Is it possible to issue a paycheck when leaving a day earlier?

Home / Labor Code / Payment upon dismissal before the date of dismissal Payment upon dismissal If this day was not worked (weekend, holiday) and the payment was not made on the day of dismissal, the employer must pay the due money within two working days from the receipt of the request for final payment .

If there is a disagreement about the amount of the accrued amount that the employee should receive upon dismissal, the employer, as specified in Art. 140 Under certain circumstances, it may be different, but in the event of termination of a business relationship at the initiative of an employee, it remains exactly this way. Other payments in such a situation are paid only if they are provided for in an employment contract, collective agreement or other internal documentation. This may be severance pay, bonuses and other payments. According to the information reflected in Article 77 of the Labor Code of the Russian Federation, in case of dismissal by agreement of the parties, the employee, as in the case of dismissal at his own request, receives a standard set of payments. If the termination of the contract is associated with a layoff, in addition to wages and vacation pay, specialists are entitled to severance pay, which is also commonly called compensation. The maximum duration for its accrual to the account of a dismissed employee is 3 months. In the case of seasonal specialists, this period is reduced to 2 weeks.

What are the “calculated” ones made up of?

Calculation of severance

- This is the payment of all funds due to the employee. The total amount consists of the following elements:

- Wage. Calculated using the formula: Salary / Number of shifts in a month × Number of shifts worked. Bonuses and allowances are also summed up here if they are provided for in the employment contract.

- Compensation for unused vacation. As a general rule, an employee has the right to leave after working for at least six months. But by agreement with the employer, vacation can be taken earlier. In case of dismissal, the employee has a choice: take unused vacation time or withdraw the money. To calculate, the accountant simply multiplies the average daily earnings by the number of days off.

- Severance pay. Required if the employment relationship is terminated due to optimization (staff reduction) or liquidation of the employer. The amount of compensation is the average monthly salary. You can receive such a payment for up to three months if you cannot find a job during this time. But only if registered with the employment service.

- In addition to accruals upon dismissal, certain amounts may be withheld from the employee. For example, for unworked vacation days (if the dismissal occurs before the end of the year for which the employee has already received vacation) or an advance received on salary (if it was not subsequently worked out). All this is considered the employee’s debt, which is deducted from the amount accrued upon dismissal.

Is it possible to pay in advance when dismissing an employee?

At the same time, if you pay the employee earlier, then his rights will not be infringed and he is unlikely to complain to the labor inspectorate, and in addition, there is no penalty for paying before the last day.

Federal Service for Labor and Employment

LEGAL DEPARTMENT OF THE FEDERAL SERVICE FOR LABOR AND EMPLOYMENT LETTER dated June 18, 2021 No. 863-6-1 [On the day of final settlement with an employee who has a shift work schedule, upon termination of the employment contract in the event that his last worker day falls on a weekend or non-working holiday]

Is it possible to pay a resigning employee a salary before the dismissal date?

Tax Code of the Russian Federation). Calculation of an employee upon dismissal: payment deadlines violated by the employer An employer who has violated the payment deadline upon dismissal of an employee must pay the latter compensation for delayed payments in the amount of no less than 1/150 of the Central Bank key rate in effect during the period of delay (Article 236 of the Labor Code of the Russian Federation). Compensation is calculated for each day of delay, starting from the day following the day when the employer was supposed to make payment upon dismissal, up to and including the day of actual payment. You can calculate the amount of compensation using our Calculator. What else does the employer face if he has not made a payment on the day of dismissal? If the employer violated the deadline for issuing the calculation upon dismissal, and the employee complains about him to the labor inspectorate, then the employer faces a fine in the amount of (Part 6 of Article 5.27 of the Code of Administrative Offenses of the Russian Federation):

- from 30,000 to 50,000 rub. for organization;

- from 10,000 to 20,210 rub.

Is it possible to make a payment before dismissal?

The law does not regulate the procedure for dismissal if the day of termination of the contract falls on a day off for the employee or employer. Therefore, the general procedure applies. This means that the employer must carry out the dismissal procedure on Saturday. This point of view is also shared by Rostrud, which in its letter No. 863-6-1 dated June 18, 2021. explained:

But in practice, everything is done much simpler: the employee is given all the documents and money either on the next working day after the weekend, or earlier, on Friday. This is a violation, of course, but if you do this, then at least make sure that the dates in the documents on which the employee signs are Saturdays (for our example).

Payment upon dismissal, payment terms established by law

The first rule is that if the employee did not go on vacation at all over the last year, then funds are accrued for all 28 days of paid legal rest. Plus, days worked by agreement with the employer that are holidays are added here (in order to receive an additional day off upon request). If the vacation has been used to one degree or another, then the calculation will be made in direct proportion to the time worked.

The exact amount cannot be stated. The thing is that it depends on many factors. For example, from the total amount of debt. And on the duration of the delay. But at the legislative level certain payment conditions are established.

The procedure and terms for payment of wages upon dismissal according to the Labor Code

According to Art. 140 of the Labor Code of the Russian Federation upon dismissal, payment of all amounts due to the employee from the employer is made on the day of dismissal of the employee. If the employee did not work on the day of dismissal, then the corresponding amounts must be paid no later than the next day after the dismissed employee submits a request for payment.

In this case, it is necessary to take into account the grounds for termination of the contract. After all, a citizen’s salary and other necessary payments will depend on this basis. In such a situation, the manager should not forget that full settlement with the resigning person must be made on the day when the employee last carries out his activities in this organization. Otherwise, the boss simply cannot avoid problems with the law.

Is it possible to issue a paycheck upon dismissal before the day of dismissal?

Despite the fact that the Labor Code clearly stipulates the deadline for payment of the entire settlement amount upon dismissal, delays often occur. It does not matter whether the employer is to blame for the delay or whether there are objective reasons (for example, there was a delay in transferring funds).

If we follow the law quite literally, then in order for an accountant (or another employee who will carry out the dismissal procedure) to come to work on Saturday, you need to document the involvement in work on a day off for at least an hour.

The deadline for the employer to pay settlements to the employee upon dismissal

Those who quit will be able to receive a payment at any time; to do this, they will just need to contact the organization with a request. Then the company will issue accruals no later than the next day. Is it possible to give money to the boss later than this time? No, this is not allowed, and you must meet it within the allotted period.

But, if you want to leave, then you should notify your superiors at least two weeks before the expected date. Because they must prepare severance payments and find a new employee. Therefore, you should keep in mind that in most cases you cannot leave immediately; you will have to work for at least 14 days.

Payment terms upon dismissal

When dismissing an employee (regardless of the reason for dismissal), the employer is obliged to make a final settlement with this employee, that is, he must pay all amounts due to the employee (unreceived salary, compensation for unused vacation.).

If an employee, for example, was on vacation or sick, that is, absent on the last day of work, and the organization’s salary is paid in cash, then the employer must make a payment upon dismissal no later than the day following the day when the employee applied for payment (Article 140 Tax Code of the Russian Federation).

Vacation pay calculation

It is understood that all monies due must be paid to the employee. At the same time, some of them can sometimes be withheld. In a specific case, we are talking about vacation pay when an employee is dismissed for the rest that he took, but the period of work was not fully worked out, and the citizen decided to terminate his relationship with this organization and wrote a letter of resignation.

But there is one more important nuance. Money for used vacation will not be withheld by the employer from a person’s salary upon his dismissal only if his departure from work is due to staff reduction or liquidation of the organization. In this case, the employee will also have the right to severance pay in the amount of average income for two months, and if he did not get a job, then for the third month.

The company from which the employee is resigning must necessarily pay him compensation for vacation that was not used during the entire period of employment. In the case where a person has not been there for several years, the amount of payments is accordingly made for all this time. If a citizen terminates his employment relationship with an organization on his own initiative, and the period of work is not completely completed, then in this case deductions are made from his salary for the vacation used. In this case, the accounting department will have to calculate the exact number of days or months of work of the person.

The amount of vacation pay upon dismissal is calculated as follows:

- The number of days of annual paid leave is taken, for example 28. Then it is divided by the number of months in the year, i.e. 12. Then the resulting number (2.33) is multiplied by the number of months worked in the working period, for example 4.

- If you multiply 2.33 by 4, you get 9.32 unused vacation days. This number is then multiplied by daily earnings, for example 900 rubles. It turns out 8388 rubles. This is the money that a person is entitled to as compensation for unused vacation. Personal income tax will be withheld from the same amount - 13%.

We suggest you read: How to write a response to a notice to the tax office

The final settlement with the employee should not be delayed by the boss. It must be done on time, regardless of which of the grounds specified in the Labor Code the citizen is dismissed from.

In a number of cases provided for by law, deduction for vacation upon dismissal is not made. The following situations fall into this category:

- Liquidation of the employer's organization.

- Staff reduction.

- Termination of an employment contract when a citizen is unable to perform duties due to illness.

- Conscription into the army.

- With a complete loss of previous working ability.

- Reinstatement to previous position by court decision.

- Termination of an employment contract upon the occurrence of circumstances beyond the control of the parties.

In any of the above cases of dismissal of a person, the boss must make a final settlement with him on the last day of his work and pay all funds due by law. Otherwise, the person has every right to defend his interests in the prosecutor’s office and the judiciary.

In a situation where the employer initiates the termination of the employment relationship, the citizen has the right in a number of cases to receive compensatory benefits. It is also called a day off. In this case, the amount of this payment can be in the amount of two weeks or one month’s earnings. Cash allowance in the amount of the employee’s salary for two weeks can be in the following cases:

- If a person’s health condition does not allow him to continue working in this organization. Or when he refuses to move to another position, and the boss has nothing more to offer him.

- In case of complete loss of a citizen’s ability to work.

- If the terms of the employment contract change.

- When a person is called up for military or alternative service.

In the amount of monthly earnings, the benefit is paid:

- upon termination of an employment contract due to layoffs;

- in case of liquidation of the organization.

Also, the collective agreement may establish other circumstances when such benefits are issued to an employee. However, payment of the final payment upon dismissal, including compensatory benefits, must be made on the last day of the person’s work activity. In addition, when calculating this type of compensation, it is necessary to take into account the payment of taxes if the amount of monetary compensation exceeds the employee’s salary three times. Otherwise, personal income tax is not paid.

A special situation is vacation followed by dismissal. How many days before dismissal is payment paid if the employee decides to take unused vacation first? In this case, the date of termination of the employment contract is considered to be the last day of vacation, and not the last day of work.

But it is on the last working day that you must make payments upon dismissal; Also adhere to the deadlines for payment and transfer of vacation pay. The employee must receive his vacation pay three days before the start of the vacation.

Read more about the risks of the procedure and potential conflicts in the Personnel Affairs magazine.

From the point of view of the law, it is the employer who bears full responsibility for the final payment upon dismissal: payment deadlines cannot be violated, even if the date of termination of the employment contract falls on a weekend or holiday.

How to act in such a situation? The answer depends on whether the organization-wide weekend or holiday is a working day for the dismissed employee.

If yes, then you will have to calculate it day by day and involve the accounting department and the personnel department in extracurricular work (Rostrud letter No. 863-6-1 dated 06/18/2012).

If not, act in accordance with Article 14 of the Labor Code of the Russian Federation - transfer the calculation to the next working day following the weekend or holiday.

It also happens that the fired person does not show up for work at all.

How many days after dismissal should such an employee be paid? The law does not establish a clear framework, but requires sending a written notification of the need to appear for documents and final payment or agree to send the work book by mail. If the dismissed person applies for payments, give the required amount no later than the day following the day of application, and the work book no later than three days (Article 84.1 of the Labor Code of the Russian Federation).

Attention! If the organization pays the staff not through the cash register in cash, but by transferring money to bank cards, list all payments accrued to the employee on the day of his dismissal (Article 140 of the Labor Code of the Russian Federation).

Payment of settlement pay before the day of dismissal violation

Regardless of the grounds on which the employment contract was terminated, the employer undertakes to settle accounts with the employee on the last working day and pay the amounts due to him. The types of payments and their size may differ depending on the reason for which the employee was dismissed.

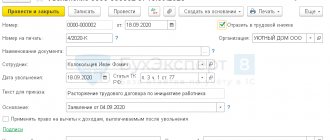

The employee receives a full payment upon dismissal based on the Order from the employer on the dismissal of this employee. The order has a unified form, which HR employees must adhere to.

Is it possible to transfer payment upon dismissal before the day of dismissal?

There are situations when an employee wants to quit before the dismissal date. For such cases, the amount is calculated according to a separate scenario. If leaving before the dismissal date on the initiative of an employee, he must receive a signed application from the manager with a request to resign without working off.

If this day was not worked (day off, holiday) and the payment was not made on the day of dismissal, the employer must pay the due money within two working days from the receipt of the request for final payment. The procedure for dismissing employees is the same for all employers. It is established by Art. 84.1 of the Labor Code. On the day of termination of the employment contract, the employer is obliged to issue a work book and all necessary documents to the employee against signature, and also to make a full settlement with him in accordance with Art. 140 of the Labor Code (Part 4 of Article 84.1 of the Labor Code of the Russian Federation).

Payment of salary upon dismissal

- Unused days of annual leave and additional leave. You can obtain information about the required vacations from the HR department upon personal request. It is drawn up in the form of an extract from the employee’s personal file. Payment upon termination of an employment contract involves compensation for each unused day of vacation during the entire period of work.

- Calculation of compensation for one unused vacation day is carried out on the basis of a 2-NDFL certificate, reflecting the employee’s income for the entire period of work in the company. This amount is divided first by the number of months in a year (12), and then by the average number of days in a month (29.3).

- Salary for one working day. Calculation of wages for a part-time working month in which an employee resigns occurs by dividing all due payments for the month by the number of full working days of the month. This number is multiplied by the number of working days in the current pay period.

The timing of salary payment upon dismissal is regulated in Article 140 of the Labor Code of the Russian Federation. According to her requirements, money is paid to resigned employees on the last day of work. If the employee was absent on the last day, the deadline for payment is the next day after notifying management of the desire to receive a payment.

Expert: Is it possible to transfer payment upon dismissal before the day of dismissal?

Online » Feed of comments to “Note to the employee and the employer - what is the time frame for payment upon dismissal?

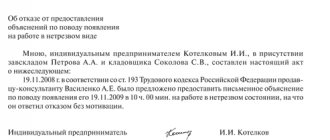

These circumstances do not occur arbitrarily; any case must have documentary evidence. Discordant acts can be carried out not in connection with the performance of official duties. The statute of limitations for such violations cannot be more than one year.

The last day worked by the resigning employee is actually the day of his dismissal. When terminating a contract with an employee, the employer must make all necessary payments for full settlement. These payments, as well as the procedure and conditions for their execution, are also prescribed in the Labor Code of the Russian Federation. Below we will consider how to correctly settle a settlement with an employee and what payments he is entitled to during the settlement. When dismissing an employee (regardless of the reason for dismissal), the employer is obliged to make a final settlement with this employee, that is, he must pay all amounts due to the employee (unreceived salary, compensation for unused vacation.).

Dismissal paid ahead of schedule

Payments upon dismissal are described in detail in the video Which dismissal is considered illegal Disputes between the employee and the employer also arise regarding the circumstances of the dismissal itself. All legal reasons for early termination of employment relations are reflected in Art. 77-84 Labor Code of the Russian Federation. All other circumstances of dismissal of an employee are considered illegal. For example, the following situations will be a violation of the law: Some facts Most often, the emphasis is on proving the absence of a certain document or action on the part of the employer, or a serious violation of the procedure.

We recommend reading: How many square meters are required per person?

Compensation for unused vacation Compensation for unused vacation, like salary upon dismissal, belongs to the category of mandatory payments. It is calculated based on the number of unused vacation days that can be found based on the number of months worked since the last vacation. So, with a standard vacation scheme of 28 days a year, the number of months must be multiplied by a factor of 2.3. Compensation for unused vacation can be exchanged for days that can be used to cover the work period. But then, in addition to the application for dismissal, you must also provide a document requesting leave. In this case, instead of compensation, the management will have to pay vacation pay to the employee. If the employer does not pay wages In case the employer does not pay compensation on time, legal liability is provided for him.

Is it possible to make a payment upon dismissal before the dismissal date?

“The day of termination of the employment contract in all cases is the last day of work of the employee, with the exception of cases when the employee did not actually work, but, in accordance with this Code or other federal law, he retained his place of work (position).”

If on the day of dismissal the employee did not work or was on a business trip, then pay the corresponding amounts the next day after the employee applies for payment (Article 140 of the Labor Code of the Russian Federation). For late payment of the final payment upon dismissal of an employee, financial and administrative liability is provided.

Care on your own initiative

The final payment upon dismissal of one's own free will must be made to the person on the last day of his employment duties, which includes:

- salary for the entire period of work;

- compensation for vacation or vacations if a person worked without annual rest for several years in a row.

An important fact should be noted here. If the vacation was used by a citizen, but the period of work was not fully completed, accordingly, upon termination of the contract at the request of the latter, the employer has the right to withhold previously paid funds from his money.

We suggest you read: Can alimony be below the subsistence level?

Is it possible to make the final payment not on the day of dismissal?

Payments to the dismissed employee must be made on the day of dismissal (Article 140 of the Labor Code of the Russian Federation), and if this requirement is violated, in addition to the amounts accrued to the employee upon dismissal, interest will also need to be paid for the period of delay in settlement (Article 236 of the Labor Code of the Russian Federation). And this obligation does not depend on the employer’s fault and/or whether he has a “valid” reason in the form of the accountant’s absence from work.

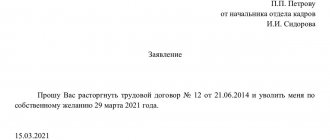

If the employee has written a letter of resignation, then after the expiration of the notice period he has the right to terminate the employment relationship, and the employer is obliged to formalize the dismissal, make the final payment and issue the employee a work book and other necessary documents ( Art.

80

,

84.1

Labor Code of the Russian Federation

).

Otherwise, this may be regarded as a restriction of a citizen’s rights to work, and he has every right to appeal to the labor inspectorate or court with a complaint about untimely dismissal, for which administrative and financial liability is provided (Article 234 of the Labor Code of the Russian Federation ,

Article 5.27 of the Code of Administrative Offenses of the Russian Federation ).

Example of final calculation

An employee who terminates his employment relationship with a specific organization has the right to receive earned money and other compensation if the grounds for dismissal allow this. Consider the following example.

Employee Ivanov leaves the company of his own free will. Naturally, in this case he does not receive severance pay and does not receive average earnings for the third month before employment. But he has the right to payment of earned money for the entire time and compensation for vacation. The final payment to the employee in this situation will be made according to the T-61 form. This is a settlement note filled out upon termination of an employment relationship.

Ivanov wrote a statement in April and resigned on the 19th. Accordingly, he should be calculated and given remuneration for work from 1 to 18 inclusive. If his average salary is 20,000/22 working days (this is the number of them in April), the resulting amount per day is 909.09 rubles. It is multiplied by the number of days worked in the month of dismissal - 18.

Ivanov worked this year for 3 months and 18 days. But the count will be 4 full. Rounding to tenths and hundredths is not done, so the amount is calculated from 28 days of vacation/12 months a year = 2.33 days. After which 2.33*4 (months worked)=9.32 days. And only then 9.32*909.9 (daily earnings) = 8480.26 (vacation compensation).

Thus, the final payment is made from all amounts due to the employee. But in this case, this is only a salary and cash payment for vacation, because Ivanov quits on his own initiative. If he were laid off or fired due to liquidation, he would also receive severance pay, which is also paid with all funds (based on Article 140 of the Labor Code of the Russian Federation).

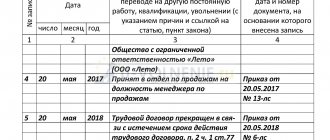

Date of dismissal order and date of dismissal

An order is a document that has a form prescribed by law. This document is an order from the manager to terminate relations with a particular employee. As a general rule, it dates back to the day of dismissal, since it is on the basis of the order that an entry about the termination of the employment contract is made in the work book, although there may be exceptions (we will talk about them later).

The form of the order was previously established by State Statistics Committee Resolution No. 1 “On approval of document forms...” dated 01/05/2021. From 01/01/2021, this form has become optional for use, and each enterprise can now develop its own order form.

Can compensation for unused vacation be paid before the date of dismissal?

Article 84.1. General procedure for formalizing the termination of an employment contract [Labor Code of the Russian Federation] [Chapter 13] [Article 84.1] Termination of an employment contract is formalized by order (instruction) of the employer. The employee must be familiarized with the order (instruction) of the employer to terminate the employment contract against signature. At the request of the employee, the employer is obliged to provide him with a duly certified copy of the specified order (instruction). In the event that an order (instruction) to terminate an employment contract cannot be brought to the attention of the employee or the employee refuses to familiarize himself with it against signature, a corresponding entry is made on the order (instruction). The day of termination of the employment contract in all cases is the last day of work of the employee, with the exception of cases where the employee did not actually work, but in accordance with this Code or other federal law, he retained his place of work (position).

On the day of termination of the employment contract, the employer is obliged to issue the employee a work book and make payments to him in accordance with Article 140 of this Code.

Upon written application by the employee, the employer is also obliged to provide him with duly certified copies of documents related to work. An entry in the work book about the basis and reason for termination of the employment contract must be made in strict accordance with the wording of this Code or other federal law and with reference to the relevant article, part of the article, paragraph of the article of this Code or other federal law.

Article 140. Terms of calculation upon dismissal [Labor Code of the Russian Federation] [Chapter 21] [Article 140] Upon termination of the employment contract, payment of all amounts due to the employee from the employer is made on the DAY OF TERMINATION of the employee.

If the employee did not work on the day of dismissal, then the corresponding amounts must be paid no later than the next day after the dismissed employee submits a request for payment. In the event of a dispute about the amount of amounts due to the employee upon dismissal, the employer is obliged to pay the amount not disputed by him within the period specified in this article.

When should compensation be paid upon dismissal?

The calculation and payment of compensation upon dismissal should be done in accordance with the provisions of the Labor Code of the Russian Federation. According to Article 140 of the Labor Code of the Russian Federation “Terms of calculation upon dismissal”, the employer is obliged to pay all due amounts on the employee’s last day of work. If the employee did not work on the day of dismissal, payments must be made no later than the next day after he submits a request for payment. Also, in accordance with Article 127 of the Labor Code of the Russian Federation “Exercising the right to vacation upon dismissal of an employee,” the employee has the right to compensation for all unused vacations.

Important: the Labor Code repeatedly states that all payments must be made on the day the employee is dismissed. For each day of delay, the employer is obliged to pay the employee compensation in the amount of at least 1/300 of the refinancing rate of the Central Bank of the Russian Federation in force at that time (Article 236 of the Labor Code of the Russian Federation). Otherwise, the employer bears administrative responsibility for delays in wages, vacation pay and other payments in accordance with Part 1 of Article 5.27 of the Administrative Code. There is also criminal liability for non-payment of wages (Article 145.1 of the Criminal Code of the Russian Federation).

Within how many days should I be given a full paycheck upon dismissal?

Upon expiration of the notice period for dismissal, the employee has the right to stop working. On the last day of work, the employer is obliged to issue the employee a work book and other documents related to the work, upon the employee’s written application, and make a final payment to him.

Payment upon dismissal is made on the day of dismissal, i.e. on the day the work book is issued to you and the order for your dismissal is issued (Article 140 of the Labor Code). If the employer refuses to pay the salary on the day of dismissal, you can complain to the labor inspectorate