Issuing 2-NDFL certificates to employees is the responsibility of employers, including in cases where the person has already stopped working in the organization.

However, there are often cases when, having applied for a certificate, a citizen receives an unmotivated refusal from the employer. How to act in such cases is described in this article.

Who issues the 2-NDFL certificate

In paragraph 3 of Art.

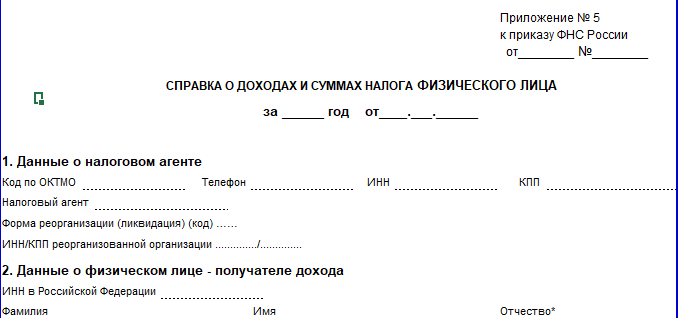

230 of the Tax Code of the Russian Federation states that a certificate of income and deductions from them is issued at the request of an individual by a tax agent. The certificate is issued according to form 2-NDFL approved by the fiscal department. During 2021 (from 02/10/2018), the certificate form approved by the order of the Federal Tax Service of Russia dated 10/30/2015 No. MMV-7-11/ as amended by the Federal Tax Service order dated 01/17/2018 No. MMV-7-11/ is valid. And from 2021 a new one will be introduced form from the order of the Federal Tax Service dated October 2, 2018 No. ММВ-7-11/

Rarely, but there are still situations when an employer refuses to issue a 2-NDFL certificate to a dismissed employee. Most often, due to the fact that the company has problems with tax accounting. In this case, the employee will need to comply with all the rules of the law in order to achieve his goal.

You will have to write a statement in writing and send it to the employer. It is preferable to send such an application by a valuable letter - then you will have an inventory of the attachment with a mark from the postal operator. If within the established period (three days from the date of receipt of the application by the employer) the certificate is not provided, you can contact the labor inspectorate directly with a complaint about the inaction of company officials.

To learn about the consequences of not issuing a certificate to an employee, read the material “The employee was not issued a 2-NDFL certificate? Wait for the trial."

In a new job, an accountant will need personal income. faces over the past year. You also need to submit a declaration on the amount of deductions and the “total” amount of personal income tax upon dismissal. In addition, you will need information about accruals and deductions for an arbitrary period of time for other purposes; this depends on the specific tasks.

For example:

- To receive a loan, when applying to credit organizations, the inspector will require information about earnings for the quarter or half a year;

- To receive funds from government funds, a certificate will be required for the period specified by the employee, for example, an annual period.

Certificate 2 of personal income tax is issued after dismissal upon application by the employee, and at the end of the reporting year.

The accountant has a question for what period is certificate 2 issued if information on income for two or more years is needed. In this case, the employer issues a certificate separately for each year.

If a woman who receives child care benefits for up to one and a half years applies for a declaration, the certificate will indicate that during this period of time, earnings were not transferred from the enterprise, and the source of income for her is a benefit from the Social Insurance Fund. The organization will issue a notification that the profit was not paid and personal income tax was not withheld.

If you need a declaration after dismissal, and the company is liquidated and excluded from the Unified State Register of Legal Entities, we provide a number of solutions for this problem:

- An accounting employee of the new organization sends a request to the local fiscal authorities, which indicates the reasons for this need. The declaration will be needed for average earnings when calculating vacation pay, sick pay, and applying standard deductions;

- also apply for such information. the person can independently.

The Federal Tax Service will provide complete information in response to the request.

Despite the fact that the Tax Code of the Russian Federation clearly states that the employer does not have the right to refuse to issue his employee a document confirming income, the deadlines are not specified there. That is, there is no set period during which a certificate is issued after the employee applies. But if you look at the Labor Code of the Russian Federation, then these exact deadlines are indicated there; according to them, the certificate must be ready no later than three days after the employee applies, and only working days are taken into account, excluding weekends and holidays. If your former employer does not issue you a 2-NDFL certificate, then this is also a violation of rights.

Legal grounds for refusal

According to the law, the storage period for data at the enterprise is 5 years, after which all documentation is destroyed. Accordingly, if the accountant does not provide a 2-NDFL certificate after this period, then you do not have the right to demand the document, because he is not obligated to provide the document.

So, if you cannot obtain a certificate from your place of work because the accountant refused to issue it to you, first write an application in his name for the issuance of the document in free form. Then ask to make a copy for you with the accountant's signature, which will indicate that you actually requested the document. If after three working days the certificate is not ready, then prepare a complaint to the Labor Inspectorate.

To whom is the certificate provided and within what time frame?

Unfortunately, the Tax Code of our country does not give exact deadlines for when an organization must issue an income certificate in Form 2-NDFL, if this is necessary for a former or current employee. But after reading the Labor Code of the Russian Federation, you can find information regarding the deadlines for issuing working documents. This Code states that a request for the issuance of any documents must be satisfied (part 1 of article 62, part 4 of article 84.1 of the Labor Code of the Russian Federation):

- within 3 days (working days) from the date of application by an existing or no longer working employee;

- in case of dismissal - on the last working day.

A certificate in form 2-NDFL is submitted by the tax agent:

- In relation to tax withheld from an individual - annually to the Federal Tax Service (no later than April 1 of the year following the reporting year). Certificates are prepared for each employee who was paid income during the calendar year. If an employee worked during the tax period in several divisions of one enterprise, then to fill out form 2-NDFL you should use the recommendations from the letter of the Ministry of Finance of Russia dated July 23, 2013 No. 03-02-08/28888.

- In relation to the tax that the employer was unable to withhold from an individual - annually to the Federal Tax Service (no later than March 1 of the year following the reporting year).

To learn about the consequences of failure to submit a certificate to the tax authority, read the article “What is the responsibility for failure to submit 2-NDFL?”

- At the request of the employee an unlimited number of times, and the employer cannot deny the employee his right (letter of the Federal Tax Service of Moscow dated February 24, 2011 No. 20-14/3/16873). The employee may also require several original certificates to be provided at once.

In Art. 230 of the Tax Code of the Russian Federation does not stipulate the period for issuing a certificate after the employee’s application. At the same time, in Art. 62 of the Labor Code of the Russian Federation for issuing a salary certificate establishes a three-day period from the date of receipt of the employee’s written application.

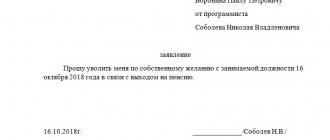

Does this mean that in order to obtain a certificate it is necessary to write an application? Not always. Some employers issue such documents at the employee’s verbal request, as well as upon dismissal - without reminders (in accordance with Article 84.1 of the Labor Code of the Russian Federation). If the enterprise is large or the employer has taken the position that nothing will be provided without an application, you should write a petition in any form.

In the application, it is important to correctly indicate your personal data, as well as the period (measured in years) for which the certificate is required. The certificate must be issued as many times as necessary upon the employee’s request within a three-year period for which his income is taken into account.

What to do and how to act if they do not issue a 2-NDFL certificate

The Tax Code does not include any exact deadlines for when a company must provide certificates to its employees, but the Labor Code states that this must be done within three days from the date the application is submitted. Moreover, if an employee notices a violation of his legal rights, he has the right to file a written application with the labor inspectorate so that appropriate penalties are imposed on the employer.

If the company refuses to provide a certificate and more than three months have already passed since the application was submitted, then the employee has the right to file a claim in court demanding that the employer issue this document. It is worth noting that the restoration of the deadline is provided only if there are valid reasons that led to the employee being unable to apply for a certificate on time.

If a citizen applies for a certificate after the final payment has been made or cannot provide evidence of the requirement to issue this document while still in the process of his work, then the situation will be more complicated, since there will be no relationship between the employee and the employer that meets the requirements of the Labor Code, and This situation is not covered by the provisions of Article 52.

Thus, it will be impossible to impose a fine on the employer in this situation, and therefore the employee will need to go to court to obtain a certificate.

Among other things, the issuance of this certificate is provided for in paragraph 3 of Article 230 of the Tax Code, but often, if employers do not hide from paying taxes and transfer all necessary payments on time, then issuing the certificate often does not cause any difficulties.

To the labor inspectorate

If the employer violates Articles 62 and 84.1 of the Labor Code of the Russian Federation and denies the employee the timely issuance of 2-NDFL, the law protects the rights of the subordinate. He can take certain actions. To do this, you should first of all complain to the labor inspectorate in writing.

Violation of the law implies penalties for the employer. The labor inspector has the right to fine the organization. According to the Code of Administrative Offenses of the Russian Federation, she is threatened with the following monetary fines (Part 1 of Article 5.27 of the Code of Administrative Offenses of the Russian Federation):

- 1000 – 5,000 rub. – on officials;

- from 30,000 to 50,000 rub. – to a legal entity;

- 1000 – 5,000 rub. - for businessmen.

Moreover, previously the law allowed for the possibility of suspending a company’s activities for up to 3 months. Now this rule no longer applies.

There is no administrative liability for violating the deadline for issuing the 2-NDFL certificate. An employer can be punished only for general failure to comply with the specified deadlines or for refusal to issue 2-NDFL.

Labor Inspectorate, relying on Art. 357 of the Labor Code of the Russian Federation, issues an order to the company, obliging it to eliminate the violation and issue the required certificate to the employee.

ADVICE If the employer continues to ignore all requirements, contact the prosecutor's office.

Declaration 2 of personal income tax for 2021 is made for each individual. to a person, including a dismissed person. The application must be submitted to the Tax Inspectorate no later than April 2, 2018.

Certificate 2 of personal income tax for an employee dismissed during the calendar year contains the same number under which he was registered upon dismissal. The same rules apply to dates.

If according to physical the person has a personal income tax debt, the certificate must be submitted to the fiscal authorities no later than March 1, 2021 and at the same time the former employee must be notified about the resulting debt.

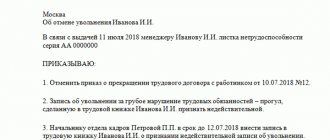

Certificates upon dismissal upon written request of the employee

An employee may need a certificate of income and deductions from them in form 2-NDFL in the following situations:

- to obtain a loan, obtain a mortgage;

- to fill out the 3-NDFL declaration;

- when applying for a new job;

- for registration of unemployment benefits, pensions;

- to receive government financial assistance;

- for obtaining a visa;

- in other situations.

For information on the form on which 3-NDFL is formed for 2021, see here. She too has changed.

For information about documents that may be needed when filing an income tax return, read the material “What documents are needed to file a 3-NDFL declaration?”

Article 84.1 of the Labor Code approves the procedure for dismissal and lists the list of documents that the employer is obliged to issue to the employee on the last day of work.

This type includes:

- Certificate of income of the employee, taking into account severance pay upon dismissal;

- on insurance amounts to the Russian pension fund;

- about your work experience in the company.

Declaration 2 of personal income tax refers to the type of certificates that are issued upon written request. A legal entity cannot deny this right to a former employee, since the indicators in these certificates relate only to the employee and the work, until dismissal, contains private information relating to a specific person.

When issuing a declaration upon written application, the following are taken into account:

- Information is provided only free of charge;

- the declaration is submitted no later than 3 days from the date of registration of the application;

- Not every organization has a personnel employee who will prepare papers on the experience of physical persons. persons in this company. In this case, if the employee quits, the responsibility for issuing falls on the accountant.

Certificates from the Pension Fund contain personalized accounting information. This information is necessary for accumulating contributions at a new workplace.

Legislative regulation

Employers are responsible for issuing documents to citizens confirming the amount of wages received (Article 230 of the Tax Code of the Russian Federation).

In this case, the document must be issued before the expiration of 3 days from the moment the person submitted the corresponding written application.

If an employee leaves his position, all papers must be issued on the day of dismissal (Article 62, 84.1 of the Labor Code of the Russian Federation).

What to do if the company is liquidated

Another rather problematic situation cannot be excluded when, at the time of applying for a certificate, the enterprise is no longer functioning (liquidated) and information about it is excluded from the Unified State Register of Legal Entities. There are several ways to obtain a 2-NDFL certificate in such a situation.

So, if a new employer requires a certificate, he sends a request to the Pension Fund branch and the local Federal Tax Service explaining the reasons for this need. A certificate may be required for the correct application of standard deductions or the calculation of vacation and sick pay, when information about deductions made by the previous employer is indispensable.

In response to this request, information will be provided on income and deductions from it for a specific individual for the requested period. Also, the insured person himself can independently send a request to the Pension Fund of the Russian Federation in the form approved by Order of the Ministry of Health and Social Development dated January 24, 2011 No. 21n.

In addition, an individual can independently obtain the necessary information about accrued and paid personal income tax through his personal account on the website of the Federal Tax Service of Russia.

Certificate 2-NDFL through the personal account of an individual

Please note that from the end of 2021, in the personal account of an individual on the website of the Federal Tax Service of Russia, you can not only view certificates of your income in form 2-NDFL, which were submitted (!) to the tax office by your employer (past employers), but also download and save it to yourself computer in pdf or xml format. In addition, it will be signed with an enhanced qualified electronic signature of the Federal Tax Service of Russia.

In general, you no longer need to go to the accounting department at your place of work, including your previous one, to get a certificate of your income in Form 2-NDFL.

For more information about this, see “How to obtain 2-NDFL through the taxpayer’s personal account.”

If there is a delay in payment of wages

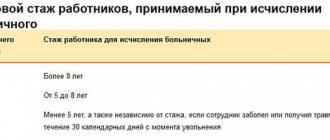

Due to the fact that in accordance with paragraph 4 of Art. 226 of the Tax Code of the Russian Federation, accrued personal income tax cannot be withheld until the employee’s salary is paid; there are particular difficulties with entering data related to accrued but not yet paid income into the 2-NDFL certificate.

According to the tax authorities, voiced in the letter of the Federal Tax Service dated October 7, 2013 No. BS-4-11/, if income for the previous tax period at the time of drawing up the certificate (upon request or within a limited period - until April 1) has not yet been paid, then they, and Also, the withholding of taxes from them in 2-NDFL should not be reflected. True, according to the letter of the law, the date of actual receipt of income in the form of wages is the last day of the month for which this income was accrued (clause 2 of Article 223 of the Tax Code of the Russian Federation).

When is refusal legal?

In accordance with the law, employers are required to store documentation for 5 years, and then destroy it. It follows that if a person applies for a certificate after this period, he may be refused on legal grounds, while it is impossible to bring him to any responsibility.

Where can an unemployed person or a pensioner get a certificate?

An unemployed person can receive a certificate of income received in the form of unemployment benefits at the employment center. All you have to do is submit an application and then pick up the completed certificate. But this will not be Form 2-NDFL. If an individual has not worked for more than three years and is not registered with the employment center, then there is simply nowhere for him to get a certificate of income, because officially there was none.

If a non-working person had income from other sources, it is necessary to report them by indicating in the 3-NDFL declaration. In addition, you will need to calculate the tax yourself and transfer it to the budget. In this case, evidence of income received and taxes paid on it will be a copy of the tax return.

Pensioners receiving payments from non-state pension funds can request 2-NDFL from the local branch of their fund. But disabled citizens who receive state pensions will not be able to obtain such a certificate from the Pension Fund of the Russian Federation, since such pensions are not subject to personal income tax.

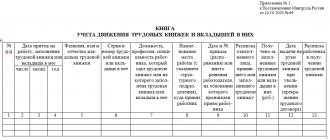

Example of registration of 2 personal income tax upon dismissal

The type of declaration was approved on October 30, 2015. The mandatory requirements when filling out 2nd personal income tax include completing the following fields:

- Information about the employer, details. Reductions are allowed only in accordance with the statutory acts;

- information about the recipient of the profit - individual. face;

- profit subject to taxation;

- deductions that were applied in the reporting period;

- the amount of profit and personal income tax.

In the information field about the agent, you must indicate complete information about the legal entity.

In the information column about physical the person is told the following:

- Last name, first name, patronymic;

- citizenship and status as a taxpayer;

- place of registration and place of residence;

- passport details.

Profit on which personal income tax is withheld is reflected by month. At the same time, indicate the code of income and tax deductions indicating the amounts. If physical the person had the right to other deductions - social or property, this information is reflected in certificate 2 and indicates that such a right was presented.

The form must be certified by the manager or other authorized person and stamped. The certificate is considered invalid without a stamp.

In relation to the calculation of 2nd personal income tax, the registration procedure applies: corrections are not allowed, if errors are detected, a new form is issued as soon as possible.

For misrepresentation of information or delay in time, administrative sanctions are applied to the tax agent.

Example of filling out 2nd personal income tax for individuals. person dismissed on June 23.

As mentioned above, starting from the 2021 report, 2-NDFL is drawn up on a new form. Or rather, on two forms:

- The first - it is now called 2-NDFL - is used for submission to the Federal Tax Service.

It has a new structure: it consists of some kind of title page, three sections and one appendix. At the very beginning of the document, information about the tax agent is provided, in section 1 - information about the individual in respect of whom the certificate is being filled out, in section 2 - information about the total amount of income, tax base and personal income tax, in section 3 - deductions provided by the agent: standard, social and property, and the appendix provides a breakdown of income and deductions by month.

- The second form, which you will issue to the employee from 01/01/2019, is simply called “Certificate of income and tax amounts of an individual” (without the usual “2-NDFL”). It almost completely repeats the previous form (from the order of the Federal Tax Service dated October 30, 2015 No. ММВ-7-11/).

Correction of data for reference

If inaccuracies are discovered (during a tax or independent audit), the tax agent must provide an updated version of the certificate to the Federal Tax Service. And do this as soon as possible so as not to become liable for distortion of information submitted to the Federal Tax Service (Article 126.1 of the Tax Code of the Russian Federation). Corrections made before the violation is discovered by the tax authority will relieve liability.

In addition, the correct version of the certificate must be given to the employee.

Non-taxable income should not be included in the certificate. If a mistake was made when preparing the original certificate, the employer should correct this violation.

If the changes are related to the recalculation of personal income tax in the direction of increasing tax liabilities, then the amended certificate does not indicate the tax overpaid by the tax agent, but not withheld from the employee, since the Federal Tax Service of Russia does not consider such an overpayment as tax.

If the previous certificate indicated the tax withheld in excess from the employee, and it was subsequently returned to the individual, then the correct amount must be indicated in the new certificate. After discovering an error in the form of excessively withheld personal income tax, the refund must be made within 3 months.

For information on how refunds are made, read the article “How to return excessively withheld personal income tax to an employee.”