Financial assistance is paid based on the order of the manager and the written application of the employee. Supporting documents must be attached to the document: in connection with the birth of a child - a birth certificate, in connection with a marriage - a marriage registration certificate, in connection with the death of a close relative - a death certificate and documents on the basis of which the family relationship can be traced (certificate of birth, marriage certificate when changing surname).

Such payments are not the responsibility of the employer and in each organization are regulated by local regulations, collective agreements or regulations, where a certain amount of compensation may be agreed upon for a particular event. But the payment amount is not limited to these documents; the employee can independently indicate the desired amount in the application. In this case, the company has the right to pay less or refuse altogether.

Financial assistance to employees can be related to current year expenses or paid out of profits. Depending on this, the final decision on assistance and its volume remains with the head of the company or founder. If assistance is provided to the head of the company, then, regardless of the source of payment, he must obtain permission from the founders. In this case, financial assistance is provided on the basis of the minutes of the meeting of participants.

Taxation of aid

Regardless of what taxation system the organization uses, all financial assistance can be divided into three main types, depending on the taxation of personal income tax and contributions to funds:

- in connection with the birth of children;

- in connection with death, natural disaster, terrorist attack;

- for any other reasons.

You also need to remember that financial assistance must be one-time, i.e., accrued once during the tax period, which is a year (Article 216 of the Tax Code of the Russian Federation). Let's look at the rules for paying benefits for all three events separately.

Reasons for support

First of all, it is necessary to understand that the payment of financial assistance cannot in any way be considered remuneration for services to the enterprise. It doesn’t matter how the employee works, how old he is, or whether he is valuable to the employer. Material assistance is social support.

In order for employees to have the right to ask the company for help, it is necessary to develop an internal document - a provision on social guarantees. The document must describe the situations that are eligible for assistance, the conditions for receiving it and the amount of payments.

There is a standard set of situations in which employees may need financial assistance:

- Birth (adoption) of a child.

- Death of a close relative.

- Death of the employee himself.

- Natural disasters and emergencies.

- Terrorism.

- Getting married.

- Vacation.

- High treatment costs.

The main conditions for providing assistance are:

- availability of an application from the applicant;

- documents confirming the incident;

- lump sum (this condition does not apply to payments in connection with natural disasters, emergencies and terrorism).

From the author! Help can be provided not only by employers, but also by government agencies, such as the Social Security Fund.

Birth of a child

So, financial assistance in connection with the birth of a child. An employer can provide one-time financial assistance to its employees who have become parents, adoptive parents, or guardians.

If such financial assistance is paid during the first year after birth (adoption), then it is not subject to personal income tax up to 50,000 rubles (clause 8 of article 217 of the Tax Code of the Russian Federation) and contributions to funds (subclause 3 of clause 1 of art. 422 of the Tax Code of the Russian Federation and paragraph 3, subparagraph 3, paragraph 1, article 20.2 of the Federal Law of July 24, 1998 No. 125-FZ). The limit of 50,000 rubles applies to each parent individually (letter of the Ministry of Finance dated September 26, 2021 No. 03-04-07/62184).

Where does a company get money from?

The set of transactions for the payment of financial assistance to an employee is standard and does not depend on the source of funding. An enterprise can choose where to get funds to support its employees:

- from the current year's profit;

- from retained earnings for previous years.

But to do this, you need to understand that only the owners of the enterprise dispose of retained earnings from previous years:

- shareholders;

- sole participant;

- Board of Directors.

The director of the company does not have the authority to dispose of retained earnings, which accumulate in account 84 “Retained earnings (uncovered loss).” If business owners nevertheless decide to distribute accumulated profits, they must issue a written decision to the company's management.

There is no unified form for such a solution, you just need to specify:

- place and time of the meeting;

- presence of participants;

- the amount of money distributed;

- direction for using profits.

If the current year’s profit is used to provide assistance, the company’s management makes its own decision without waiting for the consent of the founders.

Tragic incident

Financial assistance in connection with death, natural disaster or terrorist attack. An employer may provide one-time financial assistance to: an employee in connection with the death of his family members; a former employee who retired due to the death of his family members; to a specialist in connection with a natural disaster or other emergency; to an employee who suffered from a terrorist attack on the territory of the Russian Federation. Such financial assistance is not subject to contributions to funds within any limits (subclause 3, clause 1, article 422 of the Tax Code of the Russian Federation; paragraph 2, subclause 3, clause 1, article 20.2 of the Federal Law of July 24, 1998 No. 125-FZ), and Also, personal income tax is not withheld from the amount paid (clause 8 of Article 217 of the Tax Code of the Russian Federation).

In addition, contributions to the Social Insurance Fund for insurance against industrial accidents and occupational diseases are not assessed for financial assistance to an employee in connection with the death of his family members.

note

The 2-NDFL certificate, which the tax agent is required to submit to the Federal Tax Service at the end of the year, should not reflect all financial assistance, but only according to the available corresponding codes 2710, 2760, 2762, as well as deductions from it - 503, 508. For example, for assistance provided to an employee in connection with the death of a relative, a code is not provided; accordingly, these amounts do not need to be indicated in the certificate.

The concept of “family members” is partially disclosed in Article 1 of the Family Code of December 29, 1995 No. 223-FZ, as well as in Article 14 of the Family Code. These include spouses, parents and children (adoptive parents and adopted children), grandparents, grandchildren. Our company has practical experience in challenging additional assessments of contributions from financial assistance in connection with the death of a grandmother or grandfather (Resolution of the 13th Arbitration Court of Appeal dated April 17, 2017 in case No. A56-62276/2016 and Resolution of the 13th Arbitration Court of Appeal dated April 4, 2021 in case No. A56-56184/2016).

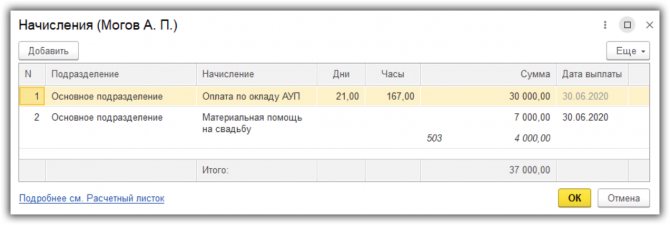

Calculation of financial assistance in 1C ZUP 3.1

To accrue financial assistance to employees in 1C ZUP 3.1, configure the salary calculation; if necessary, you can further configure or create calculation types for accrual and register the financial assistance either in the document Material assistance or in the Vacation (if you need to accrue financial assistance for vacation).

To calculate financial assistance to former employees, use the document Payment to former employees .

Other grounds

Financial assistance for other reasons. An employer can provide assistance to its employees for any other reasons, for example: on the occasion of the death of his brother/sister; for vacation; in connection with marriage; due to a long illness.

Amounts of such material assistance are not subject to personal income tax and contributions to funds only within the limit of 4,000 rubles per employee per tax (settlement) period (clause 28 of article 217 of the Tax Code of the Russian Federation; subclause 11 of clause 1 of article 422 of the Tax Code of the Russian Federation; subclause 12 Clause 1, Article 20.2 of the Federal Law of July 24, 1998 No. 125-FZ).

In the 2-NDFL certificate (order of the Federal Tax Service of Russia dated January 17, 2021 No. ММВ-7-11 / [email protected] ), which the tax agent is obliged to submit to the Federal Tax Service at the end of the year no later than April 1 (clause 2 of Art. 230 of the Tax Code of the Russian Federation), not all financial assistance should be reflected, but only according to the available corresponding codes 2710, 2760, 2762, as well as deductions from it - 503, 508 (order of the Federal Tax Service of Russia dated September 10, 2015 No. ММВ-7-11/ [email protected] ).

For example, for financial assistance provided to an employee in connection with the death of a close relative, a code is not provided; accordingly, these amounts do not need to be indicated in the 2-NDFL certificate.

The tax agent is obliged to submit Form 6-NDFL to the Federal Tax Service based on the results of each quarter no later than the last day of the month following the corresponding period, and for the year - no later than April 1 (clause 2 of Article 230 of the Tax Code of the Russian Federation) (order of the Federal Tax Service of Russia dated October 14 2015 No. ММВ-7-11/ [email protected] ).

Financial assistance, for which codes are provided, is reflected both in the first section and in the second. The date of receipt of income in the form of financial assistance is the date of its payment to the employee (subclause 1, clause 1, article 223 of the Tax Code of the Russian Federation). For example, assistance in connection with a marriage was accrued by order of the manager in January 2021 in the amount of 15,000 rubles, and paid on payday February 7, 2021. On the same day, personal income tax was withheld and transferred from her. The income receipt date will be February 7, 2021.

Due to the fact that some financial assistance is income subject to insurance premiums, it should be reflected in the quarterly calculation of insurance premiums (Order of the Federal Tax Service of Russia dated October 10, 2021 No. ММВ-7-11 / [email protected] ), which the employer submits to the Federal Tax Service no later than the 30th day of the month following the billing period (clause 7 of Article 432 of the Tax Code of the Russian Federation). And also in Form 4 - FSS (Order of the FSS of the Russian Federation dated September 26, 2021 No. 381), which the employer submits quarterly to the FSS on paper no later than the 20th day or in the form of an electronic document no later than the 25th day of the month following for the reporting period (clause 1 of article 24 of the Federal Law of July 24, 1998 No. 125-FZ).

As a rule, material assistance is non-productive in nature, and these expenses cannot be justified, economically justified expenses (Clause 1 of Article 252 of the Tax Code of the Russian Federation). That is why its amount does not reduce the income tax base if the organization applies OSNO (clause 23 of Article 270 of the Tax Code of the Russian Federation), and is not taken into account in expenses when applying the simplified tax system “income minus expenses” (clause 2 of Article 346.16 of the Tax Code of the Russian Federation) . An exception is financial assistance for vacation, provided that it is enshrined in an employment or collective agreement and depends on the amount of wages and compliance with labor discipline (letter of the Ministry of Finance of Russia dated September 2, 2014 No. 03-03-06/1/43912). But insurance premiums calculated from financial assistance in excess of the limits can be included in expenses for all organizations (subclause 1, clause 1, article 264 of the Tax Code of the Russian Federation and subclause 7, clause 1, article 346.16 of the Tax Code of the Russian Federation).

Reflection of financial assistance in section 1 of form 6-NDFL for the first quarter

| Line code | Name | Sum |

| 020 | Amount of accrued income | 15,000 rub. |

| 030 | Amount of tax deductions | 4000 rub. |

| 040 | Amount of calculated tax | 1430 rub. |

| 070 | Amount of tax withheld | 1430 rub. |

Reflection of financial assistance in section 2 of form 6-NDFL

| Line code | Name | Row exponent |

| 100 | Date of actual receipt of income | 07.02.2018 |

| 110 | Tax withholding date | 07.02.2018 |

| 120 | Tax payment deadline | 08.07.2018 |

| 130 | Amount of actual income received | 15,000 rub. |

| 140 | Amount of tax withheld | 1430 rub. |

Financial assistance for a wedding

Let's look at the calculation of financial assistance for a wedding.

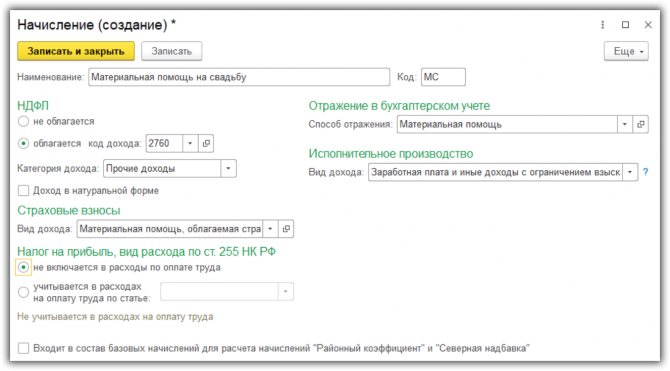

Setting up the accrual type

Let's go to the menu “Salaries and personnel - Directories and settings - Salary settings”.

Our team provides consulting, configuration and implementation services for 1C. You can contact us by phone +7 499 350 29 00 . Services and prices can be seen at the link. We will be happy to help you!

Let's go to the "Accruals" link.

Let's create a new accrual type and fill it out:

- We will indicate the name and unique code.

- In the “Personal Income Tax” section, set the “Taxed” option and select income code 2760. This type of income is partially subject to personal income tax, namely, it is not taxed in the amount of up to 4,000 rubles.

- We will indicate the method of reflecting financial assistance in accounting in the “Method of reflection” field.

- In the “Insurance premiums” section, we will set the type of income “Financial assistance, partially subject to insurance premiums.” There are also no contributions up to 4,000 rubles.

- We do not include expenses in income tax.

Calculation of financial assistance for a wedding

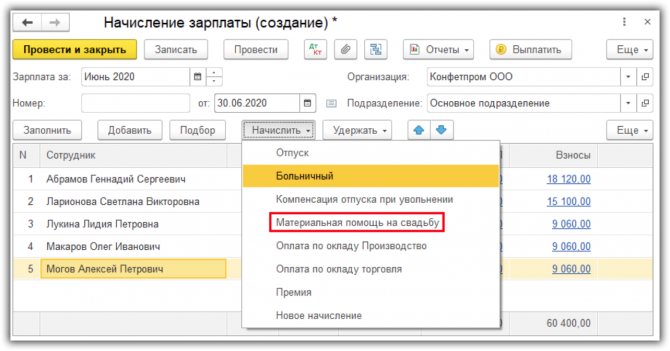

The calculation is performed when calculating salaries.

After automatically filling out the document, we will select an employee to accrue financial assistance, click the “Accrue” button and select the desired type of accrual, in this case “Material assistance for a wedding.”

We enter the payment amount, the deduction code is automatically entered and the deduction amount is 4,000 rubles. Click "OK".

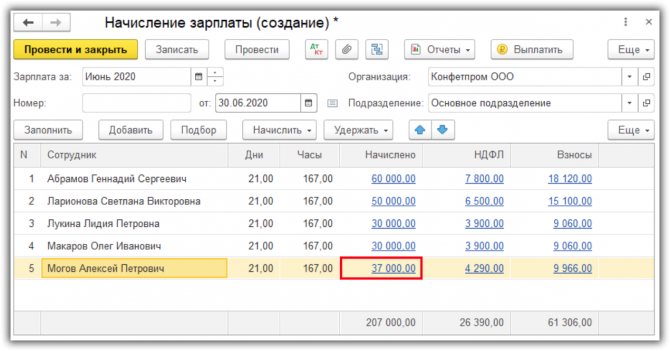

The accrual amount in the document has changed.

By clicking on the link in the “Accrued” column, you can see a detailed explanation.

Let's look at the document postings.

What operations should I use?

The posting that the accountant must make when calculating assistance:

- Dt 91.2 “Other expenses” Kt 73 “Settlements with personnel for other operations” - for your employee;

- Dt 91.2 Kt 76 “Settlements with various debtors and creditors” - for relatives of the employee (in the event of his death).

Note from the author! Financial assistance at the enterprise can be paid not only to current, but also to former employees, as well as their relatives.

Therefore, when issuing funds, the transactions will depend on the recipient of support and the method of payment:

- Dt 73 Kt 50 “Cashier” - upon receipt of cash by an employee;

- Dt 73 Kt 51 “Current accounts” - when using non-cash payments;

- Dt 76 Kt 50 (51) – when financial assistance is provided to the relatives of a deceased employee.