A single tax on imputed income

The use of UTII in 2021 as the basis for calculating payments does not imply the actual profit of the entrepreneur, but the income already preliminarily imputed by the state.

It is calculated according to special indicators. This is one of the special taxation systems (n/a).

Regarding UTII in 2021, changes and news for retail trade have occurred in a favorable direction: its terms have been extended, and the rules for deducting certain amounts have also been improved.

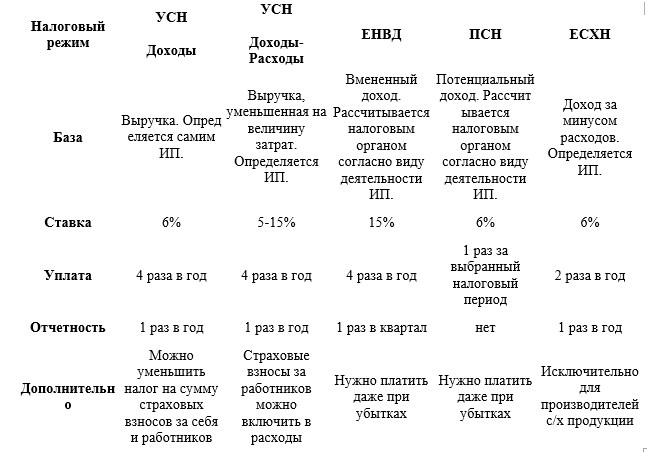

The table approved by regulations shows the coefficients for UTII for 2021 for each type of business.

It and the table of basic UTII profitability for 2021 are used for calculations and determining the parameters of the enterprise.

The amount of UTII in 2021 is directly dependent on them, as well as on the number of personnel, the volume of trading platforms and the region where the organization is located.

When using UTII in 2021, as before, an enterprise or businessman is exempt from other taxes.

The use of UTII in 2021 is voluntary, and the management of the organization decides for itself whether to switch to UTII in 2018 or choose other modes (STS, OSNO).

In 2021, a Decree was issued extending the use of UTII in 2021 for 3 years. This regime is legally regulated by Art. 26.3 NK.

back to menu ↑

Advantages

The use of UTII in 2021 has the following advantages:

| Parameter | Meaning |

| Profit Impact | The amount actually received does not matter - the amount of UTII in 2018 remains fixed. |

| Reports | Simplified as much as possible. The UTII declaration is submitted in 2018. |

| Amount of UTII in 2021 | Extremely low. Payments need to be compared with the simplified tax system when choosing a system, but, for example, UTII in 2021 for retail trade with large premises, the regime is not profitable. |

| Transition restrictions | There are no profitability limits for registration, but for example in the simplified tax system and PSNO they exist. There is no need to wait until the end of the year to switch to “imputation”; it is always available within a 5-day period, so UTII in 2018 for retail trade is in first place in terms of profitability. |

| Combination of systems | The use of UTII in 2021 is allowed to be combined with any type of non-taxable income. |

| Accounting | They are conducted at will according to simplified rules. |

| Other payments | The transition to UTII in 2021 eliminates other taxes, but the payment of insurance premiums is mandatory. UTII is reduced by their amount. The UTII declaration in 2021 must display the deduction. |

| Reduced payments | They use an adjustment: the table has UTII coefficients for 2021 for each activity, which allows you to take into account and change various factors in order to reduce payments. The amount of UTII in 2018 is adjusted using the K2 indicator if the activity was carried out in an incomplete tax period. |

| Possible benefit options | UTII in 2021 allows you to keep the money saved in circulation. In addition, this system allows for the combination of various types of information. In this case, you should carefully check whether such a combination will be beneficial. |

| Zero rate | UTII in 2021 changes and news for retail trade and for some types of commerce, for those who first received the status of individual entrepreneurs until 2020, include zero interest. However, they are introduced by local authorities quite rarely. |

| Cash registers | According to UTII in 2021, the changes did not affect deductions of funds spent on online cash registers. This is only possible for individual entrepreneurs worth 18 thousand rubles. The exemption from their mandatory establishment is valid until July 2019. |

back to menu ↑

Flaws

The disadvantages are:

- the amount of UTII in 2021 is independent of profit, and this may turn out to be a minus. If UTII for an LLC is established in 2021 and the organization is unprofitable, then it is obliged to pay it, the same applies to the period when there was no activity;

- This norm is not approved in all parts of the Russian Federation - it depends on the decision of local authorities. For example, in 2021 there are no changes to this item in UTII in Moscow and it cannot be used there;

- deduction of insurance payments is available only for the time when this information was used. Exception: when funds were deposited before the filing of the declaration for this time. That is, if an individual entrepreneur paid for the 1st quarter on April 15, and submitted the declaration on the 25th, then he has the right to deduct them. If the reports are submitted first, and then contributions are made, the inspectorate will recalculate the UTII.

- The transition to UTII in 2021 is feasible when the parameters of personnel and trading platforms are within certain limits. With “imputation” they are wider than that of PSN, so UTII in 2021 for retail trade and public catering will be more economical, but if there are a large number of employees, this regime will be inconvenient and then it makes sense to use OSNO;

- The deadline for submitting reports in 2021 is quarterly, this is a minus compared to the simplified version, in which it must be submitted once every 12 months.

back to menu ↑

Latest innovations

According to UTII in 2021, the changes are minor. As before, it has been extended until 2021 and there have been some improvements:

- You can deduct insurance premiums paid for yourself and for employees. For UTII in 2021, changes and news for retail trade on this item allow for significant savings;

- the UTII declaration in 2021 was changed in connection with the above, but the deadlines for submitting reports in 2021 UTII remained unchanged;

- the K1 indicator was increased;

- In 2021, UTII for retail trade has not changed on an issue important for individual entrepreneurs, whether it is possible to pay by bank transfer with legal entities: everything remains the same, you can do this with all counterparties;

- the deferment for online cash registers has been extended until the middle of the next 12 months.

back to menu ↑

Reducing UTII for insurance premiums

According to Article 346.32 of the Tax Code of the Russian Federation, the amount of UTII calculated for a quarter can be reduced by mandatory insurance premiums that were actually paid in a given quarter. In this case, it does not matter for what period the contributions were accrued (clause 1, clause 2, article 346.32 of the Tax Code of the Russian Federation). In this case, it matters whether the UTII payer is an employer or not:

- individual entrepreneurs who are not employers reduce the amount of the single tax by the full amount of insurance premiums paid for compulsory pension insurance and compulsory health insurance;

- individual entrepreneurs using hired labor reduce the amount of the calculated single tax on insurance premiums paid for themselves and for employees, but not more than 50% of the accrued UTII amount.

What is needed to apply for UTII

According to UTII in 2021, there are no changes in requirements for enterprises. The ability to use this mode is available if the subject follows the following rules:

- UTII in 2021 for retail trade and other commerce is acceptable if the company’s staff is up to 100 people;

- the type of entrepreneurship must be provided for in legislation;

- the transition to UTII in 2021 limits the participation of third-party organizations in business to 25%;

- there should be no use of trust agreements and simple partnership agreements;

- the occupation should not be related to the rental of gas stations (including gas stations), as well as their locations;

- UTII for an LLC in 2021 is possible if there is no patent and unified agricultural tax;

- the organization is not a major payer.

back to menu ↑

Who can use UTII in 2021

Individual entrepreneurs and organizations still have the right to choose UTII as a tax regime. In this case, several conditions must be met:

- the Russian region in which the business operates must apply the UTII regime,

- business activities must be included in the list of activities for which UTII is acceptable,

- the average number of employees in the organization should be no more than 100 people,

- the organization is not one of the largest tax payers,

- the authorized capital does not contain more than ¼ of the share of other companies,

- activities should not be conducted under the regime of trust management or a simple partnership agreement.

For whom is it available?

Activities on UTII in 2021 are possible if its parameters comply with the law:

| Entrepreneurship | Parameters that make it impossible to use |

| Household sphere | Activities on UTII in 2021 should not include the provision of land for use for commercial outlets and (or) gas station sites. |

| Veterinary | Large payers. |

| Transport repair and maintenance | Penalty parking lots. |

| Rental of parking spaces, including security services. | If trade fees apply |

| Cargo and passenger transportation, subject to the availability of up to 20 units of transport for such commerce. | In addition to that in agricultural production. |

| UTII in 2021 for retail trade can be applied if it has: 1 point up to 150 sq. m.; 2 points in stationary objects without halls (in covered markets, through tents, kiosks, vending machines) or through non-stationary objects (counters, vans, tanks). | In medical or social institutions. |

| Catering up to 150 sq. m., including those without halls. | The number of personnel last year was more than 100 people. |

| Placement of advertising outside objects on special structures, as well as on/in transport. | Activities on UTII in 2021 should not be carried out if there is a 25% contribution from another enterprise. This also applies to all types of UTII commerce. |

| Renting sites up to 500 sq. m. for rent, as well as points for retail trade, catering, including land plots. | Use of trust deeds or simple partnerships. |

| Hotel business with sleeping places up to 500 sq. m. |

Important: Local authorities are authorized to determine the compliance of UTII with commercial activities provided for in the law. If the type of entrepreneurship is in a regulatory act, but has not been introduced in a certain region of the country, then the subject does not have the right to use “imputation”.

back to menu ↑

How to transfer and deadlines

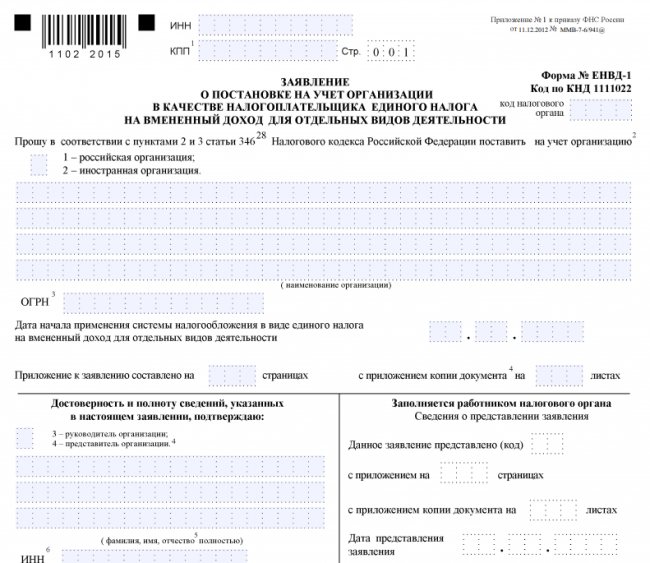

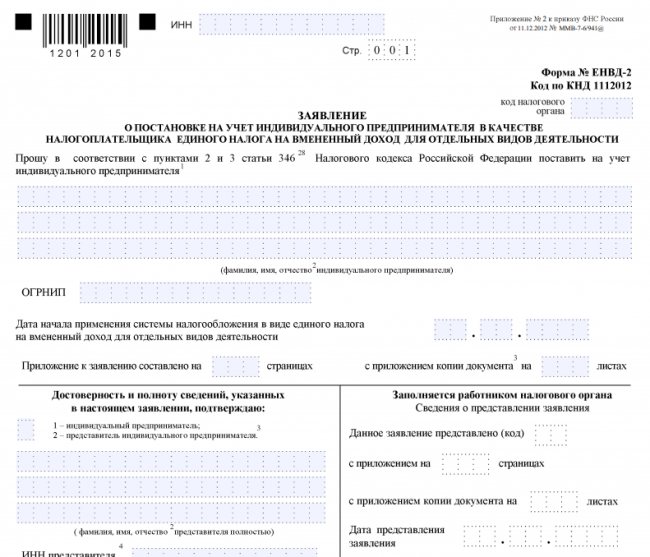

The transition to UTII in 2021 is permissible after submitting to the Federal Tax Service a completed application form in two copies, namely:

- UTII form No. 1 in 2021 for organizations;

- UTII form in 2021 No. 2 for individual entrepreneurs.

The specified templates, as well as the UTII declaration in 2021, are provided to the department at the address of the case.

For distribution/distribution commerce, transportation, transport advertising - the UTII form in 2021 is submitted at the place of registration.

At least 5 days must pass from the start of business to submit such an application.

If the case is being conducted in several regions, then it does not matter which inspection department to submit the notification to; it is enough to submit it to any office of the department in the area of doing business.

back to menu ↑

How can a businessman switch to UTII in 2021?

Until 2013, all commercial activities that fell under the “imputation” parameters were automatically assigned to this regime. A new procedure for the transition to UTII was introduced on January 1, 2013.

Now the entrepreneur chooses the system voluntarily, and then submits an application for registration as an individual entrepreneur and the selected UTII tax regime to the Federal Tax Service at the place of work. However, from the moment of official registration, the individual entrepreneur has another 5 days to decide.

Some types of activities require registration at the place of residence:

We recommend you study! Follow the link:

What type of taxation is best to apply when opening an individual entrepreneur?

- retail trade providing delivery services;

- advertising on any vehicle;

- transportation of passengers or cargo.

You can start using the UTII 2021 IP from the middle of the year, but only simultaneously with registration or when you choose a mode for the first time (for example, an IP already working on the simplified tax system decided to open a cafe and combine two modes). You can switch from one mode to another only from the beginning of the year. Notification to the tax authority is submitted within 5 days. (workers) from the date of commencement of imputation activities.

Experts recommend that in the registration application (or in the notice of transfer) indicate only those OKVED codes that correspond to the types of “imputation” activities. Otherwise, a controversial issue about combining modes may arise.

What to pay on "imputation"

One tax is an advantage of UTII in 2021. VAT, personal income tax, and payments on property are abolished (if the tax base is not considered as the cadastral value).

Activities on UTII in 2021 still involve several payments, namely: personal income tax deducted from employee salaries, insurance contributions (pension, medical, social). But they can be deducted from tax.

Important: If the property is included in a special list approved by the regional authorities and the tax regarding it is calculated according to the cadastre, and not according to the inventory value (typical of shopping centers and business centers), property tax must be paid.

back to menu ↑

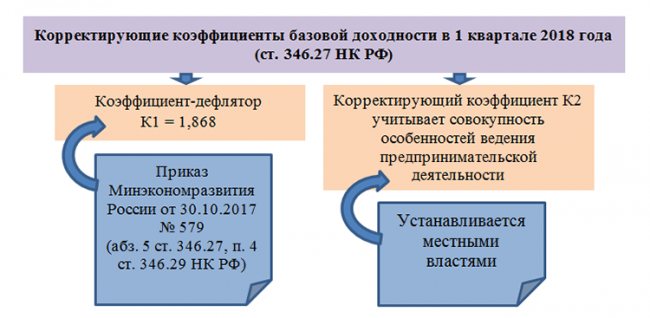

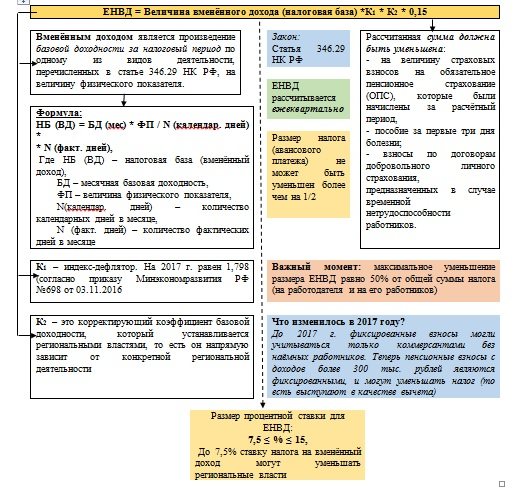

Values K1 and K2

The table records the UTII coefficients for 2021 in exhaustive form; they are established by law. Calculation of UST in 2021 is carried out by multiplying the basic profitability by these two indicators and by the physical parameters in each month (Article 349.29 of the Tax Code). This is how the tax base is calculated.

back to menu ↑

Concept K1

UTII changes in 2021 for retail trade include correction through a deflator.

The 2021 UNDV calculation includes this figure. It has a direct impact on the basic profitability (BR) for a specific type of business.

From 2015 to 2017, K1 did not change and was equal to 1.798. In the current period, according to the order of the Ministry of Economic Development No. 579 K1 for 2021, the UNDV is 1.868.

This figure is constant and does not depend on the part of the country or the type of commerce.

With the increase in K1 for 2021, the amount of the single payment has also increased.

Despite this, this type of non-profit is still very profitable for a small enterprise.

When preparing documents for UTII in 2021, the described value is prescribed to be displayed on page 050 in R. No. 2.

back to menu ↑

What is K2 for?

Calculation of the UNDV in 2021 uses the previous value as an increasing constant.

It is unchanged for the entire country and any type of commerce, and K2 is a figure for correcting the database to reduce it.

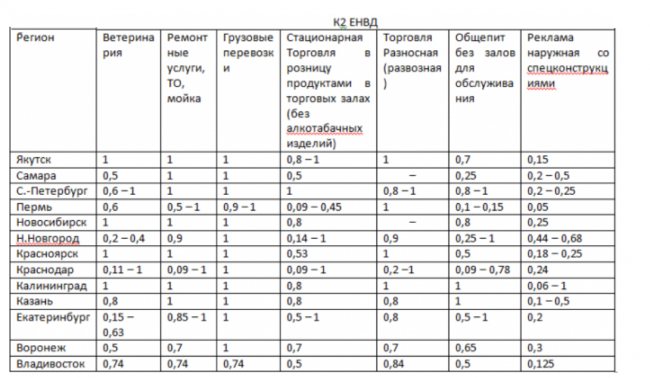

The table provides these UTII coefficients for 2021 for each type of business activity.

The table enters K2 for UTII for 2021 for 12 months, and its range is from 0.005 to 1.

If it is changed, then the new figures apply only in the following year.

At the same time, it is assumed that if K2 according to UTII for 2021 the table improves for the subject, then it can be taken into account from the date specified in the relevant act until the end of the year.

Municipal authorities are vested with the authority to change K2 for UTII in 2021.

It is by their decision that it is introduced in a specific part of the country.

Important: If the coefficient has not undergone transformations before the beginning of the year, then it remains the same throughout it. In reality, K2 rarely undergoes correction and in 2018 it remained unchanged.

back to menu ↑

Specifics of K2

The table may show different UTII coefficients for 2021 for one city.

This depends on the type of business, the place where it is run, as well as on physical indicators and the range of products sold.

UTII for LLCs in 2021 and for individual entrepreneurs has the features of K2: it may have deviations, the purpose of which is to take into account specific physical indicators of entrepreneurship (for example, seasonality).

During the calculation process, these subvalues are multiplied, and the result is K2.

If the table does not display the UTII coefficients for 2021, that is, they have not been established, but the UTII is applied, then it is assigned indicator 1.

This is the reason that in such regions the “imputation” base is stably at a constant level.

For K2 on UTII for 2021, the table and usage standards are published regularly on the regional resources of the Federal Tax Service in sections for this type of taxation.

There is also a current UTII form for 2021 and all the necessary digital values for today - payers can easily track the K2 correction for UTII for 2021.

For points of interest to business entities, you can also contact the consulting departments of tax departments.

In UTII declarations in 2021, the applied K2 is displayed on page 060 in R. No. 2. The deadline for submitting reports in 2021 UTII is at the end of the quarter.

back to menu ↑

K2 today

For K2 according to UTII for 2021, the table may have different indicators for each territory - as we wrote above, this depends on the decisions of the local authorities, approved in local acts.

All the information on the country regarding this issue is very voluminous, so here we will describe only part of it for some settlements

back to menu ↑

How to calculate tax for UTII, using what formula

The calculation of UTII has its own nuances: the formula for calculating UTII includes both real business indicators (number of employees, number of vehicles, store area) and expected ones - monthly profitability of activities. This is a fixed amount that officials calculate; it changes quite rarely. And to take into account inflationary processes and local characteristics of activity, deflator coefficients are used: K1, which is established by the Ministry of Economic Development, and K2, which is determined by municipal officials.

To calculate UTII you need to know the tax base. How to calculate the tax base for UTII - read here .

It's rare that a company starts its work on the first day of a new quarter. In this regard, the question arises: how should the imputed tax be calculated if the company began its work in the middle of the month? A detailed answer with links to explanations from the Ministry of Finance is given in the article “If a new business is started in the middle of the month, UTII is calculated only for days worked .

IMPORTANT! A company can change the amount of imputed tax payable depending on the days actually worked only at the beginning of its activities as an “imputed tax” or when closing a business on UTII. Read more about this in the material “Imputed income does not depend on the number of days actually worked .

So, you have switched to UTII and want to know how to calculate the tax base for UTII without errors and protect yourself from the nagging of tax inspectors? Then you need to read this publication .

Imputation has one undoubted advantage, thanks to which this special regime is in some cases more profitable than PSN, which can also be used for many types of activities falling under UTII. The UTII payer can reduce the tax payable by the amount of insurance premiums. “The procedure for reducing UTII by the amount of mandatory insurance contributions” will tell you how to do this .

If you are the head of a company and want to check the work of your accountants, then our article will be useful to you.

This publication contains a formula for calculating imputed tax, links to legislative acts regulating the calculation, the sizes of deflator coefficients and the calculator itself for calculating UTII. Knowing the size of the physical indicator, you can calculate the tax payable. The calculator will be useful not only for managers, but also for accountants - use it to check your calculations.

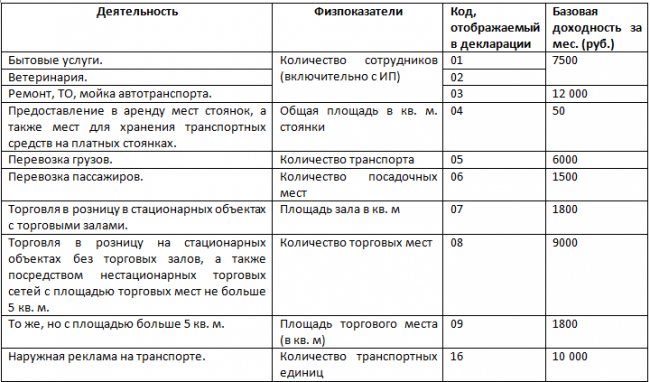

Codes and database

The calculation is carried out using the data provided by the table of basic UTII yield for 2021. DB is a conditional income based on the physical indicator. These two parameters are established by law.

The table of basic UTII yield for 2021 displays constant constants, adjusted by K1 and K2.

Let's display it along with the business codes for the declaration:

All codes and meanings are displayed in the tax code and in by-laws.

They must be strictly observed, since in case of an error, the Federal Tax Service will not accept declarations and other documents.

back to menu ↑

Calculation

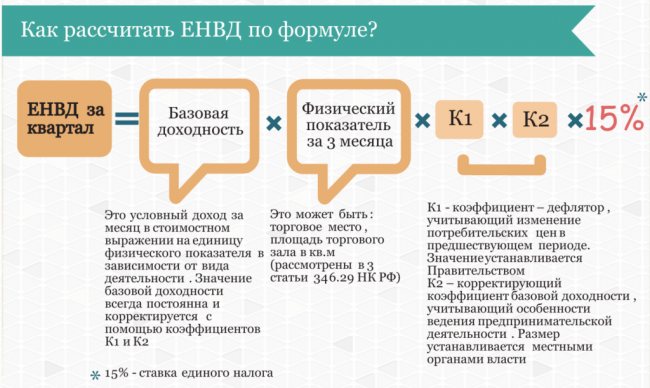

There are special formulas for calculation. You can also use online calculators.

To determine how much you need to pay the “imputed” person for the quarter, there is the following equation:

Basic UTII yield for 2021 x physical indicator x K1 x K2 x 15% x 3.

The figure 15% is the percentage of UTII, 3 is the duration of the period in months.

The table, partially given above, contains UTII coefficients for 2021 for each region; it is available in full on the tax authorities’ website.

back to menu ↑

Calculus example for trading

Let us give, as an example, a typical set of parameters (for UNDV in 2021, changes for retail trade are taken into account):

- type of commerce: stationary retail with halls;

- point area – 30 sq. m.;

- There are no employees, the entire business is handled by the individual entrepreneur alone.

Calculation of USTV in 2021 according to the given parameters is as follows:

- basic income for UTII for 2021 – 1800 rubles. (see table);

- FP – 30 sq. m.

- K1 for 2021 UNDV – 1.868. This is a stable value;

- K2 according to UNDV for 2021, the table for city A displays as 1;

- we substitute the values into the equation and get the result 45392.40;

- insurance premiums amounted to 7500, we deduct them: 45932.40 – 7500 = 37892 rubles. 40 kopecks

back to menu ↑

For advertising on transport

Situation parameters:

- external transport areas, number 3 pcs. This figure will be a physical indicator;

- the basic yield on UTII for 2021 is constant - 10,000 rubles. (see table above);

- K1 for 2021 UNDV – 1.868;

- K2. Local authorities have the right to differentiate different advertisements placed on transport, depending on its dimensions and other parameters, therefore the table may contain different coefficients for UTII for 2021 for each region. In our situation, advertising is commercial and has a value of 1.

Calculation of UTII in 2021 for this set of parameters: 10,000 x 3 x 1.868 x 3 x 15% = 25218.

back to menu ↑

For cargo transportation

The UTII tax in 2021 is calculated by an individual entrepreneur or an organization engaged in cargo transportation in the same way as indicated above.

The values that we indicated and the basic yield on UTII for 2021 are substituted into the formula.

Important: The basic UTII yield for 2021 may change every year, so it is highly advisable to clarify them. This can be done by going to the websites of tax departments and selecting the appropriate region of business activity.

Let's consider an example when the activity on UTII in 2021 consists of providing freight transportation services through three units of transport.

The table of basic UTII income for 2021 shows a value of 6,000 rubles, the physical indicator is 3, that is, as much as the equipment is available, while its brand and dimensions do not matter. K1 for 2018 UNDV is 1.868 and K2 in our region is 1.

We substitute all values into the equation: 6000 x 4 x 1.686 x 3 x 15% = 20,174 rubles. 40 kopecks.

Important: In all cases, if an individual entrepreneur paid insurance premiums for himself and his employees, they can be deducted from the UTII tax.

back to menu ↑

For household services

Activities on UTII in 2021 for household services are a commercial group that occupies a very significant part of the market and is especially popular for small organizations and individual entrepreneurs.

It includes repair shops, warranty centers, hairdressers, plumbing specialists and the like.

Activities on UTII in 2021 are beneficial for such entrepreneurs, as they do not involve maintaining complex reporting and at the same time have reduced rates.

Let's consider the parameters for a workshop for performing household work:

- DB is equal to 7500 rubles. We remind you that this value is stable;

- The FP for all kinds of ateliers, shoe shops, and technical workshops is equal to the number of workers. If there are 5 of them, then the value is equal to this figure. In our case, the citizen takes care of everything himself, so the value is 1;

- K1 is a constant parameter, we described this deflator above in the article, it is equal to 1.868;

- K2. This figure can be found on the website of the administration or local government where the entrepreneur runs his business. Let's say that for our city it is 0.8.

- we substitute all values into the equation: 7500 x 1 x 1, 868 x 0.8 x 15% = 1681.2. We multiply the result by the number of months in the quarter and get the final figure of 5043.6 rubles.

back to menu ↑

Calculation of UTII 2021

The single tax formula for calculating UTII in 2021 for individual entrepreneurs and organizations for the month is as follows:

UTII = BD*K1*K2*FP*0.15

- DB – basic profitability. This is the exact figure determined by the tax code for each type of activity. It is indicated for the unit of measurement, depending on the type of enterprise. For example, for retail trade, if the area of a retail outlet exceeds 5 sq/m, the basic profitability is 1,800 rubles per square meter. For a motor transport company for the delivery of goods – 6,000 rubles for each transport unit. For an organization providing household services – 7,500 rubles for each worker, including the entrepreneur himself. A complete list of basic income amounts is specified in the Tax Code, Article 346.29.

- K1 – deflation coefficient established by the government of the Russian Federation. For 2015, coefficient K2 = 1.798.

- K2 is a correction factor. It is appointed by local government authorities and, at their request, can be from 0.005 to 1, that is, whether or not to reduce the tax burden. When using a correction factor, the resulting value should be rounded (to the third decimal place). To find out the size of K2, you should contact your local tax office.

- FP – physical indicators of the enterprise. This is the total number of units of measurement specified in the “base yield” paragraph. For entrepreneurs in the field of retail trade, it is necessary to calculate the square meters on which the retail outlet(s) are located, for organizations providing personal services - this is the number of employees, for motor transport enterprises for the delivery of goods - the number of vehicles, etc. When calculating the single tax FP rounded to whole numbers.

0.15 is 15% of the calculated imputed income, which must be paid to the budget.

To pay for a quarter, the resulting value is multiplied by three.

How can you reduce

For UNDV in 2021, changes for retail trade are minimal, so, as before, it can be adjusted using several techniques:

- UTII tax in 2021 for individual entrepreneurs directly depends on physical indicators - the number of personnel, space, transport units - therefore, if they are reduced, it will also decrease. One of the methods regarding retail space is to transfer some of it to utility rooms;

- combination with “simplified”;

- The UTII for an LLC in 2021 can be lowered if you submit documents stating that commercial activities have not been carried out for some time;

- deduction of insurance paid for yourself and for employees, but not more than half of the amount of the fee. The UTII tax in 2021 can be adjusted by an individual entrepreneur in this way only if it is paid before filing the declaration;

- if an online cash register was installed, then the payment can be reduced by its cost, but up to 18,000 rubles.

back to menu ↑

Possible changes to UTII next year

One of the likely changes that should somewhat help entrepreneurs with the purchase of online cash registers will be possible compensation for the costs of their purchase by reducing taxes. At the same time, the state will set a limit - no more than 18 thousand rubles for each new generation cash register. In practice, online cash registers cost at least 1.5-2 times more, but such compensation, if it exists, will in any case come in handy for those who would like to continue working.

Another likely change to the UTII regime is its complete abolition or sharp restriction for individual entrepreneurs and legal entities working in the retail trade sector. One of the proposals is to reduce the limit on retail space from 150 to 50 square meters, another proposal is to abolish UTII for such establishments in principle.

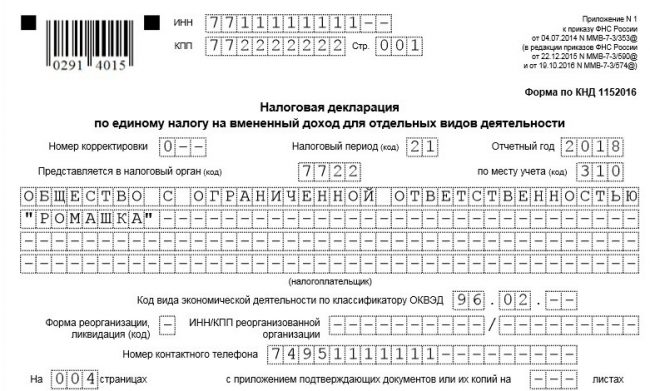

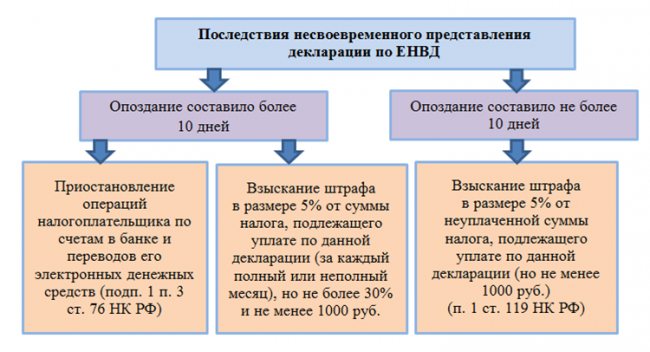

Reports

The UTII declaration in 2021 is submitted 3 months in advance, so the deadlines for submitting UTII reports in 2021 imply their preparation quarterly within a 20-day period from the date of its completion.

If the deadline falls on a weekend or holiday, it is moved to the first working day after them.

back to menu ↑

What documentation is maintained?

Entities on UTII in 2021 enjoy relaxations, one of which is simplified reporting.

It is not necessary to maintain it, like accounting, but this does not mean that control and recording tools are completely abolished.

They make it possible to monitor changes in the enterprise by the relevant authorities.

"Impostors" maintain the following documentation:

- accounting of physical indicators;

- tax return (due dates for submitting reports in UTII 2021 are quarterly);

- As a rule, they also maintain a balance sheet and employee reports;

- discipline at the cash desk.

Important: In 2021, those enterprises that make payments to clients, both in cash and electronic money, are required to install and register online cash registers.

back to menu ↑

Rules for cash registers

In 2021, UTII changes regarding cash registers are as follows.

In order to take advantage of the benefit of deducting their cost, an individual entrepreneur must register a cash register from 02/01/2017 to 07/01/2019.

If this is catering or retail trade, then the device must be registered from 02/01/2017 to 07/01/2018.

Individual entrepreneurs can reduce the UTII tax in 2021 by these amounts when calculating for 2018-2019, but not earlier than the year the cash register is registered.

back to menu ↑

When the right is lost

The right to UTII in 2021 disappears if the entity ceases to meet the parameters specified in the law, namely: if the number of employees has become more than 100 people, trust management agreements are used, with an increase in the share of other organizations (over 25%).

And also, if the activity changes and it is not on the list as one for which this right is provided.

UTII in 2021 for retail trade according to these parameters has not undergone any changes.

After losing the right, a businessman can close his business or immediately switch to a different taxation system, choosing it from among those available according to his parameters, for example, the simplified tax system and submitting the appropriate documents to the tax authorities.

back to menu ↑

How to deregister

If the imputed activity under UTII for an LLC is terminated in 2021, then the payer, within 5 days after its completion, must submit a UTII form in 2021 to the tax authorities in the form (organization). The same applies to individual entrepreneurs (form No. 4).

The filing rules are standard: at the place of registration or at the place of registration for distribution trade and transportation.

The payer is removed from the form within a 5-day period from the date of submission of the notification to the inspection.

It should be noted that all actions can be carried out through the MFC; applications can also be submitted through the government services website.

In these cases, you need to take into account the time required to transmit information to the Federal Tax Service, so the period may increase by several days.

Important: You can change UTII to another regime only from the beginning of the next year, except in situations where an “imputed” business is terminated, an individual entrepreneur or organization is liquidated, and also when the conditions do not meet the requirements for this type of taxation.

A single tax on imputed activity is ideal for small businesses.

Its advantages: simple reporting, the amount of UTII in 2021 is stable and it is possible to deduct insurance premiums from it.

It is planned to abolish it and remove it from the n/o system, but this has not yet been done.

Regarding UTII in 2021, the changes and news for retail trade are encouraging - this regime has been extended until 2021.

back to menu ↑

How to calculate UTII. Calculation of the amount of tax on UTII

Basic information about UTII

Before moving on to the formula for calculating UTII, let us briefly recall what kind of tax regime this is. UTII stands for “Unified Tax on Imputed Income” and is a special tax regime, the application of which is regulated by Chapter. 26.3 Tax Code of the Russian Federation. UTII has existed in the country's tax practice for almost 20 years and is popular among small and medium-sized businesses operating in the service sector.

To apply imputation, an entrepreneur or organization must meet a number of criteria defined by Art. 346.26 of the Tax Code of the Russian Federation: by type of activity, number of employees, etc. In addition, the future “imputed” person must check whether UTII is allowed in his region (for example, UTII cannot be used in Moscow, since this tax regime has been abolished here).

The transition to imputation is voluntary: if a company provides services for which the special UTII regime can be used, then it retains the right to switch to UTII or use other tax regimes.

UTII can be combined with other tax regimes. As for taxes, the payer of imputed income does not pay VAT, personal income tax (for individual entrepreneurs) or income tax (for organizations) for activities that are subject to UTII. Until 2014, “imputed” people did not pay property tax; currently, the obligation to pay this tax depends on whether the “imputed” property is included in the cadastral list.

For the time being, the “imputed person” is allowed not to use cash registers in his activities, but to issue BSOs at the client’s request.

Read more here.

The imputed tax payer submits declarations 4 times a year - every quarter. The UTII declaration is easy to fill out: you need to indicate the physical indicator, adjustment factors, basic profitability, BCC and OKTMO, as well as data from the company itself. Thus, the information for calculating the amounts due for imputed tax and the data for the tax return for UTII coincide.

A tax regime similar to UTII is the PSN - patent taxation system. A patent is purchased for a limited period of time, and after its expiration, you must reapply for a patent. The cost of the patent is also calculated based on the expected income. Officials offer PSN as a replacement for imputation. PSN has its advantages, but in most cases, the calculation of UTII shows that imputation is more profitable due to the presence of a number of features, which you can read about in this section .