If an organization simultaneously carries out transactions that are taxed and not subject to VAT, it is obliged to carry out separate accounting for tax amounts. This is provided for in Art. 170 Tax Code of the Russian Federation. Collection amounts for taxable transactions are accepted for deduction. In another situation, you have to draw up proportions for each tax period according to the amounts of goods shipped. The “5 percent” VAT rule has been developed specifically for these purposes. An example of calculating the amount of tax in different situations will be discussed in detail below.

The essence

Trade organizations often have to combine a general taxation regime with a single tax. The presence of export operations is also the basis for separate accounting. The reason is that when exporting, VAT is deducted on the last day of the month when documents were provided confirming the use of a zero rate for such an operation. The procedure for calculating tax on these transactions is determined by the accounting policy.

Let us consider in more detail how such organizations carry out separate VAT accounting.

To reflect the distribution of the tax amount in the accounting system, subaccounts to account 19 are used. The distribution is carried out in the period in which the goods were registered. Therefore, the proportion is carried out according to comparable indicators - the cost of the goods with and without VAT. Double accounting is also carried out if the organization has operations that are carried out outside the Russian Federation.

Features of maintaining separate accounting

Almost often, commercial enterprises work with products subject to and exempt from VAT. Determining the amounts for these transactions will not be so easy.

Separate VAT accounting should be carried out strictly according to outgoing VAT, that is, the price of shipped products, taxable and exempt from tax. It is also important to take into account the input VAT, which is already included in the price of units of services or goods purchased for taxable and fully exempt transactions.

For trade transactions that are exempt from tax, as well as input VAT, are necessarily included in the cost of all goods sold, property rights and services.

There is no special methodology for maintaining separate VAT accounting. You can use any procedure that will effectively distinguish between all exempt and taxable transactions. Accounting for such transactions must be kept in different sub-accounts that are opened to standard accounting accounts. The procedure for maintaining documents, selected according to the parameters and features of the activity performed, must be enshrined in the general accounting policy of the organization.

If you do not maintain proper separate accounting, tax officials will quickly restore the entire input VAT on such units that were purchased for use in non-taxable and taxable transactions. This will automatically lead to shortfalls in VAT, and the tax office usually charges fines and penalties on them.

Example 1

Let's consider a standard situation. During the quarter, the company shipped products worth 1.2 million rubles, including taxable products worth 0.9 million rubles. The amount of tax presented by suppliers is 100 thousand rubles. Since the cost of the goods, which is not subject to taxation, is 250 thousand rubles, the calculated coefficient is 0.75. Therefore, you can deduct not 100 thousand rubles, but only 75 thousand rubles. (100 * 0.75). And only 25% can be taken into account in the cost of purchased goods: 1.2 * 0.25 = 0.3 million rubles.

Calculations

How to distribute input VAT? An enterprise may have fixed assets and intangible assets registered in the first month of the quarter. In such cases, the proportions are determined based on the share of the cost of shipped goods manufactured on a new machine in the total sales amount for the month in which the object was accepted for accounting.

The cost of services for providing loans and repo transactions is calculated based on the amount of income in the form of accrued interest. The exception is an interest-free loan, the cost of which is equal to zero. Such operations do not affect the proportion

When calculating the Central Bank, the difference between the sale price and acquisition costs is calculated. At the same time, non-VAT-taxable transactions must also be taken into account in the cost of work.

How to count

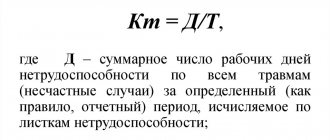

Calculate your share of expenses using the following formula:

If this rule is observed and the result obtained does not exceed 5%, then the input tax on total costs can be deducted in full without distribution.

To recap what constitutes total expenses, the five percent rule. Such costs include expenses for the acquisition of goods or their production or sale, as well as for the purchase of works, services or property rights that will be used in carrying out both non-taxable and taxable transactions.

Please note that the procedure for distributing total costs is not fixed in the Tax Code of the Russian Federation. This means that each economic entity independently determines the order of distribution of this category of costs. This decision must be fixed in your accounting policies.

5% rule

For those periods when the share of expenses on non-taxable transactions is less than 5% of the total amount of expenses, the company may not carry out separate accounting. The procedure for calculating the total amount of expenses when calculating the barrier is not established by law. An enterprise can develop its own justified methodology and consolidate it in its accounting policies.

When calculating the share, all sales excluding VAT are taken into account: non-taxable transactions, sales on imputation, expenses for transactions outside the Russian Federation. As for the first group, both direct and general expenses are taken into account. That is, you need to add up all the costs, add VAT on general business expenses in the appropriate proportion, then divide the resulting amount by the amount of costs.

The “5 percent” rule for VAT, an example of the calculation of which will be presented below, cannot be applied to export transactions. This is provided for in Art. 170 NK. For such transactions the VAT rate is 0%. That is, if:

- the barrier has not been reached;

- the enterprise has export operations;

It is necessary to carry out separate VAT accounting.

Taxpayers maintaining separate records

Paragraph 4 of Article 170 of the Tax Code of the Russian Federation provides for the obligation to carry out separate accounting for VAT amounts for organizations conducting both taxable and non-VAT-taxable transactions.

In addition, a separate procedure for calculating taxation is also provided for trade organizations whose activities involve export operations, since value added tax is deducted for them on the last day of the month in which documents confirming the exemption from VAT payment obligations are provided.

The value added tax for such organizations is 5% for the period in which the percentage of expenses for operations not subject to VAT does not exceed 5% of the amount of expenses. The procedure for calculating the total amount of expenses must be defined in the accounting policy.

The determination of the specific weight occurs by adding all costs and value added tax on business expenses and dividing the resulting amount by the total amount of costs.

Accounting for non-production calculations is carried out using account 26, which should display the costs of management, depreciation, rent, as well as information, audit and consulting services.

Advice for organizations conducting transactions that are subject to VAT

If an organization conducts operations that are subject to value added tax and only occasionally receives income from loans (or pays with bills of exchange from third parties), then it is recommended to include in the accounting policy such provisions on the use of the “Five Percent Rule” for VAT.

The use of this rule allows the organization to determine the amount of general business expenses that fall on non-taxable operations in proportion to the share of direct expenses for these operations in the total amount of expenses associated with the sale of products.

When applying the “Five Percent Rule”, if the organization provides loans, the share of expenses for non-VAT-taxable transactions will be equal to 0. Thus, it will be possible to take all VAT on general business expenses as a deduction.

Advice for organizations conducting transactions that are not subject to VAT

If an organization is engaged in operations that are not subject to value added tax on an ongoing basis, then in order to calculate the share of expenses for these operations, accounting should be organized in such a way that the following information is generated separately:

1. About the cost of sales, which are subject to VAT. 2. About the cost of sales, which are not subject to VAT. 3. About other costs associated with implementation:

- subject to VAT (for example, on the sale of fixed assets);

- exempt from VAT (for example, sales of securities).

4. About other expenses that are not related to sales (for example, interest received by the company on loans).

To make it more convenient to keep track of transactions, it is recommended to open separate sub-accounts. In addition, you can maintain separate registers.

We add that the organization should decide on the optimal procedure for calculating the share of general business expenses that fall on operations not subject to value added tax.

For example, the share of general business expenses attributable to operations that are not subject to VAT can be taken equal to one of the following ratios:

- the share of direct expenses for operations that are not subject to VAT in the total direct expenses for all operations that are related to the sale;

- the share of revenue from operations that are not subject to VAT in the total amount of sales revenue.

No less important is the issue of tax policy for separate accounting in relation to transactions that are not subject to VAT. It is worth paying attention to such points that are associated with the grounds for performing such operations, namely:

1. What preferential regimes are associated with taxation. 2. Are there any tax transactions that are not provided for in Article 149 of the Tax Code of the Russian Federation? 3. Availability of the right to exemption from VAT in case of insufficient amount of revenue received. 4. Sales of products (services or works) to other countries.

Maintaining separate accounting for VAT: what to pay attention to

The vast majority of organizations deal with both taxable and non-taxable value added tax products.

Let us remind you that separate accounting for this tax is carried out according to the output VAT - at the cost of the products that were shipped. In this case, products may be subject to VAT or exempt from it. VAT included in the product price must also be taken into account.

However, there is no single methodology for maintaining separate VAT accounting. That is why you can use a convenient order for organization. The most important thing is that when maintaining separate accounting, transactions subject to VAT and those not subject to VAT are clearly distinguished.

The procedure for maintaining separate VAT accounting chosen by the organization must be enshrined in the general accounting policy of the company.

Failure to maintain correct separate VAT accounting may result in tax authorities recovering all input tax on items purchased for use in transactions that are and are not subject to value added tax. Such actions by tax officials will lead to the organization having shortfalls in VAT, which means fines and penalties cannot be avoided.

The Ministry of Finance believes that if there are no transactions on exempt units of goods from VAT, then this is the basis for exempting the organization from maintaining separate accounting for value added tax.

Maintaining separate accounting for VAT when exporting: main points

Separate accounting for VAT when exporting products is required. In this case, the raw materials that were used in the process of export operations (the amount of operations) must be submitted to the Federal Tax Service in the form of a declaration with a zero rate.

The norms of the current Russian legislation do not provide for a clearly defined methodology for determining the input VAT of goods for export. A convenient accounting method is chosen by the organization independently. The accounting procedure should be fixed in the relevant documents (in orders related to the accounting policy of the enterprise).

If the organization did not previously assume that it would export goods and applied regular input VAT on a general basis, then the tax that was paid can be restored. To do this, the organization submits a declaration (updated) and pays tax.

The 5 Percent Rule: An Example

The enterprise's direct costs for taxable operations in the second quarter amounted to 15 million rubles, and for non-taxable ones - 750 thousand rubles. General business expenses - 3.5 million rubles. The accounting policy provides for the distribution of expenses in proportion to revenue, which in the reporting period amounted to RUB 21 million, respectively. and 970 thousand rubles.

General business expenses for non-taxable transactions: 3.5 * (0.97 / (21 + 0.97))) = 154.529 thousand rubles, or 4.7%. Since this amount does not exceed 5%, the company can deduct the entire input VAT for the second quarter.

How separate VAT accounting works in 2021

How to calculate the total costs of acquisition, production or sales. Does the organization determine the need to maintain separate accounting for input VAT? To determine the total costs of an organization, it is necessary to develop its own procedure. Fix it in your accounting policy. An organization is required to distribute input VAT if the share of expenses on transactions exempt from taxation is equal to or exceeds 5 percent of the organization's total expenses.

The 5 percent VAT rule using an example of calculation with explanations

Suppose a company produces and sells products on a common system. In the fourth quarter, the company distributed free promotional products to customers. Unit cost is 70 rubles. And the transfer of promotional items costing no more than 100 rubles. VAT is not assessed (Article 149 of the Tax Code). Thus, in the fourth quarter the organization had both taxable and non-taxable transactions.

The company simultaneously includes general business expenses as taxable and non-taxable transactions. According to the accounting policy for calculating the share of expenses for non-taxable transactions, the company distributes general business expenses in proportion to the revenue from these operations in the total revenue for the quarter. If a company gives away products for free, it uses market value instead of revenue.

The accountant distributed the input VAT taking into account the new position of officials. He reflected the data for separate VAT accounting in a special register.

Sample register for separate accounting

In the same register, the accountant calculated the share of expenses for non-taxable transactions. This figure does not exceed 5 percent. This means that the company has the right to deduct all input VAT on general business expenses in the amount of 900,000 rubles.

Input VAT on purchases for non-taxable transactions in the amount of RUB 180,000. The accountant included in the cost of purchased goods, works, and services. Input VAT on purchases that are intended only for taxable transactions in the amount of RUB 4,500,000. the company declared for deduction.

Accounting algorithm

To understand what VAT rate should be applied to goods and how to determine the amount of input tax, you can use the following sequence of actions:

1. Calculate the amount of VAT claimed that can be deducted. If the purchased goods can be directly attributed to activities exempt from taxation, then VAT is included in its cost. In other cases, the tax amount is deducted.

2. At the next stage, you need to apply the “5 percent” rule for VAT, an example of the calculation of which was presented earlier. First, the amount of expenses for non-taxable transactions is determined, then the total costs are calculated and the formula is applied:

% neoreg. oper. = (Normal / Total) x 100%.

If the resulting ratio exceeds 5%, then separate accounting of the amounts should be carried out.

3. Tax amounts with and without VAT are calculated, then they are summed up and the ratio is determined:

% calc. = (Sum of region / Sum of total) * 100%.

The following determines the VAT on OSN payable:

Tax = VAT charged * % deducted.

4. The marginal cost is calculated:

VAT limit = VAT claimed - VAT deducted

or

Cost = (Amount of goods shipped, but not taxable / Total sales volume) * 100%.

Let's look at an example

Let's look at how the 5 percent VAT rule is determined and an example calculation.

The total expenses of Vesna LLC for the 3rd quarter of 2021 amounted to 1,550,000 rubles, including for:

- Implementation of consulting services - 1,300,000 rubles.

- Provision of educational services (not subject to VAT) - 50,000 rubles.

- General business expenses - 200,000 rubles.

According to the current accounting policy of Vesna LLC, the company decided to distribute general business expenses in proportion to the revenue received for each type of service. Thus, for the 3rd quarter, revenue amounted to 4 million rubles, including:

- Consulting services - 3,500,000 rubles.

- Educational services - 500,000 rubles.

We distribute OCR.

For consultation:

200,000 × (3,500,000 / (3,500,000 + 500,000)) = 175,000 rub.

For educational services:

200,000 × (500,000 / (3,500,000 + 500,000) = 25,000 rubles.

Now we calculate the share of costs for non-taxable services:

(50 000 + 25 000) / (1 300 000 + 50 000 + 200 000) × 100 % = 4,84 %.

Since 4.84% is less than 5%, it means that Vesna LLC has the right to deduct all input value added tax presented by suppliers and contractors for the 3rd quarter of 2021.

Arbitrage practice

A complete interpretation of “total expenses” is not provided in the Tax Code. Based on definitions in economic dictionaries, this term can be understood as the total cost of production of goods incurred by the taxpayer himself. The Ministry of Finance explains that when calculating this value, direct and general expenses for conducting activities are taken into account.

Judicial practice also does not allow us to draw an unambiguous conclusion regarding when separate VAT accounting should be carried out. The 5 percent rule, an example of which was discussed earlier, applies exclusively to manufacturing enterprises. According to the judges, trading companies cannot carry out separate tax accounting.

Transactions with securities raise even more questions. In particular, some judges, referring to Art. 170 of the Tax Code, they claim that when selling such assets, the 5% rule can be used. At the same time, the cost of purchasing securities does not affect the proportion. That is, almost always the amount of expenses will be less than 5%, and the payer will be released from the obligation to keep double records.

In other court decisions there is a reference to PBU 19/02, which states that all transactions with the Central Bank in NU and BU relate to financial investments. In addition, organizations do not have expenses associated with the formation of the cost of such assets. That is, income from such transactions is exempt from taxation. Therefore, the organization must submit full VAT for deduction.

Transactions on the sale of a legal entity’s share in the management company of another organization are not subject to VAT. Therefore, in such cases double counting is always carried out.

Let's get to the bottom of the problem

So, if a company simultaneously carries out taxable and non-taxable transactions, then problematic situations may arise in taxation.

First of all, the disputes concern VAT. For example, how to apply input tax to a deduction when combining transactions of different types? Starting this year, officials have adjusted the rules. In such circumstances, the company is required to maintain separate accounting records. That is, take into account income and expenses separately for taxable transactions, and separately for non-taxable ones.

But it's not that simple. For example, certain types of costs can be allocated to both types of activities: taxable and non-taxable. For example, general business expenses that are incurred to ensure the life of the entity as a whole, regardless of the specific type of transaction. For expenses of this nature, separate accounting for input VAT is applied: the 5 percent rule.

What does it mean? Let's say an organization provides two types of services. The first is classified as non-taxable, and the second is subject to full VAT. Thus, an enterprise has the right to accept input VAT on general business costs in full if expenses for non-taxable transactions do not exceed 5% of total (aggregate) expenses for the corresponding quarter.

The 5 percent VAT rule from 2021 applies only if expenses are aimed at both types of transactions: taxable and non-taxable. But if spending is aimed only at non-taxable activities, then it is no longer possible to use the 5% rule. In this case, include the amount of input tax in the cost of services, goods, and works exempt from value added tax.

Let us note that until 2021, officials took a different position. That is, previously it was possible to accept input VAT as a deduction if expenses within 5% were directed only to non-taxable transactions.

General provisions on separate VAT accounting

If there are transactions taxable and not subject to VAT, it is necessary to keep separate records of input VAT for goods, works, services (hereinafter referred to as goods), etc. 4 tbsp. 149 of the Tax Code of the Russian Federation. The specific procedure for maintaining such records must be fixed in the accounting policy. 4 tbsp. 170 Tax Code of the Russian Federation; Letter of the Ministry of Finance dated November 20, 2017 No. 03-07-11/76412.

The organization must distribute input VAT as follows. 1, 2 p. 4 tbsp. 170 Tax Code of the Russian Federation:

•VAT relating to goods used for VAT-exempt transactions must be taken into account in the cost of such goods. This will increase expenses for income tax purposes;

•VAT related to goods used for VAT-taxable transactions can be deducted;

•VAT on goods used simultaneously for taxable and non-VAT-taxable transactions (that is, VAT on general business expenses) is deducted in proportion to the share of revenue from taxable transactions in the total revenue for the quarter:

In the general case (if there was no income from the sale of securities), such a share is calculated according to the following formula Letters of the Ministry of Finance dated July 19, 2017 No. 03-07-08/45800, dated June 26, 2009 No. 03-07-14/61:

Please note that with this calculation:

•all revenue indicators are taken excluding VAT and for the tax period as a whole - quarter Letter of the Federal Tax Service dated March 21, 2011 No. KE-4-3/4414;

•in the composition of revenue it is necessary to take into account, in particular:

—revenue from taxable and non-VAT-taxable transactions;

—revenue from transactions that are not subject to VAT;

—revenue from the sale of goods outside Russia, Determination of the Supreme Arbitration Court of June 30, 2008 No. 6529/08; Letter of the Ministry of Finance dated December 22, 2015 No. 03-07-08/75085;

•there is no need to take into account income that is not recognized as sales revenue, for example:

— interest on bank deposits and balances on bank accounts Letters of the Ministry of Finance dated January 16, 2017 No. 03-07-11/1282, dated August 18, 2014 No. 03-07-05/41205, dated May 17, 2012 No. 03-07-11/145;

—dividends on shares Letters of the Ministry of Finance dated January 16, 2017 No. 03-07-11/1282, dated July 8, 2015 No. 03-07-11/39228;

— discounts on bills Letter of the Ministry of Finance dated March 17, 2010 No. 03-07-11/64.

If during the quarter you received income from the sale of securities, then the formula for calculating the share will be somewhat more complicated. 5 clause 4.1 art. 170 Tax Code of the Russian Federation. The numerator of the formula will remain the same. But in the denominator when calculating the total amount of income, instead of income from the sale of securities, only “tax” profit from their sale must be taken into account. Letter of the Ministry of Finance dated November 26, 2014 No. 03-07-11/60111.

It is not difficult to calculate the discount during the summer sales period. But the calculations for checking compliance with the “five percent” VAT rule are not as easy as it seems

There are other nuances in separate VAT accounting. Thus, when purchasing fixed assets and intangible assets taken into account in the first or second month of the quarter, which are intended for participation in taxable and non-VAT-taxable activities, you can distribute input VAT:

•or in proportion to the share of VAT taxable revenue received in the first or second month. Consequently, the formula for determining the share of revenue will only include indicators for the first or second month of the quarter, respectively. 1 clause 4.1 art. 170 Tax Code of the Russian Federation. Then depreciation accrued starting from the next month will be calculated correctly and will not require adjustments in the future - even if the share of taxable revenue changes at the end of the quarter;

•or in a general manner - that is, based on data for the quarter as a whole. However, in this case, you will not be able to correctly calculate their full initial cost in the month of acceptance for accounting of fixed assets or intangible assets. This means that in the future it may be necessary to recalculate the amounts of depreciation accrued for the quarter. The only advantage of this approach is that in the month the fixed asset was accepted for accounting, you will not have to calculate a separate proportion for the distribution of VAT on a specific fixed asset or intangible asset.

Example 3

Before providing funds as collateral, the company hired auditors to check the financial condition of the borrower. The cost of the company's services amounted to 118 thousand rubles. VAT included. Loan amount – 1 million rubles. The cost of financial investments is determined based on the accounting policies of the lender. If it does not provide for the use of the 5% rule, then VAT for auditor services should be taken into account in the cost of the financial investment. In this case, general business expenses will have to be distributed. If there is a reservation, then all amounts are accepted for deduction.

The issue of accounting for input VAT in transactions with debt securities remains open. Using a preferential scheme for transactions with bills of exchange is risky. The Federal Tax Service will most likely challenge such operations, and then they will have to prove their case in court.

Accounting

From all of the above, we can draw the following conclusion: it is better to determine the method of calculating expenses and indicate it in the accounting policy. In this case, you need to specify the entire list of costs that relate to operations exempt from taxation, and the procedure for their calculation:

- allocate a position on staff for a responsible employee;

- prescribe the procedure for recording time for making calculations;

- determine the principle for distributing the amount of rent and utilities for such operations (for example, proportionally).

To collect information about expenses not related to production, account 26 is used. It can reflect management, general business expenses, depreciation, rent, costs of information, auditing, and consulting services.

Advice for organizations conducting transactions that are subject to VAT

If an organization conducts operations that are subject to value added tax and only occasionally receives income from loans (or pays with bills of exchange from third parties), then it is recommended to include in the accounting policy such provisions on the use of the “Five Percent Rule” for VAT.

The use of this rule allows the organization to determine the amount of general business expenses that fall on non-taxable operations in proportion to the share of direct expenses for these operations in the total amount of expenses associated with the sale of products.

When applying the “Five Percent Rule”, if the organization provides loans, the share of expenses for non-VAT-taxable transactions will be equal to 0. Thus, it will be possible to take all VAT on general business expenses as a deduction.

VAT or UTII for individual entrepreneurs

To begin with, it is worth noting that entrepreneurs who are single tax payers do not pay VAT on transactions that are recognized as taxable. At the same time, the Tax Code states that organizations that carry out transactions subject to VAT and UTII are required to maintain double accounting of property, liabilities and transactions. For such individual entrepreneurs, the VAT accounting procedure is regulated by the Tax Code. It also spells out the work procedure of exporters located on UTII for individual entrepreneurs.

Separate accounting allows you to correctly determine the amount of tax deduction: in full or in proportion. The code states that the procedure for distributing such operations must be prescribed in the accounting policies of the organization. The above ratio is calculated based on the cost of non-taxable goods sold in total sales. Let's consider another problem that presents the “5 percent” rule for VAT.

Calculation example. An enterprise engaged in wholesale and retail trade (paying VAT and UTII) must carry out double tax accounting. Even if work, equipment, or real estate are intended for “imputed” activities, VAT on them is not deductible. If the services received or real estate purchased are intended to conduct transactions subject to VAT, then the tax charged is taken into account in full. If the purchased equipment will be used on “two fronts” at once, then a proportion must be drawn up. One part of the tax is deductible, and the second is included in the cost of goods.

VAT register for the “five percent” rule

The article from the magazine “MAIN BOOK” is current as of May 25, 2021.

Contents of the magazine No. 11 for 2021 L.A. Elina, leading expert When combining VAT-taxable and non-VAT-taxable transactions, separate accounting must be maintained. The “five percent” rule allows, in certain cases, to deduct all input VAT on expenses that relate to both taxable and non-VAT-taxable transactions. But separate accounting is still necessary.

General provisions on separate VAT accounting

If there are transactions taxable and not subject to VAT, it is necessary to keep separate records of input VAT for goods, works, services (hereinafter referred to as goods), etc. 4 tbsp. 149 of the Tax Code of the Russian Federation. The specific procedure for maintaining such records must be fixed in the accounting policy. 4 tbsp. 170 Tax Code of the Russian Federation; Letter of the Ministry of Finance dated November 20, 2017 No. 03-07-11/76412.

The organization must distribute input VAT as follows. 1, 2 p. 4 tbsp. 170 Tax Code of the Russian Federation:

•VAT relating to goods used for VAT-exempt transactions must be taken into account in the cost of such goods. This will increase expenses for income tax purposes;

•VAT related to goods used for VAT-taxable transactions can be deducted;

•VAT on goods used simultaneously for taxable and non-VAT-taxable transactions (that is, VAT on general business expenses) is deducted in proportion to the share of revenue from taxable transactions in the total revenue for the quarter:

In the general case (if there was no income from the sale of securities), such a share is calculated according to the following formula Letters of the Ministry of Finance dated July 19, 2017 No. 03-07-08/45800, dated June 26, 2009 No. 03-07-14/61:

Please note that with this calculation:

•all revenue indicators are taken excluding VAT and for the tax period as a whole - quarter Letter of the Federal Tax Service dated March 21, 2011 No. KE-4-3/4414;

•in the composition of revenue it is necessary to take into account, in particular:

—revenue from taxable and non-VAT-taxable transactions;

—revenue from transactions that are not subject to VAT;

—revenue from the sale of goods outside Russia, Determination of the Supreme Arbitration Court of June 30, 2008 No. 6529/08; Letter of the Ministry of Finance dated December 22, 2015 No. 03-07-08/75085;

•there is no need to take into account income that is not recognized as sales revenue, for example:

—dividends on shares Letters of the Ministry of Finance dated January 16, 2017 No. 03-07-11/1282, dated July 8, 2015 No. 03-07-11/39228;

— discounts on bills Letter of the Ministry of Finance dated March 17, 2010 No. 03-07-11/64.

If during the quarter you received income from the sale of securities, then the formula for calculating the share will be somewhat more complicated. 5 clause 4.1 art. 170 Tax Code of the Russian Federation. The numerator of the formula will remain the same. But in the denominator when calculating the total amount of income, instead of income from the sale of securities, only “tax” profit from their sale must be taken into account. Letter of the Ministry of Finance dated November 26, 2014 No. 03-07-11/60111.

It is not difficult to calculate the discount during the summer sales period. But the calculations for checking compliance with the “five percent” VAT rule are not as easy as it seems

There are other nuances in separate VAT accounting. Thus, when purchasing fixed assets and intangible assets taken into account in the first or second month of the quarter, which are intended for participation in taxable and non-VAT-taxable activities, you can distribute input VAT:

•or in proportion to the share of VAT taxable revenue received in the first or second month. Consequently, the formula for determining the share of revenue will only include indicators for the first or second month of the quarter, respectively. 1 clause 4.1 art. 170 Tax Code of the Russian Federation. Then depreciation accrued starting from the next month will be calculated correctly and will not require adjustments in the future - even if the share of taxable revenue changes at the end of the quarter;

•or in a general manner - that is, based on data for the quarter as a whole. However, in this case, you will not be able to correctly calculate their full initial cost in the month of acceptance for accounting of fixed assets or intangible assets. This means that in the future it may be necessary to recalculate the amounts of depreciation accrued for the quarter. The only advantage of this approach is that in the month the fixed asset was accepted for accounting, you will not have to calculate a separate proportion for the distribution of VAT on a specific fixed asset or intangible asset.

The essence of the “five percent” rule

Input VAT on total expenses associated with both taxable and non-VAT-taxable transactions can be fully deducted if for the corresponding quarter the share of expenses on transactions not subject to VAT does not exceed 5%. 4 tbsp. 170 Tax Code of the Russian Federation. That is, the following condition is met: Letter of the Ministry of Finance dated July 19, 2017 No. 03-07-08/45800:

Note that data on expenses, as the Ministry of Finance explains, must be taken from accounting Letter of the Ministry of Finance dated May 29, 2014 No. 03-07-11/25771.

Attention

Even if you can use the “five percent” rule, separate VAT accounting is required. If there is no separate accounting for input VAT, then it can neither be deducted nor taken into account in tax expenses. 4 tbsp. 170 Tax Code of the Russian Federation.

However, please note that:

•VAT on goods that are used exclusively in VAT-free transactions cannot be deducted, even if the “five percent” rule is met. The deduction applies only to VAT on general expenses. 4 tbsp. 170 Tax Code of the Russian Federation; Letters of the Ministry of Finance dated 04/23/2018 No. 03-07-11/27256, dated 04/05/2018 No. 03-07-14/22135;

•the “five percent” rule cannot be applied to deduct VAT on goods used simultaneously for “imputed” and general activities. 4 tbsp. 170 Tax Code of the Russian Federation; Letters of the Ministry of Finance dated December 25, 2015 No. 03-07-11/76106; Federal Tax Service dated May 16, 2011 No. AS-4-3/ [email protected] However, if, in addition to the “imputed” activities, there are “general regime” operations, some of which are subject to VAT, and some are not, then for that part of the VAT on general business expenses, which applies to the general regime, the “five percent” rule still applies.

VAT on general business expenses when combining UTII and the general regime

— Consider a situation where an organization has general business expenses related to three types of operations:

•to transactions subject to VAT;

•to transactions not subject to VAT, but related to activities taxed under the general taxation system;

•to transactions subject to UTII.

Input VAT on such general business expenses must be distributed by type of activity in proportion to the cost of goods shipped. 4, 5 clause 4, clause 4.1 art. 170 Tax Code of the Russian Federation:

•that part of the input VAT that accounts for general business expenses related to “imputed” activities cannot be deducted, even if the organization or entrepreneur follows the “five percent” rule. After all, for transactions subject to UTII, they are not VAT payers. Letter from the Ministry of Finance dated December 25, 2015 No. 03-07-11/76106; Federal Tax Service dated May 16, 2011 No. AS-4-3/ [email protected] ;

• the remaining part of the input VAT on general business expenses related to activities taxed under the general taxation system. 4 tbsp. 170 Tax Code of the Russian Federation:

-or is fully accepted for deduction - if the “five percent” rule is observed;

—or distributed between taxable and non-taxable transactions carried out within the framework of the general taxation system, in proportion to the value of the goods shipped. In this case, the amount of VAT attributable to general business expenses related to transactions subject to VAT is taken as a deduction. And VAT on expenses related to transactions not subject to VAT is not deductible and is included in the cost of purchasing the relevant goods, works or services.

However, when combining three types of operations, “imputed” expenses cannot be discarded when calculating the share of expenses attributable to VAT-free activities.

After all, when determining it, transactions that are not subject to VAT on all grounds must be taken into account. Letter of the Federal Tax Service dated 08/03/2012 No. ED-4-3 / [email protected] Among them, in particular, it is necessary to take into account:

•operations, the place of implementation of which is not recognized as Russia, Articles 147, 148 of the Tax Code of the Russian Federation;

•operations that are not recognized as subject to VAT in accordance with clause 2 of Art. 146 Tax Code of the Russian Federation Letter of the Ministry of Finance dated July 19, 2017 No. 03-07-08/45800.

Expenses for “imputed” activities and the “five percent” rule

— To apply the “five percent” rule, it is necessary to determine the share of expenses for transactions not subject to VAT. When calculating it, both in the numerator and in the denominator of the fraction, it is necessary to take into account, among other things, the costs of “imputed” activities. After all, these are transactions for which VAT is not charged. Resolution of AS PO dated September 22, 2015 No. F06-253/2015; AS SKO dated April 11, 2017 No. F08-1951/2017; FAS SKO dated 09.09.2013 No. A63-12167/2012 (Decision of the Supreme Arbitration Court dated 30.10.2013 No. VAS-14566/13 refused to transfer this case to the Presidium of the Supreme Arbitration Court for review in the order of supervision).

If the share of expenses for transactions not subject to VAT is more than 5%, then:

•it will not be possible to fully claim VAT deduction for general business expenses - even in that part that relates to the general taxation system;

•it will not be possible to declare the full amount of VAT deduction for general production expenses that have nothing to do with imputation - if taxable and non-VAT-taxable transactions are carried out within the framework of such production.

That is, the taxpayer must, within the framework of the general rules for separate accounting of input VAT, determine which part of the VAT can be deducted and which part can be taken into account in the cost of purchased goods.

We develop a VAT register

Let's see how we can create a VAT register to check compliance with the “five percent” rule for a situation where, within the framework of the general regime, there are expenses associated with both taxable and non-VAT-taxable activities. For example, office rent and other general business expenses.

Reference

If imputation is combined with the general regime and within the latter there are transactions subject to and not subject to VAT, then the register for the “five percent” rule will be more complicated. However, expenses for “imputed” activities are extremely rarely less than 5% of the total expenses. It turns out that imputators are practically deprived of the opportunity to apply this rule.

Let's fill the register using a conditional example, assuming that:

•the organization is not a UTII payer;

•general business expenses are distributed between types of activities in proportion to income.

In our example, the share of expenses for transactions not subject to VAT (line 10) does not exceed 5% (1.4% 5%). Consequently, it is possible to deduct the entire amount of VAT on expenses that relate simultaneously to transactions subject to and not subject to VAT (line 3).

* * *

As you can see, separate VAT accounting is a rather complex and responsible matter. And the “five percent” rule doesn’t make it any easier. But it allows you to deduct more input VAT.

Other articles from the magazine "MAIN BOOK" on the topic "VAT - benefits / separate accounting":

Proportion

The Tax Code specifies the specifics of accounting for ratios for transactions that are exempt from taxation. The cost of services for providing loans and repo transactions is taken into account in the amount of interest income accrued by the taxpayer. When calculating the cost of shares, bonds, and other securities, the amount of income is calculated in the form of a positive difference between the selling price and the cost of purchasing such assets. If the market price is lower than the cost, then the resulting value will not be taken into account.