What is the deadline to submit 6-NDFL for 2021? What data should be included in the calculation for the 4th quarter of 2021? Is it really necessary to submit 6-NDFL calculations using the new form? What document approved the new form and where can I download it? How to reflect the salary for December paid in December in the calculation for 2017? How to show December 2021 salary paid in January 2021? How can legal entities reflect the annual or quarterly bonus? Should September salaries paid in October be included in the calculation? We will answer the main questions, give the necessary instructions and provide a sample of filling out 6-NDFL for 2021 using specific examples.

When do you need to submit 6-NDFL for 2021: deadline

Calculation in form 6-NDFL is submitted to the Federal Tax Service based on the results of each quarter. The due date is no later than the last day of the month following the quarter. So, for example, 6-personal income tax for 9 months of 2021 was required to be submitted no later than October 31, 2021. However, the deadline for submitting annual personal income tax reports is different. The annual calculation of 6-NDFL based on the results of 2021, as a general rule, must be submitted no later than April 1 of the year following the reporting year. This is stated in paragraph 3 of paragraph 2 of Article 230 of the Tax Code of the Russian Federation. Tax legislation provides that if the deadline for submitting the 6-NDFL calculation falls on a weekend or non-working holiday, then the reports can be submitted on the next working day (Clause 7, Article 6.1 of the Tax Code of the Russian Federation). April 1, 2021 is Sunday. Therefore, the annual calculation of 6-NDFL for 2021 must be submitted to the tax office no later than April 2, 2021 (this is a working Monday).

We recommend not to delay submitting your annual payment for 2021 until April. In April, it will be necessary to prepare the 6-personal income tax calculation for the first quarter of 2021. It will need to be submitted to the Federal Tax Service no later than May 3, 2021. Also see “Deadline for submitting 6-NDFL for 2021”.

Where and when is the 6-NDFL declaration submitted?

The declaration is submitted by those organizations and individual entrepreneurs that have employees. This also applies to notaries, lawyers and other persons with private practice. The report is provided every quarter. In this case, you must have time to submit it before the end of the month following the reporting quarter.

It often happens that the day the report is submitted falls on a holiday or weekend. In such a situation, the submission of documents is postponed to the next working day following the rest days.

An individual entrepreneur is one of the tax agents who must submit 6-NDFL

Table: deadlines for submitting reports in 2017–2018.

| Period | Deadline for submission |

| Quarter 1 | May 2, 2021 |

| Quarter 2 | July 31, 2021 |

| Quarter 3 | October 31, 2021 |

| Year | April 2, 2021 |

Unlike quarterly reporting, the deadline for submitting an annual declaration always falls on the last day of the month, the first quarter after the reporting year.

If tax agents fail to submit Form 6-NDFL on time, then penalties will be assessed in accordance with the Tax Code of the Russian Federation. Employers who violate the deadlines established by law will have to pay 1 thousand rubles to the budget. for each month of delay.

There is a fine for late submission of the 6-NDFL report.

Supervisory authorities are empowered to block the current accounts of those individual entrepreneurs and commercial organizations that are more than 10 days late in submitting reports. If business entities submit Form 6-NDFL with inaccurate data, they face a fine of 500 rubles. for each incorrectly completed report.

The report is submitted to the tax office at the location of the organization or place of residence of the individual entrepreneur.

If a company has separate divisions, reporting is submitted depending on where employees receive income.

The completed 6-NDFL declaration can be sent to the Federal Tax Service by mail

The report is sent in the following ways:

- via the Internet (in this case, the delivery date is the date the letter was sent by email);

- by mail with a list of the contents (the delivery date is considered to be the day marked by the postal worker on the shipping receipt);

- in person or through an official representative of the company (the date of submission is the date stamped by the tax inspector on the second copy of the report).

Zero report 6-NDFL

If there are no employees in the company or the company or individual entrepreneur did not accrue or pay income to individuals, then Form 6-NDFL is not submitted. But this does not exclude the submission of a zero 6-NDFL report. The sample can be found here. Tax authorities will expect reports from firms and individual entrepreneurs, even if they do not need to report to them regarding Form 6-NDFL, since inspectors may not yet have such information. To prevent a fine from being assessed in this case, many taxpayers prefer to submit zero reports.

In this regard, taxpayers can do the following:

- submit a letter to the Federal Tax Service stating that the company or individual entrepreneur is not required to submit the 6-NDFL calculation;

- submit a zero calculation of 6-NDFL.

Tax agents have the opportunity to submit a zero calculation of 6-NDFL

If taxpayers decide to send a zero report, then they should be prepared for the fact that it will have to be sent at the end of each reporting period. The title page of the zero report is drawn up in the same way as the usual form 6-NDFL, but dashes are placed in the columns of sections 1 and 2.

Video: procedure for submitting the 6-NDFL declaration

Who needs to report to the Federal Tax Service?

All tax agents must submit an annual calculation in form 6-NDFL for 2021 (clause 2 of Article 230 of the Tax Code of the Russian Federation). Tax agents for personal income tax are, as a rule, employers (organizations and individual entrepreneurs) paying income under employment contracts. Also, customers who pay remuneration to performers under civil contracts can be considered tax agents. However, it is worth recognizing that the issue of the existence of payments and accruals in 2021 is quite individual and, in practice, there may be various controversial situations. Let's look at the three most common examples and explain when and who needs to submit the annual 6-NDFL for 2021 in 2021.

Situation 1. There were no accruals and payments in 2021

From January 1 to December 31, 2021 inclusive, the organization or individual entrepreneur did not accrue or pay any income to the “physicists”, did not withhold personal income tax and did not transfer tax to the budget. Then there is no need to submit the annual 6-NDFL calculation for 2021. In this case, there was no fact upon the occurrence of which the company or individual entrepreneur became tax agents (clause 1 of Article 226 of the Tax Code of the Russian Federation). In such a situation, you can send a zero 6-NDFL to the Federal Tax Service. The tax office is obliged to accept it. “Zero 6-NDFL: is it necessary to submit it and why.”

It is worth noting that some accountants consider it advisable, instead of “zeros,” to send letters to the tax inspectorate explaining why 6-NDFL was not submitted. With this option, it is better to send such a letter no later than April 2, 2021. See “Letter about zero 6-NDFL: sample.”

Situation 2. Salaries were calculated but not paid

It is possible that there were no real payments to individuals in 2017, but the accountant continued to accrue salaries or benefits. This, in principle, is possible when there is no necessary finance to pay wages. Should I submit reports then? Let me explain.

If during the period from January to December 2021 inclusive there was at least one accrual, then it is necessary to submit the annual 6-NDFL for 2021. After all, personal income tax must be calculated from accrued income, even if the income has not yet actually been paid (clause 3 of Article 226 of the Tax Code of the Russian Federation). Therefore, the accrued amount of income and accrued personal income tax must be recorded in the annual calculation of 6-personal income tax for 2021. In fact, for these purposes, reporting in Form 6-NDFL was introduced, so that tax authorities could track accrued but unpaid amounts of income tax.

Situation 3. Money was issued only once

Some organizations or individual entrepreneurs could pay income in 2021 only once or twice. For example, the CEO, the sole founder, could receive a one-time payment from the company in the form of dividends. Is it then necessary to fill out and send the annual 6-NDFL for 2021 to the Federal Tax Service if there are no more employees in the organization? Let's assume that the income was paid in January 2021 (that is, in the first quarter of 2021). In such a situation, the annual calculation of 6-NDFL for the entire 2021 should be submitted to the Federal Tax Service, since in the tax period (from January to December 2021) there was the fact of both accruals and payments.

At the same time, we note that if payments took place, for example, only in the first quarter of 2021, then in the annual calculation of 6-NDFL for 2017 you need to fill out only section 1. Section 2 is not required. This follows from the Letter of the Federal Tax Service dated March 23, 2016 No. BS-4-11/4958, which discussed the issue of a one-time payment of dividends. See “Filling out section 1 in 6-NDFL”.

Deadlines and procedure for submitting calculations

The calculations are submitted by tax agents (clause 2 of Article 230 of the Tax Code of the Russian Federation).

A zero calculation is not submitted if personal income tax-taxable income was not accrued and paid (letter of the Federal Tax Service of the Russian Federation dated 01.08.2016 No. BS-4-11 / [email protected] ).

If a “null” is nevertheless submitted, then the Federal Tax Service will accept it (letter of the Federal Tax Service of the Russian Federation dated May 4, 2016 No. BS-4-11 / [email protected] ).

Calculations for the first quarter, half a year and 9 months are submitted no later than the last day of the month following the specified period. Therefore, quarterly calculations in 2021 are submitted within the following terms (clause 7, article 6.1, clause 2, article 230 of the Tax Code of the Russian Federation):

- for the first quarter - no later than May 4 (including postponements of weekends and holidays);

- for half a year - no later than July 31;

- for 9 months - no later than October 31.

The annual calculation is submitted in the same way as 2-NDFL certificates: for 2021 - no later than 04/02/2018 (April 1 is a day off).

Calculation of 6-NDFL is submitted only in electronic form according to the TKS, if in the tax (reporting) period income was paid to 25 or more individuals, if 24 or less, then employers themselves decide how to submit the form: virtually or on paper (clause 2 of Article 230 Tax Code of the Russian Federation).

As a general rule, the calculation must be submitted to the Federal Tax Service at the place of registration of the organization (registration of individual entrepreneurs at the place of residence).

If there are separate subdivisions (SP), the calculation in form 6-NDFL is submitted by the organization in relation to the employees of these subdivisions to the Federal Tax Service Inspectorate at the place of registration of such subdivisions, as well as in relation to individuals who received income under civil contracts to the Federal Tax Service Inspectorate at the place of registration of the subdivisions that entered into such contracts (clause 2 of article 230 of the Tax Code of the Russian Federation).

The calculation is filled out separately for each OP, regardless of the fact that they are registered with the same inspection, but in the territories of different municipalities and they have different OKTMO (letter of the Federal Tax Service of the Russian Federation dated December 28, 2015 No. BS-4-11 / [email protected] ) .

If the OPs are located in the same municipality, but in territories under the jurisdiction of different Federal Tax Service Inspectors, the organization has the right to register with one inspectorate and submit calculations there (clause 4 of Article 83 of the Tax Code of the Russian Federation).

The employee worked in different branches . If during the tax period an employee worked in different branches of the organization and his workplace was located at different OKTMO, the tax agent must submit several 2-NDFL certificates for such an employee (according to the number of combinations of TIN - KPP - OKTMO code).

Regarding the certificate, the tax agent has the right to submit multiple files: up to 3 thousand certificates in one file.

Separate calculations are also submitted in form 6-NDFL, differing in at least one of the details (TIN, KPP, OKTMO code).

Regarding the registration of 6-NDFL and 2-NDFL: in the title part, the TIN of the parent organization, the checkpoint of the branch, OKTMO at the location of the individual’s workplace is affixed. The same OKTMO is indicated in the payment slips (letter of the Federal Tax Service of the Russian Federation dated July 7, 2017 No. BS-4-11/ [email protected] ).

If the company has changed its address , then after registering with the Federal Tax Service at the new location, the company must submit to the new inspection 2-NDFL and 6-NDFL:

- for the period of registration with the Federal Tax Service at the previous location, indicating the old OKTMO;

- for the period after registration with the Federal Tax Service at the new location, indicating the new OKTMO.

At the same time, in the 2-NDFL certificates and in the 6-NDFL calculation, the checkpoint of the organization (separate division) assigned by the tax authority at the new location is indicated (letter of the Federal Tax Service of the Russian Federation dated December 27, 2016 No. BS-4-11 / [email protected] ).

What remuneration should be reflected in 6-NDFL?

The annual calculation in form 6-NDFL for 2021 should include all income in relation to which an organization or individual entrepreneur is recognized as a tax agent. Such income is, for example, wages, all types of bonuses, payments under civil contracts, benefits, vacation pay, dividends.

However, non-taxable income under Article 217 of the Tax Code of the Russian Federation does not need to be shown in the calculation. At the same time, take into account the peculiarity of income that is not subject to personal income tax within the established standards (letter of the Federal Tax Service of Russia dated August 1, 2016 No. BS-4-11/13984).

Income from Article 2021 of the Tax Code of the Russian Federation: what to do with it?

Article 217 of the Tax Code of the Russian Federation lists income that is subject to personal income tax only partially (that is, not in full). These are, for example, gifts and financial assistance. In the calculation of 6-NDFL for the 4th quarter of 2021, such payments must be recorded as in 2-NDFL certificates: the entire amount paid must be included in income, and the non-taxable part must be shown as tax deductions. Also see “New codes in 2-NDFL in 2021”.

Example: Employee Marmeladov A.P. In connection with the anniversary, they presented a gift worth 10,000 rubles. Gifts in the amount of 4,000 rubles are exempt from taxation. (clause 28 of article 217 of the Tax Code of the Russian Federation). Therefore, in section 1 of the 6-NDFL calculation, indicate the entire amount of the gift on line 020, and the deduction amount on line 030. As a result, the tax base for this income will be 6,000 rubles. (10,000 rubles - 4,000 rubles), and the amount of personal income tax that must be withheld from the cost of the gift is 780 rubles. (RUB 6,000 × 13%). In section 2, on line 130, indicate the entire amount of income paid (RUB 10,000), and on line 140, the amount of tax actually withheld (RUB 780).

As for the amounts of financial assistance paid to an employee at the birth of a child, as well as the amounts of cash prizes given to individuals, they may not be included in the calculation at all. Provided that the amounts paid do not exceed the personal income tax-free limit (4,000 rubles per tax period for prizes, and 50,000 rubles for each child for “parental” financial assistance). Reason – Letter of the Federal Tax Service dated July 21, 2017 No. BS-4-11/14329.

Do I need to submit a zero 6-NDFL report in 2020?

If you did not have duties as a tax agent during the reporting period, and you did not pay income to individuals either under employment or civil law contracts, there is no need to submit Form 6-NDFL, even “zero” form.

But if you have a desire to submit a zero 6-NDFL, the Federal Tax Service is obliged to accept it.

To avoid additional questions from tax authorities, you can provide an explanatory letter to the Federal Tax Service instead of zero. It should indicate that in the reporting period the organization (or individual entrepreneur) was not a tax agent, did not pay income to individuals, and did not have valid agreements with individuals. As a rule, this happens in the absence of financial and economic activities. You can indicate this in the letter. The letter is certified in the same way as a zero calculation of 6-NDFL would be certified.

Form 6-NDFL: new or old?

Has the new form of calculation of 6-NDFL been approved since 2021? Which form should I download to fill out the “paper” annual calculation for 2017? Has the new format required for submitting payments electronically been approved? Questions of this kind always arise before submitting regular tax reports.

The new form for calculating 6-NDFL for filling out and submitting to the Federal Tax Service for 2017 was approved as amended by the Federal Tax Service order No. ММВ-7-11/18 dated January 17, 2021. However, it comes into force on March 25, 2021. Therefore, prepare the annual report 6-NDFL after the specified date in the form approved in the latest edition of the Federal Tax Service order No. MMV-7-11/450 dated October 14, 2015. You used it throughout 2021.

Download the 6-NDFL calculation form in Excel format and the procedure for filling it out using this link.

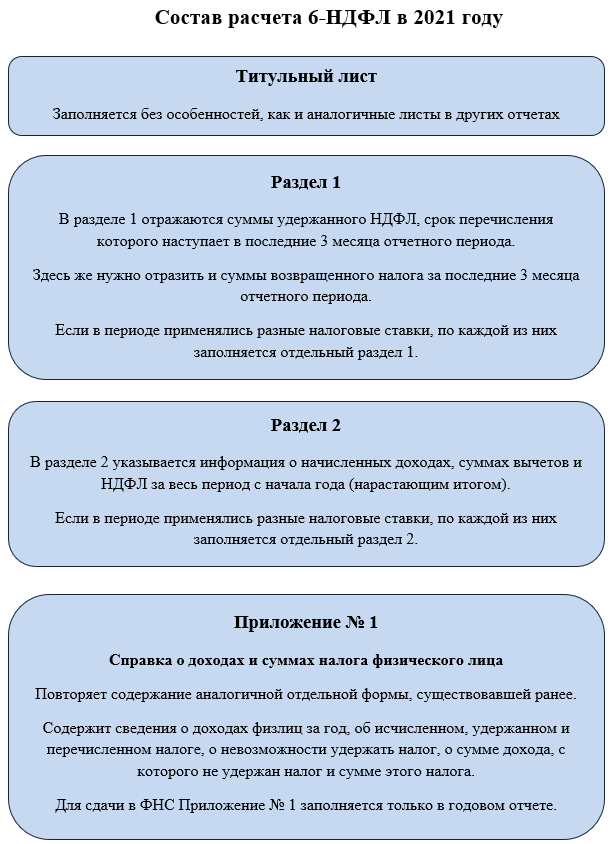

The annual 6-NDFL calculation form for 2021 includes:

- title page;

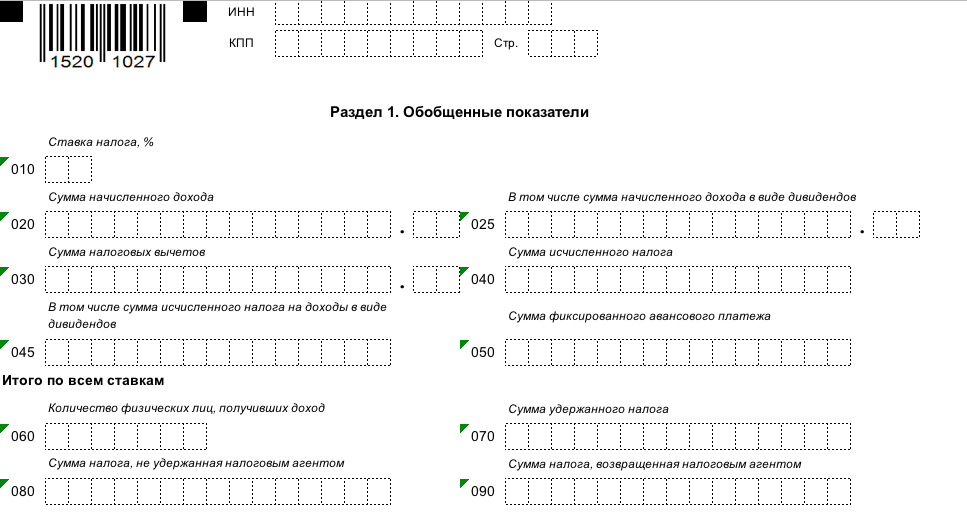

- section 1 “Generalized indicators”;

- Section 2 “Dates and amounts of income actually received and withheld personal income tax.”

Next, we will explain the specifics of filling out each section of 6-NDFL for 2021 and answer the most controversial questions about the reporting of rolling salaries for September and December 2017.

NEW FORM 6-NDFL IN 2021 - TO BE!

In 2021, the tax authorities did not significantly update the calculation form according to Form 6-NDFL. And along with it - an electronic format, rules for filling out and submitting to the tax office. The final order of the Federal Tax Service can be found here:

https://publication.pravo.gov.ru/Document/View/0001201801250013

The Tax Service of the Russian Federation has updated barcodes and introduced fields for legal successors who submit 6-NDFL (including clarifying) for a reorganized company. Therefore, at the top of the title page they need to provide the TIN and KPP of the successor organization. The latter should also appear in the main field - “Tax Agent”.

We emphasize once again that until March 25, 2021, you can fill out and submit 6-NDFL using the previous form.

Reporting rules

Appendix 2 to the Federal Tax Service order No. ММВ-7-11/ [email protected] provides the procedure for filling out form 6-NDFL.

In accordance with this procedure, you must adhere to the following rules when filling out the 6-NDFL calculation:

- data to be filled out must be taken from tax registers;

- if one sheet is not enough to fill, then additional sheets are taken;

- Each sheet is marked with a page number in continuous order in the special “page” field. in the format “001”, “002”... “010”;

- the use of correctors is not permissible;

- printing the completed report on both sides of the sheets is prohibited;

- It is not allowed to fasten the sheets, as this causes damage to them;

- Only one indicator is filled in each cell;

- the date is indicated in digital format DD.MM.YYYY;

- the decimal fraction is indicated through a dot;

- You can fill out form 6-NDFL with black or blue ink;

- all fields with amounts must be filled in; if there is no indicator to fill in, then zeros are entered;

- dashes are placed in empty cells;

- for each OKTMO calculation is filled out separately;

- each sheet must be signed either by the manager or his representative; for individual entrepreneurs, the signature is signed by the entrepreneur himself or his representative;

- if the calculation is filled out on a computer, then its subsequent printing is allowed without borders of cells and fields; it is also not necessary to put dashes, the font must be courier new 16-18.

These filling rules are required to be followed by all persons.

How to reflect in 6-NDFL:

- sick leave;

- prepaid expense.

How to compose correctly - procedure

The 6-NDFL calculation form consists of a title page and a second sheet, on which two sections are located.

In the first section, you need to show data for all employees, calculated on an accrual basis from January 1 of the current year to the end of the period for which the reports are being filled out.

The second section provides dates only for the last three months of the period.

How to correctly fill out form 6-NDFL - step-by-step instructions for filling it out

Step 1. Fill out the calculation cover page.

Here you need to indicate your tax identification number, checkpoint, general parameters about the period for which the calculation is submitted, the Federal Tax Service code and the place where the form is submitted. The necessary codes are taken from the appendices to the procedure for filling out the 6-NDFL calculation.

Next, you need to enter the name of the employer, put down OKTMO, contact details and information confirming the accuracy of the filling.

If the organization is liquidated or reorganized, then two new fields are additionally filled in on the title page.

Step 2. Complete section 1.

You should indicate the total values from January 1 to the last day of the reporting or tax period.

The data is summarized for all employees.

Step 3. Complete section 2.

Here it is enough to show the indicators for the last quarter in terms of each month. Information is also provided in summary form for all employees.

Step 4. Sign all completed calculation sheets and number them in continuous order.

Detailed completion of all lines of form 6-NDFL.

Explanations on how to fill out Section 1

The data is filled out in a generalized form for all personnel for the period from the beginning of January of the reporting year to the last day of the period for which the personal income tax calculation form is submitted. The section is filled out separately for each personal income tax rate.

All amounts are considered a cumulative total from the beginning of the tax period (year).

At the top is the TIN and KPP of the employer’s organization or the TIN of the individual entrepreneur, and also the page number in format 002.

In section 11 fields from 010 to 090, the decoding and correct filling of these lines is presented in the table below:

| Field codes | Information to fill out |

| 010 | Tax rate |

| 020 | The total amount of income accrued to employees from January 1 |

| 025 | Total amount of dividends since the beginning of the year accrued to individuals |

| 030 | Total amount of deductions since the beginning of the year |

| 040 | Tax calculated from the beginning of the year on personal income |

| 045 | Tax calculated on dividends |

| 050 | The total amount of fixed advance payments from the beginning of the year, reducing tax payable |

| 060 | Number of employees to whom income has been paid since the beginning of the year |

| 070 | Personal income tax, which is withheld from staff income, from the beginning of the year |

| 080 | Personal income tax, which for some reason is not withheld by the employer |

| 090 | Personal income tax, which was returned to employees in accordance with Article 231 of the Tax Code of the Russian Federation |

Recommendations for correct drafting of Section 2

In this section of the calculation, form 6-NDFL, it is enough to fill out information for the last three months.

Shown here are the dates and amounts that were assessed, withheld or paid on the relevant date.

Features of filling out the fields of section 6-NDFL report are presented in the table:

| Field codes | Information to fill out |

| 100 | Date of receipt of income specified in line 130 of this section (actual) |

| 110 | The date when personal income tax is withheld from the income indicated in line 130 |

| 120 | The date when this tax was paid to the Federal Tax Service |

| 130 | The amount of income on which income tax is withheld. The value is entered before taxation |

| 140 | Amount of income tax withheld |

The specified information is provided for all transferred tax amounts for the last three months. If the deadlines for transferring personal income tax are different for different incomes, then lines 100 to 140 are filled out separately for each.

If one sheet is not enough to indicate all the dates, then additional ones are filled out.

Sample

filling out the report form 6-NDFL for submission to the Federal Tax Service in 2021 - excel.

calculation - excel

General rules for filling out the annual form 6-NDFL

Calculate 6-NDFL for the 4th quarter of 2021 according to the Procedure approved by Order of the Federal Tax Service of Russia dated October 14, 2015 N ММВ-7-11/450. When filling out the 6-NDFL calculation, data must be taken from the tax registers for personal income tax.

At the same time, only those tax agents whose number of individuals who received income in the tax period are up to 25 people can fill out and submit the annual 6-NDFL for 2017.

All total calculation indicators must be filled out. If the amount is zero, you must enter “0”.

6-NDFL and its sections are certified by the head of the organization, an individual entrepreneur (lawyer, notary) or a representative by power of attorney.

If the calculation is filled out and submitted electronically, it must be signed with an enhanced qualified electronic signature. Next, we will consider the features of filling out each section.

Which 6-NDFL form is used for the 1st quarter of 2021?

All employers paying benefits to employees are required to calculate, withhold and transfer income tax to the budget. To monitor the timeliness and correctness of calculation, withholding and payment of personal income tax, tax authorities have developed 2 reports: 2-NDFL and 6-NDFL.

6-NDFL is a calculation that allows you to control the timing of withholding and transfer of income tax to the budget by tax agents. The features of this form that distinguish it from the usual 2-NDFL report include:

- frequency of presentation - based on the results of each quarter;

- lack of personification: the report provides information in general for the tax agent and does not contain data for each employee.

All employers who pay income to “physicists” are recognized as agents:

- organizations;

- IP;

- separate divisions of foreign companies in the Russian Federation;

- private practicing individuals (lawyers, notaries, etc.).

The calculation includes data on accrued income, withheld and transferred personal income tax, as well as on the planned dates for withholding and transferring tax.

Form 6-NDFL was approved by order of the Federal Tax Service on October 14, 2015 No. ММВ-7-11/ [email protected] When submitting the report for the 1st quarter of 2021, use it.

Form 6-NDFL for the reporting campaign for the 1st quarter of 2019.

Title page

When compiling 6-NDFL for 2021, at the top of the title page you need to note the TIN, KPP and the abbreviated name of the organization (if there is no abbreviation, the full name). If you need to submit a settlement in relation to individuals who received payments from a separate division, then fill in the “separate” checkpoint. Individual entrepreneurs, lawyers and notaries only need to indicate their TIN.

In the line “Adjustment number” of the year o, if the annual calculation for 2017 is submitted for the first time. If an updated calculation is submitted, then the corresponding adjustment number (“001”, “002”, etc.) is reflected.

In the line “Submission period (code)”, enter 34 - this means that you are submitting the annual 6-NDFL for 2021. In the “Tax period (year)” column, mark the year for which the annual calculation is submitted, namely 2021.

Indicate the code of the department of the Federal Tax Service to which the reporting is sent and the code in the line “At location (accounting).” This code will show why you are submitting 6-NDFL here. Most tax agents reflect the following codes:

- 212 – when submitting a settlement at the place of registration of the organization;

- 213 – when submitting the calculation at the place of registration of the organization as the largest taxpayer;

- 220 – when submitting a settlement at the location of a separate division of a Russian organization;

- 120 – at the place of residence of the individual entrepreneur;

- 320 – at the place of business of the entrepreneur on UTII or the patent taxation system.

In the line “I confirm the accuracy and completeness of the information specified in this calculation”, indicate:

- 1 – if the 6-NDFL calculation is signed by the tax agent himself or his legal representative (for example, an individual entrepreneur or the head of an organization). You also need to indicate the last name, first name, patronymic of the tax agent (his legal representative);

- 2 – if the 6-NDFL calculation is signed by a representative by proxy. In this case, you must indicate the last name, first name, patronymic of the person or the name of the representative organization.

Procedure for submitting 6-NDFL for the 1st quarter of 2019

Form 6-NDFL can be submitted to the Federal Tax Service:

- independently - to a person who has the right to act on behalf of the taxpayer without a power of attorney;

- through a representative acting on the basis of a power of attorney. Please note: if you are an individual entrepreneur, then your authorized representative must act on the basis of a notarized power of attorney;

- via telecommunication channels, certifying the payment with an electronic signature;

- by sending a letter with a description of the attachment by Russian Post.

Only small companies and individual entrepreneurs, the average number of which is 24 employees or less, have the right to submit paper calculations. If you have more than 25 employees, you can send the report only via TKS.

Form 6-NDFL is sent to the Federal Tax Service via:

- place of registration of the taxpayer;

- place of registration of a separate unit (SU) in relation to payments to employees of this SB;

- place of its registration or registration of an OP: for the largest taxpayers;

- place of registration - for individual entrepreneurs;

- place of registration as a payer of tax paid under a special regime - for individual entrepreneurs on UTII or PSN.

Section 1 of the 6-NDFL calculation for 2021: what includes

In Section 1 6-NDFL for 2021 “Generalized Indicators”, show the total amount of accrued income, tax deductions and the total amount of accrued and withheld tax for the entire year 2021.

Section 1 of the calculation includes income, deductions and taxes on them in total amounts for the first quarter, half a year, 9 months, year on an accrual basis from the beginning of 2021 (clause 2 of article 230 of the Tax Code of the Russian Federation, clause 3.1 of the Procedure for filling out the 6-NDFL calculation) . Therefore, Section 1 6-NDFL for 2021 should reflect the summary indicators from January 1 to December 31, 2017 inclusive. Take the information to fill out from the personal income tax registers. See “Tax register for 6-NDFL”.

Next, we will explain which lines of generalized values are in section 1:

| Line | What to reflect |

| 010 | Personal income tax rate (for each rate, fill out section 1). |

| 020 | The amount of accrued income. |

| 025 | Dividend income from January to December 2021 inclusive. See “Dividends in 6-NDFL: filling out a sample calculation.” |

| 030 | The amount of tax deductions “Tax deductions in 6-NDFL: we reflect the amounts correctly.” |

| 040 | The amount of calculated personal income tax from the beginning of 2021. To determine the value of this indicator, add up the personal income tax amounts accrued from the income of all employees. |

| 045 | The amount of calculated personal income tax on dividends on an accrual basis for the entire 2017: from January 1 to December 31, 2021. |

| 050 | The amount of fixed advance payments that are offset against personal income tax on the income of foreigners working under patents. However, this amount should not exceed the total amount of calculated personal income tax (letter of the Federal Tax Service of Russia dated March 10, 2016 No. BS-4-11/3852). |

| 060 | The total number of individuals who received income during the reporting (tax) period. |

| 070 | The amount of personal income tax withheld. |

| 080 | The amount of personal income tax not withheld by the tax agent. This refers to amounts that a company or individual entrepreneur should have withheld until the end of the 4th quarter of 2021, but for some reason did not do so. |

| 090 | The amount of personal income tax returned (under Article 231 of the Tax Code of the Russian Federation). |

Calculation for 2021 is submitted using an updated form

From reporting for 2021, but not earlier than 03/26/2018, the updated form 6-NDFL is used (Order of the Federal Tax Service of the Russian Federation dated 01/17/2018 No. ММВ-7-11 / [email protected] ).

The innovations are mainly related to the fact that from January 1, 2021, during reorganization, the legal successor needs to submit a settlement (income certificate) for the reorganized company if it has not done so.

In accordance with these innovations, the title page of the calculation and the rules for filling out the form have been changed:

- Details for legal successors have appeared:

1) “form of reorganization (liquidation) (code)”, where one of the values is indicated: 1 - transformation, 2 - merger, 3 - division, 5 - accession, 6 - division with simultaneous accession, 0 - liquidation;

2) “TIN/KPP of the reorganized organization”, where the legal successor puts down his TIN and KPP (other organizations put dashes);

- codes have been established for the successor (215 or 216, if he is the largest taxpayer), entered in the details “at the location (accounting) (code)”;

- in the “tax agent” field the name of the reorganized organization or its separate division is indicated;

- it became possible for the successor to confirm the accuracy of the information.

However, the changes apply not only to legal successors, but also to all tax agents,

The codes for legal entities that are not major taxpayers have changed: instead of code 212 in the details “at location (accounting) (code)” they will have to indicate 214.

To confirm the authority of the representative, you will need to indicate not only the name of the document, but also its details.

In addition, the barcode has changed.

Section 2 of the 6-NDFL calculation for 2021: what includes

Section 2 of the annual report 6-NDFL indicates:

- dates of receipt and withholding of personal income tax;

- deadline established by the Tax Code of the Russian Federation for transferring personal income tax to the budget;

- the amount of income actually received and personal income tax withheld.

Section 2 of the annual 6-NDFL for 2021 should reflect information only for the last three months (October, November and December 2017). In this case, you need to reflect only those payments for which the tax payment deadline occurs in this period. Therefore, in section 2, special attention should be paid to the dates of payment and withholding of tax.

IMPORTANT!

As part of Section 2, income and personal income tax should be shown - broken down by date - only for transactions performed in October, November and December 2021 inclusive. Do not include 2021 transactions in section 2.

Let us explain how to fill out the main rows in the table:

| Line | Filling |

| 100 | Dates of actual receipt of income. For example, for salaries, this is the last day of the month for which salaries are accrued. For some others, payments have different dates (clause 2 of Article 223 of the Tax Code of the Russian Federation). |

| 110 | Personal income tax withholding dates. |

| 120 | Dates no later than which the personal income tax must transfer the budget (clause 6 of article 226, clause 9 of article 226.1 of the Tax Code of the Russian Federation). Typically, this is the day following the day the income is paid. But, for example, for sick leave benefits and vacation payments, the deadline for transferring taxes to the budget is different: the last day of the month in which such payments were made. If the tax payment deadline falls on a weekend, line 120 indicates the next working day (Clause 7, Article 6.1 of the Tax Code of the Russian Federation). |

| 130 | The amount of income (including personal income tax) that was received on the date indicated on line 100. Also see “Line 130 6-NDFL is not reduced by deductions.” |

| 140 | The amount of tax withheld as of the date on line 110. |

Do not show in Section 2 of 6-NDFL for 2021 vacation pay and benefits paid in December 2021. The deadline for transferring personal income tax for them is 01/09/2018.

Composition of the new calculation 6-NDFL 2021

Before we talk about how to fill out the new form, let’s look at its composition. It is in this aspect that the most significant changes .

From 2021, 6-NDFL consists of two previously different reports combined into one:

- calculation of personal income tax withheld by the tax agent (“old” 6-NDFL);

- certificate of income and tax amounts (previously called 2-NDFL).

An example of filling out sections 1 and 2 as part of 6-NDFL for 2021

Now we will give an example of filling out the 6-NDFL calculation for 2021, so that the general principle of filling out the sections is clear. The main thing when filling out the annual calculation of 6-NDFL for 2021 is to correctly transfer data from tax registers for personal income tax.

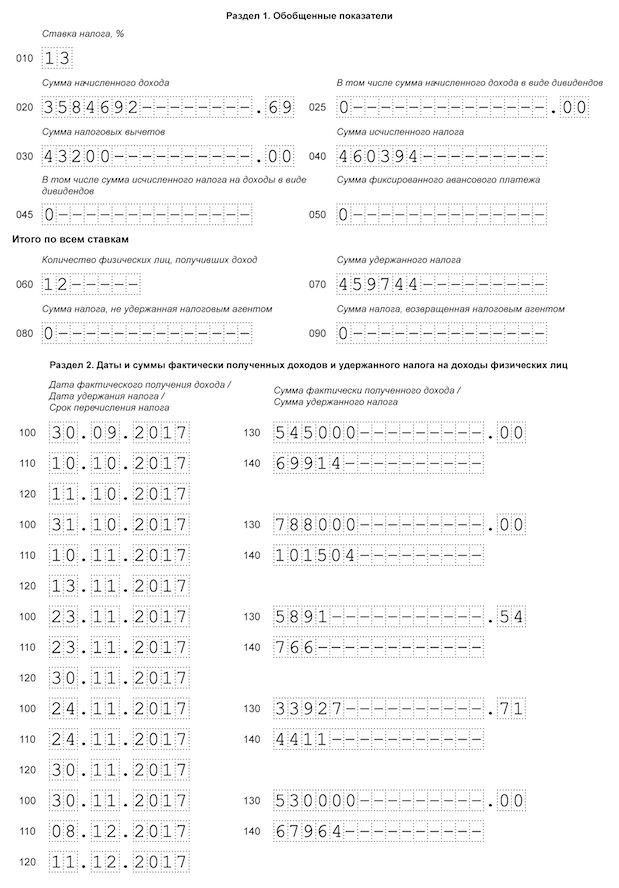

Let's assume that the company has 12 employees. For 2021, salaries, bonuses, vacation pay and temporary disability benefits were accrued in the total amount of 3,584,692.69 rubles, deductions were provided - 43,200 rubles. Personal income tax on all payments – 460,394 rubles. All personal income tax was withheld and paid to the budget, except for personal income tax on December wages - 37,050 rubles.

In January 2021, personal income tax was withheld in the amount of 36,400 rubles. from salary for December 2021 - 283,600 rubles, deduction - 3,600 rubles. In total, personal income tax withheld for 2017 was RUB 459,744. (460,394 rubles – 37,050 rubles + 36,400 rubles).

In the 4th quarter of 2021 the following were paid:

- salary for the second half of September 295,000 rubles. – October 10. Personal income tax was withheld from it from the entire salary for September - 69,914 rubles. (entire salary for September - 545,000 rubles), deduction - 7,200 rubles;

- salary for October 530,000 rubles. – October 25 and November 10, personal income tax from it – 67,964 rubles, deduction – 7,200 rubles;

- bonus for October 258,000 rubles. – November 10, personal income tax from it – 33,540 rubles;

- disability benefit due to illness RUB 5,891.54. – November 23, personal income tax from him – 766 rubles. Sick leave was issued from November 14 to November 20;

- vacation pay RUB 33,927.71 – November 24, personal income tax from them – 4,411 rubles. Vacation - from November 28 to December 22;

- salary for November 530,000 rubles. – November 24 and December 8, personal income tax from it – 67,964 rubles, deduction – 7,200 rubles;

- advance for December 250,000 rub. – December 25.

Please note: the bonus and salary for October are included in one block of lines 100 - 140, because they have the same all three dates in lines 100 – 120. Their total amount is 788,000 rubles, the tax withheld from it is 101,504 rubles. A sample of filling out 6-NDFL for 2021 in such conditions may look like this:

Next, we will examine in more detail some of the features of filling out and carryover payments as part of 6-NDFL for 2021.

Salary for December 2021 was paid in December: how to show it in the calculation

The most controversial issues regarding filling out 6-NDFL are payments during transition periods. They are encountered when a salary or bonus is accrued in one reporting period and paid in another. A similar ambiguous situation has developed with salaries for December 2021. The fact is that some employers paid salaries for December before the New Year (in December). Other organizations and individual entrepreneurs paid salaries and annual bonuses in January 2021. See “December 2021 Salary Payment Deadlines.” How to show December accruals in the report so that tax authorities accept 6-NDFL the first time? Let's look at specific examples of filling out 6-NDFD for 2021.

The right approach: recommendations from the Federal Tax Service

Were all salaries for December 2021 paid to employees in December 2017? Then fill out the calculation using Form 6-NDFL for 2021 as follows:

- the amount of accrued salary for December 2021 – stock 020;

- the amount of personal income tax calculated from wages – line 040;

- the amount of personal income tax withheld (line 070). The personal income tax withholding date is December 31, 2021.

In section 2 of the 6-NDFL calculation for 2021, do not record salary data for December. They need to be shown in calculations for the first quarter of 2018, since section 2 should be based on the date no later than which personal income tax must be transferred to the budget. That is, reflect the income paid and the tax withheld in the reporting period in which the deadline for paying personal income tax falls.

For wages for December 2021, which were paid before the New Year, the personal income tax payment deadline is the first working day after December 31, 2021, that is, January 9, 2021. Let's explain why. You will receive your salary only on December 31, 2021. The money paid for December before December 31 is an advance. The accrued salary can be offset against the advance payment only on December 31, 2021. This day will be the date the employees actually receive income. And personal income tax on wages is paid no later than the day following the date of receipt of income.

In section 2 of the 6-NDFL calculation for the first quarter of 2021, indicate by line:

- 100 “Date of actual receipt of income” – December 31, 2017;

- 110 “Tax withholding date” – December 31, 2017;

- 120 “Tax payment deadline” – 01/09/2018;

- 130 “Amount of actual income received” – the amount of salary for December;

- 140 “Amount of tax withheld” – the amount of personal income tax withheld from wages for December.

CONCLUSION

The salary for December, paid in December 2021, is shown in section 1 of the annual calculation and in section 2 of the calculation for the first quarter of 2018. After all, in section 1 you reflect data on all paid income, deductions, accrued, withheld and returned personal income tax for the year. And you paid your December salary in December. Therefore, it must be reflected in section 1 of the annual calculation for 2021. Section 2 indicates on what date the income arose, when the tax must be withheld and transferred to the budget. Since the deadline for paying personal income tax on December salaries falls on the first working day of January (01/09/2018), show the payment in section 2 of the calculation for the first quarter of 2021. This is confirmed by the letter of the Federal Tax Service dated December 15, 2016 No. BS-4-11/24063.

Example of correct reflection of December salary

Let's assume that the salary for December 2021 was paid on December 29, 2021. The month has not yet ended on this date, so it is impossible to regard such a payment as a salary for December in the full sense of the word. In fact, money paid before the end of the month is correctly called an advance. As of December 29, 2017, the employer is not yet obliged to calculate and withhold personal income tax, since wages become income only on the last day of the month for which they are accrued - December 31 (clause 2 of Article 223 of the Tax Code of the Russian Federation). Despite the fact that December 31 is Sunday, personal income tax cannot be calculated or withheld before this date (letter of the Federal Tax Service of Russia dated May 16, 2016 No. BS-3-11/2169).

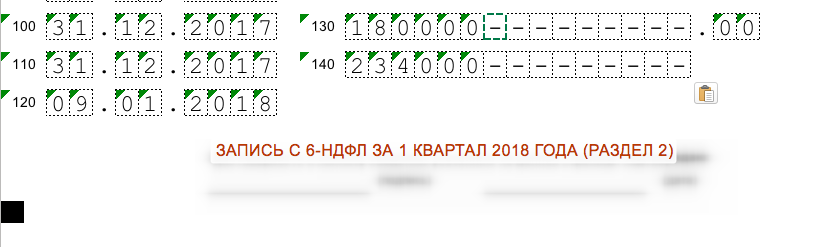

Example: December salary paid in December

The organization transferred the “salary” to the employees for December on the 29th in the amount of 180,000 rubles. From the payment made on the same day, personal income tax was calculated and withheld in the amount of 23,400 rubles (180,000 x 13%). The accountant transferred this amount on the first working day of 2021 - January 9, 2021.

Under such conditions, in section 1 of the 6-NDFL calculation for 2021, the accountant should correctly reflect the salary as follows:

- in line 020 – the amount of the December “salary” (RUB 180,000);

- in lines 040 and 070 - calculated and withheld personal income tax (RUB 23,400).

In section 2 of the 6-NDFL calculation for 2021, the December “salary” paid on December 29, 2021 should not appear in any way. You will show it in calculations for the first quarter of 2021. After all, when filling out section 2, you need to focus on the date no later than which personal income tax must be transferred to the budget. That is, paid income and withheld personal income tax must be shown in the reporting period in which the deadline for paying personal income tax falls. Such clarifications are given in the letter of the Federal Tax Service of Russia dated October 24, 2016 No. BS-4-11/20126. In our example, personal income tax must be transferred on the next working day in January – January 9, 2021. Therefore, in section 2 of the calculation for the first quarter of 2021, the December salary will need to be shown as follows:

- line 100 – December 31, 2017 (date of receipt of income);

- line 110 – December 31, 2017 (date of personal income tax withholding);

- line 120 – 01/09/2018 (date of transfer of personal income tax to the budget);

- line 130 – 180,000 (amount of income);

- line 140 – 23,400 (personal income tax amount).

The tax withholding date on line 110 of section 2 of the 6-NDFL calculation for the 1st quarter of 2021 will be exactly December 31, and not December 29, 2021 (when the payment was made). The fact is that it was on December 31, 2017 that you had to accrue the December salary and offset it against the previously paid advance (which, in fact, was the December salary). The situation is similar with payments until December 30. If, for example, the salary calculation for December was made in the period from December 26 to 29, then the date of personal income tax withholding should still be the date “12/31/2016”.

If personal income tax was withheld and transferred before the end of December 2017

Example: personal income tax was transferred to the budget in December 2021

The organization transferred the December “salary” to the employees on December 26, 2021 in the amount of 380,000 rubles. On the same day, personal income tax was withheld in the amount of 49,400 rubles (380,000 x 13%). The withheld amount was transferred to the budget the next day - December 27, 2017

In order to fill out 6-NDFL, the accountant turned to the letter of the Federal Tax Service dated March 24, 2016 No. BS-4-11/5106. In this letter, it was recommended to withhold personal income tax on the day of actual payment of salaries (December 26), and transfer the withheld amount to the budget the next day (December 27). In addition, tax authorities advise reflecting these same dates in the 6-NDFL calculation.

If the salary for December 2021 was accrued and actually paid in December (December 26, 2017), then this operation can be reflected in the calculation using Form 6-NDFL for 2021, since the withholding and transfer of personal income tax must occur in 2021 in accordance with the deadlines. specified in paragraphs 4, 6 of Art. 226 Tax Code of the Russian Federation.

In the situation under consideration, you can show the payment on lines 100 - 120 of section. 2 forms 6-NDFL for 2021 as follows:

- line 100 “Date of actual receipt of income” – 12/31/2017;

- line 110 “Tax withholding date” – 12/26/2017;

- line 120 “Tax payment deadline” – 12/27/2017.

Note that if the reflection of the transaction in Form 6-NDFL did not lead to an underestimation or overestimation of the amount of tax to be transferred, then the submission of an updated calculation is not required. Moreover, if the specified operation is reflected in the calculation according to Form 6-NDFL for 2021, then this operation is not reflected again in the calculation according to Form 6-NDFL for the first quarter of 2018 (Letter of the Federal Tax Service of Russia dated December 15, 2016 N BS-4- 11/24065). However, we do not exclude that such filling may raise questions from some Federal Tax Service Inspectors for the following reasons:

- a 6-NDFL calculation filled out in this way will not pass format-logical control and will return with the error “the date of tax withholding must not precede the date of actual payment”;

- withholding personal income tax from wages until the end of the month contradicts later recommendations of the Russian Ministry of Finance in a letter dated June 21. 2016 No. 03-04-06/36092.

Salary for December was paid in January 2018: how to show it in the calculation

Many employers paid December 2021 salaries in January 2021. If so, then show the December salary issued in January 2021 in the 6-NDFL reporting for 2021 only in section 1. After all, you recognized income in the form of wages in December and calculated personal income tax on it in the same month. Therefore, when calculating 6-personal income tax for 2021, distribute payments as follows:

- on line 020 – accrued income in the form of December salary;

- on line 040 – calculated personal income tax.

Line 070 of the 6-NDFL calculation for 2021, intended for withheld tax, is not increased in this case, since the withholding took place already in 2021 (letter of the Federal Tax Service of Russia dated December 5, 2016 No. BS-4-11/23138). In section 2 of the annual calculation, do not show the December salary paid in January 2021 at all (letter of the Federal Tax Service of Russia dated November 29, 2021 No. BS-4-11/22677).

CONCLUSION

The salary for December, issued in January 2021, is shown in section 1 of 6-NDFL for 2021 and in sections 1 and 2 of the calculation for the first quarter of 2021. Let us explain: you recognized income in the form of wages in December 2021 and calculated personal income tax on it in December. Therefore, show on lines 020 and 040 of section 1 of the annual calculation. And the personal income tax was withheld already in January 2021, reflect the amount on line 070 of section 1 of the calculation for the first quarter of 2021. This is confirmed by the letter of the Federal Tax Service dated December 5, 2016 No. BS-4-11/23138. Let us note that earlier representatives of the Federal Tax Service, in a letter dated February 25, 2016 No. BS-4-11/3058, advised to indicate the payment for the first quarter only in section 2. But this contradicts the order of the tax service dated October 14, 2015 No. ММВ-7-11/ 450.

If the deadline for tax payment under Art. 226 Tax Code will come in the 1st quarter of 2021, show income in section. 2 is not necessary, even if you reflected it in section. 1. So, there is no need to include it in Sect. 2 6-NDFL for 2017 salary for December, paid in January. Let's give an example.

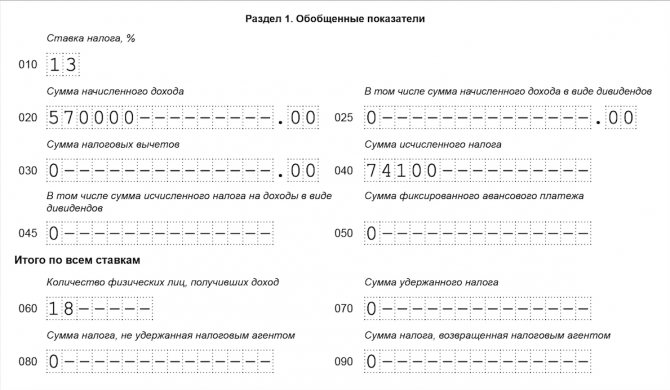

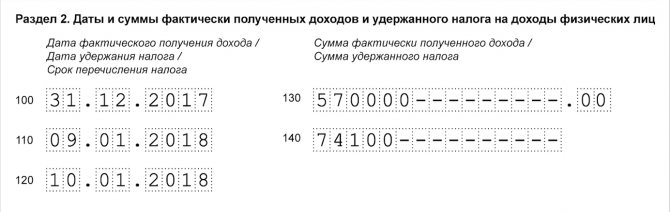

Example: salary for December was paid in January 2021

Salary for December - 570,000 rubles, personal income tax - 74,100 rubles, 01/09/2018 the salary for the second half of December was paid and personal income tax was transferred to the budget.

In 6-NDFL for 2021, the December salary is reflected as follows.

In section 2, the salary for December will be reflected in 6-NDFL for the 1st quarter of 2021.

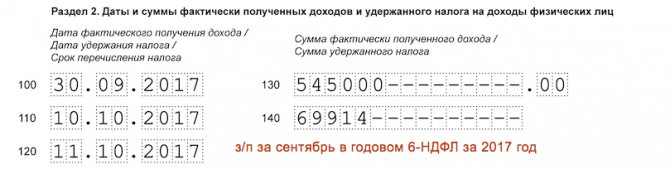

Salaries for September were paid in October

The deadline for paying personal income tax on salaries for September is October 2021. Therefore, when calculating for nine months, the accountant showed this payment only in section 1. Now these amounts need to be transferred to the reporting for 2021. See “6-NDFL for 9 months of 2021”.

In section 2 of the 6-NDFL calculation for 2021, you need to show the salary for September paid in October. Let's assume that the September salary was paid on October 10. The accountant will fill out section 2 of the annual calculation of 6-NDFL as shown in the example.

How to show bonuses in the annual 6-NDFL for 2017

Next, we will explain how 6-NDFL shows bonuses in various situations. Be careful - there are special features!

Monthly bonus

Reflect the monthly bonus in the same way as salary (Letter of the Federal Tax Service dated September 14, 2017 No. BS-4-11/18391).

In section 1 please indicate:

- in lines 020 and 040 - bonuses accrued for all months of the reporting period, and personal income tax calculated from them;

- in line 070 - personal income tax on premiums withheld until the end of 2021. This amount is usually less than the personal income tax from line 040. After all, the premium tax for the last month is withheld in the next quarter. The amounts in lines 040 and 070 will match only if the bonus for the last month was paid no later than the last working day of the quarter.

In Section 2, show all bonuses paid in the last quarter. An exception is bonuses paid on the last working day of the quarter. Include them in section 2 of 6-NDFL for the next quarter.

Indicate the bonus paid along with the salary for the same month together with the salary in one block of lines 100 – 140. If the bonus was paid separately, fill out a separate block, indicating (Letter of the Federal Tax Service dated October 10, 2017 No. GD-4-11/20374):

- in line 100 – the last day of the month for which the bonus was accrued;

- in line 110 – the day of payment of the bonus;

- in line 120 – the next business day after the bonus is paid.

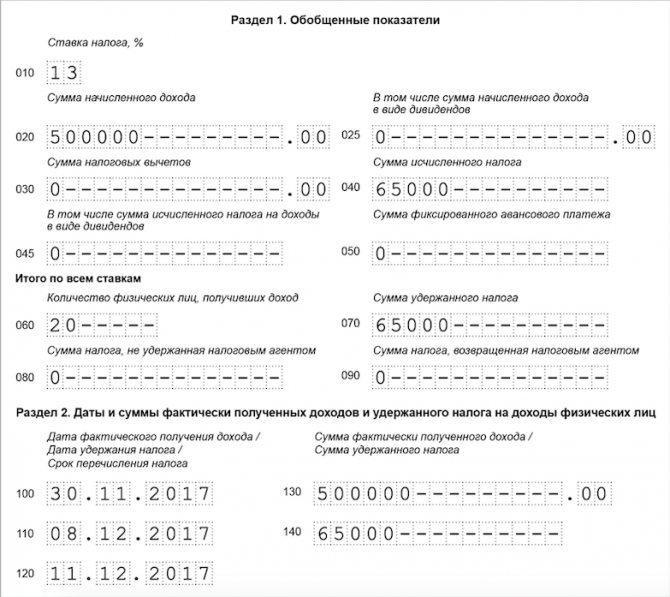

Example: November bonus paid in December 2021

On December 8, 2021, the bonus for November 2021 was paid - 500,000 rubles. and transferred to the personal income tax budget - 65,000 rubles. (RUB 500,000 x 13%).

In 6-NDFL for 2021, these amounts are reflected as follows.

IN

IMPORTANT

section 1, you need to include the amounts of accrued income, the date of actual receipt of which falls within the past year.

In Sect. 2 reflect the income paid if the deadline for paying personal income tax on it expires in October - December.

In this case, wages paid for December in January must be reflected in section. 2 calculations for the first quarter of next year.

Quarterly or annual bonus

Bonus for a period of more than a month - quarter, year, etc. reflect in 6-NDFL for the period in which it was paid (Letter of the Ministry of Finance dated October 23, 2017 No. 03-04-06/69115).

In section 1 please indicate:

- in line 020 - all bonuses for a period of more than a month paid in the reporting period, together with personal income tax;

- in lines 040 and 070 - personal income tax on premiums paid.

In Sect. 2 Show the bonuses paid in the last quarter. An exception is bonuses paid on the last working day of the quarter. Include them in section. 2 6-NDFL for the next quarter.

For bonuses, fill out a separate block of lines 100 – 140, where you indicate (Letters of the Federal Tax Service dated 01.11.2017 N GD-4-11/, dated 10.10.2017 N GD-4-11/20374):

- in lines 100 and 110 – the day of payment of the bonus;

- in line 120 – the next business day after the bonus is paid.

Show bonuses that were paid at different times in separate blocks.

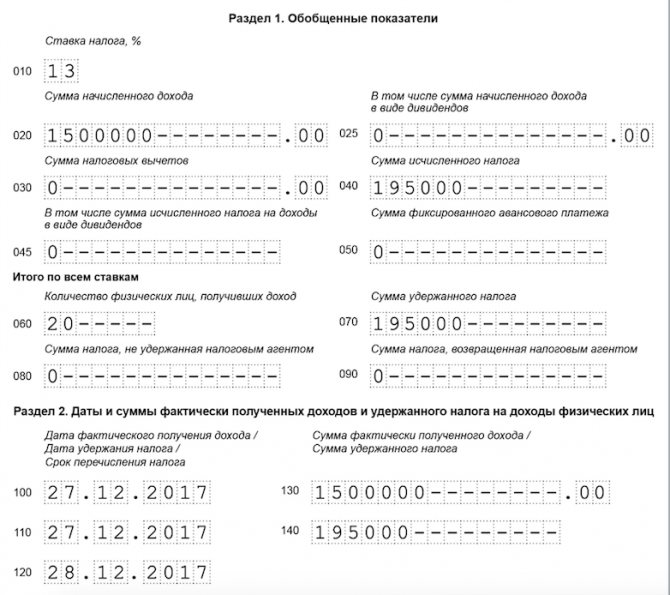

Example: annual bonus paid in December 2021

On December 25, 2017, an order was issued to pay the bonus for 2021 - RUB 1,500,000.

On December 27, 2017, the bonus was paid and transferred to the personal income tax budget - 195,000 rubles. (RUB 1,500,000 x 13%).

In 6-NDFL for 2021, these amounts are reflected as follows.

We study the explanations of controllers when filling out 6-NDFL for the 1st quarter of 2021

To fill out 6-NDFL correctly, you need to know not only the procedure for filling out the calculation and the norms of the Tax Code of the Russian Federation, but also the current explanations of officials.

If your company has delayed employee salaries, then in Section 1 of the 6-NDFL calculation it must be shown in the accrual period, despite the fact that you have not yet paid it. But in Section 2, the salary will only fall during the payment period (Letter of the Federal Tax Service for Moscow dated October 23, 2018 No. 20-15/220519).

For example, if you paid your salary for March 2021 on May 13, 2019, enter the data in Section 1 for the 1st quarter of 2021:

- on line 020 - all accruals from the beginning of the year, taking into account delayed salaries for March;

- on line 040 - personal income tax on the amount indicated in line 020;

- on line 070 - withheld personal income tax excluding tax on unpaid wages.

The salary paid in May for March will fall into Section 2 of the semi-annual report 6-NDFL:

- on line 100 - salary calculation date 03/31/2019;

- on line 110 - the date of personal income tax withholding upon payment is 05/13/2019;

- on line 120 - personal income tax payment deadline is 05/14/2019.

You cannot pay income tax before the employee has received income (Letter of the Ministry of Finance dated 02/13/19 No. 03-04-06/8932). For example, for a salary, the date of actual receipt of income is the last day of the calendar month. Even if you pay the salary for March in full by March 31, 2019, it is not considered received by the employee.

Personal income tax cannot be withheld from this salary and transferred to the budget - such tax will be considered paid at the expense of the company’s own funds, and not at the expense of the employee. The inspectorate will not accept this amount as tax and will wait for personal income tax payment. There will be arrears and penalties, and a fine is likely. To avoid this, make final payments to employees for the month after the end of the billing month.

How to show payments under civil contracts

Payments under civil contracts from which tax must be withheld must be included in section. 1 in the period when you made payments, and in Sec. 2 - only in the quarter in which the deadline for paying personal income tax on these payments expires.

Let's consider another situation when the act for work performed (services provided) under a civil contract with an individual was approved in December 2021, and payment for it took place in January 2018. In this case, the remuneration under the contract and personal income tax from it should be shown in sections 1 and 2 of the calculation for the first quarter of 2021. Do not show the operation in the 2021 calculations. This follows from the letter of the Federal Tax Service of Russia dated December 5, 2016 No. BS-4-11/23138. If in December an advance was issued under a civil contract, then it should fall into section 2 of the annual calculation.

Example: settlement under the contract “closed” in January 2021

The organization paid an advance to an individual under a contract on December 19, 2021 in the amount of 20,000 rubles. The tax withheld from this amount amounted to 2600 rubles. (20,000 x 13%). The balance was issued in January 2018 - after completion and delivery of all work.

In such a situation, reflect the advance to the contractor in the payment period (in December). The date of receipt of income in this case is the day when the company transferred or issued the money to the person. It does not matter whether the company issues money before the end of the month for which the service is provided, or after.

In section 2 of the 6-NDFL calculation for 2021, show the advance by line:

- 100 “Date of actual receipt of income” – 12/19/2017;

- 110 “Tax withholding date” – 12/19/2017;

- 120 “Tax payment deadline” – 12/20/2017.

How to reflect vacation pay in 6-NDFL

Vacation pay will be included in the report for 2021 and the report for the first quarter of 2018. In the report for 2021, show vacation pay on lines 020, 040, 070 of section 1. In the report for the first quarter of 2021, show vacation pay only in section 2 on lines 100–140. Such clarifications are in the letter of the Federal Tax Service dated 04/05/2017 No. BS-4-11/6420.

However, it is not necessary to show in Sect. 2 vacation pay paid in the last month of the quarter if the last day of this month falls on a weekend. Include such vacation pay in section. 2 6-NDFL for the next quarter. For example, vacation pay paid in December 2017 does not need to be included in section. 2 6-NDFL for 2021. After all, the deadline for paying tax on these vacation pay under Art. 226 of the Tax Code of the Russian Federation - 01/09/2018 (Letter of the Federal Tax Service dated 04/05/2017 N BS-4-11/6420).

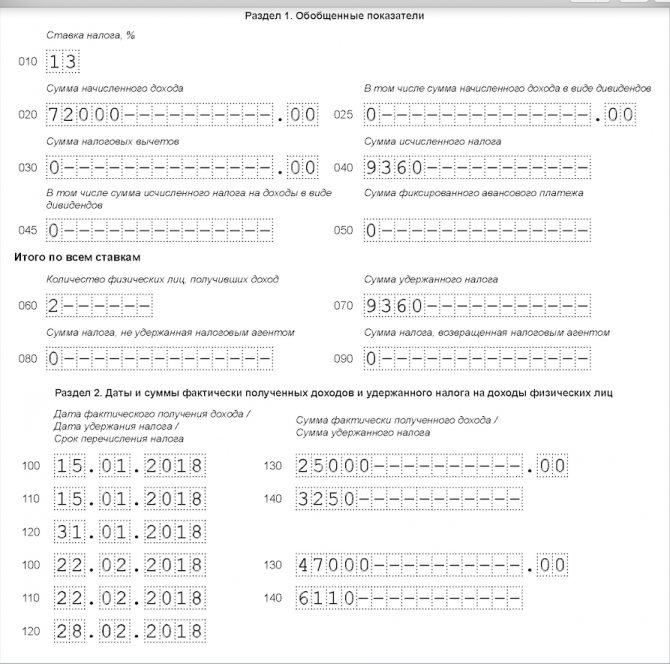

Example: vacation pay in the 1st quarter of 2021

In the 1st quarter of 2021, vacation pay was paid:

- 01/15/2018 – 25,000 rub. Personal income tax from them is 3,250 rubles;

- 02/22/2018 – 47,000 rub. Personal income tax from them is 6,110 rubles.

Personal income tax on these vacation pay is transferred on the day they are paid. On March 30, 2018, vacation pay of 27,616 rubles was accrued, which was paid on April 2, 2018.

The total amount of vacation pay paid for the 1st quarter is RUB 72,000. (25,000 rubles + 47,000 rubles), personal income tax from them is 9,360 rubles. (3,250 rub. + 6,110 rub.).

In 6-NDFL for the 1st quarter of 2021, vacation pay is reflected as follows:

Vacation pay paid on 04/02/2018 does not need to be shown in 6-NDFL for the 1st quarter. These vacation pay will be reflected in 6-NDFL for the six months.

Responsibility

If you haven’t submitted the calculation or submitted it late, then the fine is 1000 rubles. for each full or partial month from the day for submitting the calculation (clause 1.2 of Article 126 of the Tax Code). The period of delinquency will be calculated from this day until the date on which you submitted the estimate (in person, through a representative, by mail or online).

If you do not submit the payment within 10 days from the due date, the tax office also has the right to block the bank account of the tax agent (clause 3.2 of Article 76 of the Tax Code). The Federal Tax Service clarified this in a letter dated 08/09/2016 No. GD-4-11/14515.

If inspectors identify false information in 6-NDFL for 2021, the fine for each calculation with such data will be 500 rubles. But if you yourself identify an “unreliable” error and submit the updated 6-NDFL, then there will be no fines (Article 126.1 of the Tax Code).

Please note that not only the organization, but also responsible employees (for example, a manager and an accountant) can be held liable: a fine of 300 to 500 rubles. (Article 15.6 of the Administrative Code).

Methods for submitting 6-NDFL

You can submit a report to the Federal Tax Service:

- On paper.

You can submit it yourself, through a representative, or by sending it by registered mail with a list of attachments.

Be careful: a paper report can be submitted in 2021 only if the number of employees does not exceed 10 people. (Letter of the Federal Tax Service dated November 15, 2019 No. BS-4-11 / [email protected] ).

If there are more employees, you will have to report electronically. You may be fined for submitting a report on paper when you are required to submit it in electronic format.

- In electronic form.