Source of rules for reflecting sales in accounting

The principles that should be followed when registering sales transactions are set out in PBU 9/99 (approved by Order of the Ministry of Finance of Russia dated May 6, 1999 No. 32n). This document, as a basic rule, establishes the division of all income arising from a legal entity:

- for ordinary ones, received regularly from the main activities;

- others, which are not derived from core activities and, as a rule, have a small share of total sales, even if they occur regularly.

A legal entity independently (based on the characteristics of its activities that affect the classification of income as ordinary or other) makes a decision on how to divide its income into these two types (clause 4 of PBU 9/99), fixing this in its accounting policies.

Among the income classified as ordinary, PBU 9/99 (clause 5) specifies as the main income those arising from sales of products, goods, works and services. Their value should be determined without VAT and excise taxes (clause 3 of PBU 9/99).

The moment for recognizing sales revenue occurs when the following conditions are simultaneously met (clause 12 of PBU 9/99):

- has the right to receive it;

- you can determine a specific amount;

- the proceeds are recognized as providing benefits to its recipient;

- there has been a transfer of ownership of the item of sale;

- you can determine the amount of expenses incurred during the sale.

Check whether you correctly reflect the sale of goods in accounting and tax accounting using the Ready-made solution from ConsultantPlus. If you do not have access to the K+ system, get a trial online access for free.

Legal entities that use the opportunity to simplify accounting and accounting have the right to recognize income from sales as payment is received (i.e., without reference to the fact of transfer of ownership).

With a long cycle of creating an item for sale, it is allowed to recognize income not at the end of this cycle, but as individual parts are ready (clause 13 of PBU 9/99).

Postings for VAT during reverse sales

A reverse sale is a regular sale with standard transactions. In our case, the supplier and buyer change places. Therefore, the supplier becomes the buyer and builds such accounting lines.

| Debit | Credit | Description |

| 41 | 60 | Returned goods are capitalized |

| 19 | 60 | “Input” VAT is charged on the cost of returned goods |

| 68.VAT | 19 | “Input” VAT is subject to deduction |

And the buyer becomes the supplier and makes such transactions.

| Debit | Credit | Description |

| 62 | 90.01 | Revenue from the return of defective goods is reflected |

| 90.02 | 41 | The cost of defective goods has been written off |

| 90.03 | 68 | VAT is charged on the cost of defective goods |

Accounting for sales by core activity (products, goods, works and services)

All accounting operations arising in connection with sales in the main activity, the Chart of Accounts (approved by order of the Ministry of Finance of the Russian Federation dated October 31, 2000 No. 94n) prescribes to be carried out using account 90. Since both income and related expenses will fall here, account 90 will be formed financial result from sales.

Analytics organized on this account should make it possible to see sales data from each type of core activity. Trade organizations, in particular, should separate accounting entries for the sale of goods and the provision of services for their delivery to customers.

On the credit of account 90, as a result of posting Dt 62 Kt 90, income from each sale will be reflected in the full amount, including VAT and excise taxes. Since taxes should not be taken into account in the amount of income that forms the financial result, an entry will be made for their amount Dt 90 Kt 68, taking into account the accrual of taxes payable to the budget while simultaneously reducing sales income by their amount.

Also, expenses arising during the sale will be debited to account 90. This will be expressed by postings:

- Dt 90 Kt 43 (21, 40) in relation to the cost of products of own production;

- Dt 90 Kt 20 (23, 40) for the cost of work performed, services provided;

- Dt 90 Kt 41 at the accounting cost of goods sold;

- Dt 90 Kt 26 for general expenses;

- Dt 90 Kt 44 in relation to expenses for organizing sales.

In retail trade, goods can be accepted for registration not only at their actual cost, but also at the sales price (clause 20 of FSBU 5/2019, until 2021 - clause 13 of PBU 5/01), which leads to the appearance of additional posting Dt 41 Kt 42, which adds a markup amount to the supplier’s price. In this case, at the time of sale of the goods by posting Dt 90 Kt 42 reversal, the cost of its sale is reduced to the actual one.

ConsultantPlus experts explained in detail how to account for reserves according to the standards of the new FAS 5/2019. To do everything correctly, get trial access to the system and go to the Ready solution. It's free.

Postings for VAT when returning goods

The buyer can return previously delivered goods. There are two options - standard return or buyback. Which one to use depends on the terms of the contract between the supplier and the buyer. Usually a refund is issued, but the contract may contain a buyback condition.

Postings for VAT for standard returns

For a normal return, the supplier will make the following entries.

| Debit | Credit | Description |

| 62 | 90.01 | RESTORATION of revenue on returned goods |

| 90.02 | 41 | REWARD of the cost of the returned goods |

| 90.3 | 68.VAT | REVERSE of VAT accrued upon shipment for defective goods |

The buyer's accounting department, in turn, builds such accounting records.

| Debit | Credit | Description |

| 76 | 41 | The cost of goods subject to return is reflected |

| 76 | 68 | The VAT amount on the adjustment invoice has been adjusted |

Postings for the sale of property not intended for sale

In relation to other sales (not included in those related to the main activity), sales entries in accounting are made using account 91. Typically, this includes income from the rental and sale of property acquired as necessary to ensure the functioning of the legal entity, but due to for any reason that it was not sold.

On account 91, analytics by type of sales should also be organized. The financial result from them will be formed according to the same principle as on account 90:

- the credit of the account will reflect the income in its full amount (Dt 62 Kt 91);

- on debit the following will arise: VAT included in the amount of income (Dt 91 Kt 68);

- accounting value of the property being sold (Dt 91 Kt 10 (01, 04, 07, 08, 58));

- expenses associated with sales (Dt 91 Kt 23 (70, 71, 76)).

However, such entries will not have anything to do with the sale of goods, since the goods are property originally intended for sale, and they are acquired for this purpose by trading organizations, i.e. those for which trade is the main activity.

Transactions for VAT, which cannot be deducted

VAT can be deducted only if goods and materials and services are used in activities subject to VAT. Otherwise, VAT will have to be included in the cost of goods or services.

For example, Medic LLC sells medical products that are exempt from VAT. To deliver them to the buyer, the company buys a transport service for 12,000 rubles, including VAT 20% - 2,000 rubles. “Input” VAT cannot be deducted, so the tax is written off to the cost account.

| Debit | Credit | Sum | Description |

| 20 / 23 / 25 / 26 / 29 / 44 | 60 | 10 000 | The cost of the service excluding VAT is written off as expenses. |

| 19 | 60 | 2 000 | “Incoming” VAT has been accepted for accounting |

| 20 / 23 / 25 / 26 / 29 / 44 | 19 | 2 000 | “Input” VAT is included in costs, since it cannot be deducted |

Instead of cost accounts, you can use accounts 08, 10 or 41, since inventory items can also be used in activities not subject to VAT.

Important! Goods that are exempt from VAT are listed in Art. 149 of the Tax Code of the Russian Federation.

VAT cannot be deducted if there is no properly issued invoice for it. In such a situation, VAT is written off as other expenses as an accounting entry.

| Debit | Credit | Description |

| 91 | 19 | VAT is written off as other expenses |

Results

Income from the sale of goods refers to those received from the activity for which the legal entity was created, i.e., to ordinary income for accounting purposes.

The financial result from such sales is reflected in account 90, the credit of which shows the income in its full amount, including taxes, and the debit shows the amount of these same taxes, the book value of goods and sales expenses. For retail, which sets the accounting value of the goods equal to the sales price, this value at the time of sale is adjusted to the actual value by taking into account in account 90 the markup related to it, expressed as a negative value. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Postings for VAT from advances

An advance is a method of payment for goods or services. The buyer transfers money partially or in full until the goods are still shipped. In this case, the supplier makes the following entries for the advance received.

| Debit | Credit | Description |

| 50 / 51 / 52 | 62.02 | Advance received from buyer |

| 76 | 68.VAT | VAT is charged on the advance payment received |

| 62.01 | 90.01 | Revenue received from the sale of goods |

| 90.03 | 68.VAT | VAT charged on sales |

| 90.02 | 41 | Cost of goods sold written off |

| 62.2 | 62.1 | Previously received advance is offset against debt repayment |

| 68.VAT | 76 | VAT is credited from the advance payment upon completed shipment |

Accounting for an advance issued by a buyer looks different.

| Debit | Credit | Description |

| 60 | 50 / 51 / 52 | Advance paid to supplier |

| 19 | 60 | VAT is charged on the advance amount |

| 68.VAT | 19 | Accepted for deduction of VAT on advance payment |

| 41 | 60 | Goods received from supplier |

| 68.VAT | 19 | Accepted for deduction of VAT on the cost of goods received |

| 60 | 68.VAT | Recovered VAT from advance payment |

Instead of account 41, use cost accounts 20, 23, 25, 26, 29 or 44 for services and works. And to account for raw materials and supplies, use count 10.

Objects of analytics of the movement of transferred goods in management accounting

The concept of “Movement” of transferred goods in management accounting means income and expense. They are accumulated in special registers, on the basis of which reports are generated. For example, in the accumulation register of transferred goods, income is determined by the shipment of goods minus returns, and expense is determined by goods sold; in accounting language this is called the debit and credit of account 45, respectively, and the balance of this account corresponds to the balance of unsold goods.

By the concept of an analytics object, I mean measurements in these accumulation registers, which are used to record the turnover and balances of transferred goods and payments. These measurements are:

- Nomenclature

- Counterparty

- Counterparty agreement

- Deal

- Transfer status

Please note that the Commission Agent's Store, where the goods are delivered, is not the object of accounting analytics, i.e. the program does not know which items remain unsold in the stores. This is only because the only agreement that is concluded with the commission agent is not based on orders and the committent does not want to create a separate agreement with each store.

Imagine, we need to track the goods sold in each store under one contract with an agent (commission agent). In this case, the contract must be concluded based on orders, since the delivery address is indicated in the order. It is the delivery address that connects the order with the store located at this address. However, it was also possible to maintain any store identification characteristic in the order properties, for example Store number. The main thing is that in all documents drawn up under such an agreement, indication of the order is mandatory.

Thus, the concept of an order means a transaction with a commission agent’s store, and by receiving analytics in the context of the order, we can track movements across stores.

Directory “Item Price Types”

The pricing section is not covered in this part of the instructions. We only note that the directory “Item Price Types” is intended to store only types of company selling prices.

The contract with the commission agent must indicate the type of selling prices below which the commission agent should not release goods to the final buyer.

Selling prices are used to default to transfer prices in shipping documents, agent orders, and agent sales reports. If there is no price type in the contract, operators are forced to adjust the prices in the shipping documents.

Selling prices are always assigned per unit of storage of item balances.

If the user is interested, I can add that all selling prices, in terms of methods of their formation and storage, are divided into three categories:

- "Base prices" . These prices are set for each item only manually. These prices are determined by the user and stored in the system. When accessing these prices, the system takes the most recent value. For these types of prices, in the Price calculation parameter it is indicated - “Prices are assigned and stored for each item of the item.”

- Estimated prices." Just like base prices, calculated prices are specified by the user and their value is stored in the system. The difference is that these prices have an automatic way of calculating them based on the base price data. That is, calculated prices are obtained from the base prices through some procedure, for example, by increasing the base price values by a certain markup percentage. Regardless of how the calculated price is ultimately obtained, the system stores only the resulting price value itself and the type of base prices on the basis of which the calculation was made. Estimated prices can be wholesale and retail prices obtained on the basis of factory prices or based on the planned cost of production. For these prices, the “Price calculation” parameter indicates “Prices are assigned and stored for each product item”, and also sets the value of the base price and markup.

- Dynamic prices" . The values of these prices are not stored in the system; only the method for calculating them is stored. These prices, like calculated prices, are obtained from base prices using special mechanisms. However, the calculation results are not stored in the system; the calculation is performed directly at the time of accessing these prices. For these prices, the “Price calculation” parameter indicates “Prices are calculated automatically from prices of the base type”, and also sets the value of the base price and markup.

This allows you to use prices if selling prices are strictly linked to the base price, which changes quite often.

It is possible to store prices that include value added tax (VAT). For this purpose, the dialog provides a flag “ Prices include VAT” .

Writing off the actual cost of work performed as expenses

In 1C, to recognize direct expenses at the time of sale, you must set the following in the Accounting Policy : PDF

- checkbox Perform work, provide services to customers ;

- Costs are written off - Taking into account all revenue .

When performing work, direct costs are recorded in different documents depending on the type of cost, for example:

- Document Payroll PDF - to reflect the costs of remuneration of employees (insurance contributions) of employees performing work.

- Document Requirement invoice - for writing off the necessary materials when performing work. PDF;

- Document Receipt (act, invoice) transaction type Services (act) - to reflect expenses for services provided by third parties.

In order for costs to be taken into account when calculating the cost of work, they must be reflected in the same item group as sales.

The actual cost of work performed is written off as expenses using the operation Closing accounts 20, 23, 25,26 in the Month Closing procedure, section Operations – Period Closing – Month Closing.

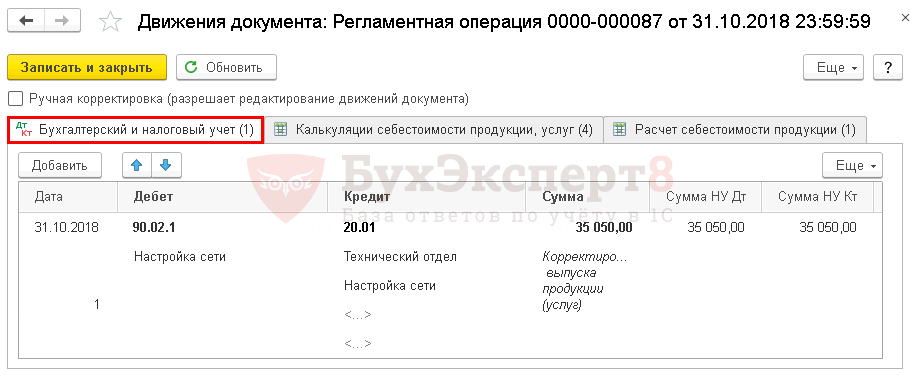

Postings according to the document

The document generates the posting:

- Dt 90.02.1 Kt 20.01 - writing off as expenses the actual cost of work performed.

Control

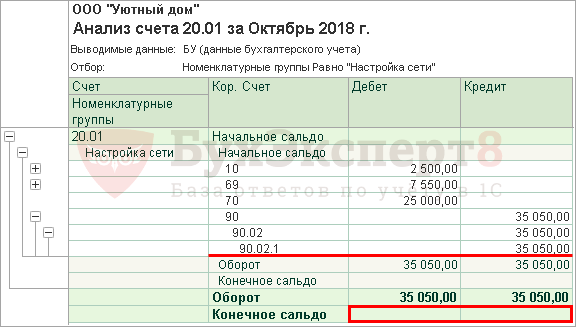

In October, costs in the amount of RUB 35,050 were taken into account for the Network Setup , including: PDF

- wages - 25,000 rubles;

- insurance premiums (including from NS and PZ) - 7,550 rubles;

- material costs—RUB 2,500.

Let's generate a report Analysis of invoice 20.01 “Main production” for October in the section Reports – Standard reports – Invoice analysis.

From the report it is clear that for the product group Network Settings :

- There was no work in progress at the beginning of the month.

- At the end of the month, all expenses in the amount of 35,050 rubles. written off as the cost of work performed.

Income tax return

In the income tax return, the cost of work performed is reflected as direct expenses:

Sheet 02 Appendix No. 2:

- p.010 “Direct costs related to goods sold (work, services).” PDF

Test yourself! Take a test on this topic using the link >>

See also:

- Revenues from sales

- Receipt of payment from the buyer (advance payment)

- Document Implementation (act, invoice)

Did the article help?

Get another secret bonus and full access to the BukhExpert8 help system for 14 days free of charge

Related publications

- Payment for travel to the work site for contract workers. Payment for accommodation at the work site for contract workers. We send an employee working under a GPC contract to the place of work....

- Test No. 8. Implementation of work...

- If the implementation is only under Art. 148 of the Tax Code of the Russian Federation, is it possible to take into account input VAT in the cost of work after 07/01/2019? You do not have access to view. To gain access: Complete...

- Implementation of work without signing the act Good afternoon! We have a contract agreement under which...

Basic Standard Management Reporting

Statement of goods sold for sale

The report is intended to analyze the movement of goods sold for sale by quantity and amount. The “Receipt” column shows the quantity and amount of goods transferred minus the return. The “Expense” column shows the quantity and amount of goods sold. The columns “Starting balance” and “Final balance” show the quantity and amount of unsold goods as of the start and end dates of the report.

Report lines can be grouped by counterparty, agreement, transaction and item. However, grouping by store transactions does not make sense since there are no transactions currently taking place.

Report “Mutual settlements with commission agents”

The report is intended to account for item items transferred for sale to commission agents. This report also tracks the status of mutual settlements with commission agents. Thus, in one report you can get complete information about what goods were given to commission agents for sale, how many of them were sold, what commission was accrued, and how much the commission agent paid the company for the goods he sold.

If you set the “Only overdue” flag in the report settings, then the report will display information only about those commission agents who did not pay for the goods sold on time. Late payment is determined only by those documents that are drawn up under an agreement with the established type of mutual settlements “According to settlement documents.” Late payment is calculated in accordance with the “Number of days of debt” parameter.

Using the groupings presented in the report settings, you can detail the information in the report down to the level of documents that completed the business transaction:

- Movement document (registrar) – a document that has completed a business transaction.

The report can be grouped by item, contract and transaction. Quantity (in balance storage units) and amount (in management accounting currency) are used as report indicators.

By setting the selection parameters presented in the report, you can select information on a specific commission agent, a group of commission agents, an arbitrary list of commission agents, or on commission agents with certain properties and categories.

The table of the generated report contains the following columns:

- Debt/Balance at the beginning - the first column displays the commission agent's debt for goods sold that were unpaid by him as of the start date of the report, and the second column shows the quantity and amount of goods available to the commission agent as of the start date of the report.

- Transferred for sale – the quantity and amount of goods transferred for sale to the commission agent during the reporting period.

- Sold – the quantity and amount of goods sold by the commission agent during the reporting period.

- Paid – the amount of payment transferred by the commission agent to the company for the period of generation of the report for the goods sold by him.

- Remuneration amount – the amount of commission accrued to the commission agent for the period of report generation.

- Debt/Balance at the end - the first column displays the commission agent's debt for goods sold that were unpaid by him as of the end date of the report, and the second column shows the quantity and amount of goods available to the commission agent as of the end date of the report.

Report “Statement of customer orders”

The “Statement of Customer Orders” report shows complete information on the fulfillment of customer orders for a certain period in terms of shipment of goods. The report displays quantitative indicators: the quantity of ordered and shipped goods in basic units of measurement, in units of storage of balances and in units for reporting, as well as total indicators: the amount in the currency of management accounting and the amount in the currency of mutual settlements under the agreement under which the order was placed buyer.

The “Incoming” column shows the number of goods ordered by the buyer and their amount; the “Expense” column shows the number of goods shipped to customers and the amount. The columns “Starting balance” and “Final balance” show, respectively, the quantity of goods not shipped according to the order as of the start and end dates of the report.

The report can be grouped by managers responsible for order fulfillment. The manager is the user who is selected as the responsible person in the “Buyer’s Order” document.

To set grouping by manager, you need to add the “Buyer’s order” field to the list of groupings. Responsible".

The report can also be grouped by days, weeks, months, etc.

0

Share link:

- Click to share on Twitter (Opens in new window)

- Click here to share content on Facebook. (Opens in a new window)

Liked this:

Like

Similar

Author of the publication

offline for 3 days

Other VAT entries

In the table below we have collected other VAT entries that will be useful to you in various situations.

| Debit | Credit | Description |

| 94 | 68.VAT | VAT on raw materials, goods and fixed assets has been restored when deviating from the norms of natural loss |

| 91 | 68.VAT | VAT is charged on the gratuitous transfer of assets |

| 08 | 68.VAT | VAT was charged on construction and installation work carried out by the company itself |

| 08 | 19 | VAT is charged to the increase in the value of a non-current asset |

| 91 | 19 | “Input” VAT is written off from the cost of inventory items that were used to generate other income |

| 94 | 19 | “Input” VAT is written off for shortages and losses from damage to valuables |

| 99 | 19 | “Input” VAT on lost property due to an emergency has been written off |

To account for VAT, we recommend the cloud service Kontur.Accounting. Accrue, deduct and recover VAT from anywhere in the world. When filling out the declaration, the system will automatically check its accuracy and correctness. We give all newbies a free trial period of 14 days.

Classifications (rev. 3.0)

In “1C: Accounting 8” (rev. 3.0), services provided to customers are divided into the following types:

- production services for which a planned cost has been established;

- services for the manufacture of products from customer-supplied raw materials;

- other services, the costs of providing which are recorded on account 20 “Main production”;

- trade services;

- other services.

The above classification is based on the accounting account, which summarizes information about the costs of providing services.

Production services for which a planned cost has been established

Production services for which the planned cost has been established include services the cost of which is formed on accounts 20.01 “Main production” or 23 “Auxiliary production” (hereinafter referred to as account 20.01). In this case, the cost may include costs accounted for in account 25 “General production expenses” and 26 “General operating expenses” (if provided for by the accounting policy). To reflect such sales transactions (rev. 3.0), the document Act on the provision of production services is intended. When posting a document in accounting, the recognition of revenue is reflected (Debit 62, 76 Credit 90.01 “Revenue”), the accrual of VAT (Debit 90.03 “Value Added Tax” Credit 68.02 “Value Added Tax”) and the write-off of the planned cost Credit 20.01). When performing routine monthly closing operations, additional entries (with a plus or minus) are entered for the amount of the difference between the actual and planned costs for the Debit of account 90.02 and the Credit of account 20.01. If in the current month the services for which the planned cost was established were not actually provided (the document Act on the provision of production services was not entered for them), but there were turnovers for these services in the debit of account 20.01, the costs incurred are recognized as work in progress (WIP), i.e. . are not written off to account 90.02.

Services for the manufacture of products from customer-supplied raw materials

A type of production service for which a planned cost is established is the provision of services for the manufacture of products from customer-supplied raw materials. The cost of such services is formed based on 20.02 “Production of products from customer-supplied raw materials.” The document Sales of processing services is intended to reflect such sales operations (rev. 3.0). When posting a document in accounting, the recognition of revenue (Debit 62, 76 Credit 90.01 “Revenue”), the accrual of VAT (Debit 90.03 Credit 68.02) and the write-off of the planned cost of services (Debit 90.02 Credit 20.02) are reflected. When performing routine operations for closing a month for the amount of the difference between the actual and planned cost, additional entries are entered (with a plus or minus) for the debit of account 90.02 and the credit of account 20.02. If in the current month processing services were not provided (the document Sales of processing services was not entered for them), but there were turnovers for these services in the debit of account 20.02, the costs incurred are recognized as work in progress, i.e. they are not written off to account 90.02. Work in progress is assessed taking into account the quantity of products that are manufactured but not presented to the customer for payment.

Other services - costs are recorded in account 20

Other services, the costs of providing which are taken into account in account 20, include production and other types of services, the cost of which is also formed on account 20.01 or 23 (hereinafter referred to as account 20.01), but in accordance with the adopted accounting policy for each product item is not calculated (see below) – Analytical accounting of services by service names). To reflect the implementation of such (rev. 3.0), the documents Sales of goods and services and Provision of services are intended. The second document is used when identical services are provided to a group of customers. When carrying out these documents, only the recognition of revenue and the calculation of VAT are reflected in accounting. The write-off of costs for the provision of these services is carried out not at the time of reflection of the sale, but when performing routine operations of closing the month. In this case, the procedure for writing off expenses from account 20.01 to debiting account 90.02 is determined by the Accounting Policy settings. By default, costs from account 20.01 are written off to account 90.02 in full, regardless of whether revenue for the corresponding product group is reflected in account 90.01. If the Inventory of Work in Progress document records work in progress, then the amount of costs minus the cost of work in progress is written off.

The program also supports an option in which expenses on accounts 20.01, 23 will be written off to account 90.02 only for dark-nomenclature groups for which revenue is reflected on account 90.01 in the current month.

For other services, costs are not written off. They form work in progress. To support this option, you should specify in the Accounting Policy settings that costs are written off from account 20 “Main production” taking into account revenue.

Trade services

Trade services are understood as services, information on the costs of providing which is summarized in account 44.01 “Distribution costs in organizations engaged in trading activities.” Such services include delivery of goods to customers, provision of intermediary services for the sale of goods, etc. To reflect such sales operations (rev. 3.0), the documents Sales of goods and services, Retail sales report, Report to the principal are intended. When carrying out these documents in accounting, the recognition of revenue and the accrual of VAT are reflected. The costs of providing trade services do not need to be taken into account separately. They are included in distribution costs recognized as expenses for ordinary activities of the current period. In “1C: Accounting 8” (rev. 3.0), these costs are written off from account 44.01 to the debit of account 90.07 “Sales expenses” when performing the routine operation Closing account 44 “Distribution costs”. There is no need to make any settings in the Accounting Policy to write off costs for the provision of trade services.

Other services

Other services are understood as services, information on the costs of providing which is summarized in accounts 44.02 “Business expenses in organizations engaged in industrial and other production activities” (delivery of products to customers) or 26 “General business expenses” (provision of intermediary services for the purchase of goods, services of brokers, dealers and etc.).

To reflect sales transactions in “1C: Accounting 8” (rev. 3.0), the documents Sales of goods and services, Report to the principal, Provision of services are intended. When posting these documents, the accounting records reflect the recognition of revenue and the accrual of VAT.

Costs for the provision of other services in organizations carrying out industrial and other production activities are not required to be taken into account separately on account 44.02. They are part of business expenses, recognized in full as expenses for ordinary activities of the current period. In “1C: Accounting 8” (rev. 3.0), these costs are written off from account 44.02 to the debit of account 90.07 “Sales expenses” when performing the routine operation Closing account 44 “Distribution costs”. There is no need to make any settings in the Accounting Policy to write off the costs of providing such services.

There is also no need to set up an Accounting Policy if account 20 “Main production” is not used, and the costs of providing services are recorded on account 26 “General business expenses”. When performing the routine operation Closing accounts 20, 23, 25, 26, the amount of costs for the provision of such services as part of general business expenses for the month is written off to the debit account 90.08 “Administrative expenses”.