions | clause 1 part 1 art. 30 of the Federal Law of December 28, 2013 No. 400-FZ | 182 1 0210 160 |

| for those employed in jobs with difficult working conditions | (clauses 2-18, part 1, article 30 of the Federal Law of December 28, 2013 No. 400-FZ | 182 1 0210 160 |

The additional rate for contributions for these categories of employees depends on the results of a special assessment.

Insurance premiums “for injuries” in 2021 must be transferred to the Social Insurance Fund according to KBK 393 1 0200 160.

Insurance premiums 2021

Back in 2021, all payments (and part of the reporting) on insurance premiums for entrepreneurs came under the jurisdiction of the Federal Tax Service. You now need to pay using new details, including KBK. Accordingly, the details of the Pension Fund for paying insurance premiums to individual entrepreneurs are no longer needed. An exception is payment of debts incurred before 2021.

Fixed payments do not depend on the presence of employees or the type of activity of the individual entrepreneur. If a businessman is registered with the Federal Tax Service, then they are accrued automatically. The beginning of this is the date of official registration, the end is the closing date. Independent termination of activity, without notifying the tax office, does not cancel the accrual of payments!

Among the innovations is that the amount of contributions no longer depends on the minimum wage. As before, payments increase annually, but now this does not depend on an increase in the minimum wage. Re-indexation is being carried out, taking into account the growth of inflation in the country.

Today, the annually increasing amounts of contributions until 2020 are known:

2018 – OPS 26,545 + compulsory medical insurance 5,840 = 32,385 rub.

We recommend you study! Follow the link:

How many insurance premiums does an individual entrepreneur pay per year to the Pension Fund and Social Insurance Fund?

2019 – OPS 29,354 + compulsory medical insurance 6,884 = 36,238 rubles.

2020 – OPS 32,448 + compulsory medical insurance 8,426 = 40,874-00 rub.

The amount of the 1% contribution is not fixed; it is independently calculated using the formula:

The total income for all types of activities is 300,000-00 x 1 percent = payment.

As you can see, this contribution is charged only on the amount of income exceeding 300 thousand rubles in a calendar year. You can generate a separate payment to the Pension Fund for individual entrepreneurs to pay this contribution on the Federal Tax Service service.

The deadlines for paying the 1% deduction have changed. It is important not to forget that when combining different taxation regimes, income for determining the base for them is summed up.

Under the main special regimes, the entrepreneur’s income is:

- for UTII this is imputed income, calculated in accordance with the Tax Code;

- PSN considers the previously determined value of the patent to be income;

- in the “simplified” version, the calculation takes into account all revenue from business activities received during the year (when only income is taxed) or the amount minus expenses incurred (if “income - expense” is applied);

- on OSNO – profit received.

For any amount of income, the maximum amount of this payment cannot, by law, exceed the amount of 212,360 rubles.

in a year. The Tax Code contains a list of grace periods for which individual entrepreneurs are exempt from paying contributions. The entrepreneur must notify the Federal Tax Service in advance by providing an application and supporting documents. Exemption is possible when an individual entrepreneur experiences the preferential cases listed in the code and at the same time there is no activity!

How to find out the status of your individual personal account

Every person, regardless of age, can find out information about the status of their personal account. To do this, it is enough to be registered with the pension fund (what is SNILS)

An individual personal account (IPA) is information not only about accumulated points, but also about the length of service, earnings and insurance premiums that you have personally accumulated to date.

Each such account has its own unique SNILS number. It is assigned to a person once. Therefore, even if your last name or other personal data changes, this number remains the same.

What if your employer does not pay insurance premiums? In this case, you will not accumulate any experience with such an employer. If you receive a “gray” salary and have worked for a long time for such an unscrupulous employer, you may find out too late that you are not entitled to a pension. Therefore, it is so important to know and periodically check the status of your personal account with the Pension Fund.

For our convenience, there are currently many ways to find out information about the status of the individual personal account of the insured person. It's completely free . You can order and view your personal account:

- through your personal account on the official website of the Pension Fund;

- on the state portal class=”aligncenter” width=”1222″ height=”361″[/img]

- in a bank (not all banks provide this service);

- at the nearest territorial Pension Fund at the place of actual residence (you only need a passport);

- by mail, sending an application form to receive notification of the status of the ILS by registered mail.

There are quite a lot of options so that, without wasting unnecessary time, you can track information about your length of service and accumulated pension points at least once a year.

How to correctly read information from the HUD

After you have received the requested information from your personal account, you must verify all data with your work history. The form of this document is called SZI-6. We recommend watching a video about what information is contained in our ILS.

The first page contains information about the insured person, the pension option, the total number of accumulated pension points and the insurance period:

All subsequent information consists of three main sections:

- Information about the rights generated after 2015. It is from this moment, in connection with the entry into force of Law No. 400, that pension points are formed for each year of your work based on the insurance premiums paid for you. Therefore, the ILS has its own separate section for this.

Please note that for each year of work the amounts of insurance premiums accrued for you are indicated, as well as points calculated from these amounts.

At this stage we need to make sure that your work is currently being paid officially and that your work experience is being taken into account. The table clearly shows the period of work, the amount of insurance premiums and the number of points taken into account during this period of work. All acquired experience up to this time is reflected in the next section.

- Information about the rights formed until 2015. This information is necessary for calculations using the old pension formula and also affects the calculation of our pension. Pension capital for them is converted into pension points.

In this section you can view the available information about your:

- average monthly earnings for 2000-2001;

- experience until 2002;

- other periods of work;

- the amount of insurance premiums since 2002 (indexed as of December 31, 2014).

It also shows detailed information about your places of work, including the name of the employer.

The information from this section of the personal account must also be carefully verified. If you think that some information about your work has not been taken into account, then contact your employer to clarify the data and provide the missing information to the Pension Fund.

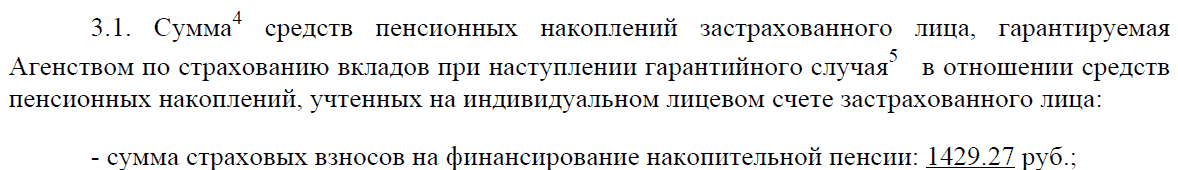

Information about generated pension savings. Information about the funds transferred to the funded pension is reflected here.

Please note that if you do not generate pension savings and are not a participant in the co-financing program, then the information in this section will not be displayed.

It is in the information about the state of your personal account that you can simply find out in which non-state pension fund the money is located.

The insurer can be either the Pension Fund of the Russian Federation or the Non-State Pension Fund (NPF).

If you did not choose a non-state pension fund or a management company, then all the funds in your pension savings by default (hence the name “silent”) are managed by the state manager.

Next, in your individual personal account you can find out both the amount of insurance contributions to finance the funded pension and the total amount, taking into account their investment.

If there are pension savings from maternity capital or additional insurance contributions, the information will also be reflected in the corresponding lines.

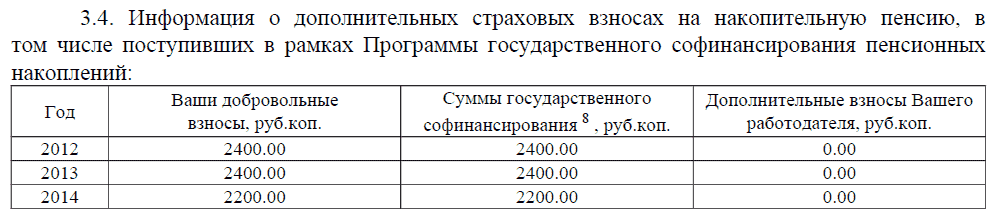

Using the pension co-financing program (if you participate in it), you can track by year the amount of voluntary contributions and the amount that the state adds to your savings.

Deadline for payment of medical contributions in 2021

Here is a table with the deadlines for paying health insurance premiums in 2020. They must be listed according to the details of the Federal Tax Service.

| Type of insurance premiums | For what period is it paid? | Payment deadline |

| Contributions from payments to employees/other individuals for compulsory medical insurance | For December 2021 | No later than 01/15/2020 |

| For January 2021 | No later than 02/17/2020 | |

| For February 2021 | No later than 03/16/2020 | |

| For March 2021 | No later than 04/15/2020 Transfer to 05/06/2020 For micro-enterprises – postponed to 10/15/2020 | |

| For April 2021 | No later than 05/15/2020 For micro-enterprises – transfer to 11/16/2020 | |

| For May 2021 | No later than 06/15/2020 For micro-enterprises – transfer to 12/15/2020 | |

| For June 2021 | No later than 07/15/2020 For micro-enterprises – transfer to 11/16/2020 | |

| For July 2021 | No later than 08/17/2020 For micro-enterprises – transfer to 12/15/2020 | |

| For August 2021 | No later than September 15, 2020 | |

| For September 2021 | No later than 10/15/2020 | |

| For October 2021 | No later than 11/16/2020 | |

| For November 2021 | No later than 12/15/2020 | |

| For December 2021 | No later than 01/15/2021 |

Federal Law No. 172-FZ dated 06/08/2020 for organizations and individual entrepreneurs affected by coronavirus canceled (reset to zero) insurance premiums for the 2nd quarter of 2021 - from payments to individuals accrued for April, May and June 2021.

Details for transferring medical contributions

Payment details for transferring pension insurance contributions (CHI) can be found on the Federal Tax Service website - service.nalog.ru/addrno.do. You can also issue a payment order there – service.nalog.ru/payment/

From 2021, to pay insurance premiums you need to use the KBK, approved by the new Order of the Ministry of Finance of Russia dated 06.06.2019 N 86n.

To pay insurance premiums for compulsory medical insurance, which are transferred to the Federal Tax Service, as well as penalties and fines for them, the following BCCs are used:

Employee contributions:

- contributions – 182 1 0213 160;

- penalties – 182 1 0213 160;

- fines – 182 1 0213 160.

Fixed contributions of individual entrepreneurs for themselves:

- contributions – 182 1 0213 160;

- penalties – 182 1 0213 160;

- fines – 182 1 0213 160.

Payment order

After choosing an activity and familiarizing yourself with the regulations, you need to set the required payment terms. This can be done either at the end of the year or every quarter.

Payment order:

- choice of terms for making contributions;

- creating reports and generating receipts;

- filling out the receipt and entering all data;

- payment of contributions and verification that the contribution has actually been received.

If the contribution has not been received, then a statement is written indicating all the details of the receipt and the date of generation.

With the right procedure, you can pay all insurance premiums in full. It is also worth considering that for any delay a penalty will be charged. For this reason, payment is required at least one week before the end date. This period is enough to correct the data if there is an error and re-make the payment.

Insurance premiums must be paid without fail. For payment, a receipt is generated, which is filled out and paid before the end date of the selected transfer period.

Starting from 2021, the formation is carried out on the Federal Tax Service website. Any errors and omissions in the receipt can be corrected by first writing an application to the tax authorities and indicating all the data with the date of generation.

What to pay attention to when filling out payment orders

When filling out payment orders, you must follow some rules:

- Regardless of what period the payments relate to, in 2020 payments for compulsory insurance are sent to the Federal Tax Service.

- The amount in bills for compulsory insurance is indicated in rubles and kopecks.

- Don't forget to indicate the period to which the payment relates! For legal entities, this is always a MONTH, the format is presented in the example of a payment for insurance transfers. To avoid mistakes, do not copy the previous payment. Create insurance premium payments anew each time and carefully fill out all the data, then carefully check in the printed form format, since otherwise you may miss, for example, an incorrect taxpayer status.

- Incorrect indication of the Treasury current account where payments are sent is a reason not to credit the money for its intended purpose. Be careful, use the sample payment slip for insurance premiums 2021 as a hint.

- Particular attention should be paid to field 104, where the BCC is entered. These codes change quite frequently, so please make sure they are up to date.

To avoid mistakes when filling out the document, use the example of a payment order for insurance premiums 2021 shown below.

KBK relevant in 2021 for legal entities

In 2021, when paying insurance premiums, it is necessary to use the new BCC.

For legal entities, when paying insurance contributions from employee salaries, the following codes are used:

- OPS - 182 1 0210 160;

- Compulsory medical insurance - 182 1 0213 160;

- compulsory social insurance in case of temporary disability and in connection with maternity - 182 1 02 02090 07 1010 160;

- compulsory social insurance against industrial accidents and occupational diseases - 393 1 02 02050 07 1000 160 (paid to the Social Insurance Fund).

KBC for payment of fixed contributions of individual entrepreneurs in 2018-2019

Since the beginning of this year, there has been a change in the administrator of contributions - now management has passed to the tax service. In this regard, new BCCs were introduced, which now begin with code 182.

For pension insurance contributions:

- Contributions in a fixed amount and 1% – 18210202140061110160

- Peni – 18210202140062110160

- Fines – 18210202140063010160

For contributions to compulsory medical insurance:

- Contributions – 18210202103081013160

- Peni – 18210202103082013160

- Fines – 18210202103083013160

Fixed payments for individual entrepreneurs

According to subparagraph 2 of paragraph 1 of Article 419 and paragraph 1 of Article 430 of the Tax Code of the Russian Federation, an individual entrepreneur is obliged to pay contributions for compulsory health insurance and compulsory medical insurance. Individual entrepreneurs are not required to pay payments in case of temporary disability and maternity, but can do so on a voluntary basis.

The Tax Code clearly defines the amounts of transfers for compulsory medical insurance and compulsory health insurance. If a businessman’s income does not exceed 300,000 rubles, he will pay for the needs of the OPS:

- RUB 29,354 - in 2021;

- RUB 32,448 — in 2021

If the income exceeds 300,000 rubles, then in addition to the indicated amounts it is necessary to add 1% of the amount exceeding 300,000. The amount of deductions for mandatory pension insurance cannot exceed:

- RUB 234,832 — 2021;

- RUB 259,584 — 2021

As for fixed payments for compulsory medical insurance for individual entrepreneurs, they will be:

- 6884 rub. — 2021;

- 8426 rub. — 2021

How to properly pay insurance premiums to the Pension Fund and the Federal Compulsory Medical Insurance Fund

Attention! Let's look at the example of contributions for 2018. Their total amount was 32,385.00 rubles.

Tip: Don't pay them every month. There is no point. We worked for the first quarter, calculated the tax, and it came out to 10 thousand rubles. So, pay these 10 thousand to the Pension Fund and the Federal Compulsory Medical Insurance Fund, and first to the Pension Fund of the Russian Federation.

Nothing for the tax authorities, because the contributions were offset against the tax. There are 22,385.00 rubles left, of which 5,840.00 are in the FFOMS.

For the second quarter, another 10 thousand in taxes came out. Again we do not pay tax, but pay to the Pension Fund. There are 12,385.00 rubles left, of which 5,840,000 are in the FFOMS.

For the third quarter, another 10 thousand in taxes came out. Again we do not pay tax, but pay to the Pension Fund.

BUT! We no longer send 10 thousand to the Pension Fund, but the remainder of the total contribution (from 26545.00), i.e. 6,545.00. And with this tranche we cover our obligations to the Pension Fund. But our tax was 10 thousand, and we paid 6,545.00. The remaining 3,455.00 is sent to the FFOMS. All that remains is to pay for honey. insurance: 5,840 - 3,455 = 2,385 rubles.

So already for the fourth quarter, when your tax amount again comes out to 10 thousand rubles, we send the remaining 2,385 to the FFOMS, and the remaining 7,615.00 to the details of the tax authorities!

Important! Sending to the Pension Fund or FFOMS means using the KBK for such payments, but the recipient is the Federal Tax Service.

Of course, this is just an example, and your tax already for the first quarter may amount to an amount exceeding insurance contributions to the Pension Fund and the Federal Compulsory Medical Insurance Fund. Then it’s better to pay everything at once in the first quarter, and then you’ll have to make quarterly advance payments.

According to this above scheme, you relieve yourself of the burden of monthly payments and any risk of imposing penalties and other sanctions from the tax authorities.

Do I need to pay insurance premiums when closing an individual entrepreneur?

If you are closing an individual entrepreneur, the tax inspector, accepting your closure documents, may require receipts confirming the fact of payment to the Pension Fund of all contributions for the year in which the closure procedure is carried out. Remember, you are not obligated to pay insurance premiums when you submit the paperwork to close! We read the article. 432 of the Tax Code of the Russian Federation, based on which this can be done within 15 days after the closure of the individual entrepreneur.

On the other hand, the insurance premium can be deducted from the tax, as we already know, which will be impossible if you transfer the money to the Pension Fund after closing, and not before. Therefore, before closing the individual entrepreneur, pay all contributions to the Pension Fund and the Federal Compulsory Medical Insurance Fund, according to the monthly calculations given above.

How to fill it out yourself and a sample

You should fill out the receipt yourself according to the norms and all the rules.

Sample:

All codes, including KBK, must be entered correctly, since they are the ones that regulate the payment of contributions. In case of errors, you will have to write a statement in which you will need to indicate that a check for relevance is necessary.

If at least one mistake was made, the payment may not be credited to the account, and therefore you will have to pay again. In most cases, the tax office sends a notification, but if you do not pay, then penalties are possible, which will be an additional amount to the mandatory insurance contribution.

In accordance with the law, all fields in the receipt are filled out.

Rules for creating a calculation form for insurance premiums

Until December 31, entrepreneurs can pay the fee at any time. If you need to generate a receipt, this can be done remotely on the Federal Tax Service website.

Important! Businessmen can make the entire payment at once or distribute it over months, transferring funds in parts.

If the entrepreneur’s income for the year exceeds 300 thousand rubles, then contributions from the excess are made after December 31 of the current year.

Businessmen prefer to use the Federal Tax Service website to generate receipts for the following reasons:

- even when using online banking or mobile banking, it is not possible to use a ready-made payment system;

- at bank cash desks or at the post office you can pay contributions using a receipt, but you won’t be able to do it, so you will have to make a payment order yourself;

- On the tax office website you can not only make a payment form, but also get up-to-date information.

To generate a receipt, the following rules are taken into account:

- Initially, you need to register on the Federal Tax Service website;

- personal information about the taxpayer is filled out in the personal account;

- on the main page, select the “Payment of taxes and insurance premiums” section;

- a form opens in which some information is entered automatically;

- click the “fill out payment document” button, which is located at the bottom of the page;

- select the type of contribution and type of payment;

- the period for which the receipt is generated is indicated;

- the details of the recipient of the money are entered;

- the details of the entrepreneur are entered, and in the “Address” line the place of registration is indicated, and not the address of the place of work;

- when selecting the Federal Tax Service branch where the citizen is registered, the line “Federal Tax Service Code” is automatically filled in.

After completing these steps, a receipt appears, which can be paid on the website or printed, after which it is handed over to bank or post office employees. It is advisable to carry out a check to ensure that the entered data is correct.

Reporting and responsibility of the entrepreneur

Declarations are now submitted only by entrepreneurs who have employees. Since 2012, the state has abolished the reporting of individual entrepreneurs on contributions to funds for themselves. The tax office automatically calculates the amounts, and after payment the debt is removed. To make sure that the payment has reached the Federal Tax Service and has been counted, you can check this in your personal account on the website or call.

Since contributions to the pension insurance of individual entrepreneurs are accrued throughout the period of work (until the moment of exclusion from the Unified State Register of Individual Entrepreneurs), they must be paid no later than the deadlines specified in the code.

If an individual entrepreneur evades or delays payment, the Federal Tax Service has the right to apply the following sanctions:

- a penalty for each day of delay in the amount of 1/300 of the Central Bank refinancing rate in relation to the amount of debt;

- Individual entrepreneurs with an income amount exceeding 300 thousand rubles are subject to fines if an audit reveals its underestimation (the sanction is set at 20% of the amount), this applies to the OSN, Unified Agricultural Tax and Simplified Tax regimes.

Penalties are due after repayment of the principal debt. If during the period of delay the rate has changed, then from that day the amount of the penalty will be reduced or increased accordingly.

The Federal Tax Service is authorized to collect overdue payments from the debtor's accounts independently. Or file a claim in court, which will forward the decision to the bailiffs. This means that the debt will be collected from the personal property of the individual entrepreneur.

Nuances of filling out a receipt

The site has a special menu with tips, so if you follow them exactly, there will be no difficulties in creating the form. To fill it out, the data available in your personal account is used, and you also have to enter information from the taxpayer’s personal documentation.

During the process, the following nuances are taken into account:

- in the taxpayer status of individual entrepreneurs, enter code 09;

- the payment basis is the TP code if there are no fines or penalties;

- When choosing a tax period, indicate “annual payment”.

If erroneous information is entered, this may cause late payment, which leads to the accrual of fines.

Reducing taxes on the amount of contributions for yourself

The taxable base of the single tax is reduced by the full amount of paid contributions for:

- simplified tax system 15%;

- UTII;

- BASIC.

But this can be done if the payment took place during the period for which the tax is calculated. When filling out the income book, payments are entered in the expenses column.

Example: the basis for calculating the advance payment of the simplified tax system of 15% for the 1st quarter of 2021. is reduced by the amount of the contribution actually paid from 01/01/18 to 03/31/18.

Individual entrepreneurs who use the 6% simplified tax system and are not tax agents have another opportunity - to reduce not the base, but the amount of tax on insurance premiums paid. Moreover, the deduction is made without limitation and reduces the tax down to 0 rubles.

This includes all amounts of mandatory contributions (actually contributed to the budget) for yourself: for compulsory medical insurance, compulsory pension insurance and the 1% fee to the Pension Fund. Voluntary insurance is not taken into account.

The annual amount is calculated using the formula:

Income x 6% – advance payments from the beginning of the year – mandatory contributions paid = tax payable to the budget.

An individual entrepreneur on the simplified tax system of 6%, using hired labor, reduces the single tax of the simplified tax system by 50% of the amount of insurance premiums paid, not only for himself, but also for his employees.

The single tax on sick leave payments for the first three days (their employer, individual entrepreneur, pays it out of his own pocket) and on the amount of voluntary insurance for employees (50%) is also reduced. The tax is also reduced by a 1% contribution.

Payment terms

For convenience, fixed contributions can be paid in installments. A receipt for the Pension Fund and Social Insurance Fund for individual entrepreneurs 2021 can be printed for any period. For monthly payments, the annual amount is divided into 12 equal parts, for quarterly payments - into 4.

For what purpose is this done:

- reducing the one-time payment amount (it is easier to pay in installments);

- Since individual entrepreneurs are required to make advance payments of the basic tax to the budget every quarter, the amounts of contributions paid in the current quarter will be used to reduce the base.

The entrepreneur must remember that, whether in parts or in full, the full amount must be repaid within the following terms:

- Compulsory medical insurance and compulsory health insurance – until December 31 of the year for which they were accrued (i.e. for 2021 they are paid until 12/31/18);

- The 1% contribution is calculated and paid into the budget before July 1 of the year that follows the current one (for 2021, the deadline is 07/01/19).

Last days that fall on weekends or holidays are transferred to subsequent working days.

An entrepreneur with no staff has the right to 100% deduct paid (not accrued!) amounts of contributions from the taxable base for the basic tax. With employees, no more than 50% of the total amount of contributions is allowed (for yourself + for employees). Accordingly, advance tax payments will be significantly reduced.