The acceptance certificate of inventory items (TMT) is written in a free form, in which all goods are scrupulously noted, displaying the quantity, valuation, parameters and defects. Today, existing legislation offers a unified template for the acceptance certificate of goods and materials. It is regulated by Resolution No. 66 of the State Statistics Committee of the Russian Federation dated August 9, 1999, which approved the MX-1 form.

At the same time, each type of economic activity is documented in a primary accounting document, which is reflected in Article 9 of Law No. 402-FZ “On Accounting”. The provisions of the Law give institutions the right to draw up templates for primary accounting acts themselves.

In the life of enterprises, circumstances often arise when it is necessary to organize the transfer of products due to various reasons, for example, vacation, illness, business trip, dismissal of a financially responsible employee. This action must be documented in an acceptance certificate.

The act of receiving and transferring valuables: what is it?

The act of transfer and acceptance of inventory items (TMT) is a special document that allows a company or individuals to control and record their movement.

What does the term “values movement” mean? This is the very moment of transfer of any object of value from one person to another.

Example. Let's consider a situation familiar to many. Two out-of-town students rent an apartment. In this case, the owner of the apartment is the person who transfers the value (apartment) to the students, who accepts responsibility for its safety and the safety of all things inside it. The process of renting an apartment itself is a “movement of material value” from its owner to student tenants.

The transfer and acceptance certificate always indicates in detail all transferred goods and materials with a clear indication of quantity and cost (for example, the same furniture from the example above). This is done to protect them and provide a refund if damaged or lost.

However, the document does not define liability for violating its terms. He only records the fact itself. Therefore, it is best to immediately draw up an addition to it with prescribed sanctions. In the case of the example with students, this is a fine or the purchase of a new thing.

The situation is more complicated when taking into account inventory items at enterprises. Since these organizations have high responsibility, they are forced to closely monitor all movements of inventory items within themselves. For them, drawing up acts is the ideal solution. Thanks to them, the enterprise creates a clear system by which it is possible to track the movement of any inventory items at a certain moment.

See also: How to issue a power of attorney to receive material assets?

For even greater convenience, all things of the organization that have any material value are divided into categories. Each of them has its own article number, which is also indicated in the contract. The categories include:

- Packaging and storage containers;

- Fuel;

- Raw materials;

- The products themselves;

- Construction materials;

- Household equipment, etc.

Example. Office products (printing paper, pens, folders, staplers, hole punches, etc.) are inventory items in the office. In a company engaged in the construction of houses from solid timber, goods and materials are construction materials (logs, materials for foundations, corrugated sheets, metal tiles, etc.)

Why do you need an acceptance certificate for the transfer of goods and materials?

An act that is simply necessary in everyday life. We transfer material assets for storage, use, and rental not only in construction, but also in other areas of activity such as trade, real estate, etc.

This act leaves a certificate/fact/trace of the receipt and transfer of goods and materials; after signing this document, the person who received the material assets bears full responsibility for their preservation. However, this act does not regulate what responsibility the person receiving the goods bears in the event of damage/loss; it simply records the fact of transfer. To secure liability, it is necessary to conclude an agreement between the parties or a contract.

Unified form of Act MX-1 and MX-3

The form for the act of transfer of goods and materials is not strict, but is of a recommended nature. You can download this unified form MX-1 and MX-3 in Excel format on our website using the links below, and based on this, make an act for yourself or your organization.

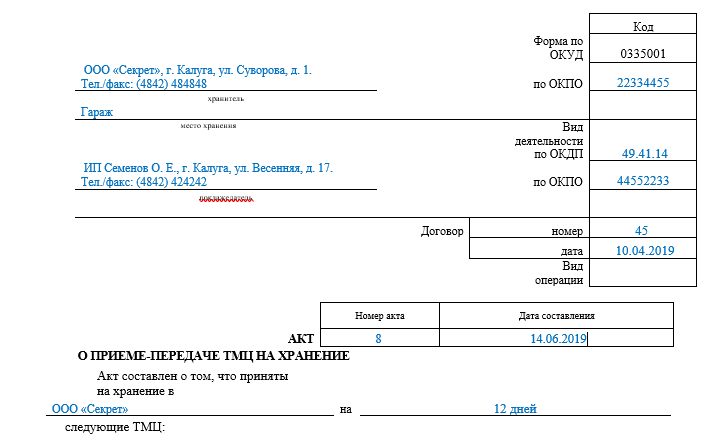

Features of using the MX-1 form

To formalize the fact of transfer of property for storage to professional and non-professional custodians, you will need to draw up a primary document. The best option for documenting the transfer of valuables for storage (although not mandatory for use) is to use an acceptance certificate for goods and materials according to the unified form MX-1, approved by Resolution of the State Statistics Committee of the Russian Federation dated 08/09/1999 No. 66.

It is preferable to formalize the transfer operation for storage in the MX-1 form because the unified form for the act of acceptance and transfer of material assets provides fields to reflect all the necessary information and, most likely, it will not need to be significantly modified. The transfer of property, as well as the transfer of all risks of possible loss or damage to inventory items, is carried out simultaneously with the signing of the act in the MX-1 form by the parties.

The completeness of the documents (the number of appendices to the act in form MX-1), as well as the number of copies of completed forms, is determined by the parties (bailor and custodian) in each specific case in accordance with the terms of the storage agreement.

Form and sample form MX-1

The unified form MX-1 can be downloaded on our website. Moreover, both this form and a completed sample will be available for download.

The sample completed document can be edited by entering your data into it.

In what cases is it compiled?

An order establishing the procedure for changing a person to whom the employer imposes measures of financial responsibility for the safety of the property entrusted to him is issued in the following situations:

- in case of termination of employment relations with an employee who bears property liability (regardless of the reasons for dismissal);

- when the employee is undergoing long-term treatment;

- when a materially responsible person exercises his right to legal rest of a specified duration (the order is drawn up before the employee goes on vacation);

- when an employee goes on a business trip;

- in case of improper handling of entrusted property (usually when it comes to premature wear, damage, deterioration or loss).

The determining factor is that the employee cannot perform functions related to ensuring the safety of material assets.

Who needs a simple sample act of acceptance of the transfer of material assets

Such forms are used mainly by those who are constantly involved in the receipt and transfer of inventory items - for example, in a warehouse. However, often such a form is not required, because it is simply necessary to record the fact of transfer of a laptop from one employee to another within the same organization. To do this, you need an act of acceptance of the transfer of material assets, a simple example. You can download this act in Word format from the link below.

About the form of the Act

To accept property for safekeeping, it is not enough to complete one inventory; it is also necessary to prepare an act in the established form. The form, as a rule, is established by enterprises, and it is not provided for by regulations.

What information should be displayed in the document:

- A list of all property in full, taking into account price indicators and technical characteristics.

- A list is prepared based on the inventory records.

- It is mandatory to indicate the calendar day for this type of inspection.

- Signing of the document by both parties.

- Certification by signatures of facility management and accounting department.

After the document is drawn up, the employee handing over the valuables may be released from performing this type of duty.

How to draw up an act of acceptance and transfer of material assets to an employee

The company develops the form independently. A similar one can be created for the case when an employee quits or returns from a business trip and hands over his work tools or equipment to the organization. The developed form will need to be consolidated in the company’s accounting policy.

What needs to be indicated in the document:

- Its name: act of acceptance and transfer of material assets to the employee.

- Place and date of compilation.

- Who transfers the values (name of the company or full name of the individual entrepreneur), full name and position of the person acting on behalf of the company, on the basis of which document it acts.

- To whom are the material assets transferred (full name and position of the employee, his passport details, place of residence).

- On the basis of what document did the employer transfer the valuables to the employee? This could be an employment contract (Article 21 and Article 22 of the Labor Code of the Russian Federation state that in order to perform duties the employee must receive everything necessary, this is stated in the employment contract), an additional agreement to it, an order.

- List of material assets with their characteristics: name (as in other documents), inventory number, quantity, cost. It is better to present this point in the form of a table. All digital data must be transcribed carefully.

- Material assets have been verified by the parties, there are no disagreements.

- Number of copies of the act. Usually there are 2 copies: for the employee and the employer.

At the end of the document there must be signatures of the parties. The document needs to be signed only when the parties have fully inspected the items.

Why do you need an acceptance certificate for the transfer of goods and materials?

Let's consider under what circumstances an acceptance certificate is drawn up:

- Discrepancy in numbers and inventory parameters.

- Arrival of goods and materials without documents.

- Transfer of inventory items for safekeeping.

- Transfer of assets by agreement of the commission.

- Transfer of inventory items within an institution between departments or financially responsible employees.

- Transfer of inventory items into temporary storage.

The example document below can be used together with the acceptance certificate for storage (form MX-1).

Receipt of products against an invoice implies the possibility that the goods delivered do not correspond to the quantity displayed on the invoice. However, there are circumstances when the actual quantity of products does not coincide with the declared quantity. To make a claim to the seller, it is necessary to reflect this circumstance in the acceptance certificate with recording of the identified discrepancies.

Acceptance of some types of goods and materials (for example, equipment) is carried out according to an act, since this is required by the procedure for its acceptance: inspection, determination of serviceability, etc. When sending inventory items for safekeeping, documents are drawn up describing the condition of inventory items, determining the conditions for their placement and appointing a materially responsible employee.

When signing an agreement for the supply of goods, the parties can write into the agreement a clause on the need to draw up an act of acceptance of the products upon transfer to the buyer.

Form of the act

The legislation does not provide for the mandatory use of any unified form. As a rule, each company independently develops a form for this act. However, the law requires you to include certain information here:

- Title of the document;

- Date of completion;

- the name of the company that filled out the act;

- information about the property being maintained;

- a unit of measurement in which the value of property is measured;

- detailed information about the persons between whom the transaction was concluded;

- signatures with transcripts, and other information allowing the identification of responsible employees. The document must be signed by all persons related to this transaction.

As a rule, to draw up this act, many companies use form MX-1. It is familiar and quite understandable. If the need arises, you can make the necessary adjustments to this unified form by adding or deleting certain data. Regardless of whether the company uses the MX-1 form or develops its own form, it must be certified by the company’s accounting policies.

How is it processed?

The order on the basis of which a change of person responsible for certain property is issued is drawn up in writing ; it must comply with the traditional requirements for this kind of documents.

An order to change the MOL can be drawn up on the company’s letterhead, and this document must also be signed by the first manager.

In addition, the order usually includes the following information:

- name of the company without generally accepted abbreviations;

- name (order);

- date and place of compilation;

- justification for the need to assign financial responsibility to another person - the reason why a certain employee will not be responsible for the property entrusted to him for a certain period of time is specified;

- a link to the document that serves as the basis for this type of change;

- data of the employee who was previously assigned financial responsibility;

- information about the employee to whom this responsibility passes;

- the date when this transition takes place (one person transfers and the other accepts property obligations);

- an indication of the fact of transfer of the entrusted property (this is recorded in the relevant act);

- the need to sign an additional agreement to the employment contract with a new employee;

- information about the employee who is entrusted with monitoring the execution of the order.

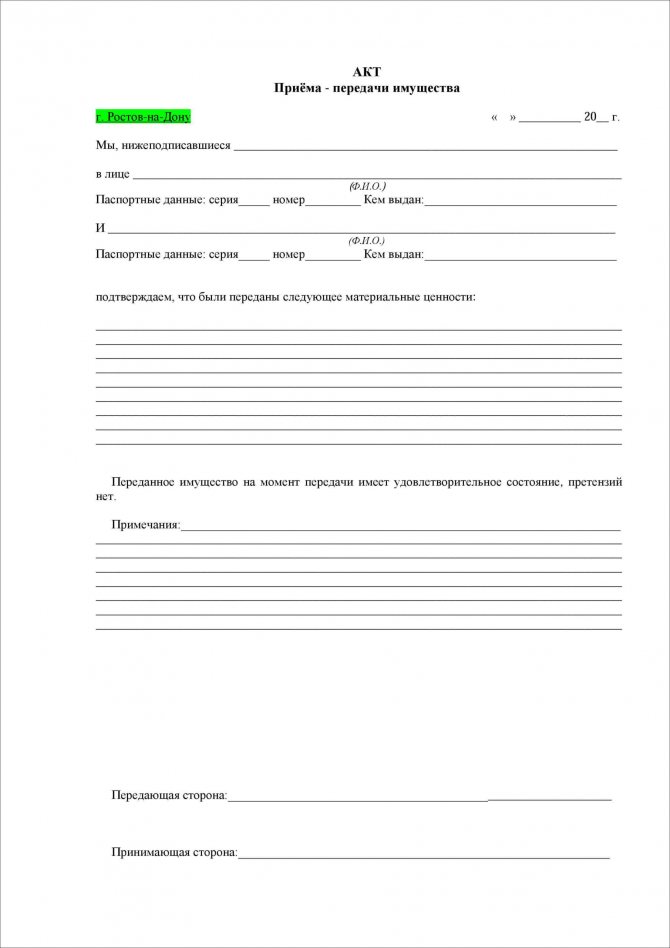

What is contained in the transfer and acceptance certificate

Persons responsible for drawing up this act must ensure that it is drawn up in duplicate. Accordingly, each of them is intended for one of the parties. In order to be able to resolve disputes through court, care must be taken to ensure that the document is properly executed. To do this, you will need to provide certain information here:

- document's name;

- place and date of execution of the transaction;

- detailed information about the participants in the transaction. For legal entities, details are indicated;

- if the act is accompanied by an agreement, provide information about it;

- information about property, its condition, quantity and quality;

- if there are defects, they must also be included in the document;

- if the property is rented for a certain period, it must be indicated. And in general, all the deadlines that both parties must comply with are indicated here;

- if there are claims regarding the quality and quantity of valuables from the receiving party, they are included in the document;

- if there are seals, they are affixed to the document;

- indicate the name of the operation that is accompanied by the execution of this act;

- information about the specific person who is responsible for the transfer of values;

- information about the person receiving the property;

- the number of copies compiled is indicated. As a rule, there are two of them. But, if the need arises, their number can be increased;

- It is necessary to indicate the value of the property being transferred.

It is worth noting that the paragraph intended to indicate claims is mandatory. Indeed, in the future, the owner of the property has the right to demand compensation for damage if it is caused to the property. Often, an act is drawn up when accepting and transferring not just one unit of property, but in relation to an entire group of material assets. This fact must also be indicated in the document.

Required details

The form must contain the following mandatory details:

- Title of the document;

- place of compilation;

- Date of preparation;

- information about the seller and buyer (name of organization, full name of director or individual entrepreneur, passport details, addresses and telephone numbers);

- reference to the subject, number and date of the contract;

- a complete description of the quality characteristics of the product, indicating defects;

- signatures of responsible persons;

- press of organizations.

One of the required details is the cost of the transferred inventory. At the same time, the seller is obliged to indicate the amount of VAT or the reason for tax exemption. In this case, the buyer will not have any controversial situations with the possibility of refunding VAT or attributing the full cost to expenses for income tax purposes.

It is also necessary to indicate the amount of funds received on the date of transfer of material assets. Indication of the prepayment received is not mandatory, but if used, it will facilitate further offsetting of mutual counter obligations, signing a reconciliation of mutual settlements, and in the case of transfer of payment for the supplier by third parties, it is mandatory to confirm the correctness of the calculations.

Examples of completed acts

For clarity, below are completed samples of the transfer and reception of values of the MX-1 form.

About the order of work

It is not possible to take into account the amount of material assets in full; every manager must understand this. In order to transfer all matters correctly, it is necessary to prepare a transfer act, which displays information about the number and names of assets entrusted to the enterprise. Such an inventory should be carried out upon going on vacation or when an employee is paid off.

The audit is carried out on the basis of methods developed by the enterprise.

Sequence of work:

- An administrative document on the creation of a commission is being prepared using a special form No. INV -22. The document must indicate the start and end dates of the work, after which it is familiarized with it to the persons participating in the event.

- Before the actual audit, it is necessary to transfer all invoices about receipts and expenses to the accounting department. This is the basic rule for carrying out work. It turns out that when materials arrive, they must be capitalized, and if the property cannot be used, it must be written off.

- The process itself is carried out in the presence of workers responsible for the materials. There must be resigning persons and newly hired persons.

- All members of the commission are involved in conducting verification activities.

- Based on the results of the inspection, an act is drawn up, which states what exactly was transferred for storage to another employee.

- The act is signed by two parties, the receiving farm and the transferring one. The date of transfer of valuables to another employee must be indicated.

After this, a reconciliation with accounting information is carried out. The documentation must be completed both on a computer and in your own hand. Moreover, the entries must be made correctly, without erasures and corrections are not allowed. You shouldn’t leave empty lines either, and if they still remain, then you need to put a dash.

What documents can replace the transfer and acceptance certificate

Everyone should understand that this act cannot fully replace a drawn up agreement, for example, a purchase agreement. The act only serves as its annex, which officially confirms the full or partial execution of the contract.

However, instead of the act, it is allowed to use some other documents. At the same time, they must also reflect the fact of transfer of property and contain other information that should be contained in the act. For example, such information may be present in the delivery note. Data about the parties and the product are also entered here, and other necessary information is indicated.

Thus, when a transfer of property occurs, an invoice may be used instead of a deed. But there are situations when such a replacement is not allowed. For example, if a transaction is being drawn up for the transfer of expensive devices or industrial equipment, when it is necessary to note the claims or lack thereof.

How to transfer upon dismissal

If an employee leaves the enterprise, he is obliged to transfer everything that he had on the farm.

In what stages is this carried out:

- A commission is being created that is independent of these cases.

- A day is set for the inventory work.

- Based on the results of the work, an inventory is prepared. The presence of material assets is checked by a commission; if the absence of any materials is found, this is also included in the act.

- The person accepting the site with entrusted valuables must check everything, the entries in the act must correspond to reality, otherwise problems may arise in the future.

- The acts are signed by both parties.

- The documents are transferred to the main accounting department, and the second copy is kept by the employee himself.

- Once the agreement on responsibility for the employer’s values has been concluded, the employee can perform his duties in full.

Legal subtleties

The document is drawn up in at least two copies for each party at the time of transfer of inventory items. Only authorized persons can sign it. If the buyer is a legal entity, then the powers of the representative, an individual, are confirmed by a power of attorney.

It should be noted that the obligation to transfer material assets with the execution of a deed is necessarily reflected in the contract. It is advisable to make the form itself as an annex to the contract. In this case, a simple sample act of acceptance and transfer of goods has the same legal force as the contract itself. If you have such a sample, you can familiarize yourself in advance with the main columns that must be filled out.

The presence of such a document as an act of transfer of material assets turns out to be very important for resolving controversial issues in court. It indicates the fact of acceptance and transfer of assets of proper quality and compliance with the entire procedure for the transfer and acceptance of goods. Proof of the absence of violations in the process of receiving goods is the following facts reflected in the document:

- material assets were inspected and accepted in the presence of an authorized representative of the supplier;

- there is no discrepancy in quality and quantity;

- delivery was carried out on time and without violation of delivery conditions;

- there are no claims against the counterparty (supplier, buyer, forwarder, intermediary).

conclusions

To summarize, it should be noted that in the event of a change in the financially responsible person, an order is issued in the established form.

This occurs both upon dismissal and when the employee is on vacation or sick leave.

The article describes typical situations. To solve your problem , write to our consultant or call for free:

+7 (499) 490-27-62 — Moscow — CALL

+7 — St. Petersburg — CALL

+8 ext.849 — Other regions — CALL

Sep 10, 2019adminlawsexp

vote

Article rating

Storage of primary documents

For tax accounting purposes, the primary record must be stored for 4 years (clause 8, clause 1, article 23 of the Tax Code of the Russian Federation). It should be noted that if a loss is incurred, then documents confirming expenses must be kept for 10 years (clause 4 of Article 283 of the Tax Code of the Russian Federation).

For accounting purposes, primary records are stored for 5 years (Article 29 of Law No. 402-FZ “On Accounting”).

Sources

- https://uvolsya.ru/raznoe/akt-priema-peredachi-tmts/

- https://profkarkasmontazh.ru/akt-priema-peredachi-materialnyh-tsennostej-obrazets-prostoj/

- https://nalog-nalog.ru/buhgalterskij_uchet/dokumenty_buhgalterskogo_ucheta/unificirovannaya_forma_mh1_skachat_blank_i_obrazec/

- https://assistentus.ru/forma/akt-priema-peredachi-materialnyh-cennostej-rabotniku/

- https://DocInfo.net/akt-priema-peredachi-materialnyh-tsennostej/

- https://InfoBlank.com/blank-akta-priema-peredachi-materialnyh-tsennostej/

- https://ppt.ru/forms/tmc/akt-priema