Filling out a sick leave certificate is not so easy, and many different rules are to blame for this

of a sick leave certificate for a citizen who is temporarily unable to work depends not only on whether he will be able to regain his health at home, but also on whether the employer will make subsequent insurance payments to this person. Therefore, there are strict rules according to which this procedure must be carried out. Let's look at them in this material.

Sick leave: general information

So, if a particular citizen, due to some illness, or, for example, injury, as well as due to the need to take care of a family member suffering from an illness, has temporarily lost his ability to work, he has the right to receive sick leave. The issuance of this document is carried out simultaneously with the payment of benefits, which should somehow support the person’s well-being for the time until he is unable to work.

Just in order to confirm his rights to absence during the specified period, as well as to receive funds to compensate for his inability to work, a citizen must provide the employing organization with sick leave, which is issued by a doctor.

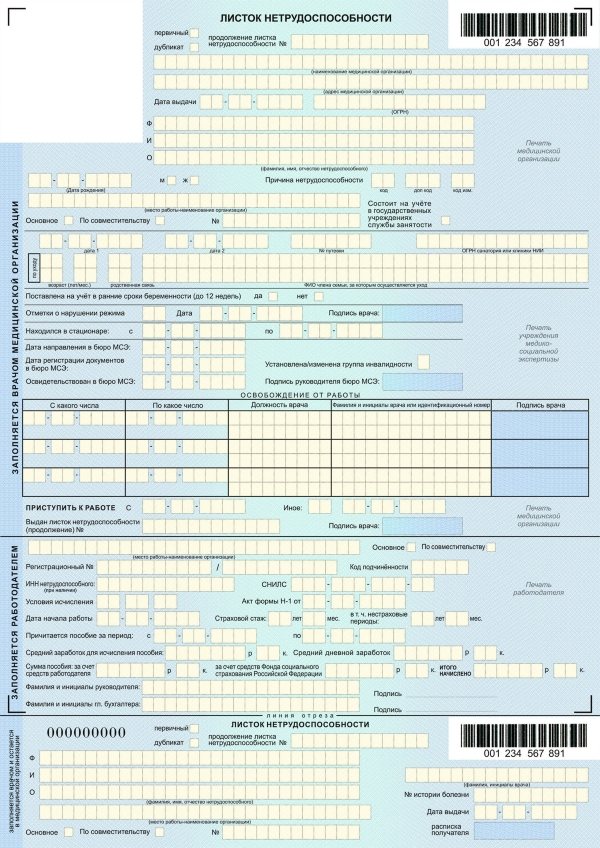

The front side of the form confirming the disability of a working citizen

The employee is not involved in any way in filling out the sick leave. Entering data into the required document is carried out:

- Therapist;

- representatives of the human resources department of the organization in which the citizen works.

The current sick leave form for 2019 was last amended in 2011 . Since then, no adjustments have been made to it. The only innovation that has taken place over the years concerns the issuance of sick leave certificates also in electronic format.

However, the type of document has not changed due to the addition of one more medium; however, now the working person has the right to make a choice of the exact form in which he will receive his certificate of incapacity for work:

- virtual;

- real.

What is indicated on the back of the document we are interested in

The form has two sides:

- facial;

- negotiable

Not both contain information. However, the data that is required to be provided to employers can be located only on the front side, while the back side contains information on how to correctly fill out the form.

The color of the citizen health information carrier is blue. The columns in which certain data must be entered are light yellow. They are represented by separate cells, each of which is designed to enter one single symbol.

On the reverse side of this document you can find a watermark in the form of the FSS RF . In addition, each paper is assigned its own number, moreover, the order in which it is assigned is arbitrary. The location of the numbers is on the right edge of the document, they are repeated twice. Each is represented 12 digits and is accompanied by a barcode .

Rules for filling out sick leave

So, it should be noted that the rules for filling out the sheet exist both for the employer and for the doctor treating a disabled citizen. However, if you do not immediately turn to the intricacies of entering information from each of these parties, you must also follow general rules that will not differ for both parties. They concern “ technical ” issues.

There are general rules for filling out the sheet that must be followed by both doctors and employers filling out the document

1. Letters must be placed strictly inside the cell without:

- letters touching edges;

- characters going over the edges.

2. Letters can be entered both in writing and using office equipment, and in both cases the information is entered in capital letters.

3. Provided that you have chosen the manual method of filling out the document, use black ink for your purpose, and the pen must be a gel or fountain pen.

Now let's discuss the rules , which are different for the doctor and the employer . So, both of them are not recommended to make mistakes when filling out the form, however, some points differ fundamentally.

- Thus, the doctor cannot make mistakes when filling out this form, since if an error is made, the document must be redone, giving the employee a duplicate (exactly the same form with the appropriate marking).

- Employing organizations, unlike doctors, have the opportunity to correct an error made when filling out, without having to replace this document. They can simply cross out the incorrectly entered information, then write the correct information on the back of the form and certify it:

- signature of the manager;

- seal of the organization;

- the inscription “believe the corrected one.”

However, although this difference is important, it is not predetermining in our question, since much more important is what is actually entered into the document by both parties filling it out.

What information does the doctor enter into the form?

So, before handing over the form that we are talking about today to the patient, a representative of the medical organization involved in his health is obliged to enter the following information into the document:

- whether this document is the primary version of the form, or a duplicate;

- the name of the clinic or other medical institution where the patient receives specialist care, in abbreviated form;

- address of the medical institution and its OGRN;

- date of issue of the document;

- patient's personal information;

- the name of the organization where the citizen who asked for help works;

- the type of position in which the patient requires temporary disability - main or part-time;

- mark that the sheet is issued for the care of relatives, if such a situation occurs, and indicate their personal data;

- fill out special fields when issuing a certificate to a pregnant or disabled person;

- indicate the period for which the person will receive release;

- endorse the document with a seal.

A special note is also required if you receive sick leave to care for a sick relative.

So, the information entered by the doctor will depend not only on factual data, such as the employee’s full name or place of work, but also on other circumstances. First of all, we are talking about the health status of the citizen applying for sick leave.

After the form is filled out at the clinic, the employee will give it to the employer . Now the organization’s task will be to fill out the bottom tear-off section of the form. Next, we present instructions especially for you, with the help of which you, as an employer, will be able to fill out a certificate of incapacity for work without any difficulty.

Instructions - how to fill out a certificate of incapacity for work from an employee for an employer

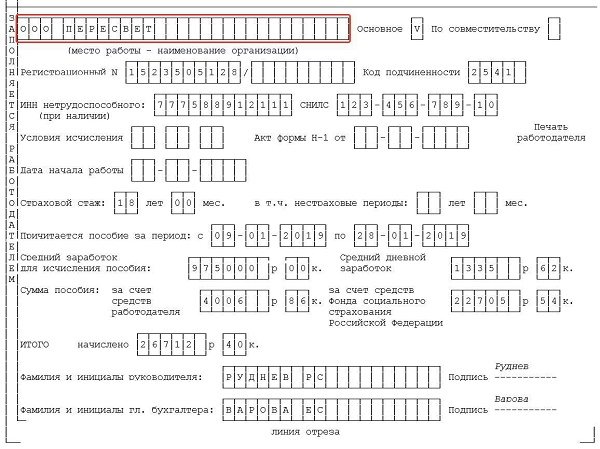

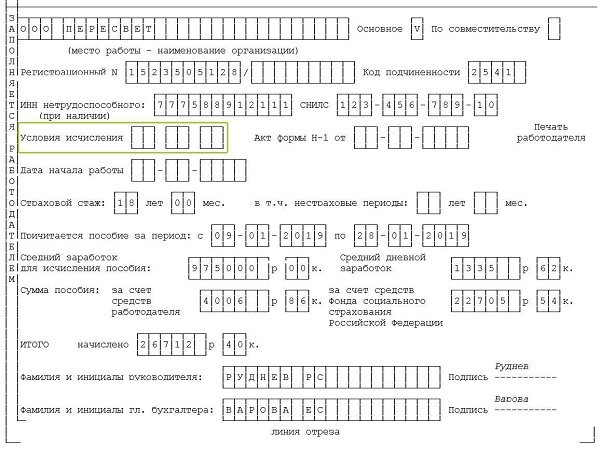

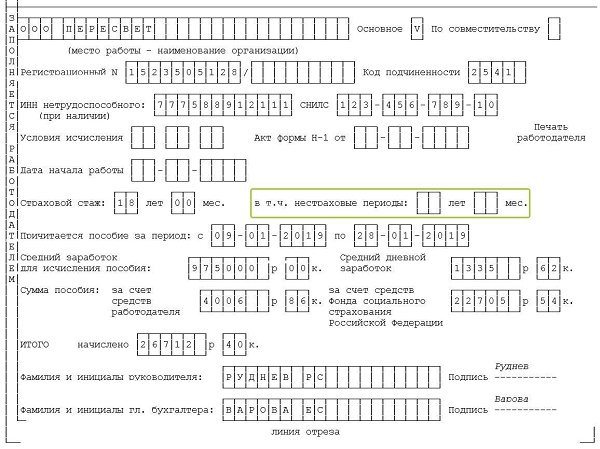

Step No. 1 - enter information about your place of work

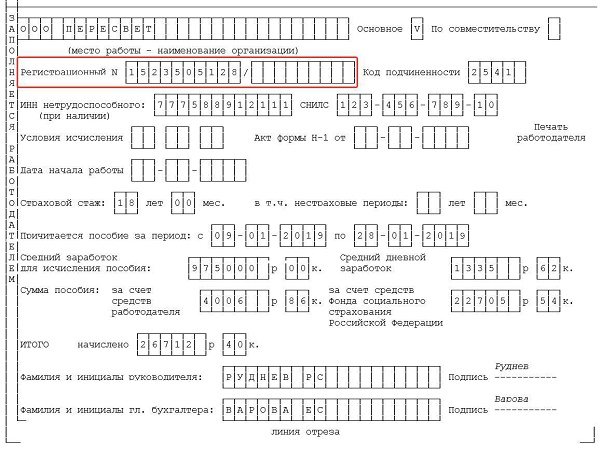

In which column should we enter the data we are interested in?

So, in the field of the form highlighted in red in the image above, you will need to enter the name of the enterprise where the employee receiving the exemption works.

It is recommended to enter the abbreviated name of the institution, if any, into the form. If there is none, do the following:

- using the principle of one character per cell, enter the company name in the column;

- if the name does not fit, stop writing at the letter where the last cell ended.

Please note: you should not go beyond the boundaries of the cells, or touch them. When writing the name, one square is skipped .

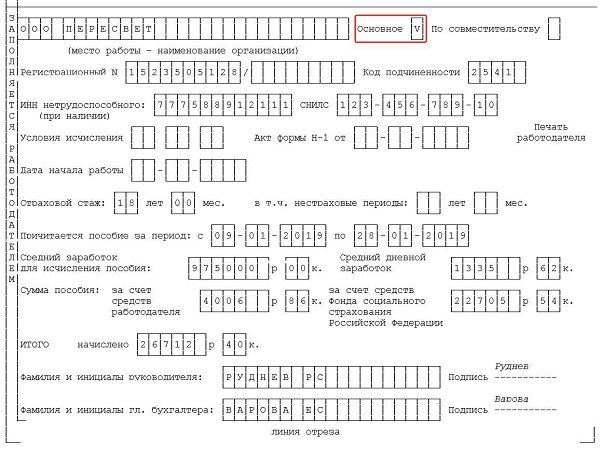

Step No. 2 – indicate the status of the worker’s workplace

Indicate the status of the place of work for which documents are submitted for consideration

So, now you must put the appropriate mark, which indicates the status of the citizen’s place of employment through which the required form is provided. You have only two options:

- main place of work;

- part-time employment.

An employee who is a part-time employee does have the right to submit a certificate of incapacity for work to two organizations at once, just as he has the right to work in several positions at once. To make such a provision, you just need to request two identical documents from the doctor.

Step No. 3 - indicate the registration number of the company in the Social Insurance Fund

We enter information about the registration number of the company in the Social Insurance Fund

In the required field, you must indicate the number that the employing organization received when registering with the FSS - social insurance fund . This state body assigns the required distinctive sequence of numbers independently after the Federal Tax Service transmits to it information that such and such an organization has been registered.

Each company receives a special notification by mail after registration is completed, in which it is notified of registration. Provided that due to some technical reasons the notification does not reach the addressee, you, as a representative of the organization, can send a second request to receive it to the FSS.

In addition, there are special services on a state scale, thanks to which you can find out your registration number in the Social Insurance Fund, using only the organization’s TIN . The assignment of a given sequence of numbers is done once and forever.

Step No. 4 - indicate the subordination code

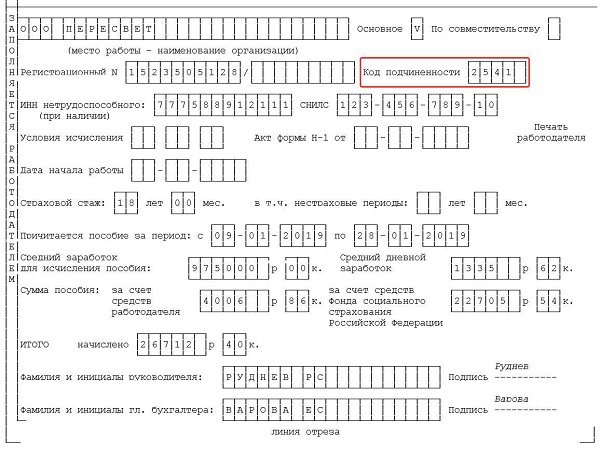

Now you need to specify the subordination code

The number that we need to indicate in this section of the form indicates the territorial affiliation of the Social Insurance Fund to which the employing organization belongs.

This code consists of 4 digits , provided that the organization is not a branch. The Fund's points located in the regions have 5 digits in the code designation.

Step No. 5 – indicate the employee’s TIN

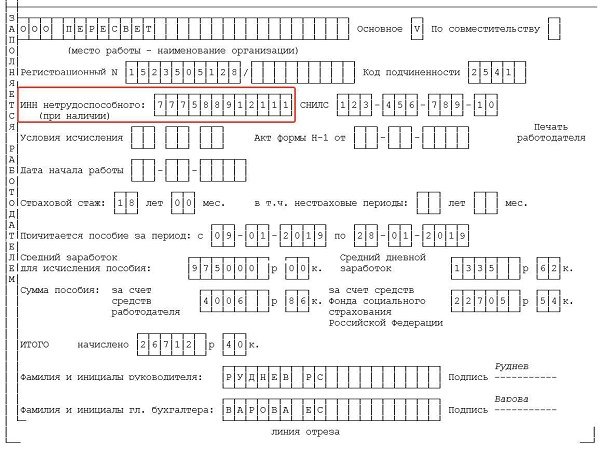

Where to enter the employee's TIN

So, next you need to enter information about the employee, namely his individual taxpayer number, issued by the Federal Tax Service when applying for a job . Every employer has one.

Step No. 6 – indication of SNILS

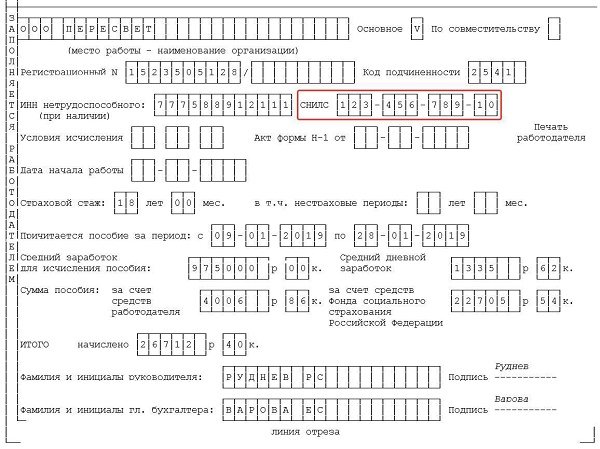

Where to enter the SNILS number

Next, the insurance number of the employee’s personal pension account is indicated, which can be viewed in a special card-certificate of its assignment.

Step No. 7 – set out the conditions for calculating benefits

The following sets out the conditions relating to the determination of benefits for a sick employee.

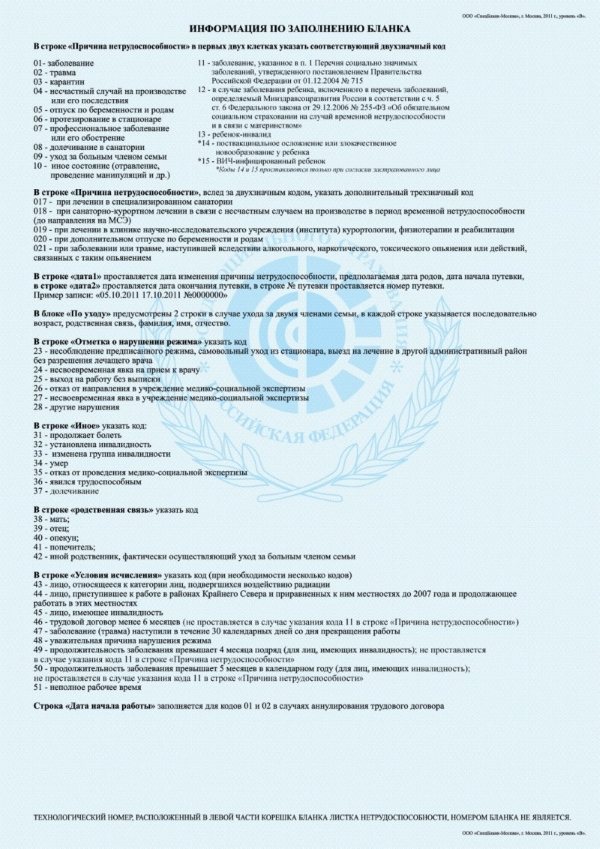

In this line you must enter data that is an encoded sequence. The sequences may contain various information regarding the conditions under which benefits will be accrued and paid to the sick person who submitted the form. The decoding of the code is located on the back of the form, you can read it there, or you can study them in the table below.

Table 1. Codings of categories of citizens, each of which claims its own conditions for the assignment of benefits.

| Code | Category of citizens |

| Code 43 | Persons with radiation injuries |

| Code 44 | Citizens living and working in the North |

| Code 45 | Persons with disabilities |

| Code 46 | Persons who have been working for less than six months at the time of sick leave |

| Code 47 | Citizens who fell ill a month after they were fired |

| Code 48 | Citizens who violated the regime due to the fact that they had a good reason for doing so |

| Code 49 | Disabled people whose illness lasts more than 4 consecutive months |

| Code 50 | Disabled people whose illness has lasted for 5 months in a row within one calendar year |

| Code 51 | Citizens with part-time work |

The required two-digit encodings are entered only if the appropriate conditions exist. In other situations, this line remains completely empty. Provided that one person has several conditions at once, you can put not one code, but as many as needed.

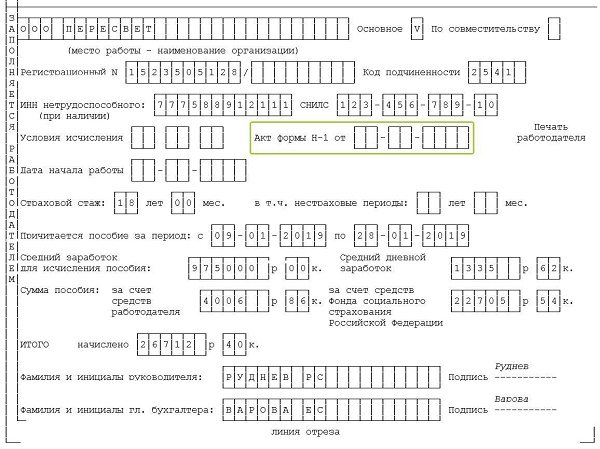

Step No. 8 – act form N-1

Enter the code in the highlighted line

Filling out this line can be carried out in the case when a citizen applied to a medical organization to receive sick leave due to an injury that he acquired at work. In this case, these cells are filled in with the date of drawing up the act recording the accident that occurred.

In all other situations, this line should remain empty .

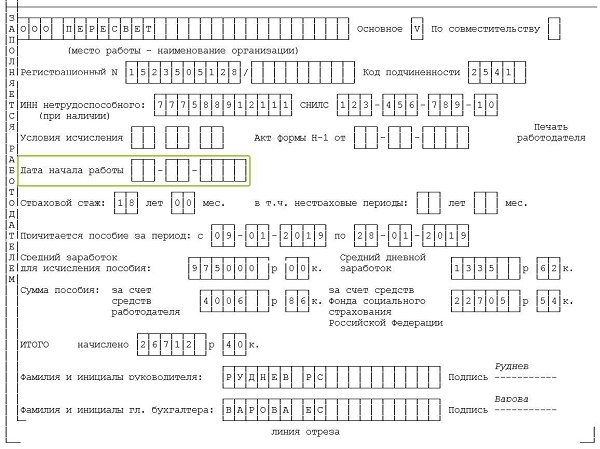

Step No. 9 – register the start date of work

Enter the data in the date column

This column is filled in only in a situation where the employment contract with the person who brought the sick leave was previously cancelled. Management has the right to revoke the required document if the citizen does not show up for work within the period established by law. At the same time, he is still entitled to sickness benefits.

In this field, provided there are grounds for this, enter the date on which you began working at the employing organization in accordance with the agreement concluded between you.

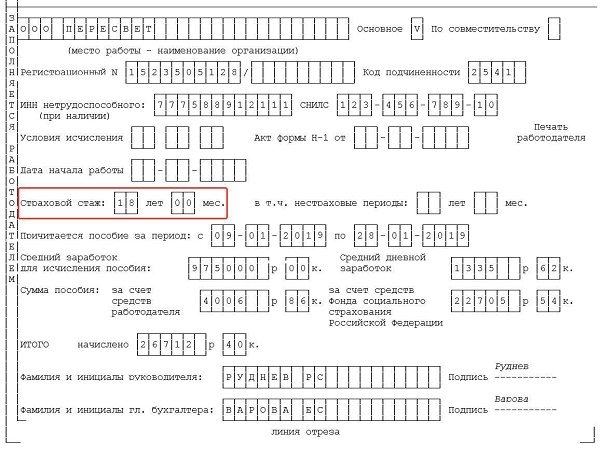

Step No. 10 - indicate the insurance period

The insurance experience column also requires mandatory completion.

The required section of the form contains information about the citizen’s total insurance experience. This concept means the time period during which he was insured, and the employer paid the required contributions for him. Most often, this period is equal to the working time under employment contracts.

Step No. 11 – enter data on non-insurance periods

We will enter information on non-insurance periods

Now we will indicate the periods that can be classified as non-insurance . So, we are talking about military service, but only after the onset of 2007. It is necessary to register not only the number of years, but also the months of this time period. Remember that periods of non-insurance category are also included in the citizen’s length of service.

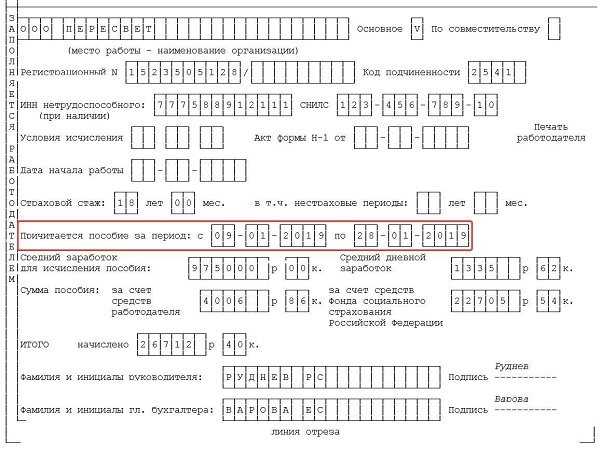

Step No. 12 - indicate the period for payment of cash benefits

We enter the data in the next column in line

This line must indicate a specific designation of the calendar period during which the sick employee was absent from work, that is, the exact date of opening and closing of the sick leave.

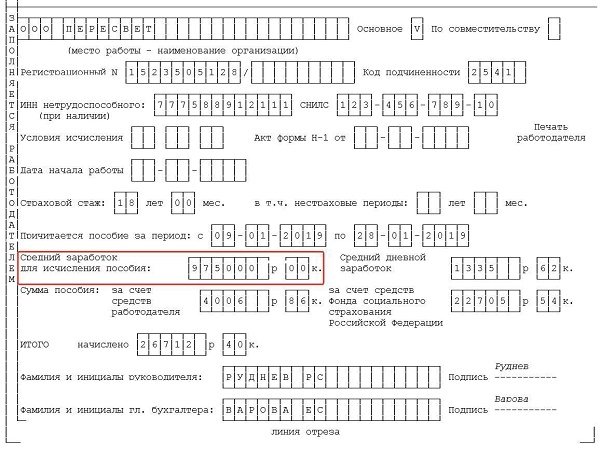

Step No. 13 – indicate the person’s average earnings

We continue filling out the document

Calculating the average salary of an employee is the responsibility of the accounting department; the information provided by its employees must be entered in this column. Remember that the value we are interested in is determined directly for the two previous calendar periods.

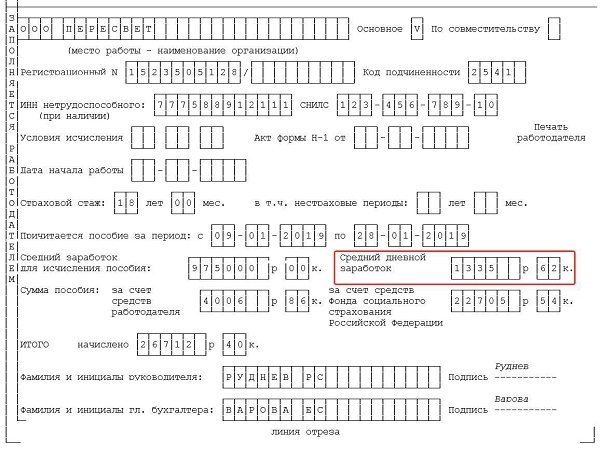

Step No. 14 – daily average earnings

We indicate the average daily earnings

Since benefits are calculated on calendar days, to determine the desired value, the total amount of payments calculated for two years must be divided by the exact number of days, and you will find out what the desired indicator is.

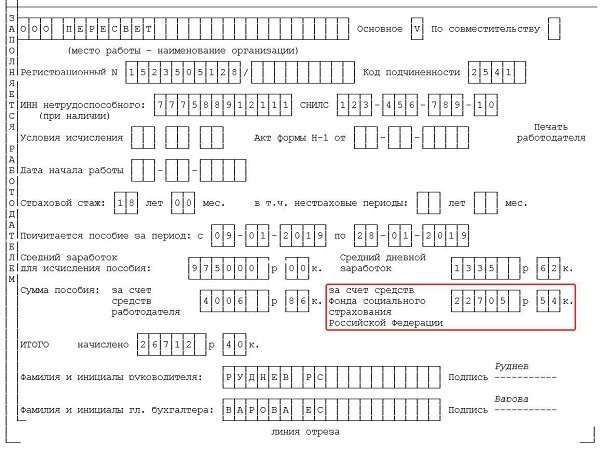

Step No. 15 - determine the amount of benefits paid from the funds available to the employer organization and the amount of payments from the Social Insurance Fund

We indicate how much you, as an employer, will pay

According to the letter of the law, if an employee is sick or injured, the company in which he works pays him for the first 3 days of sick leave from his own capital. The remaining days of payments will be made by the Social Insurance Fund.

In some situations, the entire benefit amount must be transferred from the Social Insurance Fund. So, we are talking about those cases when sick leave is issued:

- due to the need to care for a sick relative;

- for prosthetics;

- to undergo treatment in a sanatorium due to quarantine.

In some situations, benefits are paid only by the Social Insurance Fund, but more often this body pays simultaneously with the employer

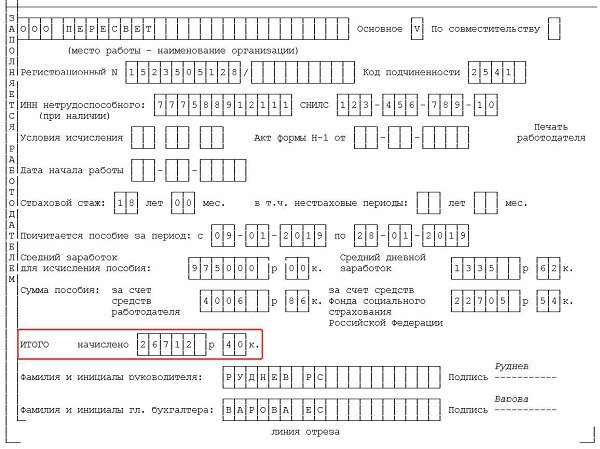

Step No. 16 – determine the total amount

We deposit the total amount

The amount of the final amount is easily determined by multiplying the number of days that the employee was sick by the average amount of his daily earnings, as well as the interest given by length of service.

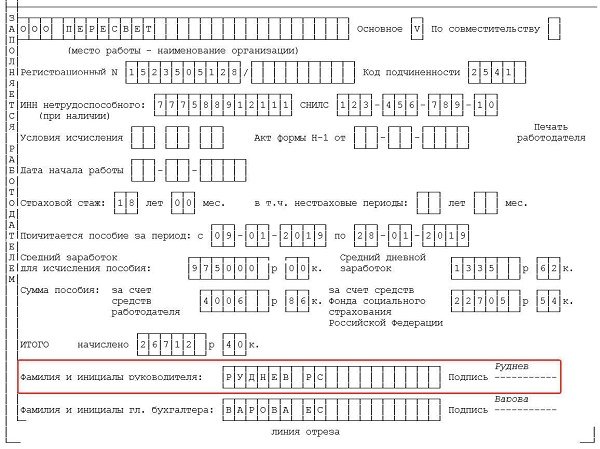

Step No. 17 – complete filling

So, the following few points will complete filling out the form.

- Indicating the full name of the head of the company and affixing his signature.

- We enter the same information for the accountant who heads the department of the same name in your organization. Provided that management is responsible for accounting in the organization, then the name of the manager and his signature are simply duplicated in the line for entering data about the chief accountant.

- Next, a round seal of the organization is affixed, which, when applying the imprint, should not touch the cells filled with information, otherwise the scanner that will read the sick leave will not see it.

Provide information about the manager

Social insurance explained how to correct a sick leave certificate if an extra line is filled in

If the line “Date of start of work” was filled in on the certificate of incapacity for work, and the employment contract with the employee was not cancelled, then the extra entry must be carefully crossed out, and on the back of the ballot it should be indicated that this line is “considered blank.” Such clarifications are given in the letter of the FSS of Russia dated October 18, 2012 No. 15-03-14/05-12954.

Let us remind you that the algorithm for correcting errors in ballots is provided for by the Procedure for issuing certificates of incapacity for work (approved by order of the Ministry of Health and Social Development of Russia dated June 29, 2011 No. 624n). So, an incorrect entry must be carefully crossed out. The correct entry should be made on the back of the sick leave sheet and confirmed with the words “corrected believe”, signature and seal of the employer. However, correction of errors using a corrective or other similar means is not permitted.

What if the employer made an extra entry: for example, indicated the start date of work when this was not necessary? After all, the line “Start date” indicates the date from which the employee was supposed to start work only if the contract was cancelled. For example, when an employer signed an employment contract with an employee, and the latter did not start work on time. Article 61 of the Labor Code allows in this case to cancel the employment contract. Moreover, if this employee did not go to work because he fell ill during the period from the date of signing the contract to the day of its cancellation, he has the right to receive temporary disability benefits. Accordingly, in a situation where the employment contract with the employee is valid, the line “Start date of work” should remain empty. If this date is nevertheless indicated, then, according to FSS officials, it should be crossed out, and the following entry should be made on the back of the ballot - “The line “Date of start of work” should be considered blank.”