If employee data does not need to be adjusted

In this case, the report includes only data on the organization with the adjustment number on the title page. There is no need to include employee data in the report. To remove employees from the report, uncheck them in Section 3.

If Section 1 is in automatic calculation mode, be sure to update the list of employees. For example, Kontur.Extern calculates amounts for all employees in the list, regardless of whether they are selected or unchecked. Check the box only for those employees who should be included in the adjustment report.

Also, in some systems, for example in Externa, amounts for employees and for the organization are reconciled only in the original report. To check the adjustment, use the following algorithm.

Algorithm for checking a corrective report

- Remove the correction number from the title page, if it is there.

- Update the list of employees in Section 3.

- Set the fields in Section 1 applications to automatic mode.

- Check the relevance of the data in previous periods if the calculation is not for the first quarter.

- If the data is not up to date, download the reports in pre-import mode into the service.

- Run the scan. Correct errors if any.

- Put the correction number on the title page.

- Generate and send a report.

If you report through Kontur.Extern, the task is simpler. The system will warn you if you try to send a report with the details of a previously sent report. Here are some tips:

- If the Federal Tax Service has accepted the initial report and you want to send an adjustment, the system will tell you which number you need to indicate.

- If the initial report has not yet been accepted, Extern will inform you that it is too early to send an adjustment and advise you to wait for a response from the Federal Tax Service.

- If the initial report is rejected, Extern will warn you that before sending the correction you must submit the primary report with number = 0.

Fill out, check and submit the RSV for free via the Internet

Try it

Methods and deadlines for submitting a new calculation

A new reporting document must be submitted to the territorial tax service. You can do this in two ways:

| Methods for submitting calculations for insurance premiums in 2017 | |

| Printed | Electronic (according to TKS) |

| Allowed to be used by enterprises and businessmen whose number of employees does not exceed 25 people (inclusive). | A method for submitting a report, which is mandatory for organizations and individual entrepreneurs with a staff of 25 or more people. |

The deadline for submitting a new calculation for insurance premiums in 2021 is until the 30th day of the month following the reporting period:

Thus, for the first time, you must fill out and submit to the Federal Tax Service the calculation of insurance premiums for the 1st quarter of 2021 no later than May 2, 2017 (this is Tuesday).

In 2021, the method of submitting calculations for insurance premiums (RSV-1) influenced the acceptable deadline for submitting reports. Those who report electronically had 5 more days to submit the RSV-1. Thus, legislators apparently encouraged employers to switch to electronic reporting. But in 2021 there is no such approach. A single deadline has been determined for all taxpayers: calculations for insurance premiums are submitted by all until the 30th day of the month following the reporting period.

If you need to adjust data on employees in Section 3 (except for full name and SNILS)

On the title page, indicate the correction number (for example, “1—,” “2—,” and so on). According to the filling procedure, include in the form only those employees for whom you need to correct the data.

In section 3 of the employee’s card, you just need to correct the necessary data (except for full name and SNILS).

Please note that the TIN, date of birth and passport must be adjusted in this way, and not through cancellation.

If you need to adjust the amounts for an employee, then do not forget to make changes to the appendices of section 1. If the amounts remain the same, section 1 with all appendices is included in the report without changes.

Please note: checks in the service work for all employees only if the title has an adjustment number = 0. To check the report, use the above algorithm.

Please indicate the correction number on the title page. For example, “1—”, “2—”, etc. Include two sections 3 with the same full name of the employee in the calculation and send them in one calculation:

- With an incorrect SNILS with zero (removed) Subsection 3.2 and a sign of cancellation of information about the insured person in line 010.

- With the correct SNILS number with the correct amounts in Subsection 3.2, without a sign of cancellation of information about the insured person in line 010.

If, in addition to the full name and SNILS, it is necessary to adjust the amounts for the employee, then do not forget to make changes to section 1. If the amounts remain the same, section 1 with appendices is included in the report without changes.

Example 1: SNILS is not the same, but real

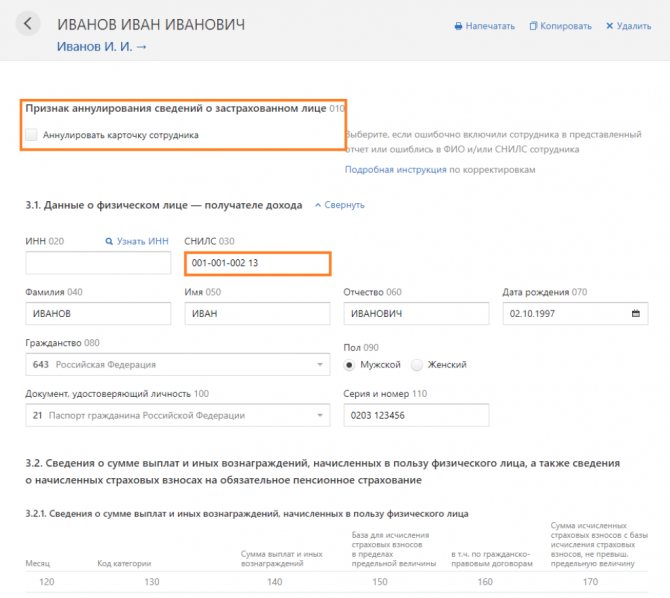

In the original report, instead of Ivanov Ivan Ivanovich working in the organization with SNILS 001-001-002 13, Ivanov Ivan Ivanovich with SNILS 001-001-001 12 was indicated. Both SNILS numbers exist, so the information was loaded into the Federal Tax Service database.

To make the adjustment, we include two employee cards in the report. The first one contains an error that needs to be corrected (removed from the Federal Tax Service database), the second one contains data that should be in the Federal Tax Service database.

In the first card in Section 3 of Ivan Ivanovich Ivanov with SNILS number 001-001-001 12, put a tick in the line “Cancel employee card.” Delete subsection 3.2.

In the second card in Section 3 of Ivan Ivanovich Ivanov with SNILS number 001-001-002 13, do not check the “Cancel employee card” checkbox and fill out subsection 3.2 with the correct amounts.

Example 2: non-existent SNILS

In the original report, instead of Ivanov Ivan Ivanovich working in the organization with SNILS 001-001-001 12, Ivanov Ivan was indicated, Ivanovich with SNILS 001-001-002 18.

Such SNILS should not pass the check for the control ratio, and the full name should not be checked according to the scheme. The Federal Tax Service should not have accepted such a report. If this happens, contact the inspector for clarification.

If the RSV-1 adjustment is submitted after the end of the next quarter

For example, you discovered errors in the Calculation for 2015 already at the end of May 2021. Corrections are made in this order (clause 27 of the Procedure, approved by Resolution of the Board of the Pension Fund of January 16, 2014 No. 2p). The first thing you need to do is fill out the correct section 6 of the RSV-1 form that was used in the period for which you are filling it out. For this:

- in subsection 6.3, in the “Reporting period (code)” and “Calendar year” fields, enter the code of the period and the year in which you are making corrections;

- In the “corrective” field of subsection 6.3, put an “X” if you are changing any information. This will mean that the type of adjustment in RSV-1 is corrective. Fill in the remaining lines of subsections 6.1-6.5 in the usual manner with correct information;

- complete subsection 6.6.

When submitting the current RSV-1, include the adjustment to section 6 as part of it. In our example, adjusting section 6 for 2015 must be included in the DAM-1 Calculation for the first half of 2021.

In subsection 2.5.2 of the reporting for the current period, fill in information about the corrections. Reflect the amounts of recalculation of insurance premiums for the previous period on line 120 of section 1 and in section 4 of the RSV-1 for the current period.

How can I clarify the data in the adjustment report?

How to clarify the DAM for the 1st quarter of 2021 if errors were identified by the Federal Tax Service at the stage of incoming control?

The inspectorate must notify the reporting submitter of the discovery of shortcomings (and the resulting non-acceptance of the DAM) by sending him a notification no later than:

- the first working day following the day the report was received in electronic form;

- 10 working days, also counted from the date of receipt, but for a report submitted on paper.

In order for the updated version of the reporting to be accepted by the date of submission of the first (unaccepted) version, it must be submitted to the Federal Tax Service no later than:

- 5 working days from the date of notification made according to electronically submitted reports;

- 10 working days from the date of sending the notification for a paper version of the report.

If the report passes control at the Federal Tax Service upon acceptance, but the submitter of the report, after submitting it, independently identifies errors that require clarification (for example, the calculation does not take into account income subject to contribution at all, or the income is mistakenly classified as non-taxable), then submitting an adjustment DAM for 1 quarter of 2020 will be carried out using the rules contained in Art. 81 Tax Code of the Russian Federation.

When filling out the updated version of the RSV, two things will distinguish it from the original one:

- in the field specially designed for this on the title page, you must indicate the correction number;

- the same correction number is indicated in the corrected information in section 3; in this case, the updated report will only include changed personal information, and those that were initially correct do not need to be resubmitted.

The data in Section 1 should be filled out in the usual manner, but with numbers corresponding to the corrections made.

Correct filling of the adjustment RSV 1

The accountant identified an error in the report, which was submitted, for example, in the 2nd quarter of the reporting period. Now you will need to generate a document with the already corrected data. If the RSV-1 adjustment for the 2nd quarter of 2021 is submitted before the end of the next reporting quarter, then you will need to make the following entries in section 6:

- In field 6.3 “Original” we put X.

- We indicate the number of the clarifying document - “001”.

Next, all fields are filled in as usual with correct data. Then the document is submitted to the Pension Fund.

If the error was discovered when the next quarter was already completed, then the document is filled out in the following order (PFR PP clause 27):

- “6.3”—indicate the period and year of the reporting period in which corrections need to be made. For example, 1 sq. is corrected. 2016, and reporting is submitted in the 3rd quarter, then in the corrective document you need to enter 1st quarter. 2021

- An X is placed in the field for corrective data, which means that the document is already a correction of the previous submitted report.

- The following lines are filled in according to the usual rules with the correct data.

Section 6 contains three types of document forms:

- Initial - if the document is submitted initially.

- Corrective - if errors need to be corrected in the document.

- Undoing - to cancel previous data in the document.

Based on which document needs to be corrected, canceled or the original created, the type of document is selected and marked in the appropriate field. If the reason for the clarification in RSV-1 and its decoding is not entirely clear, let’s see what codes there are for the reason for the clarification and what they correspond to.

| Updated document code | In what case should you use |

| 1 | Changes in information about contributions that have been paid. |

| 2 | Changing the details of contributions that have been accrued. |

| 3 | To clarify information on contributions that were paid to the medical service. fear. |

How to submit an adjustment document

When the reason for the clarification has been identified in the RSV-1 and all necessary corrections have been made, the document must be submitted to the regulatory authority.

The Pension Fund of Russia does not give any special instructions on the deadlines for submitting documents with corrections. Therefore, it can be submitted during the reporting period when the error was discovered (FZ-27).

It can be provided as a separate document or together with the reporting document for the quarter.

If the organization has 24 employees, a document is provided on paper, carefully filled out. If there are more than 25 people on staff, it must be submitted electronically, otherwise it will not be accepted and a fine will be imposed on the organization. The fine will be 200 rubles if reports are submitted in the wrong format. If you submit with errors, the fine will be greater.

This report is submitted quarterly.

It is advisable to avoid filling out clarifying documents, as fines may also be imposed for errors, except in cases where the accountant independently identified discrepancies.

Nuances of submitting a corrective report on the DAM

The DAM corrective report for the 1st quarter of 2021 must be submitted if errors and inaccuracies are identified. Let's consider when filing an adjustment report is required:

Among the most common situations that require clarification, experts name the following:

More complete information on the topic can be found in ConsultantPlus. Full and free access to the system for 2 days.

- Errors were found in the data of insured persons: TIN, SNILS were incorrectly indicated or missing, the address does not correspond to the address classifier (KLADR), etc.

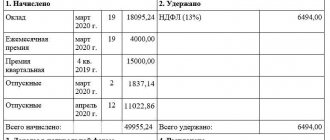

- Differences in the 6-personal income tax and RSV indicators were established. In some cases this is the norm, for example when transferring dividends, but more often these are still calculation errors. If discrepancies are justified, it is recommended to attach an explanation to the calculation.

Note! If errors in the DAM did not lead to an understatement of the tax base for contributions and do not relate to the personal data of employees, an update on the DAM for the 1st quarter of 2021 does not need to be submitted.

If you forgot to include an employee in the original report

Include the forgotten employee in the adjustment form with the adjustment number in the employee card = 0. The amounts in Section 1 and Appendices 1 and 2 to Section 1 change taking into account this employee and are indicated as they should be throughout the organization).

Please note that each time you send a new correction, you must put a new number on the title page.

Report for employees through Kontur.Extern. Loading data into RSV from SZV-M. Zero RSV in no time. Free for 3 months.

Register

Title page of RSV-1 calculation

In general, filling out the title page does not cause any difficulties, however, when filling out some of its fields, errors and inaccuracies still occur. of the Methodological Recommendations highlights the main elements to be checked on the title page.

Let's present them in table form.

| Field name | Compliance of the element being checked |

| “PFR registration number” | Must consist of 12 digits in the format XXX-XXX-XXXXXX |

| "Adjustment number" | A 3-digit code must be specified - 000, 001, 002, etc. |

| "Adjustment type" | The code must be one digit 1, 2 or 3 if the “Adjustment number” field contains a code with a value greater than 000. If the adjustment type is “1”, then at least one value in columns 3 – 7 of lines 141, 142, 143 of the entered RSV-1 must differ from the corresponding values of the last one provided before the entered calculation for this period. If the adjustment type is “1” or “3”, then not a single value in columns 3 – 7 of lines 111, 112, 113 of the entered RSV-1 should differ from the corresponding values of the last calculation provided before the entered one for this period |

| "Cessation of activity" | Can have the value "empty" or "L". If the field is filled in: – the date of deregistration must fall within the period for which the RSV-1 is presented; – the status of the insurance premium payer must be 04, 05 or 08 |

| “Name of organization, separate division...” | This field must be filled in Russian or Latin transcription |

| "INN" | Must only have 10 or 12 characters. The number is indicated in accordance with the certificate of registration with the tax authority |

| "Checkpoint" | Must be 9 digits or empty |

| "Number of insured persons..." | This field must have a value equal to the “Total” value in column 4 of subsection. 2.5.1 |

Particular attention should be paid to filling out the subsection of the title page “I confirm the accuracy and completeness of the information specified in this calculation.”

In the fields “Payer of insurance premiums”, “Representative of the payer of insurance premiums”, “Assignee”, if the accuracy and completeness of the information in the calculation is confirmed, the following digital designations must be entered ( clause 5.13 of Procedure No. 2p ):

- upon confirmation by the head of the organization - number 1;

- when confirmed by a representative of the payer of insurance premiums - number 2;

- upon confirmation by the legal successor of the payer of insurance premiums - number 3.

As a rule, in practice this field is filled in manually, so most often it is either not filled in or has an incorrect digital value.

In the field "F. Acting head of an organization, individual entrepreneur, individual, representative of the payer of insurance premiums - an individual" when confirming the accuracy and completeness of the information in the DAM-1 calculation:

- the head of the organization - the payer (legal successor) indicates the last name, first name, patronymic of the head of the organization in full in accordance with the identity document;

- the representative of the payer (legal successor) - an individual indicates the last name, first name, patronymic (if any) of the individual in full in accordance with the identity document.

When filling out this field, errors are most often identified in the last name, first name, patronymic, or the initialing of the first and patronymic of an individual.

In the field “Document confirming the authority of the representative of the payer of insurance premiums” the type of document confirming the authority of the representative of the payer (legal successor) is indicated. Most often, this field is not filled in, although the obligation to fill in the necessary details is established by Procedure No. 2p. in cases where the RSV-1 calculation is submitted to the Pension Fund of Russia by a representative of the insurance premium payer.

If you included one employee instead of another

Both employees should be included in the corrective report:

- Unnecessary - with zero (removed) Subsection 3.2 and a sign of cancellation of information about the insured person in line 010.

- Required - with correct data, correct amounts in Subsections 3.2.1 and 3.2.2 and without a sign of cancellation of information about the insured person in line 010.

Section 1 with Subsections 1 and 2 needs to be adjusted: subtract the amounts of the erroneously added employee from the total amounts of the organization and add the amounts for the employee who was forgotten to be included.

Section 1 of RSV-1 calculation

Section 1 “Calculation of accrued and paid insurance premiums” is summary and contains information on accrued and paid insurance contributions to the Pension Fund and Compulsory Medical Insurance. The procedure for filling out section. 1 is given in Sect. III Order No. 2p .

In accordance with clause 7.1 of Procedure No. 2p for reporting forms submitted by a medical institution for the reporting (calculation) periods of 2014, when filling out line 100 the following control ratios must be met.

| Column code | Meaning | Indicators with which comparison is made |

| 5 – 7 | = | Line 150, column 4 – 6 of the calculation for the previous billing period |

| 3 | = | Line 150, column 3 of the calculation for the previous billing period in the event of an overpayment for the previous billing period |

| 4 | = | Line 150, column 3 of the calculation for the previous billing period if there is a debt |

| 8 | = | Line 150, column 7 of the calculation for the previous billing period |

For reporting forms submitted by the payer of insurance premiums for reporting (calculation) periods from 2015, the values of the columns on line 100 must be equal to the values of the corresponding columns on line 150 of the calculation for the previous billing period.

of the Methodological Recommendations provides the main benchmarks for Section. 1 of the RSV-1 calculation, we present some of them.

| Column code | Meaning | Indicators with which comparison is made |

| Line 120 | ||

| 3 | = | The value indicated in the line “Total additionally accrued” in column 6 of section. 4 |

| 4 | = | The value indicated in the line “Total additionally accrued” in column 8 of section. 4 |

| 5 | = | The value indicated in the line “Total additionally accrued” in column 10 of section. 4 |

| 6 | = | The sum of the values indicated in the line “Total additionally accrued”, columns 11 and 13 sections. 4, with base code “1” in column 3 |

| 7 | = | The sum of the values indicated in the line “Total additionally accrued”, columns 12 and 13 sections. 4, with base code “2” in column 3 |

| 8 | = | The value indicated in the line “Total additionally accrued” in column 14 of section. 4 |

| Line 140 | ||

| 3 + 4 | = | The amount of payer payments received during the reporting period of the introduced RSV-1, according to the Pension Fund of the Russian Federation KBK of the insurance part of the labor pension |

| 5 | = | The amount of payer payments received during the reporting period of the introduced RSV-1, according to the Pension Fund of the Russian Federation KBK of the funded part of the labor pension |

| 6 | = | The amount of payments of the payer received during the reporting period of the introduced DAM, according to the BCC contributions at the additional tariff ( clause 1, clause 1, article 27 of Federal Law No. 173-FZ ) |

| 7 | = | The amount of payer payments received during the reporting period of the introduced DAM, according to the KBK contributions at the additional tariff ( clauses 2 - 18, clause 1, article 27 of Federal Law No. 173-FZ ) |

| 8 | = | The amount of payer payments received during the reporting period of the introduced DAM under the KBK FFOMS and TFOMS |

| 4 | = | Not more than the value of column 4 lines 100 |

note

The value of line 140 must be equal to line 140 in the corresponding columns of RSV-1 for the previous reporting period + line 144.