Advice from practitioners that will help rid bonuses from the suspicions of tax authorities.

In accordance with Art. 129 of the Labor Code of the Russian Federation, wages are remuneration for work depending on the employee’s qualifications, complexity, quantity, quality and conditions of the work performed. But in addition to salary, many employers want to further stimulate their employees by paying them bonuses.

Often, the manager does not think about the structure and nature of these payments, which can lead to adverse consequences.

The most important thing in determining this payment is that it is calculated in addition to the employee’s salary.

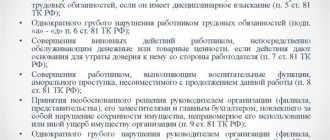

In accordance with paragraph 2 of Art. 255 of the Tax Code of the Russian Federation, bonuses for production results that are paid to employees, the organization has the right to classify as labor costs for profit tax purposes. However, the tax consequences of certain aspects of the bonuses can be very burdensome for the company.

How to develop and what documents to support?

We note that rewarding employees with bonuses is enshrined in the norms of the Labor Code of the Russian Federation (paragraph 4, paragraph 1, article 22 of the Labor Code of the Russian Federation, paragraph 1, article 191 of the Labor Code of the Russian Federation).

But to justify the costs of bonuses for its employees, the employer is obliged to fulfill a number of conditions: 1. Provide this remuneration. To do this, it is necessary to supplement the regulations on remuneration and labor (collective) agreements with information on bonuses for employees, but it is advisable to issue a new local regulatory act of the organization, namely a regulation on bonuses.

2. It is necessary to identify and consolidate specific and differentiated bonus indicators in personnel documents. This is necessary to comply with the requirements of paragraph 1 of Art. 252 of the Tax Code of the Russian Federation. An important criterion when developing bonus regulations is the use of realistically measurable indicators. It is important to avoid vague language.

Thus, in order to take into account the bonuses in question for tax purposes, the employment (collective) agreement, bonus provision or other local regulatory act must contain the following criteria:

- grounds for payment of bonuses, specific measurable performance indicators for bonuses;

- sources of bonus payment;

- amounts of bonuses and the procedure for their calculation.

3. It is necessary to have documents confirming the basis for payment of bonuses (clause 1 of Article 252 of the Tax Code of the Russian Federation). Such documents can be a petition, a memo from the immediate supervisor, supported by actual performance indicators of the employee, etc. Also, in order to document the costs of bonuses to employees, the employer must make these payments on the basis of an order (instruction) on rewarding employees (form T-11, T-11a or according to a form developed by the employer).

An important circumstance is that the bonus should not be paid at the expense of the organization’s net profit, special-purpose funds or targeted income. Payments from these sources are not taken into account for tax purposes (clause 1, 22, article 270 of the Tax Code of the Russian Federation).

Monthly bonuses to salary in the employment contract

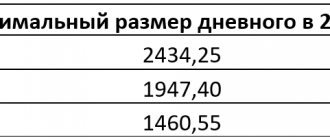

Most often, the size of the bonus is tied to salary. This makes it easier to calculate it; there is no need to sum up all the amounts received by the employee.

The amount of the premium can be set:

- As a percentage of salary. In this case, the employment contract should indicate that the employee receives bonuses (you can specify specific conditions for bonuses) in an amount that is a certain percentage of the salary portion of the salary. For example, if it is stated in the employment contract that the employee must receive a bonus in the amount of 50% of the salary, the amount of which is 10,000 rubles, every month, then the employer will be obliged to pay the employee a bonus of 5,000 rubles every month.

- In shares of salary. For example, if an employee’s salary is 5,000 rubles, and the contract states that the employee is paid a bonus in the amount of 1/3 of the salary monthly, then the employer will be required to pay the employee an additional 1,666 rubles 67 kopecks every month.

- In the amount of salary. Everything is simple here. The bonus amount is equal to the salary.

If the organization has adopted a Regulation on bonuses, then it is enough to indicate in the employment contract that bonuses are paid to the employee in accordance with such Regulations. Be sure to include the details of the document. The wording may look like this: “The employee is paid bonuses in the manner prescribed by the Regulations on bonuses, approved by order of the director of Romashka LLC dated dd.mm.yyyy No. 14-P.”

Thus, in the employment contract you can prescribe a full-fledged bonus system for a specific employee, or make a link to the company’s internal document regulating the payment of bonuses.

How much and what to pay for?

The size of the premium can be fixed, as well as differentiated (as a percentage of a certain amount).

A fixed percentage of the bonus can be set for the absence of defects and complaints, for the completion of work and services according to established deadlines, etc. For example, 20% of piecework earnings, 30% of the official salary. If the number of bonus indicators complicates the calculation of the final bonus amount, you can set a bonus limit with a gradation from minimum to maximum (the amount of the monthly bonus is from 20 to 50% of the employee’s salary).

You can also draw up a crisis sheet, which will indicate all bonus criteria. During the month, the head of the structural unit will evaluate the employee’s performance on a 10-point scale, and at the end of the month issue final grades. However, in such cases, accusations of subjectivity on the part of the employees being evaluated cannot be avoided, which can lead to an unfavorable environment within the team.

Bonus criteria deserve special attention for the reason that precisely due to their absence, ambiguity, and opacity, tax authorities may come to the conclusion that bonus payments are unjustified, which can lead to additional income tax charges.

In each company, bonus criteria differ depending on their functional purpose and the structural unit in which the employee is employed.

For employees who are directly involved in the production of products, the following bonus indicators are established: fulfillment of the production plan in a given volume, minimization of defects.

For the commercial department, important performance criteria are clearly: meeting KPI indicators, effective work with current clients, the absence of complaints and claims regarding the quality of products sold and services provided from buyers and customers. But here it is important to take into account that the monthly fulfillment of these indicators does not provide for bonus payments, since they are specified as functional responsibilities in employment contracts with employees of the commercial department. The basis for bonuses can only be exceeding KPI indicators, expanding the client base, etc.

It is important to take into account here that the use of the same bonus criteria for all structural divisions of the company is not applicable, and they must be established based on the job responsibilities of an individual employee.

Often, an employer has a question regarding the justification of bonuses for employees of the accounting department, human resources department, information technology department and other departments that are not related to the production and sale of products.

Indeed, the job responsibilities of these employees do not directly correlate with the main goal of the organization - profit maximization.

However, this does not serve as a basis for refusing bonuses to these categories of employees.

In this case, when developing bonus criteria, it is necessary to take into account job responsibilities and the effectiveness of their implementation.

For example, the basis for paying a bonus to an accounting employee may be:

- improving accounting methods through the effective implementation and use of new software;

- timely and high-quality preparation of reports on personalized data to pension and other funds, the Federal Tax Service and other regulatory authorities;

- absence of comments on the results of various inspections;

- high results when performing complex unscheduled work

- high speed while performing various functions simultaneously

- maintaining financial discipline, etc.

As for the information technology department, the employer can justify expenses here by specifying in the bonus regulations such criteria as: introduction of new technologies in order to increase the company’s information security, uninterrupted operation of infrastructure equipment, high speed of troubleshooting of computers and office equipment, development of new software equipment to improve the efficiency of various structural divisions, etc.

It is not recommended to use wording such as “for a conscientious attitude to work” or “for compliance with labor standards and labor discipline.”

Due to their “vagueness”, the company may face claims from regulatory authorities.

Monthly salary bonus in the employment contract

The employment contract may stipulate the procedure for bonuses for a specific employee. It must be strictly observed.

Can be fixed:

- The employee’s right to receive a monthly, quarterly, annual bonus, without any reason.

- The employee’s right to a monthly bonus depending on performance indicators.

- The right to a monthly bonus on other grounds. They can be absolutely anything.

- Premium size.

- Grounds for deprivation or reduction of bonuses.

Salary according to Art. 129 of the Labor Code of the Russian Federation is remuneration for work, which consists of salary, compensation and incentive payments. Bonuses can be accrued both on bare salary and on all payments in the aggregate.

Have a question? We'll answer by phone! The call is free!

Let's give an example. The employee, by virtue of the provisions of the employment contract, receives a salary, which consists of a salary, a monthly payment for length of service, and a regional coefficient. Salary 5000 rubles, payment for length of service 5000 rubles, coefficient 15%. In addition, the employment contract stipulates that the employee is paid a monthly bonus in the amount of 50% of the salary. This means that every month the employer is obliged to pay a bonus in the amount of ((5000+5000)*0.15) * 50% = 5750.

The wording in the employment contract may look like this:

- “The employee’s salary consists of a salary of 20,000 rubles and a monthly bonus of 50% of the salary.”

- “Based on the results of work for each month, an employee has the right to receive a bonus in the amount of wages. The bonus is paid if the employee fulfills the conditions of clause 12 of the Regulations on bonuses, approved by Order No. 12-P dated March 12, 2016.”

Is everything so simple with bonuses to management?

Bonuses to the company's management deserve special attention.

For top management, bonus indicators are primarily related to making a profit. Here you can take as a basis: exceeding the monthly sales plan as a percentage, effectively conducting marketing activities, reducing the number of complaints from customers, ensuring the uninterrupted operation of computer equipment and office infrastructure, increasing the volume of supplies and monitoring their uninterruption, as well as the number of new contracts with suppliers and customers. Let us remind you that when assigning a bonus to employees, a corresponding order from the head of the organization is required. But this rule does not apply when it comes to remuneration for the general director and this is due, first of all, to his special legal status.

In a company where the general director is not its sole founder, payment of a bonus cannot be made only on the basis of his order (Part 2 of Article 135, Article 191 of the Labor Code of the Russian Federation). This is due to the fact that this issue is regulated simultaneously by labor law and the norms of corporate legislation (part 2 of article 145 of the Labor Code of the Russian Federation, paragraph 4 of article 40 of Federal Law No. 14-FZ “On Limited Liability Companies”). Therefore, the amount of remuneration for the general director, including bonuses, is determined by agreement between him and the founders, the board of directors (supervisory board) of the company, and the decision to pay the bonus is made on the basis of the minutes of the general meeting of participants (shareholders) of the company, or on the basis of a decision of the board of directors or supervisory board advice.

In the case of an employment relationship between the general director, who is also the sole founder, and the organization, expenses associated with the payment of wages are taken into account according to the general rule (clause 1 of article 255 of the Tax Code of the Russian Federation, clause 6 of clause 1 of article 346.16 of the Tax Code of the Russian Federation).

But it is important to remember that the bonus was provided for in the employment contract, otherwise such payments do not reduce the taxable base for income tax (letter of the Ministry of Finance of the Russian Federation dated October 13, 2015 No. 03-03-06/1/58416, clause 21 of Article 270 of the Tax Code RF). The criteria for bonuses can be agreed upon jointly with the personnel service based on the activities of the enterprise, and the decision on payment in any case is made on the basis of the minutes of the general meeting of participants (shareholders) of the company, or on the basis of a decision of the board of directors or supervisory board.

If the director’s legal relationship with the organization is not formalized by an employment contract, then all payments in his favor cannot be accepted for tax purposes (Clause 21, Article 270 of the Tax Code of the Russian Federation).

It follows from this that the general director of the organization, who is also its sole founder, does not have the right to single-handedly calculate and pay wages, as well as make bonus payments. Consequently, the organization does not have the right to take such expenses into account for tax purposes (letter of the Ministry of Finance of the Russian Federation dated February 19, 2015 No. 03-11-06/2/7790).

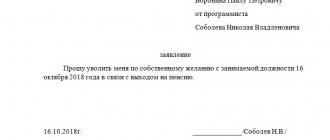

Making an entry about the bonus in the employment contract

So, how to write a bonus in an employment contract?

If there is a provision on incentive payments in the text of the employment contract, it is possible to write, for example, the following content:

“Bonus payments to employees are carried out in accordance with the rules of the employer’s Regulations on Bonuses.”

If the employer does not have an internal regulatory document or an individual bonus scheme has been established for the employee, then, for example, the following entry may be made in his employment contract:

“If the employee performs job duties conscientiously, the employee is paid a monthly bonus in the amount of 20% of the salary.”

Read about what else should be reflected in the employment contract in the material “Procedure for concluding an employment contract (nuances).”

What about bonuses for significant dates?

Some companies pay bonuses for significant dates (March 8 - International Women's Day, May 9 - Victory Day, 12 - Russia Day) or professional holidays (March 29 - Lawyer's Day, May 24 - Personnel Day, September 16 - Workers' Day forests).

The inclusion of these payments in expenses will definitely cause claims from regulatory authorities. It is important to take into account that, according to the Russian Ministry of Finance, these payments are not related to production results and are not incentives. Therefore, the employer does not have the right to take them into account when calculating income tax (letters of the Ministry of Finance of Russia dated July 22, 2016 No. 03-03-06/1/42954, dated July 9, 2014 No. 03-03-06/1/33167, etc. .).

How can an employee establish additional payment?

How can an employee set additional payment?

articles

How to set a monthly salary bonus for employees

In addition, indicate the established additional payments and increases in the employment contract with the employee (Part 1 Stat.. 129 and Part 1 Stat.. 135 of the Labor Code of the Russian Federation).

8.14. Certificates of salary amounts, accruals and deductions from it are issued only to the Employee personally.

How to include salary supplements for employees in an employment contract

It is also a violation of the employee’s rights if more than 15 calendar days pass between the advance payment and the final payment.

Seminar:\

- The form of remuneration was incorrectly indicated. An error will be considered a situation when the employer pays part of the salary in product, and this is either not fixed in any way in the contract, or the largest share of the total payment is not limited. In the Labor Code of the Russian Federation, this figure is 20% of the monthly salary. Moreover, the employee's written consent is required. If wages are indicated in foreign currency, then such a document will not be valid in our country. Regardless of what currencies the organization works with, the amount of payment in the employment contract is specified exclusively in rubles.

- Illegal penalties are prescribed. In order to further stimulate employees and preserve their own funds, employers indicate various fines in the contract.

Note! Individual increases to the official salary provided for in an employment contract with reference to the current remuneration system in the organization can be taken into account in the expenses of corporate income tax (clause 2, 25, part 2 of the statute. 255, clause 21 of the statute. 270 of the Tax Code of the Russian Federation).

Dear readers!

We describe typical ways to resolve legal issues, but each case is unique and requires individual legal assistance.

To quickly resolve your problem, we recommend contacting qualified lawyers on our website .

Note! When establishing individual bonuses, the employer must not discriminate against employees (stat. 132 of the Labor Code of the Russian Federation).

Expanding service areas correctly

When expanding service areas, as in cases of combining professions (positions), increasing the volume of work, or fulfilling the obligations of a temporarily absent employee without exemption from the work specified in the employment contract, the employee’s remuneration is made taking into account the provisions of Article 151 of the Labor Code of the Russian Federation.

What is the procedure for establishing additional payment to an employee for expanding the service area?

8. Benefits for temporary disability or pregnancy and childbirth are not accrued.

March 2, 2009

How to set additional payments based on the results of SOUT

- 1st class - rational working conditions. They are considered harmless to humans;

- Class 2 - acceptable working conditions. The employee is affected by harmful causes, but the body recovers during rest or at the beginning of the next working day (shift);

- 3rd class - harmful working conditions. The impact of harmful causes is exceeded;

- 4th class - unsafe working conditions. The impact of such causes during the entire working day (shift) or part of it can endanger the life of an employee.

TRADE UNION OF HEALTHCARE WORKERS OF THE RF MAGADAN REGIONAL TRADE UNION ORGANIZATION

Newsletter of the magazine "Personnel Department"

How is the increase for length of service paid?

Subscribers to this mailing list receive notifications about the release of new issues of the magazine, about new planned direct telephone lines, about the release of our new projects and the start of the next subscription campaign. The average frequency of mailings is 2-3 times per month.

How to correctly calculate additional payment for an employee performing the duties of a sick employee

However, labor legislation does not define the concept of “replacement”. Within the meaning of stat.. 72.2 of the Labor Code of the Russian Federation, replacement means the fulfillment of the obligations of a temporarily absent employee with release from work specified in the employment contract.

Thus, in a situation where, along with the work stipulated by the employment contract, an employee performs the duties of a temporarily absent employee during the working day (shift), this is additional work for which the employee must be paid.

The amount of additional payment is established by agreement of the parties to the contract, taking into account the content and (or) volume of additional work (stat.. stat.. 60.2, 151 of the Labor Code of the Russian Federation).

Based on the literal interpretation of stat.. 60.

2 of the Labor Code of the Russian Federation it follows that the combination of professions (positions) is understood as the performance by an employee, along with his own main work, defined by the employment contract, of additional work in another profession (position). In other words, the employee is not relieved of his own main job, and the duties of the combined profession (position) are performed during the same working hours.

How to set an employee's salary

The employee works part-time or part-time

If an employee has worked the established standard of time per month and fulfilled the established job duties, his salary should not be less than the small wage (minimum wage).

HQ — — — Lawyer

in connection with this and that I order. In general, something like this. Different organizations may have their own design rules - fonts, margins, indents.

absolutely accurate with time

In the translation, you must indicate the salary or GTS, grade and hour.

the rate depends on who is on sick leave before the fact or on this day, otherwise if the employee

knows, then this is a direct violation.

but don't forget to pay

before.

Dear readers!

We describe typical ways to resolve legal issues, but each case is unique and requires individual legal assistance.

To quickly resolve your problem, we recommend contacting qualified lawyers on our website .

Source: https://nashy-lgoty.ru/kak-rabotniku-ustanovit-doplatu/