The rules of law provide for the obligation of the employer, when carrying out the reduction procedure, to pay employees with whom contracts are terminated in the established amount of severance pay. It does not take into account whether the company's staff or number of employees is being reduced. Severance pay upon dismissal due to staff reduction is issued to each person who is terminated for this reason.

What payments are due in case of staff reduction in 2021?

When a decision is made to make reductions in an organization, its management must remember that in such a situation it is necessary to make the following payments to employees, in addition to earnings for the last month:

- Severance pay calculated on the basis of average earnings.

- If there are remaining days for rest, compensation for unused vacation.

- Average earnings determined per month, paid for the period necessary for the dismissed to find a new place, but not more than two months (in determining such payment, severance pay already issued must be taken into account, it should be deducted from the amounts paid for future employment)

Severance pay

It should be calculated by multiplying the average daily earnings determined for the employee by the number of days of work in a month. In such a situation, you need to correctly calculate your average daily earnings.

The calculation period for finding the average salary for these purposes is 12 months. Salaries are accepted for accounting, including salaries, bonuses, additional payments and allowances and other amounts accepted for calculation.

From the calculation period, it is necessary to exclude the time when the employee did not actually fulfill his work duties - vacation, disability, downtime, business trips.

Attention! Severance pay must be given to the employee based on the general rules for payments on his final day of work.

Compensation upon dismissal

The issuance of compensation is based on the need to provide the employee with annual rest time. The amount of compensation for unspent vacation is also calculated based on average earnings. It is found on average per day, and then multiplied by the number of days of remaining vacation.

When there are several such periods and types of vacation, then all these periods in total are taken into account. To determine the days of annual leave, an algorithm is adopted according to which for each month of work the employee has 2.33 days of rest.

For compensation, the payment time is set no later than the employee’s final day of work.

Average monthly earnings for the period of employment

This payment is the second part of the severance pay discussed earlier. This must be paid if it takes the employee more than one month to find employment. When a subsequent employment agreement with an employee who was previously laid off is drawn up within a period of one month from the date of dismissal, no payment is made for the duration of employment.

This means that in order for the employee to receive these amounts, he needs to not go to work immediately after termination of the previous contract.

Attention! If the dismissed person does not enter into a new employment contract after the end of two months, he, under certain conditions, can count on one more average monthly salary.

To get it you need:

- Register with the employment service within two weeks from the date of layoff.

- Three or more months have passed since the date of the layoff, and he has no new job.

- The decision on the issue of average earnings must be made by the employment service.

These payments are determined in the same manner as for severance pay. The law establishes the period for payment of benefits during employment no earlier than two months after dismissal (for benefits for the third month - no earlier than three months)

You might be interested in:

Employer's liability for violation of labor laws: what the threat is, where to complain to an employee

Local regulations may provide for other payments. Such provisions may be contained, for example, in a collective agreement. If the administration formalizes dismissal with an employee by agreement of the parties, then such termination is not considered a layoff.

In such a situation, the dismissed person may be paid compensation upon dismissal by agreement of the parties, if a condition regarding this is included in the executed document. Severance pay and amounts during employment are not issued. However, the employee can agree with the administration on the level of compensation in an amount that exceeds his three-month average earnings.

Mandatory payments

Issues related to the reduction of a company's staff are discussed in detail in Articles 178-180, as well as in Article 81 of the Labor Code of the Russian Federation. This part of the document establishes that any employee of an enterprise who loses his position at the initiative of management, due to the fact that the company has decided to reduce the scale of its activities, has the right to receive:

- Salaries for that part of the month that was worked before the official dismissal;

- Vacation payments, based on the number of hours worked during the current year;

- Severance pay;

- Average salary during the period until the employee finds a new job.

HR employees are required to prepare all the necessary papers at the time of dismissal, including properly filling out the employee’s work book. However, all the above payments are not made at once, but over a certain period.

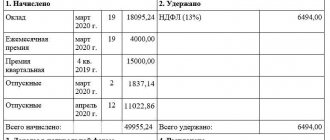

Benefit calculation example

Accountant Zhdanova A.I. was dismissed due to staff reduction on January 24, 2021. To determine average earnings, you need to take her income for the previous 12 months, excluding from it periods of unpaid leave, sick leave, and paid leave. You also need to know the number of days actually worked during this time, excluding days spent in periods excluded from the calculation.

We use the following information for calculation:

- The actual number of days worked is 218;

- The total amount of earnings during this time is 268,718 rubles.

Average daily earnings = total earnings / number of days worked.

SDZ = 268718 / 218 = 1232.65 rubles.

The first month after the reduction lasts from January 25 to February 24, 2018 - 21 days of work. The amount of severance pay for it will be: 1232.65 x 21 = 25885.65 rubles.

The next day after the termination of the contract, A.I. Zhdanova registered with the employment service.

In the second month she was unable to find a job. As confirmation, she provided a work book, where no entry was made about the appointment. The calculation period for the second month is from February 25 to March 24, which is 18 days of work. The amount of the benefit for it will be: 1232.65 x 18 = 22187.70 rubles.

Let's assume that in the third month she also couldn't find a job. Since she registered with the employment service in the first 2 weeks after her dismissal, the company pays her this benefit. As confirmation, she brings a certificate from the authority and a work permit. The third month lasts from March 25 to April 24, 2021, which is 22 days of work. The benefit amount for the month will be: 1232.65 x 22 = 27118.30 rubles.

Unemployment benefit

Unemployment benefit is a type of assistance from the state that is provided to a citizen who has lost his job while looking for a new one. In order to receive such a payment, you need to have an official job in the past, confirm the fact of dismissal and absence of work at the present time.

To receive assistance, you must submit a certificate of average earnings to the employment center. This benefit is limited in both its amount and time. In fact, the state will provide support for a maximum of 18 months from the date of job loss.

The amount of payment is determined by the state every year, and currently ranges from 850 to 4900 rubles. In addition, in the regions of the north, Siberia, and the Far East, coefficients can be established by which this amount is adjusted.

The exact amount of the benefit depends on the average salary of the citizen at the previous place of work.

Depending on the period it is:

- The first 3 months - 75% of the average earnings for the last three months before the reduction, but not more than the maximum limit;

- The next 4 months - 60% of the average salary;

- The next 5 months - 45% of the average salary.

You might be interested in:

Notification of an employee about staff reduction: how to draw up, within what time frame it is sent

After this period, for another 6 months, only the minimum benefit is paid, adjusted by the coefficient established in the region.

Attention! If, when the amount of the benefit is found, the received share of average earnings is below the minimum limit, then the minimum benefit is paid.

What is required for a contracting person?

Only strict compliance with the requirements of the Labor Code of the Russian Federation will allow management to legally terminate employment relations with part of the team and pay them the payments required by law.

The main and mandatory ones are the following: severance pay, compensation for unused vacation days, and salary. According to the law, the total amount should be enough for the dismissed person during the period of searching for a new job.

Let's look at each type of payment in more detail.

Severance pay

It is assigned to the dismissed person due to reduction in the form of compensation for subsequent income spent. The benefit amount is equal to the employee’s average monthly earnings at the enterprise. It lasts for as long as you are busy writing a new job, but no more than two months from the date of layoff.

Roughly speaking, severance pay is two salaries.

But if you found a job earlier than the two months specified in the law have passed, then the benefit is calculated for the days that you spent without work.

Therefore, many use a little trick - they do not get a job until these two months have expired. Or they agree with the new employer that they will work the first two months at the new place unofficially.

Vacation pay compensation

This is the second of the guaranteed payments. In this case, the dismissed employee will be compensated for all days of unused vacation in cash equivalent. True, this payment is assigned for any reason when an employee leaves the enterprise.

The dismissed person needs to know that the specified amount is subject to income tax.

Salary for the period of work before dismissal

In this case, the employer pays the dismissed employee wages for all actually worked days of the month. This payment upon dismissal during layoff is the main type of compensation in this case.

Ask why the main type of compensation. The thing is that its amount affects the amount of other additional payments. This payment is guaranteed by the Labor Code of the Russian Federation. Payment occurs on the day of dismissal in full.

Taxation of benefits

The Tax Code determines that the amount of severance pay, payments for the second and third months after the reduction, as well as compensation for dismissal before the stated date of the organization can be included among the “salary” expenses when determining the tax base.

This can be done both by companies on the general regime, which pay income tax, and by “simplified” companies, which calculate the tax according to the “Income minus expenses” system.

Also, these payments will not be subject to personal income tax and social contributions, but only if they are within the limit established by law. This point of view is expressed by the Ministry of Finance in its letters.

The limit for such an operation is:

- Average earnings are three times the amount for workers in ordinary climatic conditions;

- The average salary is six times the amount for employees who work in the Far North and similar territories.

This limit is uniform, and its size does not depend on the position, salary and other features.

Attention! If the total amount of compensation exceeds the specified limit, then personal income tax must be withheld from the amount of the excess and insurance premiums must be calculated.

What to do if the employer does not pay severance pay

If an employee is not paid benefits after being dismissed due to staff reduction, he can send a complaint:

- To the labor inspectorate;

- To the prosecutor's office;

- To the court.

Initially, the employee can submit an application to the labor inspectorate or the prosecutor's office. They will order an inspection of the employer, and when a violation is confirmed, they will impose an administrative fine and an order to pay the debt. If this does not help, and the payment is never made, then you can collect documents for the court.

A claim against an organization must be filed at its location. The exact address can be found in the extract from the Unified State Register of Legal Entities. The court will not consider the application if it is completed incorrectly and does not contain all the necessary documents.

Attention! The employee is not charged for legal expenses in disputes in the field of labor law.

Severance pay upon layoff

Article 178 of the Labor Code of the Russian Federation establishes the obligation for the employer to pay severance pay to a laid-off employee. Upon dismissal due to staff reduction in 2018-2019. the organization pays it within one month after dismissal. However, it can be extended for the period of searching for a new job:

- in the second month, if the employee is not employed;

- for the third month by decision of the Employment Service, if within 2 weeks after dismissal

- he registered with the labor exchange and was not employed by it.

Due to the shortage of jobs there, the payment of severance pay in the event of a layoff can be extended up to six months by decision of the employment service, if the employee registered on the stock exchange within 30 days after the layoff, but was unable to find a new job with its help - Art. 318 Labor Code of the Russian Federation. It is worth noting that such situations happen quite often, given the specifics of the economy of the Far North, where only one enterprise can operate for the entire city (monotown). At the same time, despite the fact that the decision whether to extend benefits for a laid-off employee is made by the local Employment Service, his former employer pays him out of his own funds.

Tips on the Labor Code of the Russian Federation in 2021 (clause 3, part 1, article 77) - how to resign correctly?