The concept of a point system for calculating salaries

The system is an organization of salary payment without tariffication. The amount is calculated in proportion to the contribution made by each employee to the common cause. A worker’s salary is directly dependent on the volume of his participation in the work process. Such participation is measured by points. Their quantity contributes to the accurate calculation of wages.

An employee can receive points if he meets a number of requirements in accordance with Art. 132 Labor Code of the Russian Federation:

- presence of certain qualifications;

- complexity of the work performed;

- the total volume of labor produced;

- quality of work.

To correctly assign points, it is recommended to use generally accepted calculation methods. Thus, qualifications are calculated according to two characteristics - work experience in this field and knowledge acquired during specialized studies. Training can take place during the tenure of the position; based on its results, the salary level should change.

There are no common criteria used by everyone to assess the complexity of work. Each employer resolves this issue independently. Usually the specifics of the enterprise, harmfulness, and the impact of working conditions on the health of employees are taken into account.

The most difficult thing is to evaluate the quality of work. The consideration must be carried out from the perspective of compliance with several requirements. For example, according to the number of defects or complaints received, the obligation to politely communicate with consumers and clients.

Education coefficient for wages

This is a tariff-free wage payment system , which is based on the number of points earned. This provision indicates that the employee’s earnings depend on the degree of his personal participation in the common cause. It is best suited for small businesses.

In this case, it is necessary to use several indicators when calculating salaries, but it is not enough to know on what scale the point system is formed; you need to know what to start from.

For example, the level of qualification is determined on the basis of acquired specialized knowledge and the amount of experience; the knowledge that the employee received as an apprentice in production is also taken into account.

If it is necessary to assess the amount of work done, its complexity and quality, the enterprise should develop a local internal act, in which the determinants will be indicated.

At the same time, the form of accrual of funds for piecework wages can be different; in the future, it sets the calculation parameters and the procedure for calculating wages.

Piecework – income generation based on performance results:

- direct – the net cost of the work process;

- bonus – cost of labor plus bonuses;

- progressive – assessment of the work process and increased interest for overtime work;

- regressive - the amount of income plus an addition for the number of processes performed without processing;

- indirect – settlement with an additional employee based on the salary of permanent employees;

- lump sum – income per quantity.

Time-based – the amount of time spent by the employee is taken into account:

- simple - tariff rate or salary multiplied by the period spent;

- bonus – salary generated at the enterprise multiplied by the number of hours plus bonuses.

In addition, in rare cases, rare species :

- tariff;

- tariff-free;

- rating;

- to pay government officials.

Pay systems

The remuneration system within the meaning of Art. 135 of the Labor Code is a set of rules determined by the employer in accordance with labor legislation and regulating 3 aspects:

- the method of relating labor and employee remuneration, on the basis of which the procedure for calculating wages is based;

- the form (salary or tariff rate) and size (specific amount or “fork”) of the main part of the salary;

- compensation payments in the form of allowances and additional payments and incentive payments in the same forms or in the form of bonuses and other payments in terms of establishing the conditions, amount and calculation procedure.

In a narrow sense, the payment system is understood as a method of relating the measure of labor and the amount of remuneration of employees.

The most commonly used calculation systems are those associated with 2 main forms of salary:

Salary calculation procedure

Piecework, when payment is calculated for the result of labor activity: the number of works performed, services rendered.

Price for work, service × number of work performed, services provided

Price for work, service × number of work performed, services provided + bonus

Price for work, service × the number of works performed, services provided within the norm + increased price × the number of works above the norm

Price for work, service × quantity of work performed, services provided.

Prices do not increase for exceeding the plan

The salary of a support employee depends on the salary of the main employees

Payment for the volume (complex) of work

Time-based, when the employee’s pay depends on the time worked.

Tariff rate × working hours

Salary × working hours

Tariff rate × working hours + bonus

Salary × working hours + bonus

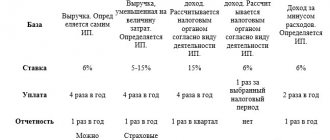

There are less common systems:

- tariff (Article 143 of the Labor Code);

- non-traditional methods, including tariff-free, rating, etc.;

- remuneration systems for civil servants (Article 144 of the Labor Code).

The concept of a point system for calculating salaries

With a non-tariff calculation procedure, the contribution of employees to the overall activity is assessed. One of the varieties of the non-tariff system is the point method of calculating payment.

The point order also assumes a direct dependence of a worker’s salary on his participation in general activities. The main unit for determining the volume of participation is the point. Points are assigned to workers for meeting a number of criteria. According to Art. 132 of the Labor Code for differentiation, it is allowed to use the following criteria:

- employee qualifications;

- complexity of the work;

- amount of labor;

- quality of work.

The worker's qualifications are assessed based on work experience and professional knowledge obtained as a result of special education.

It is more difficult to assess the amount of work performed, its complexity and the quality of the employee’s work using general indicators. It is advisable for the employer to independently establish such criteria, and it would be more useful to use not one, but a group of criteria.

For example, in general terms, the amount of labor of a teacher can be assessed by the total number of hours worked in the accounting period, and that of a seamstress by the number of items produced.

Source: https://uchastok.okd1.ru/zakon/koefficzient-obrazovaniya-pri-oplate-truda/

When to use

The commented remuneration system is actively used in government institutions - schools, kindergartens, clinics. The implementation is also taking place in private enterprises. Compliance with modern realities and trends in the management sphere is considered the main goal of introducing a new system.

A strong connection is established between the amount of payments and the employee’s performance. This allows for the selection of the most effective and efficient personnel at the state level.

The Ministry of Health and Social Development believes that high-quality provision of services in the public sector is one of the main ways of development. Therefore, the dependence of the salaries of managers on the average earnings of employees at the enterprise is established. This measure arouses the interest of managers in the quality work of staff and commensurate payment.

When is a point system used?

In order to introduce a point system of remuneration at your enterprise, you need to follow the algorithm established by law. This procedure is established in the Labor Code of the Russian Federation:

- Only the head of the entire enterprise or a person who has all the necessary powers can introduce a point system of remuneration. He decides that he wants to switch to this system in accordance with Art. 135 Labor Code of the Russian Federation. After this, the manager must decide on the circle of people who will have to develop the local act.

- The employees identified by the manager begin to develop a draft local act.

- After the project is developed, it is transferred to the authorities that will review it. They, guided by Art. 372 of the Labor Code of the Russian Federation, must make a general opinion on the project and they have 5 days to do this. The deadline begins to count from the moment the responsible body receives all the papers for the project.

The trade union or representative of the organization that is reviewing the project can make both a positive and negative opinion about the decision of the head of the enterprise. If they refuse, then the employer has three days to resolve all the troubles and disagreements that have arisen. And even if all parties have not reached a common opinion, the head of the enterprise can still send his project for further approval. But in this case, responsible organizations can appeal it and help prevent it from being resolved.

But sometimes it happens that an enterprise that wants to switch to a point system for calculating wages does not have the necessary trade unions or representatives of the necessary organizations. In this case, the employer needs:

- Obtain written confirmation from all employees that they agree to this transition. This is not necessary only in two cases, if the point system of remuneration is established at the enterprise as the first payment system, or if further use of the old system is impossible due to a change in organization at the enterprise, or if the technological working conditions of employees have changed. This is stated in Art. 74 Labor Code of the Russian Federation.

- Approve the draft local act, which was developed by the circle of employees established by the manager.

- Introduce all employees of the enterprise to the new project. This is stated in Art. 22 Labor Code of the Russian Federation.

Payment procedure

Employers often have difficulty determining the amount of salary for people occupying the same positions. Letter No. 111-6-1 published by Rostrud recorded the requirement to establish an equivalent salary for individuals serving in the same position. That is, the salary for these people should be equal.

In such a situation, the manager should fix equal salaries. But the points received by the employee should be issued in the form of bonus funds. The level of additional payment for each employee will vary depending on qualifications, quality of work, and complexity of the work.

Point system of remuneration - basic concepts

Point-based wages are a tariff-free wage payment system.

If it is used in an enterprise, then funds are paid in relation to how much each individual employee contributed to the work process. That is, an employee’s salary is directly dependent on the volume of his participation in general production. The measure of such participation is the so-called score, which helps the employer calculate exactly how much he should pay the employee. In order for an employee to have the opportunity to receive these points, he must meet certain criteria called criteria. They are indicated in Art. 132 Labor Code of the Russian Federation:

- What qualifications does the employee have?

- How difficult is the work he performs;

- The total amount of work he performed;

- The quality of the work performed by the employee;

In order to correctly assign points to an employee, you need to know what to start from. In this case, it is best to use standard calculation methods. For example, an employee’s qualifications are calculated based on two characteristics - how much general experience a person has in this specialty, and what knowledge he received during specialized training. It is also worth noting that he can undergo similar training while working in his position, which should also affect his salary.

In order to assess the complexity of the work performed by an employee, its volume and quality, there are no unified criteria. At each enterprise, the employer does this independently. It all depends on the specifics of production, its harmfulness, the influence of work factors on the health of employees, etc.

The quality of work is often more difficult to evaluate than other criteria. It must be considered from the perspective of compliance with several criteria. For example, by the number of defects or complaints and the “severity” of this defect or complaints.

Also, do not forget about the documents issued by the government that regulate some relationships between employees and clients. For example, letter from the Ministry of Labor dated September 16, 2016 No. 14-2/B-888, which states that the employee is obliged to communicate politely with consumers.

Payment calculation example

A clear example of the use of a point system is the remuneration of health workers. Doctors and other medical staff, in addition to their regular salaries, receive additional material resources for night shifts, overtime, and overtime. In the budgetary sphere, there are certain specifics in calculating the volume of payments.

To accurately determine an employee’s salary, it is necessary to calculate:

- The number of points scored by an employee for a specific period of time. The calculation is made using a special table.

- The total number of points for the entire company or institution.

- How much will be allocated to workers' salaries?

- Individual payment amount for each employee.

Thus, clinic No. 5 in Omsk scored a total of 150 points. The salary fund is limited to 150,000. Nurse Smirnova scored 10 points. Nurse's salary=10/150×150000=10 thousand rubles.

Pros and cons of the point system

Among the key advantages of the system are:

- It is excellent when used in calculations to evaluate the work of a team working in the service sector, without taking into account the number of goods or products produced in the calculations. For example, a law firm, a consulting firm, an accounting organization.

- Independent choice of scoring criteria. This allows us to determine the optimal characteristics for a particular enterprise, taking into account its specific type of activity. For example, a large records management firm may consider the quantity and timely submission of documentation when making accruals. Small institutions can focus on the correctness of the documents drawn up.

- It is considered an ideal concept when calculating bonus payments in small companies and institutions.

The disadvantages of the system usually include:

- the amount of payments will not be constant. The employee will not have the opportunity to count on a specific amount, since it will be transformed each pay period;

- not an easy concept to use. Each period when it is necessary to pay wages, you will need to again evaluate the quality of the employee’s work and other criteria, and withdraw a new amount. Such actions will be a big burden for the accounting department (especially in a large organization);

- frequent conflict situations between workers regarding the amount of funds received. The basis for the quarrels are the criteria by which the quality of work was taken into account.

Thus, the choice of ways to stimulate employees remains with the head of the organization (with the exception of budgetary institutions).

How to enter a point system

To start using the point system in an organization, you will need to perform a number of sequential actions, fixed in labor legislation and following the necessary requirements:

- The head of the enterprise or a person vested with all relevant functions is authorized to introduce the concept. He decides to transfer the material motivation of employees to a new method in accordance with Art. 135 Labor Code of the Russian Federation. Next, it determines the circle of persons who are responsible for creating an internal regulatory legal act.

- Responsible employees begin developing a local act.

- The developed project is submitted to the competent authorities for consideration. In accordance with Art. 372 of the Labor Code of the Russian Federation, the latter need to come to a general conclusion and give an answer within 5 days after receiving the document.

- A trade union or a representative of an organization has the right to make either a positive or negative decision on the analysis of the project. If the inspection agency makes a negative decision, then the manager has 3 days left to resolve any disagreements and disputes that have arisen.

Introduction of a point system by the employer

The transition to a point system or its initial establishment is made in accordance with the instructions of the Labor Code according to the following algorithm:

- The head of the organization or other person with the necessary powers, in pursuance of Art. 135 of the Labor Code makes a decision on the introduction or transition to a point system. At the same time, the circle of persons who are entrusted with the development of the draft local act is determined.

- An employee or group of employees, in pursuance of the decision, develops a draft act.

- The project in accordance with Art. 135 of the Labor Code is transferred to the representative body, which must, on the basis of Art. 372 of the Labor Code, issue a reasoned opinion on the submitted draft no later than 5 days. The countdown starts from the day the draft is received by the representative body.

If a trade union or representative makes a negative opinion about the project, then the employer’s representative is obliged to hold consultations within 3 days in order to resolve the contradictions. If in this case a mutually acceptable solution is not found, the project may be sent for approval, but the representative body has the right to appeal it.

If the organization does not have a trade union or other similar body and there is no employee representative, then you should move on to the next action.

- When switching to a point system in accordance with Art. 72 of the Labor Code, the employer’s representative obtains the written consent of the employees.

Consent is not required if:

- the system is introduced into the organization as the first;

- the transition is caused by a change in technological or organizational working conditions, and further application of the old order is impossible (Article 74 of the Labor Code).

- The head of the organization or another person with the necessary powers approves the local act.

- The employer in accordance with Art. 22 of the Labor Code introduces all workers to the new act.

Bonus and rating systems

The bonus concept is similar to the points concept. In this case, employees receive a permanent salary plus interest (bonuses) from the company’s total income. These funds are accrued to the employee in addition to his salary. This system fully complies with the established requirements of Rostrud.

The rating methodology is distinguished by greater stability of the amount of payments from the commented one. Recalculation is made only if one of the following circumstances exists:

- The employee's level of education has increased or decreased.

- The length of service in this field has changed.

- The position has changed to a higher or lower position.

The concept is based on the rating assigned to the worker, and not on the quality and quantity of work performed. The indicator varies depending on the employee’s level of education, position and length of service in a particular field. Designed for large firms and companies.

The procedure for remuneration under the point system

When trying to determine exactly how much and how to pay employees using a point system, many managers encounter certain difficulties. They are related to letter No. 111-6-1, which was published by Rostrud. It states that employees occupying the same positions are required to receive the same salary. But, as already established above, the point system of remuneration indicates that the amount of wages depends not only on the position held, but also on what skills the employee has and how well he performs his work. This means that even if two people occupy the same position, their salaries can still be very different from one another.

In this case, the employer can only act as indicated in the letter from Rostrud. All people occupying the same positions are paid the same salary. And the points begin to influence, so to speak, everything that is paid above the salary - that is, bonuses. In this case, additional payments will be calculated according to the formula of the point system of remuneration.

If the employer ignores the letter from Rostrud, employees may consider this discrimination and contact the relevant authorities.

The use of a point payment system will be optimal if the organization is small and all employees occupy different positions.

Features of the bonus concept

The effectiveness of the application of the methodology has been proven in companies engaged in production activities and engaged in the sale of goods and services. The employee should understand that the company's overall profit has a direct impact on his own income level. The system produces the desired results only if there is a close relationship between the incomes of management and workers.

A successful example of the implementation of the methodology is the transition of Russian Post to a bonus program since 2011. The system is valid for employees working in the sales department.

With the right choice of position, range of employee activities, salary amount and percentage value, the experience of applying the concept is effective.

The bonus payment system consists of:

- salary A constant amount of funds paid to the employee in any case, regardless of the profit of the enterprise and the results achieved;

- percent. Variable component, calculated based on the number of goods sold.

Receiving material resources in the form of interest allows you to significantly increase the employee’s income in the case of high sales and reduce it to a minimum in a situation where there is no trade.

A striking example of application is a company selling goods or services. Sellers receive cash for their “output” plus a percentage of each product sold.

Advantages and Disadvantages of Using the Bonus Concept

Salary is a key motivational factor for a worker. Therefore, when assigning payments and choosing a payment system, the manager must calculate all the pros and cons.

The positive aspects of the bonus method include:

- focus and interest of employees on results;

- low expenses for minimum established salaries for careless employees who do not strive to earn money;

- providing good wages to promising workers;

- renewal of the team by including ambitious, active, purposeful professionals.

This approach will not work for low-performing employees who are not willing to put in the time and effort to close as many deals as possible. For a constant salary increase, a specialist needs to work with full dedication every day.

The negative aspects of the concept are as follows:

- The lack of guarantees of receiving a regular, stable income does not allow you to apply for a housing loan or plan an expensive purchase.

- Rarely does the application of an interest rate not matter to a particular practitioner. Because the company’s income does not depend on his efforts alone.

- If there is a seasonality factor, then the rest of the time there is a risk of losing valuable employees. Or set an increased salary during a period of lack of demand for a product or service.

- The desire to increase sales sometimes fails because the product is uncompetitive and in little demand among buyers.

- The concept carries risks for both workers and employers. When choosing a technique, you should carefully weigh the pros and cons.