Employment without registration is a common phenomenon, however, most workers are not fully aware of all the consequences of unofficial work. As a rule, an employment contract is not drawn up at the initiative of the employer, who is thus trying to reduce his tax expenses.

But it is important to know that the labor rights of an employee who has not been officially hired are practically not protected by law. For example, it is easy to fire such an employee or delay his wages for a long period of time. What to do if the employer does not pay wages and the employee does not have an employment contract?

Worked without registration: features and consequences

Not all workers agree with the opinion that working without an employment contract is bad. We can say that in this way the employee saves his money without paying taxes, contributions to pension and medical funds. But you shouldn’t delude yourself with just such advantages: there are also very significant disadvantages in working without registration.

What are the consequences for an employee who was employed without a contract and receives a salary “in an envelope”:

- Lack of security for the future: the employee does not have official work experience, savings for a future pension, or health insurance;

- Financial insecurity: the employer may leave an unregistered employee without leave and the payments due to him, deprive him of bonuses or not pay wages at all;

- Job instability: An unemployed person can easily be fired, furloughed, or forced to work overtime.

The disadvantages described are the most common ones during employment without official registration. We can say that an employee who does not have an employment contract is practically defenseless before the employer.

Articles on the topic (click to view)

- What to do if the employer does not give the employment contract

- What is the difference between a collective agreement and an employment contract?

- Apprenticeship contract with an enterprise employee: sample 2021

- Terms of remuneration in an employment contract: sample 2021

- Go on maternity leave from the labor exchange

- Notice of extension of a fixed-term employment contract: sample 2021

- Notice of termination of a fixed-term employment contract: sample 2021

One of the common causes of conflicts between employees and employers is salary, or more precisely, the procedure for its calculation and payment. Is it possible to punish the manager and oblige him to repay the wages owed if you worked without an employment contract?

Not registered at work: causes and consequences

There is one misconception among both employees and employers that informal employment makes it easy to violate the law. Remember that the manager is still responsible for his employees, and employees are also required to file income tax returns and pay payroll taxes, albeit unofficially.

For the absence of an employment contract, the legislation provides for a fine for the employer, as well as obligations to pay taxes for the salary issued “in an envelope”. But the greatest consequences will be for the employee who worked unofficially. Which ones?

Employee rights when leaving

Official employment is more preferable, and not even because it does not violate labor laws. The main advantages of having an employment contract are:

- Future pension;

- Social package and financial stability;

- Full protection of employee rights.

Do you have a question about non-payment of wages during informal employment?

Ask an experienced employment lawyer as part of FREE consultation!

But in the absence of an employment agreement, contributions to the pension and insurance funds are not paid by the employer , which means that you should not expect a good pension and insurance. In addition, an employee who worked unofficially may lose his bonus and other benefits.

What payments can an employee expect upon dismissal?

Upon final payment, the employer is obliged to pay:

- The full balance of wages for all days worked, taking into account overtime and bonuses.

- Compensation for vacation, sick leave and other benefits.

- Payment for forced dismissal in the amount of the average monthly salary.

Also, on the day of dismissal, the head of the enterprise is obliged not only to make a full settlement with the employee, but also to return to him all the necessary documents, including a work book, a certificate of income and an extract on the procedure for calculating wages.

Why don't they give the payment?

If an employee has not been paid a salary (delayed or partially paid), then this is one of the reasons for a conflict with the employer. Often, employees cannot immediately receive a full payment and are forced to beg for their earned money from management. Non-payment of wages is usually associated with several things :

- The manager’s desire to save money by deceiving the employee and not giving him a salary;

- A conflict, because of which the employer, due to resentment, decided to take revenge on the former employee;

- Lack of free money, especially if the employer is an individual entrepreneur or a small enterprise.

And if the last reason can somehow be understood, then the first two are not. Full payment on the day of dismissal is the responsibility of the employer. And even if the employee worked unofficially, he must receive his wages.

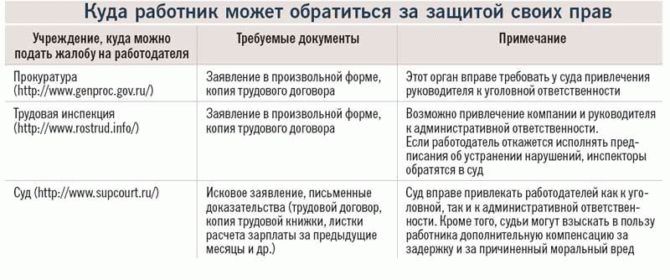

Since paying wages is the responsibility of the enterprise, you should not give up resolving the conflict with management even after dismissal. An employee has the right to contact the prosecutor's office, court or labor inspectorate and file a complaint about violation of labor laws.

No documents: what to do if they don’t give you an estimate?

An employee who is not paid a salary without an employment contract has a legal opportunity to protect his interests and receive due payment for his work. For this purpose, there are several state regulatory bodies that carry out supervision in the field of labor activity.

But before you contact, for example, the labor inspectorate or the court, it is worth talking with the employer himself , who is not paying wages. As a rule, ordinary communication about the conflict and threats to file a claim with supervisory authorities are very effective.

Instead of a regular conversation, an employee can submit a formal written complaint to his employer, which will demonstrate the fact that an attempt has been made to resolve the issue of non-payment of wages amicably. How to make such an appeal?

Pre-trial claim

In resolving any issue, the first step of the parties must necessarily be an attempt to peacefully resolve the conflict. It can be expressed in a pre-trial or claim letter. Such an appeal is made to the enterprise by a person who is not being paid a salary without an employment contract.

What should be included in the text of the claim? Please include the following information in your application :

- Place of work, date of employment and position.

- The amount of unpaid wages owed, as well as the period of delay.

- Demands for repayment of wage debts.

- Further actions of the applicant if the claim remains unanswered.

You need to write an appeal to the head of the enterprise in two copies: one will be given to the employer, and the second will remain in the hands of the applicant. Remember that you must respond to a complaint from an employee regarding delay or non-payment of wages within 10 business days from the date of receipt of the complaint.

When sending an application by mail, the response period will begin to count from the date of receipt of the letter.

In your complaint to the employer, be sure to indicate the legal norms of the Labor Code of the Russian Federation that were violated by him. For example, according to Article 22 of the Labor Code of the Russian Federation, an enterprise is obliged to pay wages on time and in full.

What to do if you worked unofficially and were not paid your salary?

When deciding what to do if you haven’t been paid, initially you just need to talk with the employer. You can write a written application in two copies with a demand to repay the debt and insist that a company representative put an acceptance mark on the copy of the employee who applied.

The effectiveness of such actions is questionable, however, they should not be neglected, since subsequently, this may become evidence of attempts to pre-trial resolve the conflict.

Expert opinion

Gusev Pavel Petrovich

Lawyer with 8 years of experience. Specialization: family law. Has experience in defense in court.

When attempts to resolve the issue peacefully have failed, and indications of violation of the law have not helped, you need to contact the regulatory authorities:

- GIT;

- Prosecutor's Office;

- Court.

Contacting the labor inspectorate does not prevent filing a complaint with the prosecutor's office or a lawsuit in court. But only a court can finally resolve a labor conflict, so if a claim has already been filed, there is no point in sending complaints to other authorities.

How to complain to the State Tax Inspectorate about non-payment of gray wages?

In order to report abuses committed against an employee to the labor inspectorate, you must make a written statement. It can be delivered in person, or sent by post with a notification; it is also permissible to compile it in your personal account on the website of the relevant branch of Rostrud.

The application must contain the following information (see sample application):

- Information about the inspection where the complaint is being filed;

- Contact information of the applicant;

- Employer information;

- Description of the circumstances of the violation committed;

- Requirements for payment of arrears of wages.

The inspectorate will accept the application and schedule an unscheduled inspection of the employer indicated in it. If the fact of evasion of wages by hired personnel is confirmed, he will be issued an order to repay debts with interest. Within 30 days from the date of registration of the appeal, the inspection must give a written response.

How to send an appeal to the prosecutor's office?

You can also complain to the prosecutor's office by submitting a written statement. It should indicate:

- The name of the body where the document is sent and the rank of prosecutor;

- Identification and contact information of the citizen whose rights have been violated;

- Employer information;

- Describe the violations committed and your requirements for debt repayment;

- Date of application and signature.

It is also necessary to attach copies of documents confirming the position stated in the appeal. The prosecutor will conduct an inspection and, if violations are identified, demand their elimination. He has the right to initiate legal proceedings against the negligent employer.

How to sue for payment of gray wages?

If all means and ways to get money earned by honest labor are unsuccessful, you need to go to court. This can be done within a year from the moment when the violation became known or should have become known (Article 392 of the Labor Code of the Russian Federation).

The statement of claim can be filed in the district court of the citizen’s choice:

- At his place of residence;

- At the location of the employer;

- At the place where work duties are performed.

There is no state fee for consideration of labor disputes.

When filing a claim, it is better to use the help of a lawyer. It must indicate:

- Name of the court;

- Plaintiff's details;

- Information about the defendant (employer);

- Describe the violations and state your demands;

- Indicate the price of the claim, if a monetary estimate is possible;

- Date of compilation and signature of the plaintiff.

It is necessary to attach evidence collected in the case that confirms the plaintiff’s position. After accepting the claim, the judge sets a preliminary hearing and then a hearing date. The court is given 2 months to make a final decision (Art.

154 Code of Civil Procedure of the Russian Federation). After it is issued, the employer has a month to appeal it, after which it enters into legal force.

Where can I go?

After receiving a claim about unpaid wages from an employee, the employer is obliged to respond to it and take action to resolve the conflict situation. However, not all managers respond to employee complaints, much less fulfill their demands. If a response has not been received or the applicant is not satisfied with it, the applicant should send a letter to the regulatory authorities.

The first authority that can help if wages are not paid without an employment contract is the labor inspectorate . There are branches in every city: you can contact a department employee directly or write an electronic complaint on the inspection website. But what if you don’t have an employment contract?

Expert opinion

Novikov Oleg Tarasovich

Legal consultant with 7 years of experience. Specializes in criminal law. Member of the Bar Association.

This means that even an unofficial employee has the opportunity to file a complaint about unpaid wages, providing government agencies with evidence of the actual performance of their duties. For example, the following can prove the fact of employment :

This is important to know: How to properly draw up a part-time employment contract

- Pay slips, accounting extracts, letters from the company to the employee.

- Working documents containing the employee’s details (invoices, invoices, statements).

- Response to a previously filed claim for unpaid wages.

If none of the specified papers is available, then witnesses can prove the fact of work activity: the employee can attract two people who can confirm that the employee was indeed unofficially employed.

In the same way you can contact the prosecutor's office if the labor inspectorate could not find violations on the part of the employer. By the way, this government agency is more effective, since law enforcement agencies have more powers. The application to the prosecutor's office is also submitted along with documents proving the fact of employment.

Review period

Note! The law requires that the circumstances specified in the complaint be verified and a response be provided within 30 days. If there are special reasons, this period may be extended for another period of time. The complainant must be notified of the extension of the period for consideration of the complaint.

The written response is sent to the address indicated by the applicant in the appeal. For emails, this is the email address; for regular letters, this is the citizen’s postal address. If the address was not specified, the complaint remains without consideration, as it is considered anonymous.

What to do if nothing helps?

Supervisory agencies are required to act on a complaint received from an employee within one month. As a rule, an audit will be carried out at a company that does not pay wages. After this, the employer will receive an order to eliminate violations, as well as a fine.

But a complaint to the labor inspectorate or prosecutor’s office does not always bring the expected result: the employer may simply not comply with the order or declare that the employee who filed the complaint has never worked for him. What to do in this case?

Filing a lawsuit against an employer

Both the employee himself and the regulatory authorities can initiate an appeal to the court if their actions were ignored by the employer. The statement of claim is filed at the place of registration of the applicant or at the location of the employer.

You can prove unofficial employment in court in the same way as when contacting the prosecutor's office or the labor inspectorate. All documents must be certified and attached to the statement of claim. How to go to court :

- We draw up a claim in which you need to indicate in detail the place and date of start of work, position, salary amount and the amount of debt for unpaid wages.

- We prepare an evidence base about employment and the procedure for paying wages. The claim must also provide an example of calculations and the amount of debt.

- Then the claim and all documents must be submitted to the court: personally to a government agency employee, by mail, or through an official representative.

The described actions are an approximate plan of exactly how to file a lawsuit against an employer who does not pay wages to an employee who does not have an employment contract. also invite two witnesses , who will confirm that the applicant was actually employed.

Such cases are considered in court within several months. As a rule, the decision will be in favor of the plaintiff: the employer will be obliged to repay the debt for unpaid wages, as well as a fine.

Where to complain

A reasonable law-abiding person should not and is not obliged to agree to informal employment relationships. Otherwise, it is easy to become a victim of an unscrupulous employer who will subsequently refuse to pay the employee.

In such situations, it is very difficult to prove that a citizen fulfilled his labor duties. If arguments are nevertheless found, this can only be done through judicial proceedings.

Officially unemployed workers, finding themselves in such situations, have the right to file a complaint with the authorized government bodies.

In case of arbitrariness of the employer, you can contact the following government authorities:

- State Labor Inspectorate;

- the prosecutor's office at the employee's place of residence or the location of the organization or individual entrepreneur;

- tax service at the location of the employer;

- court with a claim against the organization.

What to do if the employer does not pay wages and there is no contract

Expert opinion

Novikov Oleg Tarasovich

Legal consultant with 7 years of experience. Specializes in criminal law. Member of the Bar Association.

Now there is active propaganda of the need to choose an organization with “white” wages. However, there are still employers who refuse employees partial registration, when the salary is divided into the official and managerial part.

Also, a significant part of people agree to receive their salaries completely unofficially and remain socially unprotected. Sometimes employees are faced with a situation of non-payment of monetary remuneration and the question arises: what to do. Let's try to figure it out and, if possible, give advice.

How to prove debt if there is no employment contract

If the plaintiff managed to prove the existence of an employment relationship with the organization, then further proof becomes the task of the defendant. We will talk about the amounts due to the employee and the liability applied for their delay.

If the defendant proves that the citizen did not fulfill his labor duties, then the claims must be substantiated by the plaintiff. The same rule applies in cases where we are talking about an officially reduced salary.

The cases listed above are conditional. The law does not contain an exact criterion for the rightness or wrongness of the parties. However, the court always bases its decision on the evidence. The more supporting documents, the more significant the party’s position.

Please note! According to judicial practice, in such cases the following are taken into account as evidence:

- eyewitness testimony;

- documentary evidence;

- audio recordings of negotiations and video recordings;

- data from publicly available sources.

Each type of evidence deserves separate consideration.

Witness's testimonies

As a rule, if an organization has identified a case of payment of “salaries in an envelope,” then it is not an isolated case. A number of employees usually suffer from this type of violation. In court, their testimony turns out to be very important.

Also, other persons not related to this organization may be involved as witnesses. For example, these could be employees of the counterparty, employees of a nearby office. Workers in related fields can act as a person capable of confirming the performance of official duties by a person: a janitor, a cleaner, etc.

As practice shows, employees of the same company who continue to work rarely want to take legal action against the employer, so it is better to find an independent third party.

Documentary evidence

All work-related documents should be retained. These can be invoices, acts, waybills, etc.

The most advantageous option is to obtain documents that indicate the salary amount: statements, calculation sheets, time sheets and other payment documents.

Usually you can't get them on your own. But they are requested by official bodies, which citizens are advised to contact before filing a claim.

Audio recording materials and video filming

Such evidence is not always taken into account, but only if the court considers it possible to attach it to the case.

Important! For material to qualify as evidence, it must conform to a specific format:

- the entry must include a third party. It is advisable for this person to conduct the conversation with the employer. The presence of a disinterested person is important;

- the record must relate specifically to this employee and his work activity. Failure to provide such clarification may result in the defendant objecting to the subject matter of the recorded conversation or situation.

Information from publicly available sources

Here we are talking about data posted on the Internet or the media. For example, by studying job advertisements in a company, it is possible to determine the approximate salary of an unregistered employee.

Also, to consider the issue of wages, data from statistical bodies or associations of industry workers regarding the average wage in this area may be taken into account. It is also important to take into account the region for which the calculation is being made.

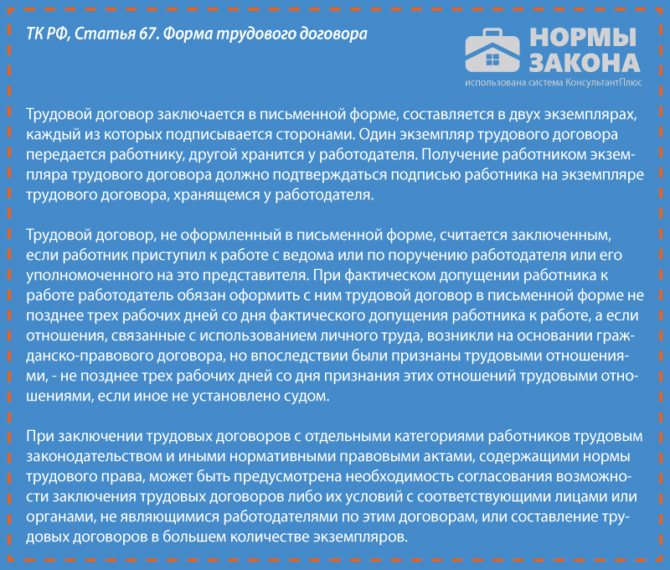

About informal employment and its consequences

In a normal situation, the organization receiving the employee enters into an employment contract with him (Article 67 of the Labor Code of the Russian Federation), which specifies the position, work schedule, and the employee’s right to leave. In addition, when an employee is faced with the fact that his salary has not been paid, he can rightfully turn to the help of the labor inspectorate or the prosecutor's office.

When an employee is hired unofficially, this actually means that no contract is signed with him, no hiring order is issued, and there are no deductions for the tax and pension fund. An entry in the work book is also not made, as a result of which the employee loses his seniority. If you don't receive money, the question arises: where to go?

In addition to non-payment of due wages upon dismissal, the employee faces the following negative consequences:

- such an employee is forced to be sick at his own expense;

- maternity leave for unemployed employees is not paid, and their job after maternity leave will also be lost;

- length of service, as mentioned above, will not be taken into account when determining the size of the pension;

- an injury at work will not be the basis for an employee to receive monetary compensation;

Positive aspects of informal employment:

- an employee without employment is free from taxes and alimony;

- there is no legal liability to the employer;

- financial liability to the organization is difficult to prove (an employer is unlikely to sue an unofficial employee);

- unofficial remuneration often exceeds the average market offer.

Signing an employment contract is the responsibility of the organization’s management.

If a violation of labor legislation is detected, the employer may be fined and its activities suspended (Article 5.27 of the Administrative Code).

In addition, for such a violation, the manager faces criminal liability (Article 199.1 of the Criminal Code of the Russian Federation) - imprisonment for up to two years.

Consequences of working without an employment contract.

Unofficial work has pros and cons, which we will discuss later.

As I already said, informal employment can entail a lot of negative consequences for the employee:

- First of all, the employer may not pay for maternity or sick leave; you may also be left without bonuses, various allowances and additional payments.

- In addition, the employer may well not pay you for overtime, delay your salary, or even leave you without any money earned.

- Your salary and length of service in such a job will not be taken into account when calculating your pension.

- If you are injured at work, your employer may leave you without financial compensation.

The positive aspects include the following:

- You save on taxes.

- You will not be deducted for alimony payments.

- You are not legally responsible for your actions.

- Perhaps your unofficial salary is higher than the salary in an official position.

As we see, there are more disadvantages to informal employment than advantages, so each of you must weigh the pros and cons and think about the possible consequences.

[ ]

What can you do if you fail to pay?

A lot of forums, if you search, are full of questions: “I work without a work book, I decided to leave, they haven’t paid me the money, what can I do?” Or these may be questions related to the fact that they do not pay money and are asked to wait.

You may receive a recommendation to forget about restoring justice, since the fact of employment lacks documentary evidence.

However, based on Art. 67 of the Labor Code of the Russian Federation, labor relations are recognized as formalized when the employee begins to perform labor functions with the knowledge of the head of the organization.

The answer to the question of where to go if wages are not paid without an employment contract can be answered: to the labor inspectorate and the prosecutor's office. Of course, this will require more strength and patience from you than if the employment relationship were secured by a contract. When a person worked unofficially, it is necessary to prove his actual cooperation with this employer.

By showing persistence, you can achieve a prosecutorial inspection and a labor inspector visit to the employer. Then the manager will be held accountable and obligated to pay everything due to the employee.

This is important to know: Labor function in an employment contract: sample 2021

When it comes to massive non-payments, it makes sense to complain as a whole team by submitting a jointly drawn up statement.

How to collect evidence?

Anyone working informally needs to understand that he is obviously taking a risk by agreeing to accept such cooperation. However, it is possible to receive wages from an unscrupulous employer.

This will, of course, require witnesses who will confirm that the person worked daily at such and such an address. For proof, clients of the organization who interacted with those who were not paid their salaries can be brought in.

Documentation can be very important evidence. An employee working without an employment contract will need to painstakingly collect all available documents that bear his signature. If there is written evidence, the inspection authorities will be required to accept the complaint. The presence of a person’s signature as a representative of the organization is strong evidence of his actual work in the organization.

It would be ideal if in some documents you find how much your earnings are - in this case it will be easy to establish what the amount of unpaid funds is.

So, we can conclude: if an unemployed employee has not been paid money, then there are ways to restore justice, but it will be more difficult to collect the evidence base.

Contacting the tax office

Unofficial employment of workers means that the organization does not make mandatory contributions to the budget and does not properly fulfill the obligations of the tax agent.

An employee’s appeal can become the basis for a tax audit.

If she confirms the existence of evasion from contributing the required amounts to the budget, the employer will have to pay a fine. It is equal to 20% of the amount unlawfully withheld.

However, in this case the applicant himself also risks. After all, he received income, but did not pay taxes, although the law allows for such a possibility.

Therefore, it is important to know that the citizen taxpayer in this case may also be held liable.

Didn't pay salary without agreement where to go

In the labor market, it is customary to distinguish between “white”, “gray” and, finally, “black” wages. The specific type of income depends on the degree of legality of the process.

“White salary” is the official income of an employee, from which taxes, social contributions and other payments provided for by labor legislation are deducted. The work takes place on the basis of a legitimate employment contract.

“Gray salary” also implies drawing up an agreement, but the employer hides the real amount of the subordinate’s income (it is negotiated orally). This is done to save on taxes.

At the same time, “black wages” are paid without formalizing the employment relationship. Money is given to workers directly in their hands (usually in an envelope).

How to write a statement of claim

The absence of a formalized employment contract is often perceived by the employer as a reason to withhold wages.

If nothing can be done peacefully, you will have to resort to legal proceedings. You need to contact the district court corresponding to the location of the employer.

If an organization has branches with different addresses, the claim is filed in court at the location of the parent organization.

Note! The statement of claim must include the following information:

- name of the court;

- information about the plaintiff and defendant;

- the cost of the claim - the amount of wages that remained unpaid;

- a statement of the circumstances of employment (date, position, salary) and calculation of debt;

- circumstances of attempts made to resolve the dispute peacefully.

It is important to know: the price of the claim declared by the employee may also include compensation calculated in accordance with Art. 236 of the Labor Code of the Russian Federation in the amount of 1/300 of the refinancing rate per day. It is also possible to add compensation for moral damage here.

Claims in this category do not require payment of a state fee (Article 333.36 of the Tax Code of the Russian Federation).

What to do if the employer does not pay wages and there is no contract?

But, before contacting the tax authority, the employee must take into account that by agreeing to work unofficially, he himself is breaking the law and evading taxes - and therefore he can also be held accountable. In order to avoid penalties, the employee can pay the taxes due on his own. Amount of wages The most difficult thing to prove in unofficial employment is not the very fact of the existence of an employment relationship between the parties, but the level of wages - after all, unofficial wages are mainly issued in an envelope.

In this case, the employee will need to provide receipts or other documents that can confirm the level of wages. In the absence of such evidence, even having established the fact of an employment relationship, collecting the debt from the employer will be very difficult, but, most often, impossible.

Probation

Practice shows that unscrupulous employers, as a rule, offer not to conclude an agreement during the probationary period. Article 70 of the Labor Code of the Russian Federation allows the establishment of a probationary period for newly hired employees.

However, it is important to know that establishing a probationary period does not prevent the conclusion of an agreement between the employee and the employer.

A person decides for himself whether to get a job under the conditions offered by the employer. You can work for a probationary period, take a closer look and find out how the organization treats its employees, whether it violates workers’ rights, and then make a final decision. True, in this case no one guarantees the subsequent employment of the employee.

Responsibility of the parties

If an employee works illegally, then disciplinary measures are provided for both parties. Income tax will have to be paid by the employee, while it is he, and not the employer, who acts as the taxpayer. Of course, without contributions to the Pension Fund, during unofficial employment, the employee will also not be accrued length of service.

It is enough to familiarize yourself with Federal Law No. 212 to understand that it is simply profitable for employers to engage in shadow business, since even if exposed, they will have to repay only 30-50% of the unpaid amounts, while law-abiding managers must pay their dues in full. Of course, if a person does not pay taxes on a regular basis, then after legal proceedings the manager may face criminal penalties.

What documents will be required

If the employee was not officially hired, it is possible to recover wages, but this is a complex and lengthy process. Usually the case requires judicial review.

To collect wages in such cases, a number of documents are required:

- a correctly drawn up statement of claim;

- a copy of the employment document (order), if any;

- calculation of wages unpaid by the employer;

- calculation of compensation amounts;

- documents confirming the existence of an employment relationship between the parties. These include eyewitness testimony, official documents signed by a citizen, printouts of work negotiations, documents on official expenses, etc.

Once again, please note that there is no fee for filing claims in this category. The law imposes legal costs on the employer.

When going to court, it is important to do so within the time limit established by law. It is equal to 1 year. A missed deadline for filing a lawsuit may be reinstated. This is permitted if there was an objective, noteworthy reason for the omission. If the court considers the reason to be insignificant, then the claim will not be considered. This means that the only way to recover the amount of wages is to contact the Labor Inspectorate.

Attention! Our qualified lawyers will assist you free of charge and around the clock on any issues. Find out more here.

The employer does not pay wages, they worked without a contract

Comments Question: Good afternoon! Please help me! I worked in a cafe, but I did not work officially, that is, without an employment contract. When I applied for my hard-earned wages, I was refused. Tell me, please, what to do if they don’t pay wages and there is no contract? The employer refuses outright!

Where can I go? Thank you! Answer: Good afternoon, V.! In your case, if there is no employment contract (or civil contract), you need to provide other evidence that you worked in this cafe (witnesses, your signature in the employer’s documents), and refer to Part 1 of Article 61 Labor Code of the Russian Federation, according to which the employment contract will not need to be submitted to the court or other body, since in such cases it comes into force from the moment you are actually admitted to work with the knowledge or on behalf of the employer or his representative.

Application to the Prosecutor's Office

The prosecutor's office monitors compliance with the law in all spheres of public life.

Its competence includes a full-scale verification of the legality of the organization’s actions.

All cases of illegal refusal to register workers and non-payment of wages will be identified.

Thus, an evidence base is collected and the perpetrators are brought to justice.

But the Prosecutor’s Office does not have the right to collect unpaid amounts in favor of the employee, so the injured employee will still have to go to court in the future.

When contacting the Prosecutor's Office, it is important to remember that the period for filing a complaint is 3 months from the date of violation of rights.

Where to go for help

Expert opinion

Novikov Oleg Tarasovich

Legal consultant with 7 years of experience. Specializes in criminal law. Member of the Bar Association.

If at work they do not pay menial wages, while a person works unofficially, then you need, first of all, to complain about the very fact of the absence of an employment contract, and then about the fact of non-payment of wages.

Concluding an employment contract is the responsibility of the employer.

According to labor law, this document must be drawn up in writing and reflect all the conditions of the employment relationship.

If the contract is not drawn up in writing, it is considered concluded from the moment the employee returns to work or is allowed to perform official duties.

This norm is enshrined in Art. 67 Labor Code of the Russian Federation.

This is important to know: Work under a contract without a work book for pensioners

The employment contract must be drawn up within three days from the date the employee actually starts work. If this does not happen, the employer’s actions can be appealed to the state labor inspectorate or the prosecutor’s office.

Responsibility for the employer in case of delay in payment.

The very fact of the absence of an employment contract entails administrative liability:

In case of repeated violation, the sanctions become more severe. In addition, the appeal must indicate the fact of delayed wages, the amount of debt and provide evidence of the existence of an employment relationship and the amount of the assigned salary.

If wages are not paid for two months (in case of complete non-payment) or three months (in case of partial non-payment), it is possible to contact law enforcement agencies with a statement to initiate a criminal case.

Sometimes a surprise audit reveals multiple violations, and evidence is discovered during these audits. It could be:

- black accounting;

- availability of statements according to which actual wages were issued “in envelopes”;

- explanations from other employees and responsible persons.

Contacting regulatory and inspection authorities is a good move, but there is no need to limit yourself to them. No one is immune from carrying out a formal inspection and receiving a written statement based on its results.

The employer may also hide the offenses very carefully, and it will simply not be possible to find evidence. In this case, you should go further and contact the judicial authorities.

If the salary paid in black money is delayed or not paid at all, you should not skip the labor inspection; first of all, you need to contact the State Labor Inspectorate.

Before going to court, it is advisable to have a response from this body available. It is better to duplicate your actions to protect rights by independently collecting evidence.

Let's summarize. It is possible to punish an employer for non-payment of wages even if the employment is unofficial.

What to do if a combination of the following factors is present: lack of an employment contract and official employment, non-payment of unpaid wages:

- Submit an application to the labor inspectorate stating that you are not officially satisfied with the job, that your salary is paid “in envelopes”, and that, moreover, delays are allowed.

- If the response from the State Tax Inspectorate is unsatisfactory, file a claim in court.

- In parallel with these actions, collect evidence that labor relations exist.

The burden of proof regarding the payment of wages generally lies with the employer. If the fact of an employment relationship is established, the defendant must provide payment documents signed by the plaintiff.

Expert opinion

Novikov Oleg Tarasovich

Legal consultant with 7 years of experience. Specializes in criminal law. Member of the Bar Association.

There is no exact list of evidence on which the court will have to make a decision. The following rule applies: the more massive the evidence base, the better.

In judicial practice, decisions were made based on:

- witness statements;

- collected documents;

- audio-video recordings;

- information from open sources;

Let's take a closer look at each possibility.

If, after dismissal, an employee is not paid “black wages,” he can contact the following authorities:

- the prosecutor's office;

- tax office;

- State Labor Inspectorate;

- local police department.

Complaint to the Labor Inspectorate

The Labor Inspectorate monitors compliance with the rights of working citizens even in the absence of the necessary documents relating to employment.

According to Art. 360 of the Labor Code of the Russian Federation, rights are protected as follows. The citizen’s appeal is accepted for processing by an inspector who will establish the circumstances of the incident.

If the citizen so desires, his name may not be disclosed. Then the organization will not know who exactly filed the complaint. Unlike the court, the period for filing an appeal is not limited by law. This is the main advantage of resolving a dispute in this way.

The general period for making a decision and notifying the applicant about it is 30 days. If circumstances require it, it may be extended for the same period.

Please note! In addition to written complaints, you can contact the Inspectorate by calling 8-800-707-88-41. The appeal can also be submitted in the format of an electronic message to the following address:

How to get money if you worked without an employment contract

Financial liability of the employer for delay in payment of wages and other payments due to the employee If the employer violates the established deadline for payment of wages, vacation pay, dismissal payments and (or) other payments due to the employee, the employer is obliged to pay them with interest (monetary compensation ) in an amount of not less than one three hundredth of the refinancing rate of the Central Bank of the Russian Federation in force at that time from amounts not paid on time for each day of delay starting from the next day after the established payment deadline up to and including the day of actual settlement.

If an agreement cannot be reached, then the Employee can submit Applications (2 copies each) to the State Labor Inspectorate, the Federal Tax Service Inspectorate (tax), the Prosecutor's Office, but it is better to go straight to the District Court (not subject to state duty) with a Statement of Claim (3 copies), from The Prosecutor's Office and the State Labor Inspectorate are usually of little use.

For information: Article 16 of the Labor Code of the Russian Federation. Grounds for the emergence of labor relations Labor relations arise between an employee and an employer on the basis of an employment contract concluded by them in accordance with this Code.

What it is

The concept of “unofficial employment” does not exist in the legislation of the Russian Federation. The Labor Code of the Russian Federation does not provide for legal relations that are not sealed by an agreement between the employee and the employer; therefore, the only correct formalization of such relations is considered to be the conclusion of an employment contract. In other cases, the employee is deprived of his rights.

Important! In accordance with Article 67 of the Labor Code of the Russian Federation, an employment contract must be drawn up no later than three days from the date the employee begins to perform his work duties.

The concept of informal employment is applied in cases where the relationship between an employee and his employer has not been formalized within the period established by law.

Typically, such relationships arise in the following cases:

- the employee is involved outside the staffing table;

- relations with the employee are formalized through the conclusion of a civil contract;

- the citizen performs the duties of a fictitiously employed employee.

Labor relations are not recognized as informal if the employer makes mandatory payments from the employee’s income. Such legal relations are always formalized legally.

Timeframe for making a decision

- Try to reach an agreement with the employer, ask what to do to pay wages, threaten to sue.

- Insist on official employment, the registration of which will be carried out in accordance with the provisions of the Labor Code of the Russian Federation. During a conversation, you are allowed to use a voice recorder in order to later provide the audio recording as one of the evidence in court.

- Proceed to contact the supervisory authorities.

The court has a maximum of 1 calendar month to make a decision. If it is confirmed that the enterprise is unofficially conducting double accounting, a request is submitted to the Federal Service of Russia to block the debtor's accounts until wages are paid.

An executive document that was received on the basis of a court decision can be taken to a financial organization if the bank where the manager’s account was opened is known. If the required amount of funds is available, their transfer takes place within three days.

Appeal to a judicial authority

Unfortunately, sometimes seeking out-of-court protection of rights does not produce results. What to do in this case? Is it worth filing a lawsuit if there is no employment contract? Many citizens consider this a losing cause, but this is not the case.

Judicial review requires the citizen to take the following actions:

- file a claim;

- collect all possible documents confirming the existence of an employment relationship and non-payment of wages;

- obtain a court decision.

The court's decision is binding. If, even if it exists, the organization does not pay the employee the amounts due, bailiffs begin to enforce the decision.

Judgment deadlines

The court decision must be executed no later than 1 month. If this period has expired and the employee has still not received the amounts due to him, the writ of execution can be handed over to the bailiffs. Next, in the course of enforcement proceedings, information about the company’s accounts will be requested from the tax authority, and they will be seized. The arrest will last until the debt is repaid by the court decision.

If the employee knows in which bank the debtor has an account, he can submit the writ of execution directly there. Then the credit institution will transfer the amount within 3 days from the moment it appears in the account. If such information is unknown, or the debtor has several accounts in different banks, it is better not to risk it and transfer the case to bailiffs.