In what cases is a notification letter written?

Chapter 11 of Federal Law-229 provides for the obligation of the employer or persons paying wages to the debtor under a writ of execution to withhold part of the funds to pay off the debt. The basis for this is a writ of execution or a court order, which can be transferred to an organization (IP) either by the collector (recipient of alimony) or by the bailiff.

How to inform bailiffs about a dismissed employee

Notice of dismissal of an employee is a document of arbitrary content. However, practice has developed unified forms, which are provided for the convenience of performers on the FSSP website. The notice must contain:

- name of the legal entity or individual employer;

- address and details of the notifying person;

- name and ID number on the basis of which deductions were made;

- the amount of existing debt under obligations;

- information about amounts withheld at the time of dismissal;

- number of the dismissal order and its grounds;

- signature of the manager and chief. accountant;

- date and seal of the company.

In addition to the specified mandatory information, the letter to the bailiffs may contain other information known to the employer. For example: about the debtor’s place of residence, his contact information, where he plans to work, the locality to which the debtor has moved.

If the original IL was kept in the accounting department of the organization, it is returned to the claimant or, if impossible, to the bailiff, for subsequent return to the recipient of payments.

Accounting statements, copies of documents submitted to the FSSP and notifications are transferred to the archive in case of inspections by fiscal authorities.

To write a letter, you can use an example notification:

Letter to representatives of the FSSP stating that the debtor resigned

In accordance with sub. 2 clause 4.1 art. 98 Federal Law of the Russian Federation “On Enforcement Proceedings”, in the event of dismissal of the debtor, the employer is obliged to send to the bailiff:

- a copy of the writ of execution with a note indicating the reason for the end of execution of the document;

- and the amount that was withheld for the entire time the employee worked in a particular organization.

Thus, the covering letter to the bailiffs is an official document that is sent to the FSSP after the termination of the employment contract with the debtor, complete with a writ of execution. An order for the dismissal of a specific employee must also be attached here.

It should be borne in mind that sending such a document is a mandatory requirement.

In case of failure to comply with the notification procedure, the employer may be fined:

- for citizens - from 2,000 to 2,500 rubles;

- for officials - director, head of the personnel department - from 15,000 to 20,000 rubles;

- for legal entities - from 50,000 to 100,000 rubles.

Such amounts are specified in Part 3 of Art. 17.14 Code of Administrative Offenses of the Russian Federation.

When is it compiled?

A covering letter to bailiffs is drawn up upon the dismissal of an employee from whose wages deductions were made on the basis of a writ of execution. It could be:

- payment of alimony;

- repayment of debt to the bank;

- compensation for damage caused to another person;

- fines;

- other types of deductions.

In this case, the main reason for sending a covering letter, including the papers attached to it, is the termination of the execution of the writ of execution. It is also worth emphasizing that the bailiffs must be notified of this event not only when the debtor is dismissed, but also in a number of other situations (for example, when transferring money in full, in connection with the filing of an application by the debtor, etc.).

How to write correctly?

The current legislation does not have any requirements or rules for writing a cover letter to bailiffs. There is also no single example of such a document.

It is drawn up in any form on A4 paper. It can be prepared on the letterhead of an organization acting as an employer.

The standard structure of a cover letter for the dismissal of a debtor is represented by the following points:

- “Head” of the document - here the details of the employing company (name, location) and information about the addressee are indicated, that is, the full name of the territorial branch of the FSSP and its address.

- Registration data - the number and date of registration of the letter in the company’s outgoing correspondence.

- Title of the document - the following wording can be used here: “Notice of dismissal of the alimony payer.”

- Content part — this section should consistently contain the following information:

- Full name of the debtor;

- the position he held in the organization;

- details of the writ of execution on the basis of which deductions from wages were made (number and date, name of the judicial authority);

- reason for dismissal;

- the day until which the deductions were made, and a note indicating the absence of uncollected debt;

- message about the return of the writ of execution.

- At the end of the document there must be signatures (of the manager and chief accountant), as well as the seal of the organization.

How to report a fired employee?

Based on the provisions of clause 4.1 of Art. 98 of the law mentioned above, the writ of execution must be sent to the bailiffs the next day after dismissal . However, in individual cases this period may change.

For example, if an employee is a payer of alimony, then the administration of the organization in which he works must notify the bailiff within 3 days of the fact of the payer’s dismissal (clause 1 of Article 111 of the RF IC). In this case, it is also necessary to inform about the new place of work of the person liable for alimony (if it is known to the former employer).

In general, a covering letter with attachments can be sent to the bailiffs in one of the following ways:

- delivered via courier;

- sent by mail (by a valuable letter with acknowledgment of delivery).

Employer's procedure

The procedure for handling a writ of execution when dismissing an employee includes 4 stages:

- Notifying the bailiff or recoverer of receipt of the document for collection. This is not a requirement, but if a notification of receipt form is included, it is best to fill it out.

- Registration in the journal of incoming documents. A prerequisite for resolving possible disputes with bailiffs or collectors.

- Storage of the document for debt collection throughout the entire period of the employment relationship with the debtor. For this purpose, a responsible person (accountant) is appointed who is in charge of the IDs for all debtor employees. The originals of the IL are stored in a safe. They are documents of strict accountability.

How to return a writ of execution to bailiffs upon dismissal

So, no later than the day following the day of dismissal, the employer must notify of the termination of the contract with the debtor employee, return a copy of the writ of execution containing the necessary information to the bailiffs and immediately report the person’s new job (or that nothing is known about it). ).

The law does not clarify what “promptly” means. And therefore, it will not be a violation to send all the information simultaneously along with writs of execution, which themselves should be sent quite quickly.

In practice, this means that the employer will do the following:

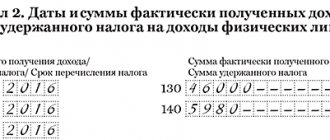

1. In the free space available on the copy of the writ of execution (or on the reverse side of it) write: “Deductions were made in the amount of ___ rubles. The remaining amount of ___ rubles was not withheld due to the employee’s dismissal.”

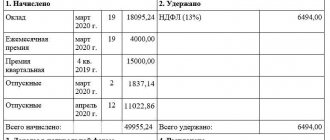

2. Draws up (in free form) a certificate that records:

- the amount that had to be recovered under the writ of execution;

- amounts that were actually withheld (monthly) from the employee’s salary;

- details of payment documents confirming the transfer of the corresponding amounts to the collector.

Each of the specified documents - a copy and a certificate, is certified by:

- organization accountant;

- seal of the organization.

This is how a writ of execution is prepared for sending upon dismissal of an employee (more precisely, a copy of the writ for bailiffs). But that is not all. After that:

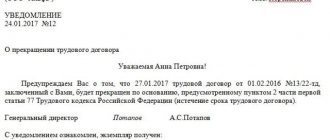

1. A notice is drawn up about the dismissal of the debtor (for example, about the dismissal of an alimony payer). This is a free-form letter that states:

- Full name and position of the person being dismissed, article of the Labor Code of the Russian Federation under which the employment contract is terminated, order number;

- details of the writ of execution;

- information about the employee’s new place of work, if it is known (or “we do not have information about the new place of work”);

- attachments - a copy of the writ of execution, a certificate of the amount of deductions made and payment documents for the transfer of funds to the recoverer.

The notification is certified by the manager and chief accountant and stamped (if available).

2. A covering letter is drawn up, which contains a list of all the documents compiled above. The letter is certified by the supervisor.

3. Cover letter, notice of dismissal and all attached documents:

- personally transferred by the employer’s representative to the Bailiff Service;

- or sent to the Bailiff Service by mail - always with an inventory and notification of receipt.

Perhaps some other scheme is more convenient for a particular bailiff - due to the fact that the transfer of documents and information to the FSSP in this case is not regulated in detail by law, you can discuss everything in advance with a representative of the department by contacting him.

What deadlines do you need to meet?

The notice period after dismissal may vary. Depends on the nature of the obligations for which the debt was collected. For general property obligations, no deadline has been established. In Part 4 of Art. 98 FZ-229 there is only an indication that the ID is subject to immediate return.

Hotline for citizen consultations: 8-804-333-70-30

More precisely, the terms of return are established in relation to debtors from whom alimony is being collected. The return period for IL is established by Part 1 of Art. 111 of the Family Code - no later than 3 days from the date of dismissal.

What to do in this situation

The practice follows the path when the former employer withholds alimony from income and notifies the bailiff about this. However, there is no legal justification for such actions.

The FSSP does not provide an official explanation regarding the current situation. The justification for the retention is a reference to Art. 109 RF IC and clause 3. Art. 98 FZ-229. However, when reading these articles, it turns out that we are talking about deductions from “salaries and other periodic payments.” Payments for temporary disability and the assignment of bonuses do not qualify as such, since they are not of a regular nature. By the time the payment is made, the employee is no longer working. The IL, which was the basis for the deduction, was returned to the bailiff or collector.

There is no explanation from the FSSP regarding the actions of the former employer. The only justification for the actions of the former employer is Letter No. 11-1/OOG-43 of the Ministry of Labor dated February 19, 2014; the drafters, in turn, refer to the List of types of income for which alimony is withheld.

In order to avoid misunderstandings and fines on the part of the FSSP, it is recommended to withhold alimony from dismissed debtors, although there is no direct indication of such actions in any law. The explanations of the Ministry of Labor are advisory in nature and reflect the subjective point of view of the lawyers of this government agency.

FAQ

I received a letter from the bailiffs that the court foreclosure on the loan was cancelled, can the bailiff subsequently resume proceedings again?

Check on the FSSP website for what reason the enforcement proceedings were completed or terminated. If you have not repaid this debt, then most likely it will be under Art. 46 part 1 clause 3. - return of the writ of execution to the claimant. If the claimant returns the sheet back to the bailiff, the proceedings will be restored.

Can the bank itself present a writ of execution to the accounting department of the organization where I work?

The claimant has the right to present a writ of execution to the bailiff, to the bank where the debtor's accounts are opened, or to the employer's accounting department if the debtor is an individual.

According to the writ of execution, 50% of the salary was withheld, but I did not know that the bank had filed a lawsuit. What can be done in such a situation?

If the amount of debt does not exceed 500 thousand rubles, then most likely the court issued a court order. It is necessary to go to court to cancel the court order and obtain an appropriate determination, which will be the basis for terminating the individual entrepreneur. But after the court order is canceled, the bank has the right to go to court to collect the debt. Your right to be present at this process and request a reduction in the penalty.

The writ of execution upon dismissal was not sent: consequences

It is unacceptable to ignore the obligations prescribed in Law No. 229-FZ, and in the case of alimony and in the Family Code, otherwise the employer will face liability.

We are talking about sanctions under Part 3 of Art. 17.14 Code of Administrative Offenses of the Russian Federation. Based on this provision, fines may be imposed for violation of the deadlines for transferring the employee to the FSSP in the amount of:

- 15,000 - 20,000 rubles per official of the employing company;

- 50,000 - 100,000 rubles per employer as a legal entity.

There are no mitigating circumstances regarding the application of these fines in the law: it does not matter, for example, that the employer did not know whether the writ of execution was withheld upon dismissal (its copy) or not, and therefore did not send the documents due to the fact that he was simply not aware of such obligation.

If the documents were sent to the FSSP by the employer by mail (and there are supporting documents), but notification of their receipt was not received, or if delivery did not take place due to the fault of the postal service, the employer’s obligations depending on it are considered fulfilled and no fine will follow.