Who does the law apply to?

Any woman, regardless of her status, can receive a lump sum payment after the birth of a child.

The law applies equally to students, working and unemployed women.

Also, by agreement between the parents, benefits can be paid to the spouse (father of the child) - but only to one of the parents. If a father who is a military man wants to receive funds, he must fill out a special application form indicating the place of service or military unit to which he belongs.

If the child is under guardianship, the guardian receives financial assistance (upon confirmation of the fact of cohabitation with the newborn).

Cases when an application for benefits is mandatory

It is mandatory to submit an application to receive maternity benefits. But this should not just be an application for sick leave, but an application for maternity leave.

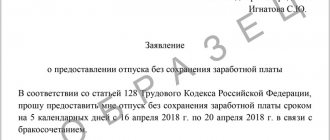

A sample application for sick leave for pregnancy and childbirth can be found on our website:

The application may also be accompanied by sick leave, for the payment of which the employee wishes to use a billing period different from the standard one to determine average earnings.

For an example of an application to change years in the billing period for calculating sick leave, see ConsultantPlus. Demo access to the legal system is provided free of charge.

An application will also be required to recalculate sickness benefits if an error was made in the calculation or if information about the employee’s income for previous years has appeared. An application for recalculation of sick leave benefits must be drawn up in a form approved by the Federal Social Insurance Fund of the Russian Federation (clause 2 of the Regulations on the payment of benefits for VNIM in 2021, approved by Government Decree No. 2375 dated December 30, 2020). So far this form exists only as a project.

ConsultantPlus experts explained in detail how sick leave is recalculated. Study the material by getting trial access to the K+ system for free.

Find out how quickly you should pay for sick leave in the publication “What are the deadlines for paying sick leave in 2021 - 2021?”

How to supplement the form

The application must be accompanied by a number of additional documents:

- document certifying the birth of the child;

- a certificate from the spouse’s employer stating that he/she was not given benefits through the accounting department of his/her enterprise (if the mother is unmarried or the child does not have an officially identified father, such a certificate does not need to be brought);

- Divorced women must provide a copy of the divorce certificate;

- in the case when the application is submitted to government agencies, you may need a certificate from the labor exchange stating that the person is not officially listed as an employee anywhere, or an extract (copy) from the employment record certified by the last employer.

Results

To receive sick pay from your employer, it is not necessary to submit an application, unless it concerns maternity sick leave.

When an individual receives sickness benefits directly from the Social Insurance Fund, it is advisable to use the form established by the department. To reimburse the employer's expenses for social benefits, there is also an application form recommended by the Social Insurance Fund. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Sample how to draw up an application for payment of a lump sum benefit upon the birth of a child

If you need to write an application for payment of a lump sum benefit for the birth of a child, and you do not know how to do it correctly, read the information below and pay attention to the sample document.

Today, an application for the payment of a one-time benefit can be written in free form or, if the employer or public service offers a document template, in its form.

The application can be drawn up on a regular sheet of any convenient format (but it is better to choose A4 - this is the standard format for business documentation), by hand (with a ballpoint pen with dark ink) or typed on a computer. There is only one important condition here: the form must be certified by the “living” signature of the applicant.

It is best to write the application in two copies , one of which should be given to the employer or a specialist of a government agency, and the second, after the representative of the receiving party has marked receipt on it, should be kept. In the future, such forethought will avoid possible disagreements about the deadline for filing an application.

How to write an application for sickness benefits and where for free

Providing sick leave to the employer in itself expresses the individual’s desire to receive payment of benefits.

A separate application for payment of sick leave issued in connection with an illness is not provided for by law. Important! Explanations from ConsultantPlus At the same time, the submission by an employee of an application for payment of benefits may be provided for by your local regulations (for example, internal labor regulations), since this is not prohibited by law. Moreover, it is advisable to ask the employee to write such a statement, for example, to record the fact and date of his application for payment of benefits, in order to avoid questions about the timing of its payment, as well as in the case of payment of benefits to an external part-time worker, if he chose your organization to pay him benefits. What information needs to be included in the application, see K+. Trial access is available for free.

Consideration of an application to the FSS

In order for the Social Insurance Fund to accept an application for sick leave and transfer funds, it is necessary to correctly draw up documents and justify the costs incurred. There are no specific deadlines for submitting an application.

However, the legislation establishes a period of time during which the FSS, in the absence of problems, transfers funds.

The standard period for making payments is 10 days . When checking, funds are transferred based on its results. The payment period begins to count from the moment the employer provides the requested documents. However, if the amounts indicated in the application raise suspicions among FSS employees that they have been calculated incorrectly, the Fund will organize a verification of the validity of the employer’s expenses and will request other supporting documents and information.

Expert commentary

Kamensky Yuri

Lawyer

Practice shows that sometimes the employer was able to achieve the cancellation of negative decisions of the Social Insurance Fund regarding compensation for expenses. To do this you need to go to court. This may be due to erroneous calculations. If the employer manages to prove the legality of the amounts presented for offset, the court will annul the initial decision of the Fund and oblige the Social Insurance Fund to transfer all due funds.

Drawing up an application to the FSS

In order to reimburse from the Social Insurance Fund its expenses for sick leave, the employer draws up a special application, after which it checks the correctness of the information specified in the sick leave certificate provided by the subordinate.

The application form for sick leave is established by order of the Federal Social Insurance Fund of the Russian Federation dated September 17, 2012 No. 355. The document must be filled out in block letters - either through a computer or by hand (ballpoint, fountain, capillary, or gleam pens are acceptable). Entries must be made in black ink, respecting the boundaries of the columns and fields. Corrections, blots, cross-outs, and blurring of already entered data are prohibited. If the document contains corrections and blots, then FSS employees may refuse to accept and consider it.

An application for the allocation of funds for payment of insurance coverage must contain the following information:

- name of the insured-employer - full name of the individual entrepreneur or individual, name of the organization;

- employer details – location address, tax identification number, checkpoint, etc.;

- a request, due to these circumstances, to allocate funds for the payment of insurance coverage in a specific amount (indicated in numbers and words);

- current account details – number, full name of the bank, its INN, BIC and other data;

- position of the head of the organization, his signature, full name and current telephone number;

- signature of the chief accountant, his signature, full name and current telephone number;

- seal of the policyholder, if available;

- passport details of the policyholder - series, number, date and place of issue;

- a document that confirms the authority of the employer's representative.

Important! Carefully double-check the correctness of the entered data to prevent possible problems.

Several documents must be attached to the application:

- a certificate containing a calculation of accrued and paid insurance premiums;

- copies of documentation establishing the correctness of expenses (for example, medical certificates or certificates issued by the registry office).

In doubtful situations, FSS employees have the right to request additional supporting documents.

How to correctly calculate sick leave in 2021

In our special article, berator experts examined 11 situations from which you will learn what’s new in accounting, look at examples from real practice and study a detailed algorithm of actions when calculating sick leave.

Test yourself, follow the links and read the berator “Practical Encyclopedia of an Accountant”. And don't get sick!

When the employer must pay the benefit depends on what date he assigns it. Here you need to link the sick leave payment to the date of salary payment in the company.

How to do this and is it possible to pay benefits in installments?

Do not forget that there are cases when benefits are not assigned

The period of incapacity for work for which benefits are paid is determined in calendar days, including weekends falling during this period.

Are there any restrictions on the duration of the paid period of incapacity?

3. The most “inconvenient” from an accounting point of view, as you know, are sick leave for care. Here it is necessary to control both the amount of benefits and the limits of paid days, and even in cases where, during illness, the child moved from one age category to another.

Let's remember the features of sick leave for care

And more about the certificate of incapacity for caring for a sick child

| All the details of calculating sick leave are in the berator | |||

| Do you want to conduct your accounting calmly, without being afraid of mistakes and constant innovations in accounting? Subscribe to the berator and don’t waste your nerves, time and money! | |||

Will the Social Insurance Fund accept expenses for prosthetics on an outpatient basis?What do the codes that a health worker puts down when issuing a certificate of incapacity for work mean? What mistakes can happen on sick leave? Will all of them entail refusal to accept expenses? Did you know that courts are increasingly beginning to support companies in disputes with the Social Insurance Fund?What condition must be met for this? See also arbitration practice The amount of sick leave benefits depends on the employee’s length of insurance coverage. Therefore, it must be calculated correctly - in calendar order, based on full months and full years.Did you know that even one day can lead to an error, or, conversely, prevent it? Many are interested in whether the procedure for providing sick leave benefits is affected by the fact that, due to the economic situation, many are transferred to part-time work.In general, it does not affect, but there is still one peculiarity Now let's move on to the calculations. To calculate benefits, an accountant needs to know:

The amount of the benefit depends on the employee’s actual earnings and its maximum values taken into account when calculating the amount.View limit values for a number of years One of the inconvenient situations for an accountant is the situation with replacing the years of the accounting period.Remember when this is possible and what it looks like in practice Traditionally, questions arise with benefits that need to be calculated based on the minimum wage.There are two such cases How to correctly apply the regional coefficient Now let’s remember the rules for calculating benefits and the procedure for reflecting them in accounting.See example |