Working overtime is considered one of the options that allows you to earn extra money and earn additional income. Sometimes bosses offer to stay at work after hours in order to complete a previously assigned task. Many agree with pleasure, knowing that this will bring them a possible additional payment. The employer does not have the right to abuse such offers according to the Labor Code of the Russian Federation, violation of which is accompanied by financial penalties in the form of fines imposed on the enterprise. How is overtime paid according to the labor code?

Is it necessary to issue an order?

The need to fulfill or exceed the production plan does not always fit into the framework of working hours. In this case, there is a need to organize work beyond the normal duration of the shift, but overtime work according to the Labor Code of the Russian Federation has restrictions on attracting personnel to work outside the limits of the normal working day. In addition to its own restrictions established by Article 99 of the Labor Code of the Russian Federation, involvement in such work requires additional payment for overtime hours, which is established by Article 152 of the Labor Code of the Russian Federation.

The Labor Code of the Russian Federation does not indicate that registration of overtime work requires the issuance of a separate order from the manager. The main requirement is the employee’s written consent to work beyond the norm.

An exception is the cases listed in Part 3 of Art. 99 Labor Code of the Russian Federation. The employee’s consent may not be asked if:

- there is a need to prevent an accident or natural disaster;

- engage an employee to eliminate a breakdown that interferes with the enterprise’s water supply, lighting, communications, transport and other communications;

- An emergency arose, martial law was introduced, etc.

Despite the fact that in the above cases the employee’s written consent to overtime work is not necessary, overtime must be formalized and paid for.

For payment, overtime time in the time sheet is indicated by the code “C” or “04”. The basis for paying overtime hours is the timesheet.

The following categories of employees have the right to refuse overtime work:

- disabled people;

- women raising children under three years of age;

- a parent raising a child under five years of age alone;

- citizens raising disabled children;

- employees caring for a sick relative.

Such employees must be informed in writing of the possibility of refusing overtime work. This information can be indicated in the order. Managers of organizations should be aware that it is prohibited to involve pregnant employees and minors in extracurricular work.

Causes

You can only be brought to work with the consent of the worker in the following situations:

- When there is an urgent need to complete any activity that the citizen himself could not complete within a certain period of time. In this case, it is possible to involve in overworking of working hours only if failure to complete such work could lead to the loss of property or create a threat to the life and health of people;

- When it is necessary to carry out temporary technical work, without completion of which a more impressive number of people may find themselves without appropriate working conditions;

- If the work is continuous and does not imply a break, and the person replacing the previous one did not show up to his workplace. In this situation, the administration must take all measures to replace the replacement;

- When there is an important task from management, the failure of which can significantly affect the work of the entire enterprise as a whole.

You can be forced to work overtime without obtaining consent for the following reasons:

- If you plan to prevent a disaster;

- If the consequences of a natural disaster, catastrophe, or industrial accident are being eliminated;

- When performing work aimed at eliminating problems in water supply, sewerage, gas, lighting and transport systems.

In all other situations not stated above, an employee can be forced to perform his duties at the end of the working day only with his written consent. If there is a trade union in the organization, it is worth taking its opinion into account in this case.

How much and how are overtime hours paid?

Organizational managers are often interested in how much to pay for overtime worked by an employee? For greater clarity, we have placed a table:

| Period of extracurricular work | Overtime pay |

| First 2 hours | Must be paid at least one and a half times the amount |

| Subsequent hours | At least double the size |

The amount of payment for overtime work indicated in the table is considered minimal, that is, the employer does not have the right to pay less. But the amount of payment for work above the norm can be increased by the head of the enterprise. Information about this should be indicated in the company’s local act or employment contract with the employee.

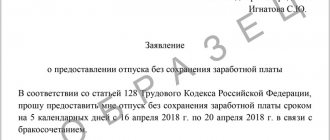

If the employee does not mind, the organization can compensate him for the time worked above the norm, not in cash, but with additional days off. The duration of the non-working period cannot be less than the time spent on work. But such overtime work is paid at a single rate.

If processing is the employee’s own initiative, then such work is not extracurricular and is not paid.

Temporary restrictions on overtime hours

Legislatively defined restrictions on the use of workers overtime. The employer has the right to involve an employee in additional work for no more than 4 hours. Moreover, this should not happen more than 2 days in a row.

Every year the government of the country approves a production calendar, which sets standard hours for all categories of workers. The management of the enterprise must ensure that employees working shifts do not overwork more than 120 hours per year. If such a situation occurs, penalties will be imposed on the organization. According to Article 5.27 of the Administrative Code, for each violation, an official will be punished from 1,000 to 5,000 rubles, and an enterprise - from 30,000 to 50,000 rubles. It is possible to suspend the organization's activities for up to 90 days. Article 5.27. Violation of labor legislation and other regulatory legal acts containing labor law norms

Important! In case of violations by the employer, an employee who has overtime exceeded 120 hours must receive full compensation for it.

Useful information about overtime work

What methods of recording working hours exist?

Choosing a method for recording working time is a concern for managers. Much in this matter depends on the scope of the organization. The chosen type of accounting must be specified by the director of the company in the internal regulations. The following types of accounting are distinguished:

- daily;

- Monday;

- summarized.

With summarized accounting, there may be a deviation in the duration of working hours during the day, week or month. The main requirement: at the end of the accounting period, the employee must have worked a number of hours in accordance with the approved norm.

The standard working day is 8 hours. With a five-day working week, the working time limit reaches 40 hours. But there are exceptions. If a person works a shift, his working day can last 12 hours. For some categories of employees, a shortened working day may be established. In this case, their working week is 24-36 hours. You can find out how much time a worker with a normal or reduced working day must work per month, quarter and year using the production calendar. Using a regular calculator, it will not be difficult to calculate recycling.

In the case of daily accounting, overtime or shortfalls are recorded within one day. Labor payment is calculated for each day of processing separately. And overtime (payment) is given at the end of the month.

Overtime pay: example

Let's look at a specific example of how to calculate overtime (2019). Manager Barulin V.M. worked 3 hours after hours on 03/03/2019 and 4 hours on 03/10/2019. His hourly earnings are 140 rubles. The first two hours of each overtime must be paid at one and a half times the rate. The rest of the time is double time. The amount will be:

March 3 = (140 rub. × 1.5 × 2 hours) (140 rub. × 2 × 1 hour) = 700 rub.

March 10 = (140 rubles × 1.5 × 2 hours) (140 rubles × 2 × 2 hours) = 980 rubles.

Barulin V.M. 1680 rubles will be credited. for extra work.

When recording working hours in aggregate, overtime work (payment) should be assessed as follows: time worked outside of normal hours is calculated based on the results of the accounting period. The first two hours of work are paid at least time and a half. The rest of the time is double time.

Sequence of processing processing

The algorithm for processing working time processing is as follows:

- Providing the employee with a notice in which he will be informed of the reasons for the additional work, time, and duties that will need to be performed;

- Drawing up an appropriate notice, according to which the employee will be instructed that he has the right to refuse to be hired for additional work;

- Obtaining the appropriate signature of the employee on the above documents;

- Issuance of the relevant management order;

- Obtaining the employee’s signature on the order;

- Entering information about additional time worked into the time sheet by entering o in the appropriate columns with a number indicating the time;

- Transferring information to the accounting department for final settlement with the employee.

Important! In all situations where the need for additional work was initiated by the administration, it must be paid for.

Current legislation does not contain a single reason why an employer has the right to refuse payment. But if an employee goes to work of his own free will or stays late at the end of the working day, in this case the administration has the right to refuse his request for additional payment, since this fact may indicate the lack of qualifications of such an employee or insufficient personnel of the enterprise.

Read also: Law on the collection of dead wood

The issue of accounting for overworking hours rests entirely with the employer, since in accordance with the law, working time standards are clearly defined. Exceeding these limits will be considered overtime and must be paid accordingly.

How is overtime paid on a salary basis?

In Art. 152 of the Labor Code of the Russian Federation there is no information about what amount should be taken into account. Therefore, many employers are wondering whether to take into account only salary or average income along with bonuses and allowances. When calculating overtime, managers often take double the tariff as a minimum. Incentive and compensation payments are not taken into account. Overtime work is paid inclusive of bonus payments only if the employer has established such a procedure.

If such a procedure is not established, then the cost of an hour is equal to the salary divided by the number of standard hours in the accounting month according to the production calendar. If the period of summarized accounting is more than one month, it is necessary to determine the average cost of an hour for the entire period (for example, salary income for a quarter divided by the standard time for the specified quarter). Overtime calculations must be made from the resulting cost per hour.

Who is prohibited from engaging in overtime work?

It is strictly forbidden to use the labor of certain categories of workers in additional time:

- pregnant women;

- minor citizens;

- workers with hazardous working conditions;

- disabled people of groups 1 and 2;

- women who have children under 3 years of age.

The last two categories, if necessary, can be withdrawn during additional hours, but they must sign 2 documents. The first is their consent to processing, and the second is that they have every right to reject such an offer. How long can you work per week?

What are the rules for paying overtime on a shift schedule?

Let's look at how overtime is paid during a shift work schedule. If a worker works in shifts, his salary can be calculated using both hourly tariff rates and on a salary basis.

In the first case, overtime is calculated as follows: the number of hours worked during a certain period is multiplied by the established rate.

If the organization uses a salary system, then every month the employee is transferred the same amount of remuneration.

Time standards for different categories of workers

Any enterprise maintains standardized records of the time worked by each employee. Overtime is usually calculated by comparing the number of planned hours for a certain period and the hours that were actually worked. Usually a month is accepted for calculations, but a quarter or even a year is possible.

Different categories have their own working week norm (Article 94 of the Labor Code of the Russian Federation):

- For minors under 16 years old - a 24-hour week, from 16 to 18 years old - a 35-hour week.

- Under special working conditions associated with danger and harmful to health, a 30 or 36-hour week is approved.

- For all other employees, the week is set at 40 hours.

Article 94. Duration of daily work (shift)

How is overtime pay for piece workers calculated?

Citizens who work piecework are paid for each part produced. Overtime pay for piece workers depends on how many parts they produce outside of normal working hours, as well as on the length of overtime work. Cash is paid without taking into account one and a half or double premium.

Example: Kurochkina A.N. works at the factory. She works piecework. For each part made, she is paid 400 rubles. On 03/09/2019 she worked 4 hours outside of school hours, producing 5 parts during this time: 2 pcs. - for the first 2 hours and 3 pcs. — for the remaining 2 hours. Payment depends on the number of parts produced and on the time worked above the norm. Therefore the calculation is:

(400 rub. × 1.5 × 2 pcs.) (400 rub. × 2 × 3 pcs.) = 1200 rub. 2400 rub. = 3600 rub.

Registration of overtime

There is no strictly established form for recording overtime hours. The following processing methods are recommended:

- The written notice contains information about the reason for additional work, indicating the date and time during which the employee must perform it. This document is handed to the employee, which he signs, expressing his consent.

- If several employees are being withdrawn, then it is wiser to draw up an order requiring them to work overtime. It specifies the basis for overtime, the date and time for each employee. There is a special column where a consent signature is placed.

- Overtime must be noted in the timesheet in the form of a special designation “C” with the establishment of the number of overtime hours. Typically, forms approved by Rosstat are used to maintain time records.

Example of a time sheet

Important! An employer can protect itself from overtime-related issues. To do this, it is necessary to stipulate in the employment agreement a provision regarding irregular working hours. By law, under this regime, no overtime hours are accrued.

An example of an order for overtime work

How is it paid according to the Labor Code of the Russian Federation?

Payment for overtime work is calculated and regulated in accordance with labor standards, the number of hours worked, in accordance with additionally completed assignments, etc. As a rule, payment terms are established either in the employment contract or in the internal local acts of the employer, with which the employee must be familiarized with painting.

In general, the amount of payments cannot be less than twice the amount provided for payment of one hour in normal time. Compensation for work beyond the norm can be challenged in the labor dispute commission or in court.

Rules for remuneration when overworking working hours

If the employee refuses double pay, then the hours of employment in excess of the norm will be summed up for the month and paid at a single rate, that is, 93.75 rubles per hour, while the worker will receive two additional days off , which will be used by him at his own discretion at a convenient time.

Who cannot be called to overtime?

Whatever the circumstances of involving an employee in additional work, management must remember to limit its maximum duration: no more than 4 hours a day, no more than two days in a row. If we are talking about shift work, then no more than 120 such overtime hours can accumulate in a year, Art. 99 TK.

Under the salary system, an employee has a summarized recording of working time with a five-day work week with two days off (Saturday, Sunday). The accounting period is a calendar month. As of August 2021, the standard working time is 176 hours.

The employer establishes a longer accounting period (but no more than a year, and in harmful and dangerous conditions usually no more than 3 months), within which the duration of working hours should not exceed the normal number of working hours (Part 1 of Article 104 of the Labor Code of the Russian Federation).

Why is summary accounting established?

The Labor Code of the Russian Federation designates only the minimum required additional payment for overtime work, that is, work performed by an employee at the initiative of the employer in excess of the normal number of working hours during the accounting period. The employer sets an increased amount of overtime pay independently and stipulates this in an employment or collective agreement or a local regulatory act (Part 1 of Article 152 of the Labor Code of the Russian Federation).

More reading -> How can the Transport Tax be replaced?

Lack of appropriate consent to perform overtime work, as well as failure to keep track of overtime, may result in administrative penalties (fine, suspension of the organization’s activities): - for officials - 1000-5000 rubles; — for legal entities – 30,000-50,000 rubles. or suspension of the organization’s activities for up to 90 days.

If the employer’s representative takes the initiative to involve the employee in performing work outside the established time period for work, he involves him in overtime work upon completion of the worked day or night shifts. Work of less than 8 hours a day will also be considered overtime for workers who work a shortened working day, and it exceeds the norm established for them. As a rule, processing is of a temporary nature, in particular it is applicable during the period of supply of materials and submission of reports. Practice, including judicial practice, indicates that processing cannot be planned in advance; it is a kind of forced measure. To implement the decision, the employee’s written consent may be required. No local act of the employer’s representative can contain provisions that, if appropriate circumstances arise, the employee is obliged to consent to overtime work.

Overtime (aka overtime)

- due to technical reasons, there was a delay in production, the employee did not complete or did not complete the work on time within working hours, and the stop may pose a threat to the life and health of people, lead to damage or loss of property; — there are malfunctions in mechanisms and structures, the lack of repairs of which can cause the work process to stop for many workers; - the replacement employee did not show up for work, and stopping the process is unacceptable; in this case, the employer must take all necessary measures to replace the employee.

By law, this type of work is paid at one and a half times the rate for the first 2 hours of overtime. If the employee stays at the workplace longer, the payment is made in double amount. Instead of money, a citizen can ask for rest in the amount of hours worked.

The labor activity of citizens of the Russian Federation is under state control. To study the norm of working hours per week and methods of payment for overtime, employees have the right to study the provisions of the Labor Code of Russia. The bill outlines acceptable hours for overtime and mandatory payment for additional activities.

Standard working hours per week according to the Labor Code of the Russian Federation

According to the law, a citizen has the right to contact the prosecutor's office or the labor inspectorate if he believes that the refusal of additional payment was unlawful on the part of the boss. As evidence, the employee can provide a record of the hours worked in a special accounting book.

We should especially talk about shift work. It raises many questions both during timesheets and when calculating wages. It is advisable to introduce a shift work mode when the duration of the production process exceeds the permissible length of a working day or the equipment at the enterprise operates around the clock.

To fill out the report card, Goskomstat has provided a system of symbols. But you have the right to develop your own. Moreover, the list proposed by the department does not take into account all possible employment options for employees. For example, there are no symbols to reflect work at night on a shift or on weekends on a business trip.

Hours of work with a shift work schedule

- At the same time, there are categories of workers for whom the shift duration cannot be set beyond the norm.

- The employee’s written consent is drawn up in the form of an additional agreement to the employment contract.

- In its absence, forcing people to work beyond the established limit is unacceptable.

- In this case, recording of labor time is carried out only on the basis of the work schedule and time sheet.

May 13, 2021 uristgd 84

Share this post

- Related Posts

- Standard for Electricity at the Common Building Needs in Ulyanov, Kaluga Region in 2021

- Payment of State Duty Extract from the Unified State Register of Legal Entities 400 Rubles 2021

- Area of One-Room Apartments for Renovation in Beskudnikovo

- How many questions are there for the 2021 traffic police exam?

Accounting for “extra” working hours, how to calculate and process them

Recycling must be properly recorded. For this purpose, a special working time log is created, which is maintained and filled out by the employer, and additional hours worked by the employee are also entered there.

This is a written document that must include the following columns:

- Full name of the employee;

- his position;

- his standard working hours;

- number of processing hours.

A separate act regulating the procedure for making payments by an employee should stipulate the corresponding payments for overtime.

Overtime is calculated in hours.

Terms of attraction

The involvement of employees in work beyond the established duration is formalized by order of the employer on the basis of production necessity.

However, the approach is different for “non-standardized work” and “overtime”, which is due to legislative differences when concluding an employment agreement. The starting point for the overtime regime is the “front” of work, and for irregular work the approved list of professions and positions.

Overtime mode

To engage in overtime work on the initiative of a business entity, the consent of the hired employee, expressed in writing, is required in the following situations:

- when there is an objective need to perform work that was not completed for reasons beyond the employee’s control or to complete a cycle that requires intervention to prevent damage to the material assets of a business entity or a threat to the health of a group of people;

- for the repair and adjustment of non-current assets, which, if measures are not taken, will contribute to the massive cessation of production activities;

- to ensure a continuous cycle in case of timely failure of the replacement person to appear.

Without written consent, personnel are involved in emergency work in the following cases:

- for urgent prevention or elimination of the consequences of industrial accidents, catastrophes and natural disasters;

- to combat the causes of disruption to the normal functioning of energy supply systems;

- if necessary, to carry out work due to the introduced state of emergency.

In other cases, the involvement of hired personnel on the initiative of the administration is permitted with prior consent, with the exception of prohibited categories and the approval of the trade union body.

Irregular mode

The Labor Code does not contain a definition of “occasional” recruitment.

As a starting point, you can focus on the rules for personnel of budgetary organizations, approved by Decree of the Government of the Russian Federation No. 884 of December 11, 2002, since standards for commercial structures are not established by labor legislation. In particular, it is necessary to determine the list of positions and professions and approve them by collective agreement. Work in irregular hours in accordance with the above normative act is established:

- top officials of the organization, deputies and heads of structural divisions, including branches and representative offices;

- Engineers involved in the development of innovative projects;

- persons whose work is not subject to timekeeping;

- specialists who allocate and plan time independently;

- employees whose nature of activity involves dividing time into intervals of non-standard duration.

The establishment of an irregular schedule must be interconnected with the performance of duties in accordance with the job function, accompanied by significant circumstances, and be episodic in nature, excluding systematicity. In the time interval, it is allowed to be involved in work before the start of the work shift and after its end.

Overtime payment methods

The Labor Code established a minimum level of payment for overtime. The employer must stipulate how overtime hours should be paid at each specific enterprise in the collective agreement or in the employment contract with the employee. Here it is also important to remember that by a local act for an enterprise, management can only increase labor guarantees; it is unlawful to establish them in a smaller amount than in the Labor Code of the Russian Federation.

If the collective agreement has not specified any additional motivating factors for paying for overtime hours, then the accounting department will accrue compensation for free time spent on the needs of the enterprise at the rates prescribed in Article 152 of the Labor Code. Namely, the first 2 hours are one and a half times the average hourly rate, and all subsequent hours are double.

| Time of occurrence of processing | Article of the Labor Code of the Russian Federation | Hourly pay factor |

| Weekdays | 152 | The first two = 1.5*bet The rest = 2*bet |

| Weekends and holidays | 153 | Average hourly rate * 2 |

| Night time (22.00-6.00) | 154, Decree No. 554 | Additional payment + rate*0.2 |

40 hour week

The easiest way to take into account and calculate overtime pay is for workers on a normal schedule (40 hours, during the day, on weekdays). In this case, it is enough that the standardizer records the date of the extended work and its duration in the timesheet with code “C” or “04”. The Code only talks about how many hours of overtime are allowed per year and per day; how many there can be per month is not indicated there. Based on this, it can be theoretically calculated that the maximum overtime is possible in 84 hours in the longest month (two days of overtime work for 4 hours with a break of one day for 31 days). In practice, it is unlikely that the employer will be able to obtain the employee’s consent to such difficult working conditions, much less the trade union will agree to such an agreement.

As an example of calculating payment for additional work, we can assume that the employee worked an additional three days in a month, two for four hours, one for three. The employee’s salary is 15,000 rubles per month, with 21 working days. Then the calculation will take place in several stages:

- Dividing the time worked into the first and subsequent hours. In the current case, more than 2 hours were worked three times. This means that 6 hours will be paid at one and a half times.

- Determining the number of “followers”. Over three days, the employee has accumulated 5 hours, which can be described as the third or more hours per day.

- Direct calculation of the surcharge itself

15000/21/8=89.29 rubles – average hourly rate,

(6*1.5+5*2)*89.29= 1696.51 rubles for the entire period of overtime work.

In the matter of fair payment for the labor zeal of employees and encouraging their loyalty, the main requirement will be the need for strict and clear reflection of real processing time in time sheets (forms T-12 and T-13)

Shift work schedule

The victory of trade unions in the struggle for the right to consider a 40-hour work week normal does not mean a strict ban on the use of other durations of employment for employees at the enterprise. For those companies whose specific work does not allow interruption of the production process or implies the population’s round-the-clock need for their availability, Article 103 of the Labor Code provides for the possibility of working in several shifts according to the approved schedule. When performing such work, it is difficult to coordinate the work of all employees within a week or month within the normal working hours. The legislator prudently allowed the employer to keep records of hours worked summed up within the period chosen by him (month, quarter, year), Art. 104 TK. At the same time, management must carefully ensure that in the extended accounting period the number of hours worked does not exceed the quarterly or annual norm.

Drawing up a shift schedule with overtime hours included in it is regarded as a violation of labor rights and is fined under the same article. 5.27 Code of Administrative Offences. In cases where the need to work longer arose unforeseen, it is worth knowing how overtime payment is calculated when accounting for working hours in total.

For example, the standard hours in one of the quarters of last year were 454, the employee actually worked 480, of which 12 were on a holiday. The employee's salary is 30,000 rubles. Here you need to know how to calculate the number of overtime hours: 480-454-12= 14 hours. Since work on a holiday is already paid twice (Article 153 of the Labor Code), its duration is excluded from the total amount of overtime.

The most controversial point arises when figuring out how to pay for overtime hours according to Art. 152 TK. There are several opinions on how to determine the number of “first two hours” of overtime during cumulative accounting. The code itself, unfortunately, does not provide clarification on this matter. Until 2012, they used Soviet practice and used a simple method:

- 14-2=12

- 2 hours are paid with a coefficient of 1.5 of the salary,

- the remaining 12 are paid at double the average hourly rate.

But, by the decision of the Supreme Court dated December 27, 2012, this methodology was no longer relevant. The calculation became somewhat more complicated, but became more objective. According to the court’s explanation, the shift schedule cannot include overtime hours in advance, which means, in fact, the time sheet can clearly be seen when the employee remained at work outside of the normal shift. Accordingly, you can calculate the number of “first” hours and the number of subsequent ones. In this situation, the need to accurately and most accurately fill out the work hours sheet comes to the fore.

Overtime with reduced working hours

Some specialties and industries provide for a shorter working week. For them, working 36 or 24 hours in five working days is recognized as the norm, and all time beyond this will be considered overtime. Some may wonder how many overtime hours are allowed per year for this schedule? The opinion that the annual limit of possible processing should also be proportionally reduced is erroneous. It’s just that in this case, when calculating the number of additional hours, the norm should be taken not 1973 hours, but 1775.4 (with a 36-hour week in 2021). Then the maximum possible duration of work in 2020 will be:

1775.4+120=1895.4 hours per year (including work on weekends and holidays).

Payment for overtime will be carried out according to the current algorithm from the previous part (as with a shift work schedule).

Payment for processing on weekends and holidays

The rule about double pay for work on weekends and holidays is widely known among workers. This is the main consoling argument for those who are “lucky” to perform work duties instead of actively celebrating or relaxing. Some believe that working overtime on a holiday will increase their earnings by another one and a half to two times. The Supreme Court’s opinion on this matter is different: the additional increase in pay and the accrual of remuneration simultaneously under Articles 152 and 153 of the Labor Code is regarded as excessive (7). Therefore, if the processing took place on a weekend, then you need to pay double for the entire duration, Art. 153 TK.

An exception is allowed only in a situation where the employee has expressed a desire to receive a day of rest instead of money. In this case, hours worked according to the schedule are not subject to payment; they are replaced by rest time. But with payment for overtime, the situation is different; the employer is obliged to accrue earnings for this time, but in a one-time amount.

Recycling at night

If forced presence at work lasts until 10 pm or later, the employee will also receive a cash bonus for working at night. The answer to the question of how to pay for these overtime hours also has its own characteristics.

For example, an employee’s scheduled shift ended at 20.00; due to the illness of his partner, he was forced to stay at work for another 4 hours, until 24.00. Consequently, the night period accounted for 2 hours of work. The average hourly rate is 100 rubles. Then the tabular chart will display new earnings amounts:

- 2*100*1.5= 300 rubles – for the first hours of extended work,

- 2*100*2= 400 rubles – for subsequent ones,

- 2*100*20%= 40 rubles - “night” surcharge,

- Total: 740.00 rubles for 4 hours of overtime work.

Overtime fine

As noted above, the employer bears responsibility for illegal processing, which consists of paying a fine.

The amount of the fine is determined in accordance with administrative legislation. Legal entities will be required to pay at least 50 thousand rubles, and individuals (for example, individual entrepreneurs) - up to five thousand rubles.

The amount of the fine increases if the employer has previously been held liable for this type of liability!

Working hours: what the labor code says about overtime

Labor legislation establishes such a concept as the normal duration of labor activity. It cannot exceed forty hours a week . Depending on the individual characteristics of each specific subject, daily norms are established. So, in some cases they are 8 hours.

Overtime work is all work that goes beyond the above limits both per day and per week.

It must be paid, otherwise the employee has the right to go to court for appropriate compensation and refuse overtime.