Business trips are an integral part of the work activity of employees, during which they leave their workplace and go to another locality to carry out an official assignment - for example, concluding contracts, carrying out repair work or the same level of qualifications.

Dear readers! The article talks about typical ways to resolve legal issues, but each case is individual. If you want to find out how to solve your particular problem , contact a consultant:

+7 (499) 938-81-90 (Moscow)

+7 (812) 467-32-77 (Saint Petersburg)

8 (800) 301-79-36 (Regions)

APPLICATIONS AND CALLS ARE ACCEPTED 24/7 and 7 days a week.

It's fast and FREE !

Accordingly, given that the employee is sent outside the enterprise, he is provided with a number of guarantees, which are stipulated not only in local acts, but also in federal legislation.

Is this legal?

If we take the phrase literally, and the employee will be sent on a business trip at his own expense, then this action will be completely illegal.

In this case, labor legislation will definitely side with the employee, since he is not obliged to spend his own money to fulfill the interests of his manager.

The phrase “business trip at the expense of the employee” refers to a type of business trip when the employee pays out of his own pocket not the full amount, but only part of the expenses. For example, buys tickets, rents housing or buys food. At the same time, the employee is obliged to keep all receipts and papers confirming the facts of expenses.

Upon return, the employee must provide the manager with all documents about expenses.

Based on them, the employee receives payments that fully compensate for the costs incurred by him. But there are cases when companies refuse to reimburse the full amount of expenses.

Most often they try to explain this by saying that the papers do not meet certain standards. Such behavior on the part of employers is also illegal.

Results

Thus, arranging a business trip at the expense of an employee is a gross violation on the part of the employer. In this case, the subordinate must act as follows:

- First of all, you need to tell the manager that his actions are illegal and violate the full rights of the employee.

- If the director uses other methods, for example, asking a subordinate to write an application for leave at his own expense, there is no need to agree to fulfill the employer’s request.

- If verbal conversations do not produce the desired results, the employee will have the legal right to make formal, written complaints. To do this, you can make a separate appeal addressed to the head of the organization. If the employer has not responded to such claims, the only option may be to contact organizations such as the Labor Inspectorate or a judicial institution.

Normative base

Each employer draws up travel conditions individually. However, he still must adhere to certain standards that are established by law, in particular, Chapter 24 of the Labor Code of the Russian Federation and Government Decree No. 749. These regulations clearly stipulate the conditions for work trips.

At the same time, enterprises are allowed to set certain conditions for the provision of compensation. Thus, employers have the right:

- set a higher daily allowance;

- refuse payments for taxi trips, or vice versa, include them as a separate section;

- establish a certain procedure for paying compensation in the event that tickets are surrendered;

- determine the possibility of booking hotel rooms.

But in any case, according to paragraph 10 of the mentioned Government Resolution, the employer is obligated to provide his employee with an advance that can cover all upcoming costs.

At the same time, in order to provide an employee with payments, it is necessary to prepare several documents, which may take more than one day. There are cases when work trips turn out to be urgent, and accountants simply do not have time to prepare the documentation.

In such a situation, there are two options. Either the trip is paid for by the receiving party, or the business trip is made at the employee’s own expense. The latter option is still illegal. However, it is practiced quite often, even in state-owned enterprises.

Business trip at your own expense

Only the company can make a business trip at its own expense. At the same time, both the sending and the receiving party can pay for the trip. There are no clear restrictions in this regard in the legislation.

This means that the employee must be financially secure in advance for his “journey”.

At the employee's own expense

As can be understood from the previous sections, sending an employee on a business trip, even if he will pay only part of the expenses, is not entirely legal. Even if the money is later returned to him in full.

A business trip for the head of an organization has its own design features. How to arrange a business trip for a part-time worker at the main place of work? See here.

Situation 2. Payment for taxi services to a posted employee

Expenses incurred by an employee on a business trip are included in expenses for income tax or tax under the simplified tax system (clause 12, clause 1, article 264, clause 13, clause 1, article 346.16 of the Tax Code of the Russian Federation).

In this case, the requirements of paragraph 1 of Art. 252 of the Tax Code of the Russian Federation. Solution

It is noteworthy that the list of travel expenses reimbursed to the employee, specified in all regulations, is open. The basis for including or not including certain expenses in income tax expenses (tax under the simplified tax system) is the provision on business trips established by an internal local act of the organization or a collective (employment agreement).

It is the organization that has the right to determine the conditions for including in expenses the payment for taxi services to a posted employee. For example, this could be the remoteness of an airport or train station, early or late arrival (departure) to the place of business travel. As documentary evidence, cash register receipts, a sales receipt, or a memo that justifies the production need to pay for taxi services can be attached to the advance report. If all the conditions are met, then the organization has the right to include costs in income tax expenses on the date the manager approves the employee’s advance report (clause 5, clause 7, article 272 of the Tax Code of the Russian Federation).

As for personal income tax, amounts reimbursed to an employee for travel expenses (an open list of them is given in paragraph 3 of Article 217 of the Tax Code of the Russian Federation) are also not subject to taxation within the limits established by the local acts of the organization. If payments are made in excess of the established norms, they are subject to personal income tax on a general basis. In this case, the date of actual receipt of income in accordance with paragraphs. 6 clause 1 art. 223 of the Tax Code of the Russian Federation is the last day of the month in which the advance report is approved after the employee returns from a business trip.

Advice

Do not forget that the tax agent is obliged to withhold the accrued amount of personal income tax directly from the taxpayer’s income upon actual payment. And transfer the amount of calculated and withheld tax no later than the day following the day of payment of income to the taxpayer (Article 226 of the Tax Code of the Russian Federation).

How to apply?

Due to the fact that a business trip at the employee’s expense is illegal, it is impossible to arrange such a trip.

If the boss wants to send his employee on a work trip, then he needs to first carry out a number of actions and collect a package of necessary documents.

Documentation

According to the law, in order for a business trip to be legal, the company must have an order.

It will form the basis for the trip and will contain the goals that the employee will need to achieve during the trip.

If any changes are made to the conditions of the business trip, they must also be present in the local acts of the organization.

A sample order for sending an employee on a business trip is here.

Employee consent

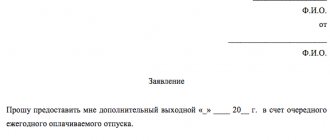

If an employee is offered to go on a business trip at his own expense, he has every right to refuse. However, some managers resort to tricks to avoid cost recovery.

Thus, some employers, in pursuit of profit during a business trip, try to send an employee on unpaid leave. Others are forced to write a statement indicating the employee’s consent to incur expenses without reimbursement. But in the first case, in the other case, actions on the part of the company will be illegal.

In the case of a regular business trip, the employee gives his consent when signing an employment contract with the organization.

This is where information about the possible occurrence of work trips is indicated. But there are several exceptions in which additional consent of employees is required, for example, when pregnant employees are traveling on business.

Order

The main document required to send an employee on a business trip is an order. It is drawn up in the legal form “T-9”.

If several people go on a trip, you can use the modified form - “T-9a”. It allows you to add several people at once.

The order must indicate:

- Full name of the employee;

- goals and objectives of the trip;

- travel time.

In addition, it will contain information about at whose expense the employee will live (the receiving or sending party).

The order form form T-9 is here,

order form form T-9a here.

Situation 1. An employee goes on a business trip using personal transport

A typical situation often arises in small and medium-sized companies that use OSNO or simplified tax system. Main questions:

- whether organizations have the right to take into account the actual costs of fuel and lubricants in expenses for income tax or tax under the simplified tax system or only within the limits of the standard;

- which document in the latter case regulates the standard;

- Are such payments subject to personal income tax?

Decision

An employer, when sending an employee on a business trip, is obliged to compensate him for business trip expenses, in particular, for travel to the place of business trip and back (clause 12, clause 1, article 264 of the Tax Code of the Russian Federation). At the same time, expenses for compensation for the use of personal cars for business trips are accepted within the limits established by the Government of the Russian Federation (clause 11, clause 1, article 264 of the Tax Code of the Russian Federation).

According to Art. 167 of the Labor Code, a business trip is a business trip, we can talk about the identity of these concepts in the Labor Code of the Russian Federation. But the Tax Code of the Russian Federation, for the purpose of attributing costs to expenses, quite clearly distinguishes between these concepts.

When an employee performs business trips, incl. to the place of business trip, in a personal car, compensation is paid for the use of personal property for business purposes (Article 188 of the Labor Code of the Russian Federation). In this case, the amount of reimbursement of expenses is determined by written agreement of the parties to the employment contract. However, the amount of compensation for the use of personal cars for business trips can be included in income tax expenses within the limits established by Decree of the Government of the Russian Federation dated 02/08/2002 No. 92. But the costs of fuel and lubricants are taken into account in the amount of actually incurred and documented expenses (Clause 12, Clause 1, Article 264 of the Tax Code of the Russian Federation). In this case, cash register receipts, acts, invoices, and other documents must be attached to the memo.

A completely legitimate question: are compensation subject to personal income tax? Let us remind you that all types of compensation payments established by the Labor Code of the Russian Federation (within the limits established by law) related to the taxpayer’s performance of labor duties are exempt from taxation (according to clause 3 of Article 217 of the Tax Code of the Russian Federation). Chapter 23 of the Tax Code of the Russian Federation does not contain compensation standards for the use of an employee’s personal property for official purposes and does not provide for the procedure for establishing them. When applying clause 3 of Art. 217 of the Tax Code of the Russian Federation, it is necessary to be guided by the provisions of the Labor Code of the Russian Federation.

In other words, the amount of compensation payments not subject to personal income tax should be determined by written agreement of the parties to the employment contract. This position was brought to the attention of taxpayers and departments: letters of the Federal Tax Service of Russia dated October 25, 2012 No. ED-4-3/ [email protected] , letters of the Ministry of Finance of Russia dated June 28, 2012 No. 03-03-06/1/326, dated August 8. 2012 No. 03-04-06/9-228 (all documents are available in SPS ConsultantPlus).

Advice

Do not forget to stipulate in the local act of the organization the very possibility of going on a business trip in the employee’s personal transport, the amount of compensation, as well as the rules for confirming the actual number of days on a business trip and paying compensation.

Payment

All payments in 2021 that relate to travel must be issued to the employee in advance. They can be transferred either through the company’s cash desk or transferred directly to the employee’s account.

Even if an employee immediately receives the amount he needs, he must keep all purchase receipts.

This is necessary so that upon arrival he can draw up a report, confirm the amount of expenses and return the balance of unspent funds to the cash desk.

A sample trip report is here,

The trip report form is here.

Employer's liability

If it is discovered that the company sends employees on business trips at their own expense, the employer will be held responsible for this. The basis for punishment will be Government Resolution No. 749.

According to the legislative document, the boss will be held accountable under Article 236 of the Labor Code of the Russian Federation.

According to it, the employer will be obliged not only to reimburse the employee for expenses, but also to pay him an additional 1/300 of the refinancing rate for each unpaid day.

In addition, administrative responsibility is also imposed on managers. It is expressed in the application of fines. Their size can vary from 30 to 50 thousand rubles. But that is not all.

If it is proven in court that non-payment was made for mercenary purposes, a half-million fine will be imposed on the employer or company.

In the worst case scenario, the employer will be deprived of the opportunity to occupy a leadership position.

The duration of working hours on a business trip is determined by local regulations of the enterprise. Is sick leave paid during a business trip? Information here.

How is salary calculated during a business trip? Details in this article.

How to restore justice?

That is, a statement drawn up by the employee in his own hand with a promise to bear all the costs of a business trip in some cases provokes employers into an even greater violation of the law, namely, refusal to compensate for the costs incurred.

In such a situation, the costs incurred are not returned to the employee, and compensation can only be obtained in court.

Employer's liability

In accordance with the law, the enterprise is responsible for late payment of funds that are due to the employee on the basis of the same Resolution No. 749.

That is, in court, the employer can be held liable under Article 236 of the Labor Code of the Russian Federation, according to which compensation for travel expenses will be made in a much larger amount, namely, taking into account each day of delay in the amount of 1/300 of the refinancing rate.

Also, in such a situation, the company’s management will be held administratively liable with penalties ranging from 30 thousand to 50 thousand rubles.

And as a last resort, if it is proven in court that advance payments, as well as compensation for travel expenses, were not made for the selfish motives of management, the company faces a fine of up to half a million rubles or deprivation of the right to hold a certain position in accordance with Part 2 of Art. .145.1 of the Criminal Code of the Russian Federation.

How to get my money back?

However, knowing about the consequences and the possible amount of punishment, many employers still violate the law, relying on the legal illiteracy of employees or their fear of being left without work.

That is why, to begin with, an employee who has been denied compensation should turn to the Labor Inspectorate and the Prosecutor's Office for help with just a statement about a violation of his rights.

They will then be defended by lawyers who have both the necessary knowledge and influence to resolve the issue in favor of the workers whose rights they are called upon to protect.

Can expenses be reimbursed?

Despite the fact that the penalties are quite severe, some employers still take risks, hoping that their employees are legally illiterate.

If the employee agrees, two outcomes arise: either the money is reimbursed in full, or payments are withheld partially or in full.

If an employer decides to deceive an employee, then the latter has every right to go to court. If there is sufficient evidence, lawyers will help the employee get his money back, and the employer will be punished in accordance with the law.