Author of the article: Yulia Kaisina Last modified: January 2021 17292

When an employee leaves the company, in accordance with labor legislation, he must be paid the last month's salary, bonus, compensation for unused vacation and other amounts stipulated by the labor or collective agreement. These may include financial assistance upon dismissal. If it is specified in a collective or employment agreement, the employer will be obliged to pay it. Otherwise, this question depends on his desire and financial capabilities.

What is financial assistance and when is it paid?

Important! Financial assistance is not a regular payment; otherwise, it is classified as monetary incentives with all the ensuing consequences.

The possibility of receiving financial assistance and its size do not depend in any way on the factors that would influence the amount of salary - experience, qualifications, knowledge, skills, etc. Management is approached for such a payment in the event of a difficult financial situation (in the event of a fire, illness of a child, theft, death of a relative, and other cases). The law does not oblige employers to agree to payment; the employee may be refused. If the opportunity to receive financial assistance is important to the applicant, you should discuss this point with the employer in advance. Payment terms may be reflected:

- in the employment contract with the employee;

- in the collective agreement of the enterprise or other local act.

Important! Only the presence in an employment or collective agreement of a clause on the payment of financial assistance upon the occurrence of certain conditions guarantees that the employee will receive payment. If financial support is not mentioned in any of the company’s local regulations, the employer is not required to make payments.

If the manager is ready to accommodate the dismissed employee, he issues a separate order indicating the exact amount of financial assistance and the date on which the payment must be made.

Is an employee entitled to financial assistance upon dismissal?

Upon dismissal, several different payments may be made, each of which could be regarded as financial assistance. Depending on what kind of payment we are talking about, the employer provides financial support on his own initiative and at his own discretion, or under duress of the law:

| Type of payment | A comment |

| Monetary incentive based on the results of a specified period of time (year, quarter, month), in other words - a bonus. | If such a payment is approved by any local company regulation, the employer is obliged to make it. Otherwise, the employer does not have to pay anything. If an employee is fired before the payment time, the amount of the bonus is determined by the number of days worked or in another manner accepted by the company. |

| Severance pay. | It is mandatory to pay if the dismissal occurred at the initiative of the employer, but the employee did not commit disciplinary or other violations. |

| Severance pay in case of bankruptcy and liquidation of a company. | It is a mandatory payment, and is accrued to the employee in a fixed amount, in accordance with the provisions of Article 81 of the Labor Code. |

| Penalty upon dismissal by agreement of the parties. | Often, the employer offers the employee a certain amount of money as compensation for early termination of the employment relationship. The amount of compensation is established by the decision of the manager and is indicated in the agreement on termination of the employment contract. |

| An additional payment requested by the dismissed employee due to his difficult financial situation. | If the employment or collective agreement does not mention such payment, the employer has the right to refuse, especially if dismissal is due to guilty actions on the part of the employee. |

Is financial assistance available for vacation?

The Labor Code (hereinafter referred to as the Labor Code) does not explain the concept of material assistance if it is provided when an employee goes on his next annual paid leave. This term is used in practice and is enshrined in other legal acts, which, as a rule, are local in nature. At the same time, the regulation of such payments follows from a number of labor legislation, including the Labor Code.

In particular, the Supreme Court of the Republic of North Ossetia-Alania, in its appeal ruling dated August 12, 2014 in case No. 33-943/14, clearly indicated that the plaintiffs cannot demand payment of financial assistance for their annual leave, since they were not on it , the rules for monetary compensation for vacations established in the relevant legal act do not provide for such payment. A similar position follows from the appeal ruling of the Kaliningrad Regional Court dated October 7, 2015 in case No. 33-4953/2015, according to which the plaintiff had the right to receive one-time assistance for her vacation, although she was on it for only 1 day, since the right to such payment is established by a number of regulations relating to the remuneration of state civil servants in the region.

If an employee wants to receive assistance, that is, not an incentive, but a social payment, he must write a corresponding application addressed to the employer with a request to pay him a certain amount of money. If the assistance is an incentive payment, then it is paid without a request, constantly and for each vacation. Depending on the size, it will be subject to personal income tax, and insurance premiums will be charged from it. When an employee decides to quit, the employer will have to pay him financial assistance of an incentive nature, but in proportion to the number of months worked in the current working year.

Often, employers provide their employees with financial assistance for vacation. It can also be set at a fixed amount, or it can be “within the salary.” The provision for the provision of such assistance may be stated in the employment contract with the employee, in the collective agreement or in other local regulations. When an employee quits without having completed a full working year, the employer will decide whether to pay him part of the assistance or not.

An application for financial assistance can be submitted along with an application for dismissal. Also, the law does not prohibit filing such an application after official dismissal. Payment of financial assistance can be provided even to those who are not employees of the organization.

After writing the application, its consideration by the boss begins. If compensation upon dismissal was stipulated in an employment or collective agreement, then they have no right to refuse the request. The accounting department makes the calculations and the employee receives all payments due to him no later than the day of official dismissal. If the employee did not go to work on the day of dismissal, the payment is made no later than the next day. This is stated in the first part of Article No. 129 of the Labor Code of the Russian Federation. Statement

We recommend reading: Is there any social program for the installation of gas equipment for elderly people for free or with some benefits

Typically, the author of the memo is the employee’s immediate supervisor. However, another colleague can write it. It is better to clarify with the responsible persons exactly who and how should draw up a document on the issuance of financial assistance. This could be a personnel officer, chief accountant or union leader (if the company has one).

In addition, internal documents may provide for regular cash payments to certain categories of employees (for example, parents of minor children or non-residents). Another option is financial assistance for annual leave. Sometimes such payments become a type of incentive (for example, quarterly or annual bonuses for all employees).

- If a person has worked at the enterprise for less than six months, it will not be possible to receive an additional amount for vacation, since the right to another paid vacation appears after working for at least 6 months.

- When terminating an employment contract immediately after a vacation, there is no point in the employer spending additional funds that are used to reward existing employees.

- Pregnant workers, when applying for maternity leave, do not have the right to count on financial assistance, since this type of leave does not apply to regular paid leave and is formalized as a social measure by the state, with the appointment of benefits to the employee for the period of maternity leave.

Before going on vacation, an employee has the right to count on receiving mandatory vacation pay, calculated based on average earnings for the last period, however, in some cases, in addition to the usual calculation, employees are entitled to financial assistance for their vacation. This payment is not mandatory under the Labor Code of the Russian Federation, but may be regulated by individual federal regulations and a collective agreement. To receive financial assistance, you should study the procedure adopted at the enterprise when an additional amount is paid.

Financial assistance upon dismissal of one's own free will

Important! If an employee leaves his job due to moving to work in another company, as a rule, he is not entitled to financial assistance, since he will immediately begin receiving a salary at the new place of work.

If an employee writes a letter of resignation for any of the following reasons (when 14 days of work are not required), the employer may, at its discretion, pay him a certain amount of money as a reward for conscientious work:

- upon retirement due to age;

- due to deteriorating health and assignment to a non-working disability group;

- due to the serious illness of a family member in need of care;

- in other cases that are prescribed by management in the collective agreement of the enterprise.

The payment amount in such cases is usually calculated as a percentage of the salary. If the dismissal was initiated by an employee who accepted a better offer from another employer, he can only write a statement asking him to help him with money (see sample statement). The employer will consider the reasons for such an appeal, determine the amount to be paid and the date of transfer of funds. But he has the right not to pay money.

Amount of financial assistance

The amount of financial assistance can be a specific amount or a percentage of the salary. If its size is not specified in local regulations, the applicant himself decides how much to ask for. In some cases, for example, when money is needed for treatment, checks and receipts for expenses may be attached to the application.

Expert commentary

Gorbunova Olga

Lawyer

If financial assistance is of a regular nature (for example, annual additional payments for vacation), and the employee has not yet received them, then the amount is calculated in proportion to the period for which it should be accrued.

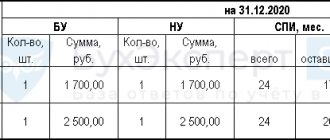

An example of calculating financial assistance upon dismissal

The employer, according to the company’s collective agreement, pays employees one-time financial assistance for vacation in the amount of 16 thousand rubles. The employee worked for 8 months, and therefore wrote a letter of resignation from work. Payout calculation:

8 months : 16 months = 0.5 – part of the year that was worked;

16,000 rub. x 0.5 = 8,000 rubles – payment;

8,000 rub. x 13% = 1040 rubles – personal income tax withholding;

8,000 rub. – 1040 rub. = 6,960 rubles – payment in hand.

A memo as a basis for payment of financial assistance

The memo is also drawn up in any form and contains similar details:

- information about the head of the organization to whom it is submitted;

- information about the person submitting the memo;

- information about the employee who may be paid financial assistance, including his full name and position;

- name of the document (service memo);

- request for payment;

- indication of the payment amount;

- signature of the employee's supervisor;

- date of writing the note.

The note is most often drawn up by the immediate supervisor of the resigning employee, but can also be written by any other person who is applying for payment of financial assistance to the resigning employee.

A sample note might look like this:

To the Director of Nova LLC

Evstafiev D. R.

From the head of the HR department

Personnel R. R.

Service memo

I ask you to pay financial assistance to the deputy head of the HR department of O.R. Karmovskikh, who is resigning at his own request, in the amount of 5,000 rubles.

Personnel R. R. / Personnel /

18.06.2019

Common mistakes

Error: Financial assistance upon dismissal is indicated in the collective agreement as an incentive payment for the period of work. The employer does not withhold personal income tax and insurance premiums from payments.

Comment: If material assistance is of a social nature, personal income tax and insurance contributions are not paid. If the payment is of an incentive nature, deductions are required.

Error: The employer paid the employee money as one-time financial assistance of a social nature. The employee soon quit, and the employer withheld this amount from his salary.

Comment: The list of possible deductions from salary is given in Art. 137 Labor Code of the Russian Federation. In this case, deduction is prohibited.

Answers to common questions

Question No. 1: Should an employee pay personal income tax on the amount of financial assistance upon dismissal?

Answer: No, financial assistance does not apply to the wage fund, and therefore no taxes are required to be paid on it - neither by the employee nor by the employer.

Question No. 2: Is financial assistance included in the amount of money taken to calculate the average earnings of a dismissed employee?

Answer: No, financial assistance should not be taken into account when calculating salary, benefits and other payments related to work activities.