Sick leave 2017 calculate

Editorial

Promdevelop editorial team

A sick leave certificate is a document certifying a valid reason for an employee’s absence from the workplace.

It is issued during pregnancy, during illness, in case of need to care for a child or for other reasons prescribed in regulations. This document serves as the basis for the employer to pay a certain amount of money. However, the procedure for calculating sick leave changes every year.

How is sick leave calculated in 2017?

The amount of money intended to pay for sick leave does not have a fixed rate. The amount of payment is calculated based on the average salary of the employee and his insurance record. In this case, the calculation scheme will look like this:

- The addition of the amounts received by the employee every month during the last 2 working years.

- Finding average daily earnings. In this case, the amount received in the first point is divided by the number of days in 2 years.

- Multiplying the result obtained in point 2 by the number of working days that the employee spent on sick leave.

When calculating sick leave, the length of service coefficient is taken into account.

Average salary in Russia. And also in Moscow, St. Petersburg and in the regions!

Calculation of sick leave according to the minimum wage

The length of service factor is taken into account on sick leave in accordance with the minimum wage (minimum wage). In this case, its calculation corresponds to the following scheme:

- If the employee’s length of service does not exceed six months, then each month of sick leave will cost no more than 1 minimum wage.

- An employee whose work experience is from 3 to 5 years receives a coefficient of 0.6.

- An employee with 6 to 8 years of experience deserves a 0.8 share.

- A person who has worked for more than 8 years is awarded a coefficient of 1.

The calculation scheme becomes clearer if you look at its example.

Can a salary be less than the minimum wage?

How is sick leave calculated in 2017?

Calculation of sick leave occurs in accordance with the following example:

- Payment terms . Two working years (2016 and 2017) gave Krotkov an income equal to 308,000 rubles. His work experience is 5 years. His sick leave lasted 12 days.

- Calculation formula . 2021 – 366 days. 2021 – 365 days. From which the amount of payment after sick leave for Krotkov corresponds to this example: 308,000: 731 days * 12 * 0.6. In total, Krotkov will receive 3,033 rubles 65 kopecks.

Procedure for paying sick leave

Payment of sick leave at the expense of the employer is made taking into account 3 days from the moment of illness of the employee. The subsequent period is paid by the Social Insurance Fund. If the purpose of sick leave is to care for a child, the employer does not participate in its payment. This responsibility falls entirely on the FSS.

Features of payment of insurance contributions to the Pension Fund: tariffs, who is exempt, payment terms

The amount of money intended for sick leave is calculated and received by the employee along with wages or advance payment. In this case, the time of their payments is taken into account. If the salary comes before the advance payment, then the sick leave will be paid with it.

Rules for paying sick leave

The accountant first checks that the sick leave form is filled out correctly. If he notices errors in the execution of the document, sick leave is not paid to the employee until he provides a correctly completed sick leave form. Despite receiving papers certifying a person’s absence from work for a valid reason, not all citizens can receive money for sick leave. Sick leave is paid in the following cases:

- The person officially works for the company. The exception is a contract.

- The employee is officially registered with an individual enterprise. Also, except for the contract.

- The employee works under a contract and at the same time this document contains a clause on providing a social package.

- A citizen voluntarily transfers funds to the Social Insurance Fund.

- The person requiring sick pay is a member of the cooperative.

Working without a work book under an agreement or contract: pros and cons, is there a difference?

If a person does not meet any of these criteria, then sick leave is not paid to him. Sick leave payment is not made under the following circumstances:

- An employee's work is regulated by a contract.

- The treatment regimen was disrupted during the illness.

- The patient's outpatient record does not contain any records of his condition.

- The sick leave was issued by a medical institution operating without a license.

- The sick leave was extended for more than a month, but the medical commission did not give an opinion on this.

- A certificate of incapacity for work was issued, but the patient was not prescribed treatment.

- The date the sick leave was issued is incorrect.

- The employee was suspended from work and his salary was not retained.

- The employee's injury was the result of a criminal violation.

- The enterprise is in a state of idleness.

In order for an employee to receive a payment, documents must be submitted to the Social Insurance Fund to pay for sick leave. Their list includes:

- Certificate of incapacity for work, supplemented by a certificate with calculation of benefits.

- Salary information related to a given pay period.

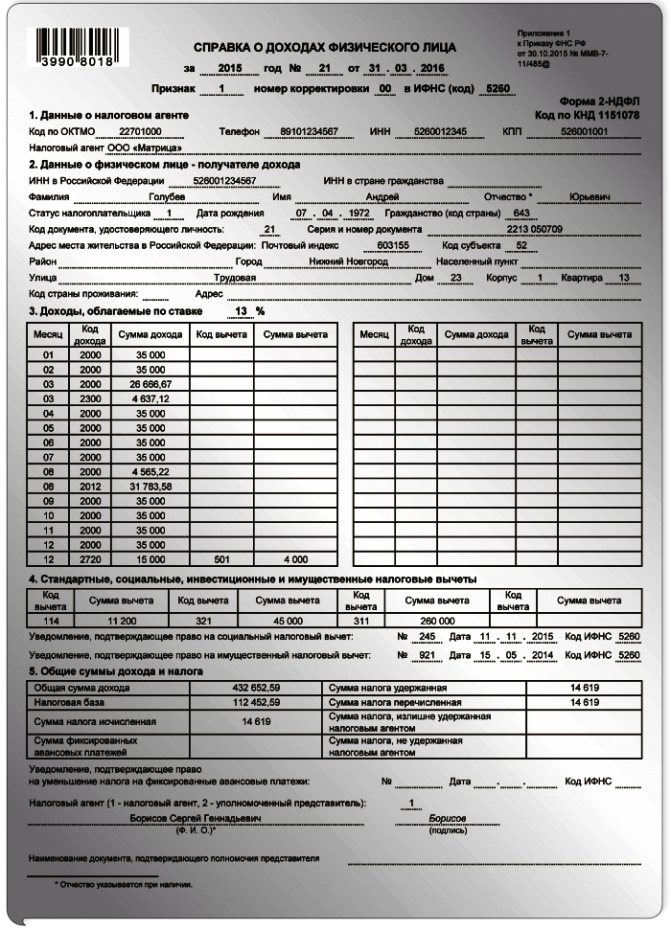

- Personal income tax-2, containing data for the last 2 years.

- Employment contract and book.

- Salary certificate taken from other employers.

- An application written by hand, which must indicate the amount of funds required to pay for sick leave.

- Calculation made in accordance with Form 4 of the Social Insurance Fund, taking into account the payment of insurance coverage.

The purpose of these documents is to confirm the status of a person entitled to receive temporary disability benefits. In addition, based on them, the required payment is calculated. Personal income tax is withheld from the results obtained.

Fines for late payment of insurance contributions to the Pension Fund

Another rule for paying sick leave applies to those who have worked at the company for less than 2 months. These employees must present to the employer a certificate from their previous place of employment, which will confirm their income for the last 2 years. The amount indicated therein will be taken into account when calculating the payment.

How to reflect personal income tax from temporary disability benefits in reports 2-NDFL and 6-NDFL

Each tax agent is obliged to correctly prepare personal income tax reports and send them to the Federal Tax Service in a timely manner. When considering personal income tax from payment for a period of temporary disability, we are interested in forms 2-NDFL and 6-NDFL.

Sick leave in 2-NDFL

Form 2-NDFL is drawn up for each employee. The employer must provide it to the employee upon his request. 2-NDFL may be needed by an employee who quits in the middle of the year to be provided with a new job. 2-NDFL is also needed when preparing a package of documents for the Federal Tax Service, if the employee has a need, for example, to receive a tax deduction for treatment fees.

The current form of certificate 2-NDFL (approved by order of the Federal Tax Service dated October 30, 2015 No. ММВ-7–11/ [email protected] ) can be filled out. When drawing up form 2-NDFL for employees who received income on certificates of incapacity for work, it is important not to make a mistake in filling out the “Income Code” column:

- for wages - code 2000;

- for sick leave, indicate code 2300;

- if the employer provides additional payment for sick leave at his own expense, then for this amount we will fill out a separate line with code 4800;

- Sick leave for pregnancy and childbirth is not reflected in 2-NDFL.

Although sick leave benefits are paid along with wages, these are two different types of income and for personal income tax they have different receipt dates:

- for wages - the last day of the accrual month;

- for a certificate of incapacity for work - the date of actual payment to the employee.

In October 2021, I.I. Ivanov was sick for a week and provided sick leave. He received benefits during his illness. And Ivanov was also paid a salary for the days worked in October. On the payday set by the employer, November 3, Ivanov received the total amount for October.

In 2-NDFL for Ivanov in October, only the line with code 2000 will be filled in, i.e. salary. Ivanov’s sick leave line (code 2300) will be reflected in the month the benefit was received, i.e. in November. In the regions included in the pilot project, employees receive 2-NDFL for sick leave in the regional offices of the Social Insurance Fund.

In form 2-NDFL, the amount of payments for sick leave is reflected using code 2300

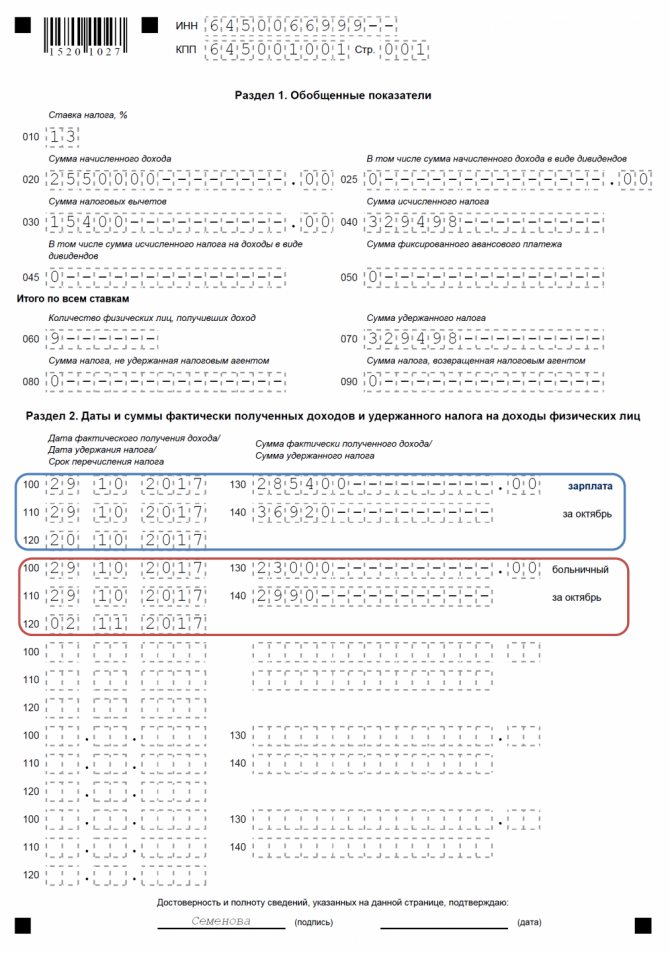

Sick leave in 6-NDFL

Since 2021, tax agents have been filling out quarterly, and since 2017, annual form 6-NDFL (Order of the Federal Tax Service of Russia No. ММВ-7–11 / [email protected] dated 10/14/2015).

Form 6-NDFL (possible) is submitted to the Federal Tax Service no later than the end of the month following the end of the reporting quarter, and the annual form - next year before April 1 (clause 2 of Article 230 of the Tax Code of the Russian Federation).

The first section of 6-NDFL reflects:

- on line 010 - the corresponding tax rate using which personal income tax amounts are calculated;

- on line 020 - the amount of accrued income generalized for all individuals on an accrual basis from the beginning of the year;

- on line 040 - the amount of personal income tax calculated cumulatively for all individuals from the beginning of the year;

- on line 070 - the total amount of personal income tax withheld on an accrual basis from the beginning of the year.

Here it is impossible to see data not only on an individual sick leave, but also on all sick leave from the beginning of the year. These amounts are included in the totals for specific lines of the first section.

In the second section of 6-NDFL the following dates and amounts are entered:

- on line 100 - the date of actual receipt of income reflected on line 130 is indicated (pay attention to the explanations of the Federal Tax Service of Russia (letters of the Federal Tax Service of Russia dated March 18, 2016 No. BS-4–11 / [ email protected] , dated November 24, 2015 No. BS-4 –11/ [email protected] ) that line 100 is filled out taking into account the provisions of Article 223 of the Tax Code of the Russian Federation, which determine the date of receipt of income);

- on line 110 - the date of withholding personal income tax from the amount of income actually received reflected on line 130 (line 110 is filled out taking into account the provisions of clause 4 of article 226 and clause 7 of article 226.1 of the Tax Code of the Russian Federation (letter of the Federal Tax Service of Russia dated March 28, 2016 No. BS- 4–11/ [email protected] ));

- on line 120 - the date no later than which the personal income tax amount must be transferred (the specified date is determined in accordance with the provisions of paragraph 6 of Article 226 and paragraph 9 of Article 226.1 of the Tax Code of the Russian Federation (letter of the Federal Tax Service of Russia dated March 24, 2016 No. BS-4– 11/5106, dated January 20, 2016 No. BS-4–11/ [email protected] ));

- on line 130 - the generalized amount of income actually received (without subtracting the withheld tax) on the date indicated in line 100;

- on line 140 - the generalized amount of personal income tax withheld as of the date indicated in line 110.

There should only be data from a specific reporting quarter, and not from the beginning of the year, as in the first section.

Letter of the Federal Tax Service of Russia dated December 28, 2015 No. BS-4–11/ [email protected]

If income of different types is paid on the same day, and personal income tax for these types needs to be transferred at different times, separate groups of lines 100–140 are automatically filled out in the second section.

For sick leave, it is important to correctly enter the dates in lines 100–120:

- date of actual receipt of income - the day of payment of the amount accrued during illness on sick leave;

- date of personal income tax withholding - day of payment for sick leave;

- The maximum permissible date for transferring personal income tax from sick leave is the last day of the month of actual payment for sick leave.

Example of section 2 of form 6-NDFL when paying for certificates of incapacity for work

The example below reports from an employer whose payday is the last day of each month:

- I.I. In October, Ivanov was absent from work for 15 working days due to illness and on October 27, 2017 he submitted a sick leave certificate, which was paid for by the employer.

- Accrued by I.I. Ivanov receives an allowance (before personal income tax withholding) in the amount of 23,000 rubles. and paid on October 29, 2017 along with the October salary.

- Let's assume that other employees did not get sick from October 1 until the end of 2017.

In form 6-NDFL for the year, this data will look like this:

- line 100 - 10/29/2017;

- line 110 - 10/29/2017;

- line 120 - 02.11.2017;

- line 130 - 23,000 rubles;

- line 140 - 2990 rub. (RUB 23,000 * 13%).

Note that I.I. Ivanov received 20,010 rubles as sick leave. (23000 – 2990).

Video: how to reflect sick leave for December in January in 6-NDFL

During a period of illness or caring for a sick family member, an employee is required to pay personal income tax in the same way as during work. Only maternity benefits issued with certificates of incapacity for work are not subject to taxation. The peculiarities of payment and taxation on certificates of incapacity for work in the regions included in the FSS pilot project “Direct Payments” need to be known to the accountants of the corresponding territories. Amounts of personal income tax withheld from sick leave are reflected in the reporting - in forms 2-NDFL and 6-NDFL.

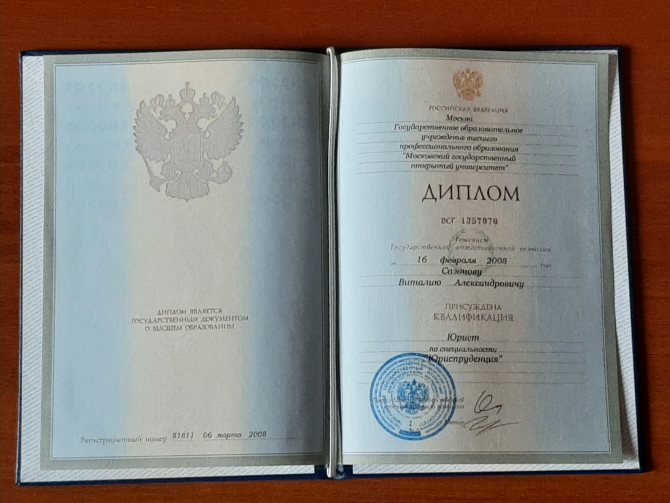

Vitaly Sazonov

Lawyer, author of articles on legal topics. Education: state educational institution of higher professional education "Moscow State Open University".

What is included in the calculation of sick leave

Based on the information presented, we can conclude that the calculation of sick leave is carried out taking into account the average salary and length of service of the employee. At the same time, years, not months and days, are taken into account as length of service. Also, when applying for payment, attention is paid to where the injury occurred. If its receipt is the result of the production process at the enterprise, then the payment for sick leave will be equal to 270,000 rubles.

When calculating wages, calendar days of the year are taken into account in full. That is, the calculations include weekends, holidays and non-working days.

Confirmation of experience

To calculate the length of service, a personnel service employee or accountant will only need a work book. If for some reason the required entry is not there, then the following documents can confirm the length of service in a specific period:

- TD;

- military ID;

- reporting with information on the payment of contributions (applies only to those persons who worked as individual entrepreneurs).

For a quick calculation, you should calculate the length of service of employees at least once every six months. This will help to avoid errors in calculations.

Similar articles

- How to calculate sick leave: formula and examples

- Is military service included in the length of service (insurance)?

- Are days off paid on sick leave?

- Are sick leave payments subject to personal income tax?

- Sick leave from 2021: changes

What else should a temporarily disabled person know?

Even if an employee falls ill during his vacation, he must consult a doctor. Having received a sick leave certificate, he has the right to ask for an extension of leave for the number of days indicated on the certificate of incapacity for work. Sick leave during vacation is paid in the same way as if the person had to work at that time.

They don't let me go on vacation - what should I do? Types of leave and procedure for granting

If a person works in several organizations, he has the right to receive sick pay in each of them. If an employee who terminates the contract with the organization falls ill, he is also entitled to disability benefits. It is paid taking into account a coefficient of 0.6 if the employee falls ill within 30 days after termination of the contract.

Calculation and payment rules

As for the specific amount of sick leave that must be paid on sick leave, it depends on various factors. First of all, it depends on the confirmed work experience and salary. By law, an ill employee receives from 60 to 100 percent of lost earnings due to disability:

- 100% is received by: a woman who takes out sick leave in connection with pregnancy and childbirth;

- employees whose insurance experience exceeds 8 years;

- persons injured at work;

Sick leave benefits are the employee’s income from which the employer or the Social Insurance Fund withholds personal income tax (clause 1 of Article 217 of the Tax Code of the Russian Federation). If you decide to independently calculate how much you will receive in your hands, do not forget to subtract the tax amount. But insurance premiums are not charged for such payments (clause 1, clause 1, article 422 of the Tax Code of the Russian Federation).

Please also note that restrictions on the amount of sick leave have been introduced by law. Thus, a person who falls ill in 2021 will receive for 1 day of illness no less than 370.85 rubles, but no more than 2150.68 rubles.

Interesting facts about sick leave

There are several interesting facts about sick leave abroad that greatly distinguish the foreign benefit system from the Russian one:

- There are no sick days in the USA. The fact of payment for a specific number of days is stated in the contract. Thus, 38% of Americans remain without temporary disability benefits.

- In Israel, only 18 working days spent on sick leave are paid per year. If the employee has not been sick all year, then these days are postponed. But you cannot accumulate more than 90 days. In addition, the first day of illness is not paid, for the 2nd and 3rd days only 50% is paid. Sick leave will be fully compensated starting from the 4th day.

- Germany provides its citizens with the opportunity to get sick for 3 days without taking sick leave. This fact does not affect their income in any way.

The system for calculating sick leave in the Russian Federation is within the strict framework provided for by Federal Law No. 255-FZ of December 29, 2006 “On compulsory social insurance in case of temporary disability and in connection with maternity.” Thus, in order to be guaranteed to receive paid sick leave, you need to follow the rules.

FSS pilot project: features of calculation and payment of personal income tax on sick leave

Since 2012, the FSS pilot project “Direct Payments” has come into effect in certain regions of the Russian Federation. The project is aimed at making it easier for Russian citizens to fully and timely receive all types of benefits from the Social Insurance Fund, including all types of payment for certificates of incapacity for work.

As part of the project, all Russians officially employed can receive:

- temporary disability benefits due to illness;

- payment for sick leave in case of injury;

- payment for sick leave to care for a sick child;

- maternity benefits;

- sick leave for injuries at work.

The activities of the pilot project in 2012–2020 are regulated by Decree of the Government of the Russian Federation dated April 21, 2011 No. 294. The pilot project is being implemented in stages, regions are included in it in the manner approved by the Government.

In the regions included in the project, sick leave payments to hired employees are made not by the employer, but directly from the Social Insurance Fund. The FSS transfers the amount of payment for days of incapacity to the account of the insured employee or sends him by transfer by mail to his residence address.

All employee data must first be entered into the Social Insurance Fund database. In the regions where the project operates, the employer pays the employee only the first 3 days of sick leave provided by the employee. Then the employer (or the employee himself, in agreement with the employer) transfers the sick leave and a certificate about the amount of the employee’s earnings for 2 years to the territorial office of the Social Insurance Fund. 5 days are allotted for this operation.

In regions where the Social Insurance Fund project operates, the employer, when filling out a certificate of incapacity for work, must leave the following lines blank:

- “Amount of benefit at the expense of the Social Insurance Fund of the Russian Federation”;

- “Total accrued.”

In the line “Amount of benefits at the expense of the employer” on the sick leave, the employer indicates the amount (including personal income tax) that he accrued to the employee for the first 3 days of the sick leave provided (letter of the Federal Social Insurance Fund of the Russian Federation dated October 28, 2011 No. 14–03–18/15 –12956).

The amount of benefits for the period of incapacity for work minus the amount of payment for the first 3 days is transferred by the FSS (after withholding personal income tax) to the employee’s personal account. With such a system of payment for disability, sick leave for the entire period, starting from the fourth day, is subject to personal income tax by the FSS department. The employer does not withhold personal income tax from the amount of sick leave paid to the employee directly from the Social Insurance Fund.

In such regions, employers must withhold personal income tax on sick leave only from their part of the benefit. Indeed, under the terms of the pilot project, the employer is no longer considered a source of payment of income in relation to sick leave beyond the first three days of incapacity for work (clauses 1–3 of Article 226 of the Tax Code of the Russian Federation).