Certificates upon dismissal from work in 2021 - we tell you in order

Share:

Plusone

Mail.ru

From this article you will learn:

- What certificates must an employer issue to an employee upon dismissal in 2021?

- Which certificates of dismissal are issued in any case, and which require a written request?

- What are the basic rules for providing certificates to a resigned employee?

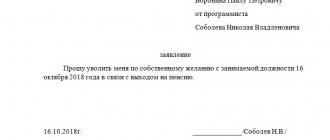

Termination of an employment contract is a serious procedure that requires special care from the employer and compliance with all legal norms. This year, the legislation regulating this issue has not changed; the Labor Code is still in effect. Its article 84.1 defines the procedure for dismissal and provides a list of certificates that must be issued upon dismissal from work, including in 2017. Let's dwell on this issue.

Employment history

On the day of termination of employment with the employer, the employee must receive his work book.

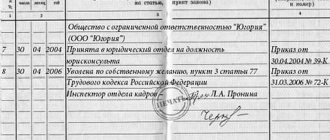

It should contain a record of an employee’s hiring for a specific position, records of movements in the company in different positions, if any. At the end - a record of dismissal with a mandatory indication of the article of the Labor Code that is the basis for the reason for dismissal.

All entries in the work book are certified by the signature of the person responsible for maintaining work books, as well as the company seal.

The employee himself also puts his signature in the work book. The employee signs on receipt of the work book in a personal card (form No. T-2) and in the book for recording the movement of work books and inserts for them.

If the employee cannot pick up the work book on the day of dismissal, then the employer must send him a notice of the need to pick up the work book or, in agreement with the employee, send it by mail.

Read also “When will electronic work books be introduced?”

What certificates should be issued upon dismissal from work in 2017

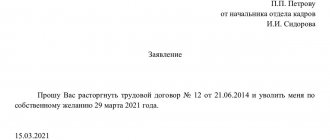

The main document that the employer must issue to the employee during dismissal is the work book. However, in addition to it, if there is a written request from the dismissed person, it is necessary to provide certified copies of documents related to the person’s activities in this company (Article 84.1 of the Labor Code of the Russian Federation). Let's look at what papers are included in this list.

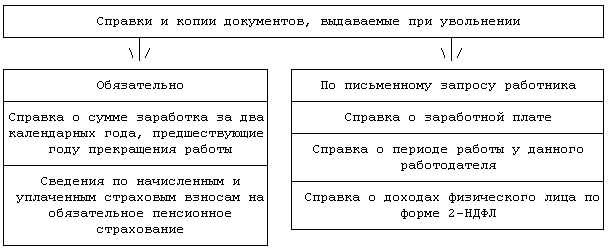

The law provides for two categories of certificates when dismissing an employee: the first are always provided, the second only at the request of the person.

The procedure for issuing certificates (copies thereof) upon dismissal from work in 2017, related to activities in the organization, is regulated by Article 62 of the Labor Code of the Russian Federation. In accordance with the provisions of this article, in order to obtain specific documents and copies thereof, the employee provides the manager with a written statement of request. After which the employer, within no more than three working days, must transfer to him:

- copies of documents related to work in the company (orders for hiring, transfer, dismissal);

- extracts from the work book;

- certificates of salary, accrued and paid insurance contributions towards compulsory pension insurance, period of work in the organization, etc.

Note! The papers from the first point must be certified and issued free of charge (Letter of Rostrud dated December 20, 2012 No. PG/9518-6-1).

Read material on the topic: Non-material motivation of beauty salon employees

Help on form 2-NDFL

To receive a certificate in Form 2-NDFL, an employee must write an application.

The number of requests for a 2-NDFL certificate from an employer is not limited. If it is lost, the former employee can re-apply to the former employer. The employer's refusal to issue a certificate is unlawful. For refusal to issue a certificate in Form 2-NDFL, the employer may be held liable.

Read also “Certificate 2-NDFL: fine for false information”

Papers on demand

The manager is obliged to give the dismissed employee, upon request, copies of the necessary documents that relate to his work activities. Government bodies and personnel services of companies at the new place of work of citizens who happened to quit have the right to request papers. Art. 89 of the Labor Code determines that every person has the right to make a request to receive the personal information he needs, which is reflected in the archive of the previous enterprise. Information about what certificates are issued to an employee upon dismissal (2017) at his request is contained in the list below:

- accident reports;

- extracts from personal files, orders for employment, transfers and dismissals, certificates for individual periods of employment at the enterprise;

- information about salary and all aspects related to it: deductions and deductions, 2-NDFL income, average for 3 months for the employment center;

- information about the staffing table of the position of the dismissed citizen.

All of the above data are provided only upon application, but many reputable enterprises, when dismissing an employee, include a 2-NDFL certificate in the mandatory list of issued papers, without waiting for the former employee to apply.

It is possible to receive a document again if it is lost, and the manager has no right to refuse this. The originals remain at the enterprise.

Certificate of earnings for the two calendar years preceding dismissal

The resigning employee will present a certificate of the amount of earnings for the two calendar years preceding the dismissal to his future employer. It is needed so that the new employer can calculate the employee’s temporary disability benefits and other types of social benefits paid from the Social Insurance Fund.

If for some reason the employee was not given such a document on the day of dismissal, then he can write an application to the employer with a request to issue a certificate. The employer has three days to complete this. If it is impossible to obtain a certificate on the day of dismissal, the employer, as in the case of delivery of a work book, must send the employee a request for his personal appearance or for sending a certificate by mail.

Read also “Recalculation of salary after dismissal”

Certificates required to be issued to an employee upon dismissal

When leaving the organization on personal initiative in 2021. the employee must receive:

- Certificate of contributions to the Pension Fund.

- Certificate of earnings for the last two years before dismissal.

Information with “pension” data is included in the list of mandatory information provided when a person leaves his place of work last year. The Pension Fund carries out personalized records of each working citizen. The employer transfers contributions for his subordinates. The Twenty-Seventh Federal Law stipulates that on the last day the employee must be given pension accounting information. The document contains the personal data of the person, the dates when the person was hired and dismissed, periods of service and other pension information necessary in the future for registration of a pension.

Personalized accounting information

Since 2021, the personalized accounting information that an employer must provide to employees upon dismissal has increased.

Read also “Personalized accounting: document forms approved”

Extract from reporting on insurance premiums

This is section 3 of the insurance premium calculation completed in relation to the resigning employee. When filling out, you must indicate the code of the period in which the employee is leaving.

If an employee is dismissed in 2021, he must also be given information in the RSV-1 form for all previous periods. That is, at the time of dismissal in 2021, the employee will receive extracts from RVS-1 for 2016 and earlier years.

Extract from the SZV-STAZH form

As a general rule, all employers submit a report to the Pension Fund of the Russian Federation on the new form SZV-STAZH for the first time for 2021 in 2021 (no later than March 1). However, if an employee retires in 2021 due to old age, the SZV-STAZH must be submitted to the Pension Fund ahead of schedule, no later than three days from the date the employee applied for a pension. This applies to both employees under employment contracts and civil law contracts.

The employer is obliged to hand over the information in the form SZV-STAZH (extract for a specific employee) to the employee who is leaving without retirement. The report is provided on the day the employee is dismissed. Or on the day of termination of a civil contract. In this case, there is no need to submit an early report to the Pension Fund.

Date the SZV-STAZH to the employee’s last day of work. Report type – “Pension assignment”.

Read also “Information on the insurance experience of insured persons (form SZV-STAZH)”

Information about insurance experience in the form SZV-M

From 2021, an organization or individual entrepreneur (policyholder) is obliged to issue to the insured persons, upon their request, copies of the SZV-M handed over for them within a period of no later than five calendar days from the date of application. To protect yourself from claims of failure to meet deadlines, you should ask the employee to write a written statement in any form.

The number of reports in the SZV-M form per employee must be equal to the number of months that the employee worked in the organization or with an individual entrepreneur.

Each person is given a personal separate sheet only with information about him in the SZV-M form. That is, in the table of the form for the reporting month, under serial number 1, only one line will be filled in - for the employee to whom the form is issued.

Rules for providing certificates

Proof of the fact of transfer of documents is: a signature on the original copy, an autograph on a separate sheet or in the registration book. The last option, using inventory numbers on primary sources, eliminates misunderstandings when fulfilling the employer’s responsibilities for issuing certificates. The process of document replication occurs when the basic rules are followed:

- any paper is handed over to the employee against receipt;

- the period for issuing a copy does not exceed 3 days;

- the presence of an employee’s debt to the company does not affect the obligation to provide a certificate;

- failure of a citizen to appear at the HR department is not an obstacle to the execution of the document transfer: sending is carried out by registered mail;

- All papers related to the employee’s work activity are certified and handed over free of charge.

For violating the deadlines for submitting papers when dismissing an employee of an organization or its manager, you will have to pay a fine; administrative liability and disqualification for 1–3 years are provided for this.

What an employee has the right to request from the personnel service after the end of the employment relationship

Accounting is required to provide data:

- A paper on the amount of earnings in form 182H - it is provided to a new place of work; the certificate is needed to calculate various types of benefits and sick leave. The document reflects data on who was a party to the labor relationship, the amount of payments for which mandatory fees were assessed over the past three years. And also the number of days that were not included when calculating benefits, moments of incapacity, maternity leave, child care.

- If a citizen requests, then the accounting department is obliged to issue accounting data - these are certificates of the form SZV-M, SZV-STAZH. All these papers are necessary for calculating pension payments or verifying the correctness of information that must be transferred to the Pension Fund.

- A certificate of the average amount of income received by a person over the last three months. This paper is required for submission to the Employment Center. In that situation, if a person decides to register as an unemployed citizen.

- 2 Personal income tax - the paper explains which contributions were calculated by the employer and which were paid. This certificate is required. It contains information about the amount of earnings, as well as other payments from which taxes are calculated. This certificate is necessary in a situation where a person has the right to a property deduction. The situation is described in Art. 218-220 Tax Code of the Russian Federation. The certificate reflects the amount of tax that was withheld from the person as its payer. As well as income on which tax was not paid.

- A note that contains settlement amounts at the end of the employment relationship.

- Extracts of calculated and paid contributions from reports to extra-budgetary funds.

The package of documents must be given to the citizen at the moment when he comes to resign. If for some reason this could not be done, then you need to send the documents via postal channel to the address of its registration. But this form of sending is carried out only with the consent of the employee himself.

All documents prepared and issued are certified by the seal and signature of the manager. Without marks they have no legal force. In other words, invalid.

The employer does not have the right to withhold documents that the employee asks to provide. If this happens, the actions of the former boss may be qualified as opposition to the further employment of the former employee. The latter, in order to ensure his rights and interests, has the right to file a claim. He is being sued. There, a trial takes place regarding the reason and motives for which the employer delays or does not provide the former employee with documents in full.

Dismissal of an employee at the initiative of the employer

Dismissal at the initiative of the employer most often occurs when the employee refuses to terminate the employment relationship at his own request or by agreement of the parties.

Typically, the main reasons for breaking the employment relationship at the request of the employer are:

- Unsatisfactory completion of the probationary period when hiring.

- Absenteeism.

- Appearing and being at work under the influence of alcohol or drugs.

- Repeated failure to fulfill job duties (if there is a disciplinary sanction).

- Disclosure of state, official or commercial secrets.

- Theft, embezzlement or damage to the employer's property.

- Violation of labor protection requirements, if this resulted in serious consequences.

- Conflict of interest.

- Immoral behavior of an employee.

- Submission of false documents when concluding an employment contract.

- Liquidation of the organization and termination of the activities of the individual entrepreneur.

- Staff reduction.

- Inconsistency with the position held.

- Other reasons provided for by current legislation.

note

, that at the initiative of the employer, an employee who is on sick leave or on vacation, a pregnant woman and a woman on maternity leave or maternity leave cannot be dismissed. These employees can be dismissed only in exceptional cases, which the law includes liquidation of the organization, staff reduction, gross violation of labor duties.

The procedure for dismissing an employee at the initiative of the employer

The procedure for dismissing an employee at the initiative of the employer depends on the reason for dismissal: when reducing staff or liquidating an organization, the procedure is the same, when dismissing for absenteeism, it is completely different.

You can find out more about the procedure for dismissal at the initiative of the employer here.

Best answers

The dismissal of an employee is formalized by order (instruction) of the administration. It must indicate the grounds for termination of the contract in strict accordance with the wording of the Labor Code of the Russian Federation and with reference to the relevant paragraph and article of the law. The order is drawn up in one copy. After it is signed by the head of the organization, the employee must be familiarized with the order against signature, and a copy of the order is sent to the accounting department.

Finally, on the day of dismissal (the last day of work), the employer is obliged to issue the employee a work book, other documents related to work, and make a full settlement with him, including paying compensation for all unused vacation days.

Keep in mind that the entry in the work book should only be formulated as follows: “Dismissed at his own request, paragraph 3 of Article 77 of the Labor Code of the Russian Federation.”

Upon written request from the employee, he is required to prepare all or specific documents related to the work. Such, for example, as copies of orders (hiring, transfers, dismissal), salary certificates, period of work with a given employer, etc. Copies of these documents are duly certified and provided to the employee free of charge.

It is logical that before dismissal, an employee must fully account for the property that he used in the organization.

To do this, you can use a worksheet, which usually includes departments such as accounting, human resources, warehouse, etc. As a rule, the organization develops the form of this document independently. On the bypass sheet, the responsible employee of each department will put a mark that confirms that all settlements between the department and the resigning person are closed. The resigning employee will have to hand in the leave sheet on the last day of work. This way, the employee will confirm that the organization does not owe him anything and that he, in turn, has returned all the items of labor provided to him by the organization.

This will end all relationships between employer and employee.

It is important to remember that a delay by the employer in issuing a work book to an employee, or entering into the work book an incorrect or non-legislative wording of the reason for dismissal can lead to adverse consequences for both the employer and the employee. User deleted: Something else you can steal

Upon a written application from the employee, the employer is obliged, no later than three working days from the date of filing this application, to provide the employee with copies of documents related to work (copies of an order for employment, orders for transfers to another job, an order for dismissal from work; extracts from the work record book; certificates of wages, accrued and actually paid insurance contributions for compulsory pension insurance, period of work with a given employer, etc.). Copies of work-related documents must be properly certified and provided to the employee free of charge.

Registration and issuance of Extracts from section 3 of the insurance premium calculation form

Now it is the employer’s responsibility to prepare an extract from section 3 “Personalized information about insured persons” of the calculation of insurance premiums on the day the employee resigns. The Federal Tax Service has combined two separate documents into one - 4-FSS and RSV-1. The document indicates contributions and income for the dismissed employee.

The document reflects information about the last three months of the reporting period in which the employee was dismissed - from the beginning of the quarter until the day of dismissal.

The order of the Federal Tax Service of the Russian Federation No. ММВ-7-11/ [email protected] dated 10.10.2016 contains a form for an extract on insurance premiums. The document contains the following information:

- information about the employee’s salary;

- about the insurance premiums that were accrued;

- employee passport details.

This document is prepared by the company's accounting department and submitted to the tax office. In a letter dated March 17, 2021 No. BS-4-11/4859, the Federal Tax Service explained the procedure for filling out section 3 of the Statement.

When filling out a document, you cannot correct errors using corrective means. Manual filling requires the use of blue, violet or black ink.

On the day of his dismissal, the employee must sign a certificate stating that he has received the payment. There is no unified form of calculation and therefore an organization can independently develop its own document template, in which the employee will need to indicate:

- FULL NAME;

- job title;

- signature;

- date.

It is necessary to take into account that the extract is issued not only when dismissing employees signed under an employment contract, but also to those persons who carried out activities under service agreements and civil law contracts.