On October 10, 2021, our legislators issued FSS order No. MMB-7-11-551. It explains how to calculate insurance premiums and what reporting employers must provide to government agencies. You should receive compensation from the Social Insurance Fund if expenses for sick leave and other social benefits occurred before 2017. Now the tax service is in charge of returning the money, but the FSS still accepts documents for compensation from policyholders and carries out a desk audit.

Tax officials will transfer funds only after representatives of the fund give permission

List of documents

To return funds spent on sick leave payments, you must provide the following documents to the territorial office of the fund:

- a correctly executed sick leave certificate for the employee, indicating the validity of the money spent;

- a calculation that indicates how many contributions were made to the budget and how much money was transferred to the employees of the enterprise;

- a written request for the allocation of funds to reimburse sick leave.

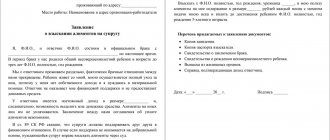

Sick leave for the benefit recipient

In addition to the mandatory documents listed above, officials may require additional papers:

- a document that can prove that the person receiving the benefit is actually employed by the policyholder;

- a certificate of the employee’s income from the previous employer for the last two years (certificate in form 182n);

- confirmation of a certain duration of insurance coverage.

Which documents

The list of documents serving as the basis for making a decision on the allocation (reimbursement) of the necessary funds for the payment of insurance coverage was approved by order of the Ministry of Health of Russia dated December 4, 2009 No. 951n (taking into account changes made by order of the Ministry of Labor of Russia dated October 28, 2016 No. 585n).

So, employers need to submit:

- application for the allocation of the necessary funds for the payment of insurance coverage (in the form provided by the Fund’s letter dated December 7, 2016 No. 02-09-11/04-03-27029);

- Form 4-FSS (for obligations arising before 01/01/2017);

- certificate - calculation and Explanation of expenses.

In addition to the above-mentioned documents, the policyholder immediately submits duly certified copies of documents confirming the validity and correctness of expenses for compulsory social insurance in case of temporary disability and in connection with maternity.

An approximate list of such documents:

- documents serving as the basis for the assignment and payment of benefits (confirming the fact of an insured event);

- documents confirming the correct calculation of benefits (for temporary disability and maternity benefits, monthly child care benefits);

- documents confirming the existence of an employment relationship between the policyholder and the person receiving the benefit.

The list of documents depends on the specific insured event.

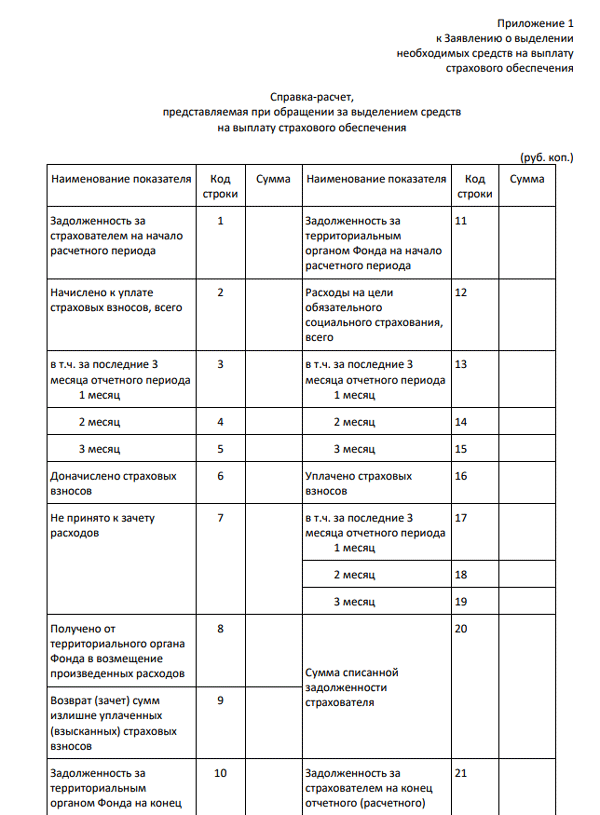

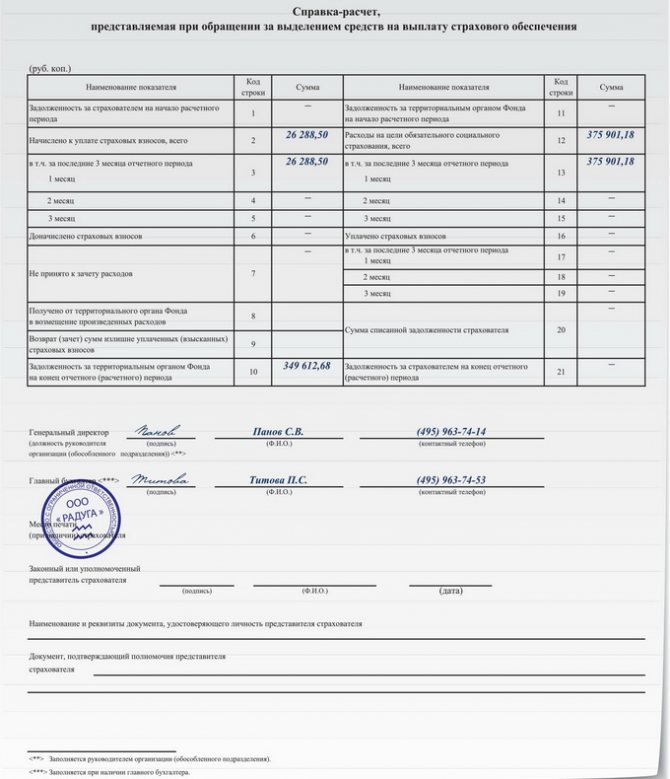

Calculation

Previously, employers reported using Form 4-FSS. In 2021, the report must be completed on the calculation certificate form.

Since recently the tax service has been accepting insurance contributions, FSS employees no longer have information about how much money a particular employer has transferred to the budget. The policyholder reflects this data in the calculation certificate. FSS employees can request information from the tax service and verify the accuracy of the information specified in the certificate.

According to the order of the Ministry of Labor of the Russian Federation No585H dated October 28, 2016, the calculation document must contain the following information:

- the exact amount of debt on contributions at the beginning of the period;

- the exact amount of debt at the end of the period;

- the amount of costs accepted for calculation;

- how much insurance premiums are charged;

- how much additional insurance premiums have been charged;

- compensation received from the insurance fund;

- how much is spent on social security.

Example of filling out a calculation certificate

What changed?

Several years before this, these responsibilities were assumed by the FSS. Now the tax authorities will deal with insurance premiums, and the insurance fund will monitor receipts and conduct audits at the enterprise. The tax office will also have to report any receipts to fund employees. Therefore, after paying the fees and sending the documents to the tax authorities, copies of the form will also need to be sent to the social fund. In addition, in order to receive compensation for sick leave and bulletins in 2021, you will need to prepare a new, comprehensive document. If previously a certificate in form 4-FSS was used to confirm the amount of sick leave expenses, now the authority will require a certificate of calculation. It should contain all information related to the receipt of funds to the social fund and expenses. What exactly should be in the calculation certificate:

- information on the amounts of insurance premiums accrued and transferred to the FSS;

- information about the possible debt of the enterprise to the social fund;

- information about whether existing debt has been written off;

- information about the funds received by the enterprise to reimburse expenses;

- whether a refund was made if the total amount of insurance premiums exceeded the required figure.

The tax service will provide you with a sample to use for drawing up a new certificate. In addition to information about contributions and expenses, in order to reimburse funds, it must contain detailed information about the legal entity and the name of the structure to which this document is being submitted.

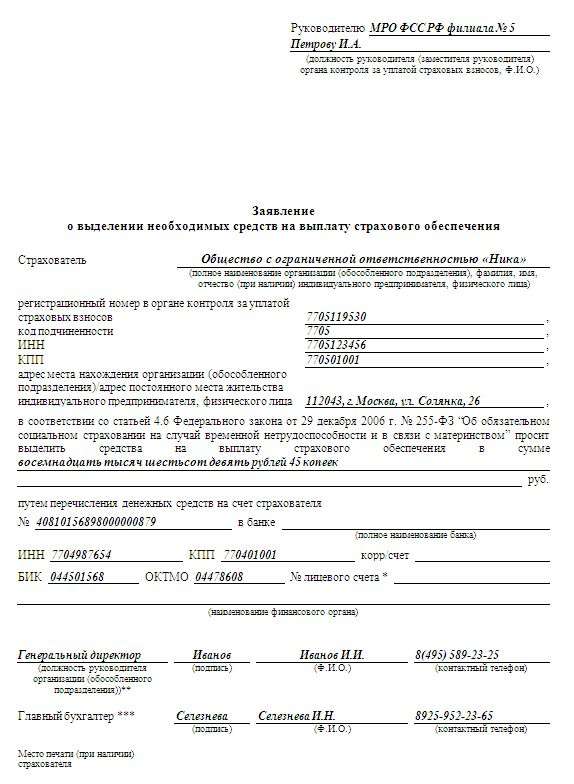

Written appeal

The application form for reimbursement of expenses for hospital and other social benefits is not approved by law. But the fund, using an internal letter, clarified what the application form should look like and how to fill it out correctly.

At the top of the document there must be data from the FSS body to which the application is being submitted:

- name of the branch;

- last name, first name, patronymic of the head of this department.

Below is information about the employer who acts as the insurer of his employees:

- Business name;

- legal address of the organization;

- TIN;

- checkpoint;

- insurance number.

The following are attached to the application:

- certificate of settlement;

- a document proving the validity of sick leave expenses.

Example of a refund application

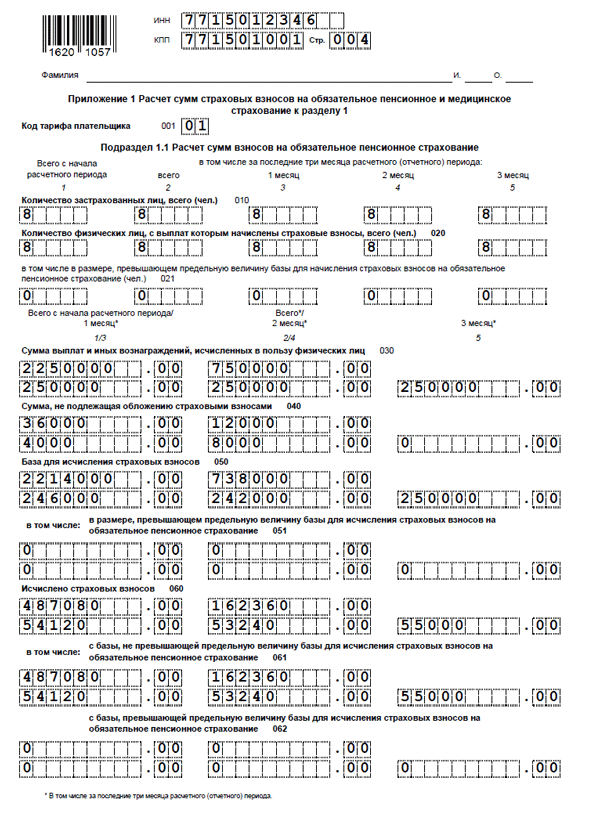

How to submit a contribution report to the tax service

Before submitting documents for compensation, you must provide a tax report on contributions. The filling out procedure is regulated by Appendix No. 2 to the Order of the Tax Service dated October tenth two thousand and sixteen No. MMB-7-11/551. This document consists of a title page and three sections. The calculation is filled out strictly in black, blue or purple ink. Letters must be capitalized only. If the document is filled out electronically, use Courier New font, size 16-18. Then the completed sheet must be printed.

Payments must be submitted by the thirtieth day of the month following the reporting month. For example, for nine months of 2021, the document must be received by the tax service no later than October 30, 2021.

If the company has more than twenty-five employees, the report should be submitted strictly electronically. For small companies, you can fill out a paper version of the document.

Report form

There are two ways to submit a report to the tax office:

- the head of the organization or his authorized representative personally visits the Federal Tax Service;

- A registered letter with a list of attachments is sent to the address of the tax service.

Tax authorities transmit to the Social Insurance Fund information about how many contributions have been accrued and paid for social security within the following time frames:

- no later than 5 days from the date of submission of the electronic report;

- no later than 10 days from the date of submission of the report on paper.

When will expenses be reimbursed?

To ensure that the costs indicated in the application are justified, fund employees conduct a reconciliation. If fund employees have any doubts, they have the right to request additional documents. Control can also be carried out by visiting officials to the enterprise.

As a result of the reconciliation, the fund may decide:

- pay money;

- refuse to issue compensation for social benefits due to unreasonable costs.

According to Article 4.6 F3 No. 255 dated December twenty-nine two thousand and six, money for the return of funds spent on sick leave will be transferred to the company’s account within ten days from the date of filing a written appeal.

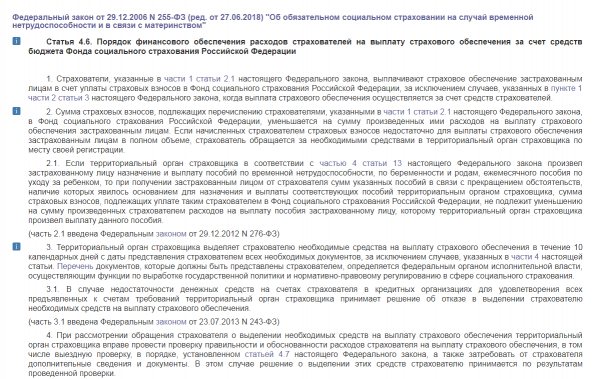

Article 4.6. The procedure for financial support for the expenses of policyholders for the payment of insurance coverage from the budget of the Social Insurance Fund of the Russian Federation

Credit for the amount of insurance premiums

The easiest way to reimburse the cost of sick leave is to subtract social costs from the amount that the employer transfers monthly to the social insurance fund.

The employer can compensate for his sick leave expenses through contributions to the insurance fund.

An enterprise has the right to deduct from contributions not only sick leave, but also other social benefits:

- in connection with the death of a close relative of an employee;

- in honor of the birth of a newborn;

- funds paid to the employee in connection with her pregnancy and childbirth;

- caring for a minor under one and a half years old;

- a pregnant woman who registered with a medical institution in the early stages of pregnancy (up to twelve weeks).

Maternity benefit

To be reimbursed for the B&R benefit and the benefit for registration in the early stages of pregnancy, the following must be submitted:

- a certificate of incapacity for work, filled out in the prescribed manner, with the benefit calculated;

- application of the insured person for maternity leave;

- order on granting maternity leave and granting benefits;

- certificate(s) about the amount of earnings from another policyholder(s) 182n;

- documents confirming insurance experience;

- cards for individual accounting of the amounts of accrued payments and other remunerations and the amounts of accrued insurance premiums to verify the correctness of determining the taxable base and the calculation of insurance premiums;

- a certificate (certificates) from the place of work (service, other activity) from another insured (other insureds) stating that the appointment and payment of benefits by this insured are not carried out if the insured person at the time of the insured event is employed by several insureds, and in two in previous calendar years was occupied by other policyholders, or by both these and other policyholders (another policyholder);

- a certificate from the antenatal clinic or other medical organization that registered the woman in the early stages of pregnancy (up to 12 weeks).

If the cost of social benefits is greater than the contribution

The reduction of contributions by the amount of sick leave within the reporting period (1st, 2nd, 3rd quarter) occurs on the basis of the Tax Code of the Russian Federation, paragraph 2, article 431. Federal Tax Service employees will automatically transfer the excess to the account of the next month.

But, if excess expenses for benefits were revealed at the end of the reporting period (1st, 2nd, 3rd quarter, year), one should be guided by the ninth paragraph of the same article of the Tax Code of the Russian Federation.

In such a situation, there are two solutions:

- contact the Social Insurance Fund for the missing amount;

- leave the excess amount towards future installments.

How to register

If Social Security costs exceed your contribution, the excess can be withdrawn in cash or used to pay future contributions. To do this, submit to the Social Insurance Fund the same papers as to receive the full amount:

- reference calculation;

- sick leave;

- a written request to offset the excess against the payment of future contributions or to issue the excess amount in cash.

Example of a written request

The set of papers listed above can be submitted without waiting for the end of the quarter.

When considering a written request for compensation, FSS employees request information from the tax service from the reports that the applicant previously submitted. Representatives of the fund can also carry out an on-site inspection and verify the legality of the funds spent. During the inspection, the FSS may request additional documents from you about the expenses you incurred. As a result, the fund issues either a positive or negative response.

If, based on the results of the audit, fund employees do not find any violations, the Social Insurance Fund informs the tax office about confirmation of expenses. The fiscal service offsets the excess against the payment of future contributions or transfers money to the account you specified. If FSS employees discover that you have paid sick leave unreasonably, a report will be drawn up. This document is provided to you for your review. You can challenge it. Otherwise, the fund makes a decision to reject the request. You will be notified of this decision within three working days. A copy of this document will also be sent to the tax office. Thus, an arrear of contributions will arise and the Federal Tax Service will issue you a demand for payment.

If the amount accepted for offset is less than the insurance premium, the difference must be paid within the time limits established by law.

Is it possible to submit documents to the tax office and not to the Social Insurance Fund?

The employer has the right to submit a written request for reimbursement of sick leave not only to the Social Insurance Fund, but also to the territorial office of the tax inspectorate. Information exchange and document flow are well established between services.

In this case, inspection staff notify the fund of the received application. In addition, tax authorities transmit the information necessary for decision-making from a unified reporting form. The Social Insurance Fund, in turn, checks the validity of expenses for sick leave and other social benefits. In controversial situations, a joint inspection by the tax office and the Social Insurance Fund can be carried out with a visit to the policyholder.

If the policyholder has committed an offense, tax authorities have the right to make a decision on whether to hold the person liable. This is also reported to the fund.

Calculation of contributions that have been assessed and paid for social insurance

The list of documents for the Social Insurance Fund for compensation for sick leave includes a calculation, the form of which has also changed, starting in 2021. It was approved by Order No. 381 of the Social Insurance Fund dated September 26, 2016. The purpose of submitting this document is to monitor the enterprise’s fulfillment of its obligations to make payments to employees who were on sick leave. sick leave

The calculation is required if the company requests compensation for periods before 2021. In other cases, its submission is not required.

Documents to confirm expenses for other social benefits

If you want to receive reimbursement of expenses not only for sick leave, but also for other types of social benefits, you must provide supporting documents.

Table. Types of social benefits, the costs of which are subject to reimbursement

| Type of benefit | Documents to be provided |

| One-time payments to women expecting a baby for up to twelve weeks | Certificate from a medical institution in which the future parent is registered |

| Maternity or one-time payments for pregnancy and childbirth | Sick leave |

| One-time payment upon birth of a baby | Certificate and certificates proving the fact of the birth of the baby; document confirming non-receipt of the same benefit from the place of employment of the second holder of parental rights |

| Payments to persons caring for a minor citizen during the same leave | Certificate and certificates proving the fact of the birth of the baby; document confirming non-receipt of the same benefit from the place of employment of the second holder of parental rights |

| For burial | Certificate proving the death of a relative of an employee |

List of documents confirming the right to compensation

The validity of the employer's expenses for paying for insurance claims is confirmed by the documents submitted as an appendix to the application. The list of documents depends on the type of insured event and is adjusted by the territorial office. Submit copies:

- A document confirming the legal relationship between the employer and the employee - a work book with a record of employment.

- A ballot issued in connection with incapacity for work, leave under the BiR.

- Birth certificates of a child, if there is more than one child, in case of reimbursement of monthly benefits - certificates of all children.

- Applications from an employee for leave for employment and labor, for child care and for the provision of benefits.

- Certificate from the second parent’s place of employment confirming non-provision of leave, benefits or additional days off. If there is no work, a copy of the spouse’s work record book is provided.

- Certificates from a medical institution confirming that the employee is registered.

- Calculation of the benefit amount based on the income previously received by the employee.

- Certificates confirming a child’s disability, applications for additional days off.

- Payment documents for payments made.

The list contains copies of orders of the head of the relevant appointment. The order must be signed by the manager and the employee. An order is not required when paying for a period of incapacity for work on a general basis or a one-time benefit. The documents are listed in the application as an attachment. Copies are certified in the prescribed manner. The document is marked with the entry “Copy is correct”, the name of the enterprise, the signature of the manager or individual entrepreneur with a transcript. The record is certified by a seal provided that it is used by the enterprise in office work.