Grounds for collecting alimony for spousal support

Article 90 of the RF IC stipulates the right of a former spouse to receive alimony after divorce. It should be noted that not all exes have this right, but only those specified in the law. These include:

- a pregnant wife or ex-wife who gave birth to a common child before he was three years old;

- a former spouse in need of such support and raising a common disabled child until he is eighteen years old;

- a disabled, needy ex-spouse who became so during the marriage or within a year after its dissolution;

- a needy former spouse of retirement age no later than five years from the date of divorce, if the spouses have lived together for a long period of time.

Thus, the Family Code provides an exhaustive list of grounds for collecting alimony for the maintenance of a spouse (spouses).

Alimony for the maintenance of a spouse (spouses) can be collected only if the marriage between a man and a woman was officially registered in the registry office. If the couple lived in a “civil marriage”, then it will not be possible to collect alimony from the former spouse.

Legislation

Both spouses are responsible for providing for their partner and common children. The main provisions are given in the RF IC:

| Art. | There are situations when a husband does not have the right to divorce his wife |

| Art. | Established the amount of payments for children under 18 years of age |

| Art. | The obligation of spouses to take care of each other and their joint children is established. |

| Art. | Reinforced the right of spouses to receive alimony after the dissolution of the union |

| Art. 117 | Fixed a requirement for regular indexation of payments |

Download for viewing and printing:

Article 17 of the Family Code of the Russian Federation “Limitation of the right of a husband to submit a demand for divorce”

Article 81 of the Family Code of the Russian Federation “Amount of alimony collected from minor children in court”

Article 89 of the Family Code of the Russian Federation “Obligations of spouses for mutual maintenance”

Article 90 of the Family Code of the Russian Federation “The right of the former spouse to receive alimony after divorce”

Article 117 of the Family Code of the Russian Federation “Indexation of alimony”

Law on alimony for a wife on maternity leave

No separate Federal Law or other regulatory act establishing the obligation to transfer funds to the wife taking care of the baby has been adopted.

All provisions regarding financial support for spouses are enshrined in Chapter 14. RF IC. Attention! According to the UK, a husband has no right to divorce his wife (according to Art.):

- before the baby is born;

- until one year after the birth of the child.

How to collect alimony for spousal support?

Supporting a minor child is the direct responsibility of the parents. Therefore, the law provides for the possibility of collecting child support in a simplified manner. To do this, it is enough to submit an application to the court for a court order. A court order is issued by a judge alone, without summoning the parties and without actual trial.

If child support can be collected in a simplified manner, then spousal support is collected in a general manner. When filing a claim for the recovery of such alimony, you must adhere to the following rules:

- The claim is filed in the magistrate's court at the location (residence) of the defendant. In exceptional cases (if the plaintiff is raising a common child), jurisdiction is chosen by the plaintiff himself;

- The amount of alimony for a former spouse is established only in a fixed monetary amount. When establishing the amount of alimony, the financial and marital status of both parties is taken into account.

- You can demand the recovery of alimony for your ex-spouse during the divorce process;

Thus, when filing an application with the court for a court order to collect alimony for children, it is impossible to simultaneously demand the recovery of alimony for the spouse. To recover alimony for a spouse or ex-spouse, it is necessary to draw up and submit a statement of claim to the court.

Alimony for a wife on maternity leave according to the Family Code of the Russian Federation

The maternity leave is specifically designed to ensure that a woman does not lose her current job and can raise a child. In such a situation, the woman essentially depends on the financial support of her husband. Moreover, even after the baby can go to kindergarten, the mother still needs financial assistance to cover the child’s needs.

Amount of alimony for a spouse on maternity leave for up to 3 years

Payments for the maintenance of a mother who has given birth to children from her husband are also established:

- on the basis of a joint agreement;

- based on the provisions of the court decision.

If payments for children can be calculated in a fixed amount or as a percentage of the payer’s income, then the maintenance of the wife is always assigned in a fixed amount. Transfers must be made every month.

On a note! The amount requested by the mother from the defendant is not limited by law. It directly depends on the payer’s solvency and the basic needs of the mother and child.

To support 2 children, at least 1/3 of his total income will be taken from the husband.

For one child, the father will pay at least ¼ of his earnings.

The necessary conditions

Requirements for potential recipients of payments are shown in the table below:

| Basic conditions | The essence |

| Official registration of marriage | The union between the plaintiff and the defendant must be registered, otherwise payments can be made solely for the maintenance of joint children. Alimony can be requested before and after the dissolution of the union. |

| Presence of blood relationship between the child and the payer | The spouse is pregnant or is raising a child with the plaintiff. It is impossible to receive payments from the defendant for a child who is not his own. |

| Child's age | Payments will be accrued until the end of the maternity leave, i.e. until the joint child turns 3 years old |

| A woman cannot support herself and her child | All income of the plaintiff is checked (benefits and allowances, passive income, etc.). If the mother gets a job, then alimony for her maintenance is canceled or reduced |

| The defendant's ability to pay alimony | The payment will also be adjusted based on the father's income level |

| The woman has not remarried | Her new husband will take responsibility for her well-being. |

How much are they charged?

The amount of alimony is established by the parties themselves or by the court in a fixed value.

Not only the needs of the recipients are taken into account, but also the financial status of the spouse. Different maintenance is established for the mother and baby, but usually the transfer of funds is carried out on the same day. When calculating alimony, the court is guided by 3 indicators:

- Living wage per child;

- Living wage for an adult;

- If the mother or child has a disability, the cost of living for a disabled person (adult or child).

Payments will be indexed periodically.

How are they paid?

If alimony has been determined by the court, then the funds are transferred monthly. In the case of a voluntary agreement between the parties, the terms of enrollment and amounts may vary.

Statement of claim for the recovery of alimony for spousal support

A claim for the recovery of alimony for the maintenance of a former spouse is drawn up according to the general rules for drawing up statements of claim. These rules are established by Articles 131-132 of the Civil Procedure Code of the Russian Federation (abbreviated as the Code of Civil Procedure of the Russian Federation). According to the Code of Civil Procedure of the Russian Federation, the content of the claim should include the following data:

- The name of the court where the claim will be filed;

- Personal details of the plaintiff and defendant, as well as their contact information (full name, registration and residence address, telephone number...for the defendant, the date of birth is additionally indicated, document details allowing identification of the person: passport, driver’s license, etc.);

- Information about joint minor children;

- Information about divorce, if the marriage has already been dissolved;

- Calculation of the amount of monthly payments that you require to be collected from your ex-spouse;

- List of attached documents;

- Date and signature of the applicant.

Other information may also be included in the content of the claim. In addition, it would not be amiss to refer to the rules of law that govern these legal relations and other legal acts. If you have never filed a statement of claim, it would be best to contact an experienced lawyer. A competent family lawyer will be able to correctly assess the situation and draw up the necessary document.

Need advice on collecting child support? Call!

Registration of alimony

First, the wife should try to negotiate with her husband about concluding an agreement on the payment of alimony.

If he refuses to provide financial support for the mother and/or child, he will have to file a claim in the magistrate’s court at the place of registration of either party (Clause 4 of Art. Code of Civil Procedure). Despite the fact that the application allows you to request maintenance for the mother and baby, the authority will set different amounts of alimony for each of them.

Download for viewing and printing:

Article 29 of the Civil Procedure Code of the Russian Federation “Jurisdiction at the choice of the plaintiff”

Collection procedure

There are two options for receiving alimony:

- The parties reach mutual agreement, draw up an agreement and have it certified by a notary;

- The payer refuses the proposed terms or avoids supporting his wife and children, and legal proceedings begin.

On a note! Bailiffs are responsible for the implementation of the transfer of alimony. Information about a citizen’s alimony obligation is transmitted to the accounting department at the place of employment. To transfer the established amount, the accountant deducts the payment amount from the salary.

If the husband agrees to help

To draw up a contract, the parties must present:

- certificates of marriage and divorce;

- passports of both parents;

- birth certificates for each child.

The agreement must be certified by a notary, otherwise it may be declared invalid. If controversial situations arise, this document will play the same role as a writ of execution issued by the court. To confirm that money has been credited, the recipient must prepare confirmation notes.

If the husband refuses to provide financially

When the spouse did not want to peacefully agree on payments, the mother has the right to file a claim to recover alimony for her own maintenance. To do this, in addition to the application, you must additionally provide:

- certificates of marriage/divorce;

- children's birth certificates;

- certificate of income of the plaintiff;

- a list of expenses for yourself and your child for the month.

The last point is confirmed by additional papers - a medical report recognizing the child or mother as disabled, a certificate from a doctor, a bill from the housing office, etc.

Important! In cases involving the collection of alimony, the filing fee is always paid by the defendant.

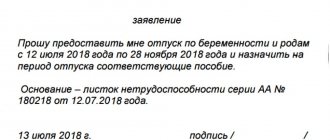

Drawing up an application

In both cases, the application contains basic information regarding the payment regulations:

- amount and frequency of payments;

- indexing order;

- sanctions for violation of agreements;

- method of delivering money to the recipient (bank or postal transfer, etc.).

The statement of claim contains the following information:

- name of the site that accepted the request;

- information about the plaintiff, defendant and child;

- text part with a description of the situation that has arisen and the requirements put forward;

- a list of documents attached to the claim;

- date of application and signature of the plaintiff.

Attention!

The court is given 1 month to review the submitted papers and respond. Sample statement of claim for alimony for a wife on maternity leave

Attached documents

The list of additional papers is determined based on the monthly needs of the plaintiff and the common child. The maintenance should cover the basic costs of:

- clothes and shoes;

- food products;

- payment of housing and communal services and other fees;

- treatment and purchase of medicines, etc.

How to calculate alimony for the maintenance of your ex-spouse?

A former spouse applying for the collection of alimony for his maintenance must justify the right to receive it, as well as present and justify the calculation of alimony.

When establishing such payments, the following rules apply:

- The calculation is based on monthly income and expenses (for food, clothing, utility and other payments, as well as medicines, etc.);

- The required amount is calculated per month. That is, the requirements of the claim should sound like this: “to collect alimony for my maintenance in the amount of 10,000 rubles, monthly starting from November 11, 2020 until my daughter reaches the age of three years”;

- The calculation of alimony can be made either in the claim or attached to it in the form of a separate document.

The list of expenses taken into account when drawing up the calculation includes benefits, pensions, subsidies and other social benefits, as well as any other incoming funds. Child support payments will not be taken into account when calculating.

If the former spouse re-entered the barque, then according to Part 2 of Art. 120 of the RF IC, they cannot claim to collect alimony from their ex-spouse.

Collection of alimony from a former spouse through the court

To collect alimony for a former spouse, it is necessary to file a completed claim at the magistrate’s station, which is located at the defendant’s place of residence. The claim can be filed either through the court office or sent by mail to the court. Before filing a claim in court, it is necessary to send a copy of it to the defendant by a valuable letter with a list of the contents and a notification of delivery.

In cases of alimony collection, the claimant is exempt from paying the state duty, therefore, when filing such claims, the state duty is not paid.

Calculation of alimony if the debtor is on maternity leave

Hello!

Deductions from maternity benefits are not made by law.

The list of types of income that cannot be levied is established by Article 101 of the Federal Law of October 2, 2007 No. 229-FZ “On Enforcement Proceedings”.

Deductions from payments that are not subject to collection in accordance with federal law are not allowed. In particular, recovery cannot be applied to sums of money paid:

- compensation for harm caused to health;

- compensation for damage in connection with the death of the breadwinner;

- persons who received injuries (wounds, injuries, concussions) during the performance of their official duties, and members of their families in the event of the death of these persons;

— compensation payments from the federal budget, budgets of constituent entities of the Russian Federation and local budgets to citizens in connection with caring for disabled citizens;

— monthly cash payments and (or) annual cash payments accrued in accordance with the legislation of the Russian Federation to certain categories of citizens (compensation for travel, purchase of medicines, etc.);

— alimony, as well as amounts paid for the maintenance of minor children during the search for their parents;

- compensation payments established by the labor legislation of the Russian Federation: in connection with a business trip, transfer, admission or assignment to work in another locality; due to wear and tear of a tool belonging to the employee; sums of money paid by the organization in connection with the birth of a child, the death of relatives, and the registration of marriage;

— insurance coverage for compulsory social insurance, with the exception of old-age pensions, disability pensions and temporary disability benefits;

— pensions in case of loss of a breadwinner, paid from the federal budget;

— payments to pensions in the event of the loss of a breadwinner from the budgets of the constituent entities of the Russian Federation;

— benefits for citizens with children, paid from the federal budget, state extra-budgetary funds, budgets of constituent entities of the Russian Federation and local budgets;

— maternal (family) capital funds;

- amounts of one-time financial assistance paid from the federal budget, budgets of constituent entities of the Russian Federation and local budgets, extra-budgetary funds, from funds of foreign states, Russian, foreign and interstate organizations, other sources: in connection with a natural disaster or other emergency circumstances; in connection with a terrorist act; due to the death of a family member; in the form of humanitarian aid; for providing assistance in identifying, preventing, suppressing and solving terrorist acts and other crimes;

- the amount of full or partial compensation for the cost of vouchers, with the exception of tourist ones, paid by employers to their employees and (or) members of their families, disabled people who do not work in this organization, to sanatorium-resort and health-improving institutions located on the territory of the Russian Federation, as well as the amount of full or partial compensation of the cost of vouchers for children under 16 years of age in sanatorium-resort and health-improving institutions located on the territory of the Russian Federation;

— social benefit for funeral;

- the amount of compensation for the cost of travel to the place of treatment and back (including the accompanying person), if such compensation is provided for by federal law.

The list of types of wages and other income from which alimony for minor children is withheld is approved by Decree of the Government of the Russian Federation of July 18, 1996 No. 841.

Withholding of alimony is carried out, while the list does not include state maternity benefits at all, among other things, for example:

from benefits for temporary disability, unemployment only by a court decision and a court order for the collection of alimony or a notarized agreement on the payment of alimony.

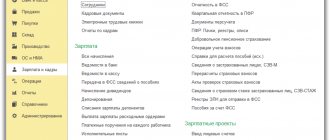

How does the court process for collecting alimony for a spouse work?

Alimony for maintenance of spouses is collected in court. First, the judge initiates a civil case and sets a date for a preliminary hearing. At the preliminary hearing, all the circumstances of the case are clarified, and the necessary documents are studied. If any documents are missing, the court will ask the parties to submit them or request them independently. There may be several preliminary court hearings, it all depends on the evidence presented and the procedural behavior of the parties.

After which the main court hearing will be scheduled. During the main hearing, witnesses may be questioned and other procedural actions may be performed. In addition, the following information will be checked at the court hearing:

- Income level of the plaintiff and defendant. To confirm income, certificates from the tax office, the unified state register of real estate, as well as 2NDFL from the employer are requested. The court, at its discretion, may request information from other authorities.

- It is checked whether the person from whom alimony is required has other dependents and persons whom he is obliged to support by law or contract;

- Disability or the presence of serious illnesses that prevent either party from receiving income.

Court decision to collect alimony for a spouse

After the court has established the relevant circumstances for the case, examined the evidence, listened to the testimony of the parties and their debates, it will retire to the deliberation room. After leaving the deliberation room, the judge will announce his decision. The decision can be positive or negative, for example:

- Collect alimony from your ex-spouse from the moment you go to court

- Refuse to collect alimony for a spouse

The court decision will come into force one month from the moment it is drawn up in its final form. Until the court decision has entered into legal force, either party can appeal it by filing an appeal.