Home/Sick leave

Various health problems of a citizen become the basis for declaring temporary disability. The manager must pay a monetary benefit for the sick period classified as an insurance risk.

Attention

His payment is provided according to a document called a certificate of temporary incapacity for work. It is a guarantee of the social plan. To purchase the right to use the guarantee, you need to register with the insurance fund.

The concept of sick leave according to the Labor Code of the Russian Federation

Article No. 183 of the Labor Code of the Russian Federation reveals topics covering the concept of leave for temporary disability. This is forced leave associated with illness, which is called sick leave. During the illness, the employee, without performing functions under the employment contract, receives a guaranteed cash benefit. To do this, you need to issue a certificate of temporary incapacity for work (hereinafter: sick leave).

When sick leave is provided according to the Labor Code of the Russian Federation:

- upon diagnosis of diseases due to which the ability to work has been lost;

- if there is a need for mandatory care for someone from the family;

- during pregnancy and childbirth;

- during quarantine days;

- in case of need for stationary prosthetics;

- upon completion of an inpatient course of therapy in a sanatorium (up to 24 days).

Please note:

The right to pay benefits upon completion of recovery in sanatoriums can be used by: pregnant women at risk, patients with angina pectoris, cerebral circulatory disorders, diabetes, myocardial infarction. As well as those who have undergone certain types of operations, parents of a disabled child undergoing sanatorium rehabilitation. This is confirmed by the medical verdict that individual care is required.

The employee's temporary disability occurred during unpaid leave

According to the current legislation, if sick leave was received by an employee during the period when he was on unpaid leave, such sick leave is not subject to payment.

In accordance with the provisions of clause 1 of Article 9 No. 255-FZ, temporary disability benefits are not assigned for periods of release of an employee from work with full or partial retention of wages or without payment in accordance with the legislation of the Russian Federation.

Accordingly, if temporary disability (including that related to caring for a sick family member) occurs during the period of unpaid leave, temporary disability benefits are not paid.

According to clause 22 of the Procedure for issuing certificates of incapacity for work, in the event of temporary incapacity for work during the vacation period:

- without pay,

- for pregnancy and childbirth,

- caring for a child until he reaches the age of 3 years,

sick leave is issued from the date of completion of the specified leaves in case of ongoing temporary disability.

If the period of temporary disability is longer than unpaid leave, then those days that go beyond the scope of such leave are subject to payment.

At the same time, the first three days, paid at the employer’s expense, are counted from the day following the end of the vacation “at one’s own expense.”

Decor

Sick leave is issued according to the Labor Code of the Russian Federation in the manner specified by the relevant instructions.

The document is issued:

- attending physicians of the LPF;

- healthcare workers in private practice;

- health workers with secondary education (at the initiative of local health authorities);

- attending physicians at anti-tuberculosis sanatoriums, prosthetics research institutes.

To register a document, the Ministry of Health and Social Development of the Russian Federation has approved a specially designed form.

According to the Labor Code of the Russian Federation, sick leave can be issued only in licensed medical institutions, public or private . A certificate of incapacity for work issued abroad is replaced upon return to the health care facility with approval by the local administration.

If the sick leave was issued abroad

If an employee’s temporary disability occurred during a vacation period when he was abroad of the Russian Federation, then in the territory of a foreign state he must receive documents confirming this.

However, benefits cannot be paid based on these documents. First, you need to obtain a sick leave certificate in accordance with the form valid in the Russian Federation.

In accordance with clause 7 of the Procedure for issuing certificates of incapacity for work, documents confirming the temporary disability of citizens during their stay abroad (after a legalized transfer), by decision of the medical commission of a medical organization, can be replaced with certificates of incapacity for work of the standard standard in the Russian Federation.

This is important to know: What is the gap between vacations according to the law?

Accordingly, after an employee receives sick leave valid in the territory of the Russian Federation, annual paid leave is extended for the period of temporary disability.

Dates of sick leave

According to the Labor Code of the Russian Federation, sick leave covers the entire period of incapacity for work. The document is issued on the day of determination of incapacity for work and includes the entire time of absence from work, both on weekdays and weekends. Before the examination is carried out, issuing sick leave is unlawful. This is possible only by decision of a special commission in special cases.

Exceptions to the general rule regarding issuance times

- In case of a controversial issue regarding reinstatement at work. The amount of sick leave benefits for this period is determined from the moment the court decision is made.

- Persons working under a fixed-term (less than 6 months) contract in accordance with the Labor Code of the Russian Federation are paid up to 75 days of forced disability. The exception is tuberculosis patients.

- If the illness is registered from the moment the contract is concluded until the end of its validity, sick leave is issued from the moment of the planned start of work for 75 days.

- Working disabled people receive benefits for 4 months without a break or 5 months throughout the year.

If an employee seeks medical help closer to the end of a work shift, incapacity for work is determined from the next day, taking into account the consent of the applicant. If a person is sent to a health care facility by a health center, the hospital document is registered from the hour of admission.

Is annual additional leave extended for a Chernobyl survivor if he gets sick during this period?

Our organization has an employee who suffered an illness after exposure to radiation due to the disaster at the Chernobyl nuclear power plant. He recently asked for additional leave, and we granted it for two weeks in accordance with labor laws. But a week later, the employee called the HR department and reported that he was sick. And we have a question: is the Chernobyl survivor’s vacation extended in this case? Or can it be postponed to another date? Tell me, what should be the order of our actions?

To help you understand this issue and determine the possibility of extending or postponing additional leave granted to an employee who suffered an illness after exposure to radiation due to the disaster at the Chernobyl nuclear power plant to another period, you must first consider the procedure for granting and paying for this leave.

In accordance with Art. 116 of the Labor Code of the Russian Federation (hereinafter referred to as the Labor Code of the Russian Federation), additional paid leave is provided to employees employed in work with harmful and (or) dangerous working conditions; employees with a special nature of work; workers with irregular working hours; employees working in the Far North and equivalent areas, as well as in other cases provided for by the Labor Code of the Russian Federation and other federal laws.

This is important to know: Vacation certificate of the Ministry of Internal Affairs (filling sample)

Other cases include additional paid leave for citizens exposed to radiation as a result of the disaster at the Chernobyl nuclear power plant. But not everything is as simple as it might seem at first glance. This type of vacation has a number of features. Let's take a look at them.

Feature 1. Additional leave is a measure of social support.

Feature 2. Additional leave is provided annually for a certain number of days.

Feature 3. Additional leave is provided in a special manner.

YOU SHOULD KNOW THIS

Additional leave for an employee exposed to radiation as a result of the disaster at the Chernobyl nuclear power plant is provided annually

Decree of the Government of the Russian Federation dated 03.03.2007 No. 136 “On the procedure for providing social support measures to citizens exposed to radiation as a result of the disaster at the Chernobyl nuclear power plant and nuclear tests at the Semipalatinsk test site, in connection with the performance of their work duties, as well as payment of funeral benefits for citizens who died (dead) in connection with the Chernobyl disaster" (hereinafter referred to as Decree of the Government of the Russian Federation No. 136) approved. Rules for payment of additional leave and payment of one-time compensation for health improvement, provided simultaneously with additional paid leave to citizens exposed to radiation as a result of the disaster at the Chernobyl nuclear power plant (hereinafter referred to as the Payment Rules).

The procedure for applying for such leave is as follows.

Step 1 Receive an employee’s application for additional paid leave.

To apply for additional paid leave in an organization, an employee who has suffered an illness after exposure to radiation applies to the head of the organization with an application to grant him the specified leave and attaches a copy of the certificate (approved by order of the Ministry of Emergency Situations of Russia No. 228, the Ministry of Health and Social Development of Russia No. 27 and the Ministry of Finance of Russia No. 63n dated 04/11/2006 “Approval of the Procedure and conditions for registration and issuance of special uniform certificates to citizens exposed to radiation as a result of the disaster at the Chernobyl nuclear power plant”), giving the right to receive this social support.

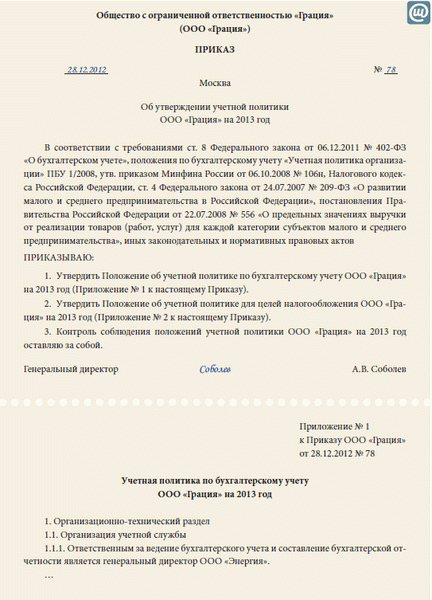

Step 2 Issuing an order to provide additional paid leave.

Based on the employee’s application, the employer issues an order to provide additional leave in the unified form No. T-6 (approved by Resolution of the State Statistics Committee of Russia dated 01/05/2004 No. 1 “On approval of unified forms of primary accounting documentation for recording labor and its payment”).

YOU SHOULD KNOW THIS

Annual additional leave for Chernobyl victims is paid from the federal budget (Resolution of the Government of the Russian Federation dated March 3, 2007 No. 136)

Step 3 Receive an application for a certificate of average earnings.

The employee applies to the employer with a written application to issue a certificate of average earnings. It reflects the total amount due (after tax) and the period for which the leave is granted. The certificate is signed by the head of the organization and the chief accountant, and is also certified by the seal of the organization.

Step 4 Submission of the employee’s application to the social protection authority for payment of additional leave and payment of a one-time compensation for health improvement.

Next, the employee applies at his place of residence to the body in the field of social protection of the population with an application for payment of additional leave and payment of a one-time compensation for health improvement, which is provided simultaneously with additional paid leave (clause 2 of the Payment Rules). This application is also accompanied by a copy of the certificate giving the right to social support measures, certified in the prescribed manner, and a certificate of average earnings.

Feature 4. Additional leave is paid from the federal budget.

The employer does not pay for this additional leave, since payment is made from the federal budget.

The territorial body of the Federal Treasury, on the basis of lists of recipients compiled by social protection authorities, transfers federal budget funds allocated for payment of additional paid leave and payment of one-time compensation to the federal postal service organization or to an account opened by the recipient in a credit institution (clause 7 of the Payment Rules) .

So, this type of vacation has a number of features.

Now let’s consider a situation where an employee who suffered an illness after exposure to radiation fell ill while on annual additional paid leave.

According to Part 1 of Art. 124 of the Labor Code of the Russian Federation, clause 17 of the Rules on regular and additional vacations (hereinafter referred to as the Rules on vacations), approved. NKT USSR 04/30/1930 No. 169, the employee’s annual paid leave must be extended or transferred to another period determined by the employer taking into account the wishes of the employee, including in the event of his temporary disability.

At the same time, the Labor Code of the Russian Federation does not indicate who determines in each specific case whether to extend or postpone vacation.

Paragraph 18 of the Vacation Rules states that if temporary disability occurs while the employee is on vacation, then the period of return from vacation is automatically extended by the corresponding number of days, and the employee is obliged to immediately notify the employer about this.

Due to the fact that additional paid leave provided to an employee who has suffered an illness after exposure to radiation is regulated by labor legislation, the norms of the Labor Code of the Russian Federation must, accordingly, be applied to it.

Our information

However, taking into account the specifics of granting the leave in question, we believe that if an employee falls ill while on such leave, only one option is possible: the additional leave is extended by the number of days of his temporary disability. It is impossible to transfer the specified leave that falls during the employee’s illness to another period.

IN THE SAME TIME.

. due to the fact that the employee warned you by telephone that he was ill and was issued a certificate of incapacity for work, which he will most likely be able to submit only after returning to work after the expiration of the period for which the leave is extended, the employee’s absences must be reflected in time sheet.

But the employee’s oral statement is not the basis for putting notes on temporary disability and extension of leave on the report card. Days of absence of an employee after the planned end of additional leave should be noted as absences for unknown reasons (until the circumstances are clarified) by affixing the letter code “NN” or the digital code “30” (example 1).

And after the employee goes to work and presents a certificate of incapacity for work, changes will need to be made to the time sheet. Days of temporary disability, which have already been properly confirmed, will need to be reflected with the letter code “B” or the digital code “19”, and the days previously marked with the code NN will be marked as days on vacation - with the letter code “OD” or the digital code “ 10" (example 2).

Summary

Additional paid leave for citizens who have suffered from illness after exposure to radiation due to the disaster at the Chernobyl nuclear power plant is a measure of social support that has a number of features. In connection with the employee’s illness, the specified vacation can only be extended by the number of days of his incapacity for work, but not postponed to another period.

We draw this conclusion due to the fact that at the time of illness the employee had already been paid for additional leave from the federal budget. In this case, there is no need to recalculate the amount of vacation pay, because payment has already been made for a specific vacation period. As for the employee’s illness, for this period he will be paid temporary disability benefits on the basis of a certificate of incapacity for work issued in the manner prescribed by law.

An order to extend leave in this case is not issued. The only thing that needs to be paid special attention to is filling out the work time sheet and the vacation schedule, in which it will be necessary to indicate the actual dates of the employee’s use of additional leave.

EXAMPLE 1

Time sheet (unified form No. T-13) (fragment)

Payment rules

Funding for sick leave according to the Labor Code of the Russian Federation is provided by compulsory insurance. The first three days must be paid at the expense of the employer’s finances, the remaining period - at the expense of the insurance fund. Individuals who care for a sick member of their family, a child, during pregnancy, or during the birth process have the right to receive benefits entirely from social insurance funds.

For your information

Payment for sick leave is sometimes issued at the previous place of employment when an illness is detected within 30 days after the termination of the work assignment.

Other citizens can count on benefits:

- employees of municipal and state institutions;

- self-employed entrepreneurs, lawyers, farmers;

- persons who are voluntarily insured with formalized payment of contributions.

Part-time workers also have the right to benefits (Article 287, part 2).

Benefit calculation

Sick leave benefits are calculated as a percentage of earnings.

- 100% of earnings - in case of occupational disease, occupational injury, its aggravation, with at least 8 years of experience;

- 80% - with 5-8 years of experience;

- 60% - with less than 5 years of experience.

The insurance period is calculated according to the order of the Ministry of Health and Social Development No. 91. It is confirmed by a work book.

Higher sick leave benefits under the Labor Code of the Russian Federation are established for:

- disabled war veterans;

- participants in the liquidation work after the accident at the site of the Chernobyl nuclear power plant, located in the zones of resettlement of minor citizens from this zone and supervising them;

- persons who received a certain dose of radiation in the conditions of the Semipalatinsk test site;

- donors who donated two norms, the maximum permissible, of blood per year;

- persons interacting with chemical weapons;

- workers in areas located in the Far North.

If the length of service does not exceed 6 months, the amount of payments is not higher than the minimum wage, taking into account the coefficients.

The following persons are not provided with sick leave benefits:

- suspended from work for this period (in the absence of salary);

- persons released from work (with or without pay);

- those who caused intentional damage to their own health (by court decision);

- persons under arrest.

According to the Labor Code of the Russian Federation, payment is made through the accounting department.

What to do if the foreign sick leave was not replaced with a Russian one?

The employing company can extend (postpone) vacation on the basis of foreign sick leave, but payment for such sick leave is not provided for by current legislation.

Accordingly, if an employer decides to pay an employee a foreign sick leave, such expenses should not be included in expenses for the purposes of compulsory social insurance and for tax accounting purposes for income tax.

Indeed, in accordance with paragraph 5 of Article 13 of Law No. 255-FZ, for the appointment and payment of benefits for temporary disability, issued by a medical organization in the form* and in the manner established by the federal executive body exercising the functions of developing state policy and regulatory legal regulation in the field of social insurance.

*The sick leave form was approved by the Order of the Ministry of Health and Social Development of the Russian Federation dated April 26, 2011. No. 347n “On approval of the form of a certificate of incapacity for work.”

Thus, a sick leave certificate of the established form is a mandatory document confirming both the fact of temporary disability and the employee’s right to receive temporary disability benefits.

Accordingly, if an employee replaces a certificate of incapacity for work issued to him in a foreign state with a sick leave certificate in the form established by Order No. 347n, then the employer is obliged to :

- pay for such sick leave in accordance with Law No. 255-FZ,

- extend paid leave in accordance with the requirements of Article 124 of the Labor Code of the Russian Federation.

An example of calculating sick leave according to the minimum wage

The minimum wage is approved by the legislation of the Russian Federation, taking into account territorial coefficients and is taken into account when regulating wages, determining the amount of benefits and other social purposes (tax calculations, for example).

The minimum wage value is used when calculating benefits:

- if the employee has not yet received a salary;

- if the average earnings are below the minimum wage.

Sick leave is calculated using the formula: Minimum wage ×24:730.

This is how the average daily earnings for 1 day are determined. 24 is the number of months in 2 years, 730 is the number of days, respectively.

From July 2021, the minimum wage is 7,800 rubles.

7800×24:730 =256.44 rubles – average earnings.

When working on a part-time basis, payment is determined based on the time worked. Example: during the previous two years, a citizen worked part-time. The average salary was less than the minimum wage. The benefit calculation will look like this:

7800×24:730×0.5=128.22 rub.

Example of calculating sick leave based on salary

It is important to correctly determine the calculated period of sick leave. Salary for the previous 24 months is taken into account. This is 730 days for calculations in 2017. First, one-day earnings are calculated. Why should the total amount earned be divided by 730?

The structure of earnings considers all types and categories of payments. The maximum monetary amount for calculating benefits was adopted in 2017 in the amount of 755,000 rubles. (in 2015 – 670,000, in 2021 – 718,000). The total amount of money earned over the past two years for calculating benefits cannot be higher than the sum of the two corresponding figures.

Example. Citizen Antonov was temporarily disabled due to ARVI from January 14 to January 23, 2021. Before that, he worked in the organization for 6 years. To calculate average earnings, we take into account the periods of the two previous years: 2021, 2015. In 2015, he earned 360,000 rubles, and in 2016 – 480,000 rubles. The total income for two years is 840,000 rubles.

The maximum base value for the two previous years in rubles: 670,000 + 718,000 = 1,388,000 . Antonov’s total income does not exceed this amount. Therefore, it is used in calculations. This includes all payments for which insurance premiums were transferred. His experience is 6 years, included in the period from 5 to 8 years. Therefore, the benefit must be calculated with a coefficient of 0.8 (or 80%).

So, the benefit must be paid in 10 days.

Average daily earnings: 840,000:730=1150.68 rubles.

The amount of the benefit due for a period of 10 days, taking into account the coefficient of 0.8, is as follows:

1150,68×0,8×10=9205.48 RUR.

How to apply for sick leave during vacation followed by dismissal?

To implement the corresponding transfer, the employee must, after returning to work, send to the personnel service an application for the transfer of additional vacation days that he acquired due to illness that were not used immediately. Based on this application, as well as the certificate of incapacity for work, the personnel service makes the necessary adjustments to the organization’s vacation schedule.

If the employee and the employer have agreed to postpone the leave that the employee took due to illness, then the employer will be obliged to calculate the benefit on the certificate of incapacity for work based on the person’s average earnings for the period preceding the employer’s obligation to provide this benefit. That is, when calculating benefits, the vacation taken by the person who was on sick leave will also be taken into account.

When transferring the remainder of the vacation to another period, a situation often arises when the amount of funds actually paid before the vacation exceeds the amount of the benefit itself. At the same time, vacation pay is subject to recalculation (since the actual vacation time has changed). What to do in this case? You cannot simply withhold these amounts from your salary (Article 137 of the Labor Code of the Russian Federation).

- After a long stay in hospital for treatment.

Thus, if the time off is 30 days, and the required time for rehabilitation is 20, then the worker has the opportunity, after returning from forced leave (for health reasons), to take another 10 days off during the year. At the same time, such time off will be paid and can be carried out outside the annual plan.

- Before going on maternity leave.

Only the pregnant woman chooses the time of maternity leave. In this case, the woman has the right to take leave before going on maternity leave or after sick leave. In this case, the time spent working for a particular employer does not matter. A pregnant woman has the right to receive a deferment before or after sick leave or maternity leave, even if she has worked for a certain company for only a few months.

- When an employee gets sick before or immediately during the weekend.

We invite you to read: For serious injury to health, the courts usually recover amounts from

If an employee falls ill immediately before a vacation, he has the right to defer his leave for as long as he needs, even if the company has already paid vacation funds. At the same time, the employee can go on weekends immediately after illness, if he correctly calculates the duration of the sick leave.

- For the purpose of healing the body. If an employee has been on sick leave for some time and, after full recovery, has received a recommendation to visit a health center, he has the opportunity to get a day off immediately after leaving sick leave. In this case, the employee must write a corresponding statement and agree on the duration of the leave with the employer.

In some cases, sick leave may be planned, for example, if an employee must go to the hospital annually to prevent illness. Thus, a person can calculate sick leave and work leave.

- Contact the accounting department and find out when exactly your time off is planned.

- Calculate the approximate duration of the disease.

The note! If you are planning to undergo preventive treatment, you can check its duration in a particular department of the medical institution.

- Take planned sick leave for the required period before the vacation.

Thus, a company employee will receive paid sick leave and days off. The amount of vacation pay will be calculated based on the employee’s profit for the year. This takes into account all payments, bonuses, travel allowances, etc.

This means that the employer is obliged to take into account all the employee’s wishes regarding new vacation dates, but may also take into account production needs, as well as the intersection of the desired dates with the vacation of other employees approved by the mandatory schedule.

But there is an important rule that limits the employer from endlessly rescheduling. Vacation can be used no later than 12 months after the end of the working year (non-calendar). Violation of this deadline is subject to administrative liability.

To postpone vacation, the employee must write a statement reflecting his intention to change the dates of vacation, as well as containing documented reasons for such a postponement.

To learn how to correctly fill out an application for leave or to postpone it, read the material “Application for another leave - sample and form (2018).”

It should be noted that the only reason for postponing vacation is the illness of the employee himself. Caring for close family members does not entail the employer's obligation to reschedule vacation time. This is provided for by the provisions of Art. 124 of the Labor Code of the Russian Federation, as well as the Procedure for issuing sick leaves (clause 40), approved by order of the Ministry of Social Development No. 624n, says that a certificate of incapacity for care cannot be issued during the period of annual leave.

The same goes for unpaid leave. Norms Art. 124 of the Labor Code of the Russian Federation on the transfer and extension of vacations are valid only for annual paid vacation. Leave without pay due to illness will not be carried forward.

Read about the general rules for granting leave in the material “Annual paid leave under the Labor Code (nuances).”

Certificate of incapacity for work during pregnancy and childbirth

For the payment of benefits during pregnancy and childbirth, documentary evidence under the Labor Code of the Russian Federation is also a sick leave certificate.

Women have the right to receive it:

- working: citizens of the Russian Federation, insured citizens of foreign states and stateless persons;

- for whom the fact of pregnancy occurred within 12 months before officially receiving the status of unemployed: those dismissed during the liquidation of the enterprise, upon termination of entrepreneurial work, the powers of a lawyer;

- who have adopted a child under 3 months;

- IVF participants;

- dismissed due to the transfer of a spouse to another territorial location or the need to care for sick family members, disabled people, if there is no more than a month left before maternity leave;

- entrepreneurs, private legal workers who voluntarily pay fees.

Women receive benefits under the Labor Code of the Russian Federation without registering sick leave:

- full-time students;

- those in military service;

- employees in the internal affairs department, criminal authorities;

- working in the drug control service.

To apply for benefits in one of these cases, a certificate from a medical institution is sufficient.

Women are not entitled to this benefit:

- housewives;

- part-time and evening students;

- notaries, lawyers who do not voluntarily pay fees.

The duration of such certificates of incapacity for work varies depending on the individual picture of pregnancy: from 140 days for a normal, without pathologies, period, to 194 for a pregnancy with complications, multiple births. Benefits are paid at 100% of earnings.

The average daily earnings for calculating these benefits cannot exceed 1901.37 rubles.

Calculation rules

First of all, we note that vacation pay is issued only for the rest period that is scheduled.

That is, if a person decides to take an unscheduled weekend, say, for family reasons, then it will be at his own expense. As already mentioned, the number of days scheduled is 28 days. This period is designed for a year, and it can be used at once or divided into several parts, a maximum of three. During this period, a person has the right to receive vacation pay, because he honestly earned his vacation. However, he should take into account that the amount for each employee is determined individually. And it is influenced by various factors, including the number of days missed. Therefore, first of all, you need to determine what will not be taken into account.

Not taken into account:

- Days when the person was not present at work. This could be a day off agreed with the management, sick leave, or downtime at the enterprise.

- The period of receiving maternity benefits, travel allowances.

- Participation in a strike.

The employee does not need to independently calculate the amount of payment, since this task is usually handled by an accountant. However, for fun, you can try to determine exactly what amount you will be able to get.

Specifics of child care benefits

When treating a child under 7 years of age, according to the Labor Code of the Russian Federation, the parent is issued sick leave for the full period of treatment, but not more than 60 days per year in total. And when the disease is included in the list approved by the Ministry of Social Development, then up to 90 days.

From 7 to 5 years, for individual episodes, a document is drawn up up to 15 days, in total no more than 45 per year.

For caring for a disabled person under 15 years of age, payment is required for the entire period by episode, a total of no more than 120 days.

The benefit is issued for the entire duration of treatment of children under 18 years of age from the first and other generations living in the resettlement zone, evacuation of people who suffered radiation exposure and became disabled as a result.

A person caring for a child under 3 years of age and a disabled child receives sick leave for the entire duration of his own illness (since he is not able to provide care).

Dismissal during incapacity

According to the Labor Code of the Russian Federation, a manager does not have the right to dismiss an employee working on an indefinite basis during sick leave on his own initiative, with the exception of the fact of liquidation of the enterprise. If the contract is for a limited period, expiring at the stage of illness, the citizen’s dismissal is possible. The procedures necessary for this can be carried out in his absence, the due payments are transferred to the card, the documentation is sent by mail.

Dismissal at the stage of sick leave at the request of the employee or by agreement of both parties is possible.