A sick leave certificate is officially a “sick leave certificate” - a document that confirms that an employee is sick, cannot work, and is entitled to compensation (temporary disability benefits). The sick leave certificate can be paper or electronic. In 2021, a system of direct payments is in effect throughout the country; it seemed that there would be fewer problems with payments. But in some cases, the Social Insurance Fund may refuse to pay benefits and the employer will have to make a number of changes to reporting and accounting.

The obligation to calculate and promptly transfer insurance premiums in full, to calculate and pay benefits for temporary loss of ability to work is assigned to policyholders - legal entities and individuals with employees, in accordance with Article 4.1 of Federal Law of the Russian Federation No. 255-FZ. Through the payment mechanism (Article 6 of Federal Law No. 478-FZ dated December 29, 2020), the following benefits :

- for temporary disability (starting from the 4th day of illness);

- for pregnancy and childbirth;

- women who registered with medical institutions in the early stages of pregnancy;

- at the birth of a child;

- for child care.

Employees have no choice; in any case, they will now be able to receive these benefits only directly from the Federal Social Insurance Fund of Russia by transferring to their bank account specified in the application or in the information register or through the federal postal service or other organization at the request of the employee (his representative).

As for employers, according to Part 3 of Art. 5 of Federal Law No. 243-FZ of July 3, 2016, from January 1, 2021, they are deprived of the right to reduce calculated insurance premiums by the corresponding benefit amounts. The rules giving the right to do this (clauses 2 and 9 of Article 431 of the Tax Code of the Russian Federation) have lost force since January 1, 2021.

Benefit payment procedure

The Social Insurance Fund pays in full for certificates of incapacity for work issued on the following grounds:

- pregnancy and childbirth;

- caring for a sick family member;

- quarantine of an employee, a child under 7 years of age (subject to attending kindergarten), an incapacitated family member;

- prosthetics in a hospital if there are medical indications;

- sanatorium-resort treatment after medical care.

The insured pays out of his own pocket only the first 3 days of temporary disability benefits in the event of the employee’s own illness not related to injury; for the remaining days, the Social Insurance Fund pays the insured person directly, as we found out just above.

The responsibilities of employers regarding payment of sick leave will now be limited to the following actions:

- Receiving from employees the documents necessary for the appointment and payment of sick leave benefits.

- Payment of benefits for the first 3 days of illness.

- Formation and submission to the Social Insurance Fund of a set of documents for payment of benefits for the entire subsequent period of temporary disability:

- application for the appointment and payment of sick leave benefits;

- a certificate of temporary incapacity for work, drawn up and issued by a medical organization in electronic form or on paper;

- a certificate of the amount of earnings, if during the billing period the citizen also worked for other employers (the employee receives such a certificate at his previous place of work in the form approved by order of the Ministry of Labor of the Russian Federation dated April 30, 2013 No. 182n).

Instructions for the employee when receiving temporary disability benefits:

- an insured employee goes to a clinic or hospital when ill;

- the doctor opens a sick leave certificate in paper or electronic form;

- the employee receives the necessary treatment;

- the attending physician closes the sick leave;

- the employee submits a paper certificate of incapacity for work or the number of an electronic certificate of incapacity for work to the accounting department;

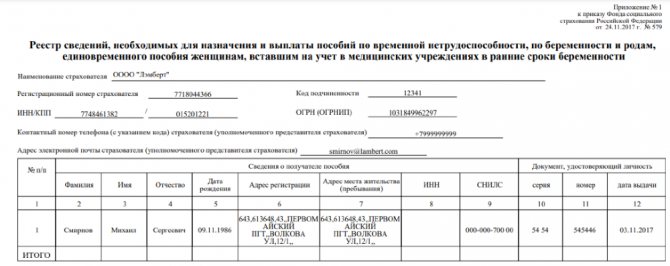

- the accountant calculates payments and transfers the register of information to the territorial Social Insurance Fund;

- The fund specialist checks the documentation submitted by the policyholder and transfers the benefit to the specified account.

You can request information on an electronic sick leave certificate from the Social Insurance Fund and fill it out on the employer’s part using the “Online Sprinter” ; it is intended not only for filing reports, but through it registers and applications for payment of benefits to employees are transmitted. Working with electronic sick leave is easier and more convenient than working with paper ones.

Sick leave and personal income tax

Income taxes are generally not withheld from state benefits paid. This applies to maternity benefits, unemployment benefits, funeral benefits, adoption benefits, etc. But the obligation to accrue it concerns payments for sick leave and other similar payments.

The personal income tax rate for sickness benefits is determined in accordance with the law.

The obligation to withhold income tax from income received during the period of illness remains regardless of the source from which it is paid. It does not matter who pays for sick leave - the employer or the Social Insurance Fund.

When calculating the amount of personal income tax, sick leave payment is attributed to the month for which it is issued.

For example, a technical maintenance engineer was sick from April 2 to April 19. During this period, a benefit in the amount of 12,000 rubles was accrued. Income for April is 25,000 rubles, including the amount of temporary disability benefits. The employee has no children; he is a resident of the Russian Federation. Let's calculate personal income tax and the amount to be issued in person for April.

Accounting for temporary disability benefits from the employer

By and large, the Employer’s area of responsibility for accounting and calculating benefits is reduced only to amounts for the first 3 days of illness, which must be properly reflected in accounting and reporting to government agencies for employee benefits. Let's figure it out.

Taxes and contributions on sick leave payments

Temporary disability benefits are not subject to insurance contributions for compulsory pension, medical and social insurance, incl. contributions for injuries (clause 1, clause 1, article 422 of the Tax Code of the Russian Federation, clause 1, clause 1, article 20.2 of the Law of July 24, 1998 No. 125-FZ).

However, personal income tax must be calculated and withheld from the entire benefit amount. That is, before transferring benefits to the employee, income tax is deducted from sick pay. And the employee is paid benefits minus personal income tax.

How to record payments for sick leave

Only information on benefits for the first three days of incapacity accrued by the employer at his own expense must be reflected in the employer's accounting records.

Accordingly, only the amount of temporary disability benefits accrued at the expense of the employer is included in the payroll payroll.

The accrual of temporary disability benefits for the first three days in 2021, as before, is reflected in the credit of cost accounting accounts 20 (23, 25, 26, 44...) in correspondence with the debit of account 70. Payment of this benefit is reflected in the debit of account 70 in correspondence with cash accounts. The withholding of personal income tax from calculated amounts is reflected by an entry in the debit of account 70 in correspondence with account 68 “Calculations for taxes and fees”, subaccount “Calculations for personal income tax”:

| Debit 20 (23, 25, 26, 44...) Credit 70 | temporary disability benefits were accrued for the first three days of illness |

| Debit 70 Credit 68 subaccount “Personal Income Tax Payments” | Personal income tax is withheld from the amount of temporary disability benefits for the first three days of illness |

| Debit 70 Credit 51 (50) | Temporary disability benefits were paid for the first three days of illness |

Are sick leave subject to insurance premiums?

Payments for the period of illness are made at the expense of the employer himself, as well as the Social Insurance Fund. According to Art. 9 of Law 212-FZ, the employee has no obligation to independently calculate the required contributions.

This fact is due to the following reasons:

- insurance premiums are already part of the disability benefit;

- The Social Insurance Fund should not make deductions for itself.

Based on this, we can conclude that sick leave payments are subject to income tax only. Such rules have been in force since 2009.

Since 2021, a new form of sick leave has been put into circulation, which contains the following main lines:

- the amount that the sick employee will receive from the Social Insurance Fund;

- the amount of funds that the sick employee will receive from the employer;

- a final line indicating the total value of these two indicators.

The employer must fill out these deadlines. Based on the calculations made, a payroll is generated, which indicates the amount to be paid. When the employee receives these funds in his hands, he signs this document confirming their receipt.

The calculation is made by the accounting service based on the following indicators:

- the length of service of this employee. If he has a total insurance period of less than 5 years, then he can count on only 60% of average earnings. If the total length of experience ranges from 5 to 8 years, then the employee will receive 80%, but if the experience is more than 8 years, then payment will be made in the amount of 100% of the average earnings;

- the average earnings of this employee for 1 working day. For calculations, you should take indicators for the last 2 years. It is for these purposes that upon dismissal, a certificate of average earnings is issued;

- duration of illness in days.

How and in what reports are amounts paid for sick leave reflected?

Report on form 6-NDFL

Since this benefit is subject to personal income tax, the employer, starting with reporting for 2021, reflects these amounts in form 6-NDFL.

The law recommends that employers pay sick leave benefits simultaneously with wages, but in the 6-NDFL certificate these payments and tax deductions on them must be taken into account separately.

According to the law, personal income tax on wages must be transferred on the next working day after payment. But the tax on sick leave payments is transferred no later than the last day of the month in which the sick leave was paid.

You can pay benefits earlier than the next payday; this is not prohibited.

Completing Section 1

Field 020 will indicate the amount of tax withheld for the tax period from the income of all individuals. That is, this line will reflect the amount of personal income tax not only from wages, but also from other taxable income, including sick leave.

Field 021 indicates the date when sick leave tax must be paid to the Federal Tax Service. Let us remind you that you must pay sick leave tax no later than the last day of the month when the employee received the payment. And in field 022 - the tax amount.

Completing section 2

Section 2 of the new report form includes the data that was in effect in section 1 of the previous form 6-NDFL. That is, the total amount of income of individuals, including hospital payments, is indicated here.

Thus, sick leave will be reflected in lines 110 and 112 in the form of the amount of income accrued to all individuals. Line 140 shows the amount of calculated tax on all income.

Also in section 2, sick leave is reflected in line 160 in the form of the amount of withheld tax on the income of individuals, the amount of which is indicated in line 120.

RSV

When filling out the DAM, payments that are not subject to insurance contributions in accordance with Article 422, which are benefits for temporary disability of employees, must be reflected in the corresponding lines of subsections 1.1, 1.2, Appendix 2, etc.

Line 030 in Appendix 2 of Section 1 must be filled out - it reflects the amount of benefits paid for the first three days of illness at the expense of the employer, which are not subject to insurance contributions; accordingly, in line 050 the taxable base will be reduced by this amount.

Therefore, in the DAM, we reflect the benefit at the expense of the employer first in the total amount of income, and then among non-taxable ones.

Similarly in 4-FSS

Reflect these amounts for the first three days of illness in the line “Amounts not subject to insurance premiums in accordance with Article 20.2 of the Federal Law of July 24, 1998 No. 125-FZ.”

To check the control ratios and make sure there are no errors in the reports, it is better to use a special program. Online Sprinter service successfully copes with this task. You will be able to control the sending, delivery and acceptance of each report. If necessary, create an adjustment based on previously submitted reports or respond to the request for supporting documents.

What tax do they pay on sick leave in 2021?

The amount calculated for standard sick leave is subject to taxation. Personal income tax is deducted from it.

This is explained by the fact that these deductions do not fall into the category of social benefits exempt from deductions at the legislative level.

The rate is established by the Tax Code of the Russian Federation and is 13 percent.

It is worth remembering that maternity leave on which a pregnant woman goes is also sick leave.

However, its nature is preferential in nature, which makes it possible to exclude benefits from the list of income subject to personal income tax (clause 1 of Article 217 of the Tax Code).

Sick leave checks FSS

The sick leave certificate is issued in accordance with the order of the Ministry of Health and Social Development of the Russian Federation dated April 26, 2011 No. 347n On approval of the form of the certificate of incapacity for work. The procedure for issuing sick leave is regulated by Order of the Ministry of Health and Social Development of Russia dated June 29, 2011 No. 624n (as amended on January 24, 2012, as amended on April 25, 2014) On approval of the Procedure for issuing certificates of incapacity for work.

Since the costs of paying the above benefits are carried out at the expense of the Social Insurance Fund, it is this control body that checks compliance with the rules for issuing certificates of incapacity for work, regulated by Procedure No. 624n.

When a FSS specialist checks the documentation for the payment of temporary disability benefits, it may happen that the Fund refuses to pay the benefit.

For example, the following may be the reason for “cancellation” of sick leave::

1. Untimely application by the employee . According to Article 12 of Law No. 255-FZ, unpaid sick leave is a certificate presented to the social insurance commission 6 months after the closing date. A dismissed and unemployed employee has the right to contact his former employer within a month.

2. Committing a crime . The fact provides for the onset of illness as a result of intentional harm to health recognized by the court or a suicide attempt not as a result of a mental disorder.

3. Incorrect document execution . Order of the Ministry of Health and Social Development of the Russian Federation dated June 29, 2011 No. 624 established uniform rules for filling out certificates of incapacity for work. Failure to comply with compliance standards by medical institutions does not exempt legal entities and individuals from the imposition of financial sanctions by the insurer.

4. Violation of the issuance procedure . The norm concerns the extension of more than 30 days without the conclusion of a medical qualification commission, the issuance of documents “retroactively” or the issuance of documents by private clinics that do not have the appropriate licenses.

5. Cooperation under a contract . The relationship between the parties is of a civil nature, the company does not make social security contributions (the employee is not an insured person) and some other reasons.

Basic information ↑

A sick leave certificate is a document that is filled out on a special form by the attending physician. It indicates the employee’s diagnosis and the dates of his visit to the clinic.

After complete rehabilitation, the employee takes the sick leave to the place of his work (Order of the Ministry of Health No. 1345n).

The accounting department of the enterprise accepts the certificate of incapacity for work and, on its basis, accrues the necessary payments to the employee.

Since these payments can be considered as cash receipts, it is stipulated that (Article 217 of the Tax Code of the Russian Federation):

- In the event of illness, injury, accident, caring for a sick relative or child, the employee pays taxes and payments to extra-budgetary funds from the sick leave benefit.

- If there is a pregnancy or childbirth, which also requires a person’s temporary absence from work and provides for the issuance of benefits, neither tax nor insurance payments are charged on this income.

What it is

Sick leave certificates are issued strictly on official forms, which have watermarks, barcodes and individual numbers.

Based on these documents, employees may be absent from work during the period of treatment, and also receive compensation, the amount of which depends on the employee’s income.

Temporary disability benefits can range from 60 to 100% of a person’s average earnings. The exact amount depends on the length of insurance coverage, as well as the reason why the employee is absent from work.

In addition, it is important to consider that:

- in case of illness or child care, the first five days of payment are made by the employer, and then by the Social Insurance Fund;

- if there has been a work injury or occupational disease. Then, during the entire period of incapacity, payments to the employee are made by the Social Insurance Fund, and in the amount of 100% of average earnings.

As for the period for which sick leave can be issued, it is important to rely on the following values (FZ-323):

| Minimum period of stay for an employee on sick leave | Is 3 days |

| The dentist can issue sick leave | For up to 10 days, and the therapist – for 30 days |

| A commission of doctors may extend the period of sick leave | For a period of up to one year or assign the employee disability |

If we are talking about caring for a child under 7 years old, then sick leave is issued for the entire duration of treatment. For the rehabilitation of children from 7 to 14 years old, you can obtain the right to be released from work duties for a period of 15 days.

Purpose of the document

A sick leave allows an employee not to officially perform work duties and not to visit the place of his work during the period of treatment, rehabilitation or caring for sick relatives.

For the name of the certificate for calculating sick leave, see the article: certificate for calculating sick leave. What is the maximum period of sick leave in 2021, read here.

In order to obtain this paper, a citizen should visit a clinic at his place of residence or place of work and undergo an examination.

The purpose of a sick leave certificate is to perform a number of important tasks with this official document:

| For employee | A sick leave not only provides the opportunity to stay at home, in a hospital or at a sanatorium-resort treatment, but also gives the right to receive financial compensation |

| For HR department | For an enterprise, this document serves as the basis for recording on the time sheet opposite the days when the employee was officially absent from the workplace |

| For accounting | The sheet provides the possibility of calculating compensation to the employee and making mutual settlements with the Social Insurance Fund |

| For FSS | The hospital document serves as the basis for the provision of insurance benefits to an individual |

The significance of the document for such a wide range of parties explains the strict requirements for its completion - information is entered into the form in dark ink, in Russian and cannot contain more than 2 blots or corrections (Order of the Ministry of Health No. 624n).

Normative base

All rules for issuing a sick leave certificate, calculating payments for it and the rights of an employee who has suffered temporary disability are set out in detail in such regulatory legal acts of the Russian Federation as:

| Labor Code of the Russian Federation, art. 124 and 183 | They reveal the guarantees that sick leave forms for an employee, as well as the features of working time management if this document is issued. |

| Tax Code of the Russian Federation, art. 217 | Describes in what cases taxes and mandatory payments to extra-budgetary funds may be charged on temporary disability benefits |

| FZ-323 | Indicates the main aspects of the use of sick leave as a document ensuring the protection of the health of citizens |

| FZ-255 | Establishes guarantees of social protection that a citizen can count on in the event of illness, injury or caring for sick relatives |

| Order of the Ministry of Health of the Russian Federation No. 624 | Describes in detail the criteria for filling out and issuing sick leave certificates |

| Decree of the Government of the Russian Federation No. 375 | Addresses issues of registration of hospital documents in case of pregnancy, childbirth and child care |

Every year, the Ministry of Health of the Russian Federation in its letters clarifies some details of the design of sick leave, which should be taken into account by medical institutions, the Social Insurance Fund and employing organizations.

What should an employer do with reports, taxes and contributions in case of refusal?

According to the official position of the Ministry of Finance (which was brought to the attention of the territorial bodies of the Federal Tax Service in Letter No. ED-4-15/19093 dated September 22, 2017), the amounts of payments accrued to the employee that are not insurance coverage for compulsory social insurance (due to the failure of the territorial body of the Federal Tax Service based on the results of the audit ), are subject to insurance premiums in accordance with Ch. 34 of the Tax Code of the Russian Federation in accordance with the generally established procedure (Letter dated 01.09.2017 No. 03-15-07/56382).

This simply means that the benefits paid do not have the status of temporary disability benefits and the obligation arises to tax such amounts with insurance contributions on a general basis.

And in this situation it is advisable to do the following:

- Reverse and exclude from tax expenses the benefit for the first three days of illness paid at the expense of the company.

- Credit the employee with a payment equal to the previously calculated benefit in the debit of account 91. It is not taken into account in tax expenses and is subject to insurance premiums and personal income tax. You have already withheld personal income tax from it.

- Submit to the Federal Tax Service an updated calculation of contributions for the quarter in which uncredited benefits were accrued. Correct in it the data on non-taxable payments, base, contributions and benefits (Letter of the Federal Tax Service dated 03/05/2018 No. GD-4-11 / [email protected] ).

- Pay additional fees according to the updated calculation and penalties.

The accounting entries will be as follows:

| STORNO D 20 (23, 25, 26, 44) - K 70 | Benefits for the first three days of employee illness were reversed |

| D 91 - K 70 | Benefits for sick leave “cancelled” by the Social Insurance Fund are reflected as other payments |

| D 91 - K 69 subaccounts of individual contributions | Insurance premiums accrued |

| D 91 - K 69 subaccount “Penies, fines on contributions” | Penalties have been accrued for late contributions to the budget. |

| D 69 subaccounts for contributions and penalties to the Social Insurance Fund and the Federal Tax Service K 51 | Contributions and penalties for contributions to the budget are listed |

Step-by-step instructions: payment of sick leave and deduction from their tax

The entire process of paying sick leave can be divided into separate actions.

Then the procedure will consist of the following independent stages:

- After an illness, a citizen submits a certificate to the employer indicating a period of incapacity for work. The document can be handed over to the accounting employee.

- After 10 days, the person is assigned a benefit. An authorized employee issues a certificate of calculation for the ballot.

- It contains all the necessary information and the payment calculation time. An order for deductions is not issued.

- The accounting service employee also fills out part of the sheet.

Personal income tax is not subject to separation in the ballot. The benefit in the document is already indicated taking into account the corresponding deductions.

The calculation certificate is generated in free form.

If you wish to indicate the amount of tax withholdings in the act, you need to supplement it with the appropriate line.

On the nearest day of payment of wages (in the organization it is established at the discretion of management in compliance with the requirements of the Labor Code of the Russian Federation), the accountant calculates the employee in accordance with the certificate of incapacity for work along with the salary. Taxes are withheld on the same day.

Next, the employer’s accounting department carries out personal income tax calculations with the budget. As already noted, the deadline is set on the last date of the month in which the calculation was made.

It is worth noting that there is a rule about transferring the period to the next weekday (Article 6.1 of the Tax Code of Russia).

Paying the treasury on the same day as the payment of wages, as well as performing these actions the next day, will also not be a mistake.

The accounting service should proceed from which method will be more convenient for the organization.

Results

Sometimes the Social Insurance Fund “cancels” sick leave. In this case, the employer will have to adjust accounting and reporting to the budget for the amount of benefits paid. However, in connection with the introduction of the direct payment mechanism, the issues of receiving funds by the employee and checking documents giving the right to calculate and pay temporary disability benefits are quickly resolved, which undoubtedly smooths out such issues that were quite often encountered under the credit system and had a negative impact on the employer.

Previously, the FSS could check sick leave after a sufficiently long period of time, and if it refused to recognize sick leave, the employer immediately ended up with a large amount of contributions (after all, many carried out offsets), plus the amounts paid became subject to assessment of contributions. Consequently, employers faced significant penalties and fines.

Changes in 2021 have made the system of interaction between the state, employer and employee regarding the payment of benefits mobile, convenient and most effective.