How to calculate the average number of employees

TSS at the end of the year is calculated using the formula: TSS year = (TSS for January + TSS for February + ... + TSS for December) / 12.

To calculate the TSS of employees for a month, add up their daily list quantity and divide the resulting value by the number of calendar days in a particular month. At the same time, do not forget that on weekends and holidays the total number of employees will be equal to the number of employees on the previous working day.

When calculating the SCH, follow the rules: an employee working under an employment contract is a whole unit, even if in fact he is on sick leave, on a business trip or does not work full time; The SSC does not include employees working under a GPC contract, hired on a part-time basis, as well as co-owners of the company who are not paid a salary by the company. Employees who have not worked full time are counted in proportion to the time they worked.

Example. Polis LLC has the following indicators of the monthly average:

- January - 1,

- February - 1,

- March - 3,

- April - 3,

- May - 5,

- June - 7,

- July - 7,

- August - 5,

- September – 4,

- October – 4,

- November – 4,

- December - 4.

TSS at the end of the year = (1 + 1 + 3 + 3 + 5 + 7 + 7 + 5 + 4 + 4 + 4 + 4) / 12 = 48 / 12 = 4.

Important! From the beginning of 2021, all employees who are on maternity leave or parental leave, but continue to work part-time or at home, while maintaining the right to receive social benefits, must be included in the calculation of the SSC (clause 79.1 of the Rosstat instructions No. 772).

SCN of part-time workers = ∑ (Employee hours worked per day / standard hourly duration of a working day * number of days worked) / number of working days in a month.

Example. Three employees at Bereg LLC worked part-time in October:

- one of them worked 2 hours a day for 21 working days. He is counted daily as 0.25 people (worked 2 hours / 8 hours according to the norm);

- three workers worked 4 hours a day for 15 and 10 working days. They count as 0.5 people (4/8).

TMR of part-time workers = (0.25 x 21 + 0.5 x 15 + 0.5 x 10) / 22 working days in October = 0.81. The company will take this value into account when determining the employees’ average wage

If an employee works part-time and is required by law to do so, count them as a full-time employee.

Some employees are not included in the SSC:

- women who were on leave due to pregnancy and childbirth;

- persons who were on leave to adopt a newborn directly from the maternity hospital, as well as on parental leave;

- employees studying at institutions of the Ministry of Education and who were on additional leave without pay, as well as those planning to enter these institutions;

- employees who were on leave without pay while taking entrance exams.

Who needs to submit the document in 2019?

A report on the average number of employees for the previous calendar year must be submitted to the Federal Tax Service:

- organizations (it does not matter whether they use the labor of employees in their activities, on the basis of Letter of the Ministry of Finance of Russia dated 02/04/2014 N 03-02-07/1/4390);

- Individual entrepreneur (only if the entrepreneur hires one or more employees on the basis of an employment contract).

These entrepreneurs must submit a report for 2021 no later than January 20, 2021.

The following are required to submit a report on the average number of employees for 2021 in 2021:

- newly created legal entities;

- reorganized organizations.

At the same time, newly created enterprises must submit the document within a time frame that differs from individual entrepreneurs and organizations. These categories must submit a report no later than the 20th day of the month following the month of their creation (reorganization). This provision is contained in paragraph 3 of Article 80 of the Tax Code. The document indicates data on the average number of employees for the month of creation (reorganization) of the enterprise.

Thus, if the date of establishment of the organization is April 17, 2021, then a report on the average number of employees must be submitted no later than May 20 of the same year.

RSV in 2021: new form and filling out rules

The rules for calculating the number from 2021 are established by Rosstat order No. 711 dated November 27, 2019. From January 15, 2021, it will be replaced by instructions from Rosstat order No. 412 dated July 24, 2020.

In general, the calculation formula looks like this:

Average year = (Average 1 + Average 2 + … + Average 12) / 12,

where: Average year is the average headcount for the year;

Average number 1, 2, etc. - the average number for the corresponding months of the year (January, February, ..., December).

For more information about the calculation procedure, read the article “How to calculate the average number of employees?” .

The information is certified by the signature of the entrepreneur or the head of the company, but can also be signed by a representative of the taxpayer. In the latter case, it is necessary to indicate a document confirming the authority of the representative (for example, it may be a power of attorney), and a copy of it must be submitted along with the ERSV.

NOTE! The power of attorney of the representative of the individual entrepreneur must be notarized (Article 29 of the Tax Code of the Russian Federation).

The completed ERSV form can be submitted in person or through a representative to the Federal Tax Service, or sent by mail with a list of attachments, provided that the average number of employees of the company does not exceed 10 people. If this indicator is higher, the report will be accepted only in electronic format.

The form is submitted to the inspectorate at the place of registration of the company or at the place of residence of the individual entrepreneur. Organizations with separate divisions report the number of all employees at the place of registration of the head office.

The tax office accepts reports with legible data entered in black ink. Forms filled out with other color variations will not be considered. Write information in cells and rows as legibly as possible. Tax professionals should not feel like graphologists.

If you are an advanced computer user, feel free to fill out the form using editing software. Tax officials accept printed forms filled out in 18 Courier New font.

When all fields of the form are completed, it must be signed manually. Only under this condition will the inspector accept your annual report for consideration. You do not have to appear in person at the tax office to submit a document. Send it by mail as a valuable letter of notification, of course taking into account the postmark date.

Useful advice! Experienced businessmen who do not like to stand idle in the crowded corridors of the tax office are advised to put an inventory of the enclosed documents in an envelope, certified with a post office stamp. The tax inspector will once again make sure that all documents are in place.

The indicator is calculated in two stages:

- For each calendar month.

- For the year as a whole.

Using an individual entrepreneur as an example, the calculation looks like this:

In January 2021, the individual entrepreneur had 6 employees. 4 of them worked 20 working days in accordance with the standard. One employee was on vacation and only worked 12 days, and one employee was sick and only worked 3 days.

The average number of individual entrepreneur employees for January 2021 is:

(4 × 20) + (1 × 12) + (1 × 3) = 95 / 22 = 4,31

The result obtained for each month is not rounded.

To determine the annual indicator, it is necessary to sum up the average for each month and divide by 12. The final total is rounded to a whole number according to the usual rule: values less than 0.5 are discarded, values of 0.5 or more are taken as one.

Example:

4.31 + 5 + 4.35 + 5.2 + 4.13 + 4.0 + 5.0 + 6.0 + 4.25 + 4.45 + 5.2 + 3.8 = 55.69 / 12 = 4.64 = 5 people

Thus, our entrepreneur has an average annual headcount of 5 employees. This is the information for 2020 that should be included in the report.

A report on the average number of employees for the previous calendar year had to be submitted to the Federal Tax Service:

- organizations (it does not matter whether they use the labor of employees in their activities, on the basis of Letter of the Ministry of Finance of Russia dated 02/04/2014 N 03-02-07/1/4390);

- Individual entrepreneur (only if the entrepreneur hires one or more employees on the basis of an employment contract).

These entrepreneurs were required to submit a report for 2021 no later than January 20, 2021.

The following are required to submit a report on the average number of employees for 2021 in 2021:

- newly created legal entities;

- reorganized organizations.

At the same time, newly created enterprises must submit the document within a time frame that differs from individual entrepreneurs and organizations. These categories must submit a report no later than the 20th day of the month following the month of their creation (reorganization). This provision is contained in paragraph 3 of Article 80 of the Tax Code. The document indicates data on the average number of employees for the month of creation (reorganization) of the enterprise.

Thus, if the date of creation of the organization is April 17, 2021, then the report on the average number of employees had to be submitted no later than May 20 of the same year.

Paragraph 6 of clause 3 of Article 80 of the Tax Code of the Russian Federation states that individual entrepreneurs may not submit a report on the average number of employees if they did not hire hired personnel in the reporting period. Accordingly, there is no zero form of report on the average headcount.

Individual entrepreneurs who have completed the state registration procedure this year may not submit a report on the average number of employees.

Everyone else had to submit a report to the tax office without fail.

However, Federal Law No. 5-FZ dated January 28, 2020 (hereinafter referred to as Law No. 5-FZ) amended the mentioned paragraph. 6 clause 3 art. 80 Tax Code of the Russian Federation. Thus, information on the average number of individuals from 01/01/2021 must be provided as part of the calculation of insurance premiums. There is no need to fill out or submit an independent report on the average number of employees starting in 2021. But it is necessary to calculate and report on the average headcount in the DAM calculation.

The title page of the DAM reporting has been supplemented with a new field “Average headcount (persons)”.

- TIN;

- checkpoint;

- Full name (for organizations);

- Full name (in full) and TIN (for individual entrepreneurs).

- January 1, 2021 – to provide information for the 2020 calendar year;

- The 1st day of the month following the month of creation (reorganization) - for the organization.

You can submit information on the average number of employees as part of the DAM report to the Federal Tax Service in 2021 in the following ways:

- In person (by visiting the Federal Tax Service).

- Through a representative.

- On paper.

- In electronic form (with enhanced digital signature).

- By Russian post (with a description of the attachment).

If there are more than 100 employees, then the report must be submitted exclusively in electronic form; if there are fewer, then submission on paper is allowed.

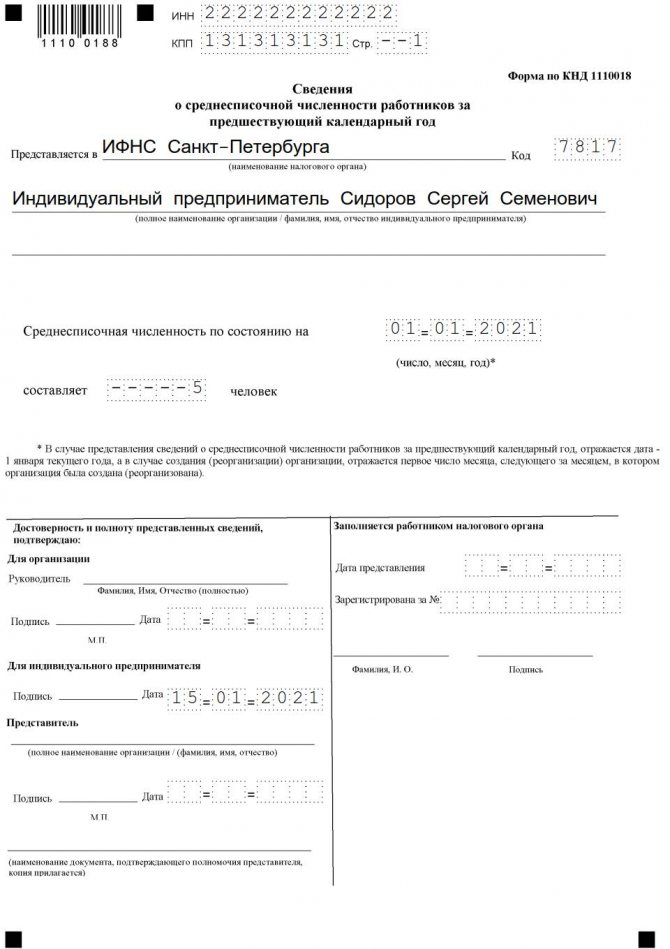

KND report form 1110018 2021: what information should I provide?

Let us recall that the document form KND 1110018 was approved by Order of the Federal Tax Service of Russia No. MM-3-25 / [email protected] dated March 29, 2007. Recommendations for filling out the report are contained in the letter of the Federal Tax Service of the Russian Federation No. CHD-6-25 / [email protected] dated April 26, 2007. Accordingly, the report for 2018 must be sent to the tax office using the KND form 1110018.

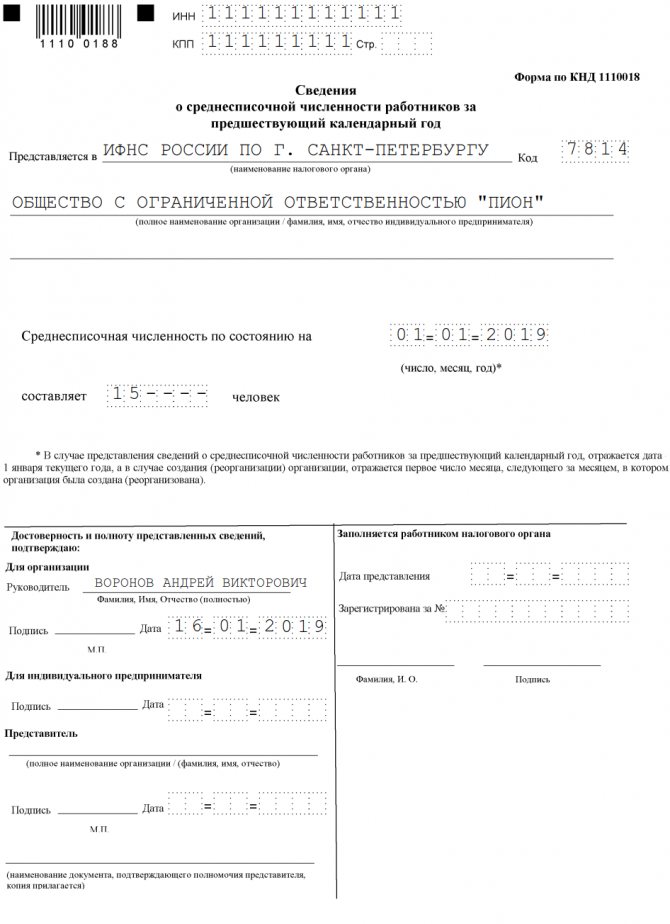

The form consists of only one sheet. What the current form of information on the average number of employees for 2021 looks like can be found here:

The report form must reflect the following data:

Taxpayer information:

- TIN;

- checkpoint;

- Full name (for organizations);

- Full name (in full) and TIN (for individual entrepreneurs).

Date of determining the average number of employees:

- January 1, 2021 – to provide information for the 2018 calendar year;

- The 1st day of the month following the month of creation (reorganization) - for the organization.

Indication of the average number of employees.

After the report is generated, it is signed by the individual entrepreneur or the head of the organization.

The completed document must be submitted:

- Individual entrepreneur – at the place of residence;

- organizations - at the place of registration.

Please note that if an organization has separate divisions, then the document must be submitted in one form throughout the organization.

What does the report form look like?

Reporting form KND 1110018 consists of only one page, and the only figure that the taxpayer must indicate is the number of employees as of 01/01/2021 or on the date of commencement of business.

The main difficulty is calculation. How to do this and what formulas to use is described in the material “Sample for calculating the average number of employees” on PPT.RU.

A completed sample certificate of the average number of employees for 2020 for an individual entrepreneur looks like this:

It shows that the following must be indicated:

- TIN of the entrepreneur or checkpoint of the organization;

- Full name of the entrepreneur or name of the legal entity;

- name of the Federal Tax Service, where the report was sent, and code;

- data on the average number of employees;

- date of data relevance;

- Date of preparation.

After filling out the form, it is signed by the head of the organization or individual entrepreneur. Submit the document at the place of residence and registration of the individual entrepreneur or at the place of registration of the legal entity. Data on employees of separate divisions of the organization are provided in one form for the entire legal entity.

Submit a report to the tax office on the average number of employees in person, send it by mail, or submit it through a legal representative (if submitted on paper). In electronic format, it is certified by the electronic signature of the sender.

General rules for determining the average number of employees

When calculating the average number of employees, you should focus on the “Instructions for filling out statistical reporting.” The document was approved by Rosstat order No. 428 dated October 28, 2013. To carry out calculations to fill out the report, you need to use special formulas. The basis for recording employees is the time sheet.

1. Formula for calculating the number of part-time workers:

The number of workers who worked part-time or full-time is calculated separately. For this purpose, the total number of person-days worked per month is determined using the following formula:

Total number of hours actually worked / Per standard working day

It is worth considering that the length of the working day depends on the number of working hours per week established at the enterprise. Eg:

- with a six-day working week - 6.67 hours;

- with a five-day working week (40 hours) - 8 hours.

In this way, it is possible to calculate how many part-time workers were employed.

2. Formula for calculating the number of full-time workers:

To calculate the average number of employees who worked full time for the entire month, the following formula should be used:

Average number of full-time workers (per month) = Sum of the number of full-time workers for each calendar day of the month / Number of calendar days in the month

3. To determine the average number of employees for the past calendar year, you need to calculate how many employees worked in each month of the reporting period (year), and then divide the resulting figure by 12.

This procedure is also relevant for those individual entrepreneurs and organizations that did not operate for the whole of 2018.

Let us add that some categories of workers are not included in the average number, for example:

- women on maternity leave;

- external part-time workers;

- employees registered under contract agreements;

- employees on study leave without pay.

From 2021, according to new instructions of Rosstat No. 722 dated November 22, 2017, the average number of employees must include:

- persons on parental leave, if they work part-time or work from home while receiving child care benefits;

- stateless persons performing work and providing services under a civil contract.

In addition, when calculating indicators, you can use rounding rules (if the number is not a whole number). That is, if the result obtained is less than 0.5 units, then it should not be taken into account. Indicators that are 0.5 units or more must be rounded to the nearest whole number.

Calculation of average headcount

Filling out information on the average number of employees is impossible until the corresponding calculation of the number of employees has been made. Let's figure out how to calculate the average annual number of people working in a company.

Information on the average number of employees is submitted not only to the Federal Tax Service, but also to statistical authorities as part of several different calculations (for example, forms 4-FSS and P-4).

We are considering annual reporting to the tax office in the form KND 1110018. However, the Letter of the Ministry of Finance of Russia dated 02/04/2014 No. 03-02-07/1/4390 explains that the average number of employees for the previous year for the Federal Tax Service is calculated taking into account the procedure for filling out the relevant forms for statistical authorities.

Therefore, to calculate the data that contains a sample of the average number of employees for 2021, we will rely on the Instructions for filling out statistical observation forms contained in Rosstat Order No. 772 dated November 22, 2017 (as amended on April 5, 2018) (Instructions). More specifically, the instructions for filling out Form P-4.

To calculate the average number of employees for the year, you must first find out the average number of employees for each month, add these numbers and divide by 12.

To find out the average number of employees per month, you must first calculate their number on the list for each day (including weekends and holidays), add and divide the resulting amount by the number of calendar days of the month.

It would seem that everything is quite simple, but there are nuances that are important to consider. Let's look at them.

Daily staff lists include:

- workers under an employment contract permanently, temporarily and seasonally (even 1 day);

- persons absent due to illness (downtime, business trip or other reason);

- part-time or part-time workers are counted in the lists for each day as whole units;

- homeworkers;

- truants, etc. (the full list is given in paragraph 77 of the Instructions).

The daily lists of employees do not include:

- external part-time workers;

- persons working under civil contracts;

- owners of the organization who do not receive a salary, etc. (full list in paragraph 78 of the Instructions).

Included in the payroll, but not taken into account in the average headcount:

- women who are on maternity leave;

- persons who are on leave to care for an adopted newborn child;

- persons who are on parental leave (except for those working part-time or at home and receiving benefits);

- employees who are in session or taking exams for admission to study and take leave for this at their own expense.

Not included in the payroll, but taken into account in the average headcount:

- external part-time workers (in proportion to time worked);

- citizens working under civil law contracts.

For weekends and holidays, the lists of employees will be the same as on the previous working day. So, if an employee quit and worked his last day on Friday, then on Saturday and Sunday he is still registered in the organization.

Citizens working part-time or part-time are counted as whole units in the daily calculation according to the lists, but in the average calculation they are already counted in proportion to the time worked. For example, if, with an 8-hour standard of working time per day, a person works 4 hours, then he should be counted as 0.5 people (4 hours / 8 hours).

Who should prepare the headcount report and when?

Based on Art. 80 of the Tax Code of the Russian Federation, individual entrepreneurs and legal entities regularly inform about the number of employees at their enterprises. Information is submitted no later than January 20 of the year following the reporting year.

The information reflects annual figures. If the economic agent did not operate all year round, then it transmits data on personnel recorded for the actual period of work.

Even if the company did not work, it still needs to report. This was reported, among other things, in the Letter of the Ministry of Finance dated 02/04/2014 No. 03-02-07/1/4390. An exception is made only for individual entrepreneurs who did not hire employees during the year.

Note that the obligation to report the number of employees also arises for newly created and reorganized companies. They report no later than the 20th day of the month following the month of creation or reorganization. Then they regularly transmit information about the number of employees, like other legal entities and individual entrepreneurs, at the end of the year.

When to and when not to include yourself in the SSC

Previously, an individual entrepreneur who worked without employees was required to submit a declaration of average headcount (ASH), where the indicator “0” was indicated. Such a certificate was provided to the regulatory authority before January 20 of the year following the reporting year.

This was regulated by paragraph 3 of Article 80 of the Tax Code of the Russian Federation. But this was the case until 2017, when changes were made to the article.

Now, if an individual entrepreneur works without staff, then there is no need to submit a declaration of the SSC!

It is also worth deciding on the question of whether an entrepreneur needs to include himself in the SSC. The answer is no. And that's why:

- An individual entrepreneur does not have the right to enter into an employment contract with himself, and also does not have the right to set his own salary.

- The organization of entrepreneurial activity, which is carried out by an entrepreneur at his own risk, according to Article 2 of the Civil Code of the Russian Federation is not equated to labor activity.

But there are options for the development of events when the individual entrepreneur still includes himself in the average number. This applies only to certain types of work and services:

- renovation work

- delivery

- retail distribution

- veterinary activities

- domestic services

In such variations, the number of employees is taken as a physical indicator, and the individual entrepreneur himself is already included in their composition.

In this case, fixed contributions are applied in the form of a tax deduction, which the entrepreneur pays for himself.

At the moment of concluding an employment contract with an employee, the right to take advantage of such a deduction immediately disappears.

Average number of employees: where to submit (2018-2019)

It is necessary for the Federal Tax Service to calculate how many people worked in an organization or individual entrepreneur. It is this department that exercises control over such information. Why does the Federal Tax Service need this? So that taxpayers do not shirk the obligation to submit declarations, calculations and reports in electronic form. By law, if the average number of employees for the year exceeds 100 people, the taxpayer is required to report via telecommunication channels. Otherwise he will be fined. To reduce the number of violations and monitor business, an additional report was introduced.

Depending on the organization, information about the number of employees may be prepared by the accounting department or the human resources department. But it doesn’t matter who calculates the average number of employees. Where to take it (2019) - that’s the question. Since the report is needed by tax authorities, organizations submit it at their location. Individual entrepreneurs send it to the Federal Tax Service at their place of residence. There are no other options in the Tax Code of the Russian Federation.

Please note that information can be submitted either electronically or on paper in person or by mail. In the latter case, you will need to send a letter with a description of the attachment and a notification of delivery.

The report form was introduced by Order of the Federal Tax Service dated March 29, 2007 No. MM-3-25/ You can download it at the end of the article. The completed sample looks like this:

Sample filling

Report form

Who should submit a report on the average headcount?

The rules for filling out information on the average number of employees are contained in the Letter of the Federal Tax Service of the Russian Federation dated 04/26/2007 No. CHD-6-25/ (as amended on 05/18/2007).

Officials give recommendations and explain the procedure for entering data. According to the explanations, as well as based on the meaning of the report itself, filling out the form on the average number of employees is the responsibility of all employers: organizations and individual entrepreneurs.

It is important that separate divisions do not need to submit these reports separately. A large organization must take into account its employees in all departments.

Responsibility for failure to submit

Information on the average number of employees must be submitted by January 20 of the year following the reporting year. If this date falls on a weekend, the deadline is transferred to the next working day. If the company does not have time or forgets to submit this report, it will be fined 200 rubles: this is provided for in paragraph 1 of Art. 126 of the Tax Code of the Russian Federation.

According to the Letter of the Federal Tax Service dated December 20, 2018 No. ED-4-15/, lists of entrepreneurs who have not fulfilled their obligation within the prescribed period in 2021 will be formed on the 20th working day after the expiration of the deadline, that is, by February 18. After this date, businesses will begin receiving notifications of fines. In addition, a tax authority that has not received the necessary information will begin proceedings on a tax offense in the manner prescribed by Article 101.4 of the Tax Code of the Russian Federation, “regardless of the conduct and implementation of the results of a desk tax audit of tax calculations,” as required by the Federal Tax Service in its Letter dated July 16. 2013 No. AS-4-2/12705. If a violation of the legislation on taxes and fees is proven, the company official will also be fined, but under Part 1 of Art. 15.6 Code of Administrative Offenses of the Russian Federation. The fine for this is small - up to 500 rubles, but still unpleasant.

Please note that if an organization has not submitted a report, it will still be required to do so. Holding the company and its manager accountable will not solve anything; the obligation to report on the number of employees will remain. The tax authority will determine when this needs to be done.

>Staffing certificate - sample

Certificate of number of employees of the organization - form

The current form was put into force by tax authorities in Order of the Federal Tax Service of the Russian Federation No. MM-3-25 / [email protected] dated March 29, 2007. The information presented in the document is required by supervisory government agencies to control the size of the company's headcount. The value of this indicator affects what tax regime can be used when conducting business, as well as the way in which reports are submitted to the Federal Tax Service and what benefits can be applied. In some situations, such data is necessary for financial institutions and/or social funds.

A certificate of the number of all types of business entities is submitted, including legal entities and entrepreneurs with hired specialists. Since the form is approved at the federal legislative level, information must be provided to the territorial office of the Federal Tax Service only on the official form. Drawing up a certificate in any form is not allowed. The frequency of information submission is annual. Deadline - until January 20 for the previous year (calendar) based on the requirements of clause 3 of the statute. 80. The date may be postponed if the weekend coincides with the deadline for submitting the document.

Certificate of number of employees - procedure for filling out

The current form (KND 1110018) has not changed for 10 years. The document is simplified as much as possible to facilitate the data reflection mechanism. When creating the form, it is required to reflect the following information:

- INN and KPP codes for the taxpayer.

- The exact name, as well as the code of the territorial division of the Federal Tax Service to which the document is submitted.

- The exact and full name of the taxpayer company or full name of the individual entrepreneur.

- The value of a certain number (average) on a given date. What exact number do you need to calculate the average value for? If the company has been operating for a long time, the data is provided as of January 1st. If the company has just been created (or reorganized), the information is indicated on the 1st day of the month that, according to the calendar, follows the month of registration (reorganization) of the business.

- In order to certify the truthfulness of the submitted data, the document is certified by the signature of the director of the company (entrepreneur). In the case when the form is submitted by a representative, the form is signed by an authorized person of such a representative, and the document justifying the authority is provided separately. Also at the end of the form is the date the certificate was issued.

Filling procedure and sample

A company or private businessman must indicate the following information in the certificate:

- TIN.

- Checkpoint (for companies only).

- Full name and code of the territorial tax service where the certificate is submitted.

- The full name of the company, in accordance with its registration documents, or the full name (the latter - if available) of a private businessman without abbreviations.

- The date as of which the average payroll number is given is indicated. For long-established firms and businessmen, the indicator must be calculated and current as of January 1 of the current year. For newly opened companies and entrepreneurs, the value of the indicator is reflected as of the first day of the month following the month of registration.

- The manager must write down his full name, affix his personal signature, and also certify it with a company stamp. It is necessary to indicate the date of preparation of the document.

- A private businessman must indicate his full name, sign the document with a personal signature and indicate the date of signing.

- If the report is filled out by a representative, he must indicate his data. If the representative is an individual, he indicates his full name in accordance with the identification document. If the representative is a company, the head of this company must affix his personal signature and certify with a company stamp. At the end, you must indicate the name and number of the document that confirms the authority of the representative. A copy is attached to the form.

A sample certificate of the average number of employees is given below:

Similar articles

- Certificate of average number of employees - sample

- Information on the average number of employees

- Information on the average number of employees

- KND 1110018

- Certificate of number of employees of the organization - sample

How to determine the average number of employees?

In order for the certificate of staffing, sample below, to be drawn up correctly, it is necessary to correctly calculate the company's average number indicator. From 2021, when determining the value, one should be guided by the provisions of Order No. 772 of November 22, 2017. Previous Orders No. 428 of October 28, 2013, 498 of October 26, 2015 have lost their effect.

In accordance with clause 79.7 of Order No. 772, the annual average indicator is determined by summing similar monthly indicators and then dividing the resulting number of employees by 12. The formula is as follows:

Annual average = (average for January + average for February + ... + average for November + average for December) / 12.

Everything is clear with the annual indicator - the main thing is to know the values for each month. How to calculate the average by month? To do this, the payroll headcount indicators for each day (calendar) of a certain month are summed up, and then the value thus calculated is divided by the corresponding number of days (calendar) for the month. Not only working days are taken into account, but also all holidays, Sundays and Saturdays.

What categories of company personnel are subject to and are not subject to inclusion in the payroll? The answer is given in clause 77-79.3 of Order No. 772. For example, when calculating this indicator, hired TD specialists, business travelers employed for part-time, on sick leave, employed on a probationary period, on maternity leave and etc. External part-time workers are not taken into account; persons taken under the GPA; transferred to other companies without retaining their earnings; military servants during the performance of official duties, etc.

Calculation of average headcount for reporting

Certificate of number of employees - sample

When generating the form, the taxpayer company enters data in all lines except the table in the lower right corner. This section is intended to be completed by tax professionals. The number of personnel obtained as a result of calculations is indicated with rounding, that is, in full units of number. The calculation of information is carried out according to personnel and accounting data. In this case, the accountant may need time sheets for recording work hours, orders for personnel movements, personal personnel cards, statements, etc.

Let’s assume that an accountant needs to create a certificate form for 2017. The company was created back in 2015, so the data is submitted to the tax authorities on January 1st until January 22, 2018. The company’s payroll for this period is:

- From January to February – 20 people.

- From March to August – 22 people.

- From September to December – 30 people.

Annual average = (20 x 2 + 22 x 6 + 30 x 4) / 12 = 24.3 rounded to 24 people.

Note! For failure to submit a certificate on time, the taxpayer will be fined 200 rubles. according to the norms of clause 1 stat. 126. But control authorities will not be able to block bank accounts, because this form is not recognized as a tax return. Additionally, it should be noted that individual entrepreneurs without hired specialists are not required to report on the certificate of average assets.

Certificate of headcount – download form here:

(Form) Information on the average number of employees

Certificate of staffing levels – sample download here:

(Sample) Information on the average number of employees

If you find an error, please select a piece of text and press Ctrl+Enter.