Article 131 of the Labor Code of the Russian Federation, like Chapter 20 as a whole, regulates legal relations related to remuneration.

The provisions of Article 131 of the Labor Code cover issues related to the form of remuneration. In this case, the form of payment refers to methods of paying wages in their material, that is, applied, understanding. Labor Code of the Russian Federation

dated December 30, 2001 N 197-FZ

Full text of the article, guides, additional information - in ConsultantPlus

When do you need to recalculate your salary?

In accordance with Article 22 of the Labor Code of the Russian Federation, the employer is obliged to pay full wages to its employees.

The amount of remuneration is established for the employee by the employment contract. The need for accounting to recalculate wages arises if the employee’s wages are not paid in full or in a larger amount. Such situations arise when:

- counting error;

- payment of bonuses for previous years;

- salary indexation;

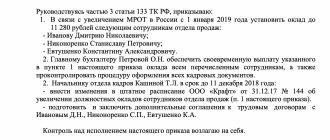

- changes in the minimum wage;

- employee illness during vacation or recall from vacation;

- receiving a court decision on additional assessments.

If, as a result, the employee received less income, then the company is obliged to recalculate wages for the previous period. If a large amount is transferred, the company is not obliged to make corrections. But in case of a calculation error, she has the right to recalculate wages (Article 137 of the Labor Code of the Russian Federation).

Recalculation in a separate document

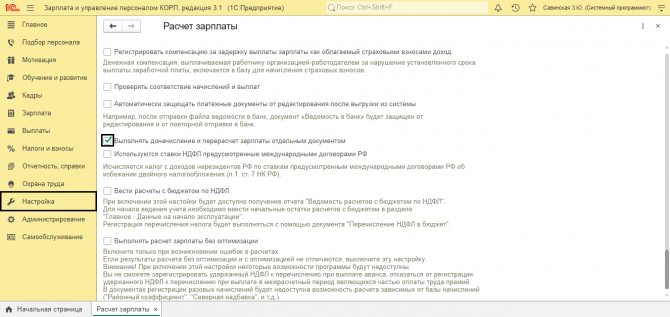

If the setting specifies that the allocation is carried out in a separate document, the user enters the allocation separately.

Fig.6 Setting up input of recalculation in a separate document

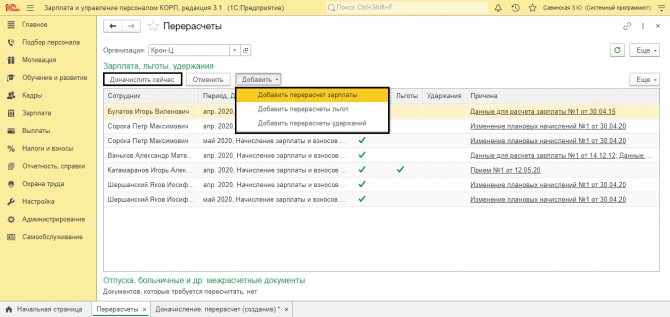

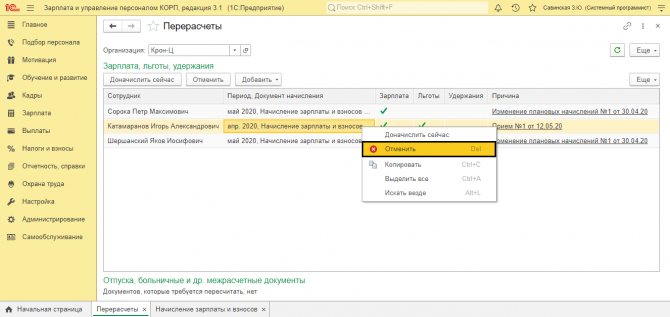

Go to the “Recalculations” service, section “Salary”.

The table lists the employees affected when entering documents that resulted in the recalculation. These documents are indicated in the “Reason” column. Clicking on the document link will open it for viewing.

To register a recalculation, click the “Add” button and select the desired action.

To perform the recalculation registered by the program, click the “Additional accrual now” button.

Fig.7 Service “Recalculations”

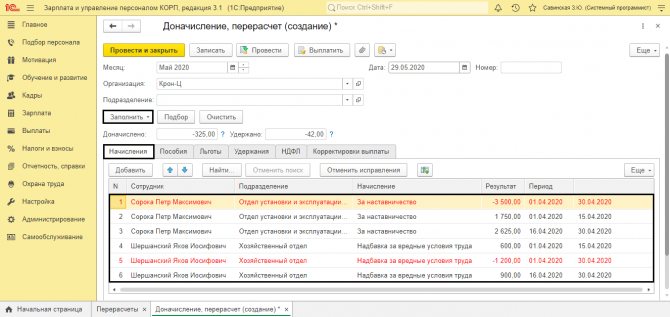

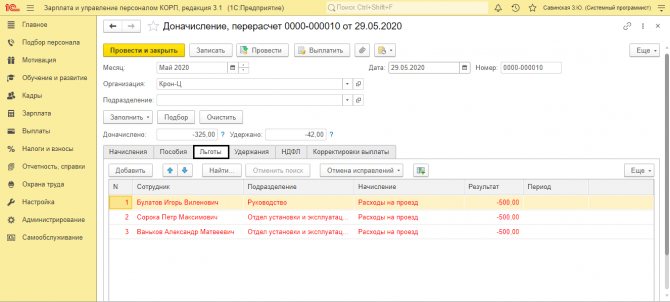

The document “Additional accrual, recalculation” will open. If necessary, change the month in which the recalculation is performed. The “Accruals” tab displays employees and the recalculation of accruals performed. Red (minus) is the accrual of the previous period, black (plus) is the accrual of the current period taking into account changes.

Fig.8 Document “Additional accrual, recalculation”

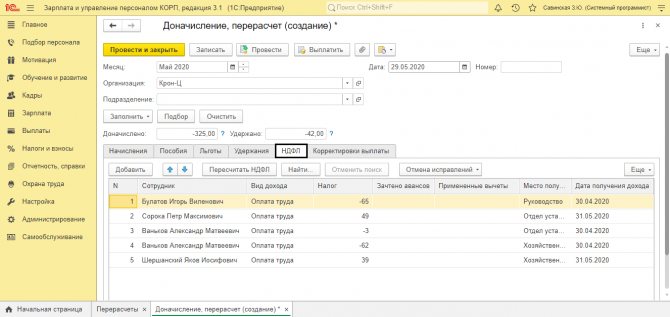

Recalculation of accruals automatically causes the recalculation of personal income tax on these accruals - the “Personal Income Tax” tab.

Fig.9 Recalculation of personal income tax

If there is any change in data from previous periods, the program will automatically see the information for recalculation - the “Benefits”, “Benefits”, “Deductions” tabs.

Fig. 10 Tabs of the document “Additional accruals, recalculation”

If the program reminds you about recalculation, but there is no need for it, the question arises - “How can I remove recalculations from the ZUP?”

The recalculation can be cancelled. To do this, right-click on the recalculation reminder and select “Cancel”.

Fig. 11 Cancel recalculation

We will help you finalize additional accruals and recalculate wages. The first consultation is free!

We looked at the recalculation procedure when correcting an error and changing the data of the previous period in the current one. But recalculations can occur not only in these documents, but also when correcting data on sick leave or vacation.

Let's look at these examples.

Counting error

A counting error is an incorrect arithmetic calculation when calculating payroll. For example, an accountant, instead of adding the amount of profit to the salary, multiplied these two values. In case of underpayment, it is necessary to recalculate wages for previous months. In case of overpayment, the employer also has the right to this, but subject to proper registration.

How to recalculate wages in case of a counting error:

- Draw up a document confirming the discovery of an error (for example, a report).

- Make sure that the month has not expired since the overpayment (Part 3 of Article 137 of the Labor Code of the Russian Federation).

- Notify the employee about the error and obtain written confirmation from him that he does not object to the corrections (you can submit an application for wage recalculation).

- Issue a withholding order and withhold the overpaid amounts.

If you do not meet the allotted monthly deadline, you can recover the overpayment in court.

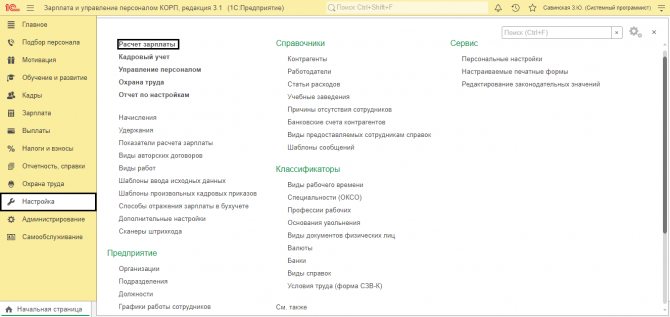

Operation Settings

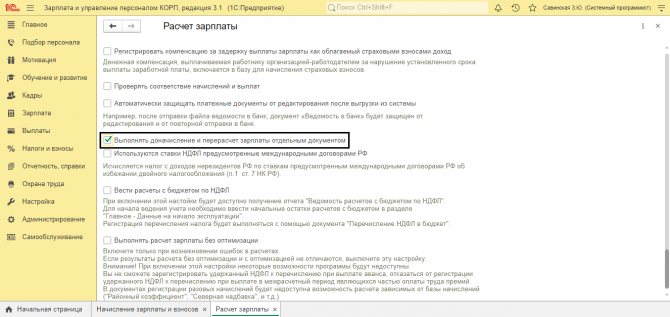

The operation itself is performed in the “Payroll” document. You can change the setting to perform it in a separate document through “Settings-Payroll”.

Fig.2 Setting-Salary Calculation

Check the appropriate box.

Fig.3 Setting up a recalculation document

When calculating salaries, the program will warn you about the need for recalculation, but it will not be reflected in the document.

How is salary indexation taken into account?

The employer is obliged to index wages annually. Indexation affects the calculation of average earnings, which is determined for vacation pay, sick leave, etc. Average earnings are calculated based on the previous 12 months. Salaries for the previous year are recalculated as follows:

- the salary and payments depending on it, accrued before the indexation, are increased by the indexation factor;

- other payments (in a fixed amount) do not change.

Example 1

Semenov S.S. upon hiring on October 1, 2017, the salary was set at RUB 30,000. and a bonus for qualifications of 20% of the salary (6,000 rubles). From 02/01/2019, wages were indexed throughout the enterprise. In Semenov S.S. from this moment the salary is 33,000 rubles. and bonus - 6600 rubles. In addition, in October 2018, the employee was paid a bonus in the amount of 10,000 rubles. As of August 1, 2019, the employee goes on vacation. It is necessary to calculate his average earnings (the entire period has been worked out in full).

Payments from February to July 2021 are taken into account in the accrual amount:

We calculate the indexation coefficient as follows:

Payments until January 2021 need to be indexed (from August 2021 to January 2020):

Average earnings will be:

Calculation of bonuses for the last year: recalculating vacations and sick leave

When calculating average earnings, bonuses based on the results of work for the year are taken into account regardless of the date of their accrual. In this regard, if, after calculating average earnings (vacation, illness, business trip, other reasons), an annual bonus was accrued relating to the billing period, it is necessary to recalculate the accrued amounts.

When recalculation is made, premiums for the previous period are taken into account if:

- they are accrued at the end of the year;

- this year refers to the billing period.

Example 2

Let's add the conditions of the first example. In April 2021 Semenov S.S. paid annual bonuses: for 2021 - 5,000 rubles, for 2021 - 30,000 rubles. Since the bonus for 2021 does not relate to the holiday pay calculation period, it does not need to be taken into account when recalculating. But the bonus for 2021 should be included in the calculation of average earnings in full:

Average earnings have increased, which means Semenov needs to pay extra vacation pay.

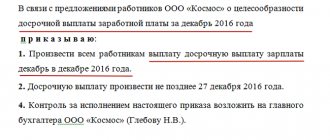

Time limits have been established for the recalculation of wages in case of underpayment. Unpaid accruals must be paid to the employee no later than the next payday after the changes are made.

The employee was overpaid

Most often, excessive salary payments are caused by one of two reasons. The first is the so-called vacation overexpenditure, when the employee was given vacation for a period not yet worked. He received vacation pay and then quit, while the period for which the vacation was granted remained unworked. In this case, the amount of vacation pay becomes an excessively paid salary, that is, the employee’s debt to the employer. The second reason is an unpaid advance, when the employee received a certain amount in the middle of the month and then quit. Further, during the final calculation, it turned out that the salary actually earned in a given month was less than the advance received. Then the “unclosed” part of the advance will be listed on the debit of account 70, as the employee’s debt.

In such a situation, the employer should invite the former employee to voluntarily repay the debt. If he refuses, the organization will only have to file a lawsuit, or forgive the debt and write off the debit balance. Let's look at each of these options.

The employee returned the money

If the employee voluntarily returns the unpaid advance, the debit balance on account 70 will be automatically repaid. And since insurance premiums and personal income tax are not paid on the advance amount, no adjustments will have to be made when returning.

If we are talking about the return of vacation pay, then the accountant needs to reverse the entry made when accruing it. In tax accounting, expenses in the form of vacation pay must be canceled.

At the same time, contributions that were transferred to the Pension Fund, Social Insurance Fund and Compulsory Medical Insurance Fund from the amount of vacation pay become overpaid. Therefore, they need to be reflected in reporting to funds as an overpayment. Moreover, the accountant does not have to submit clarifications for the period in which vacation pay was paid. It is enough to reflect the adjustments to contributions in the reporting for the current period. Such clarifications were given by the Ministry of Health and Social Development of Russia in a letter dated May 28, 2010 No. 1376-19 (see “In what cases does recalculation with an employee not lead to clarification of calculations for insurance premiums”).

The only problem that may arise is related to personalized reporting to the Pension Fund. The fact is that a report indicating negative accruals of pension contributions for any employee will not be accepted. Therefore, if, due to adjustments to vacation pay, the current period’s contributions have become less than zero, you will have to reflect these adjustments not in the current, but in the previous period.

Personal income tax, withheld from the amount of vacation pay and transferred to the budget, also becomes overpaid. If reporting for the corresponding year has already been submitted, the tax must be reflected in the updated certificate in Form 2-NDFL. The clarification number must match the number of the original certificate, and the date will be current. The rules for filling out the updated form 2-NDFL are set out in the letter of the Federal Tax Service of Russia dated August 13, 2014 No. PA-4-11/15988 (see “The Federal Tax Service reported how to fill out the updated certificate 2-NDFL when returning tax to an employee”).

Next, the accountant needs to reverse the entry for accrual of personal income tax from vacation pay. As a result, an overpayment of tax is formed, which can be returned or offset against future payments to the budget (clause 1 of Article 231 of the Tax Code of the Russian Federation). There is no need to transfer tax to the employee, since he returns the excess vacation pay minus personal income tax.

Example 1 At the beginning of 2015, employee Ivanov received leave for the period not worked. He was accrued vacation pay in the amount of 10,000 rubles. The accountant withheld and transferred personal income tax to the budget in the amount of 1,300 rubles (10,000 rubles x 13%). Ivanov received 8,700 rubles in his hands. (10,000 - 1,300). The following entries appeared in the employer's accounting: DEBIT 44 CREDIT 70 - 10,000 rubles. — vacation pay was accrued to Ivanov; DEBIT 70 CREDIT 68 – 1,300 rub. — personal income tax accrued; DEBIT 68 CREDIT 51 – 1,300 rub. — personal income tax is transferred; DEBIT 70 CREDIT 50 – 8,700 rub. — vacation pay was issued to Ivanov. Tax accounting reflects wage expenses in the amount of 10,000 rubles.

Upon returning from vacation, Ivanov resigned and returned his vacation pay to the cash register. The accountant made the following entries: DEBIT 70 CREDIT 44 - 10,000 rubles. — Ivanov’s vacation pay was reversed; DEBIT 68 CREDIT 70 – 1,300 rub. — personal income tax accrual was reversed; DEBIT 50 CREDIT 70 – 8,700 rub. — vacation pay was returned to Ivanov. In tax accounting, wage expenses in the amount of 10,000 rubles were canceled. In addition, the accountant reflected the excess withheld and paid income tax in the amount of 1,300 rubles. in the updated certificate 2-NDFL. Overpayment in the amount of 1,300 rubles. it was offset against future payments to the budget.

The employer collects money through the court

In a situation where an employer files a lawsuit to recover arrears for an advance or unworked vacation through the court, the corresponding amounts (minus personal income tax) must be reflected in the debit of account 73 and the credit of account 70. If the former employee wins the lawsuit, a reverse entry should be made. If the company becomes the winner and the employee returns the money, the amount will be debited to account 51 or 50.

Expenses in the form of vacation pay should be dealt with as follows. If the employee wins, the amount of debt must be reflected in account 91 and canceled in tax accounting. If the employer wins, the expenses must be canceled both in accounting and tax accounting.

The fate of pension, medical contributions and contributions to the Social Insurance Fund also depends on the outcome of the trial. If the court rules in favor of the employee and he does not return the money, the contributions are legally paid. Then no adjustments need to be made. If the court sides with the company, then the contributions will be an overpayment, which must be reflected in the reporting of the current period as a debt of the fund.

As for personal income tax, if the employer wins, this tax should be dealt with in the same way as with the voluntary return of money by the employee. Simply put, you need to submit an updated 2-NDFL and reverse the tax accrual in accounting. If the employee wins, the tax is considered legally withheld and paid, and no adjustments are required.

Example 2 At the beginning of 2015, employee Petrov received leave for the unworked period. He was accrued vacation pay in the amount of 20,000 rubles. The accountant withheld and transferred personal income tax to the budget in the amount of 2,600 rubles (20,000 rubles x 13%). Petrov received 17,400 rubles in his hands (20,000 - 2,600). The following entries appeared in the employer's accounting: DEBIT 44 CREDIT 70 - 20,000 rubles. — vacation pay was accrued to Petrov; DEBIT 70 CREDIT 68 – 2,600 rub. — personal income tax accrued; DEBIT 68 CREDIT 51 – 2,600 rub. — personal income tax is transferred; DEBIT 70 CREDIT 50 – 17,400 rub. — vacation pay was issued to Petrov. Tax accounting reflects wage expenses in the amount of 20,000 rubles.

Upon returning from vacation, Petrov resigned, but refused to return the money to the cash register. The company filed a lawsuit. The accountant made the entry: DEBIT 73 CREDIT 70 - 17,400 rubles (20,000 - 2,600) - the claim for vacation pay is reflected.

If Petrov wins the case, the accountant will make the following entries: DEBIT 70 CREDIT 73 – 17,400 rubles. — the claim is rejected; DEBIT 70 CREDIT 44 – 20,000 rub. – Petrov’s vacation pay was reversed; DEBIT 91 CREDIT 70 – 20,000 rub. — Petrov’s vacation pay was written off as other expenses; Expenses in the amount of 20,000 rubles were canceled in tax accounting.

If the company wins the case, the accountant will make the following entries: DEBIT 50 CREDIT 73 – 17,400 rubles. – vacation pay was returned by Petrov by court decision; DEBIT 70 CREDIT 44 – 20,000 rub. – Petrov’s vacation pay was reversed; DEBIT 68 CREDIT 70 – 2,600 rub. – personal income tax accrual has been reversed. Expenses in the amount of 20,000 rubles were canceled in tax accounting. In addition, if the employer wins, the accountant will reflect the excess withheld and paid income tax in the amount of 2,600 rubles. in the updated certificate 2-NDFL. Overpayment in the amount of 2,600 rubles. it will be counted against future payments to the budget.

The employer forgave the debt

It is possible that the employee will refuse to pay off the debts, and the company will not go to court. If the debt arose due to an unpaid advance, then the debit balance on account 70 will remain until the accountant writes it off. If the reason for the debt is overspending on vacation, then the accountant must reverse the entry made when accruing vacation pay and cancel the corresponding expenses in tax accounting. As a result, a debit balance is formed on account 70, which will remain until written off.

At the same time, the contributions that were transferred to the Pension Fund, the Social Insurance Fund and the Compulsory Medical Insurance Fund from the amount of vacation pay are legally paid. As a result, no adjustments need to be made.

Personal income tax on the amount of vacation pay is withheld and transferred to the budget on a reasonable basis, so adjustments are not required here either. And in the case of an unearned advance, the employee received income, but the company did not have time to withhold personal income tax. Therefore, the accountant must inform the inspectorate about the impossibility of withholding tax (clause 5 of Article 226 of the Tax Code of the Russian Federation). To do this, you must submit a certificate in form 2-NDFL with sign “2”. But this should not be done immediately, but only after the debt has been written off.

The debt should be written off after the expiration of the limitation period, which is three years (Article 196 of the Civil Code of the Russian Federation). In accounting, in this case, an entry is made to the debit of account 91 and the credit of account 70. But the issue of reflecting the situation in tax accounting is controversial. Clause 2 of Article 266 of the Tax Code of the Russian Federation allows you to classify “receivables” with an expired statute of limitations as losses and include them in non-operating expenses. But the Ministry of Finance of Russia, in a letter dated December 10, 2009 No. 03-03-06/1/799, spoke out against such expenses (see “The Ministry of Finance is against writing off salary receivables for unworked vacation days”). True, the officials’ conclusions relate to a situation where the company, when dismissing an employee, did not cancel expenses for unworked vacation in tax accounting. From this we can conclude that if these costs are canceled, then at the end of the limitation period, the accountant has the right to generate losses.

We make deductions when vacation is interrupted

If an employee is recalled from vacation, then he also needs to recalculate vacation payments. From the first day of work, the employee is paid a salary. But previously paid vacation pay for the days of recall from vacation must be reversed.

Another non-standard situation is incapacity for work during vacation. In this case, the employee has a choice:

- extend vacation for sick days;

- ask the employer to reschedule the vacation to another time.

In the first case, no corrections need to be made. And in the second, vacation pay will be recalculated. It is necessary to withhold payments for vacation during illness. And at the same time, accrue temporary disability benefits.

What are the dangers of making an incorrect calculation upon dismissal?

Mistakes made in any direction when making payments to employees are dangerous for the employer.

Understating payments to employees is, first of all, a violation of labor laws. Moreover, in such a situation, there is an underpayment of personal income tax and insurance premiums.

Employer's liability for underpayment of wages

Overpayment, in addition to unnecessary expenses for the organization, also entails tax consequences. At the same time, income tax and other similar taxes (USN, Unified Agricultural Tax) are underestimated.

Consequently, in both cases, penalties and interest arise.