Why you shouldn't give up your vacation

Have you ever thought that by taking compensation for unused vacation in the hope of earning more, you thereby lost money? Tatyana Pavlova, financial consultant, will tell you with examples where exactly you made (or may make) mistakes.

Rule 1. Correctly determine the composition of compensation payments

Wages consist of several parts (Article 129 of the Labor Code of the Russian Federation):

- Remuneration for work performed depends on the employee’s qualifications, complexity, quantity, quality and conditions of the work performed.

- Compensation and incentive payments - payment of this part of the salary causes the greatest difficulties for accountants.

The compensation part of the salary includes:

- additional payments and allowances for work in conditions deviating from normal;

- surcharges and allowances for work in special climatic conditions and in areas exposed to radioactive contamination;

- other additional payments and allowances.

Additional payments and allowances that are included in the compensation part of the salary include:

- remuneration for work of various qualifications;

- wages when combining professions (positions), expanding service areas, increasing the volume of work or performing the duties of a temporarily absent employee without release from work specified in the employment contract;

- remuneration for temporary substitution;

- overtime pay;

- payment for work at night, on weekends and non-working holidays;

- remuneration for workers engaged in heavy work, work with harmful and (or) dangerous and other special working conditions.

So, we figured out the composition of payments.

Rule 4. Compensation payments that are wages are taken into account when calculating average earnings

Based on average earnings, the time an employee is on vacation, on a business trip, on advanced training courses and in other cases is paid. To calculate average earnings, all types of payments provided for by the remuneration system and applied by the relevant employer are taken into account, regardless of the sources of these payments (clause 2 of the Decree of the Government of the Russian Federation of December 24, 2007 No. 922). Subclause “l” of clause 2 of Resolution No. 922 allows compensation payments to be included in the calculation of average earnings. Condition: these payments must be provided for by the organization’s local regulations (for example, the Regulations on Remuneration).

Salary composition

- salary (official salary), tariff rate;

- compensation payments (additional payments and allowances of a compensatory nature);

- incentive payments.

The salary is established in the employment contract in accordance with the current employer’s remuneration system (piecework, time-based, mixed) and is not limited to the maximum amount.

Compensation payments included in wages:

- for work in special climatic conditions

- for work in areas exposed to radioactive contamination;

- for the employee’s use of his or her tools or machinery in work;

- for working under harmful or dangerous working conditions;

- for working with information constituting a state secret;

- for work in conditions deviating from normal (when performing work of various qualifications, combining professions (positions), overtime work, night work, etc.);

- other payments provided for by the remuneration system.

The list of types of compensation payments in federal budgetary, autonomous, and government institutions was approved by Order of the Ministry of Health and Social Development of December 29, 2007 N 822.

Payments not included in wages , in particular, include payments specified in Art. 165 of the Labor Code of the Russian Federation, which are produced:

- when sent on business trips;

- when moving to work in another area;

- when performing state or public duties;

- when combining work with education;

- in case of forced cessation of work through no fault of the employee;

- when providing annual paid leave;

- in some cases, termination of an employment contract;

- due to a delay due to the employer’s fault in issuing a work book upon dismissal of an employee.

Incentive payments:

- additional payments and bonuses of an incentive nature (for length of service, for an academic degree, etc.);

- bonuses (for performing specific work, based on the results of the reporting period, etc.);

- other incentive payments provided for by the remuneration system (for quitting smoking, for saving consumable materials, etc.).

The terms of remuneration established by a collective agreement, employment contract or local regulations cannot be worsened in comparison with those established by labor legislation.

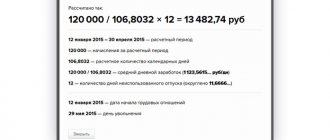

Example 2 (second way to calculate the difference)

If you have never gone on vacation.

- For 12 months of work, you have earned insurance experience, giving you the right to annual paid leave of 28 calendar days.

- Total for 36 months – 84 calendar days.

- You went on vacation every year.

- For 11 months worked, you have earned an insurance period (giving you the right to annual paid leave) of 25.67 = 28 / 12 x 11 calendar days.

Total for 33 months 77 = 28 / 12 x 33 calendar days. For 1 month of vacation, you have earned insurance experience (giving you the right to annual paid leave) 2.33 = 28 / 12 x 1 calendar days. Total for 3 months 7 = 28 / 12 x 3 calendar days. Your income is 60,000.00 / 28(*) x 7 = 15,000.00. This is where your lost income lies!

As a particular example of this situation, we can cite the current rules on regular and additional leaves No. 169 of April 30, 1930: “If you work in the company for only 11 months and decide to quit, the employer is obliged to pay you compensation for the full year worked.”

Salary amount

The minimum wage is set at the federal level. At the regional level, a minimum wage is established in a constituent entity of the Russian Federation.

Unlike other payments, the regional coefficient and percentage bonus for work experience in the Far North and equivalent areas are not included in the minimum wage.

For employees of a separate structural unit, the minimum wage norm established in the territory of the federal subject where this structural unit is located applies.

Salary growth

At the legislative level, the procedure for such indexation is not defined. This does not relieve the employer from the obligation to index. The procedure for indexing wages is determined in a collective agreement, agreement, or local regulation.

If, based on the results of the calendar year during which Rosstat recorded an increase in consumer prices, wage indexation was not carried out, the employer is subject to liability established by law, regardless of whether it adopted the corresponding local act or not. At the same time, supervisory or judicial authorities are obliged to force him to eliminate the violation of labor legislation, both in terms of indexation and in terms of adopting a local act, if there is none.

What is more profitable for the employee?

For an employee who worked at the company for 5.5 to 11 months without using the right to vacation, it is more profitable to demand compensation for vacation pay, but only if they intend to fire him. This is beneficial for him, since he will be compensated for vacation pay for the entire 12 months and will be paid more. In other cases, it does not matter what to take, since the final amount that he will be paid in person will be identical and proportional to how many vacation days he has “accumulated.”

During vacation, accrual of experience continues. In case of dismissal, accrual of length of service is stopped on the day when the normative act or order on staff reduction comes into force.

Vacation pay is money that is paid for a period of rest while maintaining a position. Compensation is funds paid for unused vacation days (above the limit of 28 days) when an employee stops working at the enterprise or is laid off. Which is more profitable? It depends on the situation and circumstances, but often compensation is preferable.

Salary payment

Upon written application of the employee, wages are transferred to the account specified by the employee in the bank (credit institution) on the terms determined by the collective agreement or employment contract.

Part of the salary, but not more than 20% of the accrued monthly salary, may be paid in kind.

In the following types of non-monetary forms, it is prohibited to pay part of the salary:

- bonds,

- coupons,

- debentures,

- receipts,

- alcohol,

- narcotic substances,

- toxic substances,

- harmful substances,

- other toxic substances,

- weapon,

- ammunition,

- other items in respect of which a ban or restriction on their free circulation has been established.

The place and timing of payment of wages in non-monetary form are determined by a collective agreement or employment contract.

Salaries must be paid at least every half month. In practice, this means that the gap between payments does not exceed 15 days.

Specific dates for payment of wages are established by internal labor regulations, collective agreement, and employment contract.

If the day of payment of wages coincides with a day off or a non-working holiday, payment of wages is made on the eve of this day.

As a general rule, upon dismissal, all amounts due to the employee (including wages for the period worked) must be paid no later than on the last day of work (Part 1 of Article 140 of the Labor Code of the Russian Federation). Otherwise, it can only be provided by agreement of the parties, in accordance with which the parties terminated their employment relationship. In this case, the agreement, which includes a condition on the timing and amount of the corresponding payment, must be drawn up in writing in 2 copies.

Rules for calculating compensation for vacation

Unused rest days are multiplied by the average daily earnings for the last working year. The calculations do not take into account days at your own expense that exceed 14. If you want to find out which is greater, vacation pay or vacation compensation, calculate both payments. The rules for calculating average daily earnings for both payments are the same.

The payment is calculated based on 2.33 days for each month worked (28 days/12).

Example. Elena has been working since October 15, 2021, leaving on July 1, 2021. She rested for 24 calendar days in March and took 18 days at her own expense in October. For 19 months of work, she is entitled to 44.27 days of rest (19 × 2.33), but she has already rested 24 days, leaving 19.27. Her salary is 30,000 rubles.

Number of days in partial months:

- March: 29.3 / 31 × 7 = 6.62;

- October: 29.3 / 31 × 13 = 12.28.

We divide the salary for the year by the sum of full months worked for the billing period (last 12 months), multiplied by 29.3, and partial days:

360,000 / (10 × 29.3 + 6.62 + 13) = 696.88 rub.

Determine the amount:

682.6 rub. x 19, 27 days = 13,429 rub.

Salary information

- on the components of wages due to him for the relevant period

- on the amount of other amounts accrued to the employee (monetary compensation for the employer’s violation of the deadline for paying wages, vacation pay, dismissal payments and other payments)

- about the amounts and grounds for deductions made

- about the total amount of money to be paid.

The form of the pay slip is approved by the employer, taking into account the opinion of the representative body of employees.

In addition to salary and incentive payments (for example, bonuses), the salary includes compensation payments . They are relied upon by an employee if he works in a place with special working conditions. These include:

If the employer does not include compensation payments in the salary, then he violates labor legislation and is liable in accordance with clause 6 of Art. 5.27 of the Code of Administrative Offenses of the Russian Federation.

Example 1 (first way to calculate the difference)

So, option one - you have never gone on vacation:

- For 36 months worked, you received 60,000.00 x 36 = 2,160,000.00 rubles.

- Then, upon dismissal, you will receive compensation for 28 x 3 = 84 days. 60,000 / 28(*) x 84 = 180,000.00

- Total earnings for 36 months will be 2,160,000.00 + 180,000.00 = 2,340,000.00

Total average monthly earnings will be 2,340,000.00 / 36 = 65,000.00

Option two – you went on vacation every year:

Over the course of 3 years, you went on paid leave three times, each time for 28 calendar days (let’s take it as a month. Accordingly, we subtract these days from the total number of months worked, since on these days you rested.

- 36-3 = 33

- For 33 months worked, you received 60,000.00 x 33 = 1,980,000.00 rubles.

- For 3 months of vacation you received 60,000.00 x 3(*) = 180,000.00 rubles.

- Total earnings for 33 months will be 1,980,000.00 + 180,000.00 = 2,160,000.00

Total average monthly earnings will be 2,160,000.00 / 33 = 65,454.55. The difference between these two examples over 3 years will be:

- (65,454.55-65,000.00) = 454.55 x 11 x 3 = 15,000.00

Let's check our calculations in one more way.

Compensation for harmful or dangerous working conditions

If an employee is employed in hazardous work or his life may be in danger, then he is compensated for such working conditions. It is paid on top of the fixed part of the salary.

Clause 4.1.1. Art. IV Order of the Federal Tax Service No. MM-7-5/ dated March 12, 2009 establishes that the amount of compensation may be:

- up to 12% of salary - for work in harmful and difficult conditions;

- up to 24% of salary - for work in particularly harmful and difficult conditions.

The minimum amount of compensation payment, according to Art. 147 of the Labor Code of the Russian Federation, is 4% of the salary (tariff rate), which is established for jobs with normal working conditions.

The employer, taking into account the opinion of the primary trade union organization of the enterprise, determines the percentage of the bonus in an internal regulation or collective agreement.

Compensation may be withdrawn or reduced if a special assessment of working conditions shows that they have improved or become safe.

According to Art. 17 of Law No. 426-FZ of December 28, 2013, an unscheduled special assessment of working conditions is carried out in the following cases:

- commissioning of new workplaces;

- obtaining an order from a labor inspector if violations of labor legislation are revealed during supervision;

- changes:

- technological process;

- equipment;

- raw materials;

- personal and collective protective equipment;

- an accident, if it did not occur through the fault of third parties ;

- detection of occupational disease;

- making motivated proposals from trade union organizations.

If, after a special assessment of working conditions, their final class or subclass has decreased , then the conditions are recognized as improved.

Calculation of compensation payments

Persons who are officially employed are required to receive paid leave.

To apply for it, an 11-month work period is required, but an employee can apply for half of the required rest after six months of work. According to standards, vacation is provided in the amount of 28 days, but some enterprises provide their employees with additional days for harmful working conditions and other stress. But what is more profitable - vacation or compensation upon dismissal - is up to the employee to decide. The subordinate does not have to take out a whole vacation. The legislation provides for partial division of vacation days. Moreover, each part of the vacation should not be less than 14 days. In case of dismissal, the employer must pay the employee compensation for unused rest days. Payment must be made no later than the employee’s last working day at the enterprise.

The compensation payment is calculated based on the average daily earnings of the subordinate.

The billing period is calculated based on the calendar year. All earned monetary resources received by the employee must be divided by 12. The amount received is divided by a coefficient of 29.4, which means the average number of days in a calendar month.

When calculating the amount of compensation payment, not all of the employee’s income is taken into account. The following types of profit received are not taken into account:

- sick leave payments;

- downtime due to the fault of management;

- travel allowances.

Some periods are also not included in the compensation payment. The following are not taken into account:

- time off taken at your own expense;

- absenteeism without good reason;

- going on maternity leave.

After determining the daily wage, this amount is multiplied by the number of days that the employee did not use for rest.

For example, if a worker’s annual income is 340,000 rubles, the calculation is carried out according to the formula: 340,000 / 12 (months per year) / 29.4 (coefficient). The total is 963 rubles. This means average daily income. If an employee has 12 calendar vacation days left, then 963 is multiplied by 12, which totals 11,556 rubles.

Compensation can be made by the employer not only in case of dismissal of the employee. This is not always justified, but there are some exceptions:

- Payment can only be accrued for additional vacation days. For example, if an employee has 28 days of basic leave and 6 additional days for harmful working conditions, then the organization has the right to issue compensation for only 6 days, and the employee will have to take the rest of the days off.

- Pregnant women and minor citizens lose the right to compensation for additional days. In this case, reimbursement of funds is possible only in the event of dismissal of the employee.

Estimated payments are calculated in the same way as compensation payments for unused vacation days. Before receiving this money, the employee must write a letter of resignation. Funds are credited to the employee’s account during the period the company makes wage payments.

Compensation for work in areas with special climatic conditions

When the workplace is located in an area with special climate conditions, the employee must receive appropriate compensation payments. These include:

- regional coefficients in the regions of the Far North;

- coefficients in high mountain areas;

- coefficients in desert and waterless areas;

- percentage bonuses for length of service in the Far North and areas equivalent to it.

The conditions for their use and the specific size are established by the Government of the Russian Federation. According to Art. 316 of the Labor Code of the Russian Federation, the authorities of the constituent entities of the Russian Federation can independently increase their value. Compensation is calculated on actual earnings and remuneration for length of service. The coefficients are indicated in the letter of the Ministry of Health No. 01/9440-8-32 dated August 29, 2008.

The employer is obliged to charge percentage bonuses and regional coefficients on top of the employee’s minimum salary, since they are not included in the minimum wage (Resolution of the Constitutional Court No. 38-P of December 7, 2017).

Employees working in regions with a special climate on a part-time basis or on a rotational basis also receive compensation payments.

According to paragraph 2 of the explanation of the Ministry of Labor Resolution No. 49 of September 11, 1995, employees of internal affairs bodies and tax police (rank-and-file and commanding officers) serving in regions with a special climate, coefficients and percentage bonuses are calculated on:

- official salary;

- salary for a special rank;

- percentage bonus for length of service.

Percentage increase for work in special climatic conditions

This bonus is a compensation and incentive payment at the same time, as it is designed to reward employees for long-term work in regions with a special climate. Its size and calculation procedure are established by the Government of the Russian Federation.

The condition for calculating the percentage increase is the length of service in the Far North and areas equivalent to it.

All periods of work in these regions are counted as work experience. If there were breaks in work or the employee terminated the employment relationship with the employer, the length of service is summed up. If an employee changes place of work, the new employer in another region recalculates the rate.

The following periods will not be included in the length of service :

- work under a civil contract;

- individual entrepreneurial activity.

The percentage bonus is calculated on actual earnings, which does not include:

- calculated from average earnings;

- not included in wages, for example, one-time bonuses.

The amounts of the percentage allowances are indicated in the letter of the Ministry of Health No. 01/9440-8-32 dated August 29, 2008.

Compensation for work in conditions different from normal

Payments due in cases where working conditions change and begin to differ from normal ones are included in the salary and are accrued on top of its fixed part. These allowances include payment for work:

The maximum possible amount of compensation is not defined by law. Its specific value can be set by the employer, but it should not be lower than the minimum provided for by labor legislation.

Compensation for work of different qualifications

Work of different qualifications can be assigned to an employee within the framework of his position or specialty. The employer does not have the right to adopt local regulations that would allow him not to pay a bonus.

Did you know about such nuances of the labor code?

* The problem assumes that during your vacation your monthly salary is retained, and the average salary is not calculated according to accounting rules. By improving your financial literacy, you can increase your personal budget.

The relevance of this topic is undeniable. After all, the issue of financial literacy is often thought about not by those who have problems with money, but by people who have plenty of it. So, being savvy and flexible to modern conditions will give you self-confidence and make you more successful. Feel free to attend courses and seminars, and get information from financial media reviews.

© Tatyana Pavlova, BBF.RU