21.03.2019

Concluding factoring transactions becomes especially relevant during the economic crisis. A constant increase in accounts receivable, combined with an unstable market situation and increasingly difficult lending conditions for legal entities, can threaten the existence of any business. Cooperation with factoring companies allows you to increase the volume of working capital and reduce cash gaps. The benefits of this service have already been appreciated by thousands of Russian enterprises, but in the course of such work many questions arise. They are mainly related to how accounting and tax accounting of factoring should be carried out in the 1C system. Below you will find answers to these questions.

Features and advantages of factoring

A debt financing agreement for the assignment of monetary claims affects the interests of three parties: the bank (factor), the supplier (lender) and the buyer (borrower). In practice this happens as follows:

The supplier enters into an agreement with the factor and begins to prepare to sell its products.

The buyer receives goods or services in accordance with the terms of the contract.

After receiving confirmation of delivery, the factor transfers 80–90% of the amount of the concluded contract to the supplier.

The buyer gradually pays the factor for the purchased goods/services. After the payment is made in full, the supplier will receive the remaining 10–20%, and the factor will receive his commission.

Thanks to this cooperation scheme, small, medium and large businesses can work in a comfortable mode. The supplier immediately receives funds for the production of the next batch of goods (performing services), while his buyer can pay the debt with a convenient deferment. The result is stable business development.

Factoring can be with or without recourse

In the first case, responsibility for the buyer's integrity falls entirely on the supplier. This means that if the former fails to fulfill its obligations, the factor will be able to demand its funds back. The fee for servicing such a transaction is low.

If a non-recourse factoring agreement is concluded, the supplier will be fully insured against the risk of non-payment by the buyer. In this case, the factor takes responsibility for collecting the debt from the customer. The commission for such a service will be much higher.

Factoring is convenient because:

- does not require additional guarantees or collateral obligations;

- debt repayment conditions are more favorable than in many banks;

- The processing time for applications is significantly shorter than in credit institutions.

Stages of agreement between the parties

To provide factoring services without recourse, the client must submit an application for an upcoming transaction on deferred payment terms. Information about the customer and the preliminary amount of shipment must be provided.

- The creditor checks the solvency of the future debtor to exclude fraud. Financial risks fall on the shoulders of a third party. The waiting period for a response depends on the speed of obtaining complete information about the buyer. If the contract for the provision of factoring without recourse is concluded with the participants not for the first time, the procedure ends quickly.

- After approval of the debtor's solvency, the supplier draws up documents for shipment: invoices for goods or services, invoices, supply agreement indicating the deferred payment period.

- If the goods have been paid for in part, the payment is indicated in the contract. Factoring financing will be done on a debt basis.

- After shipping and signing the forms, the seller is sent to the third party with all the documents for the transaction. An agreement (sample) is concluded under which the right to receivables is transferred to the creditor.

- The client receives financing. Typically the amount does not exceed 90 percent of the customer's debt. The balance is returned after the debtor deposits the entire amount into the account of the credit institution.

If the outcome of events is positive, the funds minus the commission for the financing service are credited to the seller’s account. This concludes the deal.

Sometimes the ideal verification scheme fails - the debtor does not repay the deferment on time. Under a regressive system, the client is obliged to compensate the creditor for losses. But in this case, the debt repayment procedure is handled by the factor, because according to the contract, the client is insured against such risks.

The credit institution sends a notice to the debtor so that the debt is repaid. In this case, the injured party has the right to receive interest, because the debtor was granted a loan and the money must work.

The loss for a customer who receives installment financing for shipment is 10 or 15%, which the transaction intermediary will underpay if the debtor becomes insolvent.

Accounting for factoring operations at the supplier

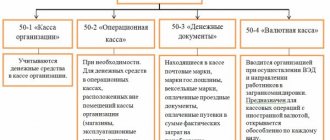

Since all mutual settlements are reflected in the 1C system, it is worth taking into account several features:

1For a factor, the amount of commission under an agreement with a supplier is subject to VAT. This means that the supplier company, in accordance with paragraphs. 1, paragraph 2, art. 171 of the Tax Code of the Russian Federation, receives an invoice. Subsequently, based on this document, you can receive a deduction for value added tax.

2If we take into account clause 11 of PBU 10/99, then the amount of financial services in the form of remuneration to the bank under a factoring agreement in accounting should be included in operating expenses.

3In accordance with paragraphs. 15, paragraph 1, art. 264 of the Tax Code of the Russian Federation, remuneration to the bank for the purpose of accounting for income tax must be included in non-operating expenses.

Accounting for factoring operations at the supplier is carried out as follows:

- Debit 62 Credit 90. Debt for goods sold is taken into account.

- Debit 90 Credit 68. The amount of VAT on goods supplied is reflected.

- Debit 76 Credit 91.1. The assignment of the monetary claim to the bank is recorded.

- Debit 91.2 Credit 62. The monetary claim assigned to the bank is written off.

- Debit 51 Credit 76. The bank transfers funds under a factoring agreement.

- Debit 91.2 Credit 76. The amount of bank remuneration is reflected.

- Debit 19 Credit 76. VAT is withdrawn from the bank remuneration amount.

- Debit 68 Credit 19. VAT on the remuneration amount is deducted.

Regression accounting for factoring (with the return of money to the bank) assumes that the following entries will need to be made in the accounting accounts:

1Debit 76 “Settlements with the bank” Credit 51. Return to the factor of previously transferred funds in the amount of 70–90% of the amount in accordance with the agreement.

2Debit 76.2 “Settlements on claims” Credit 76 “Settlements with the bank.” If the buyer does not pay for goods/services, a claim is filed against him.

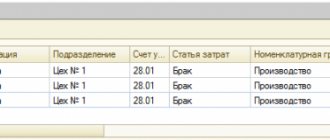

Note that in the 1C: Accounting 8 program, starting from version 3.0.53, operations related to factoring are automated. We are talking about a subaccount on account 76. It is called: “Settlements with factoring companies.”

The main idea of these transactions is that factoring is not a loan, but the sale of receivables to a bank. This procedure is accompanied by a reduction in debt and receipt of funds.

Taxation of factoring with recourse

With recourse factoring, the factor acquires from the client the right to all amounts due from the debtor. At the same time, if it is impossible to recover the amounts in full from the debtor, the client who assigned the monetary claims is obliged to compensate the factor for the missing funds.

In this case, the assignment of a monetary claim to a factor is mainly carried out by the client in order to ensure the fulfillment of its obligations to the factor, that is, the factor does not buy these claims from the client (negotiable or security factoring).

“If the assignment of a monetary claim to a financial agent is made in order to ensure the fulfillment of the client’s obligation and the financing agreement for the assignment of the claim does not provide otherwise, the financial agent is obliged to submit a report to the client and transfer to him an amount exceeding the amount of the client’s debt secured by the assignment of the claim.

Consequently, if the debtor fails to fulfill his obligations (part of them) to pay for the shipped goods (works, services) that were assigned to the factor, the latter has the right to present demands to the client for their payment. In this case, the client is the guarantor for payments from the debtor.

With recourse factoring, the factor's income will be only the commission for factoring services.

What is reflected in the tax accounting of the factor for non-recourse security factoring transactions? The main question for taxpayers is, of course, the financing fee.

According to the Russian Ministry of Finance, the financing fee, taking into account that it is expressed as a percentage, should be taken into account for tax purposes as interest (Letters dated May 13, 2009 N 03-07-11/136, dated August 4, 2008 N 03-03 -06/1/437, dated 04/17/2008 N 03-03-06/1/284, dated 11/06/2007 N 03-03-06/1/772).

“By virtue of paragraph 1 of Art. 269 of the Code, for profit tax purposes, debt obligations mean loans, commodity and commercial loans, loans, bank deposits, bank accounts and other borrowings, regardless of the form of their execution.

Meanwhile, the factoring agreement does not apply to the agreements named in paragraph 1 of Art. 269 of the Code, since it was concluded by the company in accordance with the provisions of Chapter. 43 of the Civil Code of the Russian Federation.

Due to this, the remuneration under this agreement cannot be attributed to the debt obligations listed in clause 1 of Art. 269 of the Code."

In Letter dated December 7, 2011 N 03-03-06/1/809, the Ministry of Finance of Russia expressed its opinion in a different formulation, focusing on the economic essence of the financing provided, and not on the procedure for establishing its size: “If financing is provided by a financial agent on a repayable basis , and the right of claim is assigned in order to ensure the fulfillment of the client’s obligation to return funds, the remuneration of the financial agent for profit tax purposes is recognized as interest on the debt obligation, taken into account as expenses in the manner established by Art. 269 of the Tax Code of the Russian Federation.”

Considering that for a factor, the financing fee is income that is taken into account in the tax base without any restrictions (in terms of expense, restrictions for interest are established in Article 269 of the Tax Code of the Russian Federation), there are no contradictions in qualifying obligations under a factoring agreement (for tax accounting purposes). are of such fundamental importance for the factor as for the client.

The author believes that when implementing security factoring with recourse, commissions expressed as a percentage and charged depending on the volume and period of financing provided, the factor must be reflected in tax accounting as interest. Income in the form of interest is reflected in the tax accounting of the factor in accordance with clause 6 of Art. 250 and paragraph 6 of Art.

271 of the Tax Code of the Russian Federation, according to which interest is classified as non-operating income and is included in it at the end of the month of the corresponding reporting period (if the duration of the financing falls on more than one reporting period) or on the date of termination of financing (in case of termination of financing before the end of the reporting period) . The procedure for maintaining tax accounting of income in the form of interest is established by Art. 328 Tax Code of the Russian Federation.

The taxation of other commissions charged by the factor to the client, for example, commissions for services for registering each monetary claim, commissions for services for accounting for assigned monetary claims, commissions for services for managing debt on monetary claims, etc., depends directly on the method of determining their sizes.

Thus, if the amounts of commissions are established in the factoring agreement in absolute terms, then they are included in income in accordance with Art. 249 of the Tax Code of the Russian Federation as income from the sale of services; if commissions are set in percentage terms, then they are reflected in non-operating income as interest (clause 6 of Article 250 of the Tax Code of the Russian Federation).

We invite you to read: Calculation of alimony for three years

Income from the sale of financing services under the assignment of a monetary claim is recognized in tax accounting in the manner set out in clause 5 of Art. 271 Tax Code of the Russian Federation. For banks, commissions from factoring operations are included in income according to paragraphs. 16 clause 2 art. 290 Tax Code of the Russian Federation.

Regarding the creation of reserves for doubtful debts for factoring operations in tax accounting, the following should be noted.

According to paragraph 1 of Art. 266 of the Tax Code of the Russian Federation, a doubtful debt is any debt to the taxpayer arising in connection with the sale of goods (performance of work, provision of services), if it is not repaid within the time period established by the agreement and is not secured by a pledge, surety, or bank guarantee.

For monetary claims that have been transferred to the factor according to the factoring agreement, a reserve for doubtful debts (Article 266 of the Tax Code of the Russian Federation) is not created due to the fact that such claims are not related to the sale by the factor of goods (works, services) in favor of the debtor (Letter of the Ministry of Finance of Russia dated 02/06/2006 N 03-03-04/1/87).

However, for organizations that are not banks (clause 3 of Article 266 of the Tax Code of the Russian Federation, banks are given the right to create reserves for debts incurred due to non-payment of interest), the creation of a reserve for commissions expressed as a percentage, depending on the volume and term of financing, is associated with the risk of claims from the tax authorities, especially given the position of the Russian Ministry of Finance on the issue of qualifying the commission as interest.

If the factor is a bank, then, unlike other organizations, it has the opportunity for factoring operations in accordance with the Regulation of the Bank of Russia dated March 26, 2004 N 254-P “On the procedure for credit institutions to form reserves for possible losses on loans, loans and similar debt" to create reserves for possible losses on loans depending on the category of quality of the acquired right of claim. Contributions to this reserve in accordance with Art. 292 of the Tax Code of the Russian Federation are taken into account for tax purposes.

All commissions charged by a factor to a client under a factoring agreement are subject to VAT in the generally established manner at a rate of 18%, regardless of whether the sale of goods (work, services) that are the object of financing is subject to VAT or not.

This provision also applies to banks (Letters of the Ministry of Taxes of Russia dated July 22, 2003 N VG-6-03 / [email protected] , dated June 15, 2004 N 03-2-06/1/1371/22), since financing transactions under assignment monetary claims carried out by banks within the framework of a license to carry out banking activities are not provided for in the list of paragraphs. 3 p. 3 art. 149 of the Tax Code of the Russian Federation as transactions exempt from taxation.

Non-recourse factoring is factoring in which the factor acquires from the client the right to all amounts due from the debtor. If it is impossible to recover the amounts in full from the debtor, the factoring company will suffer losses (in an amount not exceeding the financing paid to the client).

This is a type of regular factoring. With this factoring, client financing is carried out by the factor by purchasing a monetary claim from him.

The factor's rights to amounts received from the debtor are regulated by clause 1 of Art. 831 of the Civil Code of the Russian Federation: “If, under the terms of a financing agreement for the assignment of a monetary claim, the client is financed by purchasing this claim from him by a financial agent, the latter acquires the right to all amounts that he receives from the debtor in fulfillment of the claim, and the client is not liable to the financial agent because the amounts he received were less than the price for which the agent acquired the claim.”

The factor's income will be the difference between the price of acquiring the rights of claim and the amount that will be repaid by the debtor (the factor discounts invoices).

We suggest you read: Challenging paternity in court without DNA

A regular factoring agreement without recourse is very similar to an assignment agreement. However, in the Civil Code of the Russian Federation these are two different types of civil law contracts: a factoring agreement - a financing agreement for the assignment of a monetary claim (Chapter 43 of the Civil Code of the Russian Federation) and an agreement for the assignment (assignment) of the right of claim (Chapter 24 of the Civil Code of the Russian Federation).

In this regard, the Ministry of Finance of Russia in its Letters (dated 04/17/2008 N 03-03-06/1/284, dated 01/18/2006 N 03-03-04/1/33) indicated that the provisions of Art. 279 of the Tax Code of the Russian Federation, which establishes the procedure for taxation of profit upon assignment (assignment) of the right of claim, do not apply to relations under a factoring agreement. Later, the Russian Ministry of Finance indicated the application of Art. 279 of the Tax Code of the Russian Federation on financing transactions for the assignment of a monetary claim (Letters dated December 7, 2011 N 03-03-06/1/809, dated March 4, 2013 N 03-03-06/1/6366).

Accounting for factoring transactions with the buyer

If the supplier company enters into a non-recourse agreement with the factor, then it actually transfers its receivables to it. The buyer must also be notified of this step, since now he must pay for the goods or services received with the new participant in the transaction.

In order to transfer the debt from the seller to the bank, the accounting entry for factoring is performed as follows:

- Debit 60.1 (seller) Credit 60.1 (factor).

- Debit 60.1 (factor) Credit 51. This entry reflects payment.

The essence of the deal

Non-recourse factoring is a type of financial assistance that a factor provides to a client who has applied. The supplier of goods or services acts as the client if a transaction is planned with the buyer on deferred payment terms.

An application is made for a certain amount. The buyer wants to pay for the shipment not immediately, but in a month. In order for the seller not to lose money in trade turnover, he turns to a credit institution, which becomes an intermediary in the transaction. The factor pays the client up to 90% of the buyer's debt and accepts the right to receive receivables. The deal diagram looks like this.

The nuance of the transaction is the fact that the credit institution assumes the risks during non-recourse factoring. The client remains with the money even if the debtor is unable to pay off the debts.

The supplier's losses are minimal - 10-15% of the transaction is commission to a third party. You will not have to return the money to the factoring company, as in the case of recourse financing.

We invite you to read: Notice of unilateral termination of the contract

Accounting for transactions with a factoring company

The factor is a legal entity, so it also takes into account all actions related to the receipt of receivables in exchange for the provision of funds for the supply of goods or services. Banking organizations have their own accounting specifics.

Accounting entries for factoring have a number of features that will be of interest to professionals. Thus, the issuance of funds on account of assignment of debt will be reflected in the form of an entry:

- Debit 58 Credit 76 “Factoring”.

- Debit 76 Credit 51. This operation reflects the transfer of money to the seller.

- Debit 76 Credit 91.1. Posting income from a financial investment.

- Debit 91.2 Credit 58. Write-off of the amount of financial security after repayment of the debt.

- Debit 91.2 Credit 68 VAT. Calculation of VAT on the remuneration amount.

Reflecting factoring in accounting is a broad and complex topic. The methodology for these operations based on the 1C system is constantly being improved and changed, but the current legislation does not establish strict requirements for maintaining documentation. This article provides examples of how bank client reporting can be maintained.

In addition, suppliers often have questions about taxation specifics. We recommend paying attention to justifying the economic feasibility of the costs of servicing a factoring agreement (Article 252 of the Tax Code of the Russian Federation). An inflated amount of financial remuneration for signing an agreement for the assignment of receivables may attract the attention of the tax authorities.

If you have any questions about accounting when concluding a factoring agreement or you require more detailed advice on legal issues, you can always contact us in any way convenient for you. You will find telephone numbers and email addresses of our company’s offices in your city in the “Contacts” section.

Advantages and disadvantages of the financing service

Non-recourse financing is in less demand among entrepreneurs than the recourse option. This is due to the high commission fee on the part of the entrepreneur who applied and the loss of 10-15% in case of violation of agreements. This is a disadvantage, but not as significant as the loss of all money and legal proceedings with the debtor.

The advantages of non-recourse financing are as follows:

- Checking the client's solvency is a factor.

- Eliminating the risk of losing large amounts of money.

- A third party monitors the terms of the contract, which simplifies the work of the supplier itself.

- Opportunity to expand the customer base and increase the company's turnover.

Despite the fact that non-recourse financing has more advantages than disadvantages, the number of applications to a credit institution under this scheme is less. Entrepreneurs rely on the integrity of their partners.

- receiving money immediately after confirmation of delivery,

- covering cash gaps,

- increase in sales volumes,

- increasing the company’s competitiveness by providing customers with the necessary deferred payment,

- lower service rates compared to using non-recourse factoring technology.