Any enterprises and individual entrepreneurs operating in Russia can choose a special taxation regime that allows them to abandon the general system and instead pay UTII to the budget. The main thing is that their activities comply with the criteria specified in Article 346.26 of the Tax Code of the Russian Federation and that relevant laws are adopted at the local level.

To apply UTII, you must register with the territorial tax authorities as a direct payer of this tax. Organizations and individual entrepreneurs must use different application forms to switch to imputation. For companies, the UTII-1 application form is used in 2021, which can be found in Appendix No. 1 to the order of the Federal Tax Service of Russia dated December 11, 2012 No. MVV-7-6 / [email protected] (Individual entrepreneurs fill out the UTII-2 form). The data is entered into the UTII-1 form in accordance with the requirements of Appendix No. 9 of the same order. UTII-1 must be submitted within 5 days from the date of application of the imputation.

You can fill out the form using a pen or on a computer. Form UTII-1 should not be submitted with marks. Empty cells are filled with dashes. On the computer, the UTII-1 form in 2021, as before, is filled out using the Courier New font of 16-18 pixels.

What is UTII 2 and why is it needed?

UTII stands for unified tax on imputed income or “imputed income”. This tax is not imposed on a legal entity or entrepreneur, but on a specific type of activity. The regime is simplified, and its peculiarity is the calculation of tax payments not on profit, but on a certain amount. This amount is set by the state for each type of activity and reflects the profit that a businessman could receive from engaging in it.

To register when switching to this tax regime, the entrepreneur must submit UTII 2, otherwise he will not have the right to work in this format. Even if an individual entrepreneur is already registered with the Federal Tax Service, he is obliged to notify the tax authorities about the start of “imputation” activities.

If you do not submit an application, after identifying a violation, the entrepreneur will have to pay the required taxes according to the scheme that he applies, as well as pay penalties and fines. The same applies to late payments.

Application form for UTII-1 and UTII-2: how to fill out?

Application forms for UTII-1 and UTII-2 are approved by Order of the Federal Tax Service of the Russian Federation dated December 11, 2012 N ММВ-7-6/ [email protected]

Each form includes a cover page and an appendix. Forms UTII-1 and UTII-2 differ only in the title page, which is filled out by organizations and individual entrepreneurs, respectively.

Both on the title and on the application you need to fill in the page number and indicate the TIN-KPP of the organization (TIN of the entrepreneur).

Filling out the registration form in 2021

The procedure for filling out the UTII application is approved by law:

- When entering data manually, you are allowed to use a pen with black or blue ink.

- All letters must be printed.

- For electronic formats, size 18 Courier New font should be used.

- Each empty field must be marked with a dash, even if it is an empty block.

- One cell is intended for a single character.

The document consists of a title page and an appendix, on which the page number and TIN of the entrepreneur should be indicated. The title page contains the applicant's full name and OGRNIP - the registration number indicated in the certificate.

The application contains information about the activities that the individual entrepreneur intends to conduct. The application includes:

- In the column “Please register” - the full name of the businessman in the nominative case.

- Registration number.

- The date from which UTII is planned to be applied.

- Information about the type of activity being transferred to the new mode, as well as its code.

- Address of the activity.

Important! If different activities will be carried out at separate addresses, each of them is included.

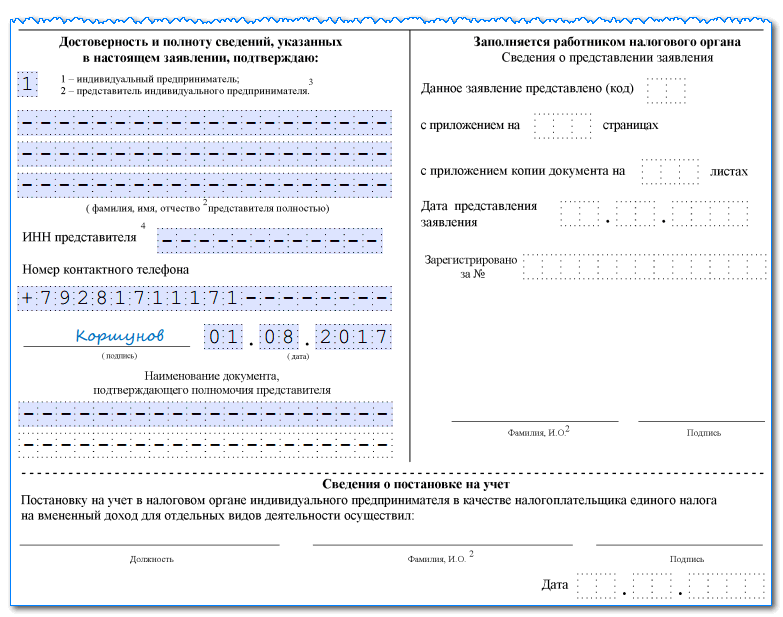

If the individual entrepreneur submits the documentation himself, the block about the representative is not filled out. If the papers are transferred by a proxy, you need to enter his full name (nominative case), as well as the number of the power of attorney or other document giving the right of representation.

Form UTII 2 for individual entrepreneurs 2021 is designed for three types of activities. If an individual entrepreneur intends to transfer a larger number of services to this taxation scheme, he will have to print the second page twice and attach it to the first. In this case, 003 is written in the header, on page one it is indicated that the application is submitted on two sheets.

The application for registration of UTII is filled out in two copies. The first is taken by the tax authorities, the second remains with the entrepreneur with a note about acceptance of the documentation.

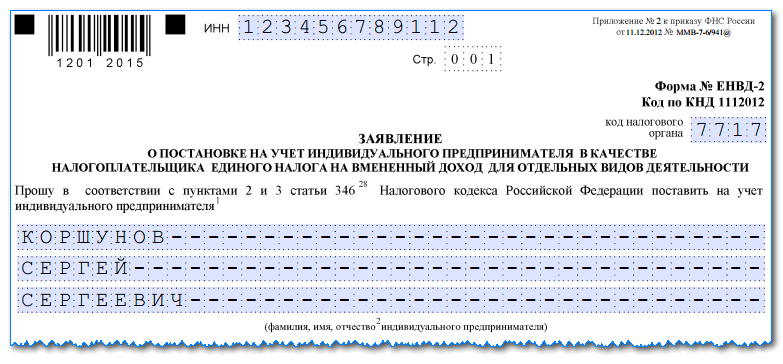

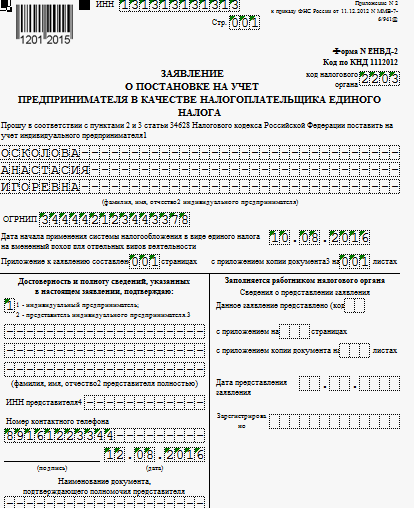

Sample of filling out an application according to the UTII-2 form

Title page

At the top of the form, the entrepreneur writes down his TIN of twelve characters.

After this, you need to enter the four-digit code of the tax authority where this application is being sent.

Next you need to write down your full name. entrepreneur without cuts. Each piece of data must start on a new line. The remaining blank lines must be crossed out.

You might be interested in:

Application for annual paid leave - how to write correctly in [year] year

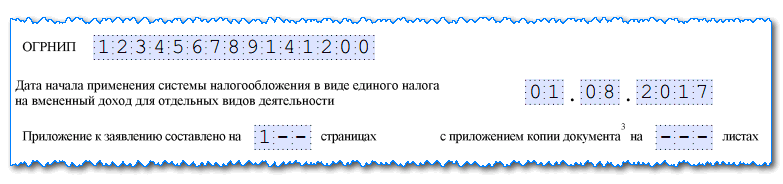

Next you need to enter the OGRIP code. Then comes the date from which the entrepreneur carries out (or plans to carry out) activities according to the types specified in the application.

Then there is a field that indicates the number of pages with applications. You need to fill in starting from the left cell, the rest are crossed out.

The application can be submitted by both an entrepreneur (code 1) and his authorized person (code 2). In the first case, he indicates his phone number, puts a date and signature. All other cells are simply crossed out. If the application is submitted by a representative, then he writes down his full name, tax identification number, information about the power of attorney, as well as telephone number, date and personal signature.

Attention! If the form is signed by an authorized person, then a power of attorney must be attached to the application and the number of attached sheets must be indicated.

Sample for individual entrepreneurs

There are samples of filling out UTII 2 for individual entrepreneurs. It is always better to focus on this option so as not to make mistakes and not redo the document. This will save time, avoid unnecessary visits to the inspectorate and quickly resolve the issue of switching to a new format for calculating and paying taxes.

XLSX format

When and where to submit UTII 2

UTII 2 must be submitted to the tax authority serving the area where you plan to operate. But there are exceptions when the document is handed over to the tax authorities at the place of registration. These include:

- Activities in the field of advertising.

- Transportation.

- Leasing of commercial properties or land.

If activities are carried out in two regions, the application must be submitted to both. Submission can be made via the Internet or via telecommunications channels.

To submit UTII 2, a period of 5 calendar days is allotted from the date of commencement of activity. The same time is given to tax authorities to consider the application. Accordingly, after 5 days the entrepreneur must be sent a notification about registration, or he can come for confirmation in person.

Important! A second copy of the paper with a mark on the date of receipt of the application will help resolve controversial issues.

The procedure for switching to UTII

Currently, UTII can only be chosen voluntarily. This regime is regulated by the laws of local authorities, so in order to find out exactly about the possibility of using UTII, you need to study the relevant acts.

You can switch to UTII immediately upon registering an individual entrepreneur with the submission of the appropriate package of documents, or from other modes. It should be taken into account that some previous systems (for example, simplified taxation system) cannot be changed until the end of the year. It is allowed to combine the taxation regimes OSNO and UTII, simplified tax system and UTII for different types of individual entrepreneur activities.

An entrepreneur who has decided to change the taxation system must notify the Federal Tax Service at the place of its activities within 5 days from the date of commencement of work. To do this, he must use an application for UTII, by order of the Federal Tax Service for which the UTII-2 form is established. The future taxpayer must take into account that there is a list of types of activities for which an application for UTII for an individual entrepreneur is submitted at the place of his registration (place of residence). This, for example, includes services for the transportation of goods and passengers.

The UTII form 2 can be filled out electronically or manually using black block letters. An entrepreneur can use specialized programs, Internet services, purchase forms at a printing house or print from a computer.

Who does not have the opportunity to register?

The list of activities for which UTII can be applied includes:

- Retail trade.

- Veterinarian services.

- Vehicle washing.

- Advertising activity.

- Domestic services.

- Renting out retail spaces or plots of land.

- Transportation of passengers and cargo.

- Parking and parking services.

- The work of hoteliers.

UTII cannot be used by residents of regions where such a regime is not provided for by legislative acts. This scheme cannot be used by entrepreneurs providing public catering services, leasing gas or gas filling stations, or engaged in financial intermediation.

To register an individual entrepreneur on UTII, several requirements must be met:

- No more than a hundred hired workers.

- Conducting activities in the region where this tax regime officially operates.

- Compliance of the activities carried out with the established list.

If these conditions are met, the entrepreneur has the right to register by submitting an application for UTII. The document exists in the form of a form that must be filled out.

Features of UTII

Before changing the tax regime and transferring one or more types of activities to UTII, you should carefully analyze the features of this scheme and the benefits of a particular business. Like all other modes, imputation has advantages and disadvantages. For some forms of business this mode will be the best option, for others it will not be suitable at all.

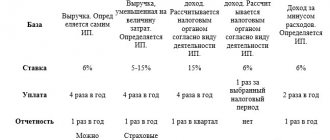

At the moment, there are two tax payment schemes in the Russian Federation, which are considered simplified. These are the simplified tax system and UTII. Both regimes reduce both the tax and administrative burden. But there are certain differences. The simplified tax system is characterized by:

- Direct connection between the amount of tax and the income received from the activity. The higher the profit, the higher the tax.

- A large number of permitted forms of activity.

- The possibility of reducing tax payments by the amount of payments to medical and pension funds, as well as social insurance, both for the entrepreneur himself and for his employees.

- Submission of the report to the tax authorities only once a year.

Using this system, you are allowed to work with government agencies and legal entities, but when making cash payments with counterparties, you must use cash register equipment. This leads to increased costs for the entrepreneur. This option is not suitable for businesses with large incomes, since taxes are also significant.

The advantages of UTII are the fixed amount of tax payments, independent of the volume of profit, as well as the absence of the need for cash registers. In this case, the tax amount is reduced by 50% of the paid insurance premiums for hired employees. Imputed income tax replaces personal income tax, VAT, and property tax, which simplifies accounting and reduces the tax burden.

But there are fewer permitted types of activities on UTII than on the simplified tax system, and working with government organizations and legal entities with non-cash payments is prohibited. Tax authorities will have to submit reports quarterly. Even if income decreases, tax payments do not decrease.

Important! UTII can be combined with other tax schemes. Thus, for one type of activity it is possible to use the simplified tax system, for another - “imputation”, but accounting for them is kept separately.

Reporting on UTII

Entrepreneurs working on UTII must submit a declaration by the 20th day of the first month in the next tax period. As for the rest of the reporting, its maintenance is not regulated by law. It is enough to take into account physical indicators in a form convenient for the entrepreneur.

Important! An individual entrepreneur is not required to record income and expenses.

On UTII, as on any other regime, it is necessary to store documentation confirming the legality of the activity in case of inspection by regulatory authorities. This applies to the origin of goods, compliance with sanitary requirements, data on the origin of goods.

Tax calculation

Calculating the amount of tax payment on imputation is quite simple. The tax base for calculating the payment is determined by several indicators:

- The basic profitability of the selected type of activity is indicated in Art. 346.29 of the Tax Code of the Russian Federation in the form of a specific amount.

- Deflator coefficient K1, which takes into account changes in the price level for services and goods in the previous tax year. The indicator is set at the federal level.

- Corrective coefficient K2, adopted at the regional level. This indicator is determined taking into account the place of business, seasonality, type of activity and other factors. Its value varies from 0.005 to 1, exact data are published on the official web resources of regional administrations.

- A physical indicator that takes into account the scale of the business - the number of employees, the size of retail space, the number of seats in transport during transportation, etc.

The tax amount is added up by multiplying all these figures by the 15% tax rate and deducting insurance premiums.

Switching to UTII is beneficial for entrepreneurs who receive fairly high income from their activities. But this mode is not available for all types of activities; it is better to clarify this point in advance. To change the tax scheme, it is enough to submit a correctly completed application to the tax authorities using a special form, but do this no later than 5 days after the start of work in the new format. It is better to use the sample filling and download the ready-made form. The Federal Tax Service must register an individual entrepreneur under the new regime within 5 days. You will have to pay tax, which is calculated on imputed income, regardless of the actual profit received.

Timing of transition to imputation

In accordance with Art. 346.28 of the Tax Code of the Russian Federation, an application for registration must be submitted to the tax authority within 5 working days from the beginning of the application of UTII.

The date of registration will be the date indicated in the corresponding line in the application (according to Article 346.28 of the Tax Code of the Russian Federation).

After receiving the application, within 5 working days the tax authority will issue (send) to the taxpayer a notice of registration under UTII.

According to Article 346.29 of the Tax Code of the Russian Federation, if an organization or individual entrepreneur is registered with the tax authorities as payers of a single tax (as well as their deregistration from such registration) not from the first day of the calendar month, then the amount of imputed income for this month is calculated based on the actual number of days of activity this month.

Violation of the registration deadline

For violation by a taxpayer of the deadline for filing a single tax application, liability may be imposed under Article 116 of the Tax Code of the Russian Federation “Violation of the procedure for registration with the tax authority” - a fine of 10 to 40 thousand rubles.