16.06.2019

0

366

7 min.

Russian legislation provides for a range of measures to support young parents. Some of them are recorded in the Labor Code. Article 256 of the Labor Code of the Russian Federation outlines the rules for granting parental leave, as well as aspects related to the payment of benefits.

Is maternity leave considered maternity leave?

Parental leave must be distinguished from maternity leave, which is leave granted in connection with pregnancy and childbirth (Article 255 of the Labor Code of the Russian Federation) and issued with sick leave. Its name goes back to the decree “On Maternity Benefits” issued in 1917 in Russia.

Maternity leave is mandatory and is given only to the mother. Leave to care for a child up to 1.5 years old (Article 256 of the Labor Code of the Russian Federation) is taken at will, can be used in parts, be provided not only to the mother, but also to other persons actually caring for the child, and allows for the possibility of continuing (resuming) work during it on a part-time basis.

Expert advice will help you arrange parental leave wisely. Get free trial access to ConsultantPlus and go to the material.

Can going on maternity leave without authorization lead to dismissal?

Obtaining parental leave depends only on the desire of the child’s mother to take it, expressed in the application. The employer does not have the opportunity not to provide such leave. So, having written the necessary application, a woman can go on vacation without waiting for the employer’s decision. Even if the latter is not satisfied with this situation, he will not be able to fire the employee for absenteeism (decision of the Moscow City Court dated November 12, 2012 in case No. 11-6805).

For more information on how to fill out an application for parental leave, read the article “Application for parental leave - form and sample” .

If the corresponding leave is taken not by the mother, but by the father or another person, simultaneously with the application, the employer must submit a document confirming that the child’s mother (or both parents, if it is not the parent who takes the leave) is either working (and such leave has not been issued at work), or is unemployed. A person who has taken out such leave is fully covered by all the guarantees provided by Article 256 of the Labor Code of the Russian Federation:

- maintaining his job;

- the ability to use vacation in parts;

- receiving care benefits;

- the opportunity to resume work on a part-time basis while maintaining benefits;

Read about how the working day must be reduced in order for benefits to be maintained here.

- accounting for vacation time in the length of service.

Working while on vacation

No one can prohibit a mother from working after the birth of her baby; she has the right to leave, but not the obligation to take it. Many women, out of the need to have more money or out of fear of losing a good job after giving birth, go back to work.

It is impossible to say unequivocally whether this is good or bad, since it all depends on the specific situation. In some families, both fathers, older generations, or even adult siblings provide excellent care for the baby.

So, both parents can work immediately after the birth of the baby, however, they will then receive less of part of the government payments. How you can maintain benefits and earn additional income is written below.

Right to keep your job

One of the important aspects is that an employee who goes on maternity leave retains his or her job. That is, after a vacation, a person returns to his same position, with the same salary.

Dismissal of pregnant women or those on maternity leave is permissible only in the event of liquidation of the enterprise. If during the rest period the workplace occupied by the employee was abolished, then management is obliged to provide an alternative. Work in another place must correspond to the level of qualifications and professional skills of the employee.

Allowance and additional income: is it possible to combine?

According to the Labor Code, the payment of benefits is a measure aimed at supporting the family due to a decrease in income. That is, previously both spouses could work, but now only one, despite the fact that there are more people. If a woman decides to go to work, then her income is restored, which means she does not need additional help. Thus, when returning to work, maternity leave is interrupted and benefits are canceled.

Changes are recorded through several documents: a request for early return to work and an order to begin activities. Management has the right to refuse employment ahead of time, based on the availability of a new employee for a given position.

There are several ways to maintain government assistance and at the same time receive the income specified in Art. 256 Labor Code:

- Part-time work at the main place. If an employee agrees on partial employment, she will not lose the right to social privileges, but will receive additional money. Part-time work is a shift of less than eight hours. For some professions, for example, for teachers, it is calculated not according to time, but according to workload.

- Unofficial placement with another employer. If the information is not recorded anywhere, then it is impossible to track that the girl is working. In case of such employment, the state payment will be provided in full.

- Working from home or remote work. These options are largely related to unregistered self-employment, when a girl performs some tasks and receives income from it. As examples, we note the work of private accountants, designers, as well as handmade or cooking.

Attention! The only 100% legal way to receive both benefits and wages is to work part-time at your main job. All other options are used in practice, but are often not completely legal, since they do not always pay taxes and contributions to the Pension Fund.

What benefits are paid during parental leave in 2020–2021?

For a person who has taken leave to care for a child, Article 256 of the Labor Code of the Russian Federation secures the right to receive benefits at work related to this leave. Including benefits are paid in case of part-time work. Moreover, it does not matter where the employee continues to work under such conditions: where he is paid benefits, or in another place.

The types and amounts of benefits provided for in Article 256 of the Labor Code of the Russian Federation (with comments for 2020–2021) are as follows:

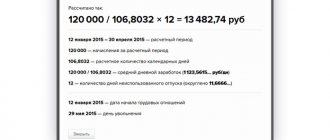

- Monthly allowance for child care up to 1.5 years (Article 14 of the Law “On State Benefits for Citizens with Children” dated May 19, 1995 No. 81-FZ). It is estimated as 40% of the employee’s average earnings determined for the 2 years preceding the vacation. However, there is an upper limit to its size, defined as the sum of the maximum values from which contributions to the Social Insurance Fund were paid in each accounting year, divided by 730 (clause 3.3 of Article 14 of the Law “On Compulsory Social Insurance in Case of Temporary Disability and in Connection with Maternity " dated December 29, 2006 No. 255-FZ), as well as the minimum benefit amount.

What are the maximum and minimum benefits in 2021, see ConsultantPlus. Trial access to this and other system materials can be obtained free of charge.

In case of interruption of vacation and return to work full-time, payment of benefits is terminated (letter of the Ministry of Labor of the Russian Federation dated May 16, 2013 No. 13-7/3030623-2831).

- Monthly compensation in the amount of 50 rubles. (Decree of the President of the Russian Federation dated May 30, 1994 No. 1110), paid until the child reaches 3 years of age and calculated taking into account the regional coefficient (Decree of the Government of the Russian Federation dated November 3, 1994 No. 1206).

Important! From 2021, compensation is 50 rubles. for child care under 3 years old has been cancelled. It must continue to be paid only for children born before 12/31/2019 inclusive (Presidential Decree No. 570 dated 11/25/2019).

- Additional payments established by regional laws, made at least once a quarter (Article 16 of Law No. 81-FZ).

Thus, parental leave provided for in Art. 256 of the Labor Code of the Russian Federation, taking into account comments regarding the timing of payment of benefits during it, is divided into 2 parts:

- up to 1.5 years, for which payment of all types of established benefits is mandatory, including monthly care allowance;

- from 1.5 to 3 years, during which care allowance is not paid, but compensation established by Decree No. 1110 continues to be paid (for children born before 2021), as well as additional payments established in the region (if the corresponding regional legislative act).

An exception is the care allowance paid to citizens affected by radiation during the Chernobyl disaster. For them, it is set at double the amount and is paid until the child turns 3 years old (Decree of the Government of the Russian Federation dated July 16, 2005 No. 439, order of the Ministry of Health and Social Development of the Russian Federation dated December 1, 2008 No. 692n).

Read more about how child benefits are assigned here .

Commentary on Article 256 of the Labor Code of the Russian Federation

1. A woman commented on in this article who has a child under three years of age is given the right to receive leave to care for him. Such leave is granted at the request of the woman in full or in parts within the established period and is formalized by order or instruction of the employer.

At any time, a woman has the right to interrupt her vacation and go to work. To do this, she must submit an application. A woman’s return to work is formalized by an order (instruction) of the employer. If her employer refuses to provide her with her previous job, she has the right to file a claim in court.

In accordance with Part 2 of the commented article, parental leave can also be used by the child’s father, grandmother, grandfather, other relative or guardian who is actually caring for the child. These persons have the same rights as mothers on parental leave. In particular, the specified leave can be used by them in full or in parts. During the period of parental leave, they retain their place of work (position). Resolution of the Plenum of the Armed Forces of the Russian Federation dated January 28, 2014 N 1 draws attention to the fact that the possibility of granting parental leave to a father, grandmother, grandfather, other relatives or guardian does not depend on the degree of relationship and cohabitation of these persons with the parents (parent) of the child . When resolving a dispute about the refusal to grant parental leave to a father, grandfather (grandmother) or other person until the child reaches the age of three, the court must check whether this person is actually caring for the child and whether this leave has been granted to the child’s mother (clause 19).

2. During the period of parental leave, persons providing such care are provided with benefits, the procedure and terms of payment of which are determined by federal laws.

In accordance with the Law on Compulsory Social Insurance in Case of Temporary Disability and in Connection with Maternity, a monthly child care benefit is paid to insured persons (mother, father, other relatives, guardians) who actually care for the child and are on parental leave , from the date of granting parental leave until the child reaches the age of one and a half years (Article 11.1).

The monthly child care benefit is paid in the amount of 40% of the average earnings of the insured person, but not less than the minimum amount of this benefit established by the Law on Benefits for Citizens with Children (Article 11.2). At the same time, the minimum amount of the benefit is indexed by the federal law on the federal budget for the corresponding financial year and for the planning period based on the forecast level of inflation, and from 01/01/2014 it amounts to 2576.63 rubles. for caring for the first child and 5153.24 rubles. for caring for the second child and subsequent children.

In the case of caring for two or more children before they reach the age of one and a half years, the amount of the monthly benefit is summed up. In this case, the summed amount of the benefit cannot exceed 100% of the average earnings determined for calculating the benefit, and be less than the summed minimum amount of this benefit.

According to Art. 14 of the Law on compulsory social insurance in case of temporary disability and in connection with maternity, the monthly child care benefit is calculated from the average earnings of the insured person, which is determined by multiplying the average daily earnings determined in accordance with this article (parts 3.1 and 3.2 ), at 30.4 (part 5.1 of article 14). In this case, the average earnings, on the basis of which the monthly child care allowance is calculated, is taken into account for each calendar year in an amount not exceeding that established in accordance with the Federal Law “On Insurance Contributions to the Pension Fund of the Russian Federation, the Social Insurance Fund of the Russian Federation, the Federal Fund compulsory medical insurance" for the corresponding calendar year, the maximum value of the base for calculating insurance contributions to the Social Insurance Fund of the Russian Federation.

A monthly child care allowance is assigned if the application is made no later than six months from the date the child reaches the age of one and a half years. When applying for a monthly child care benefit after a six-month period, the decision to assign a benefit is made by the territorial body of the insurer if there are good reasons for missing the deadline for applying for benefits. The list of valid reasons for missing the deadline for applying for child care benefits was approved by Order of the Ministry of Health and Social Development of Russia dated January 31, 2007 N 74.

The right to a monthly child care allowance is granted not only to persons subject to compulsory social insurance in case of temporary disability and in connection with maternity, but also to other persons listed in Art. 13 of the Law on benefits for citizens with children caring for a child. In particular, mothers who are dismissed during pregnancy due to the liquidation of organizations, termination of activities by individuals as individual entrepreneurs, termination of powers by notaries engaged in private practice, and termination of the status of a lawyer, full-time students have the right to a monthly child care allowance education in educational institutions, other relatives who actually care for the child and are not subject to compulsory social insurance in case of temporary disability and in connection with maternity, if the mother and (or) father died, were declared dead, were deprived of parental rights, were limited in parental rights, are recognized as missing, incompetent (partially incompetent), for health reasons they cannot personally raise and support a child, are serving their sentences in institutions that carry out a sentence of imprisonment, etc. (paragraph 6 - 8, part 1, art. 13). In accordance with paragraph. 2 hours 1 tbsp. 15 of the Law on Benefits for Citizens with Children, payment to such persons of a monthly child care allowance is made in the minimum amount, which from 01/01/2014 is 2576.63 rubles. for caring for the first child and 5153.24 rubles. for caring for the second child and subsequent children.

Provision par. 2 hours 1 tbsp. 15 of the Law on Benefits for Citizens with Children, according to which a monthly child care allowance is paid in the minimum amount to the persons specified in paragraph. 6 - 8 hours 1 tbsp. 13 of this Law, including mothers dismissed during maternity leave in connection with the liquidation of organizations, was the subject of consideration by the Constitutional Court of the Russian Federation. In the Determination of the Constitutional Court of the Russian Federation dated January 27, 2011 N 179-O-P in the case of the complaint of citizen M.N. Syroegina. for violation of her constitutional rights, paragraph. 2 hours 1 tbsp. 15 of the Federal Law “On State Benefits for Citizens with Children” sets out the Court’s conclusion that the differentiation of the procedure for determining the amount of monthly child care benefits provided to mothers dismissed due to the liquidation of organizations during the period of maternity leave after the birth of a child, and mothers dismissed on the same grounds during the period of parental leave, leads to differences in the exercise of their right to social security that are not consistent with the constitutional principle of equality, and therefore cannot be considered reasonable and justified. In this regard, the legislator is instructed to eliminate unjustified differences in the amount of monthly child care benefits for mothers dismissed due to the liquidation of organizations during maternity leave after the birth of a child, and mothers dismissed on the same basis during parental leave for the child, establishing for them uniform rules for calculating the specified benefit. If maternity leave occurs while the mother is on maternity leave, she is given the right to choose one of two types of benefits paid during the periods of the corresponding leave.

Mothers entitled to maternity benefits, during the period after childbirth, have the right, from the day of birth of the child, to receive either a maternity benefit or a monthly child care benefit with credit for the previously paid maternity benefit if the amount of the benefit is for child care is higher than the amount of maternity benefits (Article 13 of the Law on Benefits for Citizens with Children).

In districts and localities in which regional coefficients are applied to wages in accordance with the established procedure, the minimum and maximum amounts of the specified benefit are determined taking into account these coefficients (Article 15 of the Law on Benefits for Citizens with Children).

The rules for the appointment and payment of a lump sum benefit at the birth of a child and a monthly child care benefit are established in Section. IV and VI Procedures and conditions for the appointment and payment of state benefits to citizens with children, approved. By Order of the Ministry of Health and Social Development of Russia dated December 23, 2009 N 1012n.

3. State authorities of the constituent entities of the Russian Federation, in accordance with the laws of the constituent entities of the Russian Federation, can increase the amounts of state benefits established by the specified Federal Law at the expense of the budgets of the constituent entities of the Russian Federation (Article 17.3 of the Law on Benefits for Citizens with Children).

4. Persons on parental leave to care for a child under three years of age, in accordance with Decree of the President of the Russian Federation of May 30, 1994 N 1110 “On the amount of compensation payments to certain categories of citizens,” are paid monetary compensation in the amount of 50 rubles.

The conditions for the appointment, payments and sources of financing of monthly compensation payments established by Decree of the President of the Russian Federation of May 30, 1994 N 1110 “On increasing the amount of compensation payments to certain categories of citizens” are determined by the Procedure for the appointment and payment of monthly compensation payments to certain categories of citizens, approved. Decree of the Government of the Russian Federation of November 3, 1994 N 1206 “On approval of the Procedure for the appointment and payment of monthly compensation payments to certain categories of citizens.”

Such monthly compensation payments are assigned and paid to those on parental leave until the child reaches the age of three: mothers (father, adoptive parent, guardian, grandmother, grandfather, other relative actually caring for the child) who are in an employment relationship with organizations regardless of their organizational and legal forms; mothers undergoing military service under contract, serving as privates and commanding officers in internal affairs bodies; mothers undergoing military service under a contract, and mothers from civilian personnel of military formations of the Russian Federation located on the territory of foreign states, in cases provided for by international treaties of the Russian Federation; unemployed women dismissed due to the liquidation of an organization, if they were on maternity leave at the time of dismissal and do not receive unemployment benefits.

For persons working, serving, or living in areas where regional wage coefficients are established, the amount of monthly compensation payments is determined using these coefficients, regardless of the place of actual stay of the recipient during the period of parental leave.

5. For certain categories of persons, the law establishes a higher amount of child care benefits. Thus, persons exposed to radiation as a result of the disaster at the Chernobyl nuclear power plant, permanently residing (working) in the territory of a residence zone with the right to resettlement, in the territory of a residence zone with a preferential socio-economic status, in a resettlement zone before their resettlement to other areas, are guaranteed a monthly double child care allowance until the child reaches the age of three (Clause 7, Part 1, Article 18, Part 1, Article 19, Article 20 of the Chernobyl Law). Moreover, in the case of caring for two or more children, the amount of the monthly child care benefit is summed up. The summed amount of this benefit in the case of caring for two or more children cannot exceed 100% of the earnings (income) from which this benefit was calculated, but cannot be lower than the summed double minimum amount established by the Federal Law “On State Benefits for Citizens with Children.” monthly child care allowance.

This benefit also applies to citizens living in settlements exposed to radioactive contamination as a result of the accident in 1957 at the Mayak production association and the discharge of radioactive waste into the Techa River, where the average annual effective radiation dose is currently over 1 mSv (0. 1 rem) (additionally above the level of natural background radiation for a given area) (clause 4 of article 1 and article 7 of the Law on the accident at PA Mayak).

The procedure for assigning and paying this benefit is determined by the Rules for the payment of a monthly child care benefit in double the amount until the child reaches the age of three to citizens exposed to radiation as a result of the disaster at the Chernobyl nuclear power plant, approved. Decree of the Government of the Russian Federation dated July 16, 2005 N 439, and clarified by Order of the Ministry of Health and Social Development of Russia dated December 1, 2008 N 692n “On approval of the clarification on the procedure for assigning and paying a double monthly child care allowance until the child reaches the age of three years.”

Collective agreements (agreements) may establish higher monthly compensation payments to working women and other persons on maternity leave to care for a child under three years of age.

6. At the request of a woman (the child’s father, grandmother, grandfather, other relative or guardian), while on maternity leave, she can work part-time or at home. For part-time work, see comment. to Art. 93.

Since Part 3 of the commented article does not indicate that part-time work is possible only at the main place of work, it should be assumed that under the specified conditions it is possible to work part-time in another organization.

Persons working part-time or at home while on parental leave until the child reaches the age of one and a half years retain the right to receive a monthly benefit for the period of this leave.

If, during the period of maternity leave, a woman becomes entitled to paid study leave, she can take advantage of it by interrupting her maternity leave. The interrupted vacation can be taken back. However, it is not extended due to study leave.

7. For the period of leave to care for a child under three years of age, persons providing such care retain their place of work (position).

By Decree of the President of the Russian Federation dated May 7, 2012 N 606 “On measures to implement the demographic policy of the Russian Federation,” the Government of the Russian Federation and executive authorities of the constituent entities of the Russian Federation are ordered to take measures aimed at creating conditions for women to combine the responsibilities of raising children with employment, as well as organization of vocational training (retraining) for women on maternity leave before the child reaches the age of three.

In accordance with the Employment Law, state authorities of the constituent entities of the Russian Federation have the right to organize vocational training and additional vocational education for women during the period of parental leave until the child reaches the age of three years (clause 3 of Article 7.1-1). Vocational training and additional vocational education of women during the period of parental leave until the child reaches the age of three years are carried out in the direction of the employment service authorities, subject to the application of women of this category to these authorities. The procedure and conditions for the employment service to send women during the period of maternity leave until the child reaches the age of three years to undergo vocational training or receive additional vocational education are established by the state authorities of the constituent entities of the Russian Federation (clause 1.1 of Article 23).

Order of the Ministry of Labor of Russia dated February 18, 2013 N 64 approved Methodological recommendations for the development by executive authorities of the constituent entities of the Russian Federation of measures aimed at creating conditions for women to combine the responsibilities of raising children with employment, as well as for organizing vocational training (retraining) for women in parental leave until the child reaches the age of three.

8. The time of parental leave until the child reaches three years of age is not included in the length of service giving the right to annual paid leave (Article 121 of the Labor Code).

With what comments and reservations is Art. 256 of the Labor Code of the Russian Federation (Part 3) in 2020–2021?

Art. 256 of the Labor Code of the Russian Federation allows a person who has taken out parental leave to work part-time during the leave if there is a desire. The employer must provide such an opportunity (letter of Rostrud dated September 12, 2013 No. 697-6-1) and cannot force the employee to refuse this job.

At the same time, there are often situations when an employee cannot cope with the amount of work, makes mistakes or violates the work schedule established for him (is late or absent), that is, commits disciplinary offenses. Can disciplinary action be taken against him?

The Labor Code of the Russian Federation does not contain a ban on this. However, there are 2 opposing points of view regarding the use of dismissal as a disciplinary measure:

- it is acceptable (letter of the Ministry of Labor of the Russian Federation dated September 10, 2013 No. 14-2/3045-623-4334);

- it is illegal, because work is carried out during vacation, and it is impossible to dismiss an employee during this period (Article 81 of the Labor Code of the Russian Federation) (decision of the Primorsky Regional Court dated 05/03/2012 in case No. 33-4035).

Thus, disciplinary action in the form of dismissal during parental leave will most likely be considered illegal. Safe disciplinary measures against such employees should be considered:

- comment;

- rebuke.

It is also possible to influence labor results through deduction of bonuses in connection with the employee’s disciplinary offenses, if it is provided for by the employer’s bonus regulations.

For more information about the cases in which deduction of bonuses is associated with a disciplinary offense, read the material “What are the grounds in the Labor Code of the Russian Federation for depriving an employee of a bonus?” .

In what cases can an employee be fired during parental leave?

Art. 256 of the Labor Code of the Russian Federation declares the obligation to maintain a workplace for the employee during parental leave. That is, it is impossible to fire him in a normal standard situation on the initiative of the employer.

However, there are situations when dismissal due to the employer’s initiative does occur during such leave or before the child reaches the age of 3 years. These include (Article 261 of the Labor Code of the Russian Federation):

- liquidation (termination of activities) of the employer;

- termination of an employment contract concluded for a certain period;

- dismissal of an employee who has left parental leave early due to gross violations of labor discipline (for example, absenteeism, theft, disclosure of secrets, immoral acts).

However, there are no restrictions on the dismissal of an employee during this period on his own initiative. It happens as usual.

For more information about disciplinary offenses considered gross, read the article “Labor discipline and responsibility for its violation .

Women who were fired or quit during the period when they have the right to receive child care benefits for up to 1.5 years may then be:

- Employed until the end of the benefit period. Then the new employer will continue to pay him according to his own calculations.

- Not employed. Then the benefit can be received from the social security authorities. But you will have to make a choice between 2 benefits: unemployment and care (clause 40 of the order of the Ministry of Health and Social Development of Russia dated December 23, 2009 No. 1012n).

In some situations, an employee may need to resign in order to care for a child under 14 years of age. ConsultantPlus experts explained in detail how to formalize dismissal for caring for a child under 14 years of age. Get free demo access to K+ and go to the Ready Solution to find out all the details of this procedure.

Part-time employment

Some employees on maternity leave continue to perform their job duties on a part-time basis.

This allows women to maintain full benefits and receive wages. But since there is no clear definition of part-time work in the law, working conditions in such a situation depend only on the personal agreement of the employer and employee. Many specialties allow production activities to be carried out via the Internet, and therefore employers agree to this type of work process, especially if the enterprise lacks qualified personnel. A woman, devoting up to 7 hours a day to perform her job duties, is considered an employee working a part-time shift, and therefore she is not deprived of social benefits.

Even in cases where the mother is engaged in production activities and the grandmother is looking after the child, the law is not violated. Since the employee is at home with the newborn, she has the right to receive social benefits.

A woman can carry out this type of activity until the end of maternity leave . In this case, the employer is obliged to transfer her the required wages and compensation established by law. When the employee returns from maternity leave, in accordance with Part 4 of Article 256 of the Labor Code of the Russian Federation, the manager will restore her to her previous position.

As the number of professions that allow working remotely increases, this type of work is becoming increasingly popular. In addition, working from home allows a mother to fully care for her child and remain a sought-after specialist.