Source: Journal “Payment in state (municipal) institutions: accounting and taxation”

Labor legislation requires employers to provide certified special clothing, special shoes and other personal protective equipment (PPE) free of charge to employees engaged in work with harmful and dangerous working conditions, as well as in work performed in special temperature conditions or associated with pollution. The article discusses the legal basis for issuing special clothing to employees, as well as the procedure for reflecting this operation in accounting.

The employer's obligation to provide workers with protective clothing

Personal protective equipment is personal equipment used to prevent or reduce the impact of harmful and (or) hazardous production factors on workers, as well as to protect against pollution (clause 3 of the Rules for providing workers with personal protective equipment , approved by Order of the Ministry of Health and Social Development of the Russian Federation dated 01.06.2009 No. 290n ).

General provisions on the issuance of PPE. The employer's obligation to provide employees with personal protective equipment is enshrined in Art. 221 Labor Code of the Russian Federation . In addition to the general obligation of the employer, it is established that:

PPE is issued for work with harmful and (or) dangerous working conditions, work performed in special temperature conditions, and work associated with pollution;

- Providing workers with PPE is carried out at the expense of the employer. Storing, washing, drying and repairing PPE is also the responsibility of the employer;

- PPE is provided free of charge;

- PPE must have a certificate or declaration of conformity confirming its compliance with the safety requirements established by law, as well as a sanitary-epidemiological conclusion or a certificate of state registration of dermatological PPE;

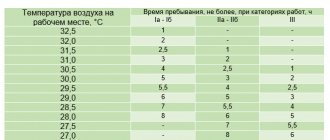

- PPE is issued in accordance with standard standards. The standards were approved by industry by separate orders of the Ministry of Labor and the Ministry of Health and Social Development. The following regulations will be relevant for all industries: orders of the Ministry of Health and Social Development of the Russian Federation dated October 1, 2008 No. 541n , dated April 20, 2006 No. 297 , Decree of the Ministry of Labor of the Russian Federation dated December 31, 1997 No. 70 .

Requirements for the acquisition, issuance, use, storage of special clothing, special footwear and other personal protective equipment, as well as for their care, are regulated by the Rules for the provision of personal protective equipment for workers .

For your information

The rules for providing workers with PPE apply to employers - legal entities and individuals, regardless of their organizational, legal forms and forms of ownership.

From this document on the issuance of PPE you need to know the following:

- an employer is allowed to purchase personal protective equipment for temporary use under a lease agreement;

- PPE is provided to employees in accordance with standard standards and based on the results of a special assessment of working conditions.

If the employer wants to improve the situation of workers... Article 221 of the Labor Code of the Russian Federation states that the employer has the right to establish standards for the free issuance of personal protective equipment to employees, which improve, compared to standard standards, the protection of workers from harmful and (or) dangerous factors present in the workplace, special temperature conditions or pollution.

In this case, the opinion of the elected body of the primary trade union organization or other representative body of workers and the financial and economic situation of the employer are taken into account. The standards established by the employer are approved by local regulations based on the results of a special assessment of working conditions and taking into account the opinion of the relevant trade union or other body authorized by employees and can be included in collective and (or) labor agreements indicating standard standards, in comparison with which the provision of workers is improved PPE ( clause 6 of the Rules for providing workers with PPE ).

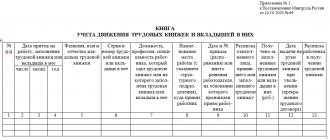

Issuance and accounting of personal protective equipment. The employer is obliged to organize proper accounting and control over the issuance of PPE to employees within the established time frame ( clause 13 of the Rules for providing PPE to employees ). The issuance and handing over of PPE to employees is recorded by an entry in the personal record card for the issuance of PPE. The form of such a card is given in the appendix to the Rules for Providing PPE for Workers . The employer can keep records of the issuance of personal protective equipment to employees using software (information and analytical databases). The electronic form of the registration card must correspond to the established form of the personal registration card for the issuance of personal protective equipment. In this case, in the electronic form of the card, instead of the employee’s personal signature, the number and date of the accounting document on the receipt of PPE, on which the employee’s personal signature is indicated, are indicated.

What is the penalty for lack of [abbr title=”Personal protective equipment”]PPE[/abbr]

At the legislative level, a fine is provided for failure to provide workers. According to the norms of administrative legislation (Article 5.27.1), failure to provide employees with personal protective equipment will result in the following penalties for the culprit (in this case, the employer):

- The official is held liable in the form of a fine in the amount of 20,000 to 30,000 rubles;

- A person who is registered as an individual entrepreneur is subject to a fine in the amount of 20,000 to 30,000 rubles;

- A legal entity is subject to punishment in the form of a fine in the amount of 130,000 to 150,000 rubles.

If such an offense was committed by a person who had previously been held accountable for failure to provide employees with information, he or she will face more severe penalties:

- The official must pay a fine in the amount of 30,000 to 40,000 rubles or may be disqualified for a period of 1-3 years;

- A person who is engaged in entrepreneurial activity, but does not form a legal entity, is obliged to pay a fine in the amount of 30,000 to 40,000 rubles or his activities may be suspended for up to 90 days;

- A legal entity that has violated the law for the second time is obliged to pay a fine in the amount of 100,000 to 200,000 rubles or its activities are suspended for up to 90 days.

Article 5.27.1 of the Code of Administrative Offenses of the Russian Federation “Violation of state regulatory requirements for labor protection contained in federal laws and other regulatory legal acts of the Russian Federation”

Accounting of operations for issuing personal protective equipment to employees

The accounting procedure for special clothing is determined by Instruction No. 157n [1]. In accordance with clause 99 of this document, special clothing is reflected as part of inventories in account 105 05 “Soft inventory”.

Due to the changes made to clause 385 of Instruction No. 157n by Order of the Ministry of Finance of the Russian Federation dated August 29, 2014 No. 89n , accounting for property issued by an institution to employees for personal use for the performance of their official (official) duties, in order to ensure control over its safety and intended use and the movement is carried out on off-balance sheet account 27.

Acceptance for accounting of property items on off-balance sheet account 27 is carried out on the basis of the primary accounting document at book value.

The disposal of property items from off-balance sheet accounting is carried out on the basis of the primary accounting document at the cost at which the objects were previously accepted for off-balance sheet accounting.

In accordance with clause 386 of Instruction No. 157n , analytical accounting of the account is carried out in a card of quantitative and total accounting of material assets in the context of users of property, its location, by type of property, its quantity and value.

Example.

The kindergarten guard was previously given a set of clothes worth 600 rubles. In March 2015, its wearing period expired. By decision of the establishment commission, the special clothing was declared unusable and written off off-balance sheet. In exchange, the employee was given a set of new clothes worth 1,500 rubles, purchased with a subsidy allocated for the implementation of a state task. The kindergarten has the status of a budget institution.

In accounting, in accordance with Instruction No. 174n [2], the following entries will be made:

| Contents of operation | Debit | Credit | Amount, rub. |

| A set of special clothing has been written off | 27 (employee) | 600 | |

| A set of clothes was issued to the employee to replace the old one | 4 109 60 272 27 (employee) | 4 105 35 440 | 1 500 |

What is the procedure for providing workers with personal protective equipment?

The first task that the employer solves when providing employees with personal protective equipment is informing employees about what protective equipment they are entitled to (clause 9 of the Appendix to Order No. 290n). In addition, the company must, during the introductory briefing on labor protection, familiarize the employee with the rules approved by Order No. 290n, as well as standard standards for the provision of PPE.

In Art. 219 of the Labor Code of the Russian Federation amends the mandatory training for employees in the use (application) of personal protective equipment. Training will need to be carried out simultaneously with instructions on labor protection and first aid training provided for in Art. 214 Labor Code of the Russian Federation.

When issuing protective equipment to employees, the employer should pay special attention to:

- on the need to ensure compliance with PPE that is suitable for a specific employee in size and the nature of his work (clause 12 of the Appendix);

- the need to control and record the provision of personal protective equipment to workers in a unified accounting card, as well as when using software (clause 13 of the Appendix);

- the need to compare the specifics of issued PPE and standard standards defined for a specific type of activity of an employee, or those that are closest to his type of activity (clause 14 of the Appendix);

- there is no need to classify PPE depending on the position held by the employee - only the type of activity and profession matters (paragraphs 15, 16 of the Appendix);

- the need to provide additional personal protective equipment for employees performing a part-time job function - in accordance with the standards defined for this function (clause 17 of the Appendix);

- the need to temporarily provide PPE to employees transferred to another job, internship, practice, and other persons who operate on the territory of the employer company, but if these are employees of third-party organizations - for example, fulfilling their duties under an outstaffing agreement - then PPE should be provided to them their employers (clause 18 of the Appendix).

If the PPE is not provided to the employee in the required completeness, then the employing company should not allow him to work.

Having issued PPE to an employee, the employer is obliged to ensure that the person uses appropriate protective equipment (clause 26 of the Appendix).

If an employee refuses to use PPE or fails to comply with the rules of use, the employer will have the right to release such employee from work without pay.

The procedure for issuing and accounting for workwear is described in the typical “ConsultantPlus” situation. Sign up for a free trial access to K+ and read the material.

The company must monitor the functionality and serviceability of personal protective equipment, conduct timely tests of protective equipment, and purchase the necessary technical means to solve these problems (clauses 29, 33 of the Appendix). If the protective equipment is being repaired or, for example, being washed, the employee must have a second, spare PPE at his disposal (clause 30 of the Appendix).

Insurance premiums

According to paragraphs. “and” clause 2, part 1, art. 9 of Federal Law No. 212-FZ [3] all types of compensation payments established by the legislation of the Russian Federation, legislative acts of the constituent entities of the Russian Federation, decisions of representative bodies of local self-government (within the limits of the norms provided for by the legislation of the Russian Federation), including those related to the execution of physical face of labor duties.

As noted above, the standards for the free issuance of special clothing, special shoes and other PPE to employees are approved by orders of the Ministry of Health and Social Development and resolutions of the Ministry of Labor.

Consequently, the cost of protective clothing issued to an employee within the established standards is not subject to insurance premiums. The cost of workwear in excess of established standards, received by an employee in connection with the performance of work duties for temporary use and not ownership, is also not recognized as subject to insurance premiums ( Letter of the Ministry of Health and Social Development of the Russian Federation dated 05.08.2010 No. 2519-19 ).

Providing [abbr title=”Personal protective equipment”]PPE[/abbr] as an employer’s responsibility

The framework of labor legislation establishes (Article 221 of the Russian Federation) that the employer must, at his own expense, provide his employees with the timely issuance of special clothing, shoes and other equipment intended for personal protection.

In addition, the responsibilities of the immediate manager or person responsible at the enterprise include storing products, drying them, washing them, carrying out repairs, and replacing them.

Article 221 of the Labor Code of the Russian Federation “Providing workers with personal protective equipment”

Price question or how you can save

The purchase of workwear requires significant expenses on the part of the employer. Therefore, the law provides for the possibility of renting PPE. Then the employee is assigned an individual kit with markings, and this information is entered into a personal card for recording and issuing PPE.

The employer also has the opportunity to receive reimbursement for the purchase of PPE if it does not have arrears in injury insurance premiums.

It is necessary to confirm that measures were taken that improved the working conditions of staff (that is, that employees were provided with PPE), and then up to 20% of insurance premiums will be returned in accordance with the “Rules for financial support of preventive measures to reduce industrial injuries and occupational diseases and sanitary resort treatment of workers engaged in work with harmful and dangerous production factors.”

After purchasing PPE, you need to prepare a report on targeted expenses, which is submitted quarterly to the Social Insurance Fund, and then contact the territorial department of the Social Insurance Fund with a corresponding application. In this case, workwear must be manufactured only in Russia. The decision to return 20% of insurance premiums is made within 21 working days.

Results

Russian employers whose production infrastructure is characterized by harmful and dangerous working conditions are required to equip their employees with personal protective equipment free of charge. The main legal regulations, the provisions of which the employer must follow when providing PPE to employees, are the Labor Code of the Russian Federation and Order of the Ministry of Health and Social Development dated June 1, 2009 No. 290n.

You can get acquainted with other aspects of ensuring labor safety at an enterprise in the articles:

- “Dangerous and harmful production factors (list).”

- “What are the responsibilities of a labor protection employee (list)?”

- “What are the responsibilities of an employer in the field of labor protection?”

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.