Additional payment of maternity benefits

If the collective and labor agreement stipulates the employee’s opportunity to receive an additional payment up to the average salary for such benefits, then these costs can also be included in labor costs.

The procedure for determining the average salary must be reflected in the local regulations of the employer. If this is not reflected in the documents of the business entity, then the average earnings can be determined in accordance with the current regulations governing the procedure for its calculation.

The Tax Code of the Russian Federation determines that an economic agent has the right to classify expenses for additional payments to maternity benefits up to average earnings as income tax expenses.

Expert opinion

Semenov Alexander Vladimirovich

Legal consultant with 10 years of experience. Specializes in the field of civil law. Member of the Bar Association.

The amounts of such additional payments are subject to income tax. Unified social tax is calculated for them. Local regulations of the tax agent in the field of labor legislation may establish an additional payment not only up to average earnings, but also up to:

- official salary. Bonuses and any allowances are not taken into account;

- actual earnings, that is, up to the salary that would have been received by the employee if he had worked for a full month;

- any fixed value that can be set the same for all employees of the enterprise, regardless of salary and job responsibilities. The amount of the additional payment depends on the employer’s financial ability to compensate for the employee’s material losses during illness.

Is additional payment for sick leave legal?

The provisions of the Labor Code of the Russian Federation, which allow participants in labor relations to agree on additional payment at the expense of the employer to state benefits, are neutral in relation to the type of benefits and do not depend on differences in their purpose, sources of payment, calculation procedure, etc. An employment contract may provide for additional conditions that do not worsen the employee’s position in comparison with those established by labor legislation and other regulatory legal acts containing labor law norms, a collective agreement, agreements, and local regulations (Article 57 of the Labor Code of the Russian Federation). A collective agreement, taking into account the financial and economic situation of the employer, may establish benefits and advantages for employees, working conditions that are more favorable in comparison with those established by laws, other regulatory legal acts, and agreements (Article 41 of the Labor Code of the Russian Federation). Judicial practice indicates the legality of improving the provisions of labor (collective) agreements of guarantees for employees in comparison with the guarantees established by law (Definitions of the Supreme Court of the Russian Federation dated 01/21/2010 N 9-В09-25, dated 02/08/2008 N 25-В07-22).

Additional payment up to the minimum wage for part-time workers

The procedure for additional payment up to the minimum wage, including for part-time workers, deserves special attention. If the employee’s salary, as well as sick pay, does not reach the minimum wage, the employer is obliged to compensate the difference.

The Labor Code stipulates that part-time workers are paid in proportion to the time worked. Additional payment of sick leave up to the minimum wage follows the same principle. The procedure for such additional payment must be reflected in the employer’s internal regulations governing wage calculations.

The provisions of these documents are brought to the attention of the employee against signature.

The additional payment is issued by order of the enterprise.

Calculation of surcharge

To calculate the amount of the surcharge, you need to determine the amount of sickness benefit that the employer must pay without fail. In this case, one should be guided by the Regulations approved by Decree of the Government of the Russian Federation of June 15, 2007 N 375, as well as Art. 14 of Law No. 255-FZ.

The amount of mandatory benefits is usually calculated based on the employee’s average earnings. First, the amount of accruals made in his favor for the billing period is determined. Typically this is the two years preceding the year in which the temporary disability began.

Only the accruals that are taken into account when determining average earnings are added up. And these are the amounts that are included in payments and other remuneration in favor of the employee, for which insurance contributions to the Federal Social Insurance Fund of the Russian Federation are calculated in accordance with Federal Law No. 212-FZ of July 24, 2009 (hereinafter referred to as Law No. 212-FZ).

Accruals are added up separately for each year of the billing period. If this time period has not been fully worked out or there is no certificate of earnings from other employers, then the actual amount available is taken into account.

The maximum benefit limit is then determined. That is, the amounts received for each year are compared with the maximum permissible value. Namely, with the maximum value of the base for calculating insurance contributions to the Federal Social Insurance Fund of the Russian Federation. In further calculations, a smaller indicator is used.

Next, the resulting amount is divided by 730, which gives the average daily earnings. It is multiplied by the insurance period coefficient, then by the number of calendar days of incapacity.

Finally, they determine how much the employee could actually earn if he worked and was not sick. The amount of compulsory benefits is subtracted from the resulting value. The result is a surcharge.

Example 1. Cashier of Magic LLC O.V. Vasilyeva was on sick leave from November 18 to November 26, 2013.

Her insurance experience is five years and two months. Earnings for 2011 amounted to 470,000 rubles, for 2012 - 530,000 rubles. The salary is 45,000 rubles.

The employment contract provides for the employer’s obligation to pay extra in case of incapacity to actual earnings.

The accountant of Magic LLC made the following calculations.

First, he determined the average earnings to determine the benefit established by law.

Since the employee’s income for the two years preceding the time when temporary disability occurred is greater than the maximum base for calculating insurance contributions to the Federal Social Insurance Fund of the Russian Federation (in 2011 - 463,000 rubles, in 2012 - 512,000 rubles), then In the calculation, the accountant took into account the maximum possible values. As a result, the average daily earnings for calculating benefits were:

(463,000 rub. + 512,000 rub.) : 730 days. = 1335.62 rub.

The amount of temporary disability benefits is equal to:

RUB 1,335.62 x 80% x 9 days = 9616.46 rub.

The accountant then calculated the amount that O.V. Vasilyeva would have received, if she had worked these days, in the amount of:

45,000 rub. : 20 days x 9 days = 20,250 rub.

The amount of additional payment before actual earnings was:

20,250 - 9616.46 = 10,633.54 rubles.

Answers to pressing questions

Question number 1 . Can an enterprise take into account in its expenses to determine the income tax base an additional payment for sick leave up to the average earnings of a citizen of another state?

Answer. An enterprise has the right to pay additional sick leave up to the average salary in accordance with the employment agreement to its employee, regardless of his citizenship.

But such costs cannot be included in expenses when calculating the taxable base for income tax. If a citizen of another state is not an insured person, then he has no right to sickness benefits.

Consequently, such costs are not regulated by Article 255 of the Labor Code of the Russian Federation and are not taken into account as expenses affecting the amount of taxable profit.

Question number 2 . How to calculate the amount of additional payment up to the minimum wage for an employee working part-time.

For an employee, on his own initiative, working days are Monday, Tuesday, Thursday and Friday, and Wednesday, Saturday and Sunday are days off. The company has a five-day work week.

In April 2021, the planned working time was 160 hours, the employee’s salary was 7,000 rubles.

Actually 128 hours worked.

Answer. The employee's salary in accordance with the number of hours worked in April 2021 is:

7000/160*128 = 5600 rubles.

The employee’s salary does not reach the minimum wage established by law as of the reporting date. Consequently, as someone who has worked the full working hours established for the employee individually, he has the right to receive an additional payment to his earnings up to the minimum wage. The additional payment will be calculated in proportion to the time of actual work:

Question No. 3. Will the amounts of additional sick leave up to average earnings be reimbursed from the Social Insurance Fund?

Answer. According to the current legislation regulating the procedure for calculating sickness benefits, the average salary per day cannot be more than the limit determined by regulations for the reporting year.

This means that only the benefit amount calculated based on this limit value, but not the actual income of the insured person, can be repaid from the Social Insurance Fund. The employer can compensate the difference at his own expense.

It should be noted that the additional payment up to the employee’s actual salary is subject to taxation as income in the generally established manner for salaries.

Question No. 4. On December 25, the employee was accrued additional sick leave up to average earnings. The next day, the employee was paid for sick leave and the income tax on this amount was transferred to the budget. How to correctly reflect the accrual of surcharges in the Form 6-NDFL report?

Expert opinion

Semenov Alexander Vladimirovich

Legal consultant with 10 years of experience. Specializes in the field of civil law. Member of the Bar Association.

Answer. The Income Tax Law stipulates that the amount of personal income tax on the income of an individual taxpayer must be transferred by the employer no later than the next day after the funds are issued to him.

There are no exceptions to this rule for additional payments for sick leave up to average earnings. The additional payment of disability benefits paid in December up to the average salary is reflected in the 6-NDFL report for the current year as follows:

- Page 100 – 26.12 – the date of payment of the additional payment is indicated;

- Page 110 – 26.12 – the day of personal income tax withholding is reflected;

- Page 120 – December 27 – the day of payment of income tax to the budget.

Question No. 5. What taxes should be imposed on the amount of additional payment to sickness benefits up to the average, actual earnings or minimum wage?

Answer. Such additional payments, as well as disability benefits themselves, are subject to personal income tax under tax law.

As with benefits, additional payments are subject to a tax rate of 13% or 30% depending on whether the taxpayer is a resident or not. Additional payments are also subject to taxation for insurance premiums, in contrast to the amount of disability benefits.

In addition, for the amount of additional payment for sick leave, you need to charge contributions for injuries, but for the amount of the sick leave itself it is not necessary.

Some organizations pay their employees temporary disability benefits higher than the amounts accrued by the Social Insurance Fund. What this entails and how to arrange an additional payment up to the average salary on sick leave , you will learn from our publication.

Tax and accounting of additional payments

The costs of paying benefits for temporary disability, reimbursed to the employer from the Social Insurance Fund of the Russian Federation, are not included in the employer's accounting and tax accounting. The employer makes additional payments for sick leave on the basis of an employment (collective) agreement at his own expense. The question arises: can they be taken into account for profit tax purposes? Which expense item is most appropriate in this case? The position of officials regarding additional payments to both types of state benefits is almost the same. It traditionally develops in favor of attributing these additional payments for profit tax purposes to tax expenses for wages. The rules for such expenses are established in Art. 255 Tax Code of the Russian Federation. The commented Letter states that the list of labor costs in Art. 255 of the Tax Code of the Russian Federation is not closed. And if so, then the Ministry of Finance recommends taking into account the amount of additional payment to the employee up to the official salary for the period of maternity leave as part of expenses that reduce taxable profit, in accordance with the provisions of the “neutral” clause 25 of Art. 255 Tax Code of the Russian Federation. This paragraph names other types of expenses incurred in favor of the employee, provided for by the employment contract and (or) collective agreement. Similar recommendations were given earlier, and were recently voiced in Letter of the Ministry of Finance of Russia dated February 24, 2012 N 03-03-06/1/98. As for additional payments for regular sick leave, there is no difference for them from additional payments for maternity benefits for tax accounting purposes. They are also proposed to be included in labor costs on the basis of clause 25 of Art. 255 of the Tax Code of the Russian Federation (Letters of the Ministry of Finance of Russia dated December 15, 2010 N 03-03-06/2/212, dated December 8, 2010 N 03-03-06/2/209).

Example. The organization's accountant (born in 1980) was awarded maternity benefits in the amount of 60,000 rubles, as well as an additional payment to the official salary on the basis of a collective agreement - 10,000 rubles. The amount of benefits paid to an employee at the expense of the Social Insurance Fund of the Russian Federation is not subject to personal income tax (clause 1 of Article 217 of the Tax Code of the Russian Federation). Additional payment up to the official salary is not a state benefit and is subject to personal income tax (clause 1 of article 210, clause 1 of article 217 of the Tax Code of the Russian Federation). This tax is withheld at a rate of 13% at the time of payment of funds to the employee (clause 1, article 224, clauses 1, 4, article 226 of the Tax Code of the Russian Federation). Insurance premiums for compulsory insurance, including compulsory social insurance against accidents, are not charged for the amount of maternity benefits (clause 1, part 1, article 9 of the Federal Law of July 24, 2009 N 212-FZ, clause 1, part 1, art. 20.2 of the Federal Law of July 24, 1998 N 125-FZ). However, in these articles, among payments not subject to insurance contributions, additional payments at the expense of the employer are not mentioned. Consequently, insurance premiums will have to be charged on the amount of the surcharge, including insurance against injury. The organization applied to the territorial branch of the Federal Social Insurance Fund of the Russian Federation for reimbursement of the benefit amount. In the accounting records of the organization, the accrual, payment of benefits and additional payments will be reflected in the following entries: Debit 69-1 Credit 70 - 60,000 rubles. — benefits were accrued at the expense of the Federal Social Insurance Fund of the Russian Federation; Debit 26 Credit 70 - 10,000 rub. — an additional payment to the benefit is accrued at the expense of the employer; Debit 70 Credit 68, subaccount “Settlements with the budget for personal income tax” - 1300 rubles. (RUB 10,000 x 13%) - personal income tax is withheld from the additional payment amount; Debit 70 Credit 50 (51) - 68,700 rub. (60,000 + 10,000 - 1300) - benefits paid minus withheld personal income tax; Debit 26 Credit 69, subaccount “Settlements with the Pension Fund” - 1600 rubles. (RUB 10,000 x 16%) - insurance contributions have been accrued to the Pension Fund to finance the insurance part of the labor pension; Debit 26 Credit 69 “Settlements with the Pension Fund” - 600 rubles. (RUB 10,000 x 6%) - insurance contributions have been accrued to the Pension Fund to finance the funded part of the labor pension; Debit 26 Credit 69 “Settlements with the Federal Social Insurance Fund of the Russian Federation for compulsory social insurance” - 290 rubles. (RUB 10,000 x 2.9%) - insurance premiums are charged for compulsory social insurance in case of temporary disability and in connection with maternity; Debit 26 Credit 69 “Settlements with FFOMS” - 510 rubles. (RUB 10,000 x 5.1%) - insurance premiums for compulsory health insurance are charged. In accordance with the type of economic activity, the organization belongs to the third class of profrisk and pays insurance premiums for compulsory social insurance against accidents at work and occupational diseases (NS and OZ) at a rate of 0.4%. The accrual of contributions is reflected in the accounting records by the following entry: Debit 26 Credit 69 “Settlements with the Federal Social Insurance Fund of the Russian Federation for contributions to insurance against personal injury and illness” - 40 rubles. (RUB 10,000 x 0.4%) - premiums for compulsory insurance from NS and PZ are accrued. After the funds have been transferred to the Federal Social Insurance Fund of the Russian Federation for the payment of benefits, their amount is reflected in the accounting records by posting: Debit 51 Credit 69, subaccount “Settlements with the Social Insurance Fund of the Russian Federation for compulsory social insurance” - 60,000 rubles. — compensation was received from the Federal Social Insurance Fund of the Russian Federation in the amount of benefits paid to the employee.

There is such a right

Not all employees have the right to receive sick leave benefits in the amount of 100% of average earnings, since the figure depends on the length of insurance coverage.

And sometimes such benefits are calculated based on the minimum wage. an additional payment for sick leave up to average earnings comes to the aid of such personnel .

In case of temporary loss of ability to work, the employee is paid sick leave benefits, calculated on the basis of average earnings. The calculation period is taken as two years preceding the year in which the insured event occurred.

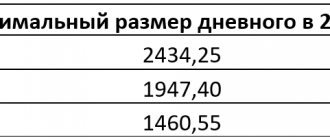

The Social Security Fund limits the value at which days of absence are paid. So, in 2021, the maximum income for the billing period is equal to:

- Is sick leave considered income?

- What to do if you have extended sick leave for pregnancy and childbirth

- What to do if your employer does not accept electronic sick leave

- What to do if you are not given sick leave

- How many days does it take for sick leave to arrive from the Social Insurance Fund?

- What to do if the place of work is not indicated on the sick leave

- Are sick leave taken into account when calculating maternity leave?

- RUB 1.388 million / 730 day (number of days in 2015 + 2021) = 1901.37 rubles/day.

Amounts above these limits are not taken into account when calculating sick leave and are not paid. But the law does not prohibit the employer from making additional payments to the average salary on sick leave for the missing amount.

Remember: providing employees with such additional payment is the right, not the obligation of the employer!

Additional payment before actual earnings to the benefit, the amount of which is limited

Source: Glavbukh magazine

According to Article 183 of the Labor Code of the Russian Federation, in case of temporary disability, the employer pays the employee benefits in accordance with federal laws. The main one is Federal Law No. 255-FZ of December 29, 2006.

Calculation of average earnings for calculating temporary disability benefits, maternity benefits, and monthly child care benefits is carried out for two calendar years preceding the year of incapacity. In this case, the denominator of the calculation indicates a fixed number of days - 730.

The company pays for the employee’s sick leave for the first three days at its own expense. From the fourth day, the benefit is paid from the funds of the Federal Social Insurance Fund of Russia.

Average earnings, on the basis of which temporary disability benefits are calculated, are taken into account for each calendar year in an amount not exceeding that established on the basis of Federal Law No. 212-FZ of July 24, 2009 (hereinafter referred to as Law No. 212-FZ) for the corresponding calendar year the maximum value of the base for calculating insurance premiums to the Social Insurance Fund of Russia.

Benefits for loss of ability to work due to illness or injury are paid in the following amount:

- with more than eight years of experience - 100 percent of average earnings;

- with experience from five to eight years - 80 percent of average earnings;

- with up to five years of experience - 60 percent of average earnings.

It turns out that employees with little experience lose a lot financially. At the same time, they can be very valuable personnel for the organization.

How to register correctly

When an enterprise makes additional payments to employees up to the average salary on sick leave in the event of their temporary loss of ability to work, this condition must be included in local regulations, an employment or collective agreement. Since the legislation does not regulate the rules regarding this issue, the employer independently determines:

- the circle of persons who are entitled to compensation (it is not necessary to pay funds to all personnel);

- procedure for calculating the amount of funds to be paid additionally.

How to calculate the surcharge?

The amount of the supplement is determined as the difference between the average earnings and sickness benefits.

The average wage is calculated by multiplying the average daily earnings by the duration of disability in days. For the calculation, all income included in the taxable base under the Unified Social Tax is taken into account. When determining the average salary per day, the calculation period is considered to be 1 year preceding the illness.

The amount of the benefit is determined depending on the length of service of the insured person. It varies from 60 to 100% of average earnings. Its maximum value is regulated by law and changes annually.

For example, a factory employee was sick for 7 calendar days in March. His monthly salary is 65,000 rubles. The billing period from February 1 of last year to February 28 of the current year has been fully worked out. Additional sick pay up to average earnings is provided for in collective and labor agreements. Work experience – 7 years.

| Index | Calculation procedure | Result |

| Average salary per day | 65000*12/365 | 2136,98 |

| Sick leave per day | 2136,98*80% | 1709,59 |

| Maximum amount of sick leave per day | 1521,00 | |

| Sick leave amount | 1521,00*7 | 10647,00 |

| Amount of surcharge | 1709,59*7 – 10647,00 | 1320,13 |

Since the maximum amount of temporary disability benefits is limited by law, the company compensates the difference of 1,320.13 rubles.

Calculations with the budget

If the documents are completed correctly, the additional payment up to the average salary on sick leave can be taken into account in income tax expenses as wages. This requires:

- comply with the conditions discussed above;

- issue an order on the basis of which such additional payments should be made.

Since the surcharges in question do not come from the government, they are subject to income tax. Its calculation occurs in the general manner.

Also, the employer must deduct contributions to extra-budgetary funds from the amount of the supplement up to average earnings.

EXAMPLE S. Mikhailov, who works in and is a tax resident of the Russian Federation, took out sick leave on September 26, 2016.

He returned to work on October 6, 2016. The average salary of an employee over the past two years per day was 2,250 rubles.

Insurance experience – 7 years. The company's collective agreement provides for additional payment for sick leave up to average earnings .

What actions need to be taken?

- Since Mikhailov has 7 years of insurance experience, he is entitled to compensation in the amount of 80% of his salary. The amount of funds allocated to him without additional payments will be:

7289.04 × 13% = 947.6 rubles. – we withhold this amount of personal income tax from the additional payment for sick leave up to average earnings .

The legislation does not regulate up to what maximum amount or period of additional payment can be made. And despite the fact that earnings can be fixed by salary, actual products produced, etc.

The main thing is that the rules for calculating the additional payment up to the average salary for sick leave are specifically reflected in the regulatory documents or the employment contract with the employee.

Additional sick pay before actual earnings

The amount of sick leave benefits is usually less than the employee’s actual earnings. Some employers make appropriate additional payments on their own initiative. Accounting for such payments will be discussed.

The company must pay a temporary disability benefit to a sick employee, the amount of which depends on the patient’s length of insurance.

Thus, if an employee’s insurance experience is eight years or more, then he is entitled to a benefit in the amount of 100 percent of his average earnings; from five to eight years - 80 percent of his average earnings; up to five years - 60 percent of his average earnings.

An employee with less than six months of insurance experience is paid sickness benefits in an amount that should not exceed for a full calendar month the minimum wage established by federal law (clauses 1 and 6 of Article 7 of the Federal Law of December 29, 2006 N 255-FZ , hereinafter referred to as Law No. 255-FZ). From January 1, 2014, the minimum wage amount is 5,554 rubles. per month (Article 1 of the Law of June 19, 2000 N 82-FZ, as amended on December 2, 2013). Let us recall that in 2013 this figure was 5,205 rubles.

It is important to know. To pay sickness benefits, the employee must submit to the employer a certificate of incapacity for work issued by a medical institution. It must be drawn up in accordance with the requirements of the Procedure, which was approved by Order of the Ministry of Health and Social Development of Russia dated June 29, 2011 N 624n.

It is according to these rules that social insurance will calculate and, accordingly, reimburse the amount of benefits to the employer (with the exception of the first three days of illness). The FSS will not pay a penny extra from above.

At the same time, no one prohibits employers from paying for sick leave in excess of the average earnings limit, paying part of the benefits (in addition to three days, which already come from the company’s pocket) at their own expense. For example, temporary disability benefits, which must be paid without fail, can be paid by the employer up to the actual earnings of the employee.

Let's figure out how to do this correctly and what consequences await kind-hearted employers.