Rates and calculation procedure

The tax period for calculating insurance premiums is the calendar year. Social insurance payments are calculated separately for each employee. The basis for the calculation is all accruals to the employee accrued from the beginning of the year and related to the performance of his job duties.

Calculate the amount due monthly as follows:

Tariffs for fees to extra-budgetary funds are established by Article 426 of the Tax Code of the Russian Federation. For social contributions for pension insurance and in case of temporary disability, tax base limits have been established. They are reviewed annually and established by the Government of the Russian Federation. Above this, social insurance contributions are not paid, and pension contributions are paid at a reduced rate.

Insurance premium rates

| Insurance type | Tariff, % | Maximum base 2021 (Government Decree No. 1378 dated November 15, 2017) | Tariff for an amount exceeding the limit |

| SS in case of VNiM | 2,9 | 815 000 | No |

| OPS | 22 | 1 021 000 | 10 % |

| Compulsory medical insurance | 5,1 | There is no maximum base, payments are calculated from all income for the billing period | |

Tariffs for payments for social protection against industrial accidents and occupational diseases are established by the Social Insurance Fund depending on the type of activity of the company. To do this, it is necessary to annually confirm the main type of activity. The rate can vary from 0.2 to 8.5%. If you do not confirm the main type of activity by submitting an application in the form established by Order of the Ministry of Health and Social Development dated January 31, 2006 No. 55, then the Social Insurance Fund will set the maximum possible tariff based on the types of activities of the company listed in the Unified State Register of Legal Entities.

Social insurance payment card

According to paragraph 4 of Article 431 of the Tax Code of the Russian Federation, all payers are required to keep records of the amounts of accrued payments to employees, as well as calculated insurance premiums from them separately for each individual. The accounting form is not established by law. Each company can develop it independently, ensuring that it reflects the required indicators.

As a sample, you can use the form recommended by the Pension Fund and the Social Insurance Fund in the Letter dated December 09, 2017.

Sample registration card

Accounting

Accounting for settlements for social insurance and security, according to the chart of accounts (Order of the Ministry of Finance dated October 31, 2000 No. 94n), is kept on account 69. To organize the division of accounting by type of payment, subaccounts are opened to the account to account for settlements for:

- social insurance;

- pension provision;

- compulsory health insurance;

- contributions for injuries.

The credit of the account reflects the amounts accrued for payment, the debit - the amounts paid to the budget, as well as the amounts of social benefits by which the amount payable can be reduced in accordance with clause 2 of Art. 431 Tax Code of the Russian Federation.

| Operation | Debit | Credit |

| Accrued wages, vacation pay | 20, 25, 26, 44 | 70 |

| Insurance premiums accrued | 20, 25, 26, 44 | 69 |

| Payments accrued on certificates of incapacity for work | 69 | 70 |

| Social insurance payments transferred | 69 | 51 |

Postings for settlements with extra-budgetary funds: nuances

Let's make a few clarifications on the postings presented above:

- If the income subject to contributions is not a salary, but a bonus (one-time, quarterly, annual), its amount should be attributed to other expenses.

Tax officials have long voiced their position, which has remained unchanged since then, that bonuses not related to the wage system cannot be included in production expenses (Letter of the Federal Tax Service of Russia dated December 3, 2010 No. 03-03-06/2/205). Accordingly, the very fact of accrual of the bonus is shown by posting to account 91 - where expenses not taken into account for tax purposes are recorded: DT 91.2 KT 70. And the accrual of contributions on income represented by a one-time bonus is shown by posting DT 91.2 CT 69 (with the necessary subaccount).

- If an employee’s illness, for which regular sick leave was paid, is reclassified as a work-related injury, the amounts are reversed:

- on payment of sick leave for 3 days at the expense of the employer (STORNO Dt 20 Kt 70);

- for payment of sick leave for the 4th and subsequent days at the expense of the Social Insurance Fund (STORNO Dt 69.11 Kt 70).

After this, a posting is generated reflecting the accrual of benefits in the amount fully subject to compensation from the Social Insurance Fund in case of an industrial injury: Dt 69.12 Kt 70.

- It happens that the FSS refuses to reimburse benefits. Most often, because they were calculated by mistake, and more was paid than was paid according to the documents. In this case, the employer, as a rule, initiates the return of the overpayment by the employee - voluntarily or through the court. Or, if there are legal grounds, it withholds the overpayment from the salary. Sometimes it forgives the debt. There is also a combination of approaches, when part of the overpayment is recovered, and part is forgiven.

Reporting

Quarterly reporting is submitted on accrued social insurance payments:

- for payments for compulsory medical insurance, compulsory medical insurance and VNiM - calculation of insurance premiums to the Federal Tax Service (by the 30th day of the month following the reporting quarter);

- for payments for injuries - to the Social Insurance Fund - form 4-FSS (by the 25th of the month following the reporting quarter, if you submit the report in electronic form, and by the 20th - on paper).

In addition, all companies using hired labor are required to submit a monthly SZV-M report and an annual SZV-STAZH report to the Pension Fund of the Russian Federation.

Account card

Legal documents

- Article 419 of the Tax Code of the Russian Federation. Payers of insurance premiums

- Federal Law of July 24, 1998 N 125-FZ

- Article 426 of the Tax Code of the Russian Federation. Lost force as of January 1, 2021. — Federal Law of August 3, 2018 N 303-FZ.

- Decree of the Government of the Russian Federation of November 15, 2017 N 1378

- Order of the Ministry of Health and Social Development of the Russian Federation dated January 31, 2006 N 55

- Article 431 of the Tax Code of the Russian Federation. The procedure for calculating and paying insurance premiums paid by payers making payments and other remuneration to individuals, and the procedure for reimbursement of the amount of insurance contributions for compulsory social insurance in case of temporary disability and in connection with maternity

- Order of the Ministry of Finance of the Russian Federation dated October 31, 2000 N 94n

- Article 431 of the Tax Code of the Russian Federation. The procedure for calculating and paying insurance premiums paid by payers making payments and other remuneration to individuals, and the procedure for reimbursement of the amount of insurance contributions for compulsory social insurance in case of temporary disability and in connection with maternity

Social Security Benefits

For the first time I am faced with the accrual and return from the budget of maternity benefits, one-time benefits and child care benefits up to 1.5 years.

Please explain how to correctly calculate and formalize all this, how and when to correctly issue a refund? List of documents.

Art. 3 of Federal Law No. 81-FZ of May 19, 1995 “On state benefits for citizens with children”

In particular, the following

types of state benefits

:

– maternity benefits;

– a one-time benefit for women registered in medical institutions in the early stages of pregnancy;

– one-time benefit for the birth of a child;

– monthly child care allowance.

These benefits relate to types of insurance coverage

in accordance with Art.

1.4 of the Federal Law of December 29, 2006 No. 255-FZ “On compulsory social insurance in case of temporary disability and in connection with maternity

.

Persons subject to compulsory social insurance in case of temporary disability and in connection with maternity are paid the above benefits at the expense of the Federal Social Insurance Fund of the Russian Federation

.

Amounts of state benefits

citizens with children in areas and localities where regional coefficients for wages are established

are determined using these coefficients

, which are taken into account when calculating these benefits if

they are not included in wages

.

Procedure and conditions for assigning and paying state benefits to citizens with children

, approved by order of the Ministry of Health and Social Development of the Russian Federation dated December 23, 2009 No. 1012n.

Persons entitled to receive benefits, their legal representatives or proxies, in order to receive benefits, apply to the organizations that assign these benefits with an application and documents

provided for by the Procedure, necessary to receive benefits.

The application indicates

:

– name of the organization to which the application is submitted;

– Full Name

without abbreviations in accordance with the identity document, as well as the status of the person entitled to receive state benefits (mother, father, person replacing them);

– document information

identification document (type of identification document, series and number of the document, who issued the document, date of issue) are filled out in accordance with the details of the identity document;

– information about place of residence

, place of stay (postal code, name of region, district, city, other populated area, street, house number, building, apartment), are indicated on the basis of an entry in a passport or a document confirming registration at the place of residence, place of stay (if not a passport is presented , and another identification document);

– information about the place of actual residence

(postal code, name of region, district, city, other locality, street, house number, building, apartment);

– type of benefit

, the appointment and payment of which is applied for by a person entitled to receive state benefits;

– method of receiving benefits

: by postal order or transfer to the personal account of a person entitled to receive benefits, opened with a credit institution;

– account details

, opened by a person entitled to receive benefits (name of the organization to which the benefit should be transferred, bank identification code (BIC), TIN/KPP assigned upon registration with the tax authority at the location of the organization, account number of the person entitled to receive benefits).

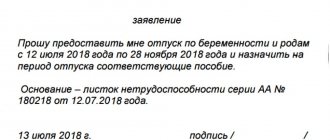

And in order to assign and pay maternity benefits, a certificate of incapacity for work must be submitted

.

One-time benefit

One-time benefit for women registered with medical organizations in the early stages of pregnancy

, is assigned and paid at the place of assignment and payment of maternity benefits.

For appointment and payment

a one-time benefit for women who registered with medical organizations in the early stages of pregnancy

is provided with a certificate from the antenatal clinic or another medical organization that registered the woman in the early stages of pregnancy

.

The one-time benefit is paid from the funds of the Federal Social Insurance Fund of the Russian Federation.

A one-time benefit is assigned and paid simultaneously with maternity benefits

, if a certificate of registration in the early stages of pregnancy is submitted simultaneously with documents for the assignment of maternity benefits.

If

this

certificate is submitted later

, the woman is assigned and paid the specified benefit

no later than 10 days

from the date of receipt (registration) of the certificate of registration in the early stages of pregnancy.

In 2015

a one-time benefit for women registered with medical organizations in the early stages of pregnancy

is paid in the amount of 543.67 rubles, taking into account the “Ural” coefficient

-

625.22 rubles.

One-time benefit for the birth of a child

A one-time benefit for the birth of a child is assigned and paid to one of the parents

at the place of work (service).

To assign and pay a lump sum benefit at the birth of a child, submit

:

a)

application

for granting benefits;

b) birth certificate

child (children), issued by the civil registry office;

c) certificate from place of work

(service, social protection body at the place of residence)

of the other parent that the benefit was not assigned

- if both parents work (serve).

In 2015

a one-time benefit for the birth of a child is paid

in the amount of 14,497.8 rubles, taking into account the “Ural” coefficient

-

16,672.47 rubles.

A one-time benefit for the birth of a child to insured persons is assigned and paid no later than 10 days

from the date of receipt (registration) of the application with all necessary documents.

Maternity benefit

Maternity benefit

is paid for a period of maternity leave lasting 70 (in the case of multiple pregnancies - 84) calendar days before childbirth and 70 (in the case of complicated births - 86, for the birth of two or more children - 110) calendar days after childbirth.

Maternity leave is calculated in total

and is provided to the woman completely regardless of the number of days actually used before giving birth.

Maternity benefits are assigned and paid for calendar days falling during the period of maternity leave

.

Maternity benefits are paid to the insured woman in the amount of 100% of average earnings

.

An insured woman with less than 6 months of insurance coverage

, maternity benefits are paid in an amount not exceeding the

minimum wage

established by federal law, and in districts and localities in which regional coefficients are applied to wages in accordance with the established procedure, in an amount not exceeding the

minimum wage taking into account these coefficients

.

Child care allowance

Pay

monthly child care benefits

are provided from the day following the end of maternity leave

until the day the child turns 1.5 years old - in the case of the child’s mother using maternity leave.

The right to a monthly child care allowance remains

if a person on parental leave works

part-time

or from home.

When caring for a child for less than a full calendar month

The monthly child care allowance is paid

in proportion to the number of calendar days

(including non-working holidays) in a month during the period of care.

Monthly child care allowance is paid in the amount of 40% of average earnings

, on which insurance premiums are charged for compulsory social insurance in case of temporary disability and in connection with maternity.

To assign and pay a monthly child care allowance, submit

:

A)

application for benefits;

b)

birth (adoption) certificate of the child (children) being cared for.

In case of caring for two or more children

Until they reach the age of 1.5 years, the amount of the monthly child care benefit is summed up.

At the same time, the total amount of the benefit

, calculated on the basis of average earnings (income, monetary allowance),

cannot exceed 100% of the average earnings

, on which insurance contributions for compulsory social insurance are calculated in case of temporary disability and in connection with maternity, but cannot be less than the total minimum amount of this benefit .

Basis for appointment and payment

monthly child care allowance is

the decision of the organization

to provide parental leave.

The decision to assign a monthly child care benefit is made within 10 days

from the date of receipt (registration) of the application for granting benefits with all the necessary documents.

All the above benefits are assigned and paid by the policyholder

—

employer

.

Accounting for insurance premiums and expenses for payment of insurance compensation

Order of the Ministry of Health and Social Development of the Russian Federation dated November 18, 2009 No. 908n approved the Procedure for accounting for insurance contributions for compulsory social insurance

in case of temporary disability and in connection with maternity, penalties and fines, expenses for payment of insurance coverage

and settlements for compulsory social insurance in case of temporary disability and in connection with maternity

.

Policyholders are required to keep records

:

A)

amounts of accrued insurance premiums, penalties and fines;

b)

amounts of paid (transferred) insurance premiums, penalties and fines;

c)

the amount of expenses incurred for the payment of insurance coverage

;

d)

settlements for

compulsory social insurance

in case of temporary disability and in connection with maternity

with the territorial body of the Fund at the place of registration of the policyholder (amounts payable to the territorial body of the Fund and amounts received from the territorial body of the Fund).

The accounting of these amounts is carried out in accordance with the legislation of the Russian Federation on accounting

.

Policyholders keep track of expenses incurred against accrued insurance premiums

for payment of insurance coverage,

in the form of

:

A)

temporary disability benefits;

b)

maternity benefits;

V)

a one-time benefit for women registered in medical institutions in the early stages of pregnancy;

G)

lump sum benefit for the birth of a child;

d)

monthly child care allowance.

Accounting for payment expenses incurred

compulsory insurance coverage for compulsory social insurance in case of temporary disability and in connection with maternity

is possible only through the payment of insurance contributions

.

According to Art. 4.6 of Law No. 255-FZ, insurers pay insurance coverage

to insured persons

for the payment of insurance premiums to the Social Insurance Fund of the Russian Federation

.

Amount of insurance premiums to be transferred

by policyholders in the Federal Insurance Fund of the Russian Federation,

is reduced by the amount of expenses incurred by them

to pay insurance coverage to insured persons.

In Art. 15 of Federal Law No. 212-FZ of July 24, 2009 also states that the amount of insurance premiums

for compulsory social insurance in case of temporary disability and in connection with maternity,

payable to the Federal Social Insurance Fund of the Russian Federation, is subject to reduction by payers of insurance contributions by the amount of expenses incurred by them for the payment of

compulsory insurance coverage for the specified type of compulsory social insurance in accordance with the legislation of the Russian Federation.

If the insurance premiums accrued by the policyholder are not enough to pay the insurance coverage

to the insured persons in full,

the policyholder applies for the necessary funds to the territorial body of the FSS of the Russian Federation

at the place of his registration.

List of documents

, which must be submitted by the insured

for a decision to be made

by the territorial body of the Social Insurance Fund of the Russian Federation

on the allocation of the necessary funds for the payment of insurance coverage,

approved by order of the Ministry of Health and Social Development of the Russian Federation dated December 4, 2009 No. 951 and contains:

1.

Written statement from the policyholder

, which must contain:

– name and address of the insured - a legal entity or surname, first name, patronymic, passport details, address of permanent residence of the insured - an individual;

– registration number of the policyholder;

– an indication of the amount of funds required to pay the insurance coverage.

2. Form 4-FSS

, approved by order of the Federal Insurance Service of the Russian Federation dated February 26, 2015 No. 59 for the corresponding period, confirming the accrual of expenses for the payment of insurance coverage.

3.

documents

confirming

the validity and correctness of expenses for compulsory social insurance :

– for maternity benefits

– a certificate of incapacity for work, filled out in the prescribed manner, with the benefit calculated;

– for a one-time benefit for women registered in medical institutions in the early stages of pregnancy

, – a certificate from the antenatal clinic or other medical institution that registered the woman in the early stages of pregnancy (up to 12 weeks);

– for a one-time benefit at the birth of a child

– a certificate of birth of a child in the established form, issued by the civil registry office, a certificate from the other parent’s place of work about non-receipt of benefits;

– for monthly child care allowance

– documents provided for in parts 6 and 7 of Art. 13 of Law No. 255-FZ.

When considering the insured's request for the allocation of the necessary funds for the payment of insurance coverage, the territorial body of the insurer has the right to verify the correctness and validity of the insured's expenses

for payment of insurance coverage,

including an on-site inspection

, and also request additional information and documents from the policyholder.

In this case, the decision to allocate these funds to the policyholder is made based on the results of the audit.

.

The territorial body of the Social Insurance Fund of the Russian Federation allocates the necessary funds to the policyholder

for payment of insurance coverage

within 10 calendar days

from the date the policyholder submits all necessary documents.

Funds for payment of insurance coverage ( with the exception of

payment of benefits for temporary disability in case of loss of ability to work due to illness or injury for the first three days of temporary disability) to insured persons who work under employment contracts concluded with organizations and individual entrepreneurs, for whom reduced insurance premium

rates

in accordance with Parts 3.3 and 3.4 Art.

58 and from Art. 58.1 of Law No. 212-FZ, are allocated to these organizations

and individual entrepreneurs by the territorial bodies of the FSS of the Russian Federation

in the order indicated above

.

The payer of insurance premiums has the right to set off the amount of excess expenses within the billing period

for the payment of compulsory insurance coverage for compulsory social insurance in case of temporary disability and in connection with maternity

over the amount of accrued insurance contributions

for the specified type of compulsory social insurance

against upcoming payments

for compulsory social insurance in case of temporary disability and in connection with maternity (Article 15 Law No. 212-FZ).

Credit is possible only within the billing period

–

one calendar year

.

If you have overspending

upon payment of insurance coverage,

it is not carried over to the next year

.

And then you will have to contact the FSS of the Russian Federation for the necessary funds

, since, as already noted, if the insurance premiums accrued by the policyholder are not enough to pay the insurance coverage to the insured persons in full, the policyholder applies for the necessary funds to the territorial body of the insurer at the place of its registration.

Thus, you pay all benefits from your own funds.

.

By the amount of benefits paid, you will reduce the amount of insurance contributions to the Federal Social Insurance Fund of the Russian Federation.

If the amount of expenses for paying benefits exceeds the amount of insurance premiums, then the excess amount can be received as compensation from the Federal Social Insurance Fund of the Russian Federation.

Calculation of benefits

Since one-time benefits are in a fixed amount, they do not need to be calculated

.

And benefits for pregnancy and childbirth and for child care up to 1.5 years are calculated based on average earnings

.

In accordance with Art. 14 of Law No. 255-FZ, maternity benefits and monthly child care benefits are calculated based on average earnings

of the insured person,

calculated for 2 calendar years preceding the year of

maternity leave, child care leave, including during work (service, other activities)

with another policyholder

(

other policyholders

).

If benefits are calculated in 2015, then the average earnings for 2014 and 2013 are taken into account

.

Moreover, if in two calendar years

immediately preceding the year of occurrence of the specified insured events,

or in one of the specified years

the insured person

was on maternity leave and

(

or

)

on parental leave

, the corresponding

calendar years

(

calendar year

)

at the request of the insured person can be replaced

at for the purposes of calculating average earnings in previous calendar years (calendar year), provided that this will lead to an increase in the amount of benefits.

If the employee worked elsewhere in the billing period before your organization

, she must

provide you with a certificate of the amount of earnings

for the two calendar years preceding the year of termination of work (service, other activities) or the year of application for a certificate of the amount of earnings, and the current calendar year for which insurance premiums were calculated, and

the number of calendar days falling in the specified period during periods of temporary disability, maternity leave, parental leave

, the period of release of the employee from work with full or partial retention of wages in accordance with the legislation of the Russian Federation, if insurance premiums are paid for the maintained wages for this period were not accrued to the FSS of the Russian Federation.

The average earnings, on the basis of which benefits are calculated, include all types of payments

and other remuneration in favor of the insured person,

for which insurance premiums are accrued to the Federal Social Insurance Fund of the Russian Federation

in accordance with Law No. 212-FZ.

In all cases, average daily earnings are used to calculate benefits.

Average daily earnings

to calculate maternity benefits, monthly child care benefits is determined by dividing the amount of earnings accrued for the billing period by the number of calendar days in this period,

with the exception of calendar days falling on the following periods

:

– periods of temporary disability, maternity leave, parental leave;

– the period of release of the employee from work with full or partial retention of wages in accordance with the legislation of the Russian Federation, if insurance contributions to the Social Insurance Fund of the Russian Federation were not accrued for the retained wages during this period in accordance with Law No. 212-FZ.

Average daily earnings cannot exceed the amount determined

by dividing by 730 the sum of the maximum values of the base for calculating insurance contributions to the Federal Social Insurance Fund of the Russian Federation, established in accordance with Law No. 212-FZ for 2 calendar years preceding the year of maternity leave and child care leave.

The size of the limit base

taking into account indexation is:

– in 2014 – 624,000 rubles;

– in 2013 – 568,000 rubles.

Maximum size

The average daily earnings for calculating benefits

in 2015

is

1,632.88 rubles.

((624,000 + 568,000) / 730).

Monthly child care allowance

is calculated based on the average earnings of the insured person, which is determined by

multiplying the average daily earnings by 30.4

.

Calculation of maternity benefits

produced by the policyholder on a separate sheet and attached to the certificate of incapacity for work (clause 67

of the Procedure for issuing certificates of incapacity for work

, approved by order of the Ministry of Health and Social Development of the Russian Federation dated June 29, 2011 No. 624n).

Law No. 255-FZ also establishes the specifics of calculating benefits

when working

part-time, in the absence

of earnings

in the billing period , when working

part-time

.

The specifics of the procedure for calculating benefits for temporary disability, pregnancy and childbirth, monthly child care benefits for citizens subject to compulsory social insurance in case of temporary disability and in connection with maternity are established by Decree of the Government of the Russian Federation dated June 15, 2007 No. 375.