Count 50: basic information

Account 50 is the active accounting account. An increase in the resource account on it is reflected as a debit, and a decrease as a credit. For example, if funds from an accountable person are deposited at the cash register, then debit entries will be generated on the account, and if a certain amount of funds is withdrawn from the cash register for transfer somewhere, then account 50 will be involved in credit entries.

Account balance 50 is debit. It is calculated by adding debit turnover to the opening balance and subtracting credit turnover from it. The ending balance shows the balance of funds in the cash register on a specific date.

Cash resources on hand are assets. The cash balance at the reporting date is reflected in the enterprise's balance sheet in the asset category (line 1250). When preparing annual financial statements, most business accountants try to bring account balance 50 to zero.

Accounting is carried out in both national and foreign currencies.

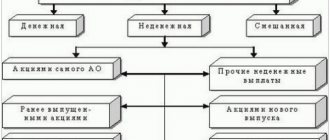

Account 76: application by partnerships

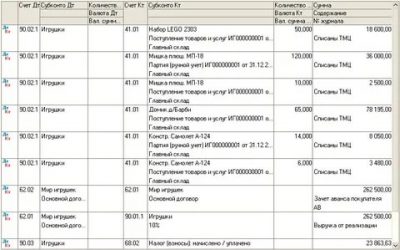

Each subaccount is filled throughout the year with business transactions. The generated turnover at the end of each period is closed at 90/9 and has no intermediate balance. The financial and economic result of work for the month is calculated as the difference between the debit turnover and the total credit turnover of the subaccounts.

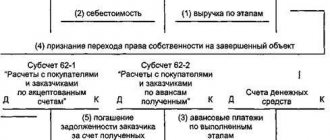

To reflect assets recognized according to PBU (accounting regulations) 9/99, subaccount 90/1 was created as income from the main activity. It takes into account revenue from products sold, work performed, goods sold, services, etc. The amount of income received appears on the credit of the subaccount in correspondence with account 62 “Settlements with customers” by debit.

Let's assume that one of the company's employees was given an advance to purchase paper for the office. The amount of the advance was 3,700.0 rubles. In fact, the cost of the purchase was 3,820.0 rubles, while the amount of VAT was 573.0 rubles. The overspent portion of the funds was returned by the employee by depositing cash into the company cash desk.

If we talk about the standards regarding the cash register limit, then the latter should be understood as the maximum allowable amount of cash that is allowed to be stored in the cash register of the enterprise at the end of each working day. The organization sets the designated limit independently based on the amount of revenue received by issuing an internal order.

Assets

The balance sheet asset consists of 2 sections:

-1. Fixed assets.

-2. Current assets.

SECTION 1 Non-current assets

Article 1110 “Intangible assets”

We take the balance on account 04 (Intangible assets) minus the balance on account 05. (Amortization of intangible assets)

Formula=04 count -05 count.

Article 1150 “Fixed assets”

We take the balance on account 01 “Fixed assets” and minus account 02 “Depreciation of intangible assets”

Formula=01 account-02 account

Article 1170 “Financial investments”

We take the balance of account 58 (financial investments in terms of long-term financial investments) + 55/DEPOSIT + 73/1 (loans issued to employees) - account 59 (reserve for impairment of financial assets in terms of long-term financial investments).

Formula=58+55/Deposit+73/1- 59 account

Article 1190 “Other non-current assets”

Formula =Dt balance on account 08+Debit balance on account 07+Debit balance on account 97 for more than 12 months. There is a letter from the Ministry of Finance saying that advance payments to suppliers for the purchase of fixed assets are reflected in the line “other non-current assets”, some kind of nonsense, but I will introduce this nuance to you.

Article 1100 “Result under Section 1”

We summarize all asset items in section 1 “Non-current assets”

Section 2 Current assets.

Article 1210 “Reserves”

Formula = Account balance 10 (materials) + Account balance 41 (goods) + Account balance 43 (finished products) + Account balance 15 + Account balance 16 + Account balance 45 (Goods shipped) + Account balance 20 (main production) + account balance 44 (sales expenses) + Account balance 97 (deferred expenses) + 21,23,28,29-Account balance 14

Article 1220 “VAT”

Formula = Debit balance on account 19 “Value added tax”

Article 1230 “Receivables”

Formula = Dt 46+Dt60/02+Dt62/01+Dt76+Dt68+Dt71+Dt73/damage compensation+Dt75/For contributions to the authorized capital.-Credit balance on account 63 (reserve for doubtful debts)

Comments: under account 60/02 (advances issued), VAT is calculated on the prepayment, as well as under account 76. In accordance with PBU, if account 60/02 is the amount of 10,000 rubles and 60/01 is 5,000 rubles, then we do not find the balance on account 60 and do not record one total balance in the balance sheet, PBU does not allow this, i.e. 60/02 will be in accounts receivable 10,000 rubles and 60/01 - there will be 5000 rubles in accounts payable in liabilities. (i.e. we do not offset accounts receivable and payable). (On account 60 there will be an expanded balance dt balance 10000 Kt balance 5000)

76 each if there are advances issued, 68 if there are receivables.

ATTENTION:

-If you have a balance on account 76/AB (VAT on advances and prepayments received), then it must be deducted from the Accounts Receivable line. (Section 2)

-There is a letter from the Ministry of Finance stating that 60-02 for prepayments issued to suppliers for the purchase of fixed assets does not need to be included in the “Accounts receivable” line, but in “other non-current assets”; you decide what to do.

Article 1240 “Financial investments”

Formula = Account debit balance 58 (financial investments in terms of short-term) + 55/deposits (special accounts in banks in terms of short-term) = 73/Loans issued to employees (in terms of short-term)

Article 1250 “Cash”

Formula = 50 balance account (cash) + 51 balance account (current account) + 55 account (except deposits) + 57 (transfers in transit).

Article 1260 “Other current assets”

Formula = Account balance 94+76/VAT (VAT accrued upon shipment of goods when ownership of the goods is transferred in a special manner after payment until the revenue is determined)

Article Result for section 2 current assets

Let's summarize all the articles in section 2

BALANCE (Balance currency is another

name )

sum up the total of section 1 + Total of section 2

Account 50 in accounting: typical entries, examples

Accounting account 50 is an active account “Cash”, it is used to record the movement of cash in the cash desk of the enterprise, control over their receipt, expenditure and intended use. Let's look at which accounts account 50 corresponds to, as well as typical transactions for account 50 using the example of an operation for issuing cash from the cash register to a sub-account for payment for the services of a counterparty.

Instructions 50 count

Instructions for using the chart of accounts for accounting the financial and economic activities of organizations in accordance with Order No. 94n dated October 31, 2000

Account 50 “Cashier” is intended to summarize information about the availability and flow of funds in the organization’s cash desks.

Sub-accounts can be opened for account 50 “Cashier”:

50-1 “Organization cash desk”,

50-2 “Operating cash desk”,

50-3 “Cash documents”, etc.

Subaccount 50-1 “Cash of the organization” records the funds in the cash desk of the organization. When an organization carries out cash transactions with foreign currency, then corresponding sub-accounts must be opened to account 50 “Cash” for separate accounting of the movement of each cash foreign currency.

Subaccount 50-2 “Operating cash desk” takes into account the availability and movement of funds in the cash desks of commodity offices (piers) and operating areas, stopping points, river crossings, ships, ticket and baggage offices of ports (piers), train stations, ticket storage offices, ticket offices post offices, etc. It is opened by organizations (in particular, transport and communications organizations) if necessary.

Subaccount 50-3 Cash documents records postage stamps, state duty stamps, bill stamps, paid air tickets and other cash documents in the organization's cash desk. Cash documents are accounted for on account 50 “Cash” in the amount of actual acquisition costs. Analytical accounting of monetary documents is carried out by their types.

The debit of account 50 “Cash” reflects the receipt of funds and monetary documents at the organization’s cash desk.

The credit of account 50 “Cash” reflects the payment of funds and the issuance of monetary documents from the organization’s cash desk.

Wiring

An accounting entry (accounting record) is a record in a paper journal or in a computer database about a change in the state of accounted objects.

Typically, an accounting entry consists of a description of the item being debited and credited, as well as numerical characteristics of the change, such as quantity and value.

We can say that accounting entry is a way of registering business transactions simultaneously on two different, but economically interrelated accounting accounts in equal amounts.

The accounting entry is compiled only on the basis of primary accounting documents.

To prepare an accounting entry, you must perform the following steps:

- determine the economic content of the object;

- recognize the accounting object;

- technically reflect the accounting object on the corresponding debit and credit accounts.

There are two types of accounting entries in accounting:

- simple postings are postings in which two accounts correspond.

Example:

The operation of issuing wages to employees of the enterprise from the cash desk in the amount of 1,000,000 rubles. will be reflected by the wiring:

Debit of account 70 “Settlements with personnel for wages” Credit of account 50 “Cash” -100,000 rubles;

- complex transactions are transactions that affect more than two corresponding accounts.

Moreover, there are two types of complex wiring.

In the first case, when one account is debited and several accounts are credited at the same time. In this case, the amount of the credited accounts is equal to the amount of the debited account.

Example:

The transaction of receipt of proceeds from the sale of products in the amount of 100,000 rubles to the current account. and from the sale of fixed assets in the amount of 50,000 rubles. can be reflected by complex wiring:

Debit account 51 “Current accounts” RUB 150,000.

Credit to account 90 “Sales” 100,000 rub.

Credit to account 91 “Other income and expenses”, subaccount “Other income” 50,000 rubles.

This complex wiring can be represented by two simple ones, namely:

Debit of account 51 “Settlement accounts” Credit of account 90 “Sales” - 100,000 rubles;

Debit of account 51 “Settlement accounts” Credit of account 91 “Other income and expenses”, subaccount “Other income” - 50,000 rubles.

In the second case, one account is credited and several accounts are debited at the same time: in this case, the amount of the debited accounts is equal to the amount of the credited account.

Example:

Materials worth RUB 10,000 were received from the supplier. and equipment for installation worth RUB 50,000.

The complex accounting entry for this transaction would be done as follows:

Debit account 10 “Materials” 10,000 rubles.

Debit account 07 “Equipment for installation” RUB 50,000.

Credit to account 60 “Settlements with suppliers and contractors” 60,000 rubles.

This complex wiring can be represented by two simple ones, namely:

Debit of account 10 “Materials” Credit of account 60 “Settlements with suppliers and contractors” - 10,000 rubles;

Debit of account 07 “Equipment for installation” of account 60 “Settlements with suppliers and contractors” - 50,000 rubles.

The use of complex entries reduces the number of accounts, which in turn saves the time required to carry out accounting and analytical functions.

Depending on the nature of the reflected data, the postings are:

a) real;

b) conditional;

c) clarifying.

Real entries are used to reflect business transactions, facts, and events that actually occurred (For example, obtaining a loan, calculating and issuing wages, etc.).

Contingent entries arise as a result of accounting methodology, although in reality the transaction is not

was made, but the accounting entry is prepared. They are used in two cases:

– to transfer indicators;

– to clarify indicators.

For example:

- the sales account is closed and the financial result is determined.

- management costs are included in production costs (management costs are recorded in the “General business expenses” account, and when they are included in production costs, no economic fact occurs).

Clarifying entries include corrective entries, as well as entries for writing off the calculation difference in the accounts of the production process.

Clarifying entries are:

a) additional – drawn up in regular ink, their amount increases the turnover of accounts;

b) reversals - are drawn up in red ink and when calculating the totals, the red amount is subtracted.

Postings in accounting

Update: October 3, 2021

Any financial and economic transaction must be reflected in the accounting records of the organization. For these purposes, there is a double entry method, that is, the accountant must make entries (clause 1, article 6, clause 3, article 10 of the Federal Law of December 6, 2011 N 402-FZ).

Postings to account 50

| Wiring | Contents of operation | Documenting |

| By debit account 50 | ||

| Dt 50 Kt 50-2 | Transfer of cash from operating cash desk to cash desk | KO-1 (receipt order), KM-6 (cashier-operator's certificate), KM-4 (cashier-operator's journal) |

| Dt 50 Kt 51, 52 | The receipt of cash from a ruble or foreign exchange bank is reflected | KO-1, bank account statement, check counterfoil of a checkbook |

| Dt 50 Kt 62 | Receiving money from the buyer | KO-1, cash receipt |

| Dt 50-1 Kt 90 | Retail cash sales revenue | |

| Dt 50 Kt 70, 71, 73 | Return to the cash desk of the salary surplus, the balance of accountable amounts, cash for other payments with staff | KO-1, JSC-1 (advance report) |

| Dt 50 Kt 75-1 | Contribution by the founder to the management company | KO-1, charter |

| On loan account 50 | ||

| Dt 51 Kt 50 | Cash delivery to the bank | KO-2 (payment order) |

| Dt 60 Kt 50 | Payments were made to the seller of goods, works, services | KO-2 |

| Dt 70 Kt 50 | Salary paid | KO-2, T-53 |

| Dt 71, 73 Kt 50 | Issuance of accountable amounts, other payments to staff | KO-2 |

| Dt 75 Kt 50 | Income paid to a member of the organization | KO-2 |

| Dt 94 Kt 50 | Identified cash shortage reflected | INV-15 (cash inventory report), INV-26 (inventory sheet) |

It is important to remember the maximum amount established by Bank Instructions 3073-U:

- for settlements between organizations and individuals (not individual entrepreneurs) there are no restrictions on the amount;

- Settlements between organizations and (or) individual entrepreneurs are carried out in an amount of no more than 100,000 rubles. under one contract.

In accordance with Letter of the Ministry of Finance No. 63 dated 03/08/1960, on the basis of a unified chart of accounts (Instruction 94n), a unified journal-order form of accounting is used, according to which the main accounting registers are order journals. They reflect in chronological order all the data on the account for the selected period, and the total is transferred to the general ledger. Maintaining them is not mandatory.

Journal order for account 50 “Cash” is a register for recording all cash transactions in the company. As a rule, it is programmed into specialized accounting programs and is generated automatically based on the input of primary documents. Journal order 1 for account 50 “Cash” is applicable only to reflect credit transactions on this account.

Using line item 50 in accounting

We will tell you about the latest news and publications. Read us anywhere. Always be aware of the main thing!

Results Posting Dt 90 Kt 90 means closing the internal subaccounts of account 90 in accordance with the financial result obtained.

Wiring diagram (3):

- Dt 76 Kt 86 – for the amount of concluded contracts, as they are concluded;

- Dt 50, 51, 55 Kt 76 - for the amount of actual receipts from investors (shareholders) as funds are received;

- Dt 08.3 Kt 60, 76, etc.

Transfer of special clothing and footwear from the warehouse into operation are documented with internal wiring: Dt 10/11 - Kt 10/10.

Specifics of working with the account

Transactions are recorded only on the basis of documentary evidence. Typical forms used to reflect movement on a count of 50 are:

- cash receipt order – confirms the receipt of funds (regardless of the type of receipt);

- expense cash order - used to formalize the issuance of money from the cash register;

- cash book - all incoming and outgoing cash orders are recorded in it.

These forms allow you to document the movement of funds in the cash register. To maintain accounting for account 50, other accounting registers are used:

- turnover balance sheet;

- journal-order;

- statement of account 50.

All of the listed registers duplicate information.

The company has the opportunity to establish accounting in accordance with its accounting policies. You can use only one of the specified registers, especially since, if necessary, the software product can generate any of the specified documents.

Correct wiring dt 90 kt 86 01

Summarizing the above, it is impossible to credit income to a balance sheet asset that cannot currently be compared with the expenses related to them.

If the property is on the balance sheet of the lessor:

- Dt 76.9 Kt 51 - lease payment transferred;

- Dt 20 Kt 76.9 - the lease payment is reflected in the accounting;

- Dt 19 Kt 76.9 - VAT is taken into account in the lease payment.

A gradual transition to the new rules is provided, depending on the activities carried out by companies and individual entrepreneurs, which will be fully completed in July 2021.

Typical transactions for 50 accounts

By debit of the account

| Contents of a business transaction | Debit | Credit |

| Cash was deposited from the operating cash desk to the main cash desk | 50 | 50 |

| Received money from the current account to the cashier | 50 | 51 |

| Foreign currency received from a foreign currency account to the cash desk | 50 | 52 |

| Received funds from a special bank account to the cash desk | 50 | 55 |

| Cash in transit has arrived at the cash desk | 50 | 57 |

| The money overpaid by the supplier has been returned by the supplier. | 50 | 60 |

| Money from the buyer has arrived at the cash register | 50 | 62 |

| An advance was received at the cash register from the buyer | 50 | 62-1 |

| Cash received at the cash desk under a short-term loan agreement | 50 | 66 |

| Cash received at the cash desk under a long-term loan agreement | 50 | 67 |

| Unused funds issued on account were returned | 50 | 71 |

| The employee returned the loan to the organization's cash desk | 50 | 73-1 |

| The employee was compensated for material damage | 50 | 73-2 |

| A contribution to the authorized capital was made in cash to the organization's cash desk | 50 | 75-1 |

| Insurance compensation has been received by the organization's cash desk | 50 | 76-1 |

| Funds received at the cash desk for an admitted claim | 50 | 76-2 |

| Cash received at the cash desk against dividends due from participation in other organizations or under a joint activity agreement | 50 | 76-3 |

| The cash desk received cash from a branch allocated to a separate balance | 50 | 79-2 |

| The cash desk received cash from the head office | 50 | 79-2 |

| Cash was received at the cash desk against the profit due under the property trust management agreement | 50 | 79-3 |

| Cash received for trust management | 50 | 79-3 |

| Money was received at the cash desk on account of the deposit under the joint activity agreement | 50 | 80 |

| Targeted funding received | 50 | 86 |

| The cash desk received money for products sold (goods, works, services) | 50 | 90-1 |

| The cash desk received money for other property sold (non-operating income) | 50 | 91-1 |

| Cash surpluses identified as a result of inventory are reflected | 50 | 91-1 |

| Positive exchange rate differences on cash foreign currency are included in other income | 50 | 91-1 |

| Money was received at the cash desk against deferred income. | 50 | 98-1 |

| The cash received free of charge | 50 | 98-2 |

By account credit

| Contents of a business transaction | Debit | Credit |

| Funds from the cash register are deposited into the current account. | 51 | 50 |

| Currency from the cash register was deposited into the foreign exchange account | 52 | 50 |

| Funds from the cash register are deposited into a special bank account | 55 | 50 |

| Cash sent by transfer to the counterparty | 57 | 50 |

| Shares purchased for cash | 58-1 | 50 |

| Purchased debt securities for cash | 58-2 | 50 |

| Cash loan provided | 58-3 | 50 |

| The debt to the supplier has been repaid | 60 | 50 |

| An advance was issued to the supplier from the cash register | 60 | 50 |

| The money overpaid by the supplier was returned | 62 | 50 |

| The advance paid by the buyer has been returned | 62 | 50 |

| The loan or interest on it is repaid from the cash register | 66 | 50 |

| Vouchers were issued to employees, paid for using social insurance funds. | 69-1 | 50 |

| Salaries (dividends) were paid to employees from the cash register | 70 | 50 |

| Cash issued on account | 71 | 50 |

| Loan provided to employee | 73-1 | 50 |

| Dividends were paid to the founders from the cash register | 75-2 | 50 |

| Deposited salary paid | 76-4 | 50 |

| Own shares were purchased in cash from shareholders | 81 | 50 |

| Negative exchange rate differences on cash foreign currency are included in other expenses | 91-2 | 50 |

| A shortage was detected in the cash register during inventory | 94 | 50 |

Typical postings to account 51

Account 51 can correspond with other accounts depending on what needs to be reflected - crediting money or writing it off. Let's look at how postings for business transactions are generated in both cases.

| the name of the operation | Debit | Credit |

| Admission | ||

| Money is credited from the company's cash register | 51 | 50 |

| Partial payment from the buyer has been credited | 51 | 62 |

| A short-term loan with a repayment period of 6 months was received from the bank | 51 | 66 |

| A tax refund was received from the state due to overpayments | 51 | 68 |

| The founders formed the authorized capital | 51 | 75 |

| Received funds included in deferred income are reflected | 51 | 98 |

| Write-off | ||

| To pay an accountable person funds for business needs, money was withdrawn from the current account and credited to the cash register | 50 | 51 |

| Payment has been made against the supplied materials from the supplier | 60 | 51 |

| The short-term loan obligation has been repaid, taking into account accrued interest. | 66, 67 | 51 |

| Salaries of the company's employees have been paid | 70 | 51 |

If, as a result of recording a business transaction, an error was made - the wrong amount was credited or an incorrect payment was written off - then the amounts identified during the audit are subject to reflection on account 76 “Settlements with various debtors and creditors”.

Which accounts does it correspond with?

Accounting account 62 can correspond with the following accounts.

From the debit of account 62 to the credit of the following accounts:

- account 46 - when writing off the cost of the next stage of work;

- account 50 - when returning from the cash register previously deposited funds to the buyer;

- account 51 - when returning funds previously deposited by the buyer from the current account;

- account 52 – when making a return from a foreign currency account of funds previously deposited by the buyer;

- account 55 - when performing a return from a special account of funds previously deposited by the buyer;

- account 57 - when making a refund by postal order or similar method;

- account 62 - when offsetting a previously received advance to repay the buyer’s debt;

- account 76 - when conducting mutual offsets;

- account 79 - when conducting a sale through the head office or branch;

- account 90 - when reflecting the shipment of main products;

- account 91 - when reflecting other sales (fixed assets, materials, etc.).

On the credit of account 62, entries can be made to the debit of the following accounts:

- Account 50 - when reflecting payment for delivered goods to the cash register;

- account 51 - when reflecting payment for delivered goods to the current account;

- account 52 – when reflecting payment for goods delivered to a foreign currency account;

- account 55 – when reflecting payment for goods delivered to a special account;

- account 57 - when reflecting payment by the buyer through a savings account, postal order, etc.

- count 60 - when carrying out mutual offsets;

- account 62 – when offsetting a previously received advance to repay the buyer’s debt;

- Account 63 - when writing off a bad debt using a pre-formed reserve;

- account 66 - when offsetting the supply of products against a short-term loan;

- account 67 - when offsetting the supply of products against a long-term loan;

- account 73 - when selling products to company employees;

- account 75 - when conducting mutual offsets according to the requirements of the founders;

- account 76 - when conducting mutual offsets;

- account 79 - when conducting a sale through the head office or branch;

You might be interested in:

Account 01 - Fixed assets in accounting: correspondence of accounts, postings

Characteristics of account 50

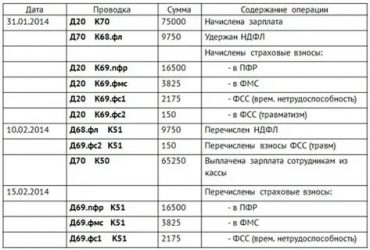

- issuing wages to employees;

- refund to the buyer;

- issuance of cash on account for the economic needs of the organization;

- cash receipts (for example, payments for goods, materials or services);

- collection procedure, etc.

Only the accountant-cashier (or a substitute person) has access to cash, as well as conducting transactions with it.

The debit of account 50 collects information about the receipt of cash, and the credit - about the issue from the cash register. For account 50 in accounting, you can open several sub-accounts, which are fixed in the Chart of Accounts (Order of the Ministry of Finance dated October 31, 2000 No. 94n).

Wiring Dt 90 and Kt 90, 68, 43, 99, 20 (nuances)

Dt 90 Kt 90 is the final accounting entry for closing account 90 at the end of the reporting period. To carry out the operation Dt 90 Kt 90 , you need to know the sequence of previous actions and the correct accounting entries. About them - in our article.

In what cases are entries made for debit 90 and credit 90, 68, 43, 99, 20

According to the chart of accounts (approved by order of the Ministry of Finance of Russia dated October 31, 2000 No. 94n), account 90 is needed to generate information about the company’s income and expenses for its main type of activity, as well as to determine the financial result of its business operations. For analytical purposes, subaccounts are opened to account 90 to record revenue (90.1), cost (90.2), VAT, excise taxes and export duties (90.3, 90.4 and 90.5, respectively), and financial results (90.9).

Accounting for subaccounts of account 90 must be kept cumulatively throughout the year. Every month, the accountant compares sales revenue with cost, VAT (if necessary, excise taxes and export duties) and writes off the final financial result to account 99. At the same time, there is no balance on account 90 as of the reporting date. At the end of the year, all subaccounts of account 90 (except 90.9) will be closed with internal postings Dt 90 Kt 90 , and subaccount 90.9, in turn, will be closed on account 99.

How is the financial result determined on account 90

To do this, accounting entries are made such as Dt 90 Kt 20, Dt 90 Kt 43 , Dt 90 Kt 41, Dt 90 Kt 68, Dt 90 Kt 90, Dt 99 Kt 90, Dt 90 Kt 99, Dt 99 Kt 90. Let's consider Learn more about the logic of posting Dt 90 Kt 90 and other accounting operations to determine the financial result using an example.

Example

Sdoba LLC operates at OSN. In December 2015, it purchased raw materials in the amount of RUB 1,180,000. with VAT for the production of confectionery products.

The following entries were made in accounting:

- Dt 10 Kt 60 - 1,000,000 rub. (raw materials for the production of buns have arrived at the warehouse);

- Dt 19 Kt 60 - 180,000 rub. (VAT on purchased raw materials);

- Dt 68 Kt 19 - 180,000 rub. (VAT on raw materials is accepted for deduction);

- Dt 20 Kt 10 - 1,000,000 rub. (raw materials transferred to production).

The confectioners made 20,000 buns from the received raw materials and transferred them to the finished goods warehouse. You can account for manufactured products in different ways. Sdoba LLC does this without using account 40, arriving ready-made bakery products at actual cost directly to account 43.

For other ways to account for finished products, read the article “How finished products are reflected in the balance sheet.”

Dt 43 Kt 20 - 20,000 buns were accepted into the warehouse at an actual cost of 50 rubles. a piece.

Next, an order was received from a buyer for 5,000 buns at a price of 65 rubles. a piece. After the products are shipped, the accountant will make the following entries in the accounting records:

- Debit 90 Credit 43 - in the amount of 5,000 × 50 rubles. = 250,000 rub. (sold buns are written off from the warehouse at actual cost).

- Dt 62 Kt 90.1 - in the amount of 5,000 × 65 rubles. = 325,000 rub. (sales revenue includes VAT).

The accountant will record the amount of VAT on buns sold by writing: Debit 90 Credit 68 - 49,576.27 rubles.

Next, at the end of December, the accountant must determine the financial results of the company.

Debit turnover on the account is 90 - 250,000 rubles. (cost of buns) + 49,576.27 rub. (VAT), and a total of 299,576.27 rubles.

Credit turnover on the account is 90 - 325,000 rubles. (proceeds from the sale of buns).

At the end of December, the accountant of Sdoba LLC will close each of the subaccounts of account 90 with entries Dt 90 Kt 90 to 90.9.