Errors on sick leave: acceptable or not?

Paper will endure anything - this is not about drawing up official documents. Any reporting document requires strictly defined completion. The same applies to a certificate of temporary incapacity for work, or, more simply put, sick leave. Any corrections or blots may make it invalid, as a result of which FSS employees will refuse to pay the corresponding benefit.

Important! If the temporary disability certificate is filled out incorrectly, not only the employee, but also the employer may suffer: the law provides for administrative liability for him.

It should be remembered that in the registration of sick leave there are errors that are considered minor and, on the contrary, those that are serious violations.

Reasons for recalculating sick leave after payment

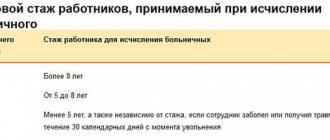

The accounting department of an enterprise calculates sick leave based on the data it has. Along with this, they may be incomplete, for example, if a person works part-time or has recently joined a specific company. Considering that the basis is the average daily income for the last two years, it is beneficial for the employee to provide information from previous employers.

This is important to know: Is it possible to go on sick leave after dismissal of your own free will?

Reasons for recalculation

There are several grounds for recalculating already paid temporary disability benefits. These include:

- The emergence of new information about the employee’s earnings, for example, receiving certificates of income from previous places of work.

- Detection of facts of employee dishonesty - provision of knowingly false information about sick leave or salary.

- Errors in calculations made by an accountant.

If management has doubts regarding the authenticity of the submitted documents, then an authorized employee has the right to submit a request to the Social Insurance Fund in order to clarify the information.

Regulations

The regulatory act governing the rules for recalculating sick leave is Article 15, Article 255 of the Federal Law. Let's consider several provisions of the document:

- You can apply for benefits within three years after your right to it arises. If the payment did not take place due to the fault of the employer, the period is not limited.

- Excessively transferred funds due to the fault of the accounting department will not be recovered from the person.

- If inaccurate information about income or sick leave is discovered, leading to an overpayment, the employer has the right to write off up to twenty percent of wages as debt.

All of the above aspects apply to both temporary disability benefits and payments in connection with pregnancy and childbirth.

Billing period

In accordance with Article 14, Article 255 of the Federal Law, the calculation period for calculating sick leave benefits is two calendar years. Moreover, all 730 days are taken into account, without excluding weekends, holidays and other periods.

It is important to know! The period counts from the day the illness or other event subject to insurance began (the need to care for a relative, prosthetics, pregnancy, and so on). If a person had no income or it was less than the minimum wage, then the basis for calculation will be the minimum wage established in the region of residence.

An employee who was on maternity leave in the previous two years has the right to change the calculation period to the one when she worked. You cannot take any years, but only those preceding the insured event associated with the birth of a baby.

The need for a salary certificate

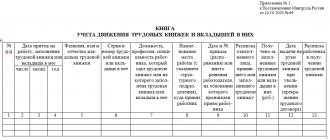

In order to legally recalculate the amount of compensation for the period of incapacity for work, you must provide your current employer with a certificate in Form 182H. It is issued to citizens in two cases:

- upon dismissal;

- former employees upon written request.

The employee has the right to receive the document for three years; it is during this period that he has the right to apply for disability benefits, which will take into account income from his previous place of work.

It is required to provide either the original certificate or a certified copy of the document (notarized or by the employer himself). Sick leave will be recalculated even if compensation has already been transferred. Based on the information received, the accountant will be able to determine the difference and transfer it to the employee.

If, for objective reasons, an employee cannot obtain a certificate from his former employer, then he submits a request to the Pension Fund for information about his income. This procedure takes more time, but is used in practice. As a rule, this is done if the company where the person worked is liquidated or located in another region.

What errors are allowed on a sick leave certificate?

Two categories of people can fill out a sick leave certificate in a way that is not required: the doctor, who fills out the top part, and the employer, who is responsible for filling out the other part of the document. Lawyers and FSS officials have provided their own options for correcting shortcomings for each of these categories.

People are not robots. Apparently, out of understanding of this fact, the social insurance fund has developed a list of inaccuracies that are quite acceptable in certificates of incapacity for work. In particular, FSS specialists will not find fault if:

- there are no dashes in empty cells;

- there are extra spaces between the doctor’s initials;

- symbols touch cell boundaries;

- some parts of words are written in cursive;

- the address of the hospital or clinic is indicated without a clear sequence;

- the seal fell on the information margins;

- there are quotation marks in the employer's name;

- small blots, like extra periods, commas or checkmarks.

Any other errors are more serious and serve as grounds for refusal of acceptance by FSS specialists and require the issuance of an appropriate duplicate.

Attention! If the sick leave sheet was folded several times or filled out with a blue ballpoint pen instead of a black gel pen, this cannot be a reason for its rejection.

Please note: the admission of two or more insignificant errors or omissions in a hospital bulletin entails its recognition as invalid . Therefore, when filling out this document you should be extremely careful.

Correction of an error when calculating sick leave

Example 4 An employee of an organization was absent from work due to illness from November 29 to December 9 inclusive (9 working days, of which 2 days in November, 7 in December).

The average daily earnings for calculating the amount of benefits for sick days is 549.12 rubles/day. The accrued amount of temporary disability benefits is RUB 4,942.08. (549.12 rubles/day x 9 days). Due to the difference in the number of working days in November and December - 21 and 22, respectively - for these months there will be different values of the maximum possible daily benefit: for November - 557.14 rubles / day. (11,700 rubles: 21 days), for December – 531.82 rubles/day. (RUB 11,700: 22 days).Let us recall that in 2004 the maximum amount of temporary disability benefits for a full calendar month could not exceed 11,700 rubles. (Article 15 of the Federal Law dated 02/11/02 No. 17-FZ “On the budget of the Social Insurance Fund of the Russian Federation for 2002”, Article 7 of the Federal Law dated 12/08/03 No. 166-FZ “On the budget of the Social Insurance Fund of the Russian Federation for 2004").

The average daily earnings are 549.12 rubles/day. the organization lawfully used it to calculate the amount of benefits for sick days in November. Since this amount does not exceed the maximum possible daily benefit for this month - (549.12

In December, the average daily earnings exceed the maximum possible daily benefit - (549.12 > 531.82). Therefore, to calculate the amount of benefit for sick days this month, you must use the value of the maximum possible daily benefit. Taking into account the fact that in December the employee was ill for 7 working days, the amount of the benefit will be 3,722.74 rubles. (531.82 rubles/day x 7 days). The total amount of temporary disability benefits for all days of illness is 4820.98 rubles. (1098.24 + 3722.74). According to the initial calculation, its amount is 4942.08 rubles. Thus, the excess accrued on sick leave is 121.10 rubles. (4942.08 – 4820.98). This means that the calculated amount of Unified Social Tax, subject to payment to the Federal Social Insurance Fund of the Russian Federation, for 2004, was unlawfully reduced by these 121.10 rubles.

Therefore, it is necessary to submit to the inspectorate of the Federal Tax Service of Russia a clarifying tax return under the Unified Social Tax for 2004 (in the form approved by order of the Ministry of Finance of Russia dated February 21, 2005 No. 21n). In the block “Expenditures made for the purposes of state social insurance” of section 2 “Calculation of the unified social tax” line by line

“for the tax period, total” (line 0700);

“including the last quarter of the tax period” (line 0710);

"3rd month" (December) (line 0740)

their specified values are indicated.

Changes in UST accruals for 2004 are reflected somewhat differently in comparison with the previous case in the Payroll for the Social Insurance Fund of the Russian Federation (Form 4-FSS of the Russian Federation). When submitting this statement for the first half of 2005, in Section I “Calculations for the Unified Social Tax”, line 2 “Changes in the accrued unified social tax in accordance with the tax return for previous years” indicates the reduced value of the difference - 121 rubles.

If in the second quarter of 2005 the missing amount of tax was transferred, then the date and number of the payment order are indicated on line 16 “Unified social tax transferred” along with other indicators of payment orders for which UST transfers were made to the FSS of the Russian Federation in the second quarter of 2005.

When submitting the Payroll Statement for the first half of the year to the Federal Tax Service of the Russian Federation, it is recommended to take with you the updated tax return for the Unified Social Tax for 2004.

As shown above, the employee was overcharged for sick leave in the amount of 121.10 rubles. as a result of a counting error. If the employee does not object to withholding the excess accrued amount for sick leave, then when calculating wages for the next month of work, the accounting department has the right to do this. In accounting, if an organization identifies in the current reporting period after approving the annual financial statements in the prescribed manner that business transactions are incorrectly reflected in the accounting accounts last year, corrections are not made to the accounting and financial statements for the previous reporting year (clause 11 of the Instructions on the procedure for compiling and presentation of financial statements; approved by order of the Ministry of Finance of Russia dated July 22, 2003 No. 67n). Therefore, the deduction of the corresponding amount is reflected in the entry above:

Debit 69 subaccount “Settlements under Unified Social Tax with the Federal Social Insurance Fund of the Russian Federation” Credit 70

— 121.10 rub. – the excess accrued amount for sick leave was reversed.

When paying the excess accrued amount for sick leave in December 2004, the employee was withheld personal income tax in the amount of 16 rubles from the specified amount. (15.74 rubles (121.10 rubles x 13%). Both the excessively accrued amount and the withheld amount of personal income tax were reflected in the tax card for accounting income and personal income tax for an employee for 2004 (form 1- Personal income tax). The procedure for filling out a tax card for accounting income and personal income tax for 2003 (approved by order of the Ministry of Taxes of Russia dated October 31, 2003 No. BG-3-04/583) does not provide for making correctional entries in the card. Therefore, the withheld amount, as well as previously calculated and withheld tax are taken into account when filling out a tax card for accounting income and personal income tax of an employee for 2005.

If the employee does not agree with the proposal to withhold the excess amount accrued from him, then the above entry will not be enough. The employee was paid additional income, the source of payment of which has changed: instead of funds from the Federal Social Insurance Fund of the Russian Federation, the organization’s own funds become such. Therefore, the organization takes into account such costs in non-operating expenses as costs for other similar events, carried out along with costs for sporting events, recreation, entertainment, cultural and educational events (clause 12 of PBU 10/99 “Expenses of organizations”; approved by order of the Ministry of Finance Russia dated 05/06/99 No. 33n):

Debit 91-2 Credit 70

— 121.10 rub. – the excess accrued amount for sick leave is reflected.

For organizations that apply PBU 18/02 “Accounting for income tax calculations,” the corrections will not end there. Since the excessively accrued amount for sick leave forms the accounting profit (loss) of the reporting period and is excluded from the calculation of the tax base for income tax for both the reporting and subsequent reporting periods, a difference in accounting arises. And it is recognized as constant (clause 4 of PBU 18/02). It must be reflected in analytical accounting for account 91. The product of the permanent difference that arose in the reporting period by the profit tax rate established by the legislation of the Russian Federation on taxes and fees and in force on the reporting date is recognized as a permanent tax liability (clause 7 of PBU 18/ 02). To reflect it in accounting, the following entry is made:

Debit 99 subaccount “Permanent tax liability” Credit 68 subaccount “Calculations for income tax”

— 29.06 rub. (RUB 121.1 x 24%) – a permanent tax liability has been accrued.

____________________

End of example

The most common mistakes in sick leave

As practice shows, there are a number of errors that are especially common when filling out temporary disability forms. These include:

- unclear seal of the organization;

- incorrect name of the organization;

- the name of the organization and the seal do not match;

- the specialization of the attending physician is not indicated;

- the use of Roman numerals rather than Arabic numerals;

- lack of signature of a doctor or representatives of the medical commission;

- the sheet contains unnecessary information;

- The disease code or date of sick leave was entered incorrectly.

All these and some other errors are, as they say, critical and invariably lead to the issuance of a duplicate.

Important! There is no need to look for a detailed diagnosis in the sick leave certificate - it is not there. Instead, the bulletin contains a specific code, for example: 01 – disease, 02 – injury, etc. Likewise, in some cases, medical organizations have the right not to indicate their profile (in particular, drug treatment centers for the prevention and control of AIDS, psychiatric hospitals, etc.)

For your information! To clarify the significance of the mistake made, you can contact the regional Social Insurance Fund. This will allow you to promptly resolve problems related to inaccurate completion of the temporary disability certificate and avoid possible legal proceedings.

Errors when paying for sick leave: how to fix it

Errors in determining the right to temporary disability benefits and its amount are by no means uncommon. But how to fix them? Our article will help with this - read, compare, correct.

Situation 1

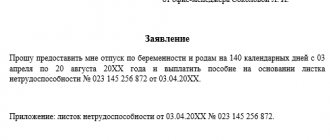

In April 2014, without interrupting maternity leave for up to 3 years, the woman went to work at 0.25 times the rate. In May, she submitted a certificate of incapacity to care for her child during his illness, but she was not assigned temporary disability benefits.

Violation

The right to temporary disability benefits was unreasonably denied. Clause 1 of Art. was violated. 18 Law No. 7-З*.

For your information! Persons caring for a sick child under the age of 14 when providing him with outpatient medical care, for whom or they themselves, in cases provided for by law, pay contributions to the Social Security Fund, have the right to temporary disability benefits for caring for a sick child.

Indeed, citizens on parental leave under 3 years of age do not have the right to temporary disability benefits.

An exception is made for persons working at home or on a part-time basis during this leave (clause 7 of Regulation No. 569**). The woman in this case is one of such persons.

How to fix

Accrue and pay benefits through the organization’s cash desk or to the employee’s personal payment card.

What an accountant should remember

1. Amounts of benefits that were not timely assigned and (or) not received due to the fault of the body assigning or paying such benefits are paid in a lump sum for the past time without limitation by any period. In addition, during this period they must be indexed (clause 2 of article 25 of Law No. 7-Z).

2. In case of accrual and payment of benefits for previous years, it is necessary to submit form PU-3 (type of form - canceling and correcting) to the Federal Social Security Fund (clause 16 of resolution No. 837***).

Situation 2

While on leave, the employee was caring for her sick 6-year-old son. This was confirmed by the submitted certificate of incapacity for work, on the basis of which she was paid benefits.

Violation

Temporary disability benefits were paid to the employee unreasonably. Clause 6 of Regulation No. 569 was violated.

For your information! A certificate of incapacity for caring for a sick child must be issued if a person cannot care for a sick child without being released from work (clause 46 of Instruction No. 52/97****).

Employees on labor leave, if they become temporarily incapacitated during this period, are entitled to benefits.

An exception is the onset of temporary disability related to care during the vacation period:

- for a sick family member;

- a child under the age of 3 years and a disabled child under the age of 18 when the mother or other person actually caring for the child is ill;

- a disabled child under the age of 18 in the event of his sanatorium treatment or medical rehabilitation.

In our situation, the days of caring for a sick child certified by a certificate of incapacity for work fell during a period that did not require release from work. Accordingly, the employee does not have the right to benefits, despite the fact that she has received sick leave.

How to fix

Option 1. The employee voluntarily returns the overpaid amount of benefits to the organization’s cash desk.

Option 2 (if there is no cash register). The employee voluntarily returns the overpaid amount to the organization’s bank account.

Option 3. At the written request of the employee, the accountant withholds the overpaid amount of benefits from her accrued salary.

Option 4. The return of the overpaid amount is paid by the guilty person (if he does not dispute the grounds and amount of the withholding).

What an accountant should remember

The excess amount of benefits paid must be returned to the Social Security Fund.

Situation 3

An employee who has been working in the organization since September 1, 2014, submitted a certificate of temporary incapacity for work for the period from September 8 to September 24 (17 calendar days).

Since in the billing period the number of calendar days for the employee was less than 30, his benefit was calculated from the established tariff salary - 1,100,000 rubles. (before the right to benefits arose, mandatory insurance contributions to the Social Security Fund were paid for it for more than 6 months).

The benefit was calculated as follows:

RUB 1,100,000 / 30 ×17 = 623,333 rub.

Violation

The benefit for all days of incapacity for work is accrued to the employee based on 100% of earnings. The calculation was made incorrectly. The norm of part one of clause 16 of Regulation No. 569 was violated.

For your information! As a general rule, the amount of temporary disability benefits is:

- for the first 12 calendar days of incapacity for work - 80% of average daily earnings;

- for subsequent calendar days of continuous temporary disability - 100% of average daily earnings.

Benefits are calculated in the same way if they are assigned based on the tariff rate (salary).

If this employee does not have the right to claim benefits in the amount of 100% of earnings from the first day of incapacity for work, then the benefit was accrued to him incorrectly.

How to fix

We recalculate the benefit and determine the amount of overpayment:

1. We determine the average daily tariff salary: 1,100,000 rubles. / 30 = 36,667 rub.

2. We calculate the benefit amount: (36,667 × 80 / 100 × 12 days) + (36,667 × 5 days) = 535,338 rubles.

3. The overpayment amount will be: 623,333 – 535,338 = 87,995 rubles.

What an accountant should remember

The overpayment amount must be returned to the Social Security Fund. Options for returning the overpayment amount are outlined in situation 2.

* Law of the Republic of Belarus dated December 29, 2012 No. 7-Z “On state benefits for families raising children” (hereinafter referred to as Law No. 7-Z).

** Regulations on the procedure for providing benefits for temporary disability and pregnancy and childbirth, approved by Resolution of the Council of Ministers of the Republic of Belarus dated June 28, 2013 No. 569 “On measures to implement the Law of the Republic of Belarus “On State Benefits for Families Raising Children” (hereinafter referred to as Regulation No. 569).

*** Resolution of the Council of Ministers of the Republic of Belarus dated July 8, 1997 No. 837 “On approval of the Rules for individual (personalized) registration of insured persons in the state social insurance system.”

**** Instructions on the procedure for issuing and processing certificates of incapacity for work and certificates of temporary disability, approved by Resolution of the Ministry of Health and the Ministry of Labor and Social Protection of the Republic of Belarus dated 07/09/2002 No. 52/97.

Ekaterina PILKEVICH , accountant-auditor

Attention!

If the article is relevant to you, get demo access for three days

and read this article and all other materials on the site in full, completely free of charge!

Get demo access!

Correcting errors on sick leave: rules and requirements

Two categories of people can fill out a sick leave certificate in a way that is not required: the doctor, who fills out the top part, and the employer, who is responsible for filling out the other part of the document. Lawyers and FSS officials have provided their own options for correcting shortcomings for each of these categories.

If any mistake is made in filling out the sick leave form, there is a strictly defined procedure for correcting it.

- The first thing you need to do is use a black gel pen to carefully cross out the corrected entry with a straight, continuous line. Important! If an entire line is written incorrectly, then on the reverse side you need to write that this line is invalid;

- Next, you should enter the correct information in the specially designated fields on the back of the sheet;

- “Believe the Corrected One”—this resolution must accompany every corrected entry. It must be supported by the signature of the responsible employee and the seal of the organization.

The person responsible for corrections may be:

- general director or director of the enterprise;

- Chief Accountant;

- HR specialist;

- any other authorized person whose responsibility is to issue sick leave certificates.

If a sick leave certificate is issued to an employee who works for an individual entrepreneur, then a stamp can be affixed only if it is available. If the individual entrepreneur does not have a seal, which is quite permissible by law, then no additional notes need to be made.

Is it possible to correct blots or errors on a sick leave certificate using a proofreader?

In no case. Clause 65 of Order No. 624n directly objects to this. Such sick leave may not be accepted as a basis for writing off expenses by auditors from the Social Insurance Fund. To avoid having to prove its validity in court, it is better to directly adhere to the established procedure for making corrections.

Is it possible to fix the fix?

It happens that when correcting his own mistake, an employee of the HR or accounting department writes the correct version not where required by law - on the back of the sheet, but next to the error. Such a correction will not be counted; it is also a violation. If this happens, the wrong “fix” needs to be corrected. On the reverse side of the sheet you should write what was supposed to be, accompanied by a note: “Believe the corrected one,” signature and seal.

ATTENTION! If the incorrect format of the correction does not obscure the information field too much and does not interfere with the reading of all necessary records, the FSS may consider this a technical defect and not be too picky. But "fix the fix" would be more reliable.

For your information: in recent years there has been a tendency to relax the requirements of the Social Insurance Fund for issuing sick leave. Minor defects are not a prerequisite for its redesign; the main thing is that the text is readable and understandable.

Errors in registration of sick leave by medical personnel

Sometimes mistakes in filling out sick leave sheets are made by employees of hospitals, clinics and medical centers. In this case, neither employers nor other employees of medical institutions have the right to correct them. Only specialists from the Social Insurance Fund can determine the severity of the error. If they consider this violation to be significant, they will return the document to the organization. After this, the employee who owns the certificate of incapacity for work can contact doctors to issue a duplicate.

Important! A duplicate is the only way to correct a mistake that a doctor made when filling out a sick leave certificate. The previous copy of the document must be cancelled.

It is important that a duplicate is requested and issued in a timely manner. In the event of disputes, judges or auditors may be confused by the long period between the initial issuance of sick leave and its replacement.

Attention! Before starting to enter the necessary information into the employee’s sick leave certificate, the employer must make sure that the notes made by the attending physician are correct.

Errors in the preparation of sick leave made by the employer

Since there is a part in hospital forms filled out by representatives of medical institutions, and a part filled out by employers, it is not surprising that there are also mistakes that are made by the latter.

Most often, these are inaccurately entered data that prevents them from being read by a machine. That is why the following rules should be strictly adhered to.

- Write block letters exclusively within the boundaries of cells;

- Start writing only from the leftmost cell and leave one empty cell between words;

- In cases where the entry is very long, it can be shortened, but only in such a way that the meaning of what is written is not lost.

If there is an error in calculating benefits, this may serve as a basis for refusing to accept a sick leave certificate from the Social Insurance Fund, about which representatives of the fund will make an appropriate decision.

As a result of all of the above, we can conclude that careful adherence to the rules and regulations for filling out sick leave forms can prevent the occurrence of such unpleasant consequences as refusal to pay compensation for the time spent on sick leave to an employee and the imposition of an administrative penalty on the employer. That is why at all stages of filling out hospital forms, responsible persons should be especially scrupulous and attentive.