Home / Divorces

Back

Published: 11/05/2019

0

17

- 1 Order on assigning the duties of a cashier to the chief accountant sample

- 2 Order on assigning cashier duties to the chief accountant

- 3 Order on assigning the duties of a cashier in the order of combining positions

- 4 Order on assigning cashier duties to the chief accountant

- 5 What is needed, in addition to the order

- 6 Is it necessary to compile

- 7 In large organizations

- 8 Job responsibilities of a cashier in a store

Can the chief accountant be a cashier?

Currently, there are no regulatory prohibitions that would prevent the chief accountant from performing the duties of a cashier on a part-time or part-time basis. Another question is whether it is worth doing this, even after concluding an agreement with the chief accountant on full financial responsibility.

It is not for nothing that the signatures of various company employees are provided on cash orders. The consequences of neglecting this obvious rule of collegiality for the sake of safety are evidenced by numerous sentences involving chief accountants-cashiers. For example, as in verdict No. 16 of September 18, 2021 in case No. 01-0222-2017:

If you completely trust your chief accountant and are confident that he will be able to manage the cash register, then you need to formalize everything properly, and not give a “verbal order”, as in the excerpt from the verdict we cited. However, first it is necessary to calculate whether it is really more economically profitable to entrust the cash register to the chief accountant, rather than outsource it.

Assigning the duties of a cashier to an accountant: how it is done, what documents need to be drawn up

Since this personnel operation can be carried out as part of a combination of professions, the manager needs to comply with the legal requirements governing this process. We are talking about obtaining consent to perform new functions and adopt relevant local regulations. To do this you need:

Conclude an additional agreement with the appointed employee. It must specify the execution of cash transactions, the amount of additional payment for combining and the period for which the agreement will be valid.- Draw up and certify an agreement on full financial liability.

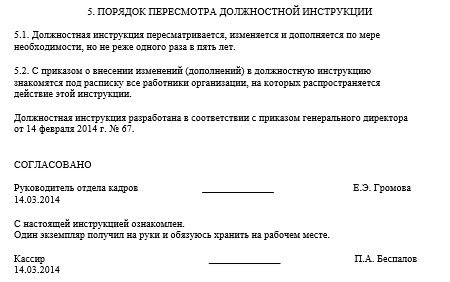

It will be mandatory to issue an order on combining positions. Without it, the procedure carried out will be unlawful. The form of this document is not fixed by law, so the entrepreneur must rely on the requirements of internal local legal acts.

When all the listed documents are ready, you should prepare and sign an order assigning cashier duties to the accountant.

This document is required, since without it problems may arise, primarily with banking institutions, which are likely to refuse to cooperate without it.

The form of the order to assign the duties of a cashier to an accountant is not included in the list of unified documents, so its preparation largely depends on the organization’s LPA.

As a rule, the document is created on company letterhead, where at the top there is information about the enterprise, indicating its name, legal address and registration codes.

Carrying out cash transactions involves interacting with cash registers of various brands and specifications, therefore the text of the order must contain information about the model with which the part-time worker will actually work.

Below, on the left side of the form, there is a field for the date and document number, and on the right - the name of the locality. Next, below on the left side you can indicate the preamble.

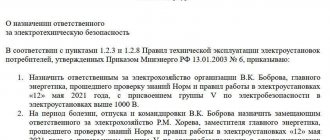

Under the title of the document there should be a brief plot revealing the reasons for accepting the order, after which the executor lists its main points. They must contain:

Information about the company employee who is assigned the duties of a cashier.- The date from which the document comes into force. It must correspond to the dates specified in the liability agreement and the additional agreement.

- The need to submit all organizational and administrative documents related to the performance of cashier functions.

The order is signed exclusively by the director of the company, after which it must also be signed below by the accountant who is assigned new responsibilities.

Accountant-cashier: job responsibilities

The job responsibilities of an accountant-cashier include the responsibilities of an accountant for a specific area of accounting work, as well as a cashier. For example, the duties of a cashier can be performed by a payroll accountant, whose functionality we discussed in our separate consultation.

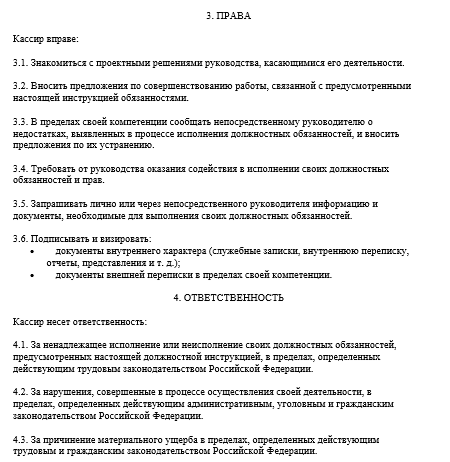

The distinctive responsibilities of a cashier include:

- reception, accounting, issuance and storage of funds and securities with mandatory compliance with the rules ensuring their safety;

- receiving, according to documents drawn up in accordance with the established procedure, funds and securities from the bank for the payment of wages, bonuses, travel and other expenses;

- maintaining a cash book based on incoming and outgoing documents, reconciling the actual availability of cash and securities with the book balance;

- compiling an inventory of old banknotes, as well as relevant documents for their transfer to the bank for the purpose of replacing them with new ones;

- transfer of funds to collectors in accordance with the established procedure;

- preparation of cash reports.

If an accountant performs the duties of a cashier, then you can conclude an agreement with him on full individual financial responsibility (clause 2, part 1, article 243, article 244 of the Labor Code of the Russian Federation, Resolution of the Ministry of Labor dated December 31, 2002 No. 85).

Order on assignment of duties: subtleties of the issue

JOB RESPONSIBILITIES 2.1. Accountant-cashier: 2.1.1. Reports directly to the chief accountant. 2.1.2. Performs operations for receiving, accounting and issuing funds with mandatory compliance with the rules ensuring their safety. 2.1.3. According to documents drawn up in accordance with the established procedure, he receives money from the bank to pay employees wages and issue money on account. 2.1.4. Prepares cash documents, documents for calculation and payment of wages in accordance with the established procedure. 2.1.5. According to documents drawn up in accordance with the established procedure, accepts cash into the cash register and issues it from the cash register. 2.1.6. Maintains a cash book based on incoming and outgoing documents, checks the actual availability of cash amounts with the balance in the cash book and account 50 “Cash”. 2.1.7.

Is there a surcharge?

As practice shows, the verbal assignment of cashier duties to the chief accountant or his performance of such duties “by default” is associated with the desire of management to reduce the wage fund. After all, when officially registering, it is necessary to indicate the amount of the surcharge.

In order to avoid numerous problems (from those created by banks to criminal prosecution), it is necessary to arrange everything correctly. There are only two design options:

- combining positions through an additional agreement to the employment contract with the chief accountant;

- internal part-time employment, formalized by a second employment contract, no longer as with the chief accountant, but as with a cashier working part-time. In this case, an order is issued for employment on a part-time basis (Letter of the Ministry of Labor of Russia dated April 26, 2017 No. 14-2/B-357).

Let us note once again that in both cases an additional payment is provided (Article 151 of the Labor Code of the Russian Federation).

Who cannot combine the position of cashier

The text should also contain information about the employee’s familiarization with such a document as the Procedure for Conducting Cash Transactions. This review will require an additional signature of the employee who assumes the rights and responsibilities of the cashier. Footnote to the agreement on mat. responsibility will also be useful.

Without it, the order will also be valid, but it will need to be supplemented in the form of this agreement. At the end of the text of the document there must be at least two signatures: the accountant-cashier and his manager. The date is already at the beginning. What else may be contained in the document If it is not planned to make changes to the job description of the accountant (or chief accountant) regarding the performance of the duties of a cashier, then the Order should contain a line (at the end of the first paragraph on the appointment) “with an additional payment in the amount of XXX.”

The term Accountant and Cashier.

As enshrined in Article 60.2 of the Labor Code of the Russian Federation (LC RF), with the written consent of the employee, taking into account the current job responsibilities specified in the employment contracts, he may be assigned to perform additional work in a different or the same profession (position) for additional pay (Article 151 of the Labor Code).

The period during which the employee will perform additional work, its content and volume are established by the employer with the written consent of the employee.

Order on assigning the duties of a cashier in the order of combining positions

Often an employee combines several professions, that is, performs several job functions. For example, a salesperson in a clothing store may also be a cashier. The organization's accountant can also be a cashier.

If the organization’s staffing table approves the position of cashier-salesperson, cashier-controller, then the labor function includes both the responsibilities of a cashier and other responsibilities. In this case, one labor contract is concluded with the employee, which states that the employee is hired for a job that, in fact, involves combining labor functions.

Since in the Qualification Directory of Positions of Managers, Specialists and Other Employees, approved by Resolution of the Ministry of Labor of Russia of August 21, 1998 No. 37, there are no positions of salesperson-cashier, cashier-controller and other similar positions, then the organization, approving such a labor function, must also develop and a job description for such an employee, which defines responsibilities and establishes qualification requirements.

In this case, when concluding an employment contract, an agreement on full financial responsibility is immediately concluded.

If an employee was initially hired for a job that does not involve performing such duties, and he was additionally charged with this job function, then the sequence of actions is as follows.

First of all, an additional agreement to the existing employment contract is drawn up, which must indicate that the worker is entrusted with, and he assumes, the duties of a cashier. The period during which a person will perform additional work, its content and volume are established by the employer, also with the written consent of the employee. The amount of additional payment for combining positions is also established.

Secondly, an order is issued to assign the duties of a cashier in a combination manner.

Thirdly, an agreement on full financial responsibility is concluded.

And only after all of the above is the acceptance and transfer of the cash register formalized.

In this case, the employee must be familiarized with the job description by signature.

Chief accountant and combination of positions

If you have any questions, you can consult for free via chat with a lawyer at the bottom of the screen or call by phone (consultation is free), we work around the clock.

In some cases, discussed with a higher management body, a specialist with secondary vocational education may be appointed chief accountant. But this candidate must have about 3 years of work experience in this specialization and no less. There is also another document - the Qualification Directory, which specifies the requirements for the positions of managers, specialists, etc. It was approved by the Ministry of Labor in 1998. The requirements for the qualifications of the chief accountant are completely different. It states here that this employee must have a higher economic education.

What will you need besides the order?

Paper alone is not enough for the full legality of ongoing processes.

There are several options that the head of an organization can resort to if it is necessary to perform the duties of one employee by another.

First option. An order is drawn up, signed, and then an agreement on full swearing is concluded with the employee. responsibility, is certified, then changes are made to the employment contract of the accountant (or the chief accounting specialist in the organization, depending on the circumstances), which provide for him to perform all the functions of a cashier. This option is more logical.

Second option. An order and an agreement are formed and signed, as in the first option, plus amendments to the acting status are made. cashier in the accounting job description.

Order on assigning cashier duties: rules for drawing up

The order has been read by: Chief Engineer Timofeev A.V. Date Signature If a certain additional payment is established for the performance of duties, then this fact is reflected in the order as a separate paragraph. Responsibilities of a cashier If there is no cashier on staff, then the order may look like this. But there are often situations when there is a vacant position, but management is in no hurry to hire an individual employee for it. There are several options that the head of an organization can resort to if it is necessary to perform the duties of one employee by another. First option. An order is drawn up, signed, and then an agreement on full swearing is concluded with the employee. responsibility, is certified, then changes are made to the employment contract of the accountant (or the chief accounting specialist in the organization, depending on the circumstances), which provide for him to perform all the functions of a cashier. This option is more logical. Second option. An order and an agreement are formed and signed, as in the first option, plus amendments to the acting status are made. cashier in the accounting job description. Algorithm for drawing up a document At the top of the paper there is a header in which the name of the document and the date of its preparation are written. Then, after the title, the reasons for the absence of the employee as such are indicated.

Assignment of cashier duties to an accountant: sample order

If, in order to save money, the combination option is chosen, it is advisable to take advantage of another safety net and, based on the addition to the employment contract, issue a personnel order. It is important to take into account that, in contrast to registration of a part-time job:

- there is no unified form of order for registering an employee in a combination order;

- developers of accounting programs do not offer special forms of personnel orders for registration of combinations in standard versions of their programs.

If your HR software is not customized for this case, you can use our sample.

order on combining positions

additional agreements on combination

Let us note that the choice of a fixed salary or interest rate both in the additional agreement to the employment contract and, accordingly, in the personnel order is entirely at the discretion of the parties. As a rule, chief accountants and personnel officers prefer a percentage rate, so as not to later make changes to the additional agreement and not to issue another personnel order when the salary increases for the whole company.

Sample order on assignment of duties

The agreement must establish: - the amount of additional payment for combination; - the period of combination - for example, for the period of the cashier’s vacation or until the employee is hired as a cashier; 2) issue an order in free form to assign the employee the duties of a cashier in order to combine positions; Example. An order to assign the employee the duties of a cashier 3) formalize the acceptance and transfer of the cash register. To assign the duties of a cashier to an employee whose employment contract and job description provide for replacing the cashier during his absence (vacation, illness), it is enough to issue an order for the employee to temporarily perform the duties of a cashier and formalize the acceptance and transfer of the cash register. In this case, it is not necessary to enter into an agreement on combining positions and make additional payments (Letters of the Ministry of Health and Social Development dated March 12, 2012 N 22-2-897, Rostrud dated May 24, 2011 N 1412-6-1. For example: RUSSIAN FEDERATION LIMITED LIABILITY COMPANY “VETER” ORDER “06” March 2015 No. 17-P Samara city On assigning the duties of a mechanic Due to the absence of a chief mechanic position in the staffing table of the enterprise, I order:

- Assign the duties of the chief mechanic to the chief engineer Timofeev A.V.

- I reserve control over the execution of this order.

Director of Veter LLC Karpov I. I.

Can the chief accountant perform the duties of a cashier?

This conclusion is fully consistent with our state’s policy of creating even more favorable economic and legal conditions for business entities and reducing administrative barriers to their activities. After all, not every micro-firm and small enterprise can afford to have a cashier on staff. * Auditor's opinion * Guzal ISLAMOVA, Norma Profi expert: – There are no direct restrictions in the accounting legislation on combining the positions of chief accountant and cashier. However, despite their absence, it should be borne in mind that such a combination will make it impossible to carry out some procedures provided for by law. Thus, in the Regulations on Documents and Document Flow in Accounting (registered by the Ministry of Justice on January 14, 2004