The employer must establish compensation for employees for the traveling nature of their work. And of course, I would like to make them so that they are not subject to personal income tax and insurance premiums. Is it possible? We are talking about compensation for the traveling nature of work in 2021 from the perspective of accounting.

Also see:

- What should be the provisions regarding the traveling nature of work?

- Taxi payments for commuting to work during the coronavirus period: how to process and accept them as expenses

What does labor law say?

An employee who has a traveling nature of work, in accordance with Part 1 of Art. 129, art. 149 and art. 168.1 of the Labor Code of the Russian Federation, the employer must establish additional cash payments. They are aimed at compensating employees for costs associated with the performance of their work duties.

Such payments and compensation include:

- Additional payment for travel . This bonus is compensatory in nature and is part of the salary. The additional payment can be established by a local regulatory act (for example, Regulations on the traveling nature of work), a collective agreement, an agreement or an employment contract.

- Reimbursement for business travel expenses. These may include expenses for renting accommodation, travel, as well as other expenses that the employee made with the instructions or permission of the employer. The list of reimbursable expenses is open . Also, the law does not limit the amount of compensation. The employer sets the size independently, taking into account the requirements of Part 2 of Art. 168.1 Labor Code of the Russian Federation. The only thing that is important to remember is that the compensation amounts should not be unreasonably underestimated .

Next, we will analyze these payments in more detail.

Remuneration for traveling work

If an employee has a traveling schedule, then there are no fundamental features of her payment. However, in practice, constant travel is associated with additional costs, which determines the need to compensate for them in one form or another.

The obligation to do this is provided for in Article 168.1 of the Labor Code of the Russian Federation. However, neither the amount of compensation nor the procedure for its provision is established. The form of payment may be determined by the employment contract concluded with the employee, the collective agreement in force at the enterprise and other internal regulations of the enterprise. In practice, two forms of payment have emerged in the case under consideration: the establishment of a special allowance and compensation payments.

Travel surcharges

An allowance or additional payment for traveling work is not required . But the employer can set it at his own discretion. Only the reimbursement of expenses mentioned above is required.

Thus, in labor legislation there is no direct prohibition on establishing a fixed additional payment for travel to an employee as compensation for expenses incurred by him. Moreover, these payments are in no way related to the employee’s achievement of work results. The company must take into account that such an additional payment must fully compensate the employee’s possible expenses for travel, renting accommodation and other agreed expenses.

But with this type of compensation for travel, inspectors may have questions. Especially if there are no documents that confirm the expenses incurred by the employee. In this case, the amounts of additional payments made cannot be considered compensatory. This is what the Russian Ministry of Labor thinks. This position is set out in letter dated September 30, 2014 No. 17-4/B-462).

In the case of fixed compensation for the traveling nature of the work, the employment contract must make reference to the Regulations, which stipulate the amounts and conditions for receiving such allowances. Or you need to indicate the amount of additional payment in the employment contract itself.

You can study in more detail the issue of drawing up an employment contract for traveling work in our material “What should be an employment contract regarding the traveling nature of work.”

What kind of work is considered traveling?

The Labor Code does not contain a definition of traveling work. Searches for such a definition in departmental sources did not yield a positive result. For example, the traveling nature of work for military personnel and employees of internal affairs bodies implies the possibility of their daily return to their place of residence, and in construction - organized trips to the site during non-working hours. Meanwhile, the Labor Code of the Russian Federation does not provide for such restrictions.

| Traveling nature of work (official activity) | |

| Source | Definition |

| Instructions on the organization of business trips for military personnel of rescue military units of the Ministry of Emergency Situations of Russia... and employees of the State Fire Service in the system of the Ministry of the Russian Federation for Civil Defense, Emergencies and Disaster Relief (approved by order of the Ministry of Emergency Situations of Russia dated January 10, 2008 No. 3): clause. 2 | Carrying out regular business trips within the service territory (areas) with the possibility of daily return to the place of residence |

| Instructions on the organization of business trips for employees of internal affairs bodies... and military personnel of the internal troops of the Ministry of Internal Affairs of the Russian Federation on the territory of the Russian Federation (approved by order of the Ministry of Internal Affairs of Russia dated November 15, 2011 No. 1150): clause 2 | |

| Regulations on the payment of bonuses related to the mobile and traveling nature of work in construction (approved by Resolution of the USSR State Committee for Labor dated 01.06.1989 No. 169, Secretariat of the All-Russian Central Council of Trade Unions dated 01.06.1989 No. 10-87): clause 2 | The nature of the work, which involves travel during non-working hours from the location of the organization (assembly point) to the place of work at the facility and back in connection with the performance of work at facilities located at a considerable distance from the location of the organization |

| Methodology for determining estimated prices for labor costs in construction (approved by order of the Ministry of Construction of Russia dated December 20, 2016 No. 1000/pr): clause 2 | |

The position of the Russian Ministry of Finance on the issue of whether the work of employees of certain positions is of a traveling nature is presented in letter No. 03-04-06/45182 dated October 25, 2013. Officials indicated that for appropriate clarifications one should contact the Ministry of Labor and Social Protection of the Russian Federation (Ministry of Labor of Russia). In our article (see below) we refer to the letter from Rostrud. So Rostrud is the Federal Service for Labor and Employment, under the jurisdiction of the Ministry of Labor of Russia (clauses 1, 2, 6.2 of the Regulations on the Federal Service for Labor and Employment, approved by Decree of the Government of the Russian Federation of June 30, 2004 No. 324).

However, from the content of a number of articles of the Labor Code of the Russian Federation, one can discern a number of qualifying features of this nature of work. Namely, the traveling nature of the work:

1) refers to the conditions that determine the nature of the work, that is, it actually reflects the content of the labor function (Article 57 of the Labor Code of the Russian Federation);

2) involves business trips for employees on a permanent basis (Article 166 of the Labor Code of the Russian Federation);

3) allows the employee to live outside his place of permanent residence (Article 168.1 of the Labor Code of the Russian Federation).

Important

Rostrud (letter dated December 12, 2013 No. 4209-TZ) considers: if an employee’s job function involves constant work on the road, the employer has the right to establish for such an employee the traveling nature of the work. In our opinion, the law establishes not a right, but a direct obligation of the employer.

The work of car drivers and couriers meets the above criteria. In addition, this category includes service technicians who repair large household appliances at home, as well as full-time advertising agents. The work of inspectors will also have a traveling nature, carrying out systematic inspections of the network of territorial divisions of a large organization. In general, you need to proceed from the employee’s labor function, as specified in the employment contract.

Article 166 of the Labor Code of the Russian Federation warns: business trips of employees whose permanent work is of a traveling nature are not recognized as business trips. For this reason, truck drivers should not arrange business trips! Indeed, during a business trip, the employee performs a specific official assignment, and therefore only part of the labor function stipulated by the employment contract.

Current

Regulations on the peculiarities of working hours and rest time for car drivers (approved by order of the Ministry of Transport of Russia dated August 20, 2004 No. 15, registered with the Ministry of Justice of Russia), paragraph 15

The driver's working time consists of the following periods:

a) driving time;

b) time of special breaks for rest from driving on the way and at final destinations;

c) preparatory and final time for performing work before leaving the line and after returning from the line to the organization, and for intercity transportation - for performing work at the turnaround point or on the way (at a parking place) before the start and after the end of the shift;

d) the time of the driver’s medical examination before leaving the line (pre-trip) and after returning from the line (post-trip), as well as the time of travel from the workplace to the place of the medical examination and back;

e) parking time at loading and unloading points, at passenger pick-up and drop-off points, at places where special vehicles are used;

e) downtime not due to the driver’s fault;

g) the time of work to eliminate operational malfunctions of the serviced vehicle that arose during work on the line, which do not require disassembling the mechanisms, as well as performing adjustment work in the field in the absence of technical assistance;

h) the time of protection of cargo and vehicle during parking at final and intermediate points during intercity transportation if such duties are provided for in the employment agreement (contract) concluded with the driver;

i) the time the driver is present at the workplace when he is not driving a car, when two or more drivers are sent on a trip; j) time in other cases provided for by the legislation of the Russian Federation.

Taxes and contributions from compensation payments

The fixed additional payment is taken into account as part of the salary. It is subject to both personal income tax and insurance premiums in the general manner. It is also included in tax expenses (letter of the Ministry of Finance dated March 26, 2012 No. 03-04-06/9-76, clause 3 of Article 255 of the Tax Code of the Russian Federation).

But targeted compensation for the traveling nature of work is not subject to insurance premiums and personal income tax.

EXAMPLE

Option 1

An employee with a traveling nature of work is paid a monthly bonus of 5,000 rubles, calculated in such a way as to cover the employee’s possible expenses on work trips. This means that the amount of 5,000 rubles is subject to both contributions and personal income tax.

Option 2

An employee in traveling work is reimbursed monthly for the expenses he incurred in the process. The amount is determined based on the report and primary documents provided to them. This means that such a payment is considered compensation and is not subject to personal income tax and contributions.

The amount of compensation for travel is included in income tax expenses on the basis of the employee’s supporting documents (letter of the Ministry of Finance dated July 6, 2018 No. 03-04-05/46903).

Accounting for amounts for traveling work

When calculating and paying compensation for expenses incurred, the following accounting entries are made:

- Debit 20 (26, 44) Credit 73 – compensation was accrued to the employee for expenses incurred for travel, accommodation, etc.;

- Debit 73 Credit 50 (51) – compensation paid.

IMPORTANT!

Funds for compensation can be issued in advance. In this case, they should be recorded as accountable amounts.

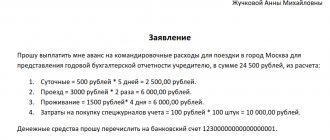

EXAMPLE

At the beginning of the month, an employee with a traveling nature of work was given an advance payment for expenses on a business trip of 3,000 rubles:

Debit 71 Credit 50 – 3000

Upon returning, the employee submitted an advance report with supporting documents in the amount of 3,500 rubles to the accounting department. On the date of approval of the report, the accountant made the following entries:

- Debit 44 Credit 71 – 3500 – reflects the amount of the employee’s reimbursable travel expenses;

- Debit 71 Credit 50 – 500 – overexpenditure to the employee was compensated according to the approved report.

The amount on the advance report is also not subject to personal income tax and insurance premiums.