There are often cases when tax officials call heads of firms and entrepreneurs for conversations (committees) on various occasions, including the issue of the average salary for the entire business entity. The reason for the close attention of the Federal Tax Service to the size of the wage fund is the discrepancy between the average salary for the enterprise and one or several employee income criteria. These include, for example, the following:

The average salary of employees is below the industry level, i.e. by type of activity in the region;

the average salary is below the established regional subsistence level.

Tax officials are trying to identify companies that practice issuing salaries “in envelopes,” i.e. bypassing the calculation of insurance premiums and personal income tax, which significantly reduces the tax base. Such a level of salaries becomes a condition for an enterprise to fall into the risk zone of becoming a candidate for an on-site audit by tax authorities (clause 5 of section 4 of the Federal Tax Service order No. MM-3-06 dated May 30, 2007/ [email protected] ). Therefore, it is better for the company’s accountant to calculate the average salary for the enterprise in advance, and compare the results of the calculations with statistics from Rosstat or information from the websites of regional branches of the Federal Tax Service.

These actions are also supported by the fact that Article 133 of the Labor Code of the Russian Federation dictates the following condition: the salary of an employee who has worked the full monthly standard of time and completed the assigned work tasks cannot be lower than the established minimum wage. Considering the above aspects, it becomes clear why calculating the average salary for an enterprise is so important for tax authorities. For the head of the company and the accountant, it is equally important to correctly justify the obtained indicator.

In what cases is an employee entitled to an average monthly salary?

The list of situations when payments to an employee are calculated based on the calculation of the average amount of earnings is determined by the Labor Code of the Russian Federation. Among the most common and most often encountered situations in the activities of an ordinary organization that require the calculation of average earnings include:

- payment of vacation pay (Article 114 of the Labor Code of the Russian Federation);

- issuance of compensation for unused vacation - upon dismissal or for part of the vacation over 28 calendar days (Articles 126, 127 of the Labor Code of the Russian Federation);

- employee going on a business trip (Article 167 of the Labor Code of the Russian Federation);

- payment to employees for periods of training while away from work (Articles 173–176, 187 of the Labor Code of the Russian Federation);

- payment of severance pay (Article 178 of the Labor Code of the Russian Federation).

In addition, based on the average monthly salary, the following categories of employees are calculated:

| Employees | Article of the Labor Code of the Russian Federation |

| Those engaged in collective negotiations or preparing a draft collective agreement (agreement) with exemption from their main job. At the same time, the average earnings for such workers can last up to 3 months. | 39 |

| Temporarily transferred to a job other than that provided for in the employment contract | 72.2 |

| Those forced to terminate an employment contract due to non-compliance with the rules for its conclusion (if the violations were not the fault of the employee) - in this case, severance pay is due in the amount of the average monthly salary | 84 |

| Failure to comply with labor standards and labor duties due to the fault of the employer | 155 |

| Forced to remain idle due to the fault of the employer - in such a situation at least 2/3 of the average salary is paid | 157 |

| Members of labor dispute commissions | 171 |

| The manager, his deputy or the chief accountant, dismissed upon change of ownership in the amount of 3 times the average monthly salary | 181 |

| Transferred to lower paid work due to health reasons | 182 |

| Sent for mandatory medical examinations | 185 |

| Employees undergoing medical examination (from 01/01/2019) | 185.1 |

| Donors | 186 |

| Employees during suspension of the organization's activities | 220 |

| Pregnant women and women with children under 1.5 years of age transferred to another job | 254 |

| Women breastfeeding – when paying for breastfeeding breaks | 258 |

| Parents of disabled children when paying for additional days off and in some other cases | 262 |

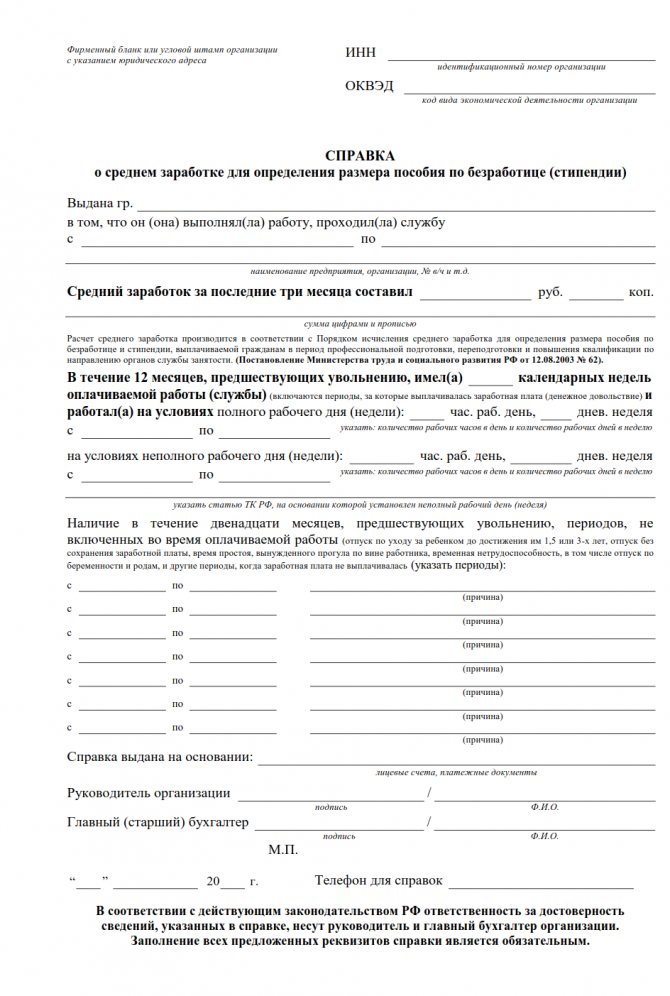

You will need to calculate your average earnings when filling out an unemployment certificate. ConsultantPlus experts told us what formula to use to calculate benefits and how to fill out such a certificate correctly. Get a free trial access to the system and see recommendations.

Certificate of average daily earnings for the court, sample

To obtain a visa to enter a foreign country, representatives of a foreign embassy require confirmation of the citizen’s official employment. Some representatives of European countries also prefer 2-NDFL, explaining this by the fact that the tax form KND 1151078 is documentary evidence of employment, and a certificate of average earnings for a visa can be easily falsified.

To receive social benefits and other financial assistance, for example, social protection authorities will also require confirmation of average income. This is necessary to establish preferential status for the applying citizen.

The certificate of average earnings for social security (sample) does not have a unified form and is compiled in any order. When generating information, please provide the required details:

- name of the organization, its registration and contact details;

- last name, first name and patronymic (if any) of the employee, position;

- information on accruals with a monthly breakdown.

The paperwork for receiving subsidies is prepared in a similar way.

You may be required to confirm your income and other receipts in court. For example, when assigning alimony, when considering a case of causing material damage or in violation of the Labor Code. The need to provide data is determined by the prosecutor or lawyer. Fill out the document in accordance with Art. 139 Labor Code of the Russian Federation.

A statement of claim for the recovery of wages is filed with the district (city) court, regardless of the cost of the claim.

Justices of the peace do not have jurisdiction over labor disputes.

This situation is a violation of the basic provisions of the Labor Code.

Initially, you can try to get funds without going to court. If negotiations do not help, you need to follow the following algorithm:

- Drawing up a complaint to the employer; Contacting the labor inspectorate; Filing a complaint to the prosecutor's office.

After contacting the labor inspectorate, a check is carried out to determine the reasons for the formation of debt.

The employer has the right to go to court in disputes regarding compensation by the employee for damage caused to the employer within one year from the date of discovery of the damage caused. If, for good reason, the deadlines established by parts one and two of this article are missed, they may be restored by the court.

Payments that are not related to wages (for example, financial assistance, payment for the cost of food, travel, etc.) for the billing period, as well as those that do not need to be adjusted, are not taken into account.

The salary for the billing period () is divided by the amount of time worked during the billing period (), this is how the average daily (or average hourly) earnings is determined. The resulting value is multiplied by the amount of paid time, as a result, the desired average earnings are determined - SZ. Note. In working days, leave is granted to employees who have entered into an employment contract for a period of up to two months (Art.

Although an exact sample is not provided, mandatory requirements have been established that this document must meet. If a debt obligation arises to employees, the managers of the enterprise will be punished as prescribed by the legislation of the country.

The Labor Code of the Russian Federation establishes disciplinary measures applicable to an unscrupulous director. These include: Reprimand. Typically used when a violation first occurs.

Its purpose is to stimulate greater responsibility on the part of the manager who has made late payments. May be issued several times. Warning. This is a more severe measure, indicating that the business owner's patience is running out.

Fine. A negligent manager who provoked a violation of the Labor Code can be deprived of a bonus or a certain amount can be written off from his salary. Dismissal. This is a last resort measure, which is used only if other disciplinary actions have not led to the desired result.

Worked as a sales manager. According to clause 5.8 of the employment contract, the plaintiff’s official salary was 40,000 rubles.

On 05/01/2019, employment contract No. was terminated on the basis of Art. 80 of the Labor Code of the Russian Federation - at your own request (order No. dated 05/01/2019).

In accordance with Part 6 of Art. 136 of the Labor Code of the Russian Federation, wages are paid to an employee at least 2 times a month. How to file a lawsuit for non-payment of wages Attention

Sashka Bukashka The Labor Code of the Russian Federation establishes that wages must be paid at least every half month.

We invite you to familiarize yourself with: Sample application for property tax relief for pensioners

However, most violations of citizens' labor rights are associated with non-payment of wages.

In this article we will tell you how to sue an employer yourself, using a sample statement of claim for recovery of wages.

- Why calculate average earnings? ↓

- Calculation of average daily earnings ↓

- Formula ↓

- Calculation example ↓

- Calculation of average monthly earnings ↓

- Formula ↓

- Calculation example ↓

- Payments that are taken into account when calculating ↓

- Subtleties of calculating average earnings ↓

By law, to calculate most benefits and vacations, as well as many other payments to company personnel, the calculation of average earnings is required. In this case, you may need not only the average monthly wage, but also the average daily or even average hourly wage. In order to correctly determine the amount of average earnings, it is important for each specialist to know the many subtleties of this calculation.

At the same time, in the new order, be sure to cancel the previous one - about dismissal. After all, the meaning of the reinstatement procedure is, in essence, that the parties return to their original position only after some time.

In addition, make an entry in the employee’s work book with the following content: “The entry behind the number is invalid, reinstated in the previous position.” Opposite this entry in column No. 4, indicate the details of the restoration order.

Such rules are established by paragraph 1.2 of the Instructions, approved by Resolution of the Ministry of Labor of Russia dated October 10, 2003 No. 69. Look at a sample of filling out a work book for such a case (see sample below. - Editor's note). I note that the employee has the right to demand a duplicate of the work book - without the entry that was ultimately declared invalid (clause 33 of the Rules for maintaining and storing work books).

How to calculate average monthly earnings: general procedure

The general and uniform procedure for calculating average earnings for all these cases is enshrined in Art. 139 Labor Code of the Russian Federation. The main rule: in any mode of work, the average salary is calculated based on the earnings actually accrued to the employee and the time actually worked by him for the 12 calendar months that have elapsed before the period in which the calculation of the average monthly salary is required. These 12 months are called the billing period.

The calculation procedure is spelled out in more detail in the regulation “On the specifics of the procedure for calculating the average salary,” which was approved by Decree of the Government of the Russian Federation dated December 24, 2007 No. 922. We will tell you in more detail about how to calculate the average monthly salary. The latest changes to this document were made in 2021, so you need to rely on it when calculating average earnings in 2021.

For information on how to calculate the average number of employees, read the article “How to calculate the average number of employees?” .

Task No. 4

This task is similar to task b) with the only difference that the role of the number of employees in this case is played by its share in the total, expressed as a percentage. To calculate, we will use the weighted arithmetic average:

That is, the numerator in the formula for calculating the average salary is now known, but the denominator is not known. The number of employees for each enterprise can be obtained by dividing the wage fund by the average monthly wage. Then the average salary for the two enterprises as a whole will be calculated using the weighted harmonic average formula:

Calculation of average earnings: formula

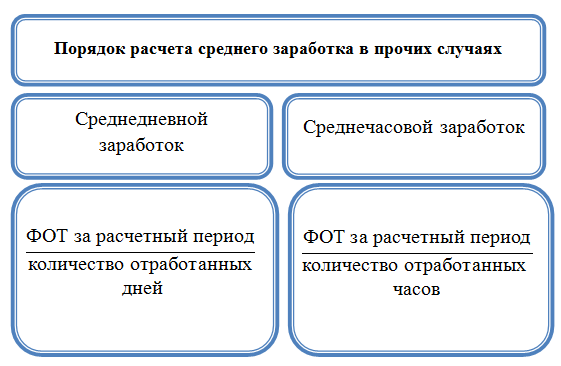

Calculation of average earnings for certain payments is always done based on average daily earnings.

The general formula for calculating average earnings can be presented as follows:

SmZ = SdZ × N,

Where:

SMZ - average monthly salary;

SDZ - average daily earnings;

N is the number of days to be paid according to average earnings.

For more information on how to calculate average daily earnings in different situations, read the following articles:

- “Average daily earnings for calculating vacation pay”;

- “Calculation of average earnings for a business trip”.

Anishchenko N

– for heads of organizations for which, according to the law, official salaries are established in multiples of the level of the average monthly salary for the corresponding type of economic activity, the ratio of their average salary to the average salary for the organization as a whole is not established (subclause 2.2, clause 2 of Resolution No. 1003 ).

To correctly calculate the coefficient, it is necessary to apply the norms of the Instruction on the application of the Regulations on the conditions of remuneration of heads of state organizations and organizations with a state share of ownership in their property, approved by Resolution of the Ministry of Labor and Social Protection of the Republic of Belarus dated September 20, 2002 No. 122 (hereinafter referred to as the Instruction).

Features of calculating average daily earnings

The main feature of calculating average earnings per day is that different rules for its calculation have been established:

- for payment of vacation pay and compensation for unused vacations;

- all other cases.

Calculation of average earnings (except for vacation situations):

SD = salary for the billing period / days actually worked in the billing period.

The billing period is 12 months (Article 139 of the Labor Code of the Russian Federation). If the employee worked for less than 12 months, then the calculation period is equal to the actual period of work.

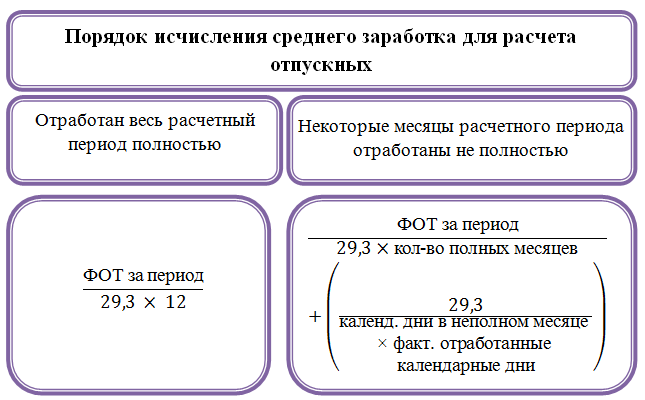

When paying for vacations, including unused ones, which are provided in calendar days:

SDZ = salary for the billing period / 12 / 29.3.

If some months out of 12 were not fully worked out or there were periods that need to be excluded from the calculation (we will talk about them below), the average daily earnings are calculated as follows:

SDZ = salary / (29.3 × full calendar months + worked, calendar days in incomplete calendar months).

The number of calendar days in incomplete calendar months is determined as follows:

29.3 / number of calendar days in a month × calendar days worked.

Example

Let's say the employee was sick from October 17 to October 31, 2021. Then the number of days in partially worked October: 29.3 / 31 (calendar days of October) × 12 (calendar days worked for the period from October 1 to October 16) = 11 days.

Let’s assume that for 12 months from November 2021 to October 2020, the employee was credited with 494,600 rubles. He worked all the remaining 11 billing months in full. Then the average daily earnings in November is:

494,600 / (29.3 × 11 + 11) = 1,483.95 rubles.

If vacation is provided in working days, the calculation of average earnings for vacation pay is calculated as follows:

SDZ = salary / per number of working days according to the calendar of a 6-day working week.

Systematization of accounting

on

enterprise

products and purchase of resources

for

the needs of the state, i.e.

of state costs for

paying

wages

... Bank,

calculation methodology based on

the current ...

organization

of the movement of refugees;

providing

states with a forum

for

...

... calculation of average wages

key personnel

for

...

subsidies

of the Ministry of

Affairs

... incl.

methods of sampling

...

organizations

regardless of their form

of ownership

, that have heavy engineering equipment, and conclude agreements with them

for the provision

...

Payments that are taken into account when calculating average earnings

The calculation of average earnings takes into account all payments provided for by the organization’s remuneration system, including:

- wages - time-based, piece-rate, as a percentage of revenue, paid in cash or in kind;

- various incentive bonuses and additional payments, as well as all payments for working conditions - read more about them here;

- bonuses and other similar rewards;

- other payments applied by the employer (clause 2 of regulation No. 922).

At the same time, the calculation of average earnings does not include social payments, such as financial assistance, payment for food, travel, utilities, etc.

Periods excluded from the calculation period

We have already said that the billing period is 12 calendar months preceding the period in which average earnings are calculated. However, individual periods, as well as the amounts accrued for them, are excluded in the calculation. These are the periods when:

- the employee retained his average earnings (only breaks for feeding the child are not excluded);

- the employee was paid sick leave or maternity benefits;

- the employee did not work due to downtime for which the employer was to blame, or for reasons beyond the control of the employer and employee;

- the employee did not participate in the strike, but did not work because of it;

- the employee was given days off to care for a disabled child;

- in other cases, the employee was released from work with full or partial retention of wages or without it (clause 5 of Regulation No. 922).

Situations when there was no salary in the billing period

If the employee’s salary was not accrued during the billing period, the calculation of average earnings is based on the salary accrued for the previous 12 months. In the case where the employee does not have a salary (time worked) before the start of the billing period, but has one in the month of calculation, the average earnings are determined by the amounts accrued for this month. If there is no salary in the month of calculation, the average salary is calculated based on the assigned tariff rate or salary.

Find out more about unpaid leave in the material “How to take unpaid leave.”

Payment for forced absence due to illegal dismissal

A dismissed employee has every right to disagree with the employer's decision to fire the employee. And submit a corresponding application to the court, the labor dispute commission (if there is one) or the state labor inspectorate, art. 382 and 352 of the Labor Code of the Russian Federation). And if in the end the organization’s decision is declared illegal, it will be obliged to reinstate the dismissed person at his previous job and pay him the average salary for the period of forced absence. And if the employee demands, then compensation for moral damage caused (Article 394 of the Labor Code of the Russian Federation).

The average salary is calculated based on payments accrued to the employee for the 12 calendar months preceding the moment of dismissal (Article 139 of the Labor Code of the Russian Federation, paragraph 62 of the resolution of the Supreme Court of the Russian Federation of March 17, 2004 No. 2). Workdays (hours) falling within the period from the moment of dismissal until the moment of reinstatement are subject to payment.

Please note: the salary that an illegally dismissed employee received in another organization does not reduce the amount of payment for forced absence (clause 62 of the resolution of the Supreme Court of the Russian Federation of March 17, 2004 No. 2). Therefore, when calculating the average salary, amounts paid to an employee at a new place of work are not taken into account.

Using this online service, you can keep accounts for OSNO (VAT and income tax), simplified tax system and UTII, generate payments, personal income tax, 4-FSS, SZV-M, Unified Accounting 2021, and submit any reports via the Internet, etc.( from 350 RUR/month). 30 days free (now 3 months free for new users). With your first payment (via this link) three months free.

The calculation is based on the employee’s average earnings over the last 12 calendar months. Let's say a person was fired in April 2021. This means that the billing period is from April 1, 2021 to March 31, 2021.

A different billing period may be established in the following cases.

If the employee has not yet worked for the organization for 12 months. In this situation, the billing period will be the period during which the person is registered in the organization. For example, an employee joined the company on July 8, 2021, and was fired on February 2. The billing period is from July 8, 2021 to January 31, 2018.

If a person got a job and was fired in the same month. Then the calculation period is the actual time worked. Let's assume that an employee joined the company on January 12, 2021, and was fired on January 20. If the court decides that this was done illegally and obliges the company to pay for the time of forced absence, the billing period will begin on January 12 and end on January 19.

If it is more convenient for an organization to set its own billing period other than 12 months. However, in such a situation, the average earnings will have to be calculated twice (for 12 months and for the established billing period) and compared the results. The fact is that average earnings in any case cannot be less than the amount calculated on the basis of annual earnings.

If a reorganization has occurred and the employee is transferred to a new company. A person can move to a new company in different ways. He can be fired from the old organization and immediately hired into a new one, or simply transferred by drawing up an additional agreement to the employment contract. When a person quits, when calculating average earnings after this event, only those payments that were accrued to him in the newly created organization are taken into account. If the employee is transferred, payments for the last 12 months are taken into account, including those accrued before the reorganization.

| Average earnings | = | The amount of accruals for the billing period taken into account | : | Number of days (hours) worked in the billing period | × | Number of working days (hours) to be paid |

We invite you to familiarize yourself with: Application for bankruptcy trustee to the arbitration court. Sample complaint about illegal inaction of an arbitration manager

Example. Sidorov V.S. was fired on January 25, 2021, and reinstated by court decision on May 12 of the same year. He returned to work on May 13.

The organization has a regular five-day work week. During the forced absence from January 26 to May 12, 2021 inclusive, there were 73 working days.

Sidorov's salary is set at 20,000 rubles.

The billing period is 2021. It accounts for 249 working days. Information about the periods excluded from it is given in the table.

Periods that are excluded from the calculation period when determining average earnings

| Base | Period | Length of period in working days | Accrued for time worked in partial months |

| Business trip | From 20 to 30 April 2021 | 9 days | RUB 11,818.18 |

| Annual leave | From 3 to 30 August 2021 | 20 days | RUB 952.38 |

| Temporary disability | From 9 to 20 February 2021 | 10 days | 9473.68 rub. |

(RUB 20,000 × 9 months RUB 11,818.18 RUB 952.38 RUB 9,473.68) : 210 days. = 963.07 rub.

RUB 963.07 × 73 days = 70,304.11 rub.

| Mandatory | On request |

|

|

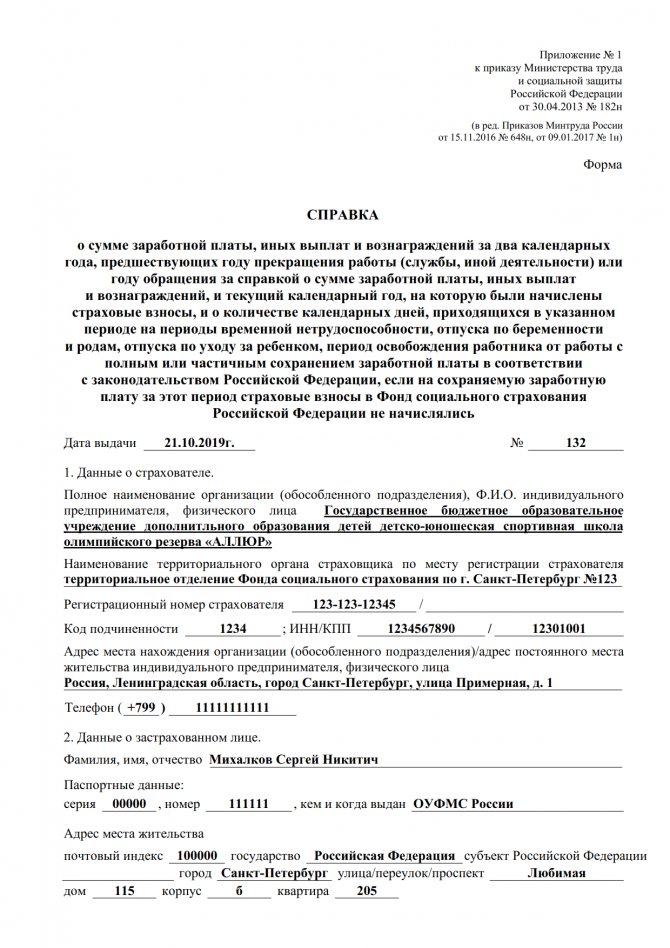

Generate information about your salary in a unified document form approved by Order of the Ministry of Labor of Russia dated April 30, 2013 No. 182n. Information in form No. 182n is generated for the period worked in the current year, as well as for the two previous calendar years.

Special rules for accounting for bonuses

When calculating the average monthly salary, different bonuses are taken into account differently, depending on the period for which they were accrued (clause 15 of Regulation No. 922).

When paying monthly bonuses, the calculation includes no more than 1 bonus per month for each bonus indicator, for example, 1 bonus for the number of attracted clients and 1 bonus for sales volume. As a result, no more than 12 bonuses of each type can be taken into account during the billing period.

If bonuses are accrued for a period of more than a month, but less than the calculation period, for example, for a quarter or half a year, they are taken into account in the amount actually accrued for each indicator. And if the duration of the period for which they are accrued exceeds the duration of the billing period - in the amount of the monthly part for each month of the billing period.

Annual bonuses and one-time remuneration for length of service (work experience) are taken into account in full, regardless of the time of their accrual.

In a billing period that is not fully worked, bonuses are taken into account in proportion to the time worked. Bonuses accrued for actual time worked are taken into account in full.

Cases when wages increased

An increase in wages in an organization also affects the average monthly salary of an employee. It is important in what period the salary growth occurs:

- If the increase occurs during the billing period, all payments for the time preceding the increase are indexed. The indexation coefficient is calculated by dividing the new tariff rate, salary, etc. by the tariff rates, salaries that were in effect in each of the 12 billing months.

- If the salary increases after the billing period, but before the occurrence of the event for which the average earnings need to be calculated, the average earnings itself increases. The correction factor here is the ratio of the new wage to the previous one.

- If the increase is carried out already during the period of maintaining average earnings, only part of it increases from the date of the increase until the end of this period. The indexing coefficient is calculated in the same way as in the second case.

See also “Salary indexation in 2021: how, by how much and what is the fine.”

Rules for calculating average earnings for payment of benefits

In conclusion, we would like to draw the reader’s attention to the following. The concept of average earnings is used not only by labor legislation, but also by social security legislation. Thus, sick leave, maternity and child benefits are paid based on average earnings. However, this earnings are considered differently - in the manner established by the law “On compulsory social insurance in case of temporary disability and in connection with maternity” dated December 29, 2006 No. 255-FZ.

Since 2021, all regions have switched to “Direct payments from the Social Insurance Fund”. This means that the first 3 days of sick leave are calculated and paid by the employer, and the subsequent days of sick leave are paid directly by the Social Insurance Fund to the employee.

Our reminder will help you avoid getting confused in the calculations. Go to the material and study this material for free.

Read more about calculating average earnings for social benefits in the following articles on our website:

- for sick leave - here ;

- for child care benefits - here ;

- for maternity payments - here .

If you need to calculate the average daily earnings for payment of severance pay, use the explanations of ConsultantPlus experts. Get trial access and proceed to the calculation example for free.

Results

The rules for calculating average earnings (average monthly wages), described by us above, apply exclusively to the cases listed at the beginning of the article, including when calculating average earnings when an employee is laid off to pay him severance pay, and social benefits and unemployment benefits do not apply .

You can find out more about social payments in our “Benefits” .

Sources:

- Labor Code of the Russian Federation

- Federal Law of December 29, 2006 No. 255-FZ

- Decree of the Government of the Russian Federation dated December 24, 2007 No. 922

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Calculation of average wages in 2021

In case you were asked for a certificate of FFP. For this reference, the average monthly salary is used. This indicator is calculated as follows: the actual accrued wages for three or six months are summed up and divided by the number of months.

Example: part-time employee Ivanov I.I. I asked the accountant for a certificate for social security authorities to issue subsidies for utility bills. The reference period is six months. Sample calculation of SWP for reference:

Period from November 1, 2018 to April 30, 2021

| Month | Salary, rub. |

| November | 6300 |

| December | 6500 |

| January | 6000 |

| February | 6150 |

| March | 6000 |

| April | 6000 |

| TOTAL: | 36950 |

The size of the SPP will be:

RUB 36,950/6 months = 6,158 rub.

In this example, we see that the employee receives on average 6,158 rubles. per month.

The income for the certificate includes absolutely all payments to the employee for the period required for calculation.

Such results are taken into account by the employment center when calculating unemployment benefits.

The bank takes into account the FFP when applying for a loan. A bank employee sees whether a person has enough funds to make a loan payment depending on the size of his monthly salary.

FFP for a month can be calculated using the 2-NDFL certificate.