What applies to business travel expenses?

Most of the employee's duties must be performed directly at his main place of work.

However, there are often situations in which it is necessary to send an employee to another location. For example, to submit reports to a higher authority, to undergo retraining, or to conclude an agreement. Regardless of the purpose of the trip, travel expenses must be paid by the employer and then reflected in the organization's accounting records. What is required by law (Article 168 of the Labor Code of the Russian Federation):

- The employee’s workplace, as well as the position, will be retained for the entire period of absence - being on a business trip.

- Average salary for all days of stay on a business trip. Let us remind you that days of downtime, days of departure and arrival, as well as days of travel are subject to payment.

- Travel and accommodation expenses. The employer is obliged to pay at his own expense for rented housing, as well as the employee’s transportation costs.

- Costs that compensate for the inconveniences associated with a specialist living outside his home, that is, outside his main place of residence. Such costs are also called per diem.

- Other expenses. For example, purchasing teaching aids or additional supplies. However, such expenses must be agreed upon separately with management. Otherwise, the employee will not be reimbursed.

Rules for accounting for business travel expenses in budgetary institutions

Source: Educational

Since October 25, 2008, business trips of employees, both in Russia and abroad, are formalized in a new procedure, in accordance with the Regulations on the specifics of sending employees on business trips, approved by the Decree of the Government of the Russian Federation of October 13, 2008 No. 749. The document removes many previously controversial and unresolved issues related to employee travel.

The procedure and amount of reimbursement of expenses related to business trips are determined by a collective agreement or local regulations.

This is the requirement. 168 of the Labor Code of the Russian Federation. The employer is obliged to reimburse an employee sent on a business trip for: travel expenses, expenses for renting living quarters, additional expenses associated with living outside the place of permanent residence (per diems), and other expenses incurred by the employee with the permission of the employer. Previously, organizations that sent employees on business trips were forced to follow the Instruction of the USSR Ministry of Finance, the USSR State Committee on Labor and Social Issues, All-Union Central Council of Trade Unions No. 62 of 04/07/88 “On business trips within the USSR.”

On October 25, 2008, Decree of the Government of the Russian Federation No. 749 of October 13, 2008 “On the peculiarities of sending employees on business trips” came into force, which approved the Regulations of the same name. This new document clarified the wording and expanded some of the requirements contained in Instruction No. 62. In the new Regulations, the definition of a business trip was expanded. A business trip is also recognized as a trip by an employee sent to a separate unit of the sending organization, located outside the place of permanent work.

The list of expenses reimbursed to a posted worker has been added. Previously, it was possible to reimburse expenses for renting accommodation and travel to the place of business trip and back to the place of permanent work, as well as pay daily allowances. Now, along with the listed expenses, the employee is also reimbursed for other expenses incurred by him with the permission of the head of the organization, these include: - payment for luggage, - communication services, - services of halls for officials and delegations, - parking services, - luggage storage services and others.

These expenses are not limited by any standards, and are reimbursed to the employee in their actual amount, subject to the presentation of the relevant documents. Let's consider the services of halls for officials and delegations. These services are used by certain categories of federal civil servants. Paragraph 23 of Decree No. 813 states that the list of civil service positions, the replacement of which gives the right to use the halls of officials and delegations, is approved by the President of the Russian Federation. In accordance with Order No. 168n, business trip expenses are paid according to the following subsections of the economic classification of expenses: - 212 “Other payments” - expenses for paying daily allowances; — 222 “Transport services” — expenses for travel to the place of business trip and back; — 226 “Other services” — expenses for renting residential premises; — 290 “Other expenses” — expenses of a protocol nature in accordance with the legislation of the Russian Federation during business trips to the territory of foreign states.

The Ministry of Finance of Russia, in agreement with the Ministry of Foreign Affairs of Russia, establishes maximum standards for payment of expenses for hiring residential premises for employees sent on business trips abroad. These standards were developed based on the cost of a one-room (single) room in a mid-range hotel.

After the new Regulations come into force, employees are reimbursed not only for travel expenses to the place of business trip in Russia and back, but also for travel expenses from one locality to another if the employee is sent to several organizations located in different localities.

If previously a posted worker was paid for travel expenses by public transport (except taxis) to a station, pier, airport, if they are located outside the populated area, now he is also paid for travel expenses from the station, pier, airport, if they are located outside the boundaries settlement. In addition, the Regulations clarify that travel expenses are reimbursed if there are documents (tickets) confirming these expenses. The list of travel expenses reimbursed to the employee is also supplemented by an insurance premium for compulsory personal insurance of passengers on transport. The type of expenses provided for by the Instruction, such as “payment for services for the pre-sale of travel documents,” has been corrected to “payment for services for issuing travel documents.” Reimbursement of travel expenses is made by budgetary institutions within the limits of the allocations allocated to them from the federal budget for business trips, or (in the case of using these allocations in full) through savings in funds allocated from the federal budget for their maintenance.

In budgetary institutions, workers are divided into various categories, in particular: - “workers”, - “managers”, - “assistants (advisers)”, - “specialists”.

The procedure for reimbursement of travel expenses for different categories of employees has some differences. In accordance with paragraph 21 of Decree No. 813, travel expenses for civil servants are reimbursed in accordance with the following standards: - those holding senior positions in the “managers” category: · by air - on a 1st class ticket; · sea and river transport - at tariffs set by the carrier, but not higher than the cost of travel in a luxury cabin with comprehensive passenger services; · by rail - in a luxury carriage classified as a business class carriage, with double compartments of the "SV" category or in a category "C" carriage with seating that meets the requirements for business class carriages. - filling positions in the categories “assistants (advisers)”, “specialists”: · by air - at a business class rate; · sea and river transport - at tariffs set by the carrier, but not higher than the cost of travel in a double cabin with comprehensive passenger services; · by rail - in a luxury carriage classified as an economy class carriage, with four-seater compartments of category "K" or in a category "C" carriage with seats.

For budgetary organizations, to reimburse accommodation costs, one should be guided by Resolution No. 729, which establishes that reimbursement of expenses for renting residential premises (except for the case when an employee sent on a business trip is provided with free accommodation) is carried out in the amount of actual expenses confirmed by relevant documents, but not more than 550 rubles per day. In the absence of documents confirming these expenses - 12 rubles per day.

The costs of renting residential premises are reimbursed to different categories of employees of budgetary institutions in different ways. Thus, paragraph 18 of Decree No. 813 states that for federal civil servants there is no maximum amount for renting residential premises, but, at the same time, it should not exceed the amount determined for employees holding senior positions in the civil service category “managers”, that is, the cost of a two-room room, and for other employees - no more than the cost of a one-room (single) room. And if documents confirming the costs of renting housing are not provided, federal civil servants are reimbursed the costs of renting housing in the amount of 30% of the established daily allowance (currently 100 rubles) for each day they are on a business trip.

Expenses for renting accommodation at the place of business trip are reimbursed to the posted worker from the day of arrival until the day of departure to the permanent place of work. If a posted worker was forced to make a stop along the way, then in this case, reimbursement of housing rental costs will be made only if there are supporting documents. In the absence of such documents, neither 12 rubles nor 30% of the established daily allowance will be paid. Documents confirming the costs of renting housing are cash receipts, invoices, invoices of form No. 3-G.

Quite often, seconded workers submit only invoices for reporting in Form No. 3-G, without a cash receipt. The Ministry of Finance of the Russian Federation in Letter dated June 15, 2006 No. 03-05-01-04/164 provides the following clarifications on this issue. Organizations and private entrepreneurs providing hotel services to the population have the right to conduct cash transactions without the use of cash register equipment, but subject to the issuance of strict reporting forms.

By Order of the Ministry of Finance of the Russian Federation dated December 13, 1993 No. 121, strict reporting form No. 3-G was recommended for use by hotels. Therefore, to confirm expenses for housing, an invoice in Form No. 3-G is quite sufficient. Subparagraph “b” of paragraph 1 of Resolution No. 729 establishes that a posted employee of a budgetary institution is paid a daily allowance in the amount of 100 rubles for each day of a business trip, including days en route.

It should be noted that Article 168 of the Labor Code of the Russian Federation gives the right to organizations, including budgetary institutions, to independently determine the procedure and amount of reimbursement of expenses associated with business trips, enshrining them in a collective agreement or in a local regulatory act (for example, in an order on accounting policies ). This means that if a budgetary institution carries out income-generating activities, it can increase the daily allowance rate by any amount if it pays it from funds received as a result of this activity.

The Decree of the Government of the Russian Federation No. 749 of October 13, 2008 “On the peculiarities of sending employees on business trips” introduced completely new provisions and requirements. Previously, the question of whether it was possible to send citizens who were not in labor relations with the organization on business trips was a cause for heated debate. Now the new Regulations clearly state that only employees who have an employment relationship with the employer can be sent on business trips.

Another major innovation is the definition of rules for issuing a travel certificate. Instruction No. 62 did not regulate the procedure for sending workers on business trips outside the territory of Russia. Now there is a clear procedure for sending an employee on a business trip abroad. A number of requirements present in Instruction No. 62 are absent in the new document. So, in particular, according to paragraph 2 of Instruction No. 62, a travel certificate may not be issued if the employee must return from a business trip to his place of permanent work on the same day on which he was sent. The provision does not contain such permission.

In this regard, it should be noted that Instruction No. 62, in connection with the release of a new regulatory act, does not cease to be in effect; it continues to be in force to the extent that does not contradict the Labor Code of the Russian Federation and the new Regulations on the specifics of sending employees on business trips.

New standards: the procedure for reimbursement of expenses is determined by the organization independently

The new document contains completely different norms. Thus, previously the Instruction limited the period of business trips for workers, determined by the heads of associations, enterprises, institutions, organizations, to the following periods: - 40 days, not counting travel time; — 1 year for business trips of workers, managers and specialists sent to perform installation, commissioning and construction work.

Currently, the duration of a business trip is determined by the employer, taking into account the volume, complexity and other features of the official assignment. The purpose of the business trip, previously recorded in the travel certificate, must now be indicated in the official assignment, which is approved by the employer. From now on, it is not regulations, but the decisions of the organization (collective agreement, local regulations) that determine the amount of reimbursement of expenses for posted workers, including the amount of daily allowance and expenses for renting accommodation in the event of a forced stopover. Reimbursement of expenses for renting living quarters if the employee remains at the place of business trip at the end of the working day if he has the opportunity to return to his place of permanent residence every day, previously, according to Instruction No. 62, was made if the employee remains at the place of business trip “at his own request.” According to the new regulatory document, such expenses are reimbursed if the employee remains at the place of business trip “in agreement with the head of the organization.”

The issue of reimbursement of expenses to an employee in the event of his temporary disability during a business trip until October 25, 2008 was resolved as follows: expenses were reimbursed on a general basis, but not more than two months. At the same time, days of temporary incapacity for work were not included in the business trip period. After October 25, 2008, these expenses are also reimbursed to the employee, but the reimbursement period is not limited to any period. In addition, there is no indication that days of temporary incapacity for work are not included in the business trip period. A range of issues are listed that, according to the new Regulations, must be regulated by a collective agreement or local regulations.

The procedure for sending on business trips is new, the procedure for registering business travelers is still the same.

The forms and procedure for registration of employees leaving on business trips from this organization to other organizations and arriving from other organizations to this organization, in accordance with the new Regulations, must be determined by the Ministry of Health and Social Development of the Russian Federation. However, at present, neither the form nor the procedure for registration have yet been developed.

Before their publication, organizations should be guided by the registration logs provided for by Instruction No. 62. In accordance with this instruction, the registration forms for business travelers are: - a log of employees leaving the organization on business trips; — a log of employees arriving on business trips to the organization.

The person responsible for maintaining logs of employees arriving and departing on business trips and making notes on travel certificates is appointed by order of the manager. In the register of employees leaving the organization on business trips, the last names, first names and patronymics of the seconded workers are indicated; position held; travel certificate number; last name, first name and patronymic of the employee who signed the travel certificate; date of actual departure and date of actual arrival. In the logbook of employees arriving on business trips to the organization, the last name, first name and patronymic of the seconded employee are indicated; the position he holds; name of the organization that issued the travel certificate; arrival date and departure date.

In conclusion, it is worth noting that the Regulations preserve the rules regarding the procedure for calculating average earnings for the period of being on a business trip, regarding the advisability of returning to the place of permanent residence when an employee is sent on a business trip to an area from which the business traveler has the opportunity to return daily, etc. Thus Thus, the new Regulations, on the one hand, tighten the requirements for the preparation of documents confirming the economic feasibility of expenses incurred, and on the other hand, expand the list of expenses reimbursed to a posted employee and remove restrictions when taking into account a number of expenses for tax purposes.

Limit on travel expenses in 2021

For a long time, Russian legislation had limited norms for expenses on business trips. That is, the employee was calculated an advance for expenses during the trip, based on the current limits. It was not possible to obtain a refund for the overdrawn funds.

Currently, such limits have been abolished. They were preserved only for certain federal government employees. Consequently, organizations now determine their own limits.

IMPORTANT!

For public sector employees, different rules are established. The maximum permissible amounts for them are established by the local government body or the founder. Such norms can be circumvented; for example, autonomous institutions can set their own limit based on the economic situation of the state institution, or pay extra from business funds. This exception is not provided for government and budgetary types of organizations.

Let us remind you that such restrictions are established not only on daily costs. That is, during the financial crisis, most organizations introduced limits on both accommodation and travel, which does not allow employees to make unreasonable expenses.

At the same time, the Tax Code of the Russian Federation establishes a limit on the taxation of daily allowances. Thus, for travel expenses abroad there is a limit of 2,500 rubles per day, for trips within our country - 700 rubles per day. That is, amounts exceeding the specified limits must be included in the base for calculating personal income tax and insurance premiums.

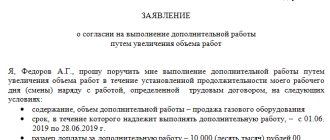

Example: claim for travel expenses

If an employee wishes to receive an advance in cash for travel expenses, an invoice does not need to be specified.

Please note that the application must be checked by the responsible accountant before being submitted to the manager. The accounting employee must verify the correctness of calculations for the number of days, according to the limits established by the institution and other conditions.

Then the manager endorses the application. Based on the document, you can immediately issue funds or draw up an order.

Travel expenses reimbursement period

Question

Good afternoon An employee of the organization will go on a business trip at the end of April to participate in the conference. He bought his plane tickets in advance, paying with his bank card. Can we reimburse him for the costs of these tickets now or only after he returns from the conference and submits an advance report?

Answer

According to Art. 168 of the Labor Code of the Russian Federation, in the event of being sent on a business trip, the employer is obliged to compensate the employee for:

— travel expenses;

- expenses for renting residential premises;

— additional expenses associated with living outside the place of permanent residence (per diem);

- other expenses incurred by the employee with the permission or knowledge of the employer.

The procedure and amount of reimbursement of expenses associated with business trips to employees of other employers (not related to those mentioned in parts 2 and 3 of Article 168 of the Labor Code of the Russian Federation) are determined by a collective agreement or a local regulatory act, unless otherwise established by the Labor Code of the Russian Federation, other federal laws and other regulatory legal acts of the Russian Federation.

Thus, labor legislation does not establish exactly when business trip expenses should be reimbursed, that is, before the start of the business trip or after its end. Based on this, we can conclude that the organization can independently establish by an internal document (for example, a regulation on business trips) that the expenses incurred by the employee on a business trip are reimbursed by the organization upon its completion and after drawing up an advance report with all the necessary documents attached.

However, in accordance with clause 10 of the Regulations on the specifics of sending employees on business trips, approved by Decree of the Government of the Russian Federation of October 13, 2008 N 749 (hereinafter referred to as the Regulations), when sent on a business trip, an employee is given a cash advance to pay travel expenses and rental accommodation and additional expenses associated with living outside the place of permanent residence (per diem).

And upon return, in accordance with clause 26 of the Regulations, the employee is obliged to submit to the employer within 3 working days an advance report on the amounts spent in connection with the business trip and make a final payment on the cash advance issued to him before leaving for the business trip for travel expenses. Attached to the advance report are documents on the rental of accommodation, actual travel expenses (including payment for services for issuing travel documents and providing bedding on trains) and other expenses associated with the business trip.

Thus, it has been established that before the start of a business trip, the employee is given an advance payment for which he is obliged to account. There are no sanctions for non-compliance with this procedure. At the same time, the Regulation obliging the issuance of an advance before a business trip is applied to the extent that does not contradict the Labor Code of the Russian Federation (Article 423 of the Labor Code of the Russian Federation). And as stated above, the Labor Code of the Russian Federation does not establish a procedure for reimbursement of travel expenses for ordinary employers; this procedure is developed by the organization itself, including establishing the period within which such expenses must be reimbursed.

As for documenting the reimbursement of travel expenses: one of the documents confirming the organization’s expenses for a business trip is an advance report (unified form N AO-1, approved by Resolution of the State Statistics Committee of Russia dated 01.08.2001 N 55). But in the case when an advance is not given to the employee, there is no reason to issue an advance report. However, in practice, in situations where an employee of an organization pays for business trip expenses from his own funds, and only then the organization reimburses the employee for the money spent for these purposes, without preparing an advance report it would be difficult to reimburse him for the amount spent.

Taking into account the above, the amount of travel expenses actually incurred by the employee is reimbursed to him on the basis of documents attached to the advance report ( clause 26 of the Business Travel Regulations).

Applications

- Question ___Can an organization pay for travel expenses (173 kB)

- Typical situation How to reimburse travel expenses during a coma (288 kB)

- Typical situation How to pay and account for travel expenses (481 kB)

Related questions:

- Registration of a business trip extension Please tell me, our employee has a business trip planned abroad until Friday. At the same time, he wants to spend his weekends (Saturday and Sunday) abroad on his own initiative, due to......

- Payment by corporate card - postings Good afternoon. We are your client. Contract 49825. Two related issues. The corporate card was issued directly to the current account. The employee withdrew cash from an ATM and deposited it into the organization’s cash desk.……

- Assignment of debt: LLC-1 has a debt to LLC-2 and wants to assign its debt to LLC-3. In other words, LLC-3 will have a debt to LLC-2. Thus, company LLC-1 has a debt to LLC-3. which……

- Extension of a commercial lease agreement for residential premises The Administration received an application from a citizen to extend the commercial lease agreement. 1.Is the commercial lease agreement renewable? 2. If it is extended, is a new contract concluded for a new period or an additional agreement is made? 3.……

367

Option No. 1. Limits approved

If the institution has limits on business travel expenses in separate local regulations, then ask to provide this information. Calculate the amount of the requested advance using the formula:

Cost rate = number of days × limit per day.

Transport costs are rarely limited, since tickets (travel) are paid upon delivery. However, it should be borne in mind that the employer has the right to refuse reimbursement of expenses for travel on certain types of transport. For example, a taxi ride when there are regular flights (train, bus). They may also refuse to pay for a premium seat (business or first class ticket).

Example.

The employee is sent to Tver for 11 days. The institution has the following limits:

- daily allowance - 200 rubles per day;

- accommodation - 700 rubles per day;

- actual travel.

Therefore, a specialist has the right to claim:

Daily allowance - 2200 (11 × 200 rubles), accommodation - 7000 (10 × 700) and 2000 for tickets at actual cost (1000 one way).

Option number 2. No limits

If the institution does not provide restrictions on who. expenses, estimates can be drawn up for a larger amount. However, you should not escape reality. All the same, the costs will have to be documented. In addition, a luxury hotel room and a business class flight are unlikely to be paid for using budget money.

How to plan costs correctly:

- Check the cost of tickets (train, bus, plane, etc.). Include the best travel option to your destination in your travel cost estimate.

- Book your hotel room. When making a reservation, immediately check the cost per day. Take this price into account in your calculations.

- Daily allowance. The amount of such costs should be agreed with management. Let us remind you that there are no restrictions in the legislation. However, if the amount exceeds 700 rubles per day when traveling within Russia and 2,500 rubles per day for foreign business trips, then the difference is subject to taxation (personal income tax and insurance contributions).

IMPORTANT!

To eliminate problems with supervisors, develop and approve a travel policy in the institution. And also establish in a separate local order the norms of expenses for business trips.

If this is not done, then some of the institution’s costs may be considered inappropriate. As a result, the manager will be fined and forced to return the money to the budget. When approving standards, follow the recommendations and orders of higher ministries and departments.

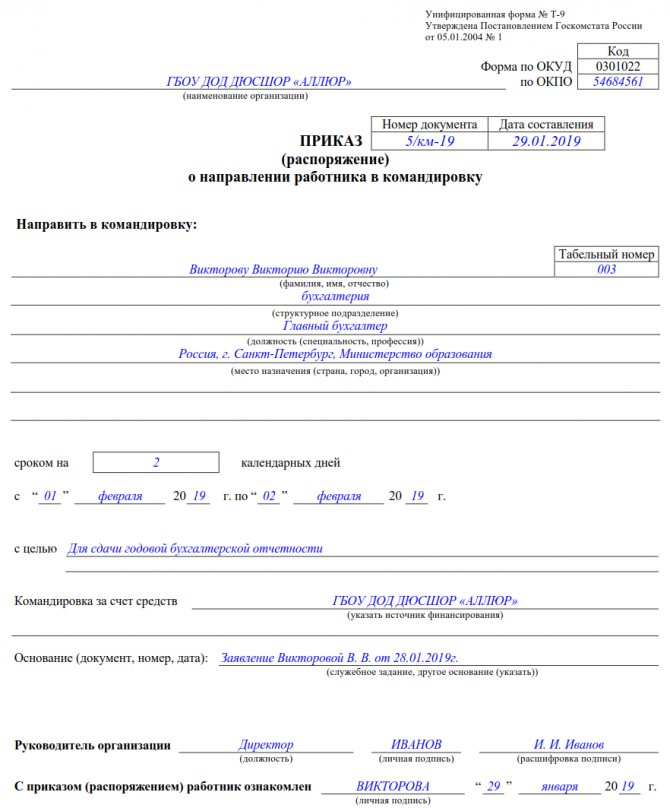

What documents are needed for a business trip?

Let's say the application for an advance payment is approved. What to do next?

First of all, draw up an order to send a specialist on a business trip. In the administrative act it is necessary to indicate not only the full name. and the position of the employee, but also the period of business trip, destination, purpose of the trip. It is acceptable to provide additional information about the job assignment. For example, write in the order “sent for submission of annual financial statements to the Ministry of Education.”

Use the unified order form No. T-9 (OKUD 0301022), approved by Resolution of the State Statistics Committee of the Russian Federation dated January 5, 2004 No. 1.

The use of a unified order form is not necessary. The institution has the right to use a form developed independently. However, regardless of the chosen form of the document, it must be fixed in the accounting policy.

Example of filling out a unified document

In addition to the order to send on a business trip and pay an advance for travel expenses, the employer must issue a work assignment. This document contains a list of duties that the employee must perform while traveling. However, the formation of a job assignment is not mandatory. It is quite enough to list the duties and purposes of the trip in the order.

Just a couple of years ago, it was possible to confirm travel expenses only with a special document - a travel certificate. Other checks and receipts were considered secondary documents. Currently, legal norms have changed. Now you do not need to issue a special certificate. But many institutions continue to issue the canceled form. Why?

Firstly, the validity of the form was preserved. Officials only determined that the document has now become optional. However, it can be issued at the discretion of the company management. Secondly, the ID allows you to confirm your daily expenses. Thirdly, the form allows you to mark the receiving party. That is, confirm that the employee has arrived at his destination.

You can develop your own certificate form or use the unified form No. T-10 (OKUD 0301024), approved by Resolution of the State Statistics Committee of the Russian Federation No. 1 of 01/05/2004.

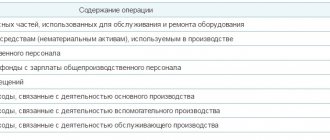

KOSGU

As noted above, travel expenses are considered in the context of the Labor Code of the Russian Federation as reimbursements (compensations) related to the employee’s performance of work duties. In international statistical practice, such payments are not considered as payments in the interests of employees, but belong to the category of expenses made by the employee for the purpose of performing work duties. In this regard, reimbursement of expenses related to business trips (travel, accommodation, other expenses related to the performance of official assignments on a business trip), starting in 2021, were transferred to subarticle 226 “Other work, Other payments” * (3) KOSGU ( clause 7, clause 10.2.6 clause 10 of Procedure No. 209n, clause 2.1.4 of the Methodological recommendations for the procedure for applying KOSGU, communicated by letter of the Ministry of Finance of Russia dated June 29, 2018 No. 02-05-10/45153).

More on the topic: Form 0503769: we keep records of receivables and payables

If we are not talking about reimbursement of expenses, but about providing the employee with everything necessary before a business trip (when the institution independently purchases tickets, pays for a hotel, etc.), then the institution’s expenses will include, in particular:

- to subarticle 222 “Transport Other work, Payment for work, services” of KOSGU, articles and subarticles of group 300 “Receipt of non-financial assets” of KOSGU, based on the economic sense.

Note! Expenses regarding daily allowances are still included in subarticle 212 “Other non-social payments to staff in cash” of KOSGU (clause 10.1.2 clause 10 of Procedure No. 209n).

How to report travel expenses

Expenses incurred on a business trip must be reimbursed by the employer. Of course, within the established norm, in compliance with expediency and validity, as well as in the presence of supporting documents. So, how to confirm a specific type of cost:

- Transport. For this category of expenses, supporting documents are tickets, checks and taxi receipts, electronic receipts (for example, when issuing an electronic ticket).

- Housing. A receipt from a hotel or a rental agreement can confirm the rental of housing. Please note that when renting a home from third parties, it is necessary to check the correctness of the lease agreement. You should also be given a check, receipt or receipt indicating that you have received money to pay for the rent. Incorrectly completed documents cannot be accepted for registration.

- Daily allowance. It will not be possible to confirm this category of travel expenses with a special document. Previously, an identity card was used for this; now it is not necessary to use this form. You can confirm the number of days using your tickets.

- Other expenses. To receive reimbursement for other types of expenses while traveling, please attach receipts, sales receipts, receipts, invoices and other documents. Please note that such costs should be agreed upon with management in advance. Otherwise, you may be denied payment.

If you received money from someone. expenses in advance, that is, a report, then upon return you must fill out an advance report. Attach all supporting checks, tickets and receipts to it and submit it to the accounting department.

IMPORTANT!

The advance report must be submitted within three days of returning from a business trip. Exception: the employee fell ill immediately after completing the trip. In this case, you should report for the advance on travel expenses no later than 3 days from the date of closing the certificate of incapacity for work.

The accountant will check the advance report, check the authenticity and correctness of filling out the supporting documents. Based on the results of the inspection, final calculations will be made. The excess will have to be returned, and the overexpenditure will have to be paid extra.

We send a student on a “business trip”

Documents that the university must prepare First of all, the institute must develop and approve regulations on sending students (graduate students) to events. It should reflect the basis and rules for sending students, the procedure for financing, as well as determine the procedure for compensation of expenses incurred by the student and the procedure for reporting. In the same document, it is advisable to establish the amount and limits of reimbursement to students for travel, accommodation, and food expenses. After all, there are no such norms in the current legislation. When a student is sent to another city, the rector of the university issues an order. It must indicate the student's last name, first name, patronymic, what city he is going to, for how long, for what purpose and at what cost. The same order can approve the cost estimate for the trip. Also attached are documents received from the receiving party (call), defining the financial conditions of the trip. Then the student is given a cash advance to pay expenses associated with renting living quarters, travel, etc.

Documents that the student must submit Upon return, the student must, within three working days, submit to the university accounting department an advance report on the expenditure of the amounts received. Of course, the accountant always remembers that all actual expenses incurred (except for daily allowance) must be documented. But does the student remember this? To avoid problems with an inexperienced business traveler, it makes sense to provide him with a reminder in advance (when issuing an advance, for example). Indicate in it a list of documents that he will have to attach to the expense report. For example: - travel certificate with marks from the receiving party; — documents on the rental of residential premises; — travel documents; — documents confirming the payment of various types of fees (for example, organizational fees). The student should also be reminded that in the advance report, a separate line must reflect the amount of daily allowance (meals) for each day of stay.

Reflection of transactions in accounting Institutional expenses associated with payment for travel, meals, rental of living quarters for students when they are sent to various events should be attributed to article 290 “Other expenses” of KOSGU. This follows from the letter of the Ministry of Finance of Russia dated July 21, 2009 No. 02-05-10/2931. When reflecting transactions in budget accounting, the accountant will make the following entries:

| Contents of operation | Debit | Credit |

| An advance was issued to a student of an educational institution to pay expenses for traveling to the conference | 208 18 560 “Increase in accounts receivable of accountable persons for payment of other expenses” | 201 04 610 “Disposals from the cash register” |

| The advance report of a student of an educational institution has been accepted for accounting | 401 01 290 “Other expenses” | 208 18 660 “Reduction of accounts receivable of accountable persons for payment of other expenses” |

| The unused advance amount was returned to the cash desk of the educational institution | 201 04 510 “Receipts to the cash desk” | 208 18 660 “Reduction of accounts receivable of accountable persons for payment of other expenses” |

Taxation of expenses for participation in the conference Income tax for individuals

. When sending individuals on business trips, daily allowances paid in accordance with the legislation of the Russian Federation (that is, established by a local act of the university), but not more than 700 rubles, are not subject to personal income tax. for each day of a business trip in the Russian Federation. The following actually incurred and documented expenses are also exempt from tax: - targeted expenses for travel to the destination and back, fees for airport services, commission fees, expenses for travel to the airport or train station at the places of departure, destination or transfers, for baggage transportation ; - expenses for renting residential premises; — costs of payment for communication services. But if a person does not provide documents confirming the costs of renting a living space, then the amount of such payment is exempt from taxation up to a maximum of 700 rubles. for each day you are on a business trip in Russia (clause 3 of Article 217 of the Tax Code of the Russian Federation). The specified procedure for assessing personal income tax applies to payments received by persons who are under the authority or administrative subordination of the organization (Article 217 of the Tax Code of the Russian Federation). The student is administratively subordinate to the educational institution (Federal Law of August 22, 1996 No. 125-FZ).*

* Resolution of the Federal Antimonopoly Service of the Volga Region dated January 19, 2006 No. A65-16313/2005-SA2-8. Thus, if the local act of the university stipulates that students participate in events (in accordance with the established curricula), then payments for their travel , accommodation, food are not subject to personal income tax in the amounts indicated above. If the limits are exceeded, taxes must be calculated on amounts in excess of the norms. Income tax.

Even if the costs of the conference are covered by funds received from business and other income-generating activities, the costs are not recognized in tax accounting (Article 252 of the Tax Code of the Russian Federation).

OFFICIAL POSITION

I.Yu.

KUZMIN, 3rd class adviser to the State Civil Service of the Russian Federation - The Institute sent full-time students to another city for sports competitions, whose education was paid for from budget funds.

Under what budget classification item should expenses related to their trip be reflected? — Such expenses are included in article 290 “Other expenses” of the classification of operations of the general government sector.

These may include the costs of paying: - an organizational fee to the inviting party; - rental of residential premises; — meals (in full or in part, depending on the conditions for using the funds from the registration fee); — travel of students to the venue of the above events and back, payment of daily allowances. The article was published in the journal “Accounting in Education” No. 2, February 2010.

Features of accounting

In the accounting of a budgetary institution, travel expenses should be reflected in the appropriate account:

- to reflect daily allowances - 0 208 12 000 “Settlements with accountable persons for other payments”, according to KVR 112 and KOSGU 212;

- to reflect other costs - according to subaccount 0 208 26 000, according to KVR 112 and KOSGU 226.

The new provisions have been in effect since 2021 (Orders of the Ministry of Finance No. 132n and No. 209n).

However, if the payment for housing is carried out by the organization itself, for example, an agreement for the provision of services has been concluded between the institution and the hotel, then such costs are reflected in account 0 302 26 000. And if payment for the hotel is carried out under an agreement between the organization and the hotel, but with accountable money through an employee, such costs We reflect on the account 0 208 26 000.

A similar procedure is provided for purchasing tickets. So, for example, if an employee himself bought a ticket for a train (bus, plane), then travel expenses for transport are reflected in account 0 208 26 000, according to CVR 112. If the institution entered into an agreement with a transport company and transferred money for the ticket from the current account , reflect the costs at 0 302 22 000, use KVR 244. But if the employee paid under such an agreement with accountable money, then reflect the transaction at 0 208 22 000, KVR 244, KOSGU 222.

KVR

One of the essential requirements of the approved structure of types of expenses, enshrined in clause 46.5 of Procedure No. 85n, is the reflection of travel expenses * (4), as follows:

- issuance of cash to seconded workers (employees) (or transfer to a bank card) on account of the guaranteed expenses listed above - according to CVR 112 “Other payments to personnel of institutions, with the exception of the wage fund”, 122 “Other payments to personnel of state (municipal) authorities, with the exception of the wage fund", 134 "Other payments to military personnel and employees with special ranks" and 142 "Other payments to personnel, with the exception of the wage fund" (see also clause 48.1.1.2, clause 48.1.2.2, clause 48.1.4.2 clause 48 of Order No. 85n);

- payment for the purchase of tickets for travel to and from the place of business trip and (or) rental of residential premises for seconded workers under agreements (contracts) - according to KVR 244 “Other procurement of goods, works and services”.

Thus, Procedure No. 85n clearly establishes the use of various CVRs when reimbursing an employee’s expenses and when an institution purchases services for him under a contract.

Note! According to clause 46.5 of Procedure No. 85n, the list of other expenses incurred by a posted employee with the permission or knowledge of the employer, attributable to CVR 112, 122, 134 or 142, is determined by the employer in a collective agreement or local regulation (due to the specifics of the activities of individual main managers of budget funds - in a normative legal act). That is, if the relevant act does not indicate certain expenses incurred by an employee on a business trip with the knowledge of the employer, they cannot be attributed to CVR 112, 122, 134 or 142. In this case, the expenses will be attributed to CVR 244 * (5) .

More on the topic: Incoming balances on settlement accounts for receivables and payables: a new procedure from 01/01/2021 for public sector institutions

As we can see, the attribution of travel expenses can be carried out according to various CVR and KOSGU, depending on whether funds are issued (compensated) to the employee or whether the institution purchases services for him. And the procedure for attributing other expenses incurred by an employee on a business trip depends on the availability of a list of such expenses, enshrined in the relevant act, and the presence of specific expenses in such an act.

Along with the above, it is interesting that if the purpose of the business trip is the purchase of material supplies, for example, fuels and lubricants, then the purchase costs should be reflected according to KVR 244 and subarticle 343 of KOSGU (letter of the Ministry of Finance of Russia dated March 15, 2019 No. 02-05-10/17872 ).

Let us remind you that the CWR and KOSGU expenditure subitems are used in mutual coordination. In this regard, we advise you to always check the CVR for coordination with the articles (sub-articles) of the KOSGU according to what is posted by the Ministry of Finance of Russia on its official website (www.minfin.ru). Please note: the table of correspondence between the CWR and the articles (subarticles) of the KOSGU related to expenses often undergoes changes. At the time of preparation of the material, the correspondence table posted on the website of the Ministry of Finance of Russia on 04/09/2020 is valid (Budget - Budget classification of the Russian Federation - Methodological office).