What is the regional coefficient

In the context of labor relations, the regional coefficient is understood as a financial indicator by which the salary (all its components - salary, bonuses, incentive payments) of a person working in regions (municipalities) is multiplied, in which:

1. As a rule, difficult climatic or environmental conditions are observed living conditions of citizens and work activities. For example, in the Far North and areas that are equivalent to it. Hence the unofficial name of the indicator - “northern coefficient”.

2. The corresponding regional coefficients are established by law.

Examples of regulations that set coefficients for certain regions (municipalities):

- Decree of the Government of the Russian Federation dated May 29, 1993 No. 512;

- Resolution of the State Committee for Labor of the USSR, the Secretariat of the All-Union Central Council of Trade Unions dated August 17, 1971 No. 325/24;

- Order of the Government of the Russian Federation dated January 29, 1992 No. 176-r.

A significant part of the regulations establishing coefficients were adopted in the USSR. In the absence of newer sources of law, they are recognized as fully valid.

A complete list of regional coefficients is available in ConsultantPlus. To view the Handbook, get a trial access to the legal system. It's free.

The regional coefficient is calculated on the salary regardless of the person’s work experience in general and in the region where the coefficient applies, in particular. This is the difference between the financial indicator under consideration and another similar in purpose - the percentage markup (often called the “northern markup”).

You can learn more about the use of regional coefficients and “northern bonuses” in the article “What benefits are available to employees of the Far North?”

How is sick leave with the regional coefficient calculated?

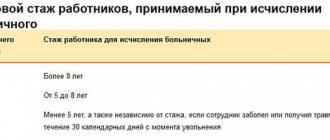

This procedure is purely individual for each subordinate, as it takes into account many nuances. If an illness, injury of any severity or quarantine has caused the need to undergo sanatorium-resort, inpatient rehabilitation or rehabilitation after prosthetics, the size of the coefficient is affected by work experience:

- If the experience is 8 years or more, then the additional payment is 100%, that is, it is identical to the salary.

- If an employee has 5 to 8 years of experience, the coefficient is slightly lower - 80% of the salary.

- And if an employee has worked for only 5 years, then the additional payment for sick leave is only 60% of the standard salary.

In addition to information about percentages, when calculating sickness benefits, the average salary per day and how many days the temporary disability lasted are taken into account.

Before calculating the amount of the benefit with the regional coefficient, it is necessary to calculate the employee’s earnings per day. To do this, use the following formula: SDZ = Zp2/730 .

The designations are deciphered as follows:

- SDZ is the average wage per day;

- Zp2 is the employee’s salary for the two previous years.

After this calculation is completed, they begin to calculate the regional coefficient. The formula used is: PVN = (SDZ × KD) × RV + RK.

Let's understand the notation:

- PVN is sickness benefit;

- SDZ – a person’s salary for the previous two years;

- CD – the sum of days during which the employee was temporarily disabled;

- РВ – payment of benefits based on length of service;

- RK is the regional coefficient.

Expert opinion

Polyakov Pyotr Borisovich

Lawyer with 6 years of experience. Specialization: civil law. More than 3 years of experience in drafting contracts.

An example of calculating PVN. Let's take the following information. The employee was sick for 14 days – this is a sickness period. We take 60% for RV, and 15% for RK. SDZ is known from the previous calculation. Further:

- Calculate (SDZ × CD) – 1897.26 × 14 = 26561.64.

- We make the final calculation: (SDZ × KD) × RV + RK – 26561.64 × 0.6 + 0.15 = 15937.134.

As a result, it turns out that the benefit for temporary unemployment due to illness is equal to 15,937.134 rubles for two weeks for this prospective employee.

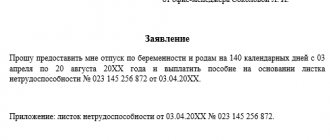

This is important to know: Is sick leave for pregnancy and childbirth subject to personal income tax?

In what cases is the regional coefficient for sick leave calculated?

As we already know, the regional coefficient is an indicator by which the salary of an employee working in a region for which the corresponding coefficient is determined by law is multiplied. When calculating sick leave, such multiplication is generally not carried out: this is due to the fact that disability benefits are calculated based on actual earnings (which have already been calculated and paid taking into account the established coefficients).

You can learn more about the features of calculating sick leave based on average earnings in the article “Average daily earnings for calculating sick leave.”

However, the regional coefficient when calculating sick leave can still be applied if:

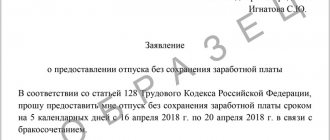

1. The employee has an insurance period that does not exceed 6 months.

2. The employee’s average monthly earnings for the 2 years preceding the year in which the sick leave is issued is less than the minimum wage.

3. The employee did not work under the Labor Code of the Russian Federation for 2 years preceding the year in which the sick leave was issued (and, accordingly, did not have a salary).

4. The employee violated the treatment regimen.

5. The employee’s incapacity for work was due to intoxication.

Let us consider in more detail the procedure for calculating sick leave in these cases in practice.

Who calculates the amount of benefits and pays the funds to the employee?

The benefits are paid either by the manager himself or by the Social Insurance Fund of the Russian Federation.

If the employer pays:

- The employer pays for three sick days. At the same time, he uses company funds.

- After four days of illness, sick leave is also paid by the manager, but in this case the Social Insurance Fund of the Russian Federation compensates for losses.

- If sick leave is issued due to injury, then the employer pays for the entire period of incapacity for work.

The benefit is paid by the Social Insurance Fund of the Russian Federation after four days of illness of the employee. The fund compensates for the employer's losses. After four days from the moment of illness and from the first day after the injury of the employee, the FSS of the Russian Federation pays benefits in the following cases:

- if at the time the employee went on sick leave the company dissolved and ceased to exist;

- if the employer does not have excess funds to pay benefits, that is, the funds for such expenses are simply not available in the company’s account;

- if the manager is unable to pay the required amount because the company is facing bankruptcy in the near future.

Remember that at the legislative level there are deadlines for when benefits with a regional coefficient for sick leave are received:

- The manager assigns benefits and pays them in one of two options. Option one – after ten days after the payment is assigned. Option two - on payday.

- The Social Insurance Fund of the Russian Federation pays benefits ten days after the request.

Calculation of sick leave with a coefficient: nuances

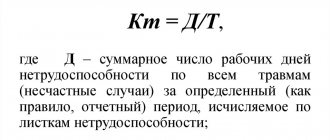

In all of these cases (if at least 1 of the listed conditions is met), sick leave is calculated according to the minimum wage. In most cases, the calculation formula will be like this:

VN = KB × (minimum wage × 24 / 730) × K,

Where:

VN - disability payment;

KB - the number of days of illness of the employee;

K is the length of service coefficient equal to 0.6 for employees with less than 5 years of experience, 0.8 for 5–8 years of experience, 1 for more than 8 years of experience.

An example of calculating benefits when the average monthly salary of an employee is less than the minimum wage, from ConsultantPlus From January 14 to January 20, 2021, the employee was sick according to the sick leave. He was hired in January 2021. Until that moment, he had no insurance coverage and no earnings taken into account when calculating benefits. In this case, sick leave must be calculated based on the minimum wage. See K+ for the calculation algorithm. Trial access is available for free.

If the employee’s length of service is less than 6 months, then a slightly different calculation formula is used based on the minimum wage:

VN = KB × (minimum wage / Number of calendar days in the month of illness).

An example of calculating benefits for an employee with less than six months of insurance coverage and average monthly earnings greater than the minimum wage from ConsultantPlus From January 29 to February 5, 2021, the employee was ill on sick leave. The average daily earnings of an employee for the billing period is 700 rubles. The employee’s insurance period on the date of onset of temporary disability is 5 months. The calculation of temporary disability benefits in such a situation will be as follows. See K for the full example. Trial access is free.

The minimum wage value is taken as of the date of opening of the employee’s sick leave. If, after the start of the period of incapacity, a normative act establishing a new minimum wage came into force, then the one approved by the previously valid normative act is nevertheless used.

If in the region (municipality) where a person on sick leave is employed, a regional coefficient has been adopted, you can see the procedure for its application below in the examples.

Examples of calculating benefits taking into account the regional coefficient from ConsultantPlus 1. The average daily earnings of an employee are less than the average daily earnings calculated on the basis of the minimum wage established taking into account the coefficient on the date of onset of illness . The employee works in an area where the regional coefficient is set at 1.4. He was ill from January 13 to January 22, 2021. The average daily earnings of an employee, calculated for the period 2021 - 2020, amounted to 307 rubles. The employee's insurance coverage as of the date of onset of illness is 9 years. The calculation of temporary disability benefits in this situation is as follows. … 2. The employee’s insurance coverage is less than 6 months. The employee works in an area where the regional coefficient is set at 1.15. He was ill from January 11 to January 15, 2021. The average daily earnings of an employee, calculated for the period 2021 - 2021, amounted to 800 rubles. The employee's insurance coverage as of the onset of illness is 5 months. The calculation of temporary disability benefits in this situation is as follows. You can view the examples in full in K+ by getting free trial access to the system.

When to apply the regional coefficient

If the organization is located in an area with difficult climatic conditions, employees are paid increased wages.

So, if an employee had no earnings during the billing period or his insurance period is less than 6 months, the benefit is paid in the minimum amount (based on the minimum wage), and it must be increased by the regional coefficient.

Keep in mind that in other cases the regional coefficient is already taken into account in the actual earnings of the billing period.

Officials in the letter under consideration noted: the final amount of benefits calculated on the basis of the minimum wage is adjusted by the regional coefficient.

This is important to know: is it possible to fire on the last day of sick leave?

That is, at the stage of comparing the actual average daily earnings and the average daily earnings based on the minimum wage, the regional coefficient is not taken into account.

Results

The regional coefficient when calculating sick leave is applied only in cases where the amount of temporary working capacity benefits is calculated based on the minimum wage. This is due to the fact that the corresponding coefficient is “automatically” taken into account in the average earnings, on the basis of which sick leave is calculated in the general case.

You can learn more about the application of the regional coefficient in various areas of labor relations in the articles:

- “What is the amount of the premium for shift work?”;

- “Allowances for work in special climatic conditions are not compensation and are subject to personal income tax”.

Sources:

- Decree of the Government of the Russian Federation of May 29, 1993 N 512

- Resolution of the State Labor Committee of the USSR, the Secretariat of the All-Union Central Council of Trade Unions dated August 17, 1971 No. 325/24

- Order of the Government of the Russian Federation dated January 29, 1992 No. 176-r

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Case Study

Let's look at a specific example of how the regional coefficient is used when calculating sick leave in 2021. Let's take the real situation as a basis, when the actual average daily earnings of an employee were 163.85 rubles. (read here how the average salary for sick leave is calculated), and the figure calculated on the basis of the minimum wage turned out to be less - 151.59 rubles.

If the regional coefficient in the region is 1.15, then when multiplied by 151.59 rubles. the total is 174.33 rubles. This exceeds the actual average daily earnings.

Average daily earnings are calculated based on actual earnings or the minimum wage. The regional coefficient is taken into account in both indicators, because only under this condition will the comparison be correct. If the actual average daily earnings are less than the amount calculated on the basis of the minimum wage, then in such a situation the benefit should be calculated based on the minimum wage.

The legislative framework

The following legislative framework regulates the regional coefficient:

- “Labor Code of the Russian Federation”, Article No. 129 and Article No. 316;

- Federal Law No. 255 of December 29, 2006;

- Decree of the Government of the Russian Federation No. 512 of May 29, 1992;

- Order of the Government of the Russian Federation No. 176 of January 29, 1992.

You can also learn about the basic rules for paying the regional coefficient in the following video:

The regional coefficient is an excellent monetary compensation for citizens of the Russian Federation working in regions with a harsh climate and poor ecology. This coefficient is usually not calculated on sick leave, but there are exceptions to the rules that allow employees to receive involuntary unemployment benefits due to illness.