Advantages of dismissal by agreement of the parties

There are various grounds for terminating an employment agreement (contract) between an employer and an employee. But most often this basis becomes an agreement of the parties.

There are several reasons for the popularity of this ground for dismissal:

- Often it is this option that allows you to maintain loyalty in the eyes of the employer and employee towards each other.

- this is a peaceful way to terminate the employment relationship between the parties, which in practice makes it the most painless and simplest to formalize from a legal point of view and, accordingly, the most reliable.

- the method in question requires the consent of both parties, and consent is usually achieved when both parties are satisfied and their wishes and interests are equally taken into account.

- Dismissal by agreement of the parties is possible in a number of cases when dismissal is impossible for other reasons (for example, it is prohibited to dismiss an employee at the initiative of the employer during the period of temporary incapacity for work of the employee or while the employee is on vacation).

- Dismissal by agreement of the parties, unlike other grounds, does not impose on the parties such additional obligations as compliance with deadlines established by law, written warning of dismissal, payment of severance pay in connection with dismissal.

- An entry in the work book about dismissal by agreement of the parties does not discredit the employee in the eyes of a potential employer and does not interfere with the further employment of such an employee.

Termination of an employment contract by agreement of the parties is provided for in Article 37 of the Labor Code of the Republic of Belarus. Despite this, it is worth remembering that when drawing up the documents necessary for dismissal by agreement of the parties, a reference is given to clause 1, part 2, article 35 of the Labor Code.

Return to contents

Termination fee

When a person starts a new job, he does not always think that the situation may develop in such a way that he will have to leave production or the company. There can be many reasons for this:

- reduction;

- failure to fulfill labor obligations;

- conflict with superiors;

- failure to comply with the agreed conditions on the part of the employer.

In order not to bring the situation to the limit, both parties can enter into a formal agreement. It will indicate that the employer and employee are ceasing their joint activities. According to Article 78 of the Labor Code of the Russian Federation, both parties can terminate cooperation mutually. And then the question logically arises: how much salary should the employee receive by agreement of the parties?

Disadvantages and possible risks

As we can see, dismissal by agreement of the parties is very convenient for both the employer and the employee. But in practice there are cases when parties abuse this. Thus, we will separately mention cases where the employee has committed guilty actions, but the employer does not want to spoil the employee’s work book by writing about dismissal “under the article”, and therefore initiates the dismissal procedure by agreement of the parties. In such cases, we recommend that you proceed as described in our instructions on dismissal for a system of violations.

The fact is that in this case there is a concealment (or substitution) of the grounds for dismissal of the employee, because there are grounds for dismissing an employee for committing guilty actions. So, in practice, doing this (especially if an employee commits gross violations) is not worth it for the simple reason that such a concealment may entail the unconditional bringing of the head of the organization (director) to disciplinary liability (up to and including dismissal from his position). Therefore, the use of such a universal and convenient mechanism as dismissal by agreement of the parties must be approached consciously and carefully.

Conditions for dismissal by agreement of the parties

Dismissal by agreement of the parties is one of the most universal and widely used grounds for dismissal.

By agreement of the parties, it is possible to terminate any employment contract, including:

— all types of fixed-term employment contracts (for a certain period, including an employment contract; for the duration of a specific job; for the duration of the duties of a temporarily absent employee; for the duration of seasonal work);

- an employment contract concluded for an indefinite period.

Here are some other features of dismissal by agreement of the parties:

- Almost any category of workers can be fired, including:

— pregnant women;

- women with children under 3 years of age;

- single mothers with children aged 3 to 14 years (disabled children under 18 years old).

True, there are some exceptions, for example, it is impossible to terminate an employment contract by agreement of the parties with young specialists (before the end of the distribution).

- the parties can agree on any date of dismissal (even while the employee is on vacation or during the period of temporary disability of the employee).

Let us remind you that, in contrast to dismissal by agreement of the parties, during these periods it is prohibited to dismiss employees at the initiative of the employer. In case of dismissal by agreement of the parties, the employer and employee are not limited by such a prohibition.

- when dismissing by agreement of the parties, there is no need to additionally indicate the real reasons for dismissal. The agreement of the parties automatically implies that this ground for dismissal suits both parties fully, regardless of the objective or subjective reasons that prompted the parties to terminate their employment relationship precisely on the basis of clause 1, part 2, art. 35 TK.

- the employer does not have to pay the employee any severance pay in connection with dismissal (however, if the payment of severance pay in the event of dismissal by agreement of the parties is provided for in an employment or collective agreement, or other legal regulations of the employer, then the employer will still have to make such a payment).

- there is no need to notify the employment service or trade union about dismissal under clause 1, part 2, art. 35 TK.

- a minimum of formalities when documenting dismissal.

Return to contents

By agreement of the parties, both an open-ended employment contract and a contract can be terminated

Dismissal by agreement of the parties presupposes the existence of an agreement between the employee and the employer to terminate the employment relationship. At the same time, it is permissible to terminate on the specified basis both a fixed-term employment contract (including a contract) and an employment contract concluded for an indefinite period. Separately, it should be noted that the obligation to pre-warn the other party about the intention to terminate the employment relationship by agreement of the parties, as well as for the employee to work a certain period of time before dismissal on the specified basis, is not provided for by labor legislation.

Stage 1. Reaching an agreement between the parties on dismissal.

For legal dismissal by agreement of the parties, it is necessary to reach an agreement on termination of the employment agreement (contract) between the employer and the employee.

- Elements of an agreement

An agreement must be understood as reaching agreement between the parties simultaneously on 2 elements:

a) the parties agreed to terminate the employment relationship precisely under clause 1, part 2, art. 35, art. 37 TC, i.e. agreed on the grounds for dismissal.

Those. if the employee applied to the employer to resign at the request of the employee, and the employer fired the employee by agreement of the parties (Clause 1, Part 2, Article 35, Article 37 of the Labor Code), this will be a violation, the dismissal of the employee will be considered illegal, and the employee will has the right to be reinstated at work. And all because the employee expressed his will to dismiss at the request of the employee, the employer fired him on a different basis (agreement of the parties), but an agreement between the parties regarding changing the grounds for dismissal was not reached. Therefore, taking into account the above, the employer can dismiss an employee by agreement of the parties only in the case when the employee asks to dismiss him precisely by agreement of the parties.

b) the parties have precisely determined and agreed upon the date of dismissal.

In practice, this is often forgotten, which can cause problems for the employer in the future. Therefore, it is not enough to reach an agreement simply to terminate the agreement (contract) by agreement of the parties; it is also necessary to clearly define the date of dismissal (the last day of the employee’s work with the employer). Such a day can be any working day from the moment an agreement is reached between the employee and the employer. However, do not forget that on the day of dismissal, the employer must make a final settlement with the employee and return the work book to the employee. Therefore, when agreeing on the date of dismissal, try to take into account all the circumstances.

- Agreement form

We recommend that the parties’ agreement on dismissal be drawn up exclusively in writing. The agreement of the parties on dismissal by agreement of the parties can be oral. But in the event of a dispute, the courts check the evidence of an agreement between the parties (including by date). As you understand, without a written agreement, it can be problematic to prove its existence (although it is possible: it can be confirmed by witness testimony and other evidence).

To reach an agreement, the initiator of termination of the employment contract draws up a written document. The initiative to terminate the contract by agreement of the parties can come either from the employee or from the employer, so there are 2 options.

- Methods of registration (depending on the initiator)

a) Dismissal at the initiative of the employee

Step 1. The employee submits a letter of resignation to the employer by agreement of the parties.

Step 2. The employer signs on the employee’s application a resolution agreeing to dismiss the employee by agreement of the parties.

Do not forget that the employer has the right to refuse dismissal by agreement of the parties. In this case, the employee may resign on other grounds provided for by law.

b) Dismissal at the initiative of the employer

Step 1. The employer submits to the employee a proposal to dismiss by agreement of the parties or an agreement to terminate the contract. The contract termination agreement most fully reflects the mutual rights and obligations of the employer and employee in the process of dismissal by agreement of the parties.

Step 2. The employee puts down a note of consent to dismissal and his signature on the employer’s proposal.

Return to contents

Final payment upon dismissal

In the event of dismissal of an employee, the employer is obliged to pay him all amounts due on the day of dismissal <1>. Let's consider when an employer is obliged to make a final settlement with an employee and what liability the employer faces for delaying payment or making incomplete payments.

Calculation terms

As a general rule, all undisputed amounts due to the employee from the employer on the day of dismissal must be paid by the employer no later than the day of dismissal <2>.

Note! The day of dismissal is considered to be the last day of work <3>, i.e. the last day of the employee’s employment relationship with the employer. However, this is not always the last working day.

Example An agreement was reached between an employer and an employee to dismiss the latter by agreement of the parties on September 15, 2017. However, according to the work schedule, September 15, 2017 is a day off for the employee. This day, not being the last working day, will be the last day of work. Therefore, payments due to the employee must be made no later than September 15, 2017. In such a situation, the employer can make final settlement with the employee, for example, on September 14, 2017.

Upon dismissal, the employee is paid wages for the period of work before dismissal <4>. In a number of cases, other payments are made in accordance with the law, collective and labor agreements, including:

— monetary compensation for unused vacation <5>.

Note: Cash compensation is paid for all unused vacations, regardless of the periods for which they were not used;

— severance pay (the possibility of its payment, as well as the amount, depends on the grounds for dismissal) <6>.

Note: Part-time workers are not paid severance pay <7>;

— travel expenses <8>;

- bonuses;

— temporary disability benefits;

- compensation for wear and tear of vehicles, equipment, tools and fixtures belonging to the employee <9>.

Let us note once again that no later than the day of dismissal, those payments that are due to the employee on the day of dismissal are made. Sometimes at the time of dismissal the amount of some amounts is unknown. In this case we are talking about payments such as bonuses, labor participation rate, etc. If the relevant local regulatory legal acts (hereinafter referred to as LLA) of the employer do not directly stipulate that the payment of bonus amounts, etc. is made on the day of the employee’s dismissal, then we believe that these amounts can be paid to the employee within the time limits provided for by the LLA governing the procedure for making such payments. This means that failure to pay such amounts on the day of dismissal, in our opinion, will not entail a violation of the deadlines for the final payment.

Example An employee was dismissed by agreement of the parties on August 31, 2017. On the day of his dismissal, he was paid wages for the period worked and compensation for unused leave. On September 4, 2017, the organization summed up the results of work for August 2021. It was determined that the dismissed employee is entitled to a bonus for August 2021 in the amount of 95 rubles. The specified amount was transferred to his bank account on September 11, 2017 (the day of payment of wages in the organization).

Currently, all payments are usually made to the employee by transferring funds to his bank account. Therefore, regardless of whether the employee was at work on his last day of work or not, the employer should not have problems with the final payment.

However, in some organizations, payments can be made from the organization's cash desk. What should an employer do in this case? According to labor legislation, if an employee did not work on the day of dismissal, appropriate payments must be made to him no later than the next day after he submitted a request for payment <10>.

Example: Payment of wages in an organization is made in cash from the organization's cash desk. On the day of dismissal, August 31, 2017, the employee was absent from work. On September 4, 2017, she submitted a demand for full payment. In this case, the employer must pay the amounts due to the employee no later than 09/05/2017.

The employee has the right to make a demand for payment orally. He can also contact the employer with a written statement. In order to avoid controversial situations, we believe it is advisable to request payment by submitting an application drawn up in any form to the employer.

Responsibility for delay in settlement

The legislator clearly defined the employer's obligation to make payments no later than the day of dismissal <11>. This means that he has the right to pay the amounts due to the employee before the day of dismissal. But there is no delay in payment. Even if the employer believes that he has good reasons for this. For example, there are no funds in the current account or the employee refused to move out of the hostel.

Therefore, in the event of a delay in the final payment, the employee has the right to recover from the employer the average salary for each day of delay. And if an incomplete payment is made - in proportion to the amounts not paid during the calculation <12>. At the same time, such a right arises for the employee only when the employer is at fault for these violations (intentional or negligent). Otherwise, the employee will not be able to recover the average salary from the employer for a delay in the final payment or for incomplete payment. In particular, if the cause of such violations was the actions of the employee himself (he did not show up for payment, despite notifications from the employer, etc.).

Note! The procedure for calculating average earnings is determined by the Instruction on the procedure for calculating average earnings maintained in cases provided for by law, approved. Resolution of the Ministry of Labor dated April 10, 2000 N 47.

Example from judicial practice The plaintiff was dismissed on June 23, 2016 by agreement of the parties. The final payment on the day of dismissal was not made to her due to the fact that on the day of dismissal the plaintiff refused to receive the amounts due to her. This is evidenced by her statement, in which she asked the employer to leave the estimated funds until the dispute regarding the recovery of child care benefits for a child under three years of age is resolved. Meanwhile, on August 26, 2016, the plaintiff contacted the employer with a written request for payment of the settlement. Thus, the employer had an obligation to make a final payment to the plaintiff no later than August 27, 2016. However, payment of the amounts due to the plaintiff was made only on September 30, 2016 due to the fault of the employer, since he did not have any valid reasons for refusing to pay the plaintiff. The panel of judges determined that the period of delay in payment without valid reasons is 34 calendar days (from August 27 to September 29, 2021). It is during this period that the employer must recover in favor of the plaintiff the average salary for the delay in payment upon dismissal. The plaintiff’s arguments about the forced nature of filing an application in which she refused to receive the amounts due to her are not confirmed by any objective data and are refuted by written notifications sent to her name by both the employer and the district department of the Federal Social Security Service, according to which the plaintiff was asked to return what was illegally received childcare allowance for children under three years of age. In the presence of such data, taking into account the absence of the employer’s fault in the delay in payment on the day of dismissal, the court had no reason to calculate the period of delay in the final payment upon dismissal starting from 06/24/2016.

Decision of the district court dated October 20, 2016 Determination of the judicial panel for civil cases of the regional court dated December 15, 2016

Delay in final payment upon dismissal is a violation of labor laws. In this regard, the following may be involved, in particular:

- to disciplinary liability in the form of a reprimand, reprimand, etc. <13> - officials of the employer directly responsible for the delay in payment <14>;

- administrative liability in the form of a fine - the employer and his authorized official who violated the procedure and deadlines for paying wages (which occurs when payment is delayed) <15>.

Note! Persons working under a civil contract do not have the right to recover average earnings for delays in payment. Liability for violation of obligations in this case is regulated by civil law.

Stage 2. The employer formalizes the dismissal of the employee by agreement of the parties.

Step 3. The employer issues an order to dismiss the employee by agreement of the parties.

Step 4. The employer introduces the order to the employee against signature.

Step 5. The employer makes a notice of dismissal in the employee’s work book.

Step 6. The employer familiarizes the employee with the notice of dismissal in the work book (this is done if the company maintains a personal card for the employee and there is a column in the card for such familiarization). A bypass sheet is also issued.

Step 7. The employer attaches a copy of the dismissal order to the employee’s personal file, and the personal file is transferred to the archive.

Termination of an employment contract by agreement of the parties in 2018

The process of leaving work by mutual agreement of management and employee includes several successive stages. They are not stipulated by law, but in order to avoid conflict situations resolved in court, documentation must be drawn up in writing, with copies of official paper forms being issued to interested parties. Termination of labor activity occurs according to the following algorithm:

- An initiative expressed orally by management or subordinates to stop work.

- Writing a statement indicating the date of termination of activities, oral discussion of conditions and compensation payments.

- Written consent, with registration and signing by the parties to the transaction.

- Issuance of an order in the established form, under which the employee must sign.

- Settlement with the issuance of agreed funds.

- Entry in the work book.

- Handing money and documents to the dismissed person.

Application for dismissal by agreement of the parties in 2021

The HR department of an enterprise requires a clearly and competently drawn up application for dismissal. The employee can type on a computer or write a statement in his own hand indicating the necessary data:

- In the upper left corner - the full name of the company, surname, initials of the general director, surname, initials, position of the employee.

- In the middle, in large font, is the word “Statement.”

- The main text contains the essence of the petition, indicating the end date of the work, the reasons for the severance of the employment relationship, and the legislative norms justifying the initiative. For dismissal by agreement of the parties with payment of compensation in 2021, the standard is Art. 77, clause 1 of the Labor Code of the Russian Federation.

- Date, applicant's signature and transcript.

Discussion of the conditions and amount of compensation payments between the parties

Agreement to terminate cooperation is beneficial to the worker if he receives large amounts of money. The employee is entitled to wages for the time actually worked, additional payments for unused leave, compensation for termination of the transaction, if such is stipulated in the employment contract. There are nuances that a citizen signing a document with payment of compensation should know. If compensation is not specified in the company’s local regulations, then management is not obligated to make payments.

Registration and signing of the agreement

The document is drawn up in any form. The agreement must indicate the following information:

- Company name, last name with initials of the manager, full name of the employee.

- Details of the employment contract that needs to be terminated, an indication of legal standards.

- The date of termination of contractual obligations (depending on whether the employee leaves with or without work), the amount of compensation payments by the employer to the employee.

- Obligations of the employee to return material assets, documents, and other property used in the process of work.

- The obligation of the parties not to have mutual claims after signing the document.

- Signatures and details of the parties to the agreement.

Order and familiarization of the employee against signature

After signing the form, the HR department issues an order for the enterprise, which indicates the full name of the dismissed employee, details of the contract, agreements, and the wording of termination of the contract. The paper has a number that is entered in the work book. The order form is signed by the head of the company; in addition, the signature of the resigning employee is required, indicating the fact that he has read and agreed with the text of the document.

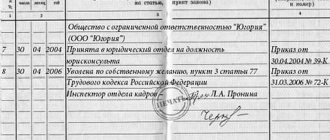

Entries in the work book and personal card

After registering the order, the head of the personnel department (HC) enters the following information into the work book of the resigning worker:

- Serial number of the record, date.

- Information about dismissal - number, date of the document, articles of the Labor Code of the Russian Federation justifying the action.

The personal card must have similar information about the reasons for dismissal, details of the order, agreement. Records are made for verification of record keeping by supervisory authorities. The work book with a record of dismissal is provided to the employee immediately after payment of the payroll. The following documents are issued:

- employment history;

- copy of the order;

- copy of the agreement.

Calculation note in form T-61

For the management of the enterprise, the act of the unified form T-61 serves as evidence of payments made to the dismissed party. The details are filled in by the OK employee; the calculation of the amount of salaries due for compensation payments is made by the organization’s accounting department. Columns 3 and 4 of the document indicate the average salary of a worker and the number of hours worked. The rules for calculating compensation are the same as for calculating regular vacation pay.

- Dried figs - benefits and harm. Medicinal properties of dried figs, how to eat them correctly and contraindications

- 4 ways to cook delicious sausages: cooking recipes

- Carp in the oven: recipes with photos

Issuance of documents and monetary compensation on the employee’s last day of work

According to the legislation, a dismissed citizen can apply for calculated additional payments from the moment of signing the order, without waiting for the day the salary is issued. Along with financial resources, documents are issued indicating the peaceful settlement of monetary and legal disagreements regarding the premature termination of the contract at the initiative of one of the parties.