When is sick leave issued?

Sick leave is issued by doctors upon identification of an injury or illness. The document is valid only when it was issued in a certified medical institution approved by the FSS. After the doctor closes the certificate, the employee provides it to the employer to calculate the amount of benefits and transmits the information to the Social Insurance Fund.

The doctor will issue a certificate if:

- the employee is sick;

- the employee was injured at home or at work;

- care is required for a child no older than fifteen years;

- requires care for an adult family member;

- Rehabilitation after surgery is required;

- An employee has become pregnant and is facing childbirth or termination of pregnancy.

A physician can refuse to issue a certificate of incapacity for work only for reasons established by law. If there are obvious facts of instability of health, the doctor does not have the right to refuse to issue a sick leave to the patient. The refusal can be appealed to the head physician or regulatory authorities.

How many days does the employer pay for sick leave?

To ensure that an accountant does not make a mistake in calculating and paying sick leave benefits, you need to know how many days of sick leave are paid per year. And this period depends on whether the sick leave was due to the employee’s own illness or to care for a child/relative.

Option 1. The employee was sick himself

As a general rule, if the employee himself is ill, he is paid for absolutely all sick days during the year (Part 1, Article 6 of the Federal Law of December 29, 2006 N 255-FZ). True, there are some exceptions (Parts 2-4 of Article 6 of the Federal Law of December 29, 2006 N 255-FZ). For example, an employee recognized as disabled is paid sick leave for no more than 4 consecutive months or 5 months in a calendar year.

This is interesting: Help for young families from the state 2021

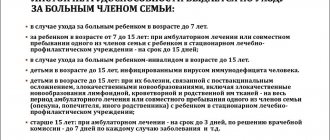

Option 2. The employee took sick leave to care for a child.

The number of paid days per year depends on the age of the child.

| Child's age | Number of paid sick days per year (clauses 1-5, part 5, article 6 of the Federal Law of December 29, 2006 N 255-FZ) |

| Up to 7 years | No more than 90 calendar days in a calendar year, if the child’s disease is included in a special list (Order of the Ministry of Health and Social Development of the Russian Federation dated February 20, 2008 N 84n) |

| No more than 60 calendar days in a calendar year for all other diseases | |

| From 7 to 15 years | No more than 45 calendar days in a calendar year. In this case, for each case of illness, payment is made for a period of up to 15 calendar days. |

| Under 18 years old | No more than 120 calendar days in a calendar year, if sick leave is issued to care for a disabled child |

| Without restrictions, if sick leave is issued for inpatient care (in a hospital) for an HIV-infected child | |

| Without restrictions, if sick leave is issued for caring for a child whose illness is associated with a post-vaccination complication, with malignant neoplasms, including malignant neoplasms of lymphoid, hematopoietic and related tissues |

Here it is important to understand that sick leave for child care must be paid, even if such sick leave was not taken by one of the child’s parents, but by another family member, for example, a grandmother. Those. What matters is not the fact of the parent-child relationship, but only the age of the sick family member for whose care a sick leave is issued.

Option 3. The employee took sick leave to care for an adult family member.

In this case, sick leave benefits are paid in total for no more than 30 calendar days of care for each family member in a calendar year (clause 6, part 5, article 6 of the Federal Law of December 29, 2006 N 255-FZ). Moreover, for each specific case of a relative’s illness (during his treatment on an outpatient basis), the benefit is paid for no more than 7 calendar days.

When is sick leave paid?

When the doctor closes the sick leave, he hands the document to the patient. He is sent to the employer for subsequent calculation and payment of compensation for the period of forced absence from the workplace. The accounting department calculates the amount of benefits and then sends the information to the Social Insurance Fund. Even when an employee is sick for three days, which are paid for by management, all documents are sent to the Social Insurance Fund. If the paper raises suspicions, the manager can check its authenticity. To do this you need:

- Send a request to the clinic or hospital where the employee underwent rehabilitation. Find out whether the institution has a doctor whose details are included in the document. The answer will come in writing.

- Call the local FSS office and check the authenticity of the document by serial number. Each form has a number consisting of numbers in random order. Each form is unique, its number is entered in the regional office of the Foundation. The regulatory authority also has information about which medical institutions received leaflets with specific numbers.

- Organize a check through friends who have access to such information or through your own security service. Contacts will help verify the employee’s illness in a short time.

The original form must be in A4 format, with the FSS watermark, a barcode in the upper right corner and a number.

There are also requirements for filling out a temporary disability certificate:

- data is entered into paper in black;

- printed font;

- no typos or errors;

- the text should be easy to read.

Minor errors and margins may be allowed.

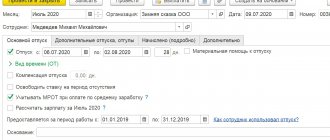

A sheet of temporary incapacity for work is drawn up both in 1C and on the FSS portal. On the Federal Tax Service website you can fill out an application for sick leave in accordance with the established form. When a document is received by an employee for a good reason, even if the employer doubts and decides to check its authenticity, benefits are still paid based on the results of the checks. If with such measures management is trying not to protect itself from fraudsters, but to find a reason not to pay compensation to employees, it will not succeed. Sick leave is always paid by the company.

Sick leave payment terms

The company's accounting department calculates the amount of benefits for the Social Insurance Fund when the employee has provided a closed and correctly completed temporary disability certificate. This must be done ten days after the employee handed over the paper to the accounting department. The money will go to the employee when the company pays salaries. If a company pays an advance on the 25th and a salary on the 10th, and a person returns to work on the 3rd, the funds should arrive in his account on the 10th. But if an employee comes back on 9 after illness, he will have to wait until the end of the month. In this situation, the employer will not break the law; compensation is paid on the days when the organization transfers wages to employees.

How sick leave benefits are paid

The company makes all calculations related to the transfer of funds for sick leave and enters this information into the employee’s disability form. The Federal Tax Service monitors how documents are filled out, and any errors may emerge during verification. It is important to fill out sick leave taking into account all the rules and requirements. Information about calculated payments is sent to the Fund, where the funds are transferred to the employer for subsequent payments to the employee. The Social Insurance Fund pays for sick days after the management of the organization; the first three days of sick pay are borne by the hirer. The only exception is maternity leave, which is paid by the state. In this case, the Social Insurance Fund will transfer the benefit to the employer, who will transfer the money to the employee’s account or transfer the entire amount in cash.

A number of nuances affect the calculation of compensation due to illness, namely:

- insurance experience;

- average employee income for the last two calendar years;

- periods not considered insurance periods;

- compliance with the hospital regime and aggravating factors, which include alcohol and other intoxication;

- duration of illness.

When it comes to workers who visit several enterprises and work part-time, benefits are paid to them on general terms. According to Order of the Ministry of Health 624 n:

Employee's insurance experience

The insurance period is the entire period of work of an employee when he was officially employed according to the Labor Code of the Russian Federation and the employer regularly made contributions to the Social Insurance Fund from his income. If the employee’s length of service is very short and has not exceeded six months, he will receive compensation in the amount of the minimum wage in the region in which he lives. For 2019, the minimum payment is 11,280 rubles. With less than five years of experience, an employee will receive 60% of the income, more than five years - 80%. And when a person has been working for a long time and his experience has exceeded eight years, he will receive 100% of the average earnings.

How many days of sick leave does the employer pay?

According to the legislation of the Russian Federation, the employer pays only the first three days of sick leave for an employee. All subsequent days are paid from the Social Insurance Fund. Also, Law No. 255-FZ stipulates the types of sick leave paid by the Fund from the first to the last day:

- Caring for a sick or disabled family member.

- Treatment in a sanatorium-resort institution.

- Staying in quarantine.

- Installation of prosthetics.

The main criteria taken into account when calculating sick leave benefits are the employee’s length of service and his average earnings. The dependence of the sick leave payment rate on the length of service is as follows:

- Up to five years of experience – 60% of the average salary.

- The patient's experience from five to eight years is 80% of earnings.

- If an employee has been working for more than 8 years, sick leave is paid at 100%.

- If the work experience is less than six months, sick leave will be paid based on the minimum wage (minimum wage) of the region.

What affects sick leave benefits?

The amount of sick leave benefits cannot be lower than the minimum wage in a particular region, therefore the smallest compensation that can be transferred to an employee is equal to the minimum wage. Benefits cannot be paid longer than the month in which the form is issued by the doctor and the year in which the medical commission was convened. Periods called non-insurance periods will affect the amount of compensation, but will not be included in the insurance period. When the hospital regime was violated, the amount of payments will be reduced to the minimum wage level. This will also affect those who have extensive experience and initially received 100% of average earnings. For example, if an employee went on sick leave on the 10th and violated the regime on the 16th, then on the 15th inclusive he will receive the required payments, and from the moment of the violation he will only receive the minimum wage.

Become an author

Become an expert

How is sick leave paid?

Calculations for issued sick leave are carried out in full accordance with the amount of the employee’s salary. What matters is the person’s length of service at their current place of work. Only a violation of the established hospital regime can reduce the amount of the due payment.

Modern labor legislation establishes special rules for payment for periods of incapacity:

- If a person has worked at one company for more than 8 years, sick leave will be compensated strictly at 100%.

- If the length of service ranges from five to a full eight years, about 80% of the required amount will be transferred.

- For less than five years of experience, the payment will be 60%.

- If a person was fired due to illness, sick leave will also be paid at the rate of 60%. The overall length of service will not matter.

Often you have to be absent from work longer than expected, for example, if a child is sick. Such absence is legal, but only the number of days indicated above will be paid.