Labor legislation assigns a number of obligations to the employer: in particular, the mandatory maintenance of payslips reflecting data on all accruals during the month in favor of the employee and on all deductions from the total amount.

Dear readers! The article talks about typical ways to resolve legal issues, but each case is individual. If you want to find out how to solve your particular problem , contact a consultant:

+7 (499) 938-81-90 (Moscow)

+7 (812) 467-32-77 (Saint Petersburg)

8 (800) 301-79-36 (Regions)

APPLICATIONS AND CALLS ARE ACCEPTED 24/7 and 7 days a week.

It's fast and FREE !

But how the agreed slips should be handed over to workers and how their receipt can be recorded is not regulated by law.

Sample journal for issuing pay slips

Each employer is required to notify employees monthly of the amount of accrued wages, deductions and payments made.

The requirement is enshrined in Art. 136 Labor Code of the Russian Federation. To simplify the process of informing about the features and subtleties, the employer has the right to approve an arbitrary form of pay slip (hereinafter referred to as the pay slip) and issue it to employees monthly. Receipts must be issued regardless of the method of receiving wages, observing the established time frame - no later than the day on which wages were paid.

For violation of current legislation, regulatory authorities will issue a fine: for an official from 1,000 to 5,000 rubles and for a legal entity from 30,000 to 50,000 rubles (Article 5.27 of the Administrative Code). It is difficult to prove the fact of timely and regular issuance of receipts without documentary evidence. Develop and approve a sample log for receiving pay slips against signature - this will allow you to avoid penalties from the labor inspectorate.

The journal for issuing pay slips: how to fill it out correctly

Abramson Sofia Author PPT.RU March 6, 2021 The journal for issuing pay slips is a consolidated register in which employers can keep records of pay slips issued and collect employee signatures confirming the receipt of “settlements.”

Some enterprises take the T-49 payroll form as a basis, adding two columns to it: date of issue and signature.

We will tell you what information this document should contain and how long it should be stored.

ConsultantPlus TRY FOR FREE According to , employers must transmit information about wages to employees in writing - issue pay slips to employees. The Labor Code article also regulates their content. The document is a salary notice, which, according to the Labor Code, must contain the following information:

- the sum of the components of wages for a specific period;

- the amount of other accruals due to the employee, for example, due to delays in wages, vacation pay or dismissal payments;

- the amount and reasons for the deductions made;

- the total amount of money to be paid.

Despite the fact that the legislation clearly regulates the content of the salary notice, according to Article 136 of the Labor Code of the Russian Federation, the form of this document is developed and approved by each employer independently.

There is a form of “calculation” developed by experts in practice. Evasion from issuing “settlements” may result in a fine being imposed on the employer and the accountant. Such measures are provided for in. For example, if the “settlement” was not handed to the employee or all the necessary information was not indicated in it, the organization faces a fine of 30,000 to 50,000 rubles.

Accounting and registration

A payslip is a form that displays the following information:

- parts that make up the salary. Depending on the organization, wages may include salary, bonuses for length of service, for special working conditions, for class rank, and others;

- the amount of deductions indicating the grounds for their creation;

- the total amount to be paid to the employee via a bank card or by hand.

The Labor Code of the Russian Federation obliges each employer to issue this payment form so that the employee can track the correctness of the accruals and the employer’s compliance with labor law standards.

The Labor Code of the Russian Federation does not oblige employers to keep records of their issuance or register them in a consolidated journal.

However, there are cases when employees claim that they did not receive this document from the employer. Basically, such moments are associated with disputes that often arise in labor relations.

For this reason, many employers keep special accounting journals reflecting information about the issuance of pay slips to employees.

Receipt of such a document is confirmed by the employee’s signature.

The employer has the right to approve any form for accounting control. In this case, it does not matter how the employee receives his salary: in person or in a bank account.

The procedure for their issuance and registration is established by the employer in a local regulatory act.

Payment of funds is carried out on the basis of the payroll after the calculations have been made in the payroll.

Is it required for use?

Keeping a logbook and issuing slips for signature, registering all issued payroll forms is a guarantee that the employer complies with the necessary labor law standards.

If the issuance of such documents is violated, the employer may be held accountable by the labor inspectorate.

Therefore, filling out the journal, which reflects the fact that the worker has received a pay slip, is carried out in the interests of the employer and is a necessary guarantor of the company’s law-abiding nature.

The law of the Russian Federation does not provide for such a document.

There are no specific requirements for its registration and maintenance, except for the standard rules adopted for maintaining documentation of this type.

The logbook must have:

- title page, indicating the date of its maintenance;

- numbering, indicating the number of pages; the logbook must be stitched and numbered. The last page must be affixed with the organization's seal.

The financial department is responsible for maintaining all documentation related to payroll and other documentation.

The accounting department must store payslips for at least 5 years; their destruction is possible only after an audit.

How to fill it out?

The legislation of the Russian Federation does not provide for the existence of a standard form of a logbook for recording the issuance of salary slips. However, there is a sample form that employers should follow. Its sample can be downloaded below.

The title page of the journal must contain the following information:

- name of the organization or enterprise;

- log start date;

- end date of logging;

- storage;

- number of pages.

The main content of the document is presented in a table that contains fields for registration:

- serial number of the registered form;

- date of issue of the payslip;

- information about the employee who received the document;

- worker's position;

- the period for which the employee received a pay slip;

- employee’s signature confirming receipt of the salary slip.

Do payslips need to be kept in the organization?

Contents When receiving wages, each employee must receive a payslip. Despite the fact that the procedure for providing a document to an employee is not a right, but an obligation of the employer, many managers shy away from issuing it.

In accounting, you often hear the opinion that salaries are white, which means there is no point in simply printing and translating sheets. They only issue receipts upon request.

The issuance of pay slips is prescribed in labor legislation.

Therefore, each institution must follow the procedure for providing a document to an employee.

A pay slip is an important document for the employee and the employer himself. It is necessary to know the legal requirements regarding its issuance, as well as the main obligations of the institution’s management to the employee.

Payslips are provided for by the Labor Code of the Russian Federation. If they are not issued, the organization may be held accountable by the Labor Inspectorate.

A fine is an unpleasant consequence of non-delivery.

However, this is not the main negative aspect of the lack of sheets. The document is considered to confirm the fact of payment of wages.

If an employee decides to sue the employer, then there is a high probability that management will lose the case. According to the law, an employee must file a claim for illegal dismissal within a month after receiving the order or work record book.

If other disputes are considered, then it is given three months. If the application is submitted late, the employer will not be held liable.

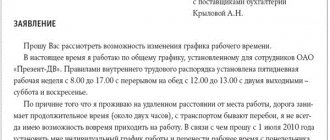

Application for receiving an electronic certificate

The employer must receive a written request from each employee to receive payslips by email. The application is also required in order to find out the email address to which earnings data should be sent. An employee can independently determine to which email the employer should send the form, or the company itself chooses how to organize the mailing (for example, this could be the employee’s personal account on the corporate website).

Consent to the processing of personal data will also be required. Only the employee and an authorized representative of the employer should have access to confidential information contained in the payslip.

Sample application for receiving a payslip in electronic form:

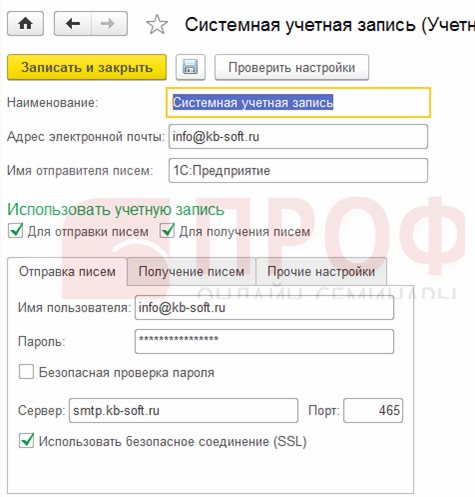

How to set up the distribution of payslips in 1C ZUP 8.3

Let's take a step-by-step look at how you can organize sending payslips to employees by email.

Step 1. Set up (if not already set up) an email account from which we will send leaflets and other types of emails. The account is configured in the Administration – Organizer section. You must enter an email address. email and password:

In more detail, how to set up mail in 1C 8.3 ZUP for sending documents and letters is discussed in our video lesson:

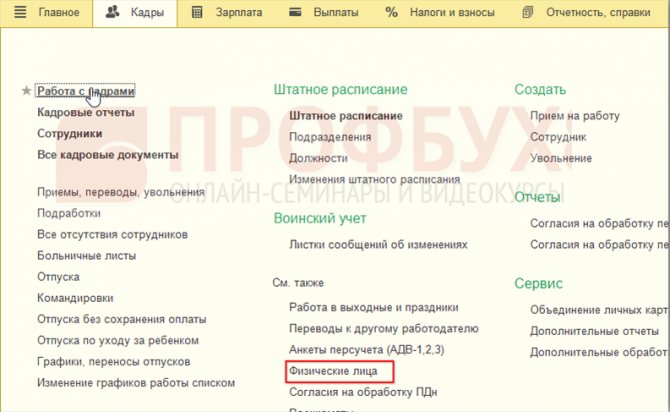

Step 2. Let's check whether individuals have entered their email addresses. Let's open the card of individuals: Personnel - Individuals:

If not entered, fill in the email address in the Email field on the Addresses and Phones tab:

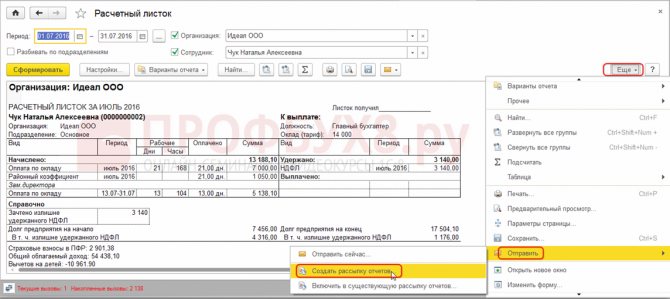

Step 3. Set up the mailing: menu Administration - Printed forms, reports and processing - Report mailings or directly from the payslip: More - Send - Create report mailing:

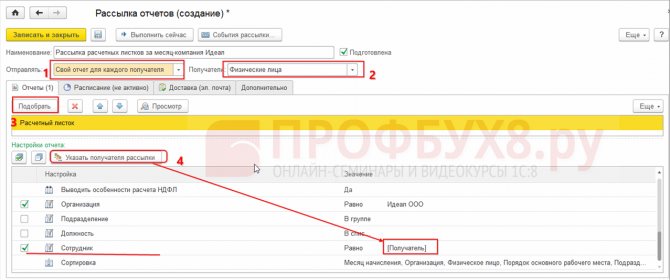

Let's set up the newsletter like this:

- “Send”: Your own report for each recipient;

- “Recipients”: Individuals;

- In the “Reports” table, select the Payslip using the Select button;

- In the settings, set the selection to Employee Equal to [Recipient]. [Recipient] is set by clicking the Specify mailing recipient button;

- On the Additional tab, define the format for sending the report (xls, .pdf...):

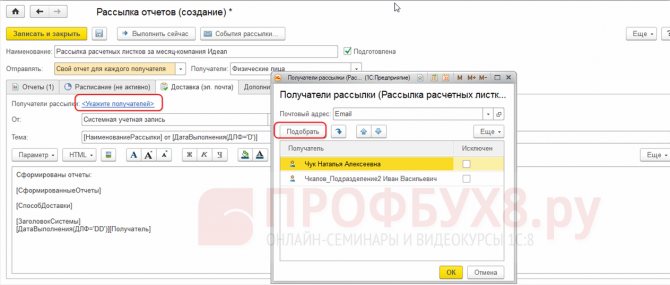

Step 4. On the Delivery (email) tab, use the “Specify recipients” hyperlink to select employees (individuals) to whom we will send payslips:

Directly from the Mailing settings, you can send payslips by clicking the Execute Now button. You can also set up a schedule for sending pay slips:

Distribution of payslips in 1C ZUP 8.3 can also be done from the payslip form: More – Send – Send now.

Timely issuance of payslips will not only help employees navigate the correctness of remuneration payments, but will also protect the employer, as it acts as proof of expenses and as a means of reducing the statute of limitations for employee wage claims. Employees can submit claims within 3 months from the date of receipt of the pay slip. But if the pay slip was not issued, then the claim period will be counted from the moment the employee learned about the violation of the correctness of the calculations, for example, upon dismissal.

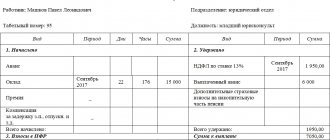

Pay slip and order to approve the pay slip form

A payslip is a written notice (extract) that must be handed to the employee upon receipt of wages.

Article 136 of the Labor Code of the Russian Federation establishes that when paying wages, the employer is obliged to notify each employee in writing about the components of the salary due to him for the corresponding period, the amount and grounds for deductions made, as well as the total amount of money to be paid.

In connection with the adoption of Federal Law No. 35-FZ of April 23, 2012, employers are now required to indicate on the pay slip other amounts accrued to the employee: in particular, the amount of monetary compensation for the employer’s violation of the established deadline for payment of earnings, vacation pay, dismissal payments and ( or) other payments due to the employee must appear on separate lines on the sheet.

Issuing a pay slip is not an employer’s right, but an obligation. It is necessary to notify not only the main employees, but also part-time and temporary employees about the components of the salary. Pay slips must be issued in any case - when paying in cash, when transferring to a bank card, or in another form not prohibited by labor legislation.

There is no unified form of payslip , so each employer independently develops and approves the form of the payslip for its organization in a local regulatory act. And this, in turn, serves as an additional guarantee of workers’ rights.

Typically, in organizations where accounting is carried out using an automated form, the form of pay slip is approved, the formation of which is provided for by the capabilities of the program.

If the organization has a trade union or there are elected representatives from employees, then its position should be taken into account. In this case, the sheet indicates: “The opinion of the representative body has been taken into account, protocol No. ... dated ....”

If there is no representative body, then the following entry is made: “At the time of approval of the standard pay slip form, a representative body of the organization’s employees has not been created.”

When approving a payslip, it is recommended to issue an order (instruction) from the manager, since it can delineate the powers of the organization’s employees (for example, indicate who is responsible for notifying employees, the days on which it should be done, etc.).

The storage period for the order to approve the pay slip is established by Article 19 b of the “List of standard administrative archival documents generated in the process of activities of state bodies, local governments and organizations, indicating storage periods” (approved by the Ministry of Culture of the Russian Federation on August 25, 2010), and is 75 years old.

What should be on the payslip? The procedure for notifying employees about payment of earnings and the employer’s responsibility for violation of labor laws

The pay slip must indicate:

- FULL NAME. and the employee’s personnel number;

- accrual period;

- hours and days worked;

- components of earnings;

- grounds and amounts of deductions;

- amount to be paid to the employee.

If the employees’ wages include many components (hazard pay, overtime, work on weekends, bonuses, etc.), then they should all be written down on the sheet separately. Combining different types of payments is equivalent to an error. If the enterprise has a social package, payments in kind are also included in the payslip.

Deductions that may be included on a payslip include:

- alimony and other penalties according to executive documents;

- personal income tax amounts and insurance contributions to extra-budgetary funds;

- union dues;

- unearned advance issued on account of wages;

- unspent and not returned timely advance payment issued in connection with a business trip;

- amounts overpaid to the employee due to accounting errors, etc.

All types of deductions are also listed separately, for example: personal income tax (rounded to whole rubles), alimony, unreturned accountable amounts, deduction for unworked vacation days, additional insurance contributions for pensions, etc.

The procedure for notifying employees about payment of earnings

The Labor Code of the Russian Federation obliges the employer to issue pay slips to employees, so the fact of their transfer to employees must be confirmed. But the Labor Code of the Russian Federation does not prescribe that pay slips be handed over to employees against signature, so the introduction of any form of registration for receipt of slips remains at the discretion of the employer.

Storage period for salary slips

Contents > Labor Law > Salary > Payment > How, according to the law, payslips are issued in paper, electronic form - rules, procedures, fines A payslip is an official written notification to employees about the calculation of their wages, indicating the amount of earnings, allowances or funds charged and the total wages for the period worked. Is it obligatory for an employer to notify his subordinates about wages, and what rules for issuing notification sheets are provided for by current legislation.

Dear readers! The article describes typical situations, but each case is unique. If you want to find out how to solve your particular problem, use the online consultant form in the lower right corner of the site or call direct numbers: +7 (499) 653-60-72 ext.445 — Moscow — CALL+7 ext.394 — St. Petersburg — CALL here — if you live in another region. It's fast and free!

Article 136 of the Labor Code of the Russian Federation provides for the employer’s obligation to issue pay slips in order to inform employees about the accrual of earnings without fail.

It does not matter how the salary is paid - in cash through the cash register or to the employee’s card. This article states that the employer is obliged to notify each of his employees in writing about the accrual of wages for the period worked.

This notice is called a payslip and must contain the following information:

Why is it needed?

By virtue of Article 136 of the Labor Code of the Russian Federation, company management is obliged to notify each employee about the following components of wages accrued during the month:

- the salary is proportional to the hours worked;

- additional payments and allowances if there are harmful factors in the workplace or overtime in the form of night or holiday hours;

- the amount of personal income tax withholding or other deductions, for example, alimony;

- the total amount that will be issued.

At the same time, this norm states that the form of the pay slip in each company is approved by the management together with the trade union committee, which implies an arbitrary drawing up of the pay slip with the obligatory reflection of the above data.

Also, the Letter of Rostrud dated March 18, 2010 No. 739-6-1 states that slips should be issued to workers no later than the day the salary is paid, but how many times a month - twice or once a month - is not specified, and therefore it is possible to issue a slip only when transferring wages, not advance payments.

Of course, in every institution, the norms of Article 136 of the Labor Code of the Russian Federation are carried out by the accounting department, that is, they prepare pay slips on a monthly basis and hand them over to employees.

But in practice it is quite difficult to prove during an audit that the employees received the agreed document.

That is why some organizations keep a journal in which the receipt of a sheet by each employee against signature indicating the date is recorded in order to avoid accusations by the same regulatory authorities of failure to fulfill the obligations enshrined in Article 136 of the Labor Code of the Russian Federation.